In the last chapter, you learnt how to view the money you earn in the stock market on Interactive Brokers. But, in Switzerland (well, like everywhere else I think), when you make money on the stock market, you have to send in a tax return every year!

This is one of the obstacles for many people who do not dare to start investing. But really, it’s not that complicated. To help you, I have created this complete Swiss tax guide for ETF investors.

Once you’ve read it, and if you’re using the best online broker (Interactive Brokers Switzerland), then you can come back here to find out where to get the information you need to file your Swiss tax return.

Information needed to declare your Interactive Brokers shares to the Swiss tax authorities

When filling out your Swiss tax return, you need the following 3 pieces of information:

- The transactions (buy and sell) that you have made, so that the Swiss tax authorities know the amount on which to tax your assets

- The dividends you received, because you are taxed on them

- The withholding taxes that the different countries where your ETFs come from have levied on you (not to be confused with custody fees, which are charged by your broker for holding your assets), so that you can claim them back (because in the end it is their goal with this withholding tax system to force you to declare all your assets)

Interactive Brokers’ “Reports” section to the rescue again!

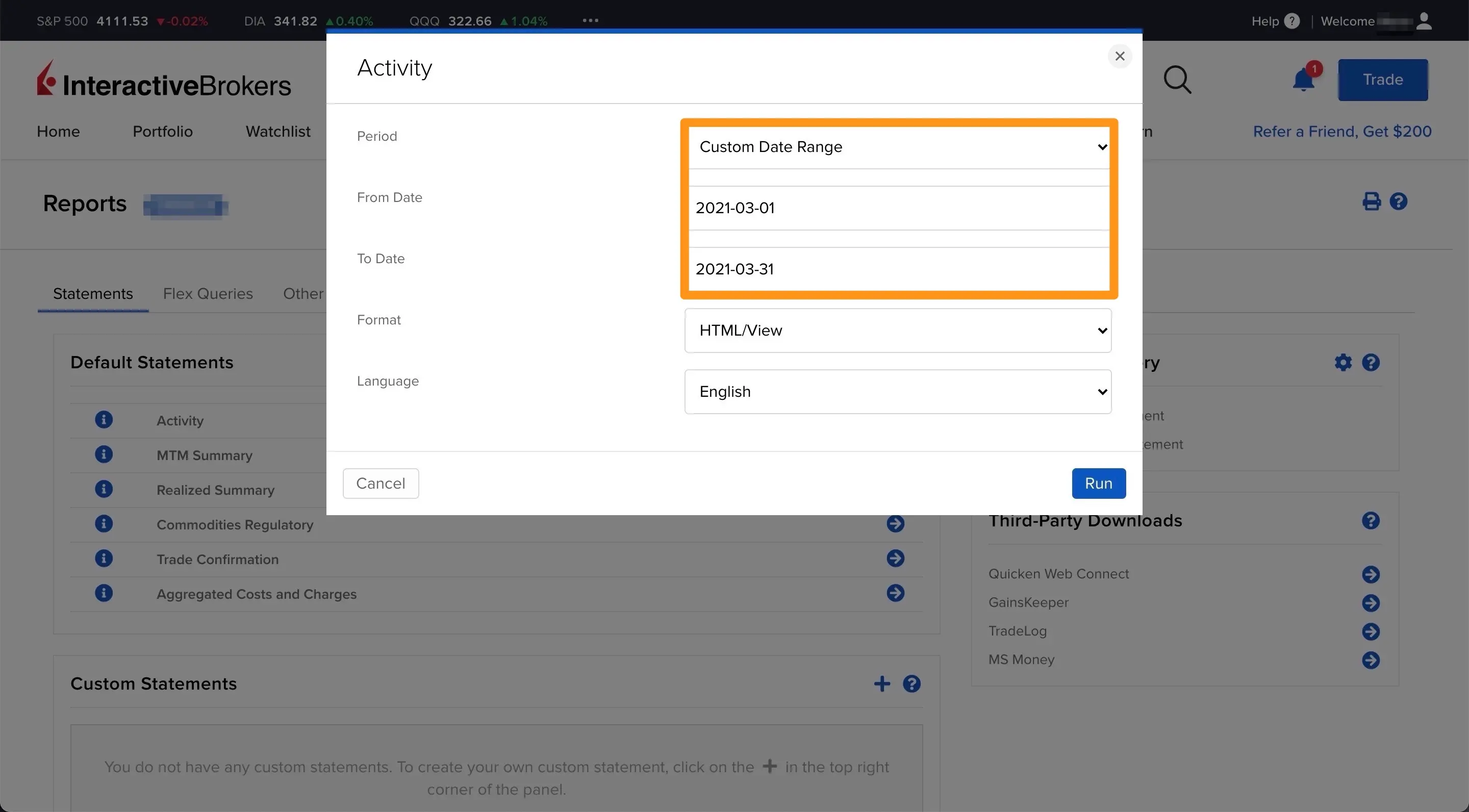

We’re going to reuse the same “Reports” feature on your IB account from the previous chapter to find all the information a Swiss investor need to complete our tax return. I recommend to use the desktop version instead of IBKR Mobile for this procedure (for better readability).

Buy and sell transactions

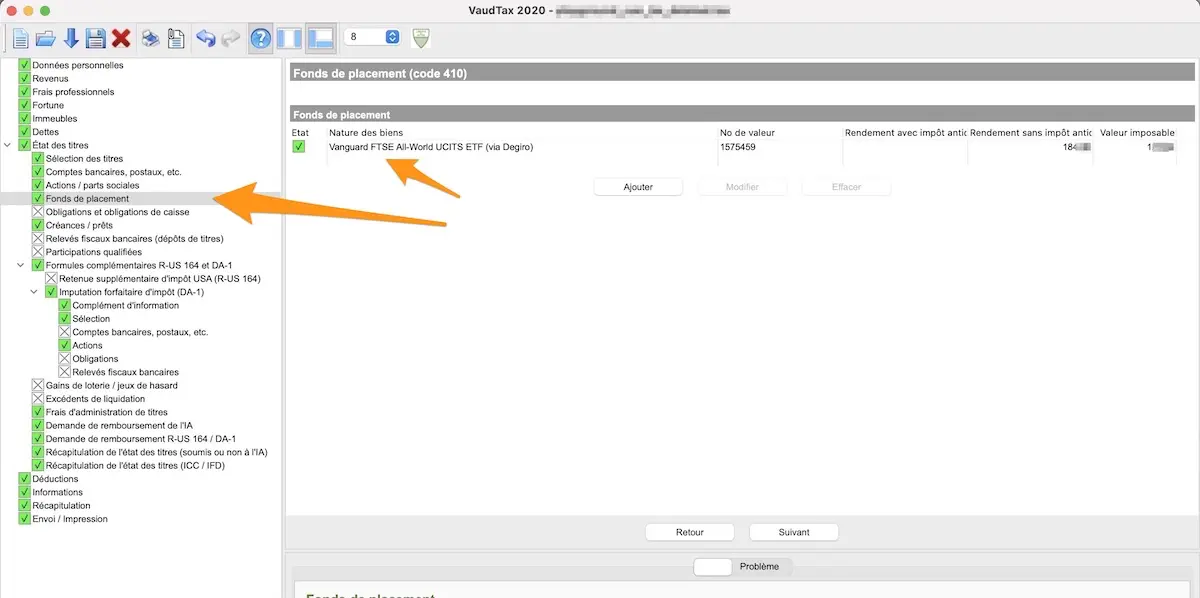

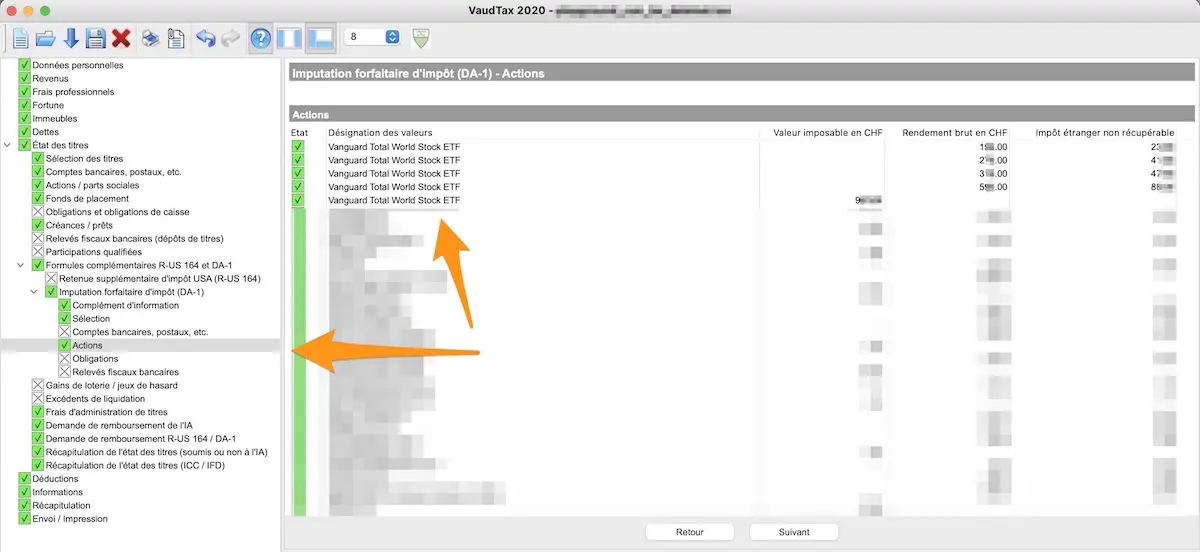

As a reminder, at least for VaudTax (canton of Vaud), you have to report all your non-US securities (Swiss stocks, Irish ETFs, etc.) in the section “État des titres > Actions” ou “État des titres > Fonds de placement” (for ETFs). And for your US securities, you must report these transactions in the section “Formules complémentaires R-US 164 et DA-1”.

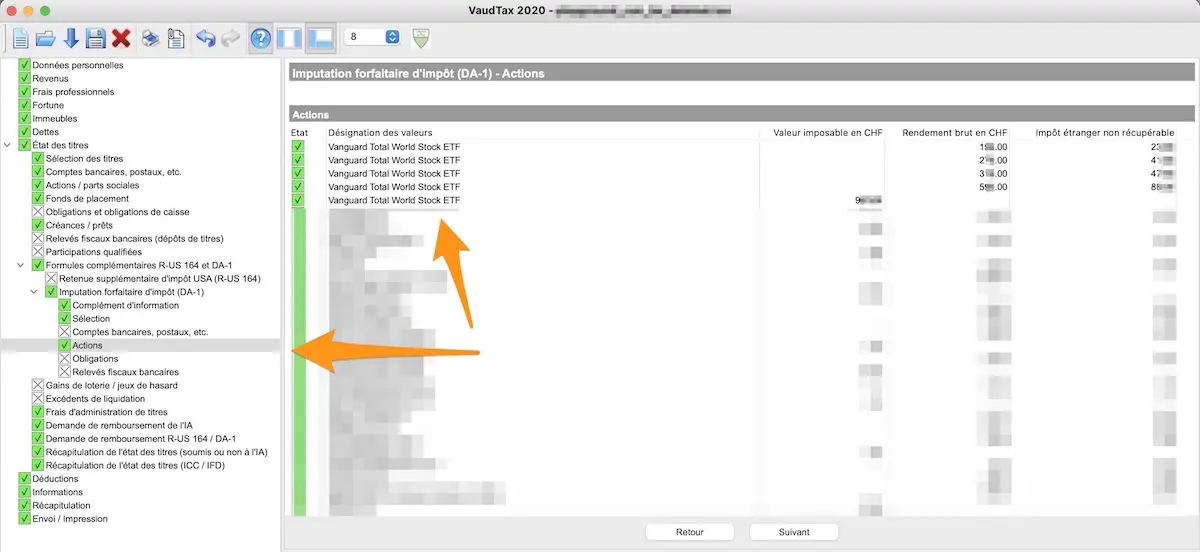

Declaration of my VT ETF via VaudTax (the first 4 lines for dividends, the rest for the total amount I own of this ETF)

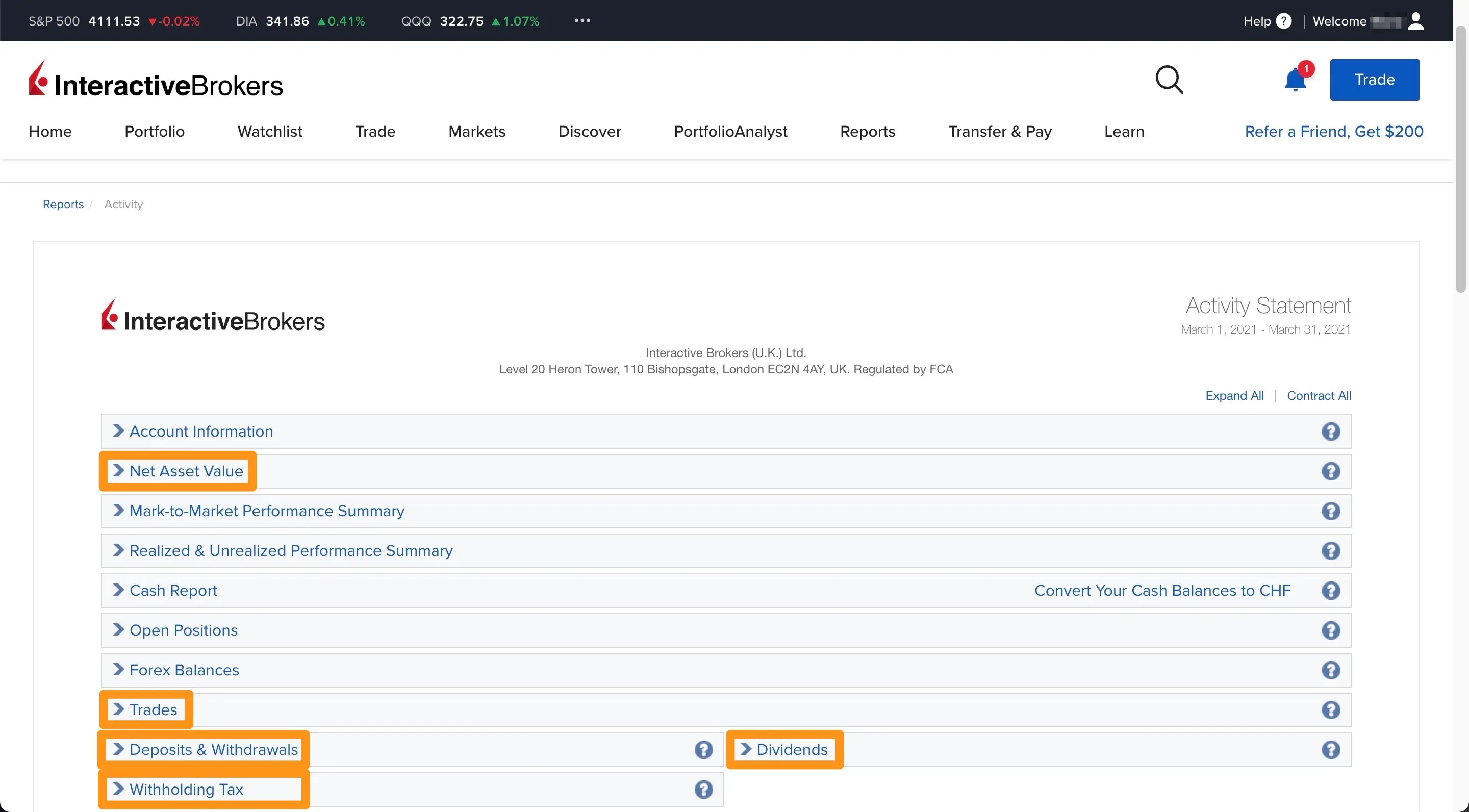

When you go through the VaudTax screens, you will have to declare any buy or sell, like this screen for my VT ETF. To do this, you will go back to the “Reports” section of Interactive Brokers, generating a statement for the entire year of your tax return:

And it is the “Trades” section (2nd orange rectangle) that will interest us in the latter:

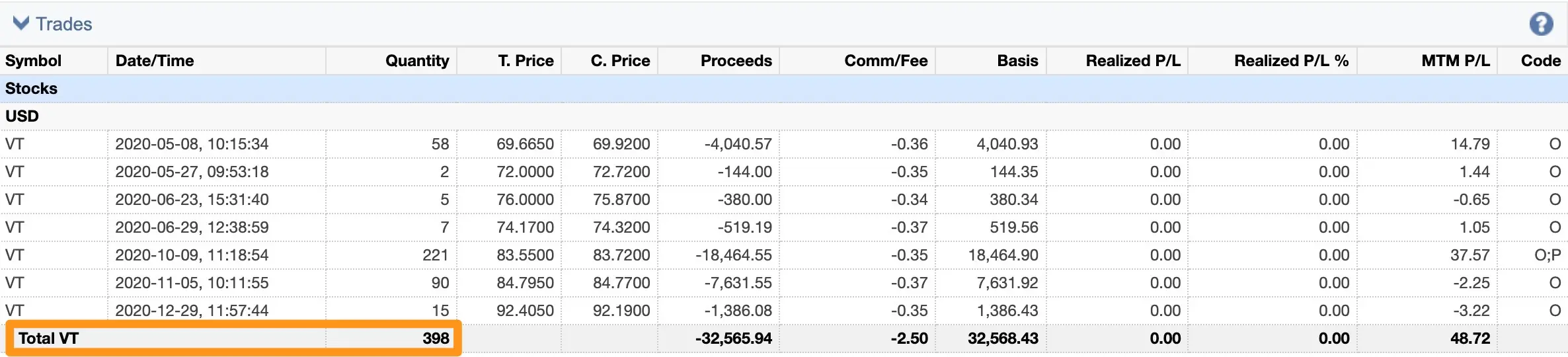

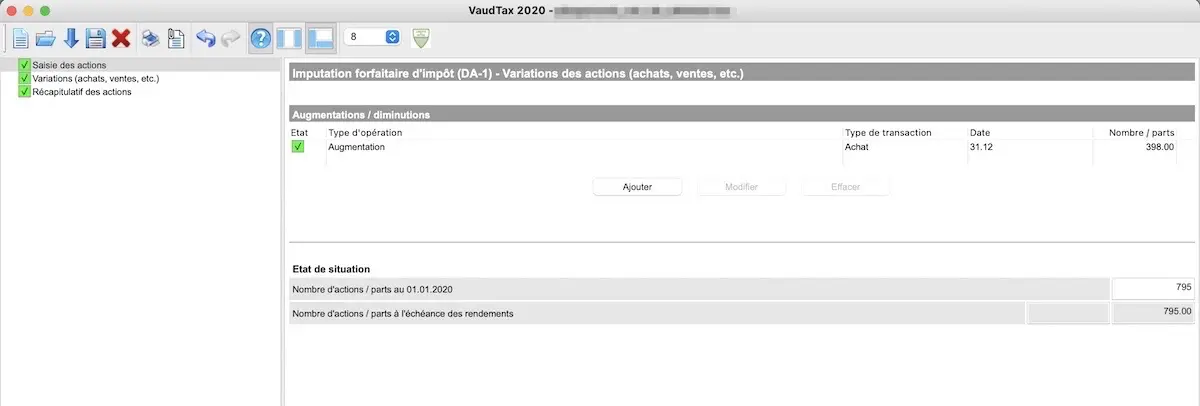

As you can see below, I bought 398 shares of VT ETF:

And the cool thing is that in VaudTax (and in the other Swiss cantons, I think), you can declare all your purchases of the same ETF in a single line. Indeed, what matters to the taxes is to tax you on all your securities as a whole:

Dividends and withholding taxes

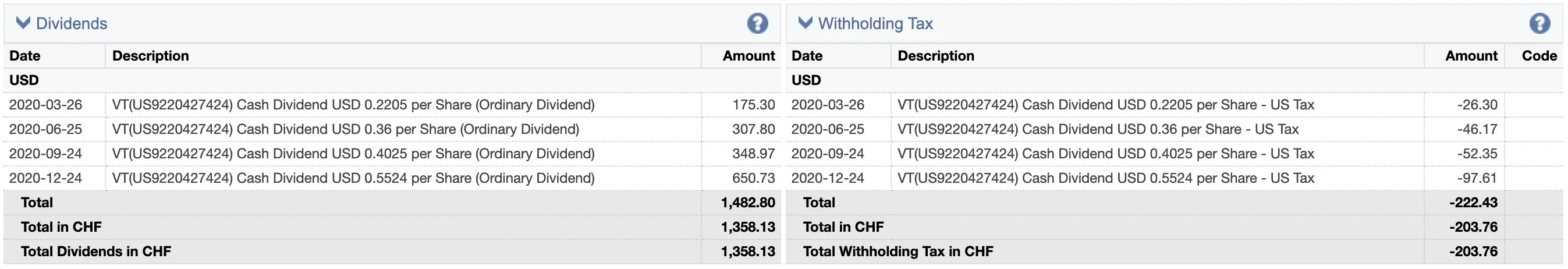

In the same statement you generated above, you will also find a list of all your dividends, as well as the taxes withheld on these dividends:

As mentioned in my Swiss investor’s tax guide, the US charges me 15% withholding tax on my VT ETF dividends, which is exactly what you see in the screenshot above.

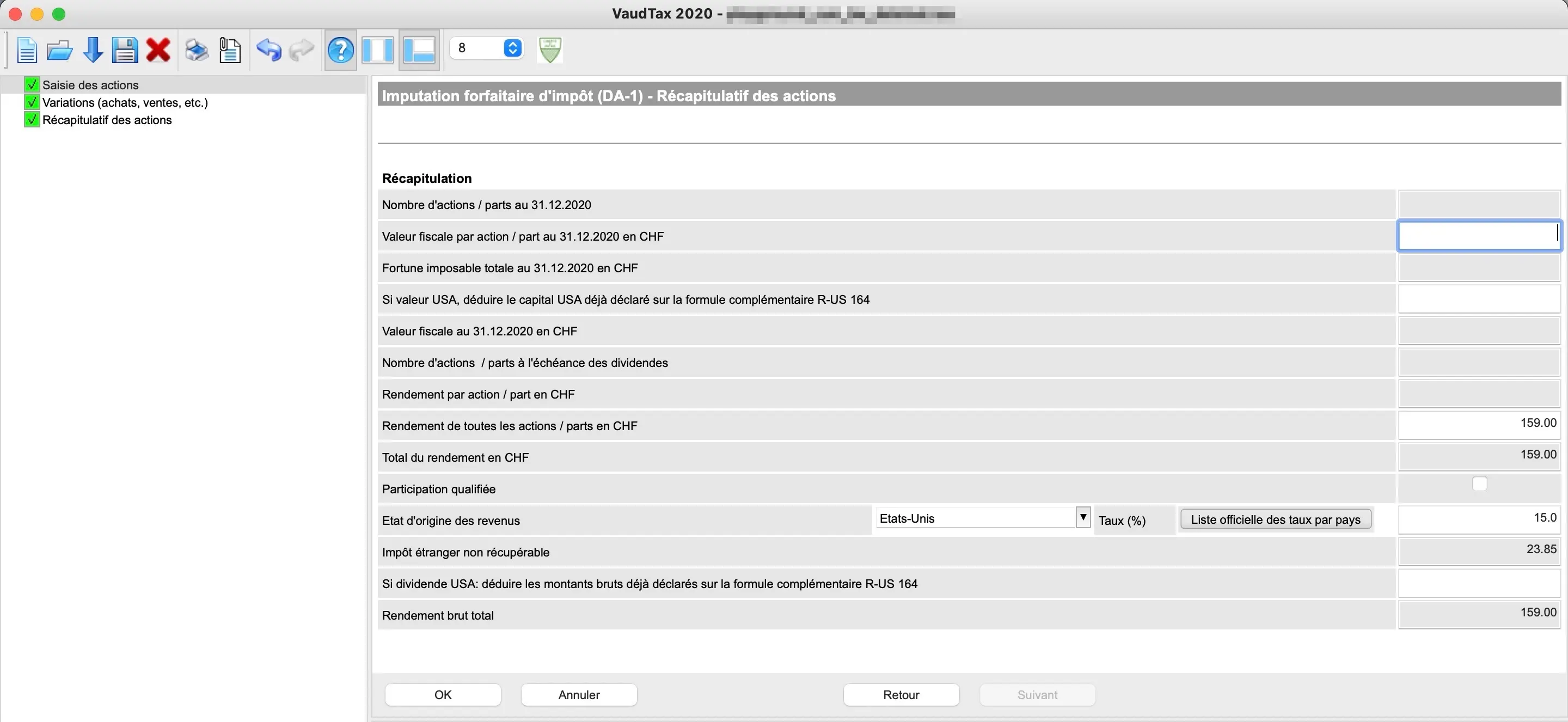

Once you have found this information, all you have to do is insert it into VaudTax, with the first 4 lines corresponding to the dividends and its corresponding withholding tax (which you will recover thanks to these lines).

The last line corresponds to the sum of your ETFs at the beginning of the year + those you bought during the year (and that we declared above):

Declaration of my VT ETF via VaudTax (the first 4 lines for dividends, the rest for the total amount I own of this ETF)

For each of the 4 lines, the VaudTax detail screen below allows you to enter the Interactive Brokers information — as you can see, everything corresponds exactly with the 15% withholding tax charged by the United States (if you wonder why I put CHF 159 and not USD 175.30, it’s because in VaudTax everything must be entered in CHF and not in USD):

“And that’s it? It’s that simple?” I hear you say.

Yes Sir/Madam!

Here you go, now you know where to find the necessary information on the brokerage firm Interactive Brokers in order to file your Swiss tax return properly.

So there’s really no reason for you not to buy stocks or ETFs to start earning Swiss Francs passively for your future early retirement in Switzerland.

Now it’s your turn!