Now that you’ve transferred money into your Saxo Bank Suisse account, let’s see which trading platform to use to buy your future ETFs.

The different Saxo Bank trading platforms

Saxo Bank Suisse offers you two trading platforms:

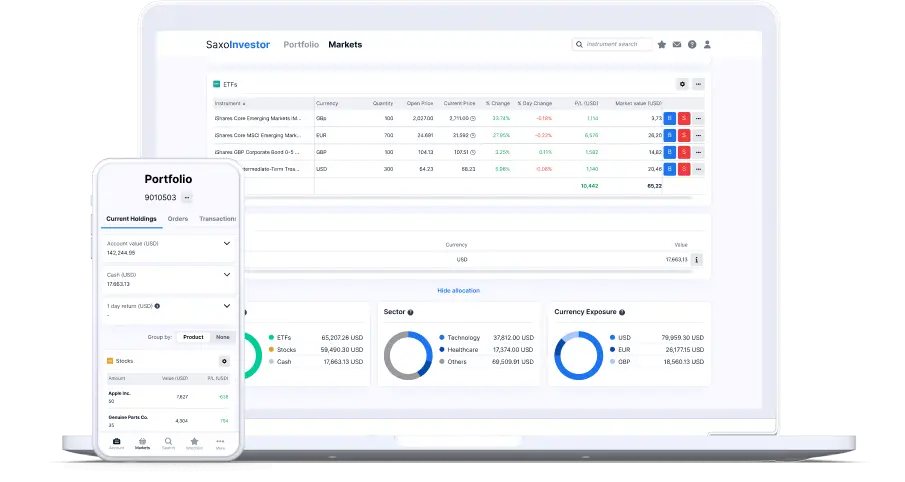

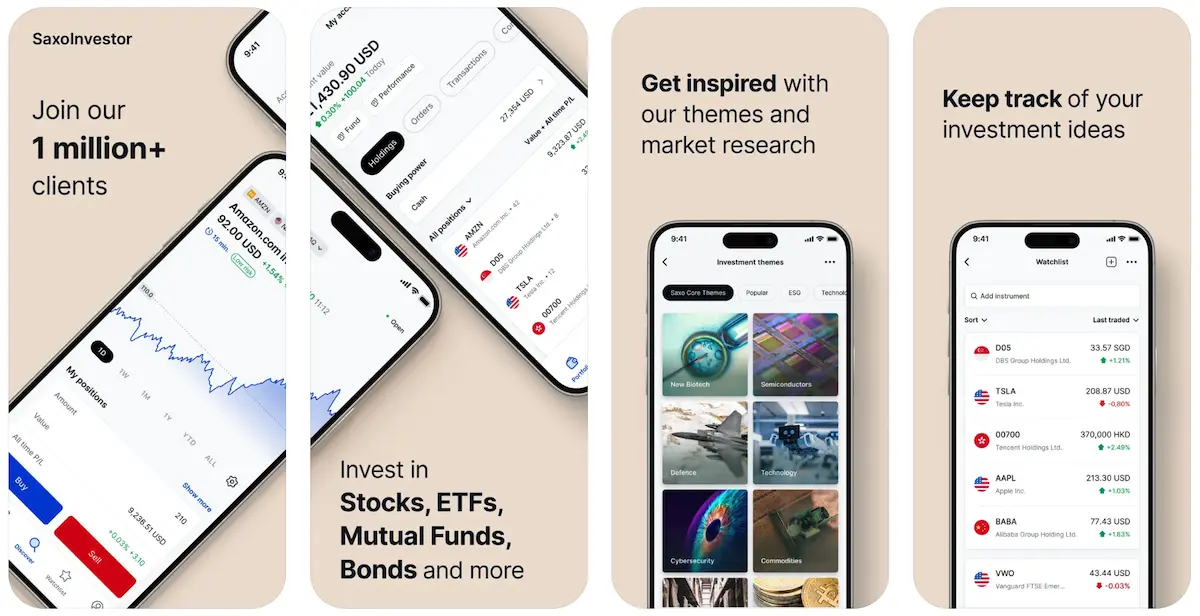

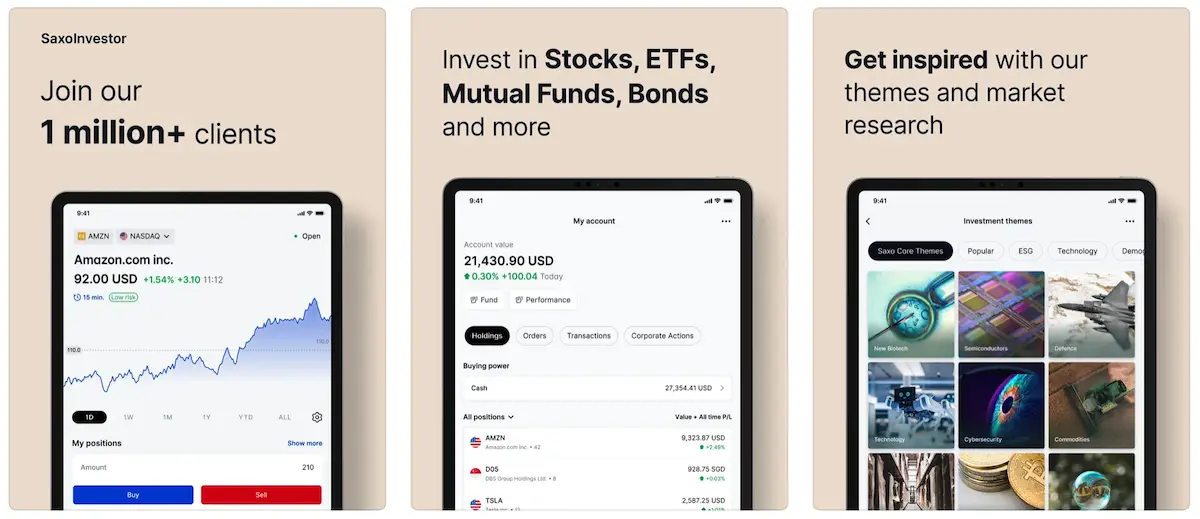

1. SaxoInvestor — For beginners or passive investors

Advantages:

- Simple, intuitive interface

- Detailed portfolio view

- Available on web and mobile

Disadvantages:

- Limited functionality for active trading

- Fewer advanced analysis tools

2. SaxoTrader — For active investors and professional traders

Advantages:

- Advanced platform with a full range of products

- Detailed analyses, charts, and sophisticated tools

- Available on web and mobile

- Supports up to six screens on Windows and Mac

- Advanced trading tools and in-depth market analysis

Disadvantages :

- Can be complex for beginners

- Some advanced features may require a subscription

My Saxo platform of choice as a Mustachian investor

As a reminder, on this blog, we invest passively via ETFs (Exchange-Traded Funds). This means buying ETFs about once a quarter, or at most once a month.

So we need a simple, efficient platform, so that we can do our shopping in a matter of minutes, then get back to the more interesting things in our lives.

And above all, we don’t need complex analysis charts that we don’t understand and don’t use.

I therefore use and recommend the SaxoInvestor trading platform for any investor following this passive investment strategy.

You will find more information and detailed documentation on their SaxoInvestor investment platform on this official page.

Saxo Bank promo code

You can get a CHF 200 trading fee credit from Saxo Bank, applied within 24 hours of the initial funding (valid for 3 months after opening your account) by using the link of the blog.

With this link, you’ll also be helping to support the blog by the way, thanks!

Next step: buy your first ETF on Saxo Bank!

Now that we know which Saxo platform to use, it’s time to take action for real! And buy our first ETF to make your savings grow in Swiss francs.

That’s what we’ll be looking at in the next chapter.