Spring is slowly arriving. The birds are singing, the days are getting longer, and a letter from the tax authorities arrives: access data for the tax return.

After the initial shock, the conscientious taxpayer immediately takes the first step: scanning the QR code with his smartphone and requesting an extension of the deadline from March 31 to the end of September. Deadlines are a source of stress, and some documents may not be received until after March. Better safe than sorry.

There are various ways to file your tax return in Canton Zurich. The easiest is to do it online with the ZHprivateTax software. All you need is a smartphone, a computer and an Internet connection. If you’re using this method for the first time, you’ll need to install the AGOV application on your smartphone and request access, which may take a few days as some data is sent by post.

Apart from the administrative jargon, the tax return is relatively simple to complete. And if you have any questions, you can always (and free of charge!) contact your local tax office, which has a counter to answer your questions and is generally very helpful. They know that the more they can help you now, the less paperwork you’ll have to fill in later.

Now that you’ve got all the documents you need, and the application installed, you’re ready to go!

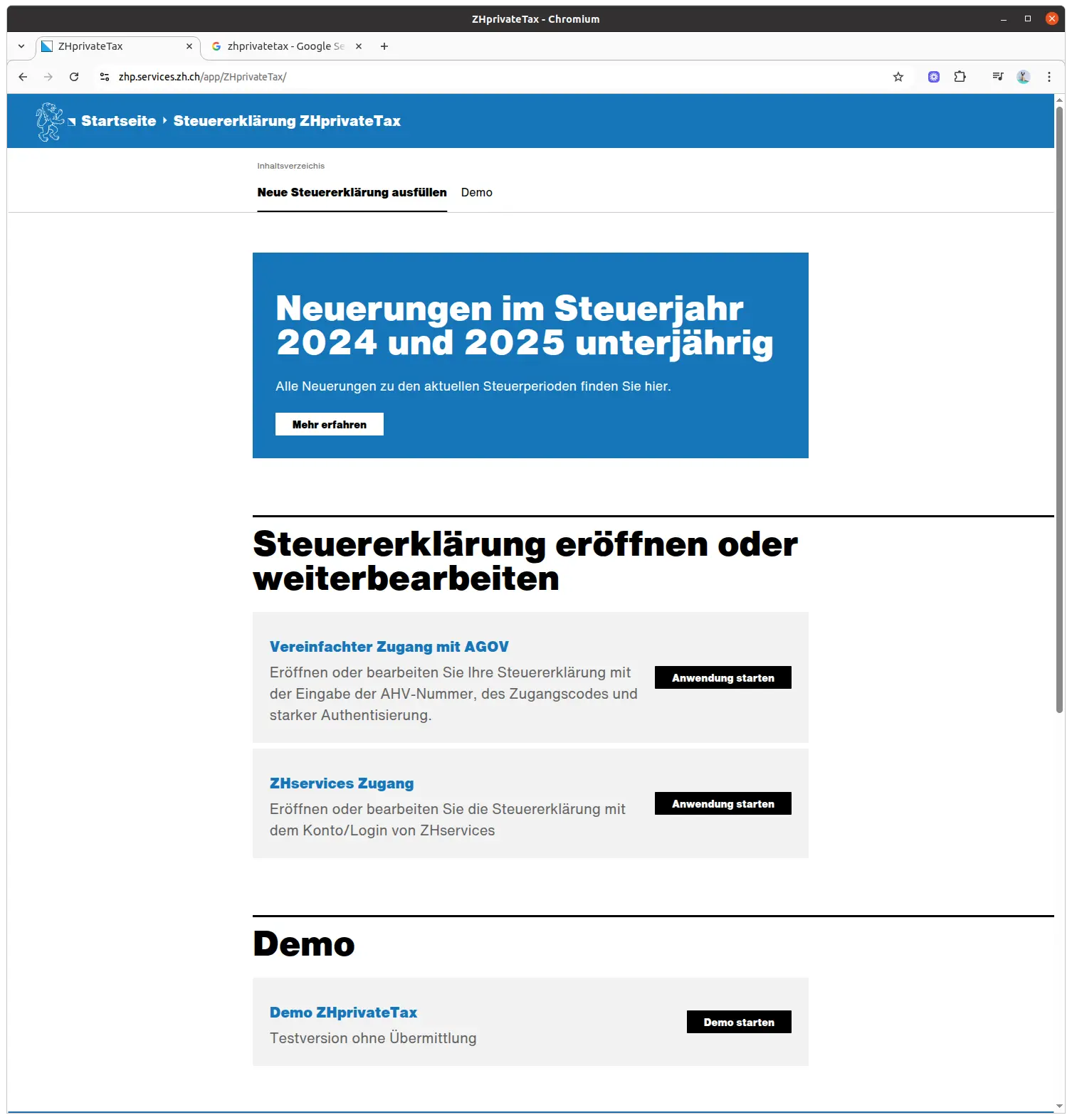

Step 1: accessing ZHprivateTax

You’ll find ZHPrivateTax at this link:

The first time, you’ll need the login details provided in the letter from the tax authorities. Then you can log in directly with AGOV.

Start the app with simplified access via AGOV, scan the QR code with your smartphone and you’re done. The first time, you’ll need the login details provided in the letter from the tax authorities. Then you can log in directly with AGOV.

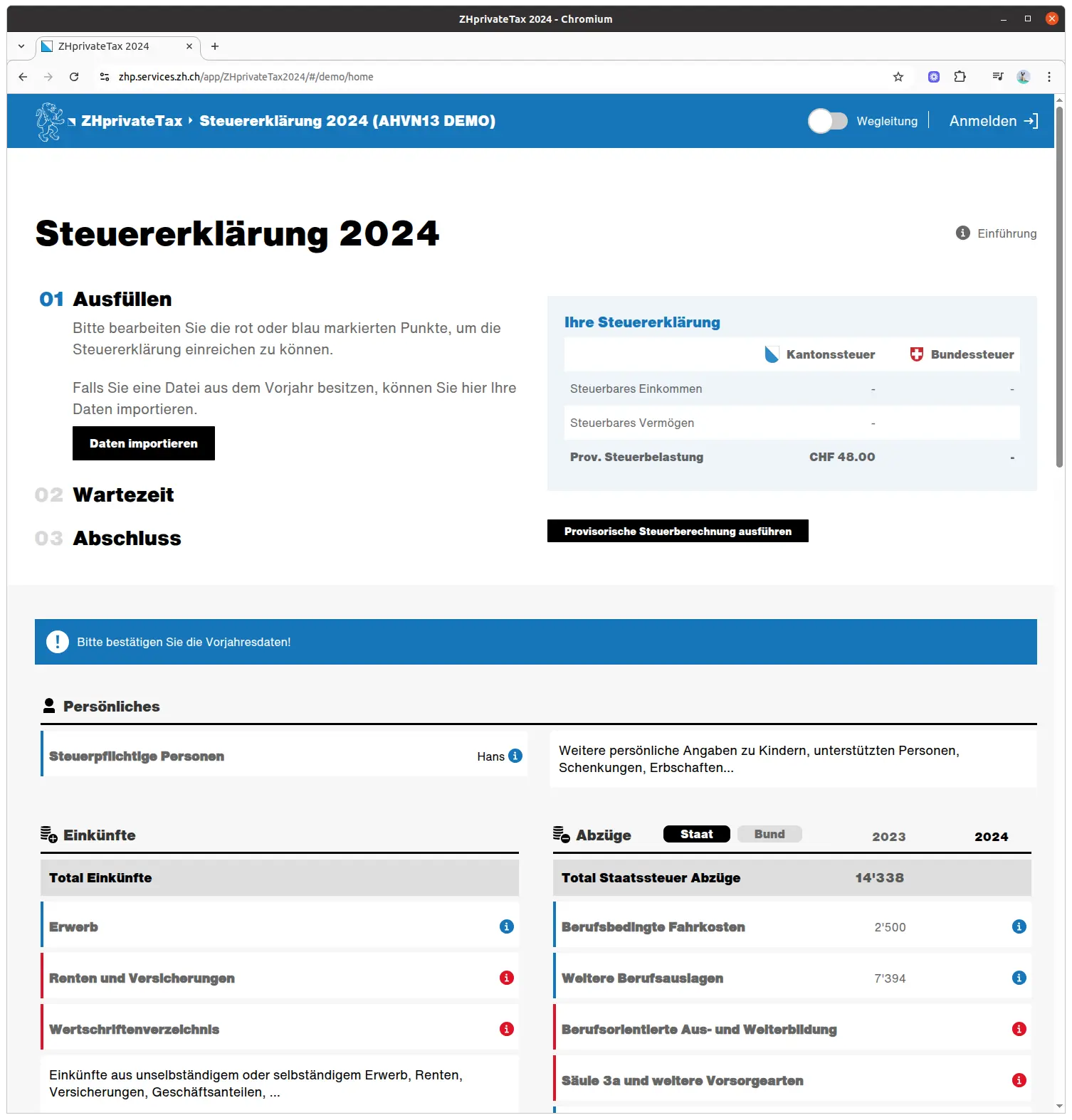

Step 2: Import last year’s data

If you already filed your tax return with ZHprivateTax last year, a lot of data will be imported automatically and you’ll just have to check that it’s still valid. The “Import data” button is only useful if you filed your tax return offline last year and want to import it as a file.

In the tax return, you’ll find instructions in the top right-hand corner. They contain detailed explanations of the currently open part of the tax return page.

To complete your tax return, you now need to go through the various forms in the order shown. The blue and red information symbols show you which information is missing or incorrect.

And you can stop whenever you like and continue on another day, simply by logging out. The next day, you reconnect and pick up where you left off.

Step 3: No need to save

The app automatically saves your data, you don’t need to do it yourself, and there’s no “Save” button anyway.

The only exception: titles. Here, entries are complex and need to be saved explicitly. If you leave the page, the data disappears, so watch out!

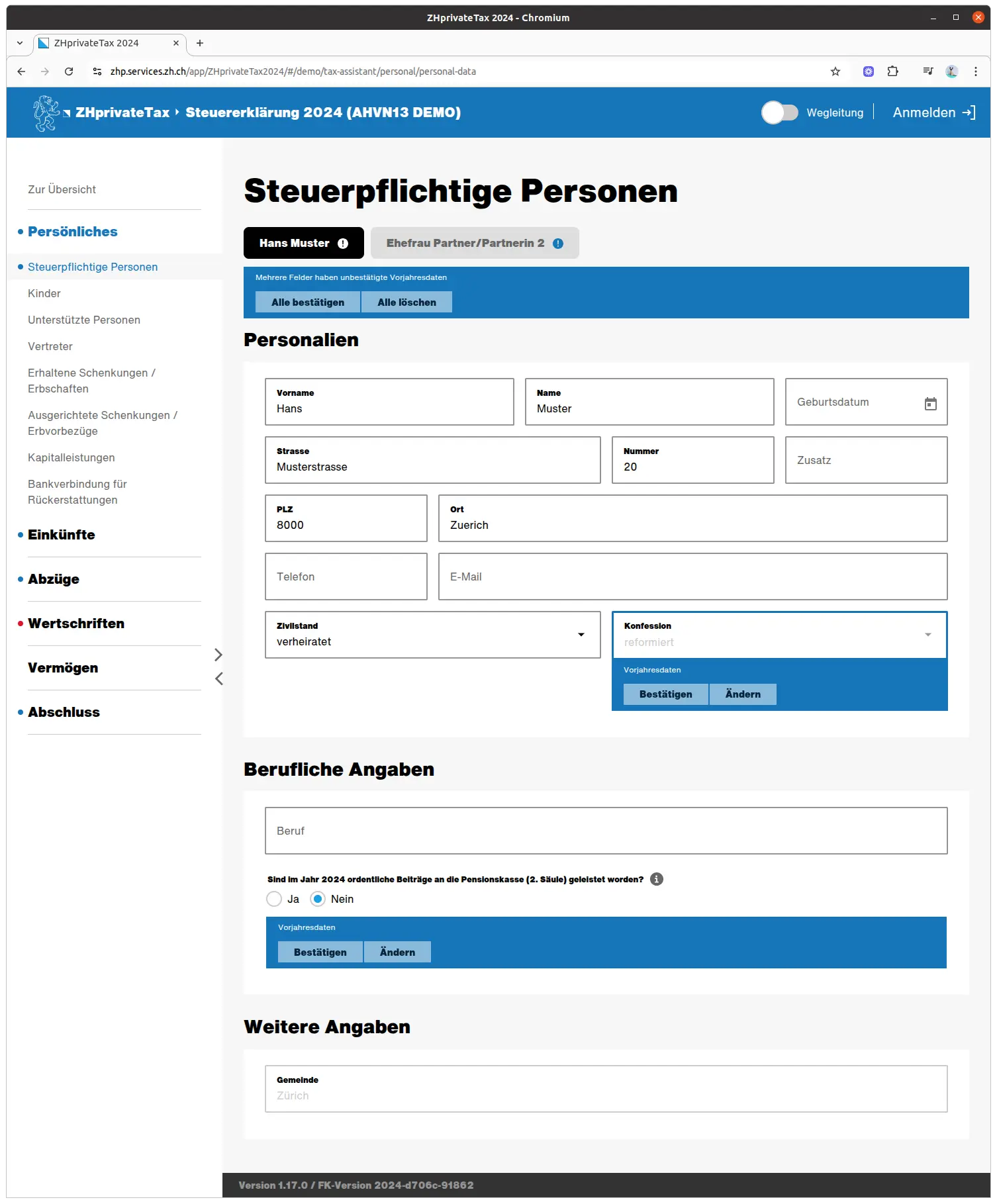

Step 4: “Taxable persons” form

Click on “Taxable persons” to access the corresponding form.

You are now on the “Taxable persons” form in the “Personnel” group. There are several fields to fill in.

The information from your last tax return is already there. All you have to do is click on “Confirm all” and repeat them. And correct if anything has changed.

If your marital status is “Married” or “Registered partnership”, a button for the second person appears at the top. You’ll need to fill in this info too, but finish your own first, otherwise you might forget something.

Your occupation and the question of whether regular contributions have been made to the pension fund are very important here. This is the case if your annual salary is at least CHF 22'680 (situation in 2025). In case of doubt, you’ll find this information on your salary certificate under point 10.1 (ordinary contributions).

You can now enter your wife’s or partner’s details. The form is the same.

From now on, follow the series of forms shown in the left-hand menu. You’ll probably only need two of them: “Children” and “Bank details”.

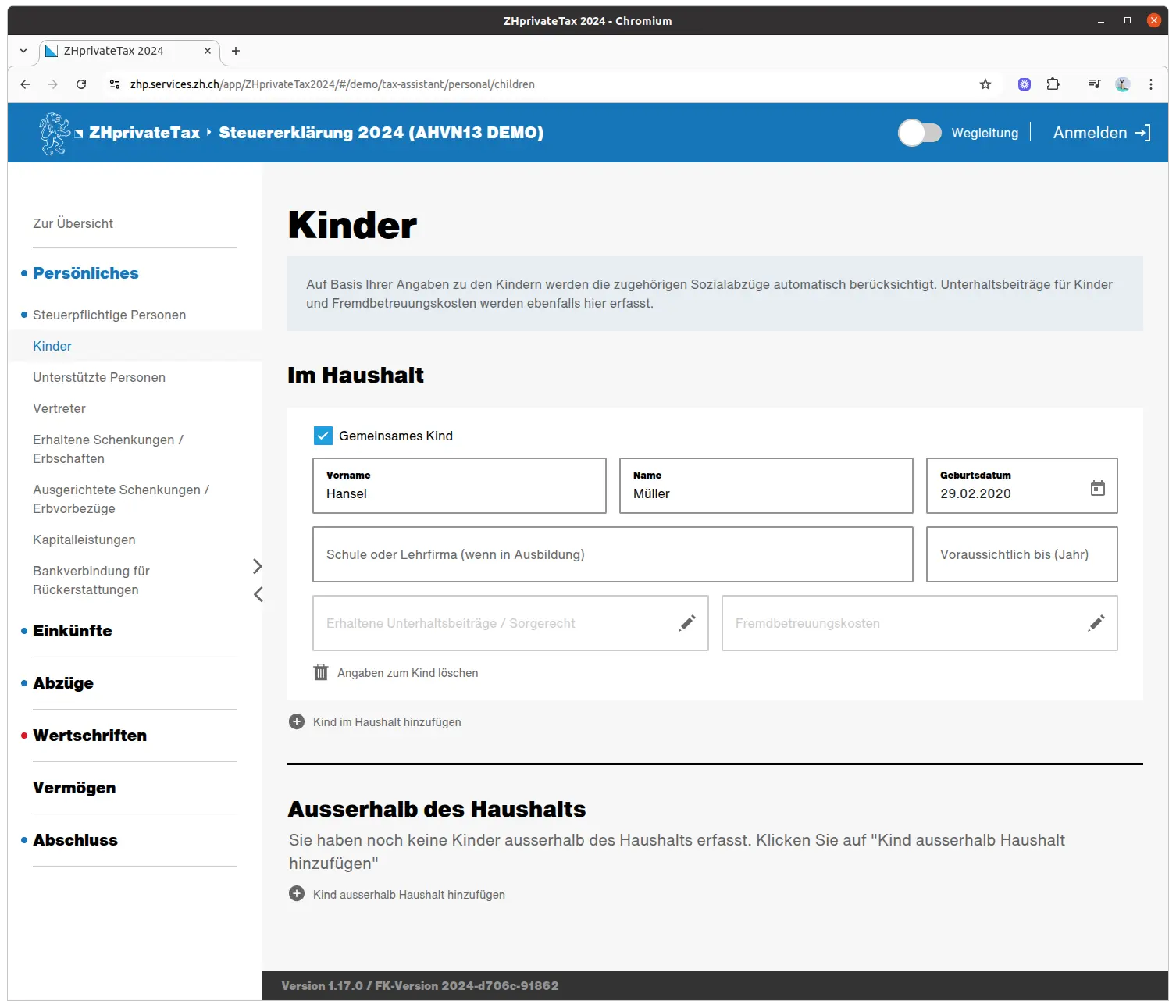

Children

In this form, you must indicate the children you are still supporting financially. The form distinguishes between children who live with you and those who do not.

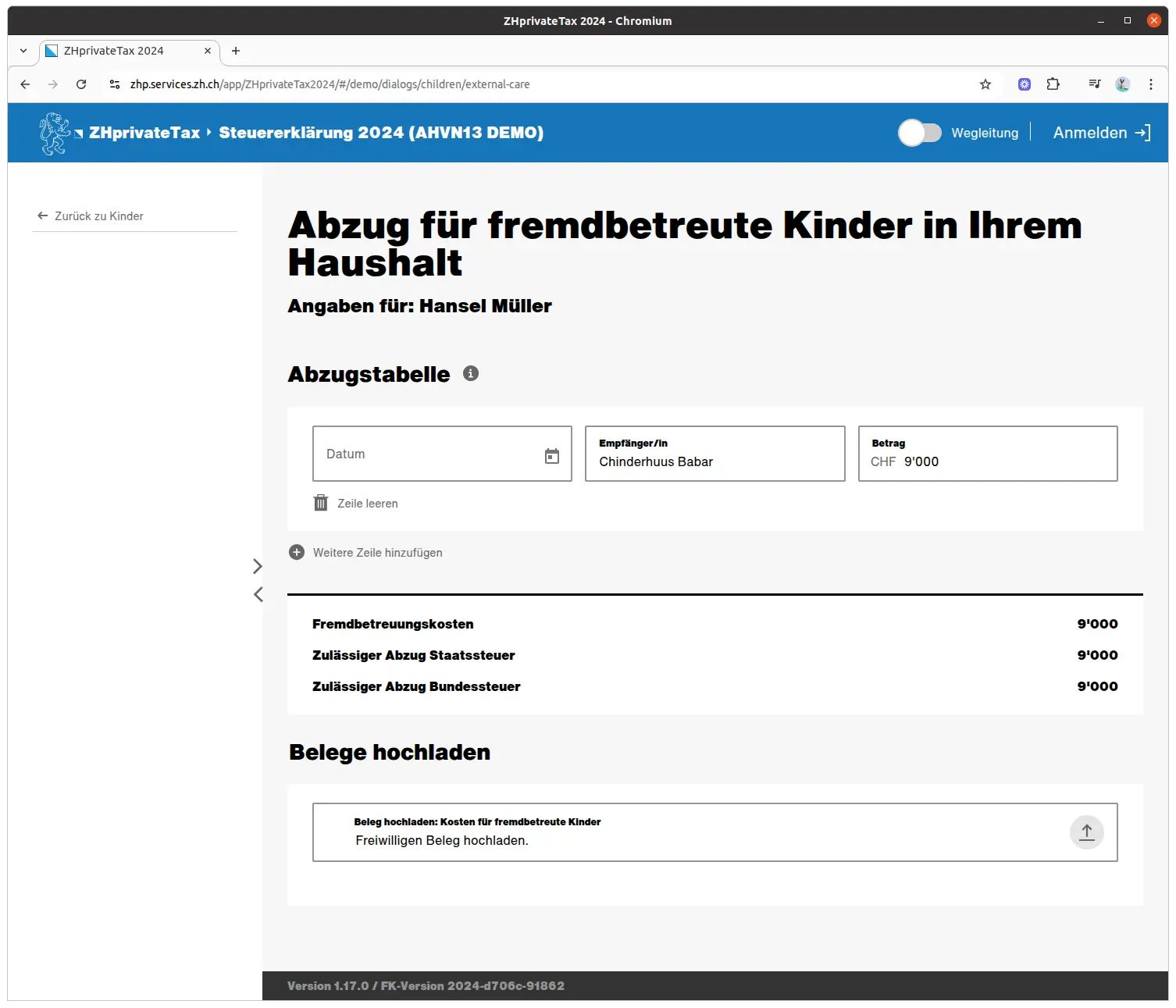

Very important. Here you can enter the costs of third-party childcare. This includes kindergartens, day-care centers and similar facilities.

Bank details for reimbursements

In this form, you enter your bank details. This is super important if the tax department wants to refund money to you. Who wouldn’t want that?

Other forms

The other forms are for very special cases.

Dependants: if you are helping someone financially, often a parent or relative in need.

Representative: if someone else is doing your tax return for you. But this is obviously not your case.

Donations/inheritances received: if you have inherited or are in the process of inheriting (undivided inheritance), this info goes here.

Donations/advances on inheritance paid.

Capital benefits: if you have received capital, for example from a vested benefits account, 2nd pillar, 3rd pillar or life insurance. This is particularly the case if you have withdrawn money from your pension accounts to buy a home (EPL), set up your own business or retire.

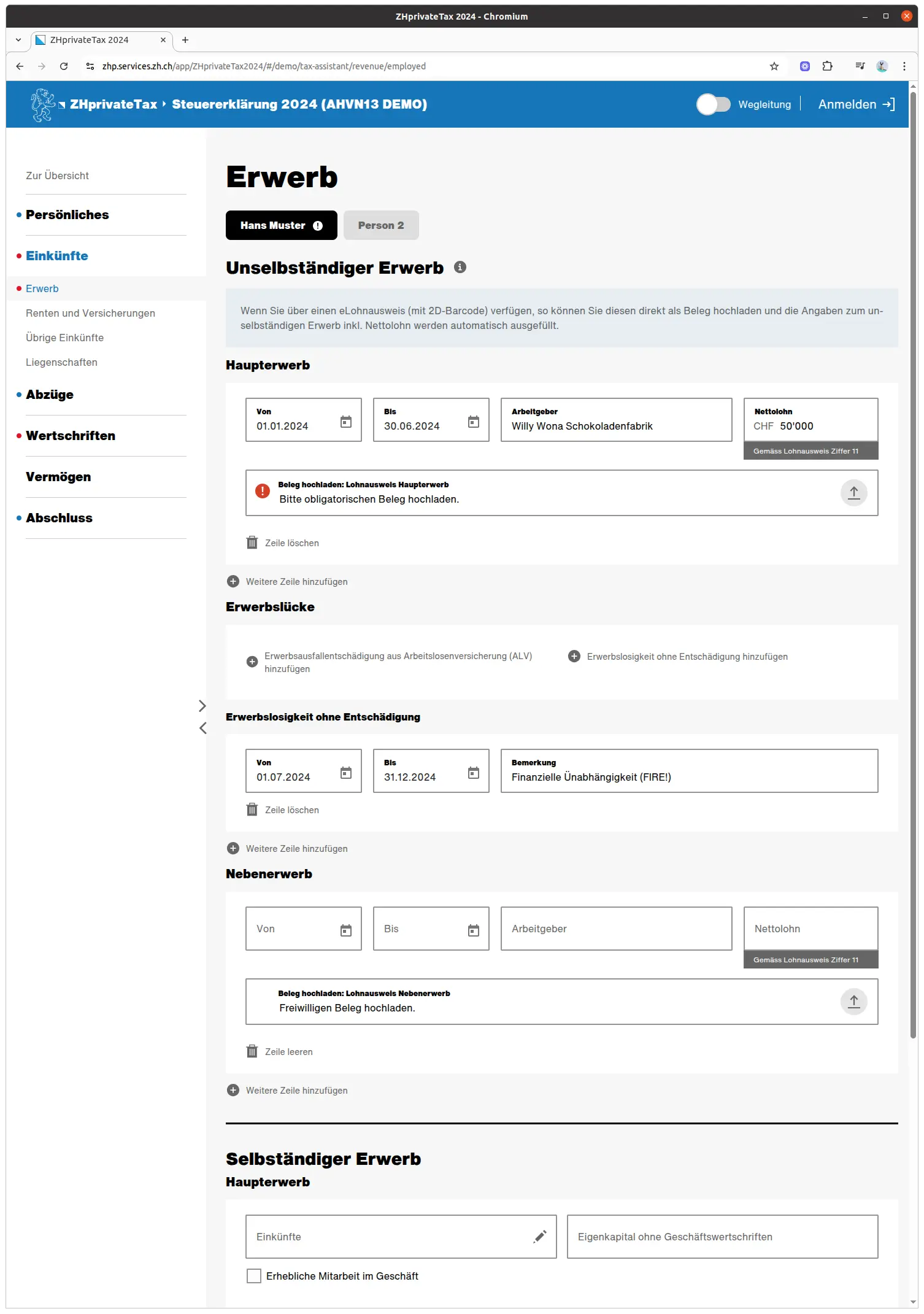

Step 5: Income, earnings, gaps in earnings

You’ve completed all the points under “Personal”. Now let’s move on to the next group: “Income”. Open the “Income” section and go to the “Acquisition” form. Here you can declare your income. And, as with your personal data, you can choose between your own data and that of your wife/partner.

If data from the previous year is available, you can now confirm, modify or delete it.

“Salaried income” is the official term for employees, while “self-employed income” means that you are self-employed. Incidental income refers to small activities such as blogging or mowing the neighbor’s lawn, generally with an income of less than CHF 22'680/year.

As an employee, you’ll find this information on your salary certificate. Indicate your employment details and your net salary (under number 11 on the salary certificate) as they appear on the salary certificate. This already covers all AHV and pension fund deductions, as well as child allowances.

As a self-employed person, you can enter your income and accounting data here.

If you’ve worked for less than 12 months, another entry for breaks in employment will appear automatically. Here you can enter the unemployment insurance you received. And if you’re already FIRE (bravo!), you can declare an “Interruption d’activité sans indemnité”. And don’t forget to register with the OASI administration and pay OASI contributions for people not in gainful employment.

Download proof documents

At this point, you need to provide proof of your declarations (“Pics or it didn’t happen”). But uploading proofs is super simple. Just click on “Download proof”. You now have two options.

The easiest is to already have the documents in digital form, for example in PDF or JPG format. You can then download the files directly from your computer.

And almost as simple. Take a picture of your paper documents with your smartphone and upload them. Choose the appropriate option here, scan the QR code and your smartphone is ready to photograph the documents. Don’t forget to accept the file at the end, otherwise it will be lost.

Other income

You’ll find other forms here. They cover a few special cases.

The “Pensions and insurance” form is for AHV/IV benefits and pensions (e.g. 2nd pillar).

The “Other income” form is for maintenance contributions (e.g. alimony after a divorce), retroactive payments, daily allowances or other payments.

Next step

If you’re salaried like me, these first steps were easy enough.

In the next article, we’ll talk about the following sections:

- Real estate (as a tenant, owner or real estate investor)

- Business-related deductions (travel and other expenses)

- Debt deductions (as a tenant, landlord or lessor)

- Deductions for pillar 3a, pension provision, insurance costs

- Insurance premiums (health insurance)

- Sickness and accident expenses

And if I’ve missed any tax-saving tips in the screenshots above (or if you have any questions), let me know in the comments section below.