In the previous chapter, we saw the theory of how withholding taxes work for a Swiss investor.

Let’s now move on to practice :)

Let’s start with the simple case of the Swiss withholding tax on a Swiss share dividend.

Reminder for new readers: a security simply means something you own in your name, such as a share, an ETF, a bond, or any other financial security.

Scenario 1: a Swiss buys a Swiss share

The Swiss withholding tax law for Swiss securities observes the following rule:

- You have a brokerage account with cash on it

- You buy Swiss securities (such as Roche, for example) with this cash

- During the year, you receive dividends from Roche

- These dividends are subject to 35% Swiss withholding tax before you even see the cash in your brokerage account

Then, since you are not the type to let 35% of your passive returns fly away, you declare your Swiss taxes correctly, by following my comprehensive guides on how to complete your Swiss tax return:

- Tutorial ZHprivateTax Tax Return (Part 3)

- Tutorial TaxMe-Online Bern Tax Return (Part 2)

- Tutorial eTAX AARGAU Tax Return (Part 3)

- Tutorial GeTax Tax Return (Part 2)

- Tutorial VSTax Tax Return (Part 2)

- Tutorial FriTax Tax Return (Part 2)

- Tutorial VaudTax Tax Return (Part 2)

- Tutorial eTaxes St.Gallen Tax Return (Part 1)

- Tutorial eTax Solothurn Tax Return (Part 2)

- Tutorial eFisc Thurgau Tax Return (Part 3)

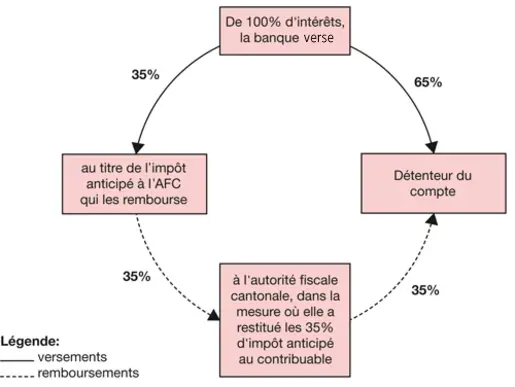

This is how the scenario unfolds:

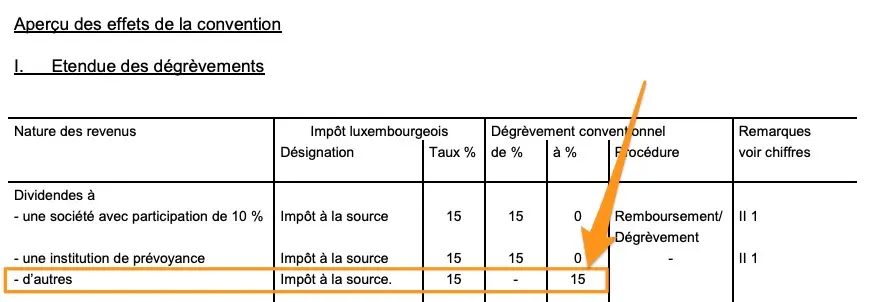

- You receive CHF 500 in dividends from Roche in 2020

- You therefore only received CHF 325 on your brokerage account (because CHF 500 - (500 x 0.35) = CHF 325) as the state withheld 35% tax on it

- Then, in March 2021, when you receive your tax bill of CHF 10'000 for example, well then these CHF 175 (= CHF 500 - CHF 325) are returned to you at that time. This means that instead of CHF 10'000, you will only pay CHF 9'825 in taxes

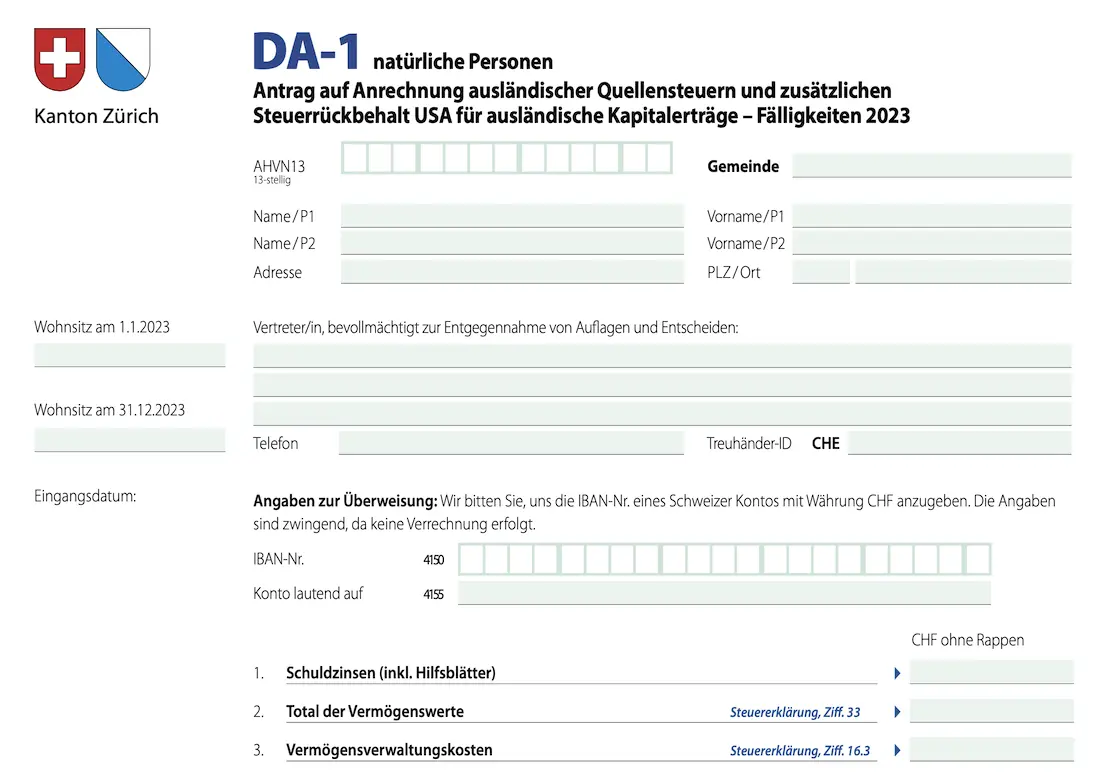

Federal Tax Administration’s image summarizes the situation well (all the details are on this page of their site if you are interested):

And if you defraud the Swiss tax authorities by not declaring your securities, this is what happens:

How does the Swiss withholding tax on Swiss securities work, when you defraud the tax authorities (original image credits: Federal Tax Administration)

The case of the Swiss withholding tax on the dividend of a Swiss share is therefore as simple as that: 35% withholding tax on Swiss dividends, which you can reclaim on your Swiss tax return.

Swiss share withholding tax summary for L1TW and L2TW:

- L1TW: not applicable (because you hold the share directly and not via an ETF)

- L2TW: 35%, recoverable on your Swiss tax return

Let’s see how it goes when you own a Swiss ETF.

Scenario 2: a Swiss buys a Swiss ETF such as “UBS ETF (CH) SMIM (CHF) A-dis”

This UBS ETF replicates the SMIM index, which contains the 30 largest mid-sized companies in the Swiss equity market (including Lindt, Schindler, Logitech, Sonova, etc.) that are not included in the SMI index (containing for its part the Nestlé and Roche companies).

Here is what happens in terms of dividends:

- You buy an ETF “UBS ETF (CH) SMIM (CHF) A-dis”

- Each company in this ETF will pay its dividends to the distributor of the fund (i.e. UBS in this case)

- Then, once a year (in September for this ETF), the UBS ETF will pay you a dividend

Swiss ETF withholding tax summary for L1TW and L2TW:

- L1TW: the Swiss tax authorities will deduct 35% of all dividends paid by the companies in this ETF to UBS. Then, UBS will recuperate these 35% via a specific tax form (as if UBS were filing its Swiss tax return) (source: Asset Management Association (point 27), FTA circular no. 24, point 2.5 — thanks to Jonas for providing me with these verified sources!). So, as an investor, you don’t suffer any losses in this area

- L2TW: when UBS (the one that issues our ETF) pays you your dividends, the Swiss tax authorities take 35% of withholding tax which you can recover on your Swiss tax return (as we saw for Roche in the section above)

Now it’s time to focus.

We’re going to deal with the question that everyone is asking me:

But MP, how does it work with the withholding taxes if I own US/Irish/German/Japanese/etc. securities? Is it the same mechanism that applies with a rate of 35%?

The answer: nope!

The 35% rate corresponds to the Swiss withholding tax law. For your securities from other countries, it’s in the next section.

Specifics of withholding taxes on foreign securities

As long as we’re talking about Swiss securities, the process is simple.

But as soon as we talk about foreign securities (such as my favorite ETF VT), it gets a bit more complex. Again, the recipe is complex, but not complicated once you know what to do. That’s what we’ll see below with lots of concrete examples.

The basic rule to understand is that each country has its own withholding tax law.

So, each country levies withholding tax on your dividends before they arrive on your account.

And the complexity of this section lies in the fact that you need to find out about each country where you invest to know the tax rules, so that you can recover this withholding tax and not lose part of your returns.

Then, if you are like me, i.e. an investor who focuses on simplicity and efficiency, then you will only have to control the tax rules of two or three countries maximum [1].

In the tax software VaudTax, you report Swiss shares and ETFs in section 1, and foreign shares and ETFs in a separate section 2

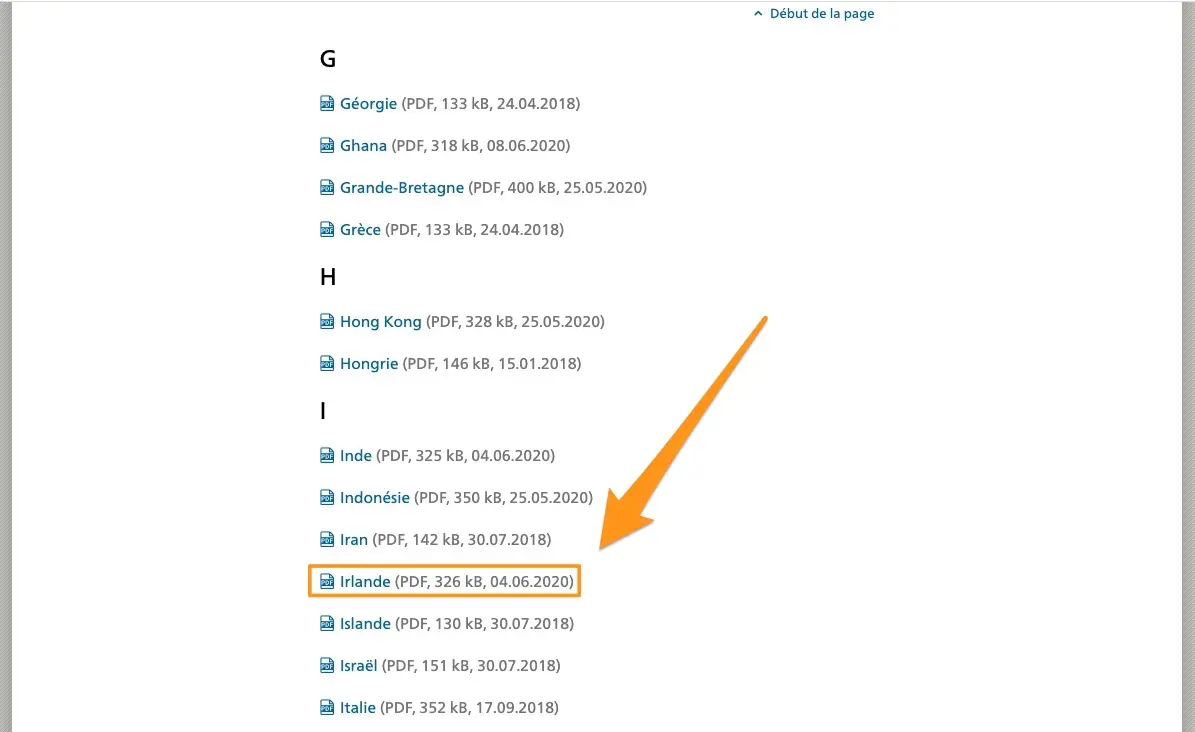

The Swiss website to know about withholding tax on foreign income is this one: FTA — Foreign withholding tax by country. Here you will find all the agreements between Switzerland and each country.

But as you can see, it’s a lot of jargon to read. So, to get straight to the point, here are the two other sites I recommend to find out the amount of withholding tax per country:

- Default withholding tax rate for each country in the world (site by PWC)

- Swiss resident withholding tax rate for each country in the world, including double tax treaties (i.e. with the default rate reduced)

To fully understand this mechanism of conventions, I am copying here the explanatory text of the FTA:

Double tax treaties are designed to avoid double taxation of the income or assets of individuals or legal entities that meet the foreign connection criteria. These conventions are therefore an important element in the promotion of economic activities on the international scene. Switzerland has concluded more than 100 of them to date and is striving to further extend their network.

Without jargon, you, the Swiss investor does not want to pay taxes on your dividends in Switzerland and abroad too. Hence the existence of these conventions aimed at avoiding this double taxation.

It’s easy for the Swiss shares/ETFs that pay you dividends as a Swiss investor. Because it is declared and done automatically via the tax software of your canton.

On the other hand, to be able to claim the withholding tax levied from any country other than Switzerland, you have to use a specific form.

[1] If you are interested in value investing, you will have to do more homework. But if you’re at this level of investment knowledge, it shouldn’t be a problem for you ;)

DA-1 form for the refund of withholding taxes on foreign dividends, the Swiss investor’s sesame

This DA-1 form is the key to getting your withholding tax refunded on foreign income.

Imagine that you have CHF 500'000 invested in a French ETF, and that this ETF pays you CHF 20'000 (aka 4%) in dividends every year.

We agree that you would not want to see the French government take 15% (the amount of the French withholding tax according to the Franco-Swiss treaty), i.e. CHF 3'000, and never see them again? Do we agree?

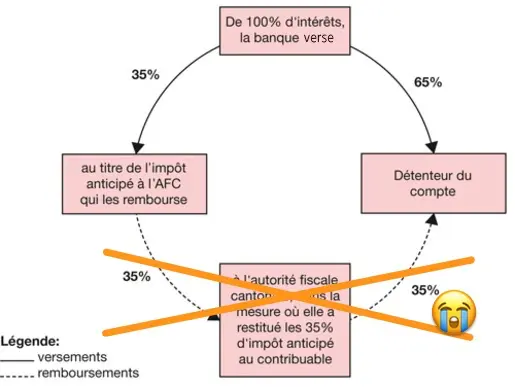

Well, when you fill out your Swiss tax return, instead of declaring your dividends in the section we saw above for Swiss securities, all you have to do is declare these French securities in the section named “Foreign shares according to complementary formulas R-US 164 and DA-1” (it’s like that in the VaudTax software anyway, but it must be similar for the other cantons).

Thanks to the addition of this line of CHF 15'000 of French dividends, your CHF 3'000 of French dividends will be automatically refunded to you. Because yes, nowadays, the Swiss tax return software (VaudTax in my case) takes care of filling out and processing your DA-1 form automatically, and you are immediately reimbursed with a “credit” on your Swiss tax return.

You’re really lucky if you start your investor journey today, because before it was a lot of paper forms that had to be filled out. It was much more tedious. But now, in two or three clicks it’s done, and you get your cash back :)

Now that this is explained, let’s continue with the different scenarios most frequently encountered by a Swiss Mustachian investor.

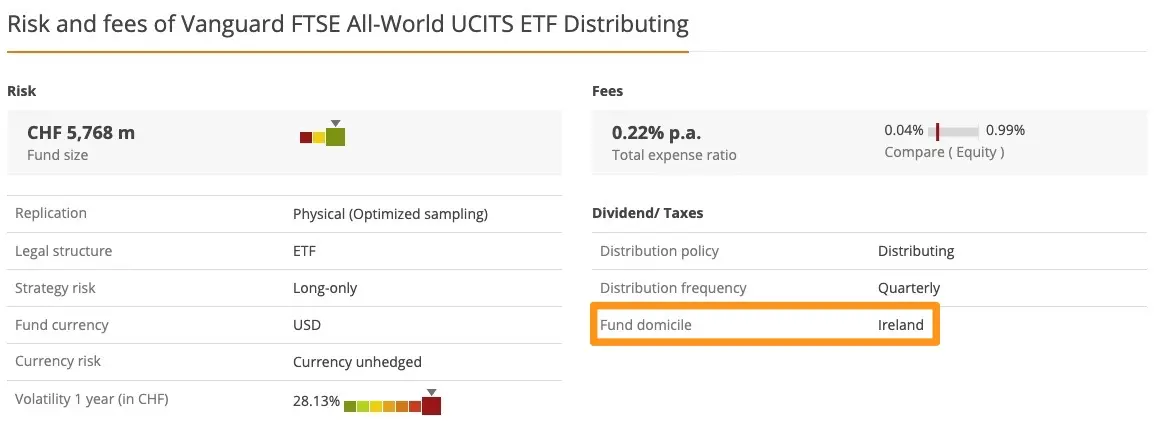

Scenario 3: a Swiss buys the VWRL ETF (Vanguard FTSE All-World UCITS ETF) domiciled in Ireland

I don’t put my favorite VT ETF first voluntarily because the US is a special case.

This VWRL ETF is well known to older readers. We use it to invest money set aside for our MP children, via the online broker DEGIRO.

Let’s assume that you use this ETF and buy CHF 500'000 of it. As a reminder, your home (i.e. where you pay your taxes) is obviously Switzerland.

This Irish VWRL ETF is a “global” ETF, which means that by buying a share of it, you invest in about 3'945 companies all over the world.

But what is even more important for us regarding withholding taxes is to know that the domicile of this ETF is in Ireland as you can see on the site justetf.com:

When you have to file your tax return in Switzerland, your first reflex is to find out what percentage of withholding tax the Irish government will charge you.

Neither one nor two, you go to the above-mentioned site: summary of withholding tax rates by country in the world (from PWC). Small shock when you see that for a non-resident, you will have to pay 25% withholding tax:

Knowing that this VWRL ETF pays about 1.5% in dividends, that would give us:

- Amount invested: CHF 500'000

- Dividends received over one year: CHF 7'500 (= CHF 500'000 x 0.015)

- Irish withholding tax amount: CHF 1'875 (= CHF 7'500 x 0.25)

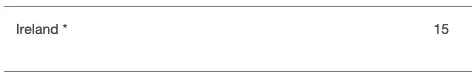

But fortunately, you remembered the fantastic guide by a certain MP who told you about double taxation treaties. So you go to the second link of PWC: summary of withholding tax rates for Swiss residents per country in the world. And then, phew, you see that your anticipated tax rate has been reduced to 0%:

Irish withholding tax is reduced to 0% (instead of 25%) in accordance with the double taxation treaty between Switzerland and Ireland

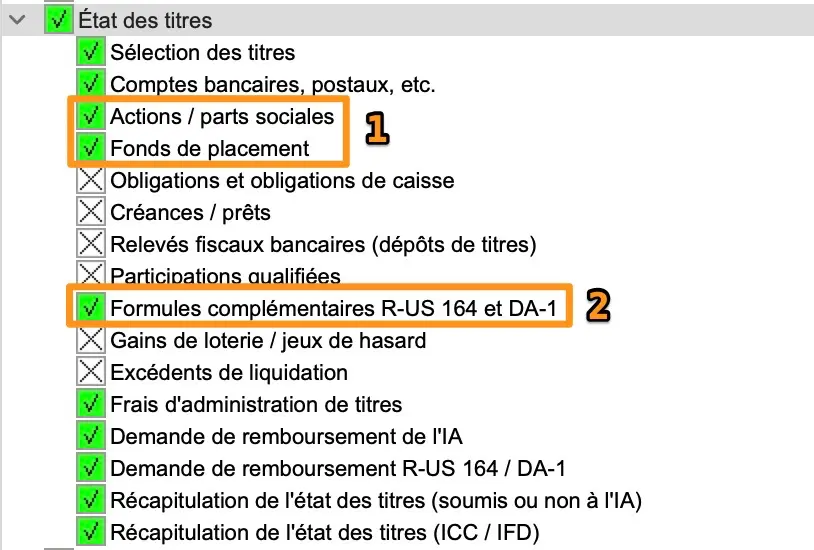

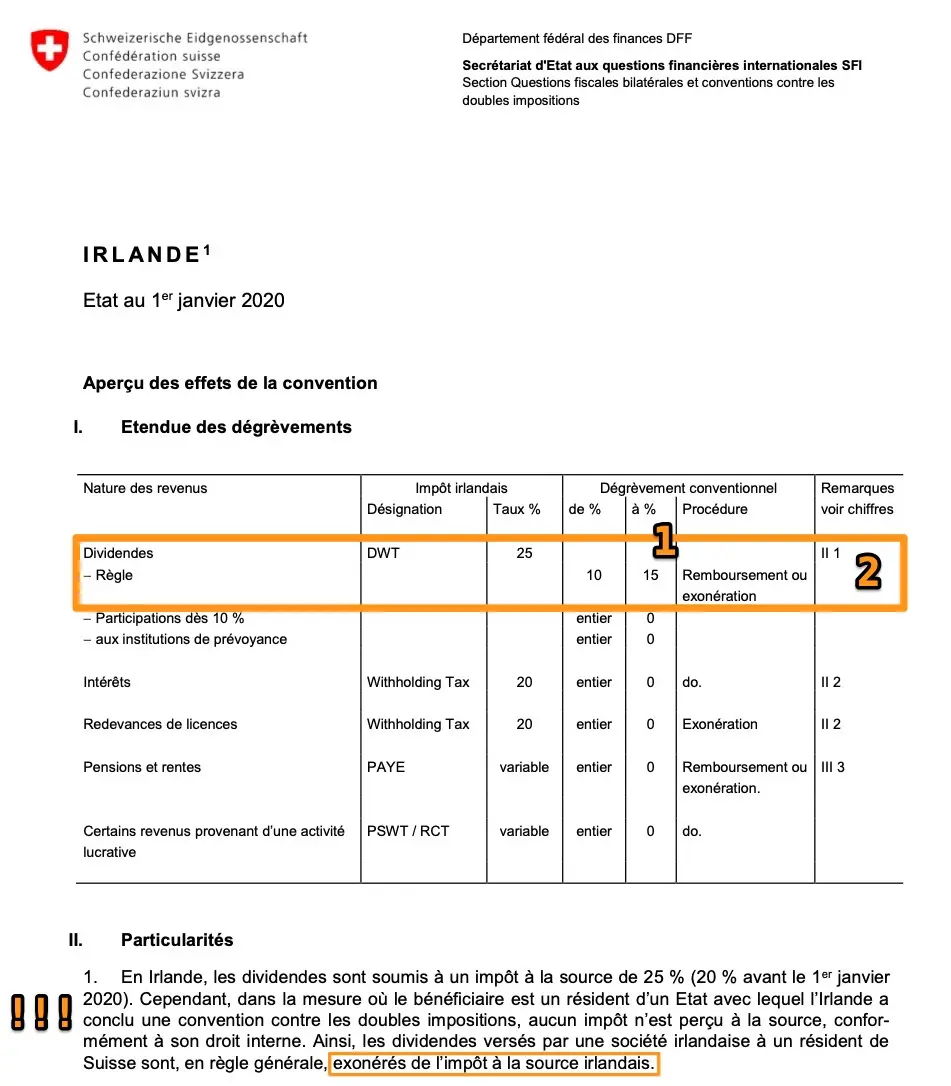

Just to make sure that the PWC website is up to date with all these rates, you can quickly check on the website of the Federal Tax Administration (aka FTA) if the Irish withholding tax rate is correct by following this link.

As you can see by opening the PDF, Ireland and Switzerland have reached an agreement to limit the withholding tax on dividends to 15% — with a nice peculiarity:

Ireland has reached an agreement with Switzerland to limit the withholding tax on dividends to 15% — with a nice peculiarity

In point 1, we see that the Irish withholding tax rate is 15%. But, the peculiarity II.1 tells us sympathetically that we, dear Swiss residents, are exempt from any tax on dividends paid by an Irish company. O joy!!!

So we are talking here about the L2TW withholding tax (levied on the money paid by the fund to you the Swiss investor) which is equal to 0%.

But we must not forget the L1TW withholding tax which is levied when the shares contained in the ETF pay dividends to the ETF. As for you as a private investor, tax treaties apply to define which withholding tax is levied by which state.

Considering that this VWRL ETF is composed of more than 50% US shares, it is interesting to know that the US only taxes 15% (instead of the default 30%) withholding tax on any dividend paid to an Irish ETF.

On the other hand, this L1TW withholding tax on our VWRL ETF is not recoverable.

Concretely, if you take the company Google which is part of the ETF VWRL. Well, when they pay their dividends, the United States levies a 15% withholding tax before these dividends even arrive at the VWRL ETF. And you have no way of getting that L1TW withholding tax back.

Irish ETF withholding tax summary for L1TW and L2TW:

- L1TW: depends on the source of the dividend — e.g. 15% for US shares that pay a dividend to the Irish VWRL ETF

- L2TW: 0% (thanks to the double taxation treaty between Switzerland and Ireland)

Scenario 4: a Swiss buys the VT ETF (Vanguard Total World Stock ETF) domiciled in the US

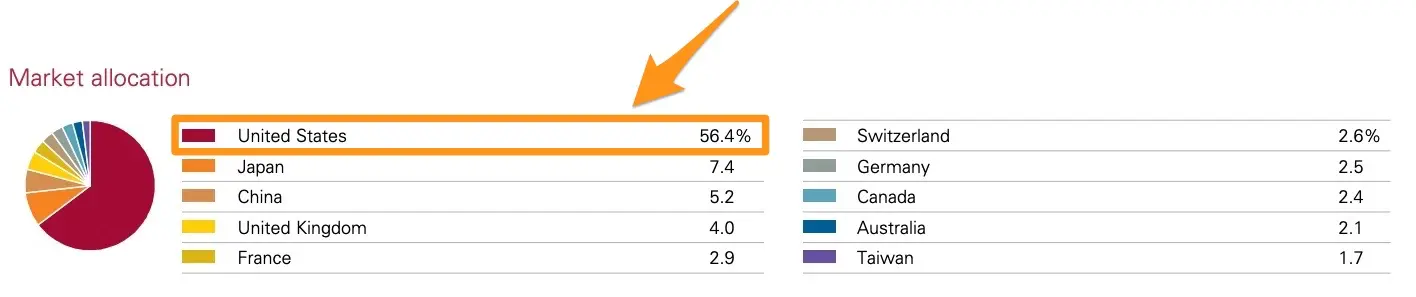

This ETF is the one in which I invest most of our savings. It is a “Global” ETF that allows me to invest in one click in 8'751 companies around the world.

Let’s list our variables again to see what’s in store for us with withholding tax:

- My tax domicile remains Switzerland

- The domicile of this ETF VT is the United States

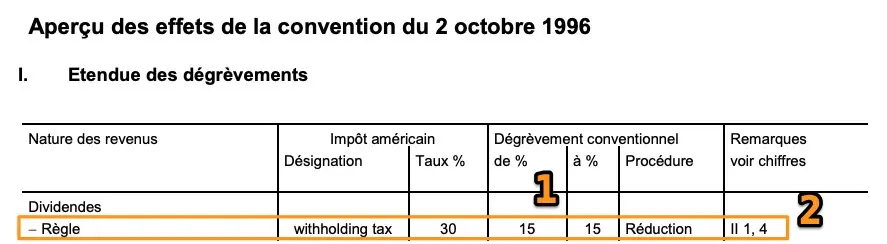

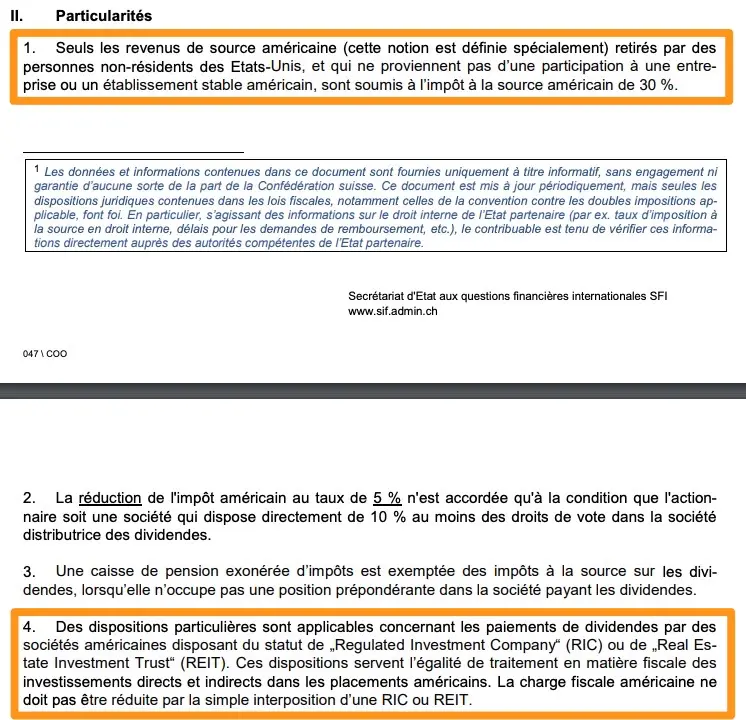

If one checks on the websites of PWC (list of withholding tax rates by country and list of withholding taxes by country for Switzerland) and of the FTA, this is what one finds:

Thanks to the double taxation treaty between Switzerland and the USA, the US withholding tax rate on dividends is reduced to 15%

The triple verification allows us to affirm that the L2TW withholding tax rate as a Swiss resident with a US ETF is 15%.

On the other hand, to benefit from this favorable withholding tax rate of 15%, it will depend on the status of your online broker.

And more precisely concerning its “Qualified Intermediary” status, which is defined by the American tax authorities. Basically, this status entitles an online broker to manage US withholding tax in one way or another. This is done by filling in an umpteenth famous form called “W8-BEN” which reduces the US withholding tax from 30% to 15%. To find out if your online broker is eligible, just ask him!

Note MP: in point 4, the FTA talks about 'RIC', which I equate to the same thing as Qualified Intermediary but I'm not sure it's the same (to be confirmed — if you know more, please let me know)

There are three options:

- Swiss or foreign broker without “Qualified Intermediary” status: The United States will therefore deduct 30% L2TW withholding tax. You will therefore need to use form DA-1 to recover 15% in Switzerland. And if you want to recover the additional 15% (from the US tax authorities), you will need to use the US form 1040-NR (this is extremely complicated for a Swiss individual, due to accounting fees, obtaining an ITIN number, and paperwork); if you have millions or billions invested in the stock market, it may be worth it, otherwise you might as well forget about it.

(Thanks to reader John for correcting a misunderstanding on my part in this section by pointing me to the correct sections III. 1. c., IV. 1., and III. 2. c. of this document in German from the Federal Tax Administration! — document also available in French here) - Foreign broker with this status of “Qualified Intermediary “ (this is the case of Interactive Brokers and DEGIRO for example): your broker will therefore fill in (usually when you create your account) and use the W8-BEN form so that you will only be taxed at 15%. The United States will therefore only charge you 15% withholding tax L2TW, which you can simply claim on your Swiss tax return using the DA-1 form

- Swiss broker with “Qualified Intermediary” status (such as Swissquote): the United States will deduct 15% L2TW withholding tax, your broker will deduct 15% (equivalent to the famous “Additional US Withholding Tax”), and you will have to claim the first 15% via the DA-1 form in Switzerland, and the remaining 15% via the form called “Form R-US 164 — Request for Refund of Additional US Tax Withheld”, which will allow you to recover the additional 15% (depending on your broker, they may make this request automatically for you). See section III. 1. b of this same document in German from the AFC (the same document in French is available here).

These two forms, DA-1 and R-US 164, are automatically generated when you complete the relevant section of your Swiss tax return (at least with VaudTax in the canton of Vaud).

In summary, it is this W8-BEN form that allows you to reduce the withholding tax on dividends of US securities to 15%. And that depends on your broker.

Note regarding Saxo broker: since January 8, 2022, and for US securities only, Saxo can be considered as Swissquote in option 3 above. This means that the 30% withholding tax can be recovered in full.

Then comes the L1TW withholding tax. You know, the one on dividends paid by companies to your ETF.

The good news is that dividends paid by a US corporation to a US ETF are not subject to withholding tax. And since 57.4% of the VT ETF is composed of US companies at the time of writing, that means that you don’t lose L1TW withholding tax on more than half of the dividends received by your US-domiciled VT ETF :)

US ETF withholding tax summary for L1TW and L2TW:

- L1TW: depends on the source of the dividend — e.g. 0% for US shares that pay a dividend to the US ETF VT

- L2TW: 15% (thanks to the double taxation treaty between Switzerland and the United States), recoverable via the different forms W8-BEN, DA-1, and R-US 164 depending on the status of your online broker

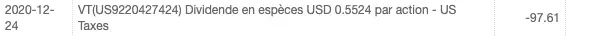

Below you find a concrete screenshot of the dividends paid to me in December 2020 for my VT and VWRL ETFs.

As you can see, my VT dividends did suffer a 15% L2TW withholding tax from the US tax authorities, and my VWRL ETF did not suffer any L2TW withholding tax from Ireland:

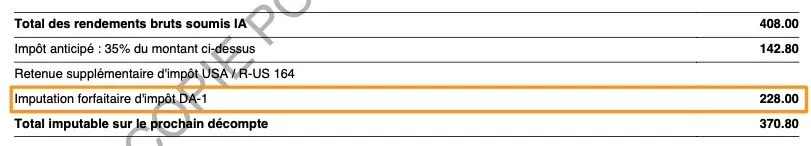

And as you can see below, I declared in my Swiss tax software VaudTax that I had received US dividends, that they had been taxed at 15%, and that I wanted (and was going to!) get them back via the famous DA-1 sesame.

I have filled in each dividend received via my VT ETF, claiming my 15% dividend withheld by the US tax authorities — N.B. this form is automatically generated by VaudTax :)

Then, in this next screenshot, you see that indeed the Swiss tax authorities give me a tax credit (i.e. they deduct the amount of withholding tax from my total amount of Swiss taxes to be paid) on my Swiss tax return:

The most perceptive among you will note that I do not use the R-US 164 form to recover my withholding tax. Indeed, my Interactive Brokers brokerage company is a Qualified Intermediary, so I only need to complete the DA-1 form.

Scenario 5: a Swiss buys the ACWI ETF (iShares MSCI All-Countries World Index ETF) domiciled in the US

If you have a preference for iShares/Blackrock (vs. Vanguard), then your “global” ETF of choice may be ACWI.

A quick check on Google for the ETF’s domiciliation brings me to Bloomberg this time. And this ETF does come from the US.

So in terms of withholding taxes, it will be the same regime as the VT ETF described above.

Scenario 6: a Swiss buys an ETF domiciled in Luxembourg

Note: I have never owned such an ETF myself in my investment portfolio.

In the world of ETF investment in Europe, there is a lot of talk about ETFs domiciled in Ireland and Luxembourg. Indeed, these two countries have rather interesting double taxation treaties with Switzerland.

As usual, let’s first check our famous L2TW withholding tax (i.e. when the ETF pays you dividends) on the FTA website:

If you check on the PWC website, you will realize that you do not really benefit from a special treatment as a Swiss since this 15% withholding tax is the default one.

This treaty between Switzerland and Luxembourg only becomes interesting if you receive Luxembourg dividends as a Swiss company, and again there are conditions on the % you have to own.

Then comes the subject of the L1TW withholding tax. Since as a Mustachian investor, you usually invest in a global ETF that is largely composed of US shares, it is interesting to see how much the US tax authorities charge on US companies paying a dividend to a Luxembourg ETF.

Once again, I would like to thank the reader @San_Francisco for his research and the sharing of information on the forum. According to his sources, there is a treaty between the US and Luxembourg reducing the L1TW withholding tax from 30% to 15%.

However, this treaty does not apply to Luxembourg funds (i.e. ETFs) specifically.

Therefore, unless otherwise stated from another source, the L1TW withholding tax for US shares of a Luxembourg ETF remains at 30%.

Luxembourg ETF withholding tax summary for L1TW and L2TW:

- L1TW: depends on the source of the dividend — e.g. 30% for US shares paying a dividend to the Luxembourg ETF

- L2TW: 15%, recoverable via the DA-1 form when you declare your Swiss taxes

I will add other scenarios as I experiment, and especially according to what you, dear reader, ask me for information.

Withholding tax ETFs and shares as a Swiss investor

Here is a small table that summarizes everything we have just seen together in this chapter. The basic assumption (as with the entire guide) is that your tax domicile is Switzerland.

| Share or ETF domicile | Withholding tax L1TW | Withholding tax L2TW |

|---|---|---|

| Switzerland stock | n/a | 35%, reimbursed by tax credit on your Swiss tax return |

| Switzerland ETF | 35% (to be confirmed as perhaps 0%), reimbursed by request from the fund itself | 35%, reimbursed by tax credit on your Swiss tax return |

| Ireland ETF | 15% for US equities, composing the major part of a global ETF | 0% (thanks to the Ireland-Switzerland double taxation treaty) |

| ETF US | 0% for US equities, composing the major part of a global ETF | 15%, reimbursed by tax credit via the various forms W8-BEN, DA-1, and R-US 1641 on your Swiss tax return (thanks to the US-Switzerland double taxation treaty) |

| ETF Luxembourg | 30% for US equities, composing the major part of a global ETF | 15%, reimbursed by tax credit via the DA-1 form on your Swiss tax return |

Considering the amounts much higher than a simple stamp duty (we are talking about tens of % for these withholding taxes), this last section remains very important for you who wish to live off the returns of your investments from 40 years old in Switzerland. But by following my process to the letter, you will be able to recover all the cash you are entitled to.

Next step: FAQ Swiss taxes as an investor

As you can see, the most complicated thing with withholding taxes on your stock or ETFs dividends is often finding the information. But the subject itself is not that complex.

The last chapter we will cover in this tax guide for Swiss investors is a FAQ. Indeed, I often receive similar questions from readers, and I have decided to group them together and fill out a FAQ as I go along (and also with my own questions).