When I first started investing in the stock market, I was tempted by Swissquote’s marketing. I didn’t understand much about the brokerage world, and I thought there were no other solutions. Above all, I thought you had to have your broker based in Switzerland.

A decade later, I’ve learned a lot, not least that you are free to choose the location of your broker and are not restricted to having one based in Switzerland.

For my part, as I repeat to every new reader:

- I use Interactive Brokers (an American broker), because it’s the best at every aspect

- For any Mustachian investor wanting a broker based on European soil, then I recommend DEGIRO

- And if you want to choose a Swiss-based trading platform, then my recommendation is Saxo Bank - that’s why you’re reading this article :)

As a reminder, here are the criteria I use to choose my brokerage firm:

- Accessibility as a Swiss resident

- Stable and sustainable over time

- Protection of my securities

- Access to international markets

- Product availability

- Tools available

- Fees (the best for last :))

And here’s how Saxo Bank answers each of the points:

1. Is Saxo Bank accessible to Swiss residents?

Yes, Saxo Bank is accessible to all Swiss residents. It is a Danish investment bank, founded in 1992 and based in Copenhagen. It operates in several countries, including Switzerland, via branches or local entities. In Switzerland, Saxo Bank is present through Saxo Bank (Switzerland) SA.

This Swiss branch is regulated by FINMA, the Swiss financial market supervisory authority. As evidenced by the Saxo website here:

Saxo Bank (Switzerland) SA is authorized to operate as a bank and securities dealer in Switzerland. […] Saxo Bank is authorized to provide the full range of banking services, including order execution, portfolio management, custody services, and the operation of an organized bilateral trading system for certain derivative transactions.

Also, Saxo Bank’s Swiss subsidiary can be reached by different means of contact listed here.

2. Is Saxo Bank (Switzerland) SA safe and stable over time?

When you place your money with a broker, you want to know who you’re trusting.

Saxo Bank isn’t a start-up that just appeared on the scene. Headquartered in Denmark, it has been in existence since 1992 and has built a solid reputation in the world of online trading. In Switzerland, it has been active since 2001 via its subsidiary Saxo Bank (Switzerland) SA, which holds a genuine Swiss banking license, validated by FINMA. In other words, it plays in the big league, just like any other Swiss bank.

Another reassuring point is that Saxo is not just a name or an empty shell. Founder Kim Fournais is still at the helm today. He launched the company over 30 years ago, successfully weathering all the financial crises as well as the IT and Internet revolution, and is still CEO of the group. This provides a certain stability, with a long-term vision that avoids short-term poker games. So we’re dealing with a well-established company, which has held its ground for decades, and which is properly supervised in Switzerland.

And, another important point, the founder and CEO’s interests are still aligned with ours as an investor, since Kim Fournais still owns 28% of Saxo Bank shares. So he has a vested interest in keeping the company running for his own personal fortune. I approve!

Finally, Saxo returned to Swiss majority control, with Swiss banking group J. Safra Sarasin becoming the majority shareholder in 2025. Personally, I prefer this to the former Chinese investment fund :)

3. Is my money safe with Saxo Bank?

When you entrust your money to a broker, you want to be sure that if anything goes wrong, it doesn’t all go up in smoke. At Saxo Bank (Switzerland) SA, you’re protected just like at any other Swiss bank. Your cash assets are covered up to CHF 100'000 by Esisuisse, the Swiss deposit guarantee.

And the rest of your assets (securities, ETFs, shares…) remain in your name, separate from the bank’s assets. So even if Saxo were to go bankrupt, these securities would remain yours.

4. Can I trade on international markets?

When you invest, you buy ETFs or stocks that are listed on specific exchanges. If your broker doesn’t have access to that exchange, well, you’re stuck. It’s as simple as that.

For example, when I did “value investing” following the Daubasses portfolio, I bought a lot of Japanese stocks, because they were well undervalued. These stocks are traded on the Tokyo Stock Exchange, of course.

With Saxo Bank, no problem, I would have had access to this market and could have shopped as if I were shopping at Migros. On the other hand, if I’d been limited to a more local or restricted broker, I’d only have been able to watch opportunities from afar. That’s why I like Saxo: you have access to a wide range of global stock markets without getting in over your head.

(I say “would have”, because I personally use Interactive Brokers — as I don’t mind having my broker based in the United States, but it would have worked the same way with Saxo.)

5. Product availability

Big good news on this point, because compared to other Swiss brokers, Saxo went out of its way to offer us our favorite VT ETF (Vanguard Total World Stock Index Fund)!

In 2019, the new European PRIIPs regulation (“Packaged Retail Investment and Insurance-based Products”) came into force to require fund initiators (such as Vanguard with the VT ETF) to provide a “Key Investor Information Document” (“KIID”) that complies with European standards and is available in several languages for investors. Except that Switzerland is not part of Europe.

Nevertheless, some multinational brokers are taking a shortcut and subjecting our beautiful country to the same rules as other European countries.

But that’s not the case with Saxo Bank. So we can rest assured that Mustachian has access to the best ETFs available.

6. What tools does Saxo Bank offer?

One thing I always check before choosing a broker is the quality of the tools they offer. And by “tools”, I’m talking as much about the platform for buying or selling, as anything that allows me to track my portfolio, extract info for taxes, or synchronize my data with my budget in YNAB.

Personally, I want at least a web platform and a mobile app. All the analysis, research, and order placement I do is from my computer. It’s much more practical for reading annual reports or comparing companies. And for the rest, such as tracking the performance of my portfolio or retrieving tax data, it’s also much smoother on the computer. I use the app mainly to consult on the move, or to make a quick purchase when I see an opportunity for my value investing portfolio that I don’t want to miss.

Saxo meets all these criteria with:

- A simple and efficient web platform called “SaxoInvestor” to buy, sell, analyze performance reports and much more.

- A mobile application, also called “SaxoInvestor”, which serves as a consultation and trading app.

7. What are Saxo Bank’s fees?

Fees are a key element in your choice of broker, as they can eat into your returns.

If all the other criteria were OK, but this one wasn’t, then it would call my choice into question.

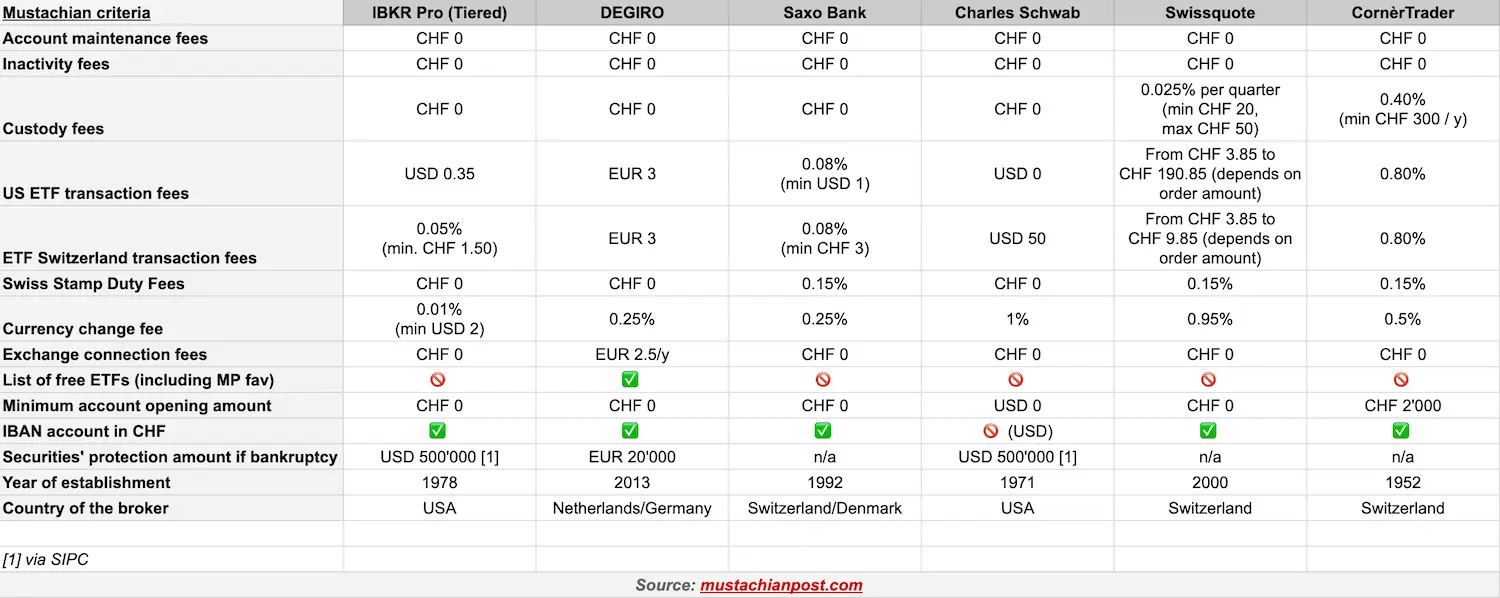

As I explain in detail in my comparison of the best brokers for Swiss investors, there are many different types of fees.

To evaluate an online brokerage platform correctly, you need to look at the following fees:

- Custody fees: fees charged by the brokerage company for “housing” your securities with them (rather than in your safe-deposit box). These fees may also be called “management fees” or “account maintenance” fees (and include custody fees).

- Transaction fees: commission taken by your trading platform on the buying and selling transactions you carry out.

- Foreign exchange fees: commission taken on your currency changes

- Account opening fee: explicit

- Closing fee: in case you need to change brokers one day

- Incoming transfer fee: to fund your account

- Outgoing transfer fee: to take advantage of your cash by transferring it to your favorite Swiss bank - Bank WIR in my case.

Custody fees

Saxo abolished all custody fees at the beginning of 2025. This makes it THE best Swiss-based broker for a Swiss Mustachian investor.

Transaction fees

Saxo is very aggressive in being two to four times cheaper than its nearest competitor - bearing in mind that I’m only talking about equities and ETFs here.

You’ll find all the details on this Saxo Bank commissions summary page, as well as further down on this page.

Exchange fees

Exchange fees at Saxo Bank are equivalent to the transaction amount x 0.25%, with no minimum amount.

Account opening fee

CHF 0 (that would be the last straw in a field as competitive as online trading :)).

Closing fees

Saxo Bank does not charge account closure fees.

Incoming transfer fee

Saxo Bank does not charge an incoming transfer fee.

Outgoing transfer fees

Saxo Bank does not charge outgoing transfer fees.

Summary of Saxo fees compared to competitors

Saxo Bank promo code

You can get a CHF 200 trading fee credit from Saxo Bank, applied within 24 hours of the initial funding (valid for 3 months after opening your account) by using the link of the blog.

With this link, you’ll also be helping to support the blog by the way, thanks!

Conclusion

To sum up, I recommend Saxo Bank for its reputation, stability, management, and above all, its cheapest fees for an online brokerage platform.

If you want a Swiss-based broker, this is the best trading platform to date.

In the next chapter, I’ll show you step-by-step how to open an account with Saxo Bank (with a bonus link to get a Saxo Bank fee credit).