In the last article, we completed the second part of our Swiss tax return (for the canton of Zurich): real estate, tax deductions, interest expenses, deductions for pillar 3a, pension provision, and insurance premiums.

If you’ve taken a break, you can come back to ZHprivateTax and continue where you left off.

Now it’s getting cool: we continue with one of the most interesting topics, your stock market investments (ETFs and equities), as well as other categories such as donations, deductions, and wealth, right up to the tax register.

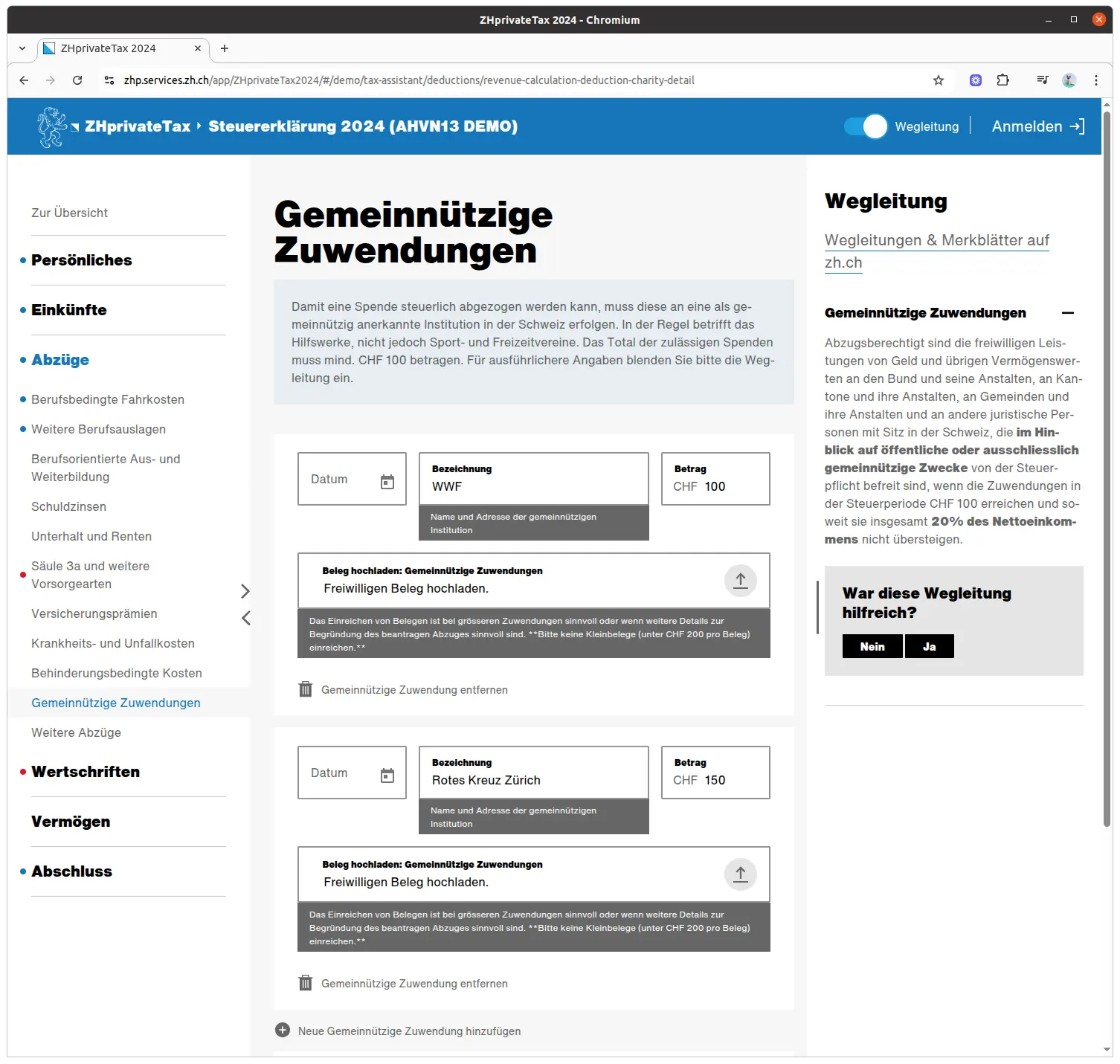

Step 1: Charitable donations

You can deduct your charitable donations here. The total amount must be at least CHF 100. Beneficiaries must be based in Switzerland.

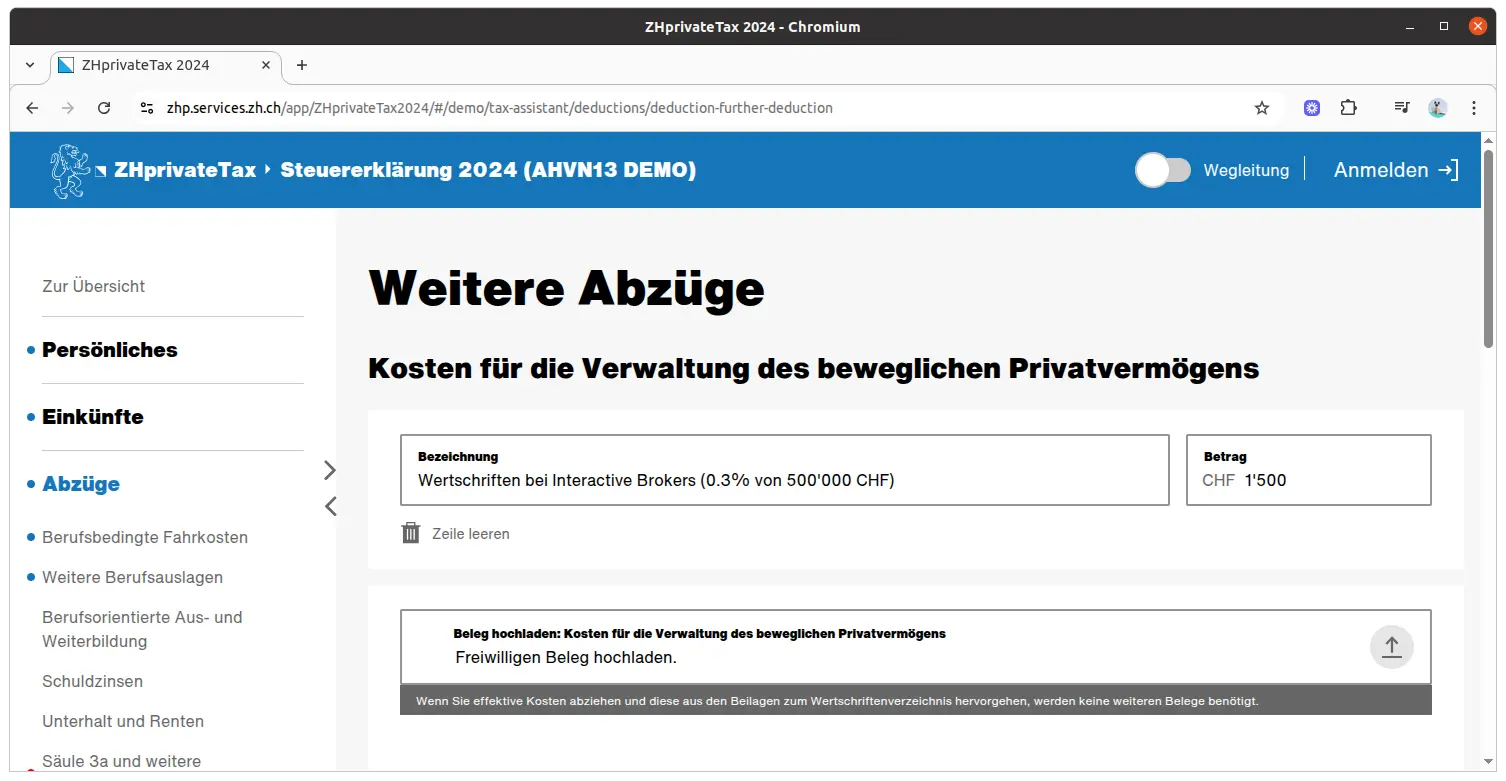

Step 2: Other deductions

Here you need to deduct the costs associated with loading assets. As a Mustachian, you’ve probably invested your money and can deduct the corresponding fees here. Please note that these are management fees for securities (i.e., ETFs and equities), not purchase/sale fees. But as a thrifty investor, you shouldn’t be putting your money into this kind of investment anyway. There are two options:

- Your broker gives you a list of fees: you can enter them here

- Flat-rate deduction: 0.3% of the value of your securities, up to a maximum of CHF 6'000

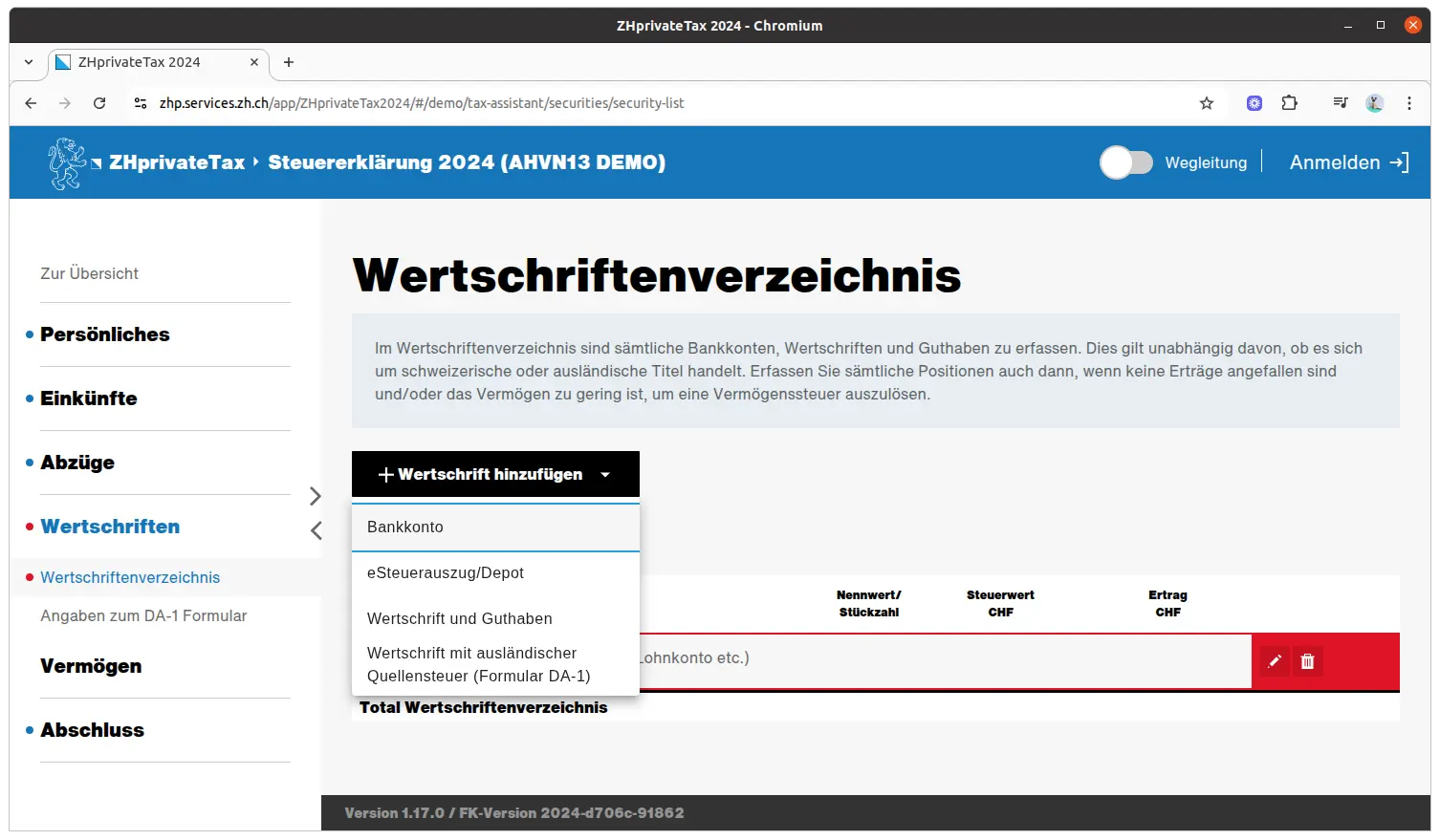

Step 3: Assets / Bank accounts

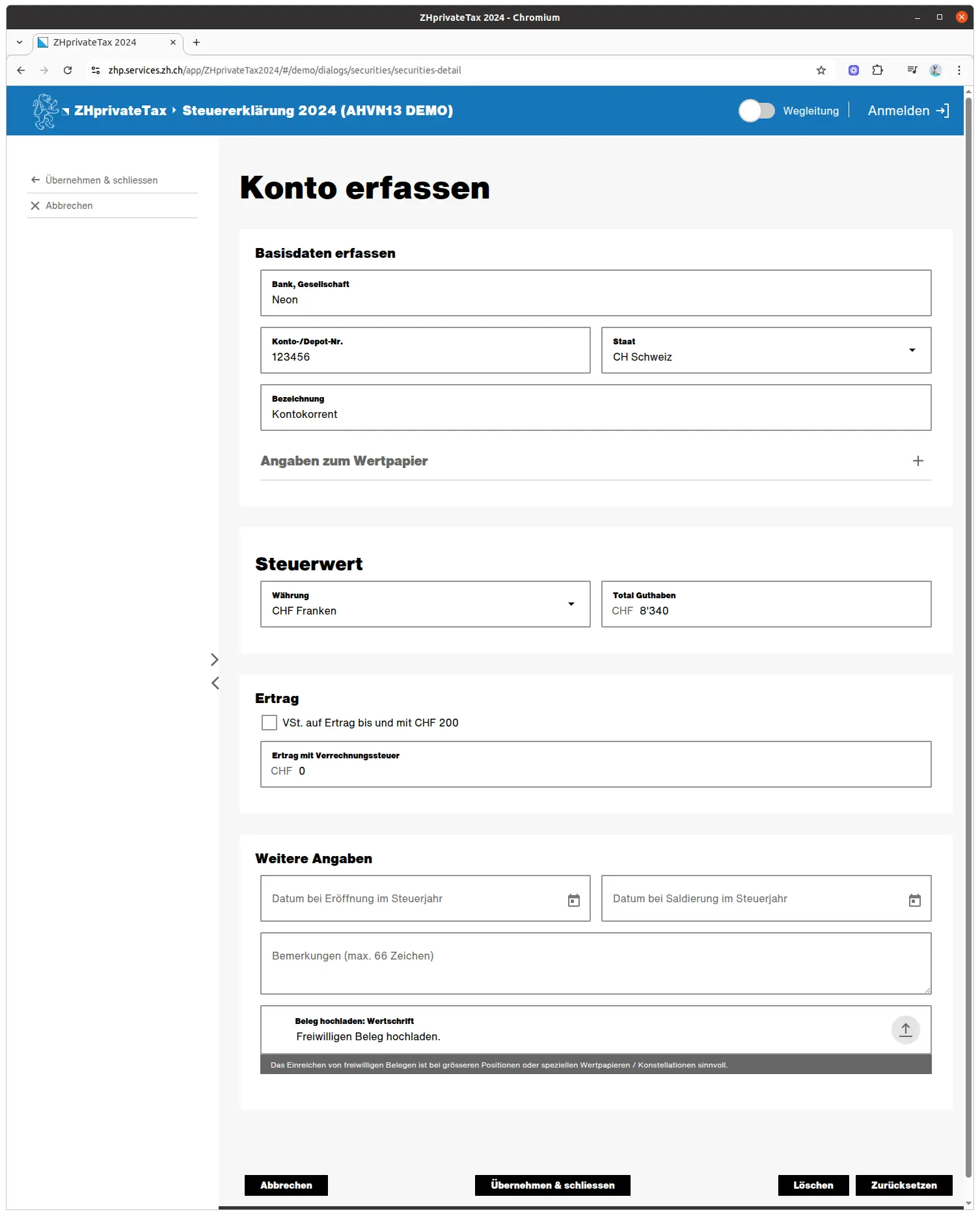

All bank accounts must be declared. This has been done in the securities register.

Every year in January, your bank sends you a statement of your accounts. It is often accompanied by a special note “for tax purposes” or similar. You should indicate this here.

You need to put the certificate info here. You need the name of the bank, the account number, and the domicile of the account. Then your balance on December 31 and the income (interest) on the account.

Very important: the form makes a difference between withholding tax and without withholding tax. In general, this tax (33%) is only paid on income of CHF 200 or more. As soon as the account is declared, the withholding tax will be credited to you.

Most important of all: this form has no automatic save function, so you must click explicitly on “Apply and close”, otherwise everything will be lost.

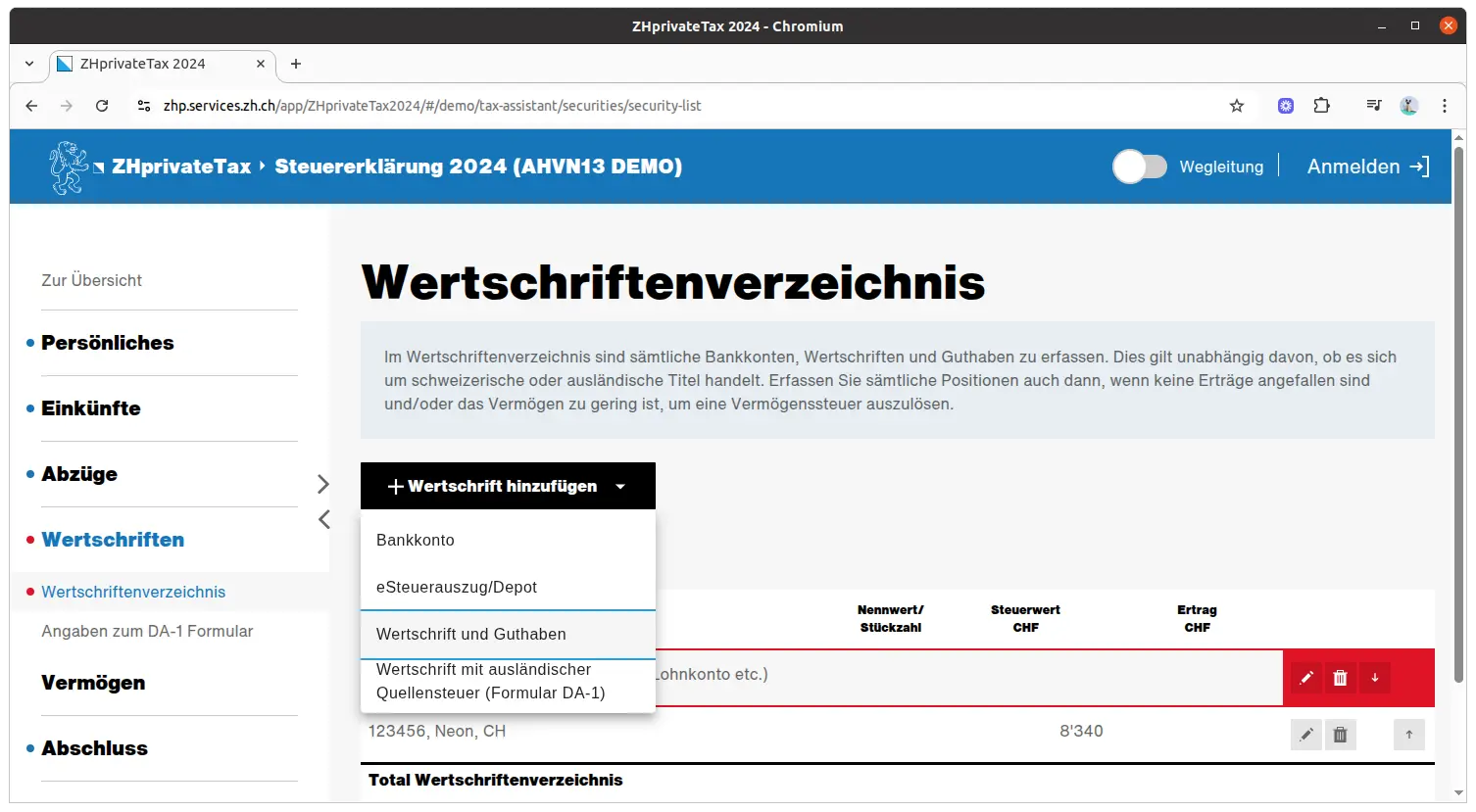

Step 4: Wealth / Shares and other securities

If you’re reading this article, you probably own some shares. Now, you can reveal your entire investment strategy to the tax authorities.

Let’s take a simple strategy as an example, of course via my favorite broker IB:

- 200 VT ETFs, of which 40 were purchased during the tax year

- 100 ETF CHSPI

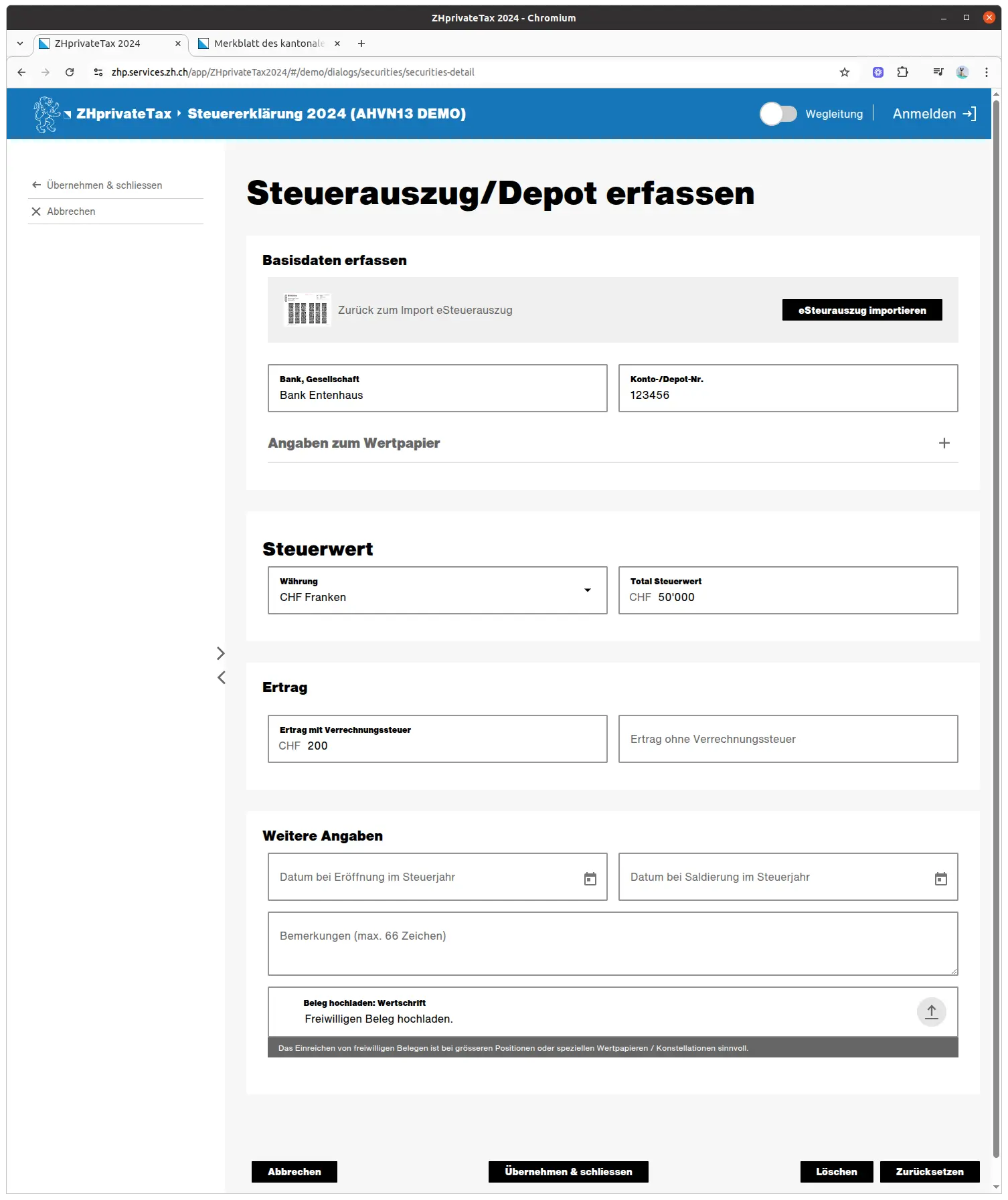

First, you add a new stock:

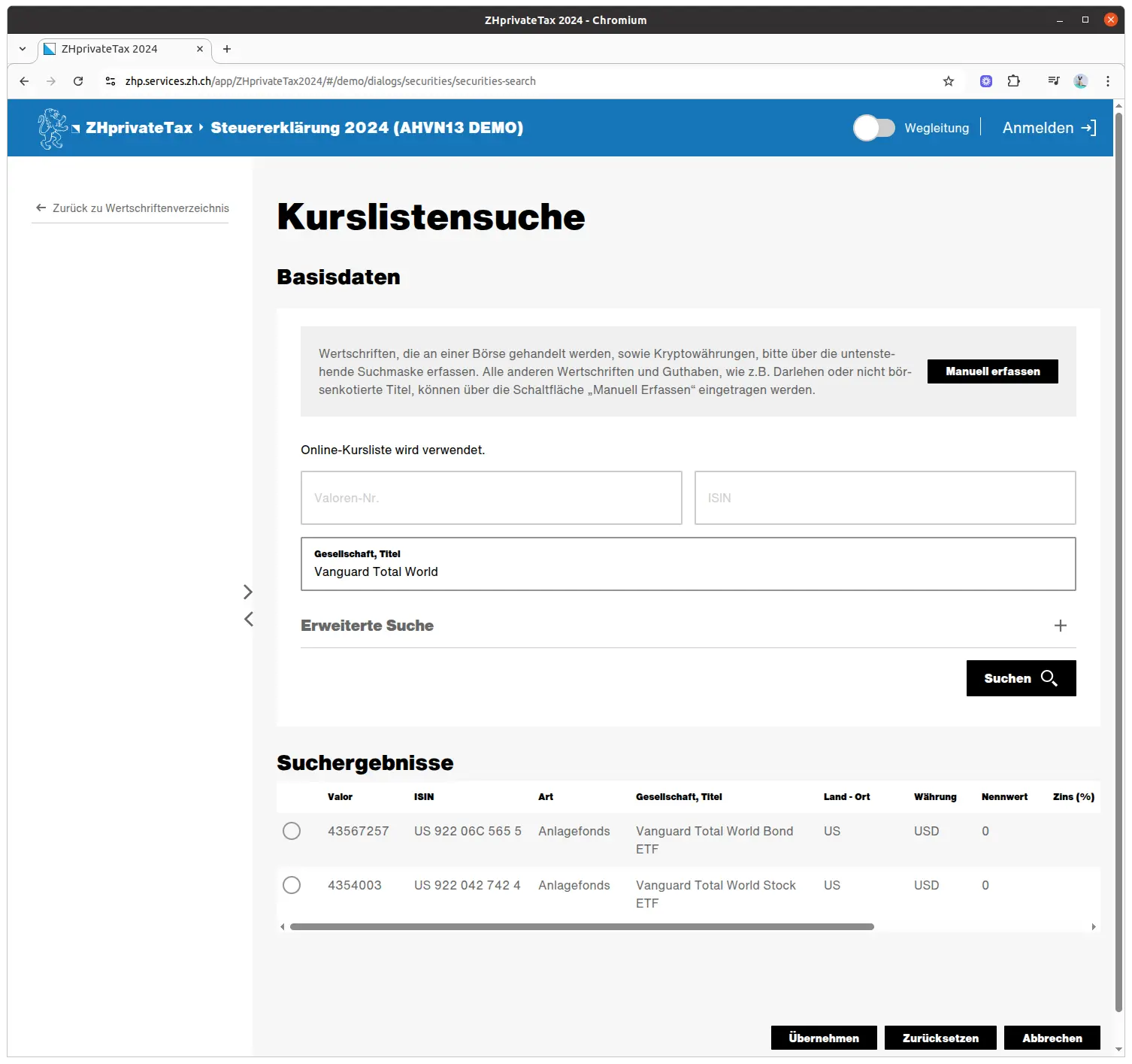

Now you can use the search field to find your title. If you know the security number or ISIN code, it’s super easy. If not, you may have to search through a long list.

The tax authorities already know a lot of stuff about financial investments like the VT ETF, so this info is already there, and you don’t need to type it in. That means currency conversions, the value at the beginning and end of the period, dividends, it’s all there. What you still need:

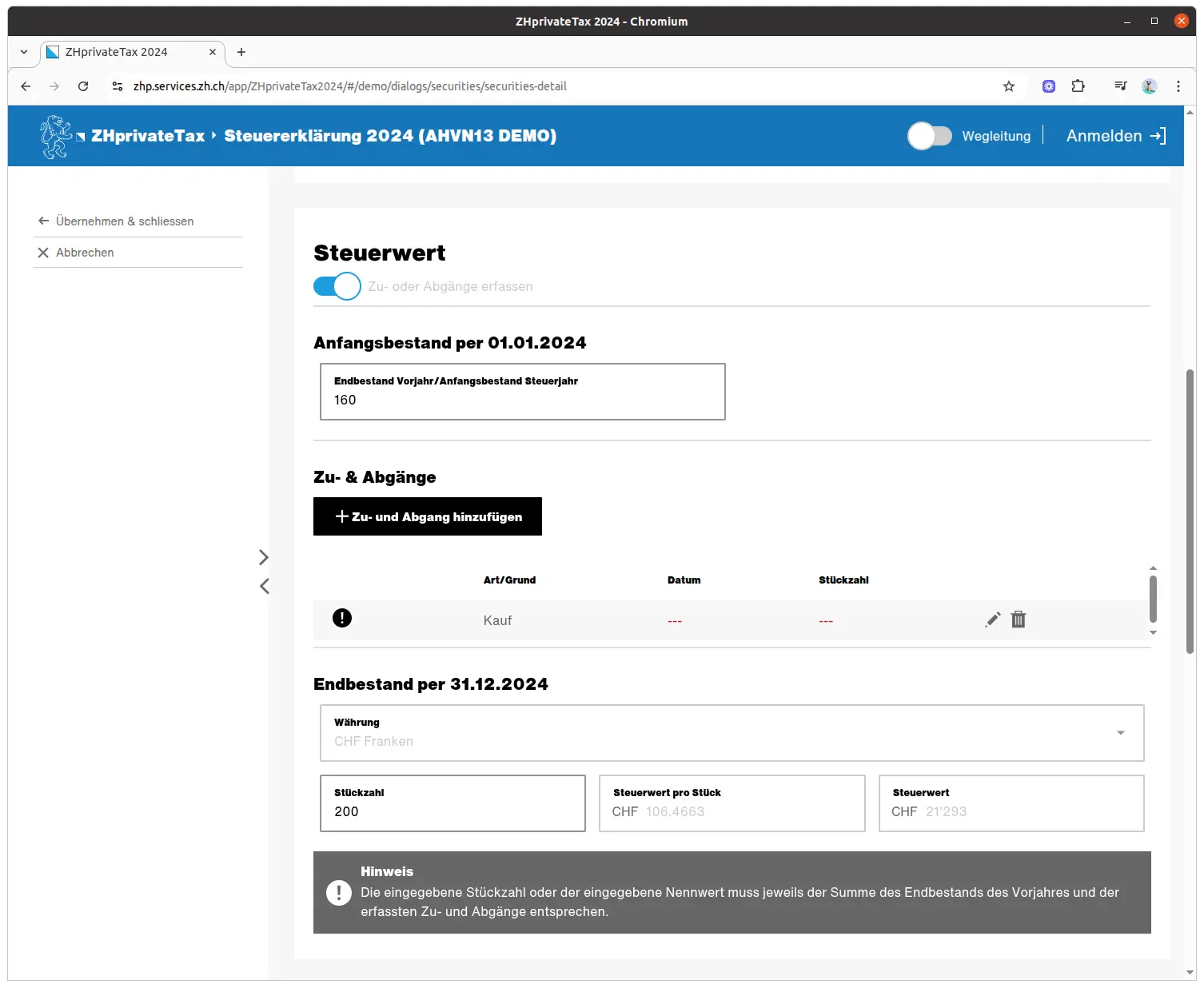

- The initial balance. How many shares did you have at the beginning of the year? Normally, this figure is taken from the last tax return.

- Final balance. How many shares do you have at the end of the year?

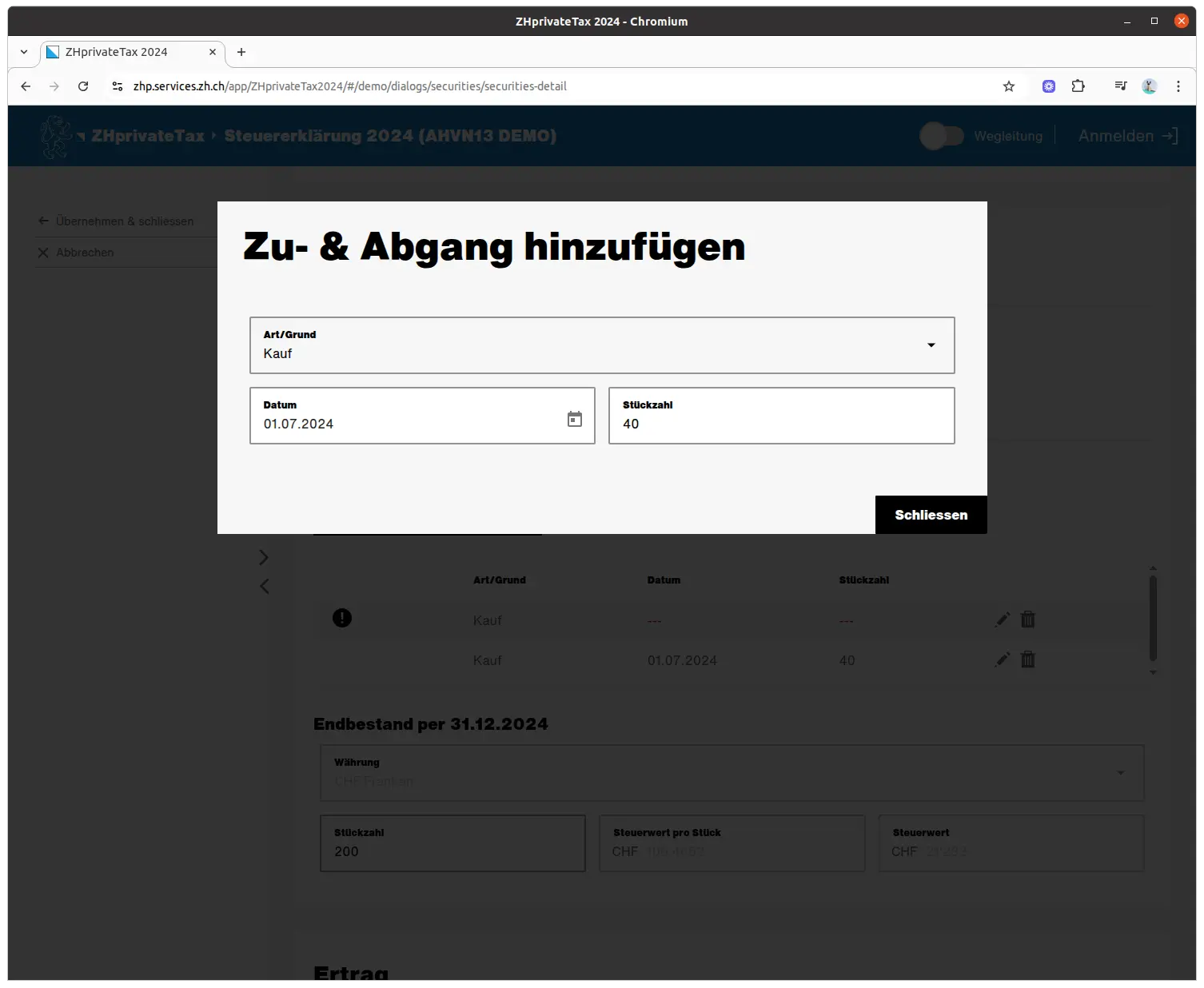

- All purchases and sales must be listed. As VT ETF distributes dividends (taxable income!), the tax authorities need precise information on the number of shares you own at any given time.

If the figures match, so much the better. If not, you’ll get a message telling you that the quantities shown are incorrect.

Very important: this form has no auto-save function, so you must click on “Apply and close” or everything will be lost.

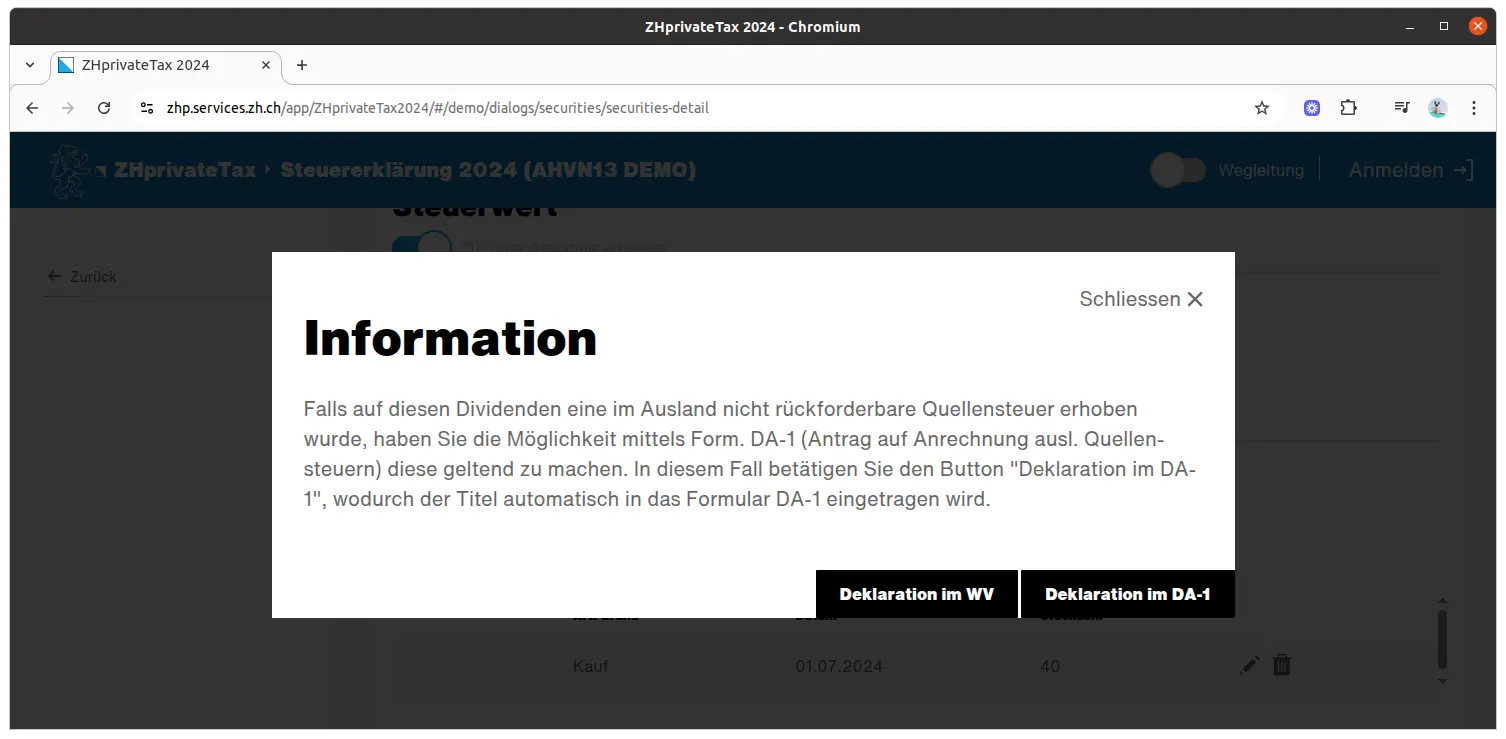

When you save, you’ll get a surprise info. VT ETF is an American security with withholding taxes. These must be indicated on the DA-1 form as soon as the withholding tax (total) is at least CHF 100. You can move titles from the main directory to the DA-1 at any time. Unfortunately, the reverse is not possible: you have to delete and add them. That’s why we advise you to put American titles in the DA-1 only at the end (if necessary).

Step 5: Tax statement

Some banks provide you with a tax statement to facilitate your tax return. You can upload this statement to your tax return. To do so, click on “Electronic tax return/Filing”.

If your tax statement has the right barcode, you can scan it directly. Otherwise, you’ll have to copy the information by hand.

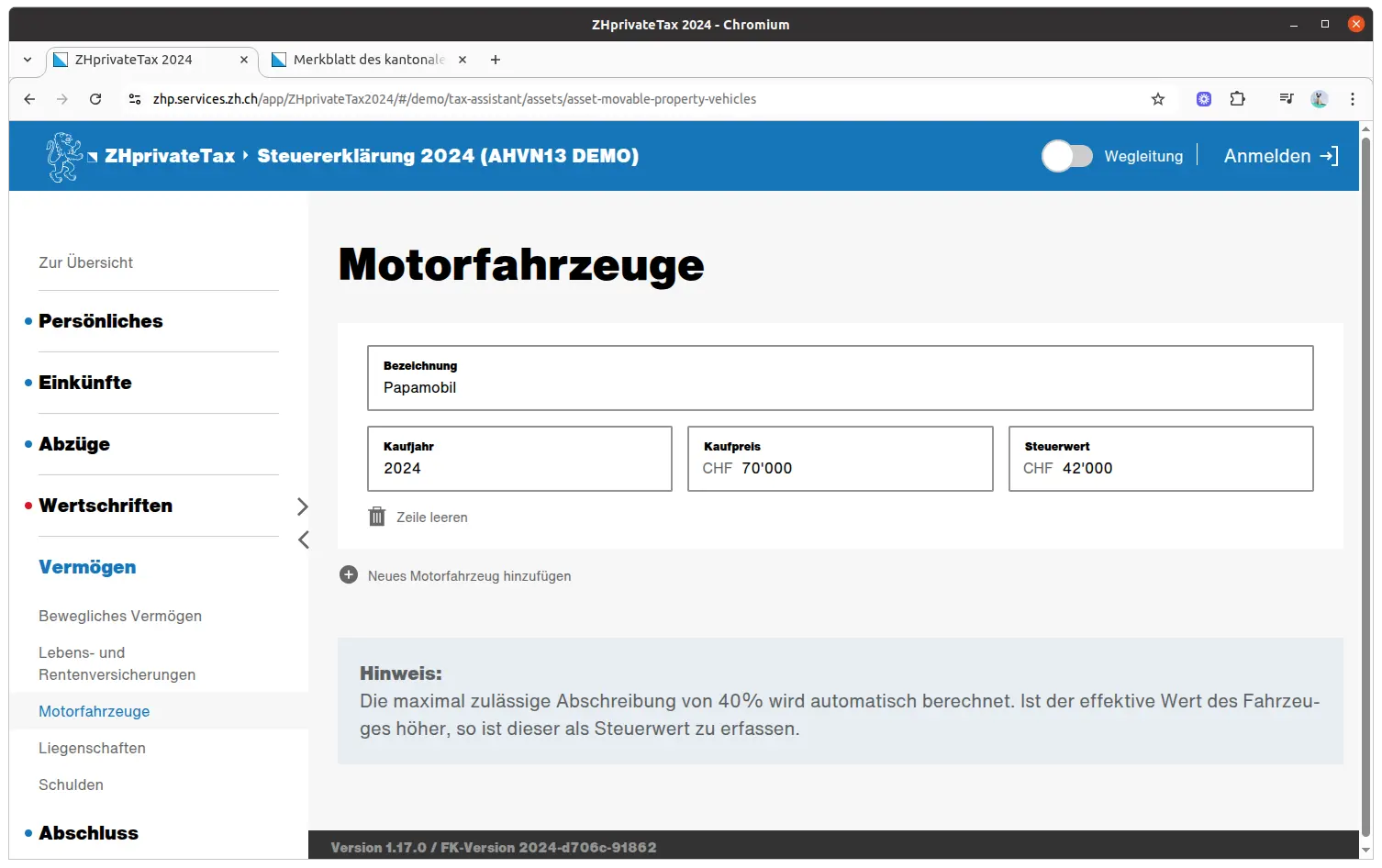

Step 6: Other assets

Here you need to list your other assets. If you have a car (not leased!), this is the place to put it.

You can deduct up to 40% of the car’s value each year.

Step 7: Closing

Tax allocation

If you have real estate or self-employed activities in other cantons or abroad, you must complete this step.

Here, income and assets are split between the various cantons or foreign countries to calculate the correct tax rates.

Remarks

Here you can add remarks and notes about your tax return. This is useful for information that is not justified or obvious.

Send

If there are no errors and you have all the necessary supporting documents, you can now reread your entire tax return and check it one last time with your spouse for added security.

You can also make a provisional calculation to see the estimated amount of taxes.

Now you can send in your entire tax return, and you’re done.

In a few weeks or months, you’ll receive the final tax notice and a bill or refund if there’s a difference between the provisional and final calculations.

Conclusion

I hope this step-by-step guide to completing your tax return has helped you.

If I’ve missed any tax-saving tips in the screenshots above (or if you still have questions), let me know in the comments section below!

Good luck saving taxes!