In the last article, we completed the first two parts of our Swiss tax return (for the canton of Zurich), namely: personal information, salaried activities, and other potential income.

If you’ve taken a break, you can return to ZHprivateTax to continue where you left off.

Let’s move on to the next categories, in particular, the interesting sections on real estate and tax deductions!

Step 1: Real estate

We’re in the “Income” section, but the form for real estate is super-complete, covering income, deductions, and assets. Only debts (mortgages) are on a separate form (see step 8).

As a tenant

You can skip these forms and go straight to step 2.

Owner-occupied properties

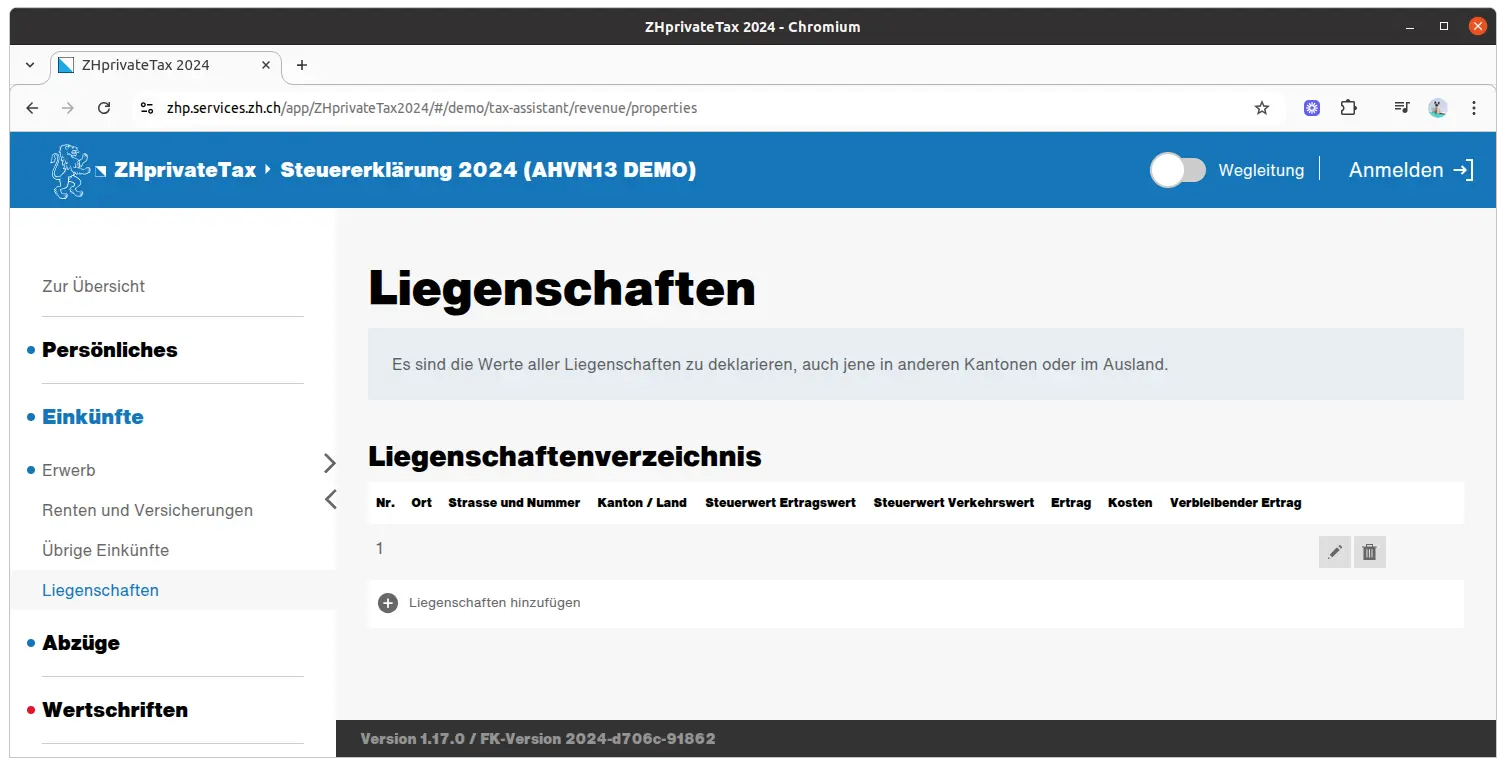

You must repeat these steps for each property. If the form is empty, you can add a new line by clicking on “Add properties”. You can then modify this line.

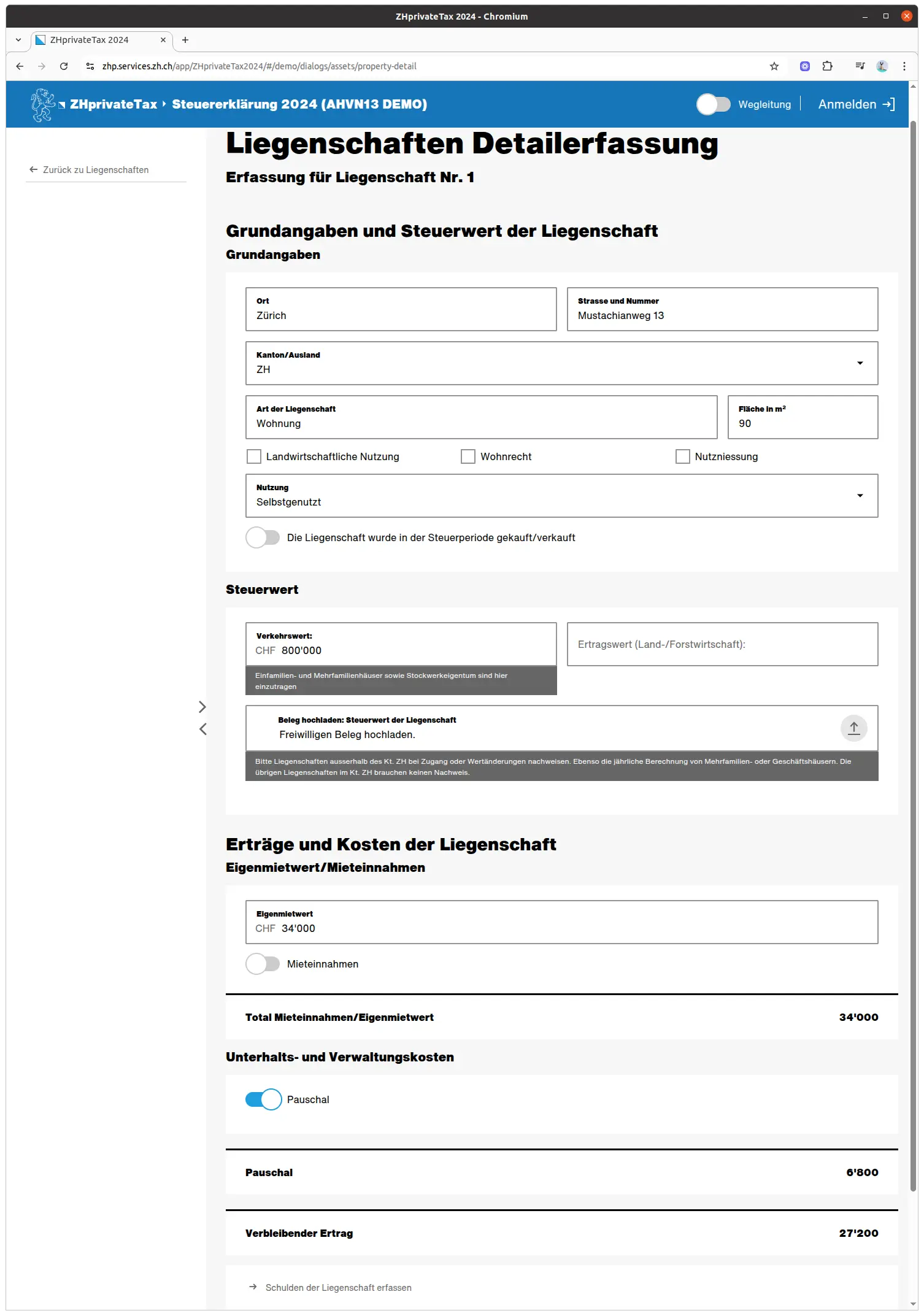

Enter your property details. This is for personal use only.

For the tax and rental values of your property, you will receive a certificate from the canton, which you can enter exactly as you see fit. If your apartment is located abroad, you can calculate these values yourself as follows.

The tax value is 70% of the purchase value (i.e. CHF 700,000 for a property costing CHF 1,000,000). The rental value is 3.5% (for houses) or 4.25% (for apartments) of the tax value.

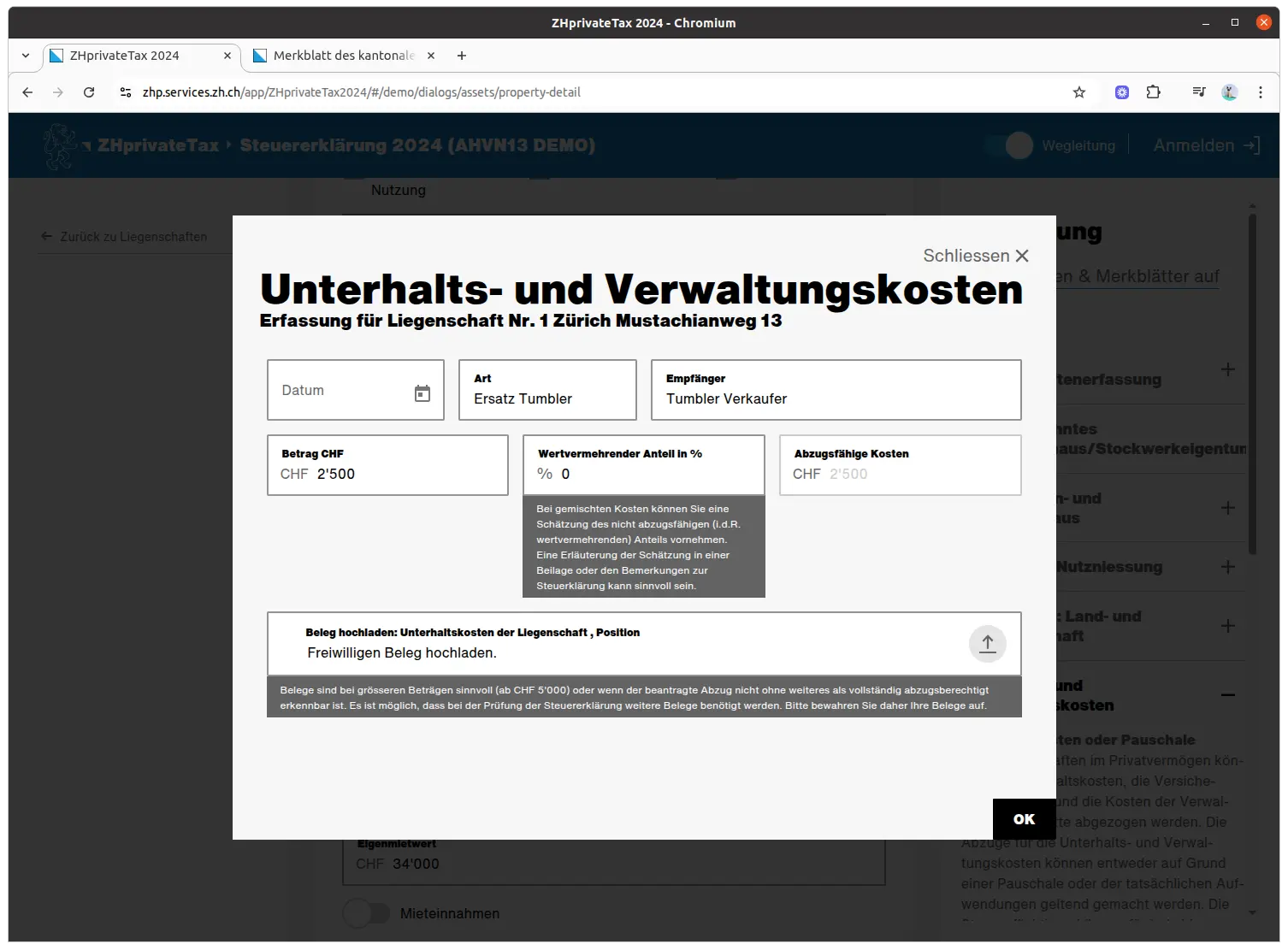

Maintenance costs are fixed at 20% of the rental value. You can also deduct actual costs if they are higher. But in this case, you must list and justify them. Only “conservative” maintenance costs can be deducted, i.e., those that replace items in the same condition. If you’ve replaced all your toilets with gold ones (a thrifty Mustachian would never do that!), you can’t deduct them, or only part of them. But you still need to keep the receipts, because you’ll need them to explain the increase in value of the property on sale and to calculate the real estate gains tax.

You can deduct certain expenses, such as garden maintenance work, payments into the renovation fund, and certain insurances, such as fire and explosion insurance. You’ll find more details in the information sheet on this subject.

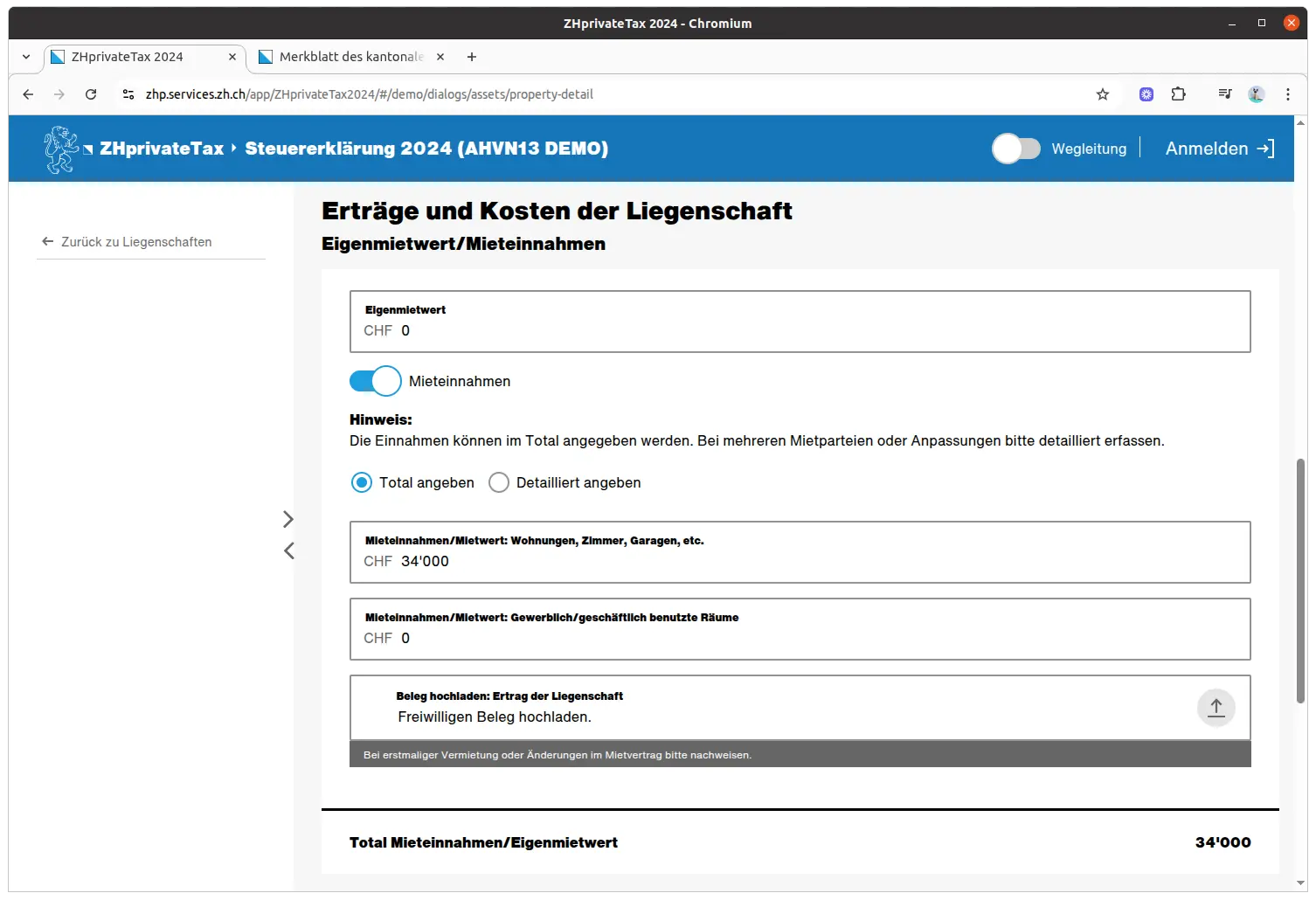

Real estate leased as owner

Entering a rental property is quite similar to entering an owner-occupied property, with a few differences.

Rental income instead of rental value. In the “Income” section, select “Rental income” and enter this information, either as a total or in detail.

The same applies to maintenance and administration costs. Indicate flat-rate or actual costs.

Step 2: Work-related deductions

Next, it’s time for deductions. Start by entering your job-related deductions.

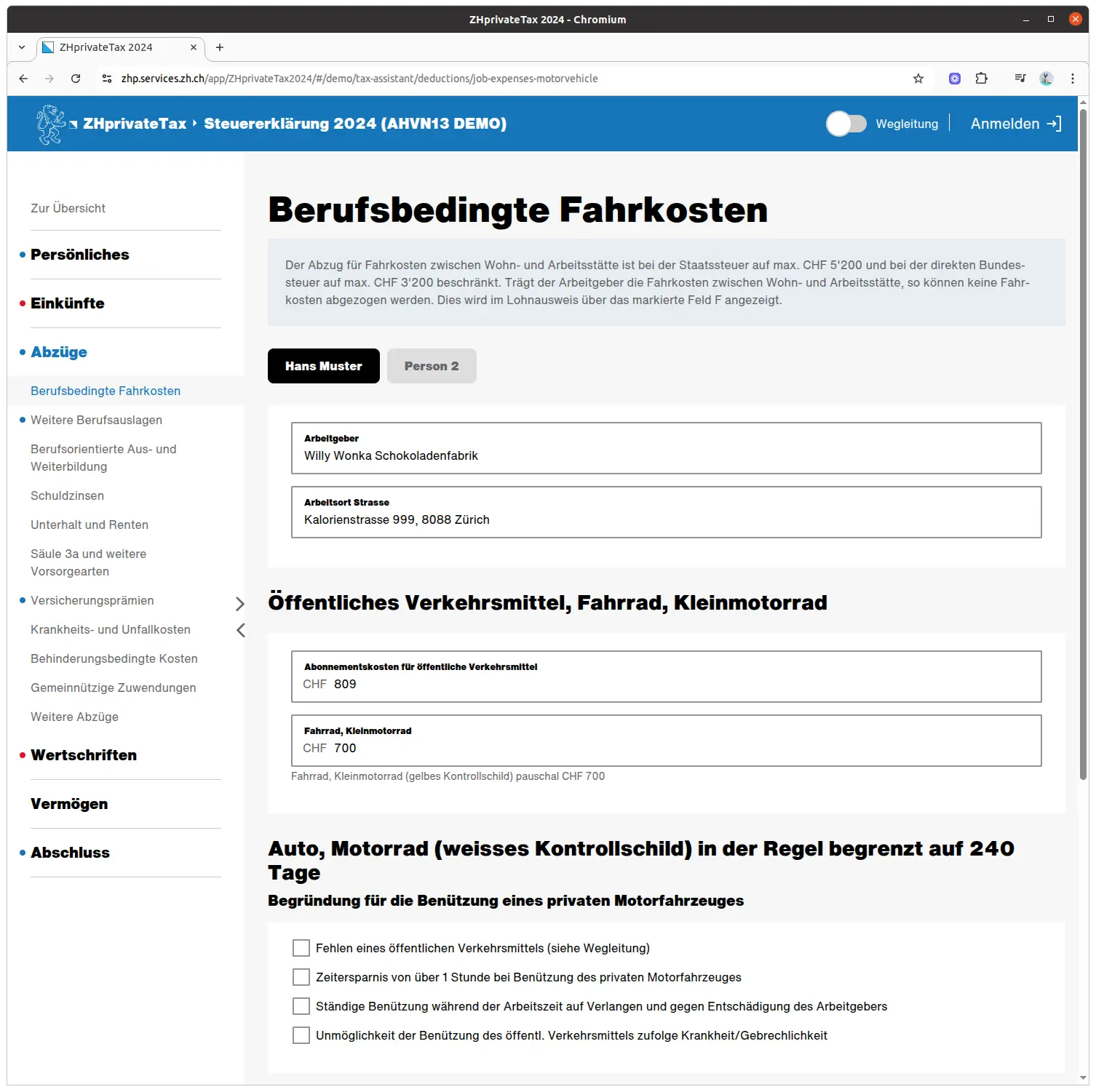

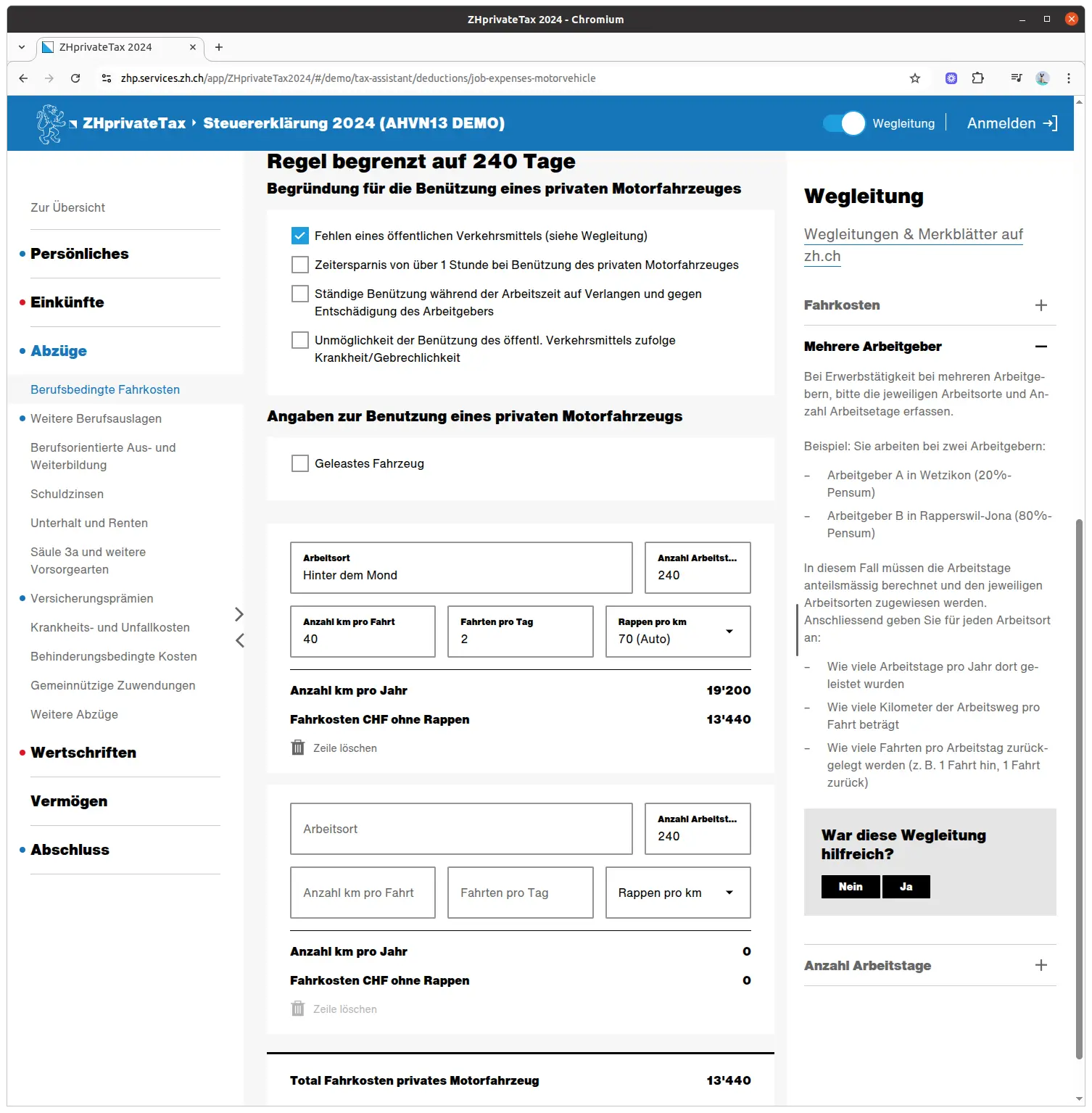

Work-related travel expenses

You can deduct the cost of transportation to and from work. But only if you have to pay them yourself. If your employer pays them, you can’t deduct them.

Most of the time, you can just declare the cost of public transport. The easiest way is to declare the cost of a 2nd-class annual season ticket for the VBZ or ZVV for the corresponding zones. And, of course, the flat-rate cost of a bicycle, i.e., CHF 700. You can make both deductions.

In certain situations, you may be able to claim expenses for a car or motorcycle. In this case, you cannot deduct public transport expenses:

- There is no public transport because the nearest stop is at least 1 km away or because there is no public transport during your working hours

- Your boss asks you to use your private car during working hours. For this, you need confirmation from your boss

- You take 1 hour less by car than by public transport

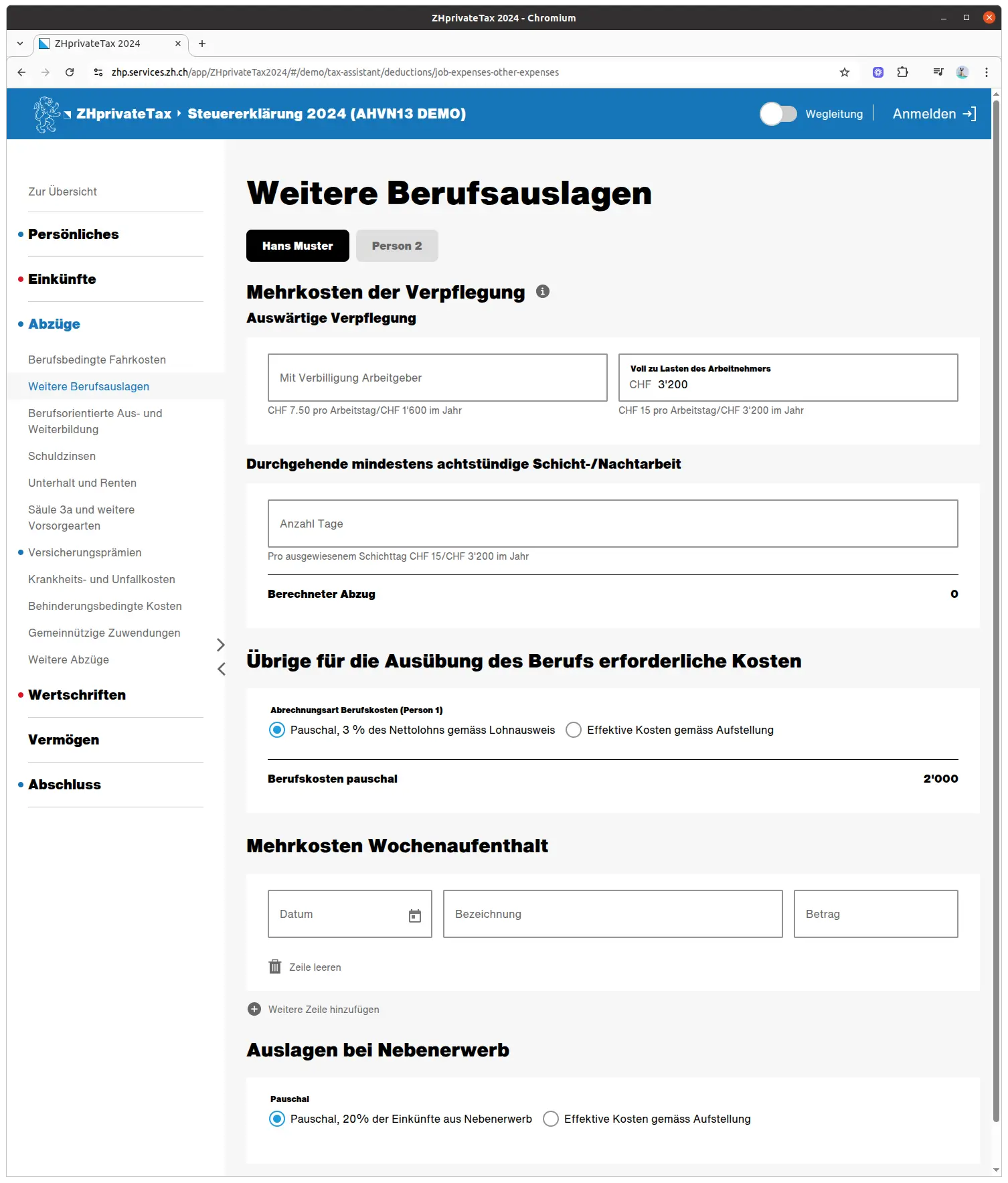

Other business expenses

You can enter your catering expenses here. Standard rates apply. CHF 3200/year if you cover all costs, CHF 1600/year if your boss covers part of the costs (e.g., in a company canteen), or CHF 0 if your boss covers all costs. You’ll find this information on your payslip.

You can also claim other expenses, for example, if you’ve bought special work clothes or tools, used a private office, or paid for memberships. By default, a flat-rate deduction of 3% is allowed, so think carefully if your expenses exceed this value. If you declare actual expenses, you must be able to justify them with receipts.

If you’re a weekly resident, you can also claim expenses for accommodation and meals (dinners).

If you have several jobs with different conditions, you must prorate your deductions.

The guide contains examples for many cases. Alternatively, you can ask your local tax office for help.

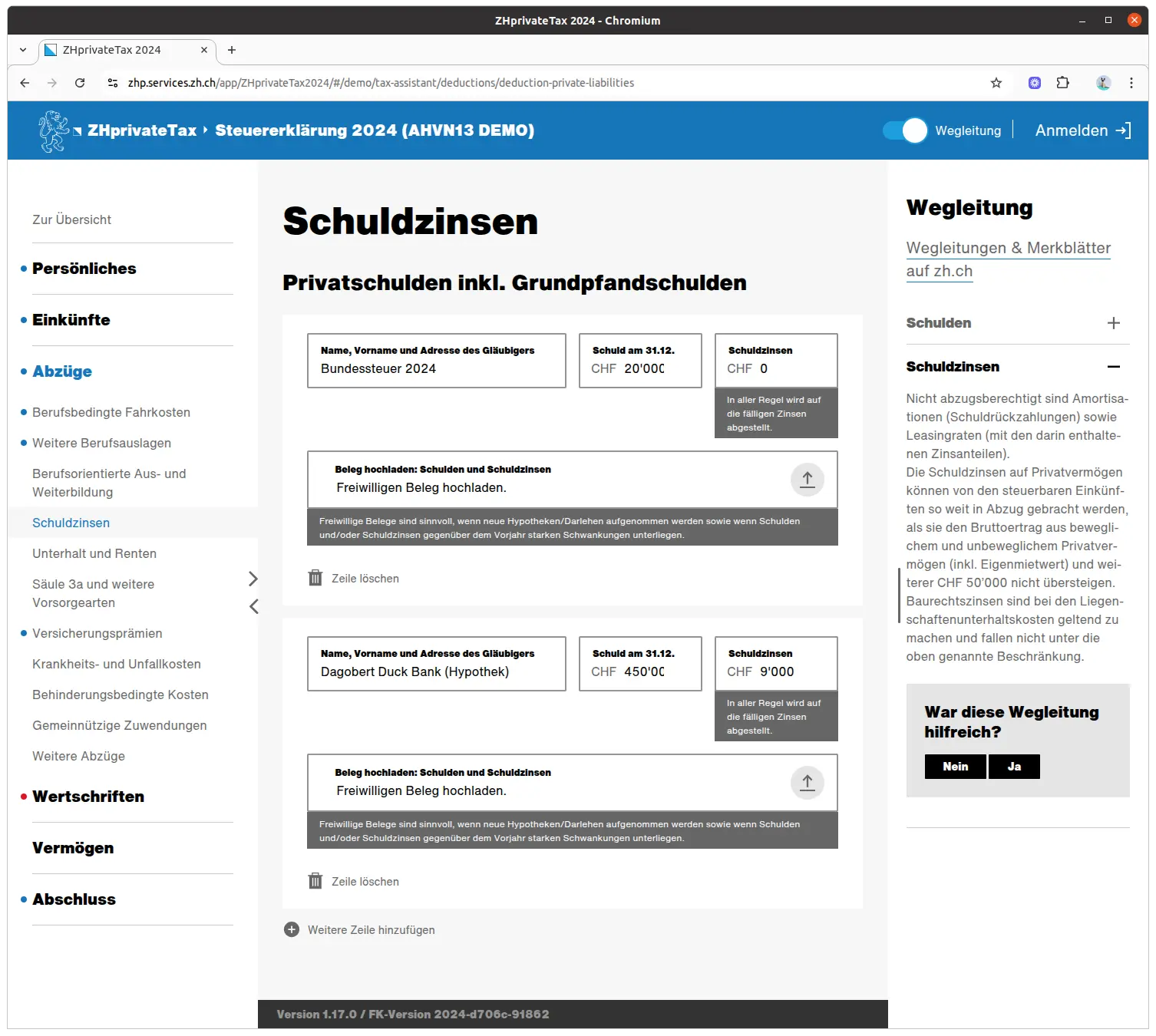

Step 3: Debt deductions

You can deduct your debts. The only debts that cannot be deducted are car leasing debts. This deduction serves two purposes: it reduces your assets by the amount of the debt, and it reduces your income by the amount of the interest.

Mortgages: If you have mortgages, you can list them here and deduct the interest.

Debts: If you have debts because you borrowed money from friends or companies, you can list them here. Or just because you paid your credit card bill late or accidentally exceeded your bank overdraft. But in principle, you should only have debts in exceptional cases.

Federal tax is always due the following year: federal tax for 2025 is due in March 2026 (at least in the canton of Zurich, as no advance is paid). This means that on December 31 of that year, you are in fact indebted to the Confederation, as you have not yet paid the federal tax. And it’s very practical: when you fill in your tax return, the administration sends you the documents relating to the federal tax due. You can then enter this amount and the provisional tax estimate as proof.

And what’s more: if your bank sends you an electronic statement, your credits and mortgages are probably already registered there and will be automatically entered when you download the document.

Note: You’ll find the same form under “Assets and debts”.

As a tenant

You don’t have a mortgage. And you shouldn’t have any debts. Only federal taxes should be entered here.

As an owner or lessor

You should enter your mortgages here.

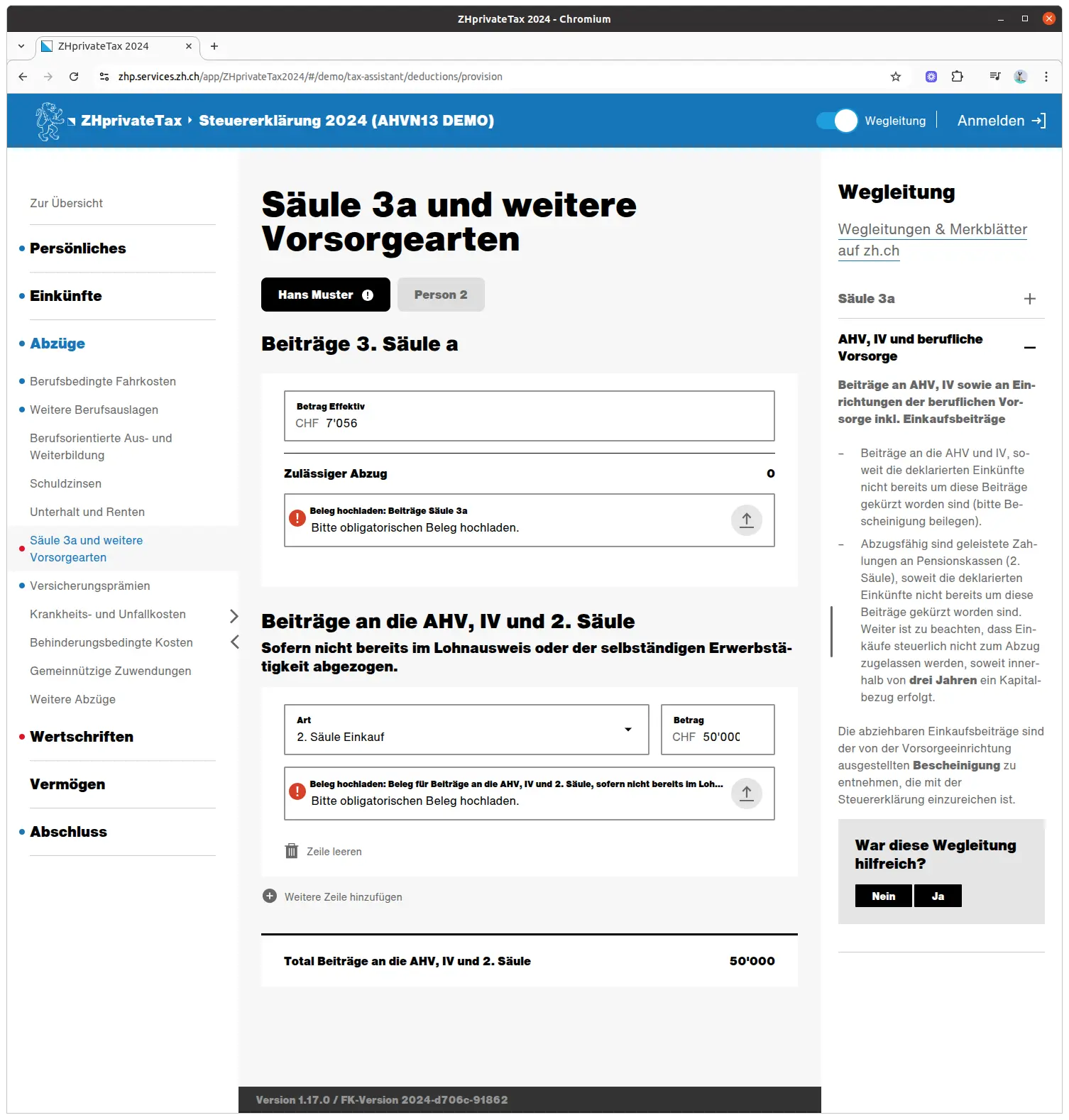

Step 4: Deductions for Pillar 3a, pension provision and insurance costs

Pension

This is where you enter all your pension payments. If you are an employee, your AVS/AHV contributions and regular pension fund contributions are already shown on your salary.

In some cases, however, you must enter these amounts yourself:

- Pillar 2 / pension fund contributions

- Pillar 3a purchases

- As a self-employed person or employee without a pension fund (e.g., salary less than CHF 22,000/year): Pillar 3a contributions (20% of salary, up to CHF 33,000/year)

- AHV contributions for non-employed persons

The last point is important for Mustachians aiming for FIRE: AVS contributions are compulsory up to the age of 65. If you are no longer working because you are FIRE, you will have to pay AHV on your assets. You can deduct these amounts here.

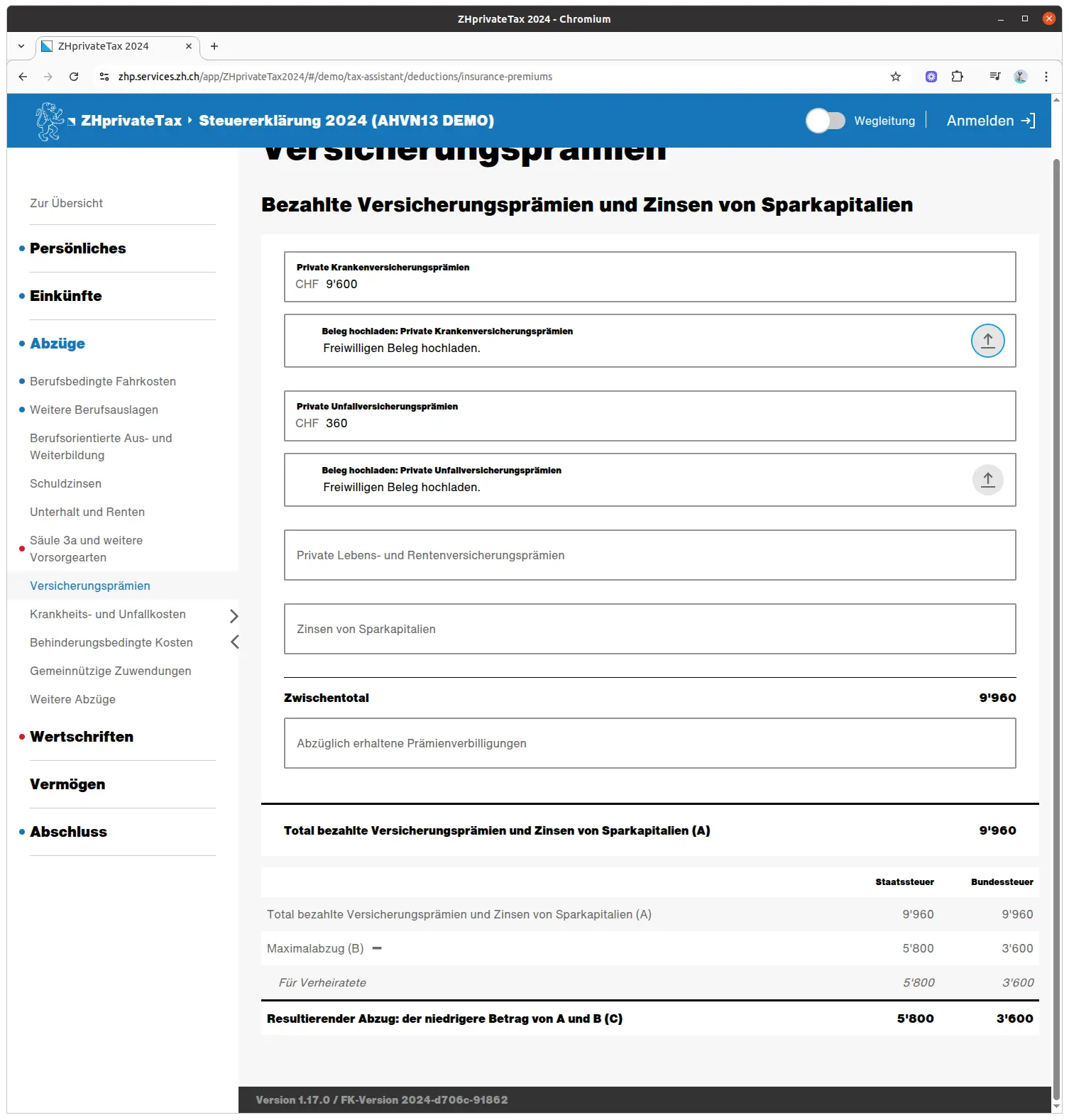

Insurance premiums (health insurance)

You must deduct your health insurance premiums. Your health insurance company gives you a summary of your premiums and other costs, so it should be easy to find this information.

Under “Health insurance premiums”, you should enter the annual costs for you and your family.

If you also have accident insurance and pay the costs yourself (for example, if you’re self-employed), enter the annual costs under “Private accident insurance premiums”.

Interest on your assets influences the calculation. It is automatically added by the software as soon as you have entered your assets.

Subsidies for your premiums should also be entered here.

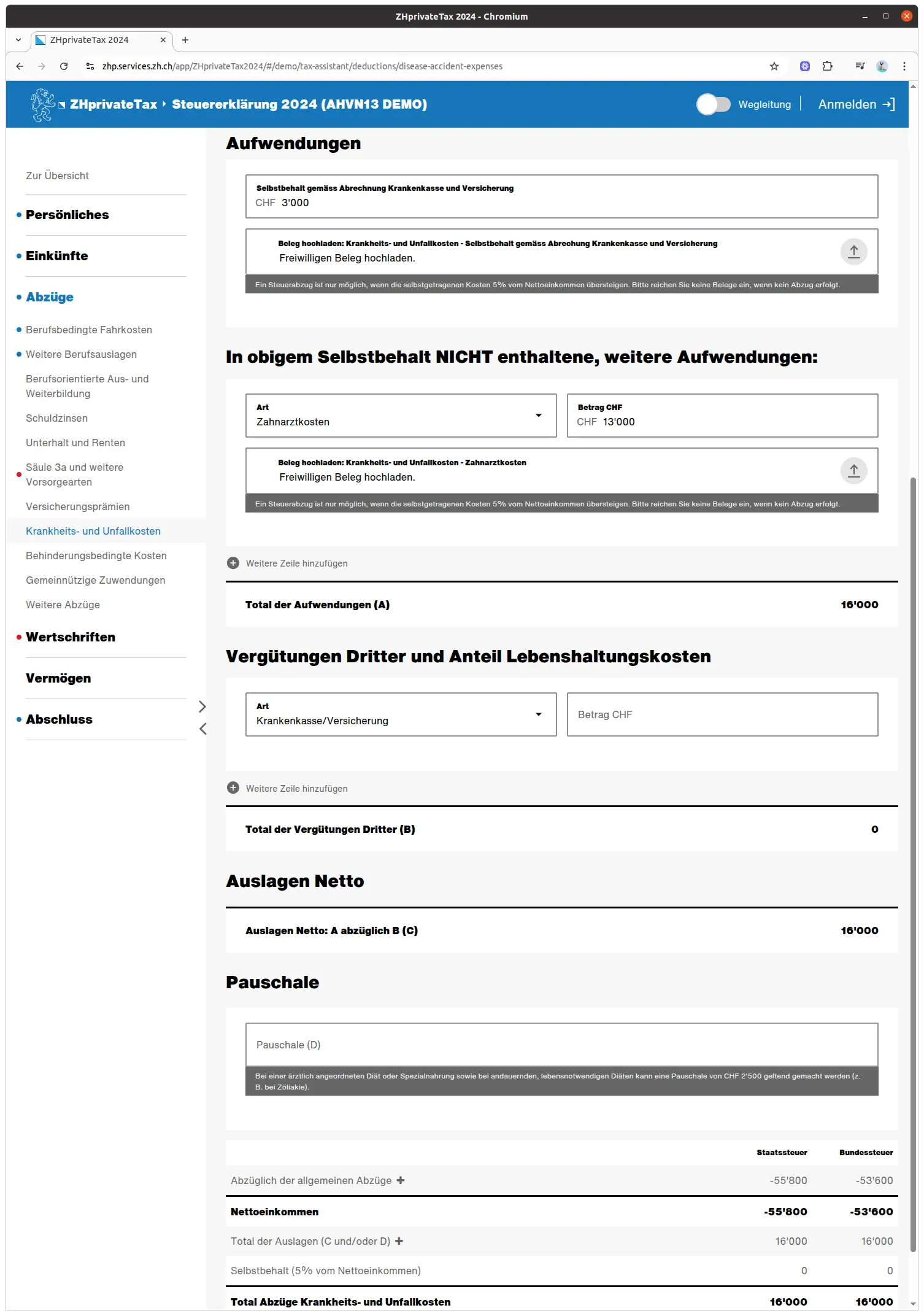

Sickness and accident costs

If you have already received a statement of expenses from your health insurance fund, you must also deduct any expenses that are not covered.

These include

- the deductible paid to the health insurance fund

- dental expenses

- nursing staff

- glasses, hearing aids, etc.

Next step

You see, it’s not that complicated to file your Swiss tax return!

In the next article, we’ll talk about the following sections:

- Donations

- Other deductions

- Bank accounts

- Shares and other securities

- Tax certificate

- Other assets

If you find other tax optimization possibilities in the screenshots above (or if you have a question), don’t hesitate to let us know in the comments!