In the beginning, I used Swissquote like many Swiss people because I didn’t understand the online broker world. I thought that to trade from Switzerland, you had to go through a brokerage company located in Switzerland.

But in the end, the only thing that matters is to have a brokerage company that can access the exchanges on which the securities (shares, ETFs, bonds, etc.) you want to buy, are available for you.

Imagine you want to buy my favorite ETF VT. As indicated on the Vanguard website, this VT ETF is listed on the New York Stock Exchange (codename: NYSE Arca). As a result, if the brokerage company you use does not give you access to the NYSE Arca, then you cannot buy/sell the VT ETF. Pretty simple, isn’t it?

When I realized that I was not limited to Swiss brokerage firms, I began to research and discuss alternatives with friends. Several people (including my friend Mr. RIP) have advised me to try out Interactive Brokers.

As a reminder, here are the criteria I use to choose my brokerage company:

- Accessibility as a Swiss resident

- Stable and sustainable over time

- Protection of my securities

- Access to international markets

- Product availability

- Available tools

- Fees (best for the end :))

And here is how Interactive Brokers did on my criteria:

1. Is Interactive Brokers available to Swiss residents?

Interactive Brokers Switzerland: Unlike the other interesting platforms often reserved for US residents, Interactive Brokers is available for Swiss residents.

And also something interesting that I don’t pay much attention to because often this information is not available on the sites: The Interactive Brokers Group has three contact points for Switzerland (I now realize that they are institutional contact points… but anyway — ideally you only contact them at the beginning, then you go through the customer service messaging, just as efficient). And when I say points of contact, I mean real people.

For my part, my reference person is Corinne Nabholz (UPDATE 20.08.2021: Mrs. Nabholz now only deals with institutional clients, and therefore cannot answer questions from private clients like you and me — so there is no point in contacting her directly ;)).

I had contact with her in 2016 for questions when I opened my account. She has always answered me very quickly and efficiently. And in 2019, she is still my referent. This proves that they do not have a crazy turnover in their staff, and therefore demonstrates a certain stability of the company.

If you contact her for questions before opening your own account at Interactive Brokers, say hello from Marc from Mustachian Post :)

Alternatively, send me your questions directly by email or via social networks for me to answer them.

2. Is Interactive Brokers safe and stable over time?

The thing you don’t want to see happen is for your online brokerage company to go bankrupt. So certainly, there are protections on this subject (see next point), but it would cause you a lot of administrative worries.

As we have seen, IB has existed since 1978 (since 1994 under the name Interactive Brokers LLC). This is already proof of stability, especially when considering online broker reviews, which often highlight their longevity, and the fact that they are still around today, while many companies from the 2000s were shut down due to their inability to adapt to the evolving IT environment.

Another interesting point (which I also look at when I do value investing on the stock market) is that founder and CEO Thomas Peterffy is still at the head of the Interactive Brokers Group at 74 years old (the year I wrote this article, aka 2019). And, even more interestingly, he holds 75% of the shares in his company! As a result, he has every interest in maintaining his long-term vision for IB in view of his personal wealth represented by his shares alone.

Which brings us to the next point: IBKR’s parent company is publicly listed on the stock exchange. And since its introduction on the market in 2007, its value has almost doubled with some ups and downs, but the trend is going in the right direction. This shows a certain stability and perrenity of the company.

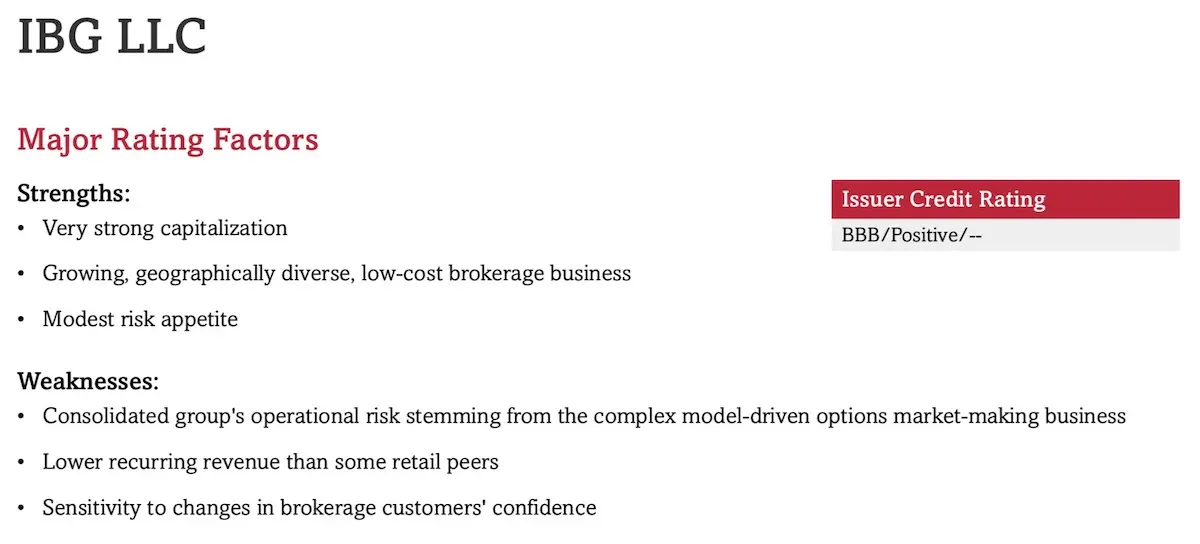

Also a noteworthy aspect is the financial rating provided by the well-known rating agency “Standard & Poor’s”. To recap, their ratings range from the highest AAA to the lowest D. A strong rating indicates that a company’s ability to meet its obligations to creditors — such as suppliers, banks, and bondholders — is very solid.

I have put below the summary of the report:

As well described in the Standard & Poor’s report (available on this page), the rating could move to the top A category over the next 12-24 months if IB continues to diversify its customer base (which would make it even more stable).

Which is a good thing, since it is currently doing so, for example with the recent announcement to remove the minimum amount of USD 10'000 to open an account in order to attract even more retail investors like you and me (i.e. people who do not swim in money every morning ^^).

Finally, Interactive Brokers LLC is in Barron’s top ranking (highly respected financial magazine) for the ninth consecutive year in 2019. Our favorite online broker in Switzerland did not get there by sheer luck in such a famous ranking.

3. Is Interactive Brokers safe?

As I said in the previous point, even if your online broker is the most reputable in the world, you still want your assets (ETFs, stocks, bonds, forecast contracts, cash, etc.) to be protected in case of bankruptcy.

If IBKR were to default (i.e. they lose in any way the shares or ETFs you “stored” there), then your shares are protected up to a maximum of USD 500'000, including USD 250'000 at most for cash. This protection is provided by the SPIC (meaning “Securities Investor Protection Corporation”), which is a non-profit company founded by broker-dealers who are members of the SPIC.

To reassure you that all this talk is not only for US residents, I have delved into the subject in this article and the SPIC website explains well who is protected:

A non-U.S. citizen with an account at a brokerage firm that is a member of SIPC is treated the same as a resident or citizen of the United States with an account at a SIPC member brokerage firm. https://www.sipc.org/for-investors/what-sipc-protects

4. Can I trade on international markets?

When you invest, you buy an ETF or share of a company that is listed on a specific market.

If we take the example of my favorite ETF, the Vanguard VT (VT is the short name, the long name being Vanguard Total World Stock ETF), the latter is listed — and therefore tradable — on the NYSE Arca market (aka the New York Stock Exchange).

Although very rare, but imagine if you use an online broker who does not have access to this market, then you could not buy this ETF VT.

I will give you another more realistic example: since the beginning of 2019, I started with value investing and at that time there were many nuggets in Japan. Given the size of the country, the Land of the Rising Sun only has one stock exchange, which is the Tokyo Stock Exchange. With Interactive Brokers, I have access to the Japanese stock exchange and was able to enjoy the stocks :)

However, if I were using Cornèrtrader, I would not have had access to it.

So a big advantage of Interactive Brokers is its access to 125 markets in 31 countries (full list here on their website).

5. Product availability

So for this point, I’ll be honest: until now, I’ve only traded ETFs and shares on the stock exchange. No derivatives, options or futures.

Obviously I was never limited. But from everything I’ve read on many blogs and forums, I’ve never saw anyone that was limited by the product availability from Interactive Brokers LLC.

Another point to the advantage of Interactive Brokers is that they seem more granular in their management of the laws of different countries.

In 2019, the new European regulation PRIIPs (“Packaged Retail Investment and Insurance-based Products”) came into force to require fund originators (such as Vanguard with ETF VT) to provide a “Key Investor Information Document” (KIID) that complies with European standards.

Vanguard, who is selling the most in the US, decided not to comply. As a result, European online brokers could no longer legally offer their products to European investors.

Great thing for us is that Switzerland is not part of Europe and will have its own set of laws from January 2020 (named FinSA and FinIA). Well, DEGIRO 1, which is a leading online broker in Europe, has simply denied Swiss investors access to it as well, in order to simplify their regulatory management for all the countries where they are present. This is something Interactive Brokers has not done, by allowing Swiss investors to continue to have the power to trade US ETFs until Swiss law comes into force.

6. What tools does Interactive Brokers offer?

Another important criterion for me is the free tools provided by the online broker I choose. By tools I mean how easy is it to search for a specific stock, as well as what tools are available to analyze my portfolio or to retrieve information for my taxes.

In terms of research, buying, and selling, I expect the online broker to have at least one web platform and one mobile app.

It’s very important to me because I research and buy stocks from my laptop, where it’s easier to read annual reports and other company analyses (especially when exploring investment opportunities and monitoring stock prices for my “value investing” portfolio).

The same applies to portfolio performance analysis or tax information retrieval or to synchronize/reconcile my data with my budget tracking in YNAB.

And I use the IBKR mobile app for consulting, or to buy a security that is really cheap at some point.

Interactive Brokers offers you many more platforms than necessary to build your wealth as a Swiss investor

And so, IB meets all these criteria with:

- A centralized web platform (called “Client Portal”) to buy, sell, analyze performance reports, and much more — this is a big step forward compared to 2016 when it was more complex, with separate access for buying/selling securities and account management with professional pricing.

- A desktop application called “TWS” (for Trader Workstation) that can be installed on Windows, Mac, or Linux. It has all the advanced analysis tools of IB (compared to the web version), which I personally never use :)

- A unique mobile application called “IBKR”, which serves as a consultation and trading app as well as a double authentication factor login tool

7. What are the fees of Interactive Brokers?

Ah, the fees. I kept them for the end because it is one of the most important elements. If all the other criteria were green but this one red, then it would totally question my choice.

And I can tell you right now that Interactive Brokers plays it big time on this subject (it’s not my favorite online broker for nothing since 2016 :)).

As explained in detail in my comparison of the best broker for Swiss investors, fees can quickly eat up a large part of your earnings. And there are quite a few options for brokers to make money off you.

In order to evaluate an online brokerage platform globally, you should look at the following fees:

- Custody fees: these are fees charged by the brokerage firm to “host” your securities in their homes (rather than in your safe). Sometimes they are also called management fees or account maintenance fees (and they include custody fees)

- Transaction fees: this is the second type of fee that brokerage firms make money off you, and it consists of taking a commission on the buying and selling transactions you make

- Foreign exchange fees: commission taken on your currency changes

- Account opening fees

- Closing fees in case you have to change your online broker one day (as I did switch from Swissquote to Interactive Brokers)

- Incoming transfer fees (to fund your account)

- Withdrawal fees (to enjoy your cash by transferring it to your favorite Swiss bank — Bank WIR in my case)

Custody fees

UPDATE 07.2021: Interactive Brokers dropped its activity fees, making it THE best online broker for Swiss Mustachian investors.

They call it activity fees. If you have more than USD 100'000 under management at IB, then you have no activity fees. If you have less, but more than USD 10 in transaction fees per month, then you don’t pay activity fees. Otherwise, you pay a USD 10 inactivity fee. Everything is explained in detail on this Interactive Brokers pricing page.

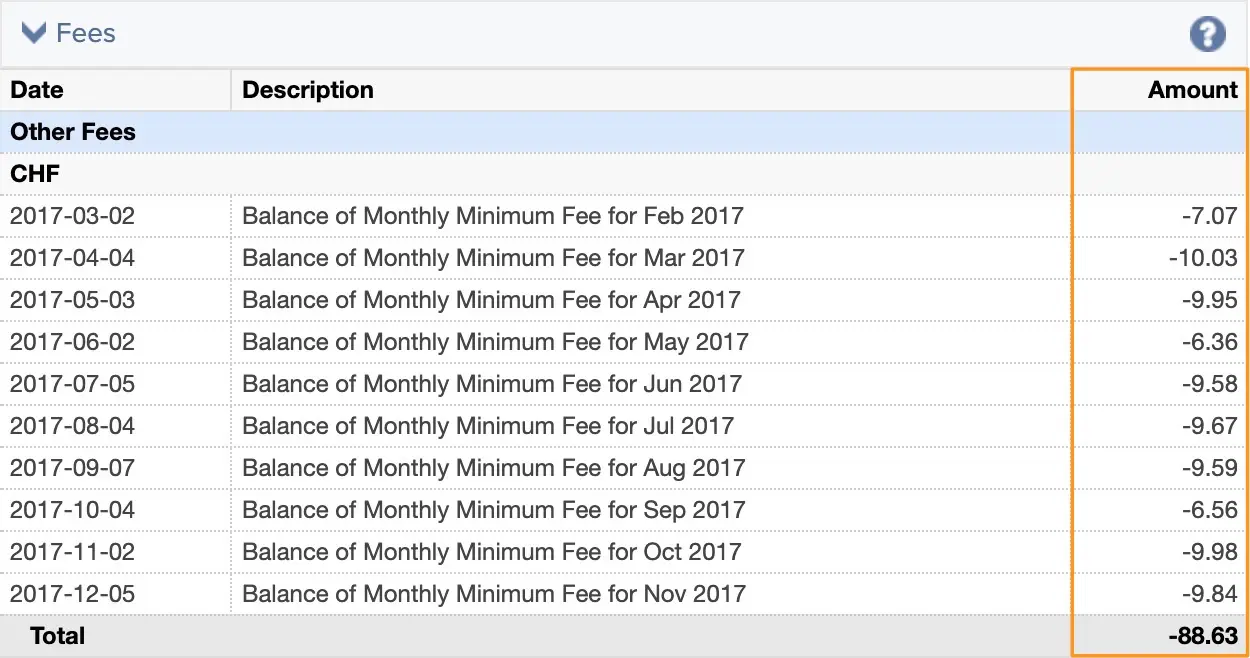

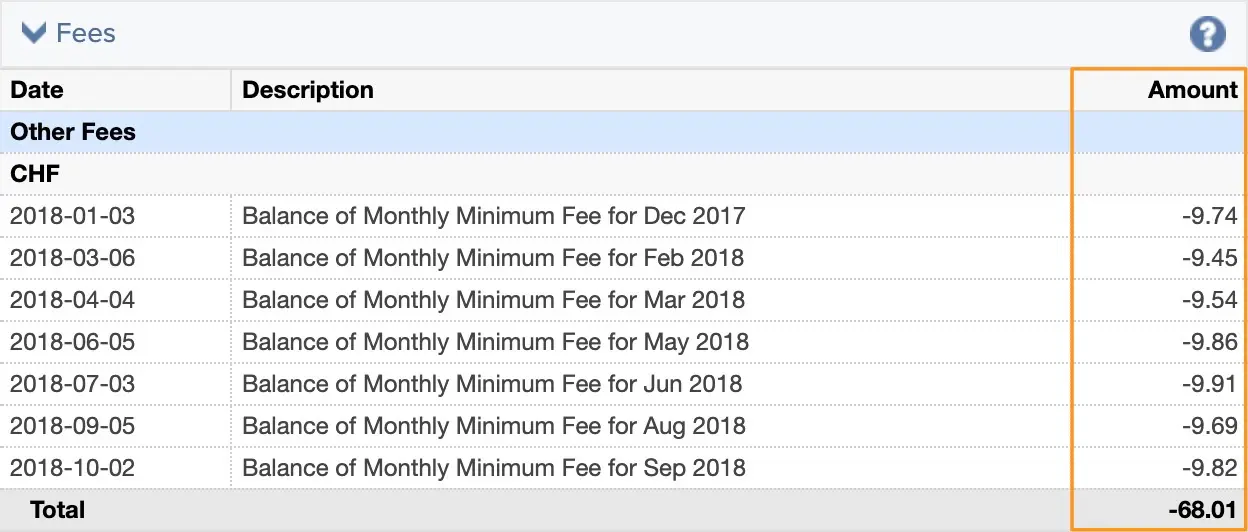

Below is the concrete example with my IB account:

I only started paying my fees when I bought my first ETFs (early 2017): USD 10 per month because I did not yet have more than USD 100'000 on my account at Interactive Brokers in 2017, nor did I have more than USD 10 in transaction fees

The months I didn't pay any activity fees (January, April, July, and October 2018) were because my transaction fees were higher than USD 10/month. Then, in November 2018, it was because I had finally reached USD 100'000 under management at Interactive Brokers

So in 2019, I don’t have any screenshots because I don’t have any more activity fees :)

Transaction fees

While there are no commission-free trades, IB offers extremely low fees, with 83% lower transaction costs than its competitors (that’s for professional pricing available to retail investors!)

Personally, I am only interested in equities and ETFs.

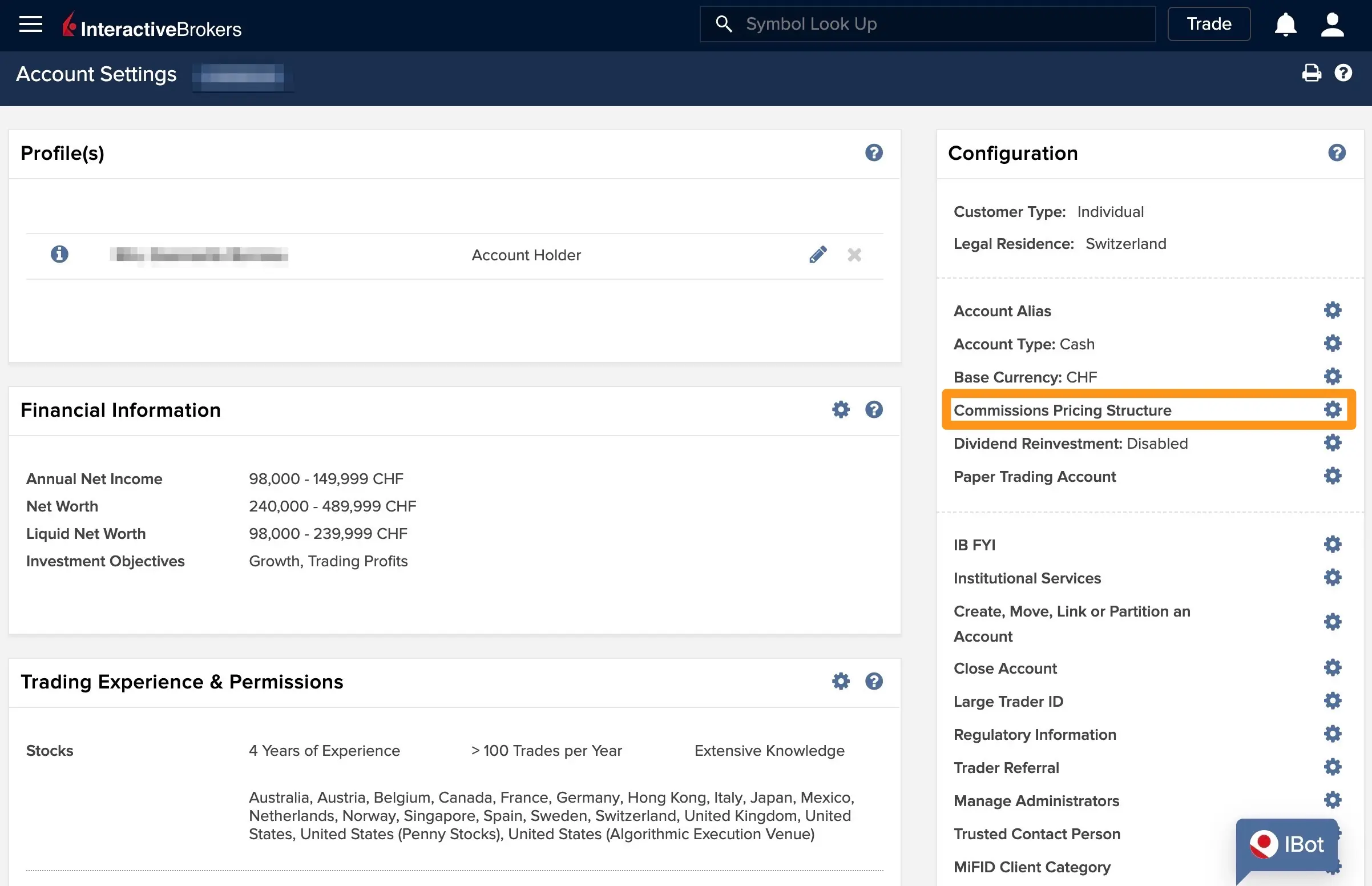

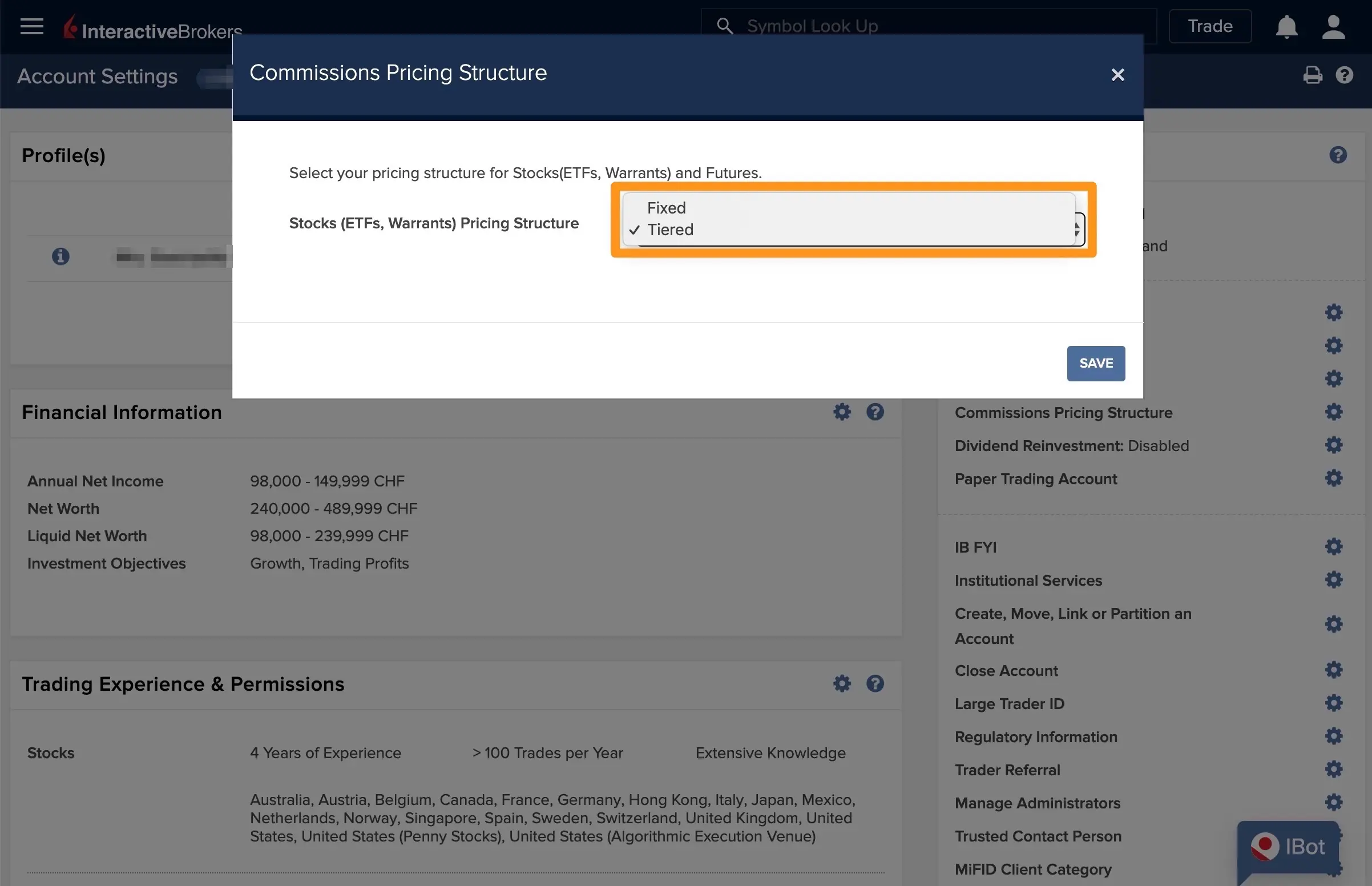

IB offers two types of fee structures: fixed and tiered.

In fixed mode, for the US, we are on USD 1 minimum, and maximum 1.0% of the transaction value. In Switzerland, it is 0.1% of the transaction value with a minimum of CHF 10. And another example with Japan: 0.08% of the transaction value with a minimum of JPY 80 (about CHF 0.75).

You will find all the details on this summary page of Interactive Brokers commissions.

The tiered price-level plan (described in the previous link) is more complex to understand because it takes several variables into account. I had never considered it until now (thanks to the reader Alberto!) because I only invested once a quarter (this is currently changing with my move to value investing). Wrongly!

Because for the US, it goes to a minimum of USD 0.35.

In Switzerland, it is “CHF 1.5 + 0.015% of the transaction” for purchase costs + CHF 0.55 for compensation costs + CHF 1 for reporting costs. So for example with a CHF 1'000 purchase of Swiss ETFs, that gives us CHF 1.5 + 1'000*0.015% + CHF 0.55 + CHF 1 = CHF 3.20 instead of CHF 10 with the fixed mode.

And for Japan, commissions get lowered to 0.05% of the transaction value, to which we must then add 0.002% of purchase costs + “JPY 2.95 + 0.0004%” of compensation costs. This again results in savings compared to the 0.08% fixed cost.

Make your own calculations according to how you invest, but as far as I’m concerned, I just switched to the tiered plan after writing this paragraph:

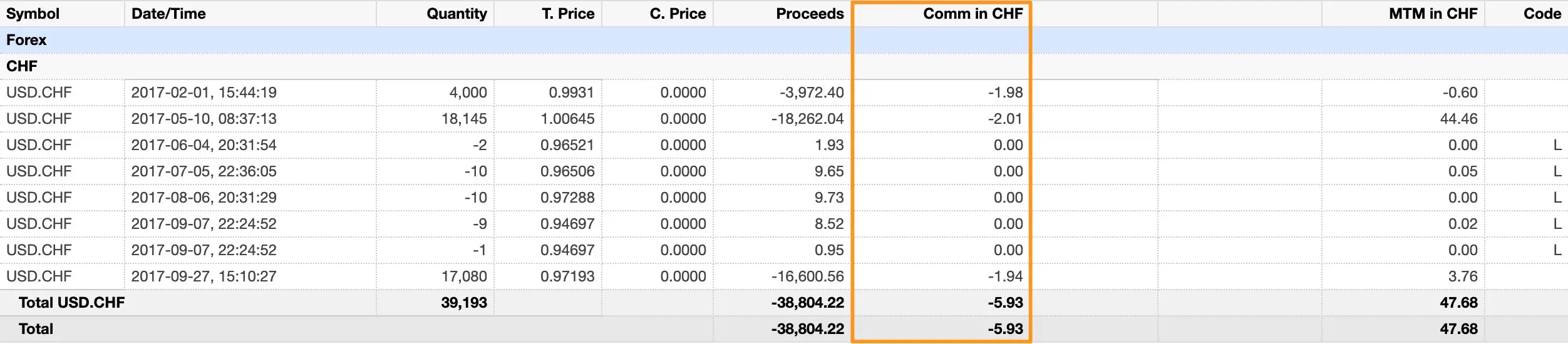

In reality, it looks something like this with my Interactive Brokers account:

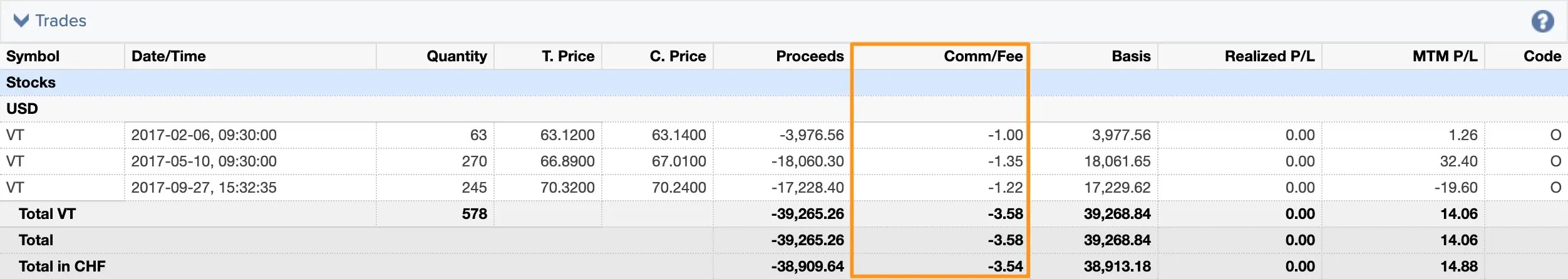

In 2016, no transaction, therefore no transaction fees (therefore no screenshot). And in 2017, CHF 3.54 in transaction costs for approximately CHF 40'000 of VT ETFs purchasing. I love it

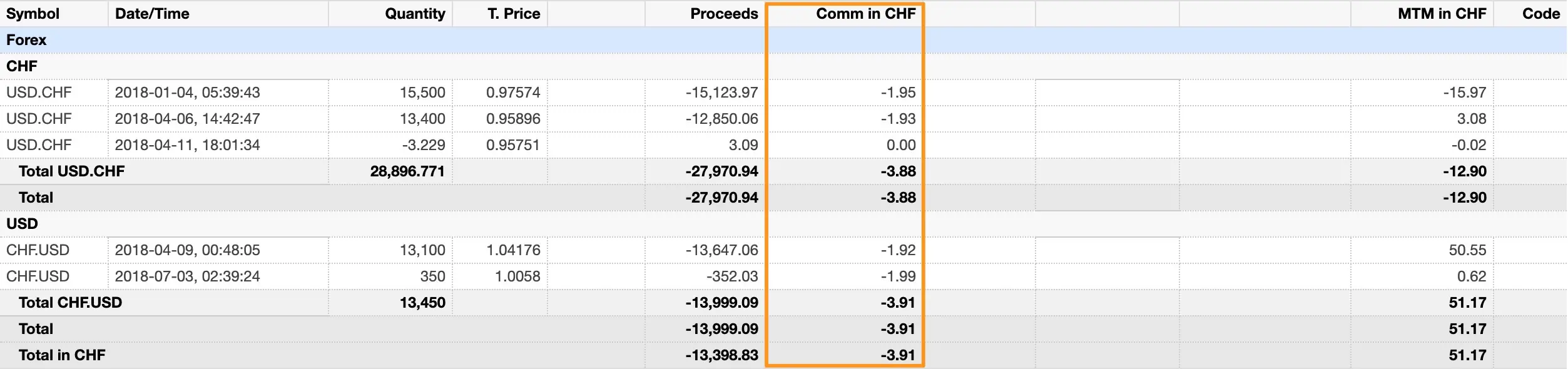

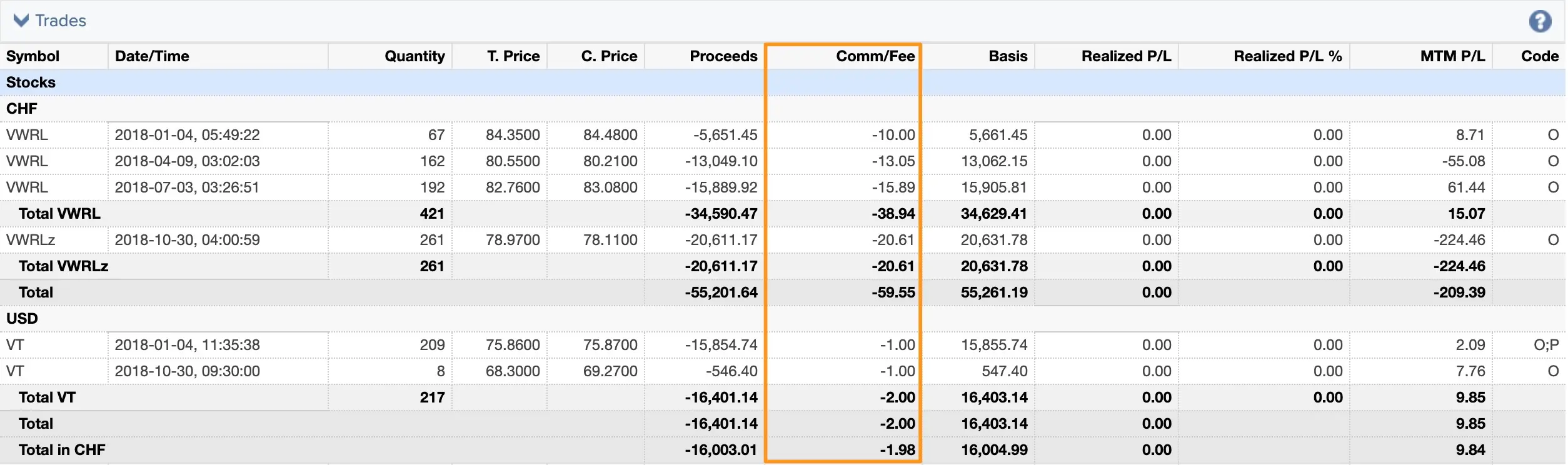

I bought the ETF VWRL via the Swiss stock exchange in 2018, which implies more costs (0.01%, with a minimum of CHF 10) than the USD 1/transaction for the ETF VT :)

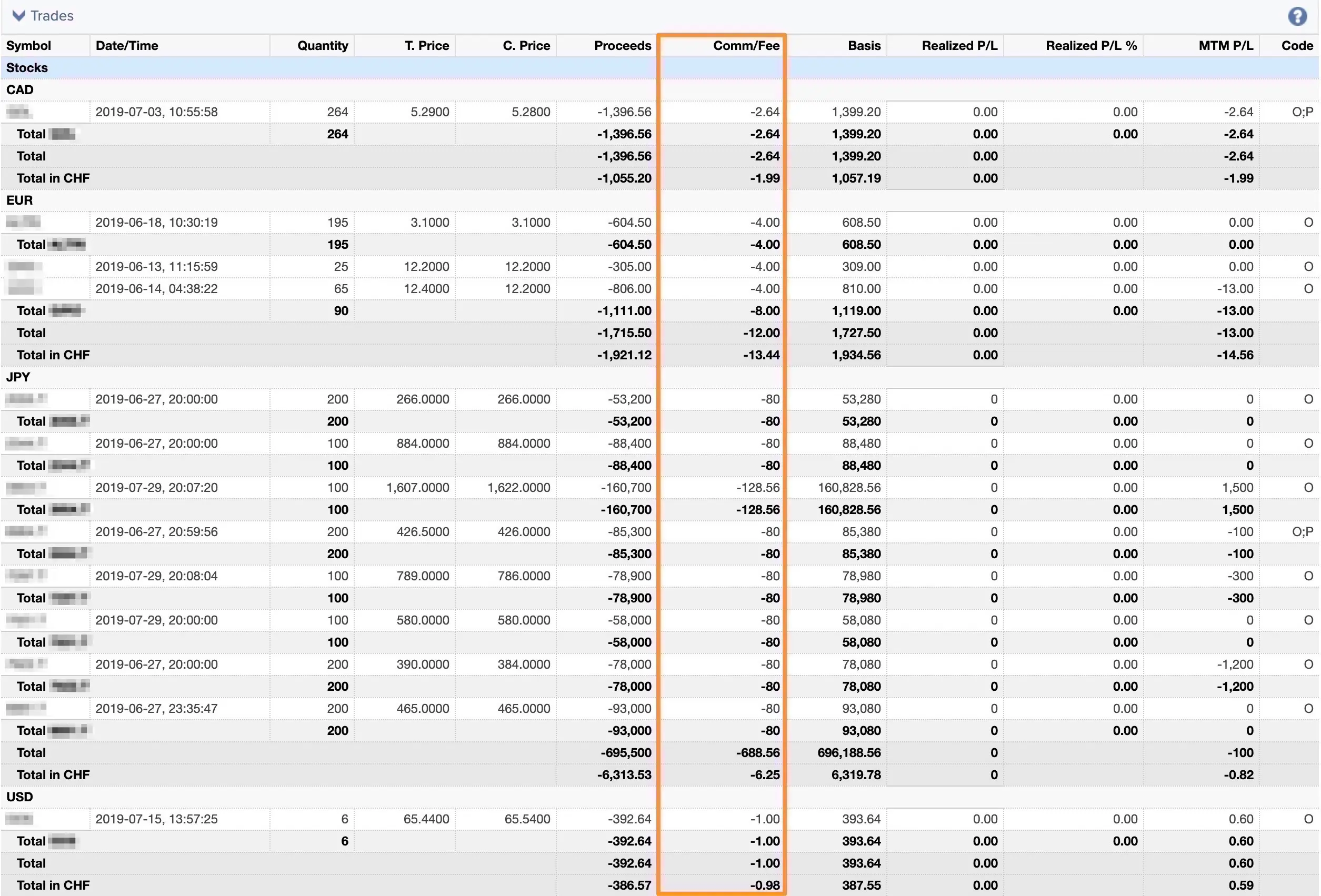

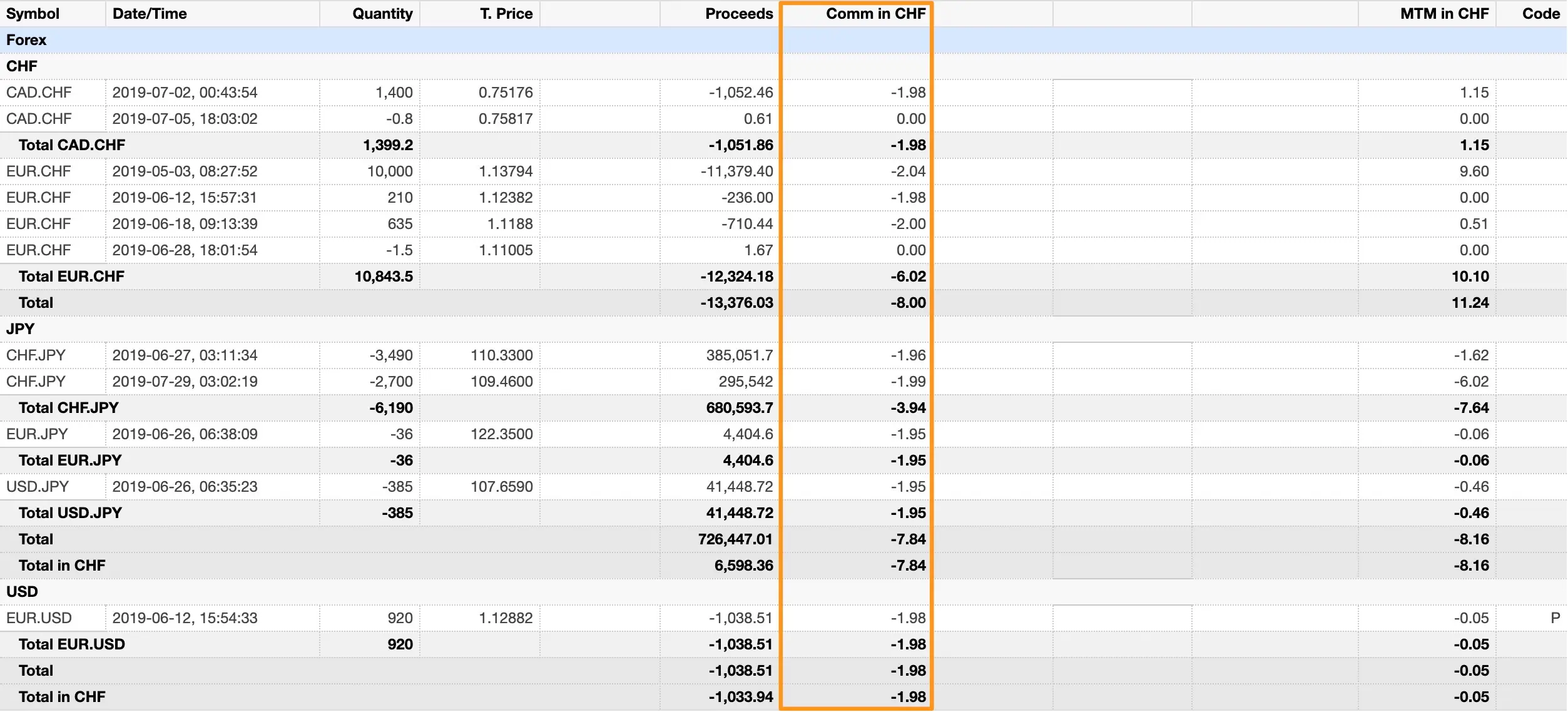

2019, the year I started with value investing — more information on this in a future blogposts' series

Foreign exchange fees

As we discussed above, it is quite regular to have to change cash into another currency to buy certain ETFs or shares.

Interactive Brokers’ exchange fees are equivalent to the amount of the transaction x 0.00002, with a minimum of USD 2.

The other critical point compared to other financial institutions (bank, exchange office) is that Interactive Brokers uses the real-time interbank exchange rate (i.e. the rate at which banks exchange money, which you can find on Google with this search for instance) without adding any hidden price differential, price increase or other hidden commission.

It is the way to exchange Swiss francs for any other cheapest currency I know. I use it for all my foreign exchange needs, such as when I had to pay €15'000 in notary fees to acquire my first investment property in France.

Welcome to Canada, France, Japan, and the United States :) When you say value investing, you also mean a little more transaction costs for foreign exchange. Because if you're open to the whole world, then there are nuggets everywhere

Account opening fees

CHF 0 (that would be a joke in a field as competitive as online trading :)).

Closing costs

CHF 0.

Incoming transfer fees

CHF 0.

Withdrawal fees

You can withdraw cash from your Interactive Brokers account by free transfer once a calendar month.

If you want more, you have to pay USD 10 per transfer if you withdraw USD, otherwise CHF 11 to withdraw CHF, or €8 to withdraw euros.

All details of Interactive Brokers’ outgoing cash withdrawal fees can be found on this page of their website.

So on the fees level: Interactive Brokers is the best online broker for a Swiss investor.

Conclusion

To summarize, I chose Interactive Brokers because of its reputation, stability, management, and especially its lowest fees for an online brokerage platform.

This is my platform of choice since 2016 and I will let you know by blogpost (you can subscribe to the newsletter so you don’t miss anything) the very moment I open some account type elsewhere. But it is not in my plans with the current situation.

If you understand the advantages of choosing Interactive Brokers, with its strong capital position, rather than remaining isolated with the more expensive Swiss solutions, then just go to the next chapter where I will describe step by step how to open an account at Interactive Brokers.

Investing involves risk of loss. ↩︎