Yuh referral code 2026

Use the promo code "YUHMP" when creating your Yuh account on the Yuh app.

You'll get CHF 50 trading credit (valid for 3 months) and 250 Swissqoins after depositing CHF 500 into your account (and you'll help support the blog by the way, thanks!)

For several years now, many of you have been asking me my opinion of Yuh banking and financial services. Each time, I replied that neon was better. Indeed, until early 2025, they offered all the features necessary for a Mustachian wanting a frugal and efficient bank.

But since then, things have changed, and so has my opinion of Yuh. This neo-bank, based on Swissquote’s infrastructure, has become one of the best secondary banks in my opinion.

Yuh Bank review in a nutshell

In a nutshell, here’s my review of Yuh, starting with the benefits of this neo-bank:

What I like about Yuh’s banking services

- Built on a proven and secure banking infrastructure, since it was a joint venture between Swissquote and PostFinance that gave birth to Yuh (initiated by Swissquote CEO Marc Bürki himself). And since 2025, Swissquote has owned 100% of Yuh

- Free account in Switzerland, with no hidden annual fees over the long term (i.e., not a promotion to attract customers)

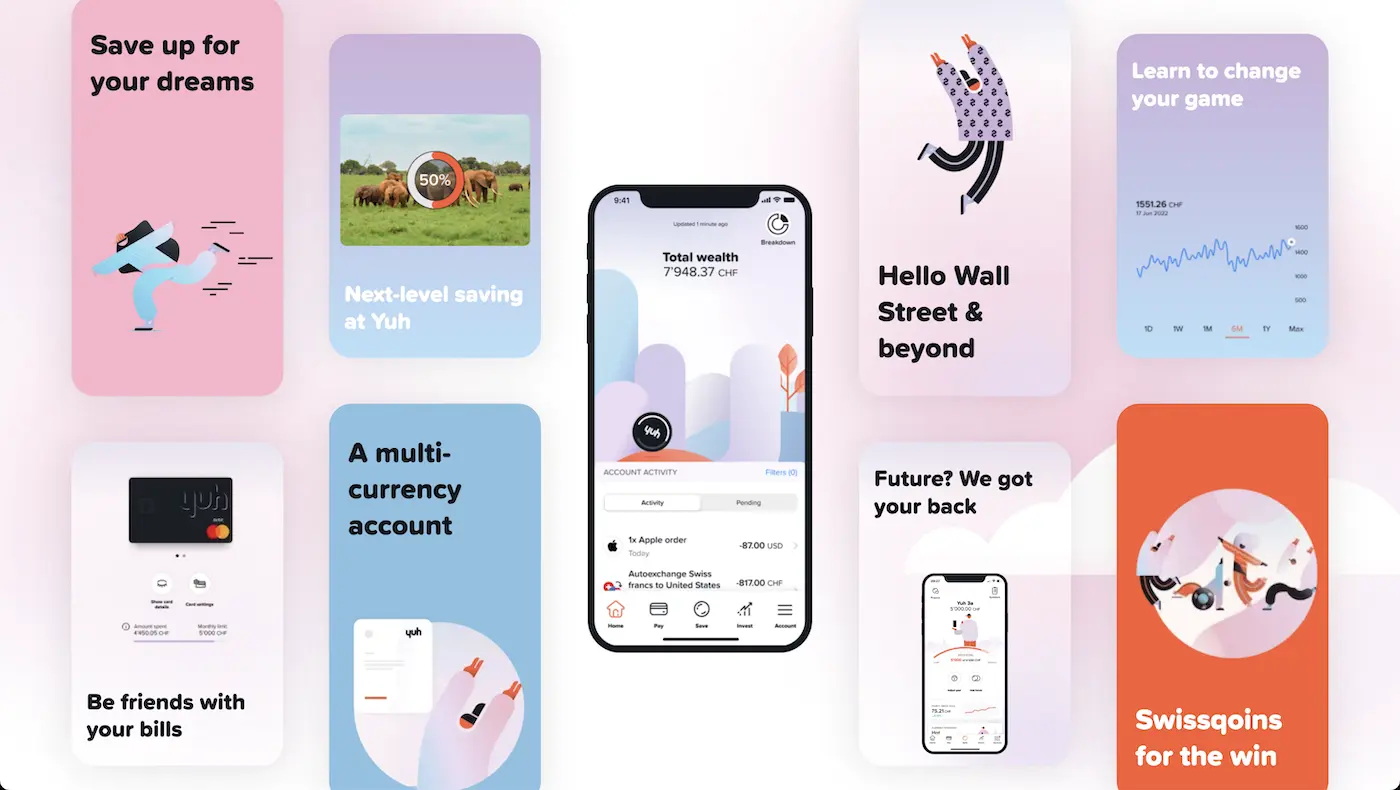

- Nice and easy to use mobile app, and as fluid as a finance app like Revolut (vs. the less fluid mobile banking app from Zak or neon)

- Yuh account is available for cross-border workers, which is not possible with many other Swiss neo-banks (and often forces cross-border commuters to repatriate their salary to a euro account in France or Germany, or opt for an expensive Swiss bank)

- A real, dedicated TWINT Yuh app, rather than the really impractical TWINT Prepaid solution where you have to top up your account before spending (very annoying the last few times I used this via neon)

- Yuh app available in English, which can be very handy for newcomers who haven’t yet mastered one of our national languages

What could Yuh improve in the future?

- No high currency exchange fees, so I can use my Yuh account and debit card for all my online or foreign payments in a currency other than the Swiss franc

- Yuh joint account, but according to their roadmap, this is a feature that should arrive soon in 2026

- More aggressive fees for their Yuh 3a pillar and online trading platform, in order to become so good that they take over the entire Swiss market from their competitors (like IBKR does for brokerage)

MP’s recommendation

Leaving aside my emotional attachment to neon (the first real Swiss neo-bank to exist, and one that I used for a long time), I recommend Yuh Bank to all Mustachians looking for a backup secondary bank. Like neon, Yuh is one of the cheapest and most comprehensive online banks in Switzerland.

If you’re sensitive to a beautiful, fluid and convenient mobile app developed to the highest standards, then I’d recommend Yuh over neon.

To simplify my banking setup, I’m keeping my neon account as a secondary bank. But if I had to choose today, I think I’d choose Yuh for its more fluid mobile application, the ability to withdraw cash once a week for free, and its dedicated TWINT mobile application.

And if you live only in Switzerland without ever spending in foreign currency, or you absolutely want to separate your CHF and “other currencies” spending, then Yuh is one of the best choices for the Swiss franc part.

My story with Yuh

For my part, I started lurking about neo-banks as soon as Zak (Bank Cler) came out in 2018, and neon in 2018-2019.

I started with Zak, then switched to neon. Indeed, the latter is much more innovative as its product is its livelihood, not just a side project.

Then, the neo-bank Yuh was born in 2021, from a partnership between Swissquote and PostFinance. And, in 2025, Swissquote announced that they were taking over 100% of the shares, so as to be fully independent and be able to develop this banking solution even further.

So, for several years now, readers have been talking to me about the advantages of Yuh. Except that, until now, neon has been better than Yuh.

But things changed when neon introduced new fees in order to be profitable in the long term (while Yuh CEO Markus Schwab confirmed publicly that Yuh got profitable after four years in business).

I, for one, chose to switch to Bank WIR’s Bankpaket top, while neon is my secondary bank in case of trouble with the former.

As I explained above, Yuh and neon are equivalent for me. And if I had to choose one today, I’d choose Yuh. After all, I prefer Yuh’s smoother interface for my day-to-day banking, even though it offers almost the same functionality.

Why is Yuh one of the best Swiss banks for a Mustachian?

Yuh online banking is one of the cheapest banks for the everyday banking needs of Swiss Mustachian residents (as long as you don’t need to make payments in foreign currency). From Yuh’s slick mobile app to manage your bank account entirely online, to the free basic fees, Yuh gets the job done — with a very good level of security since it’s based on the infrastructure of their parent company, Swissquote.

Mustachians’ criteria for selecting your frugal Swiss bank

Below are the criteria I use to define the best Swiss bank for a Mustachian:

| Mustachian criteria | Yuh | Comments |

|---|---|---|

| Free base fees | ✅ | No base fee. |

| Mobile and digital banking | ✅ | |

| Secure | ✅ | Regulated by FINMA, data stored in Switzerland, and two-factor authentication for online banking |

| Personal CH IBAN | ✅ | |

| Free bank transfers within Switzerland | ✅ | |

| Free bank transfers within the eurozone | ✅ | Via SEPA transfers (no transaction fees, but exchange rate surcharge) |

| Cheap international transfer costs | ❌ | 0.95% currency conversion fee |

| Free Yuh debit Mastercard | ✅ | |

| No exchange rate surcharge (card) | ❌ | 0.95% currency conversion fee |

| Free ATM withdrawals | ✅ | 1 free withdrawal per week |

| Free cash deposit | 🟠 | Via TWINT |

| QR bill payment via scan | ✅ | |

| eBill support | ✅ | |

| Pot system to sync with YNAB | ✅ | Or CSV export |

| Download account statements in PDF format | ✅ | |

| Real-time push notifications | ✅ | |

| Mobile payment methods | ✅ | Apple Pay, Google Pay, Samsung Pay, and Swatch Pay |

| Dedicated TWINT app (not prepaid) | ✅ | |

| DE / FR / IT | ✅ | And English also supported! |

| Free joint account | ❌ | Not available at all. |

With its bank account and Mastercard debit card, Yuh meets all my Mustachian criteria except:

- Currency conversion fees of 0.95% (both for online and foreign payments, as well as on foreign currency transfers)

- No joint account yet (but it should be sometime in 2026, I think)

But otherwise, financial services offered in the Swissquote’s solution here provides a near-ideal solution for anyone who lives solely in Swiss francs.

In short, when choosing between Yuh or neon without emotional bias, I would take Yuh over neon at this point as my secondary banking solution in Switzerland.

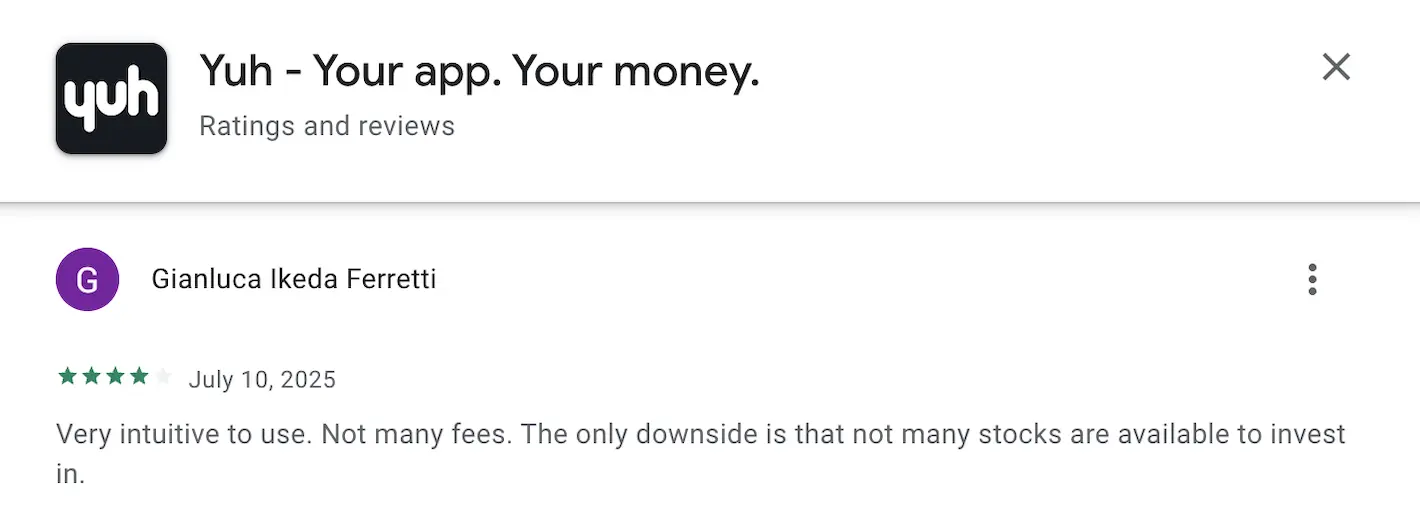

Reviews from Yuh users

As usual before signing up for a new financial service, I check out the online reviews.

Here are a few screenshots (from January 2026).

Average ratings Yuh mobile application on app stores

First of all, you’ll find below the average ratings of Yuh app reviews on iOS and Android app stores:

Yuh does well with a mobile app downloaded thousands of times, and ratings above 4 on 5 on both major mobile platforms.

Yuh finance app reviews on app stores

And here are some public reviews from Yuh users on Apple’s App Store and Google’s Play Store (most of them positive reviews at the time of writing, with a few grumblers in the middle as usual):

You can also use these links to check out the most recent reviews of the Yuh iOS app and the Yuh Android app depending on your smartphone type.

You’ll appreciate that Yuh’s customer service responds to many comments in real time.

Alternatives to Yuh — and how they compare

neon or Yuh

neon was the best Swiss bank until 2025. Then, with the introduction of their new neon fee schedule, Yuh became better for all operations in Switzerland in terms of fees.

This is where Yuh stands out from neon:

- 4 free withdrawals per month, at any ATM (whereas neon charges after the first one)

- A dedicated TWINT Yuh app, rather than neon’s TWINT Prepaid app, which is much more cumbersome to use

- Smoother Yuh mobile application than neon’s, on both iOS and Android

On the other hand, neon offers a joint account solution (called neon duo) at CHF 3/person, while Yuh has yet to release its own.

Similarly, if you want to make neon or Yuh your main account, be aware that Yuh’s exchange fees are high at 0.95% (of the transaction amount), compared with 0.35% for neon (“free” plan).

Also, note that I’m not talking about the stock market investment features offered by both Yuh and neon, as there are Swiss trading platforms for Mustachians that are much more advantageous for you (to buy ETFs or stocks).

As a reminder: I use WIR bank as my main bank, and I recommend Yuh as my secondary bank.

Yuh or WIR Bank (Top banking package)

Bank WIR has launched its “Bankpaket top”, which ticks all the boxes for Mustachians like you and me, whether it’s the free private bank account or the 100% free joint account too, via a dedicated WIR Bank TWINT app, and with an interbank rate with no surcharges applied for foreign currency transactions (both online and abroad).

So, of course, the Yuh mobile app is much more modern than the three (!) Bank WIR mobile apps. But in use, that’s not really a problem: you have a main Bank WIR ebanking app, an app to confirm your transactions (when there’s an anti-fraud check, for example), and an app to track your transactions instantly with the Bank WIR debit card.

But when you’re looking for a single bank for all your daily transactions (whether in CHF, EUR, or USD), then you choose the Bank WIR. And you take the online bank Yuh as your secondary backup bank.

Another alternative for the more anxious: Yuh as your main CHF bank, and Bank WIR as your bank for online and foreign transactions. But that makes the setup too complex for me.

Yuh or ZKB (Zürcher Kantonalbank)

Zürcher Kantonalbank offers a free private account: the “ZKB Banking” package. Like Yuh, it includes a free debit card, a dedicated TWINT app, and the usual e-banking platforms. On the other hand, ZKB’s foreign currency transaction fees are 1.25%, compared with Yuh’s 0.95% — in both cases, far too expensive for a Mustachian.

ZKB Banking’s biggest disadvantage is that it’s only available in German (whereas Yuh is available in four languages: French, English, German and Italian).

On the other hand, ZKB Banking does offer a joint account (free of charge).

So if you speak Swiss-German and want a joint account, then ZKB Banking is better. But in all other cases, Yuh and ZKB Banking are equivalent, as long as you only use them in Switzerland in CHF.

Yuh or Zak

In its early days as the first neobank, Zak was one of the best online banks in Switzerland. Then came the competition, like Yuh. For use in Switzerland in CHF, the two neo-banks are virtually equivalent, apart from a few specific features.

Yuh is better than Zak for:

- Yuh offers its mobile app in English, Zak does not

- Yuh offers one free withdrawal per week at any bancomat, while Zak offers unlimited withdrawals, but only at Cler Bank bancomats

- Yuh doesn’t have an annoying daily payment limit of CHF 5,000 (and CHF 25,000 per week), as Zak does

On the other hand, Zak offers you physical branches (those of Banque Cler). At first, this reassured me. But I’ve never actually been there, so it’s not really an argument of choice for me anymore.

Good to know: neither Yuh nor Zak offers you a joint account.

If I had to choose between the two for a Swiss secondary bank, I’d take Yuh, because the Yuh app is more fluid and pleasant to use.

Yuh or Radicant

The neobank Radicant ceased all operations in November 2025. They will recommend a way out to all their customers. All of their assets are protected (i.e., no money is lost).

So Yuh is the logical winner.

Yuh or Migros Bank

Despite its status as a traditional Swiss bank, Migros Bank is one of Switzerland’s least expensive solutions. It has its own branches and offers you the largest number of ATMs in Switzerland, with the possibility of withdrawing money from all Migros cash dispensers!

Another feature that sets Migros Bank apart from Yuh is that it offers a free joint account. On the other hand, Migros Bank charges for SEPA transfers in EUR, whereas Yuh does not.

By contrast, the Yuh mobile app is available in English (Migros Bank isn’t) and is much more modern and fluid.

If you want a joint account, Migros Bank is better than Yuh.

If English is more important, then Yuh takes first place.

And else, Yuh and Migros Bank are equivalent as a secondary bank for a Swiss Mustachian.

Yuh or Alpian

Alpian is an online private bank. It also offers investment services. However, as a premium bank, it charges premium account management fees (minimum 0.75% investment mandate fee). And Alpian does not offer joint accounts (like Yuh, for that matter).

Where Yuh sets itself apart from Alpian is by offering a free physical debit card, free ATM withdrawals, eBill support, and a dedicated Yuh TWINT app.

For all these reasons, Yuh is better than Alpian.

Notes on Revolut and N26

Although Revolut and N26 offer innovative banking services, they are not suitable for everyday use in Switzerland.

For example, neither provides a personal IBAN in Swiss francs.

Revolut only offers a pooled Swiss IBAN, which often complicates the receipt of the monthly salary. In fact, a specific reference must be indicated in the “Message to recipient”* field, which is not always compatible with automatic salary payment systems.

On the N26 side, the IBAN is in euros, which makes it impractical for personal finances in CHF.

The same restrictions apply to typical Swiss functions, such as the absence of TWINT or eBill.

Finally, neither Revolut nor N26 has a Swiss banking license, which may pose a problem for some people.

So, as a Swiss bank, Yuh is better than Revolut, and Yuh is also better than N26.

Yuh: open an account in 10 minutes

The opening procedure is so simple that I don’t need to provide you with detailed screenshots.

The whole 3-step process is fully digitalized and takes just 10 minutes:

- Download the Yuh app (iOS AppStore, Android Google Play Store on your smartphone

- Create your account with the code “YUHMP” via the Yuh app by entering your personal details (have ready your ID card or passport and proof of address, such as a utility bill or mobile phone bill)

- Fund your account (by making an initial cash deposit from a bank account held in your name). Pro tip: if you deposit CHF 500 when you open your account, you will receive 250 Swissqoins (+ CHF 50 in trading credit, valid for 3 months, if you use my code)

And… that’s it!

FAQ about Yuh

Who can open a Yuh multi-currency account?

Anyone over 18 can open a Yuh account. Another big advantage of Yuh over the competition is that you can open a Yuh account even if you live in one of these countries:

- Switzerland

- Germany

- Austria

- Italy

- Liechtenstein

- France (these departments only: Ain, Allier, Alpes-de-Haute-Provence, Hautes-Alpes, Ardèche, Aube, Côte-d’Or, Doubs, Drôme, Isère, Jura, Loire, Haute-Loire, Haute-Marne, Meurthe-et-Moselle, Meuse, Moselle, Nièvre, Puy-de-Dôme, Bas-Rhin, Haut-Rhin, Rhône, Haute-Saône, Saône-et-Loire, Savoie, Haute-Savoie, Vosges, Territoire de Belfort)

However, as with many Swiss banks, you cannot open a Yuh account if you are an American citizen or a permanent resident of the USA.

Can a German person open a Yuh account in Switzerland?

Yes, a German resident can open a Swiss bank account at Yuh.

Can a French person open a Yuh account in Switzerland?

Yes, you can open a Yuh account as a French cross-border commuter. However, you must reside in one of the departments listed above.

Which bank is behind Yuh?

The Yuh neo-bank was originally founded by Swissquote and Postfinance. Then, in 2025, Swissquote acquired 100% of the shares and now runs Yuh on its own.

Whatever happens, this is a major advantage for Yuh. Indeed, it benefits from Swissquote’s banking license, which offers you deposit guarantee of up to CHF 100'000 thanks to the Swiss banking law and other Swiss financial laws.

Does Yuh offer a youth account?

Yes, Yuh has the advantage of offering an account for 14-17 year olds with a free card, TWINT, free withdrawals, and zero overdraft.

This Swiss teenager’s account for teenagers is called Yuh 14.

Does Yuh offer a free physical Mastercard debit card?

Yes, compared to other neo-banks, Yuh offers a Mastercard debit card in physical format 100% free of charge.

Does Yuh offer a pillar 3a?

Yes, Yuh also offers a pillar 3a for your private pension provision. However, there are other, better 3a pension solutions on the market (you can find my comparison of the best 3a pillars on this link).

Do I pay conversion fees if I deposit foreign currency directly into my Yuh account?

No. If you deposit euros, US dollars, or any of the 13 foreign currencies supported by Yuh, no conversion fees apply.

You can then use these currencies directly to make payments or transfers.

Conclusion Yuh account

For us, Swiss Mustachians, the neo-bank Yuh is one of the best digital banks in Switzerland for a secondary bank account.

If I had to choose today, I’d choose Yuh over neon, because Yuh offers free ATM withdrawals, a dedicated Yuh TWINT app, and a smoother Yuh mobile app.

I’m staying with neon (as a secondary account) only because I have an emotional attachment to this bank AND above all, because I don’t want to close one account to open another (especially as it’s my backup Swiss bank account).

You'll get CHF 50 trading credit (valid for 3 months) and 250 Swissqoins after transferring CHF 500 into your account (and you'll be helping to support the blog in the process, thanks in advance!)