In the last article, we completed the following parts of our tax declaration in Switzerland (Vaud tax declaration, for the canton of Vaud): tax deduction, insurance, status of assets and other assets.

As mentioned at the beginning, if you took a break in the middle of doing it, you need to import your .vaudtax recovery file to carry on from the place you stopped at.

So we’re now on the final stretch, including the important section on real estate :)

By the way, a promise is a promise: I’m going to do all this both as a “Tenant” AND an “Owner” when it comes to your main residence. Isn’t that great?

And I’m even adding the sections for direct rental property owners. Thanks, who? ^^

Step 1: Buildings, land and forests

As a “Tenant”

Let’s start logically, i.e., as if we, the MP family, were still tenants renting property in Switzerland.

So all that for this, but: there’s nothing at all for you to fill in for this section!

As an “Owner”

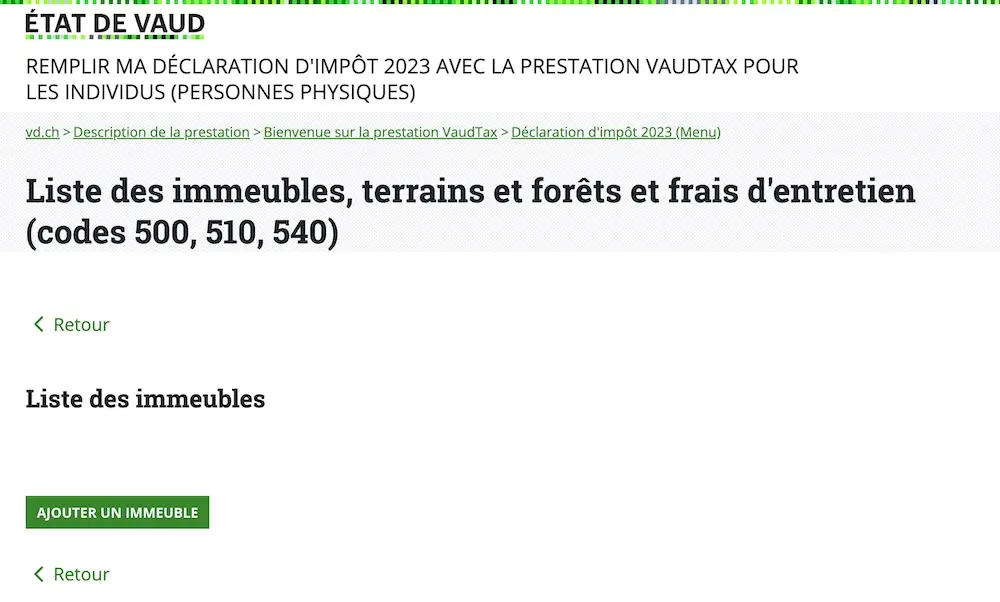

If you own your main residence, you’ll have to do more homework ;)

First, click on the link “Buildings, land and forests” (“Immeubles, terrains et forêts”).

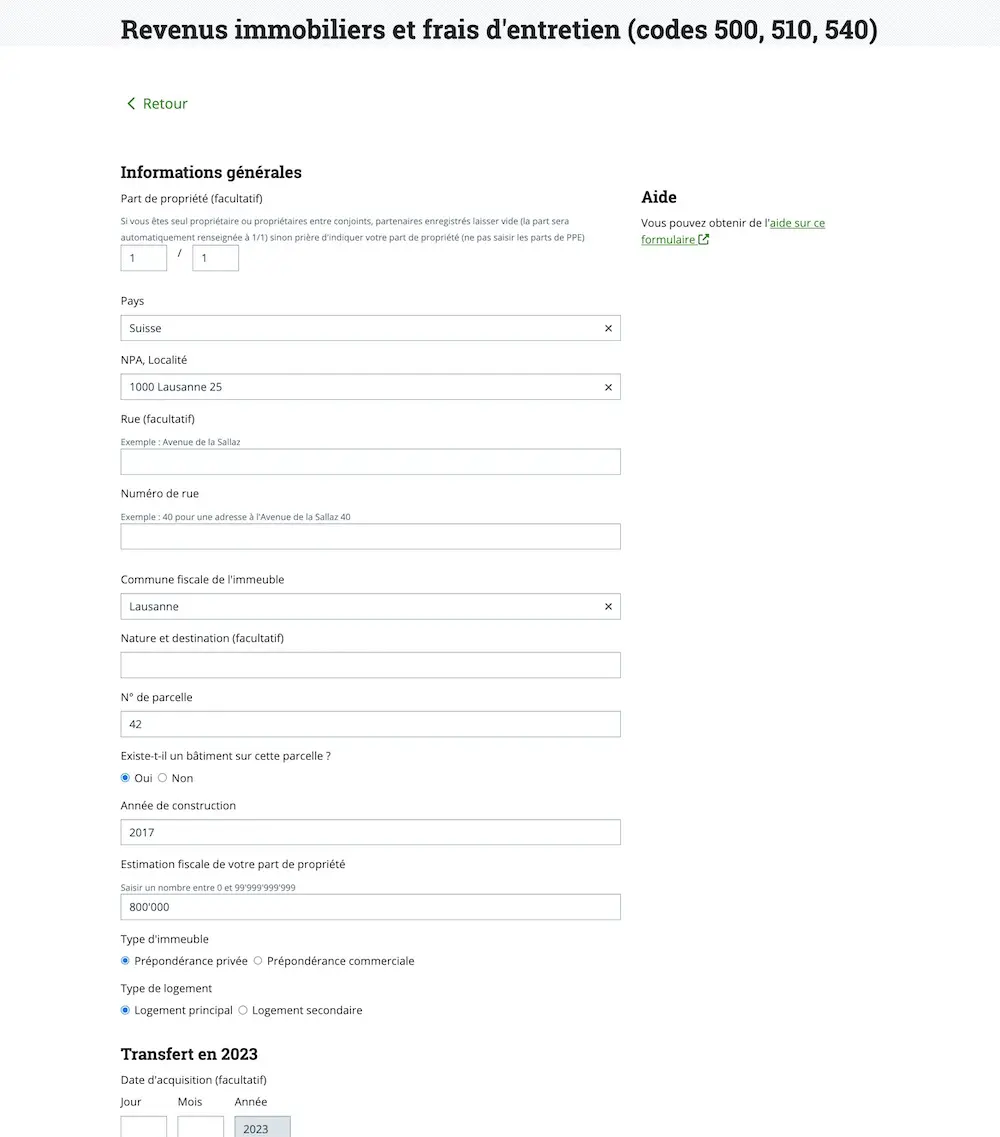

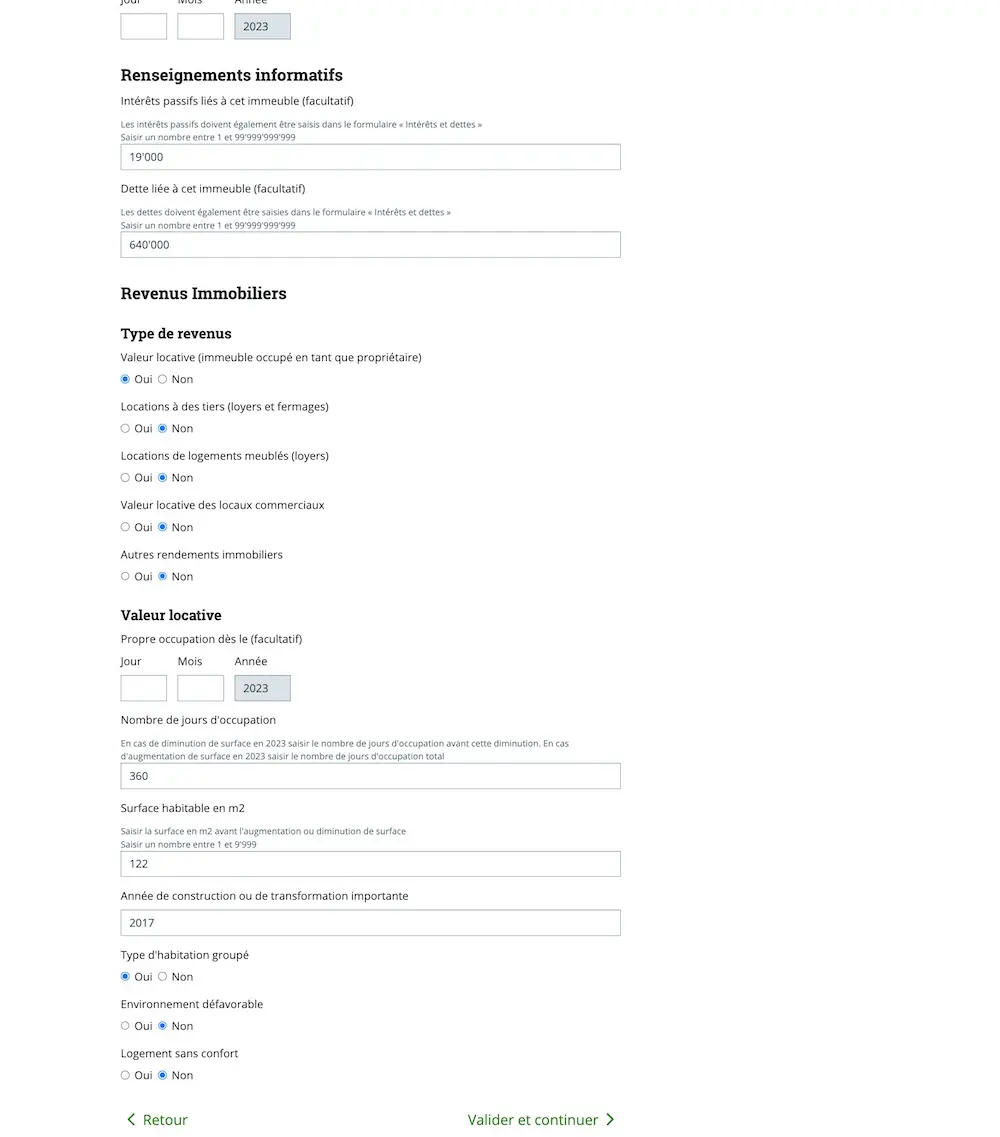

Then fill in each field with your figures (including your mortgage interest):

'Debt interest' ('Intérêts passifs') relates to your annual mortgage interest, and 'Debt linked to this building' ('Dette liée à cet immeuble') relates to the amount of your mortgage

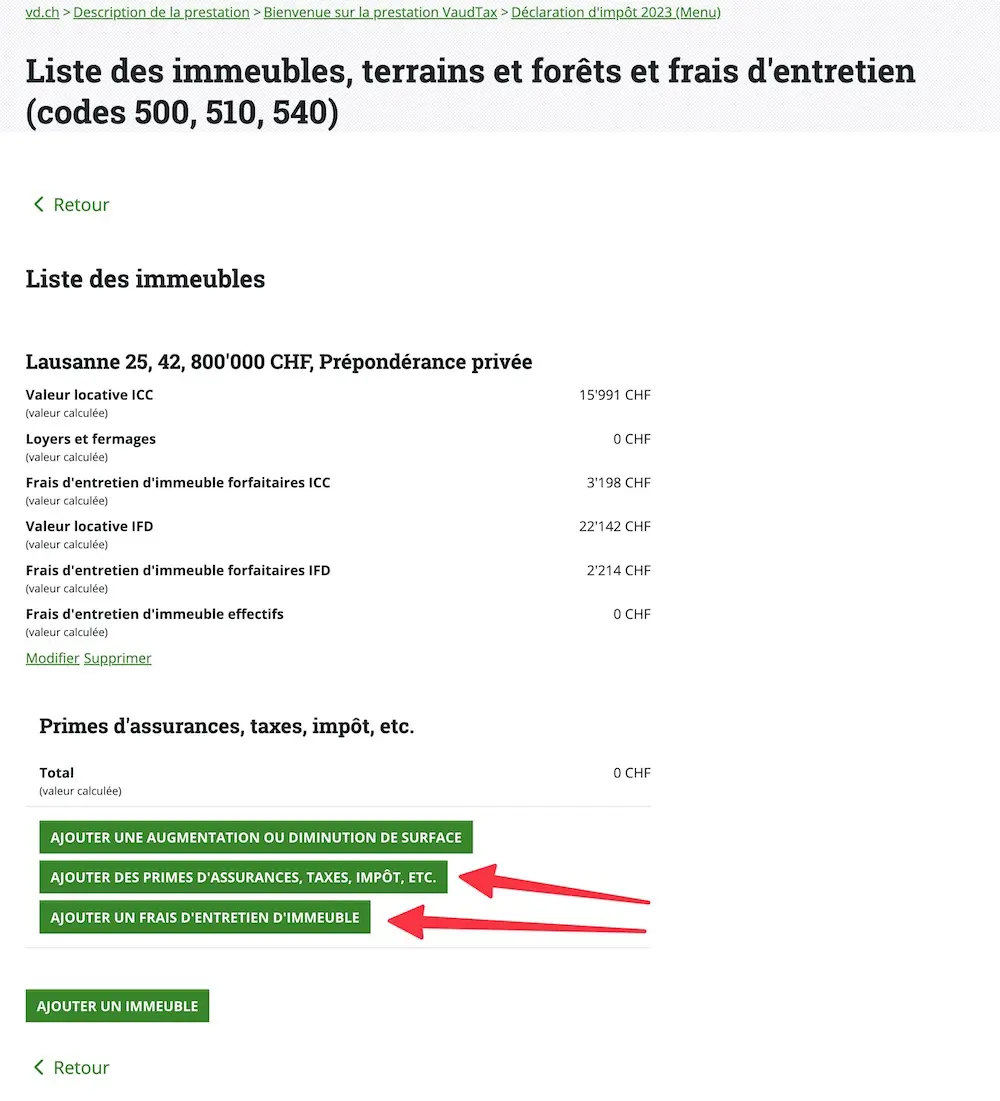

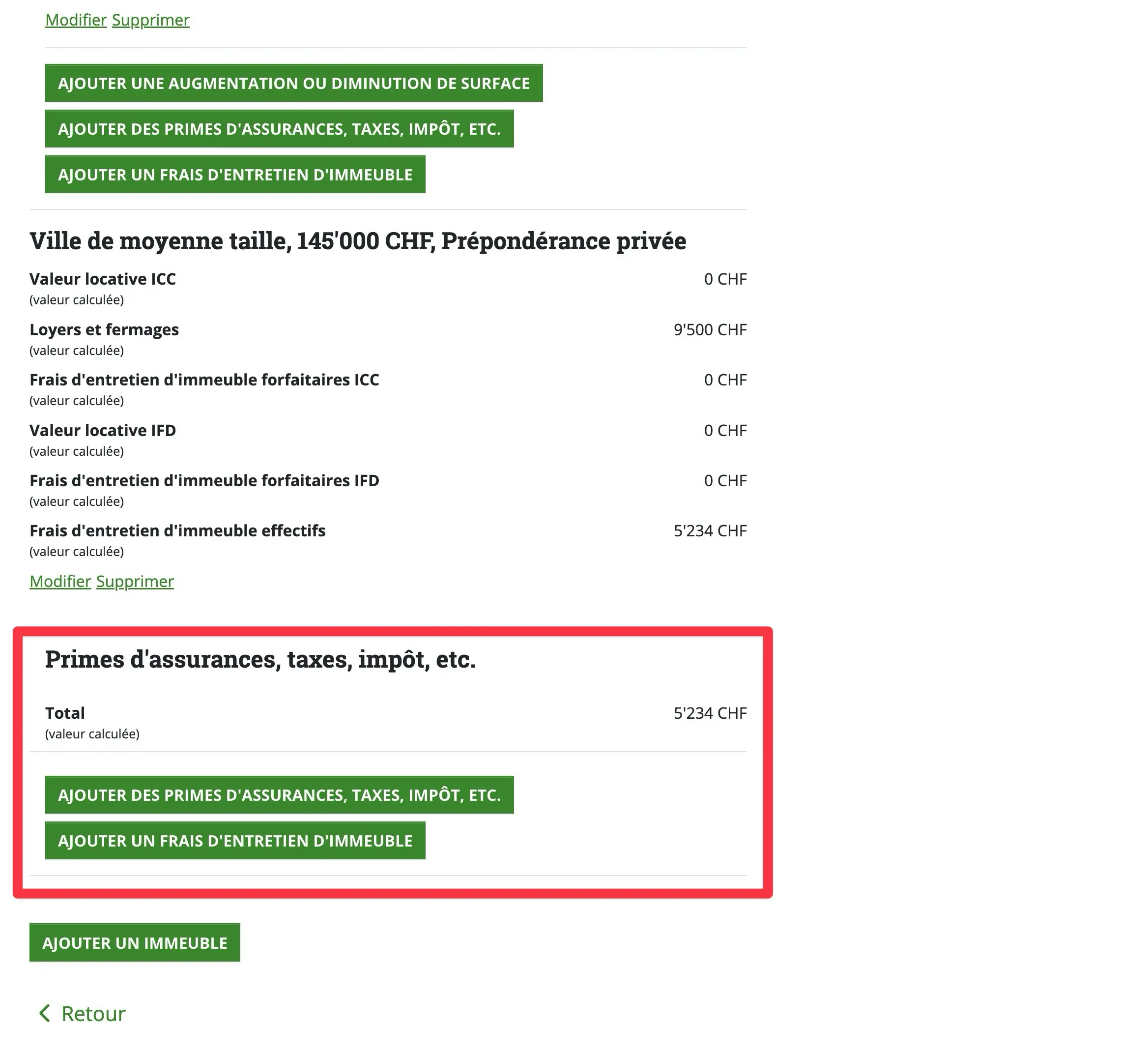

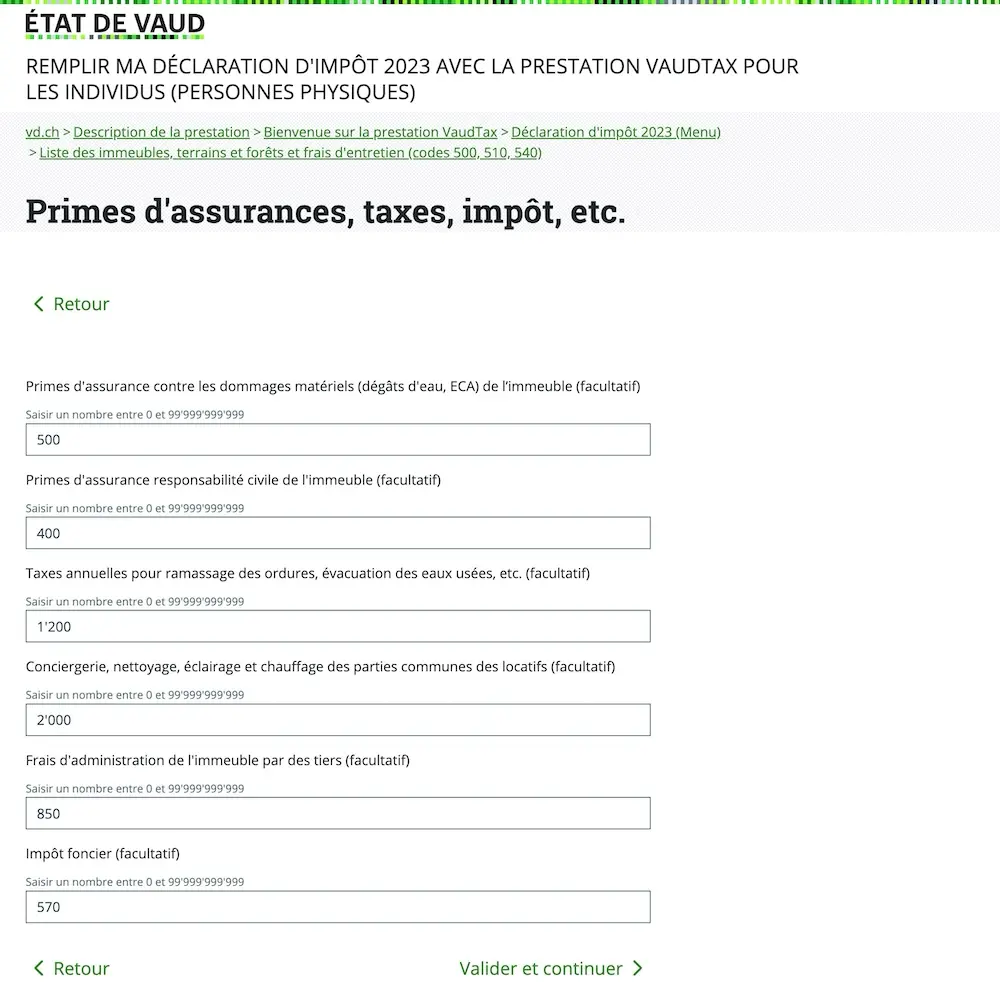

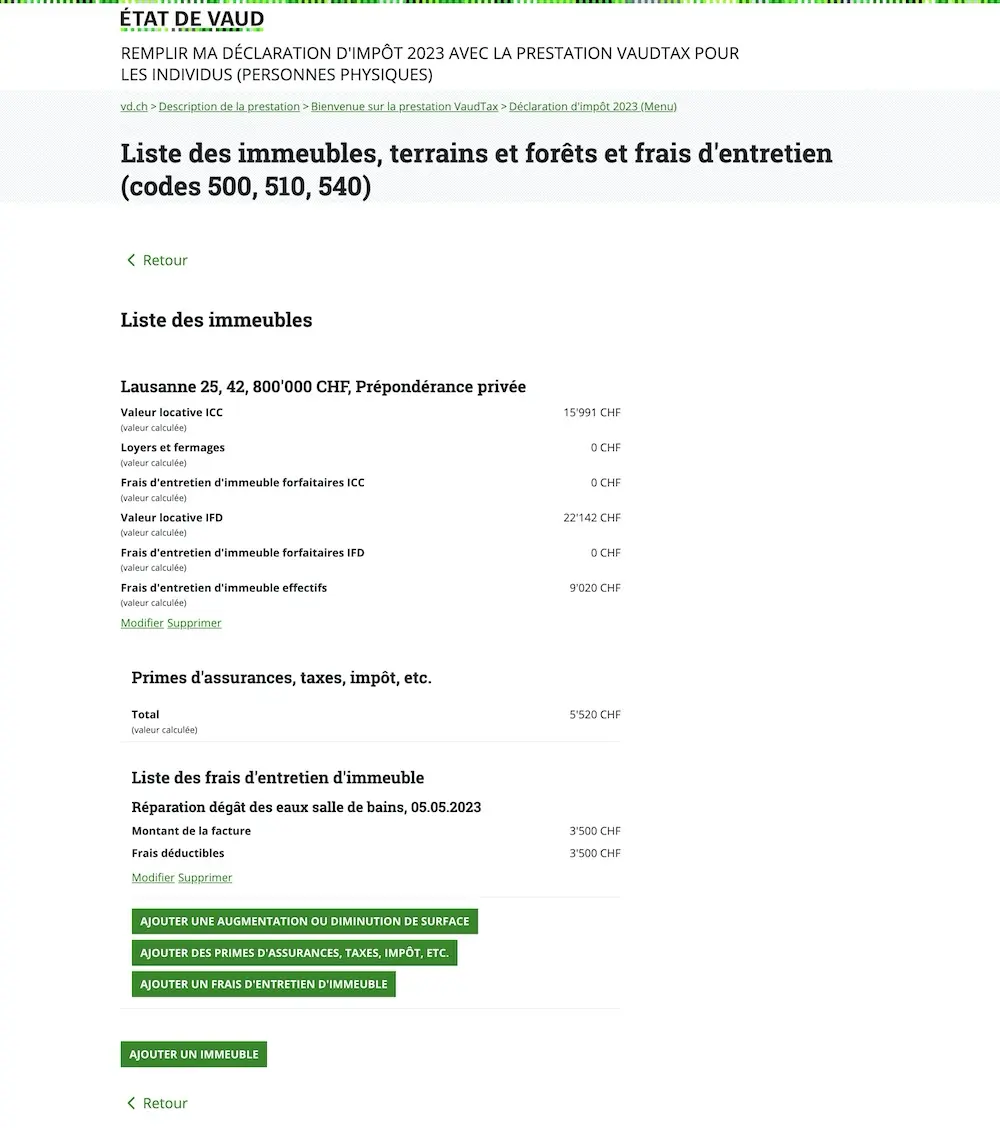

Once you’ve added the property, then all the “Insurance premiums, levies, taxes, etc.” (“Primes d’assurances, taxes, impôt, etc.”) need to be declared, as well as a “List of building maintenance costs” (“Liste des frais d’entretien d’immeuble”) (optional):

Declaration of the tax deductions for our main residence in Switzerland (if you're in a PPE, the administrator will normally provide you with this information)

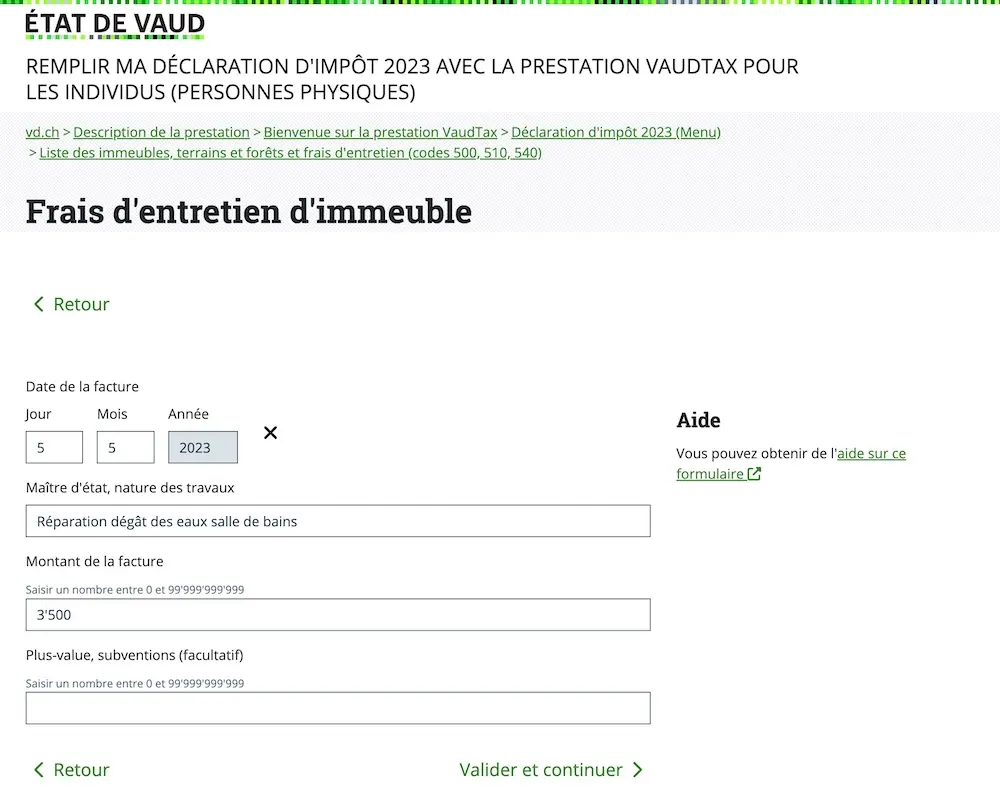

You can also declare all the maintenance works in this section (as long as they’re not works that increase the value, like adding a jacuzzi or similar):

Declaration of additional maintenance costs (for your property in particular, as anything that relates to your PPE is declared in the previous screen)

And this is what the summary of the tax declaration for your main residence looks like when you’re a property owner in Switzerland:

And in just a few fields and clicks, you've now completed the tax declaration for your main residence :)

As a “Rental real estate investor”

As you know, I invest substantially in rental real estate in Switzerland, and I also have rental investments in France.

Rental real estate in Switzerland

My real estate investments in Switzerland are managed by a dedicated company. So I don’t need to declare anything here.

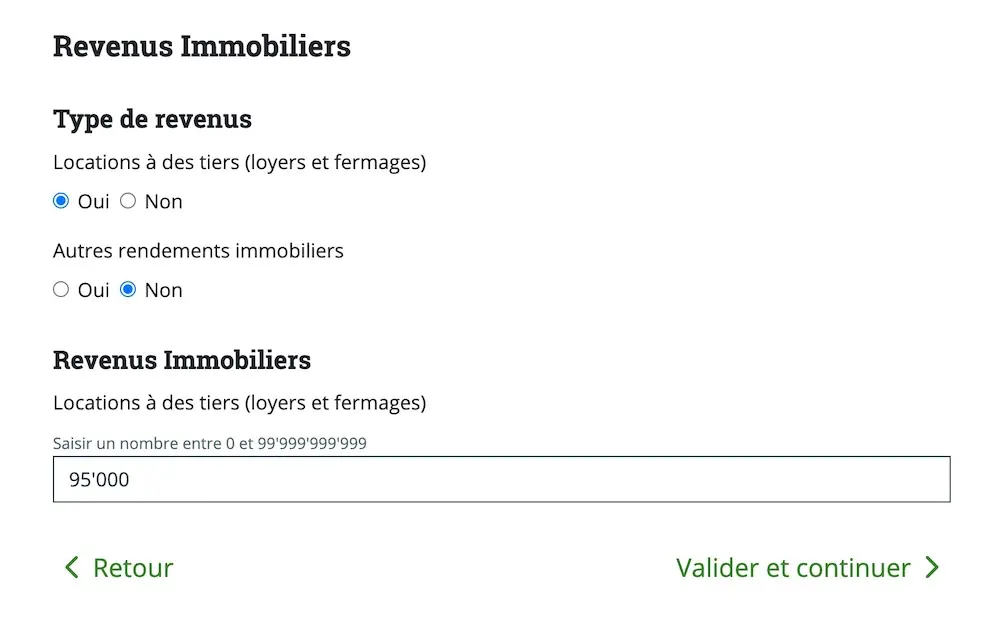

But if you own a rental property directly, then you can simply repeat the previous steps (where you declared your main residence), and tick “Yes” (“Oui”) for the “Rental to third parties (rent, leaseholds)” (“Location à des tiers (loyers, fermages)”) part:

Then, you can also declare here your insurance premiums, levies, taxes and property maintenance costs.

Rental property in France

Our rental investments in France are held through a French SCI (civil company).

However, you do still need to declare them to the Swiss tax authorities so that these assets are included in the total calculation of your wealth.

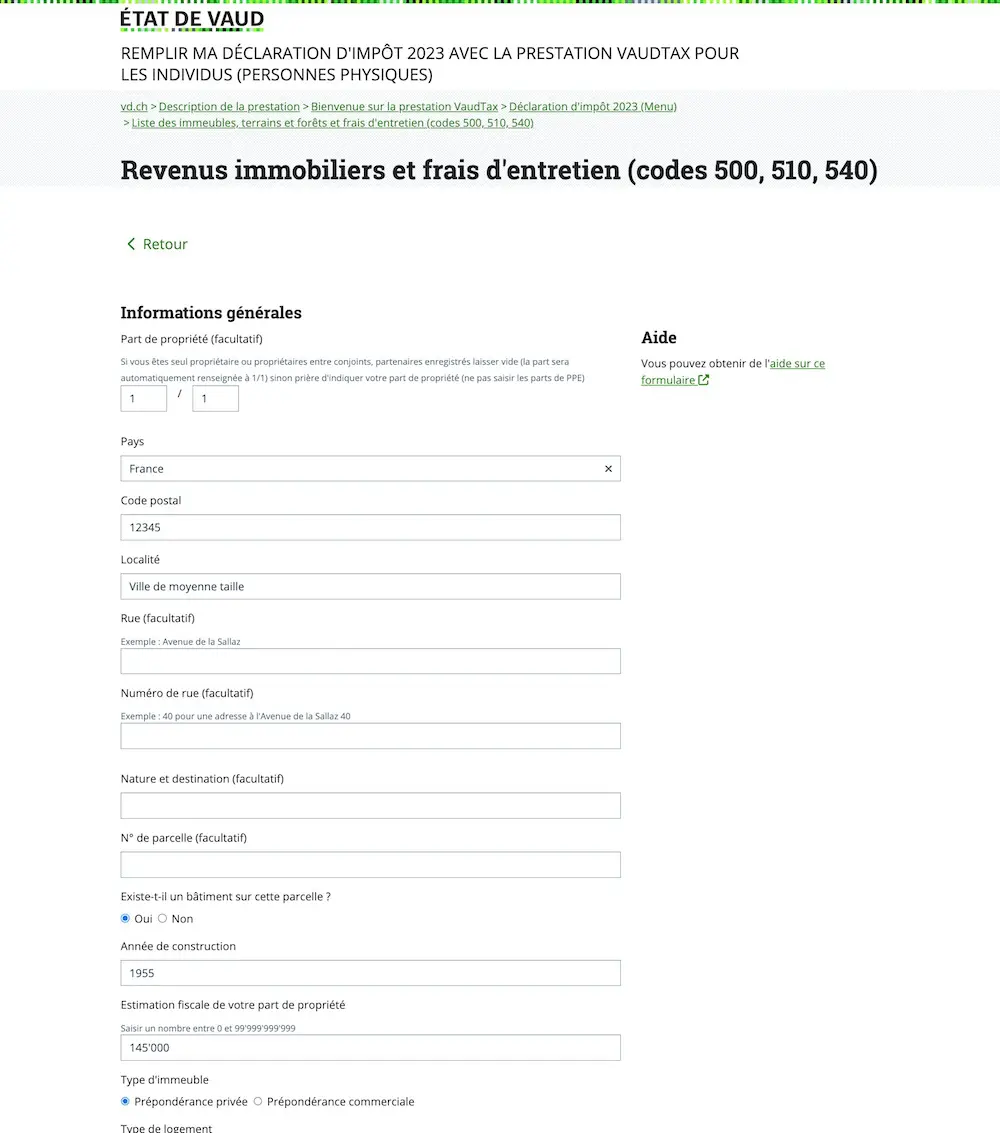

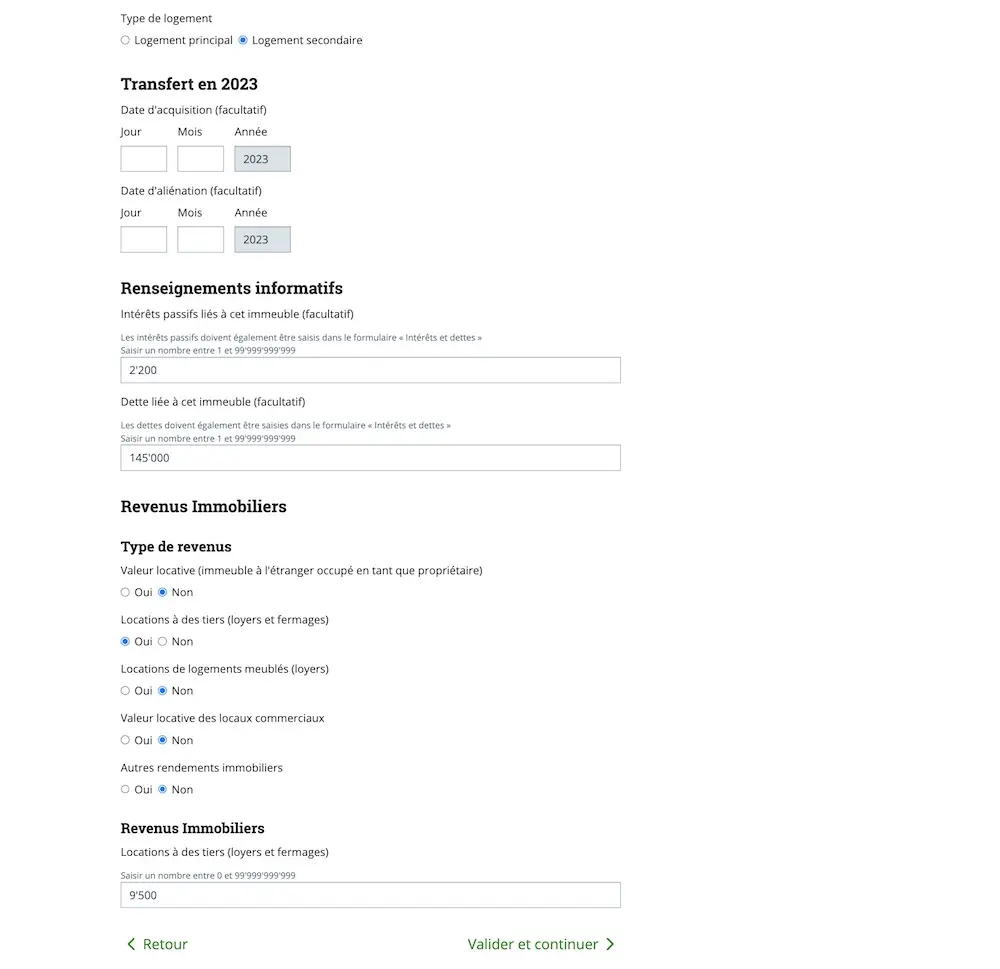

To achieve this, you need to fill out the same form in the tax system as before, but with a few different parameters:

And just like with the previous properties, you can deduct the fees and associated costs:

And… that’s it!

Step 2: Interest and debts

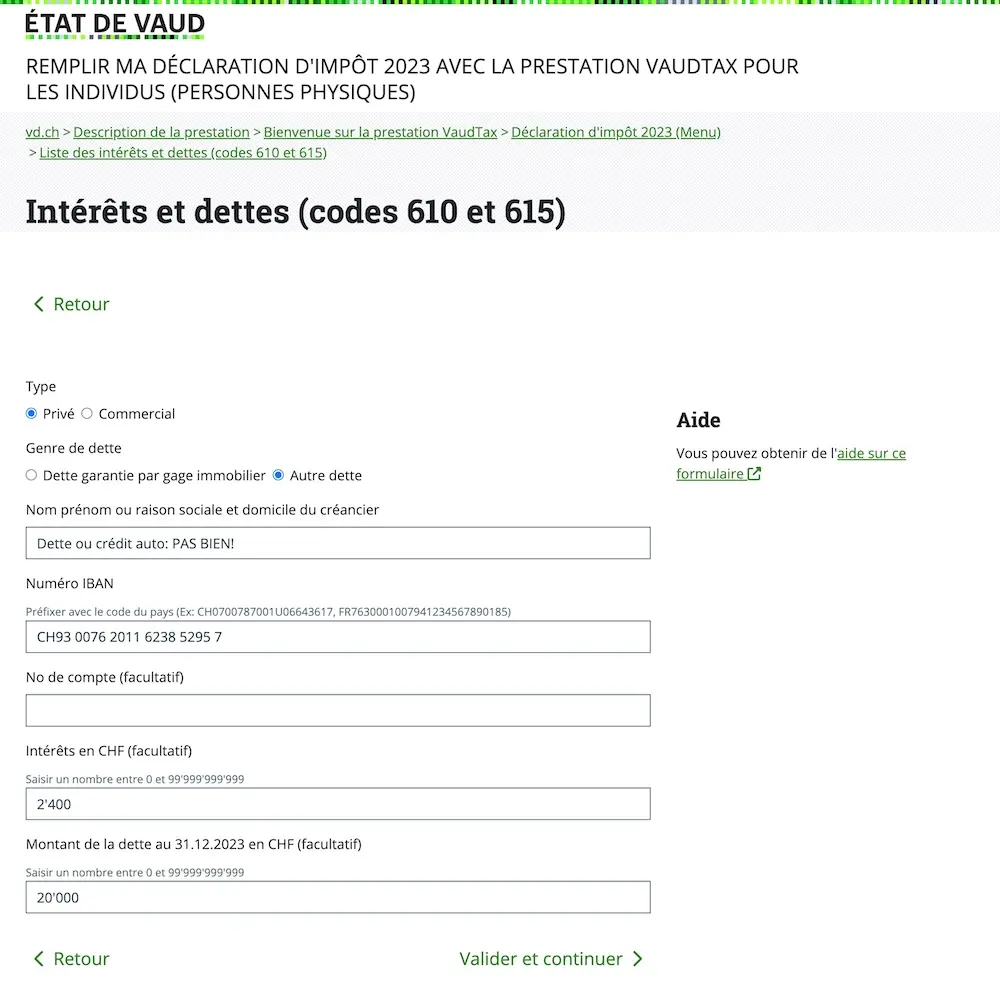

This is where you can declare a debt, a car loan, a mortgage, or negative returns on capital investments (e.g. if you sold ETFs with realized losses).

I’ll show you how to fill out a debt or car loan in Switzerland, but really, I’m not joking: your goal FROM NOW ON is to pay it off as quickly as possible!

You need to be the master of your money, not the servant.

Lesson over, let’s move on:

Declaration of our car loan to be paid off as fast as possible! Yeah, I know, I'm repeating myself, but it's for your own good, I promise ;)

As a “Tenant”

If you’re a tenant, there’s nothing particular to complete in this section. You can move on to the next section :)

As an “Owner”

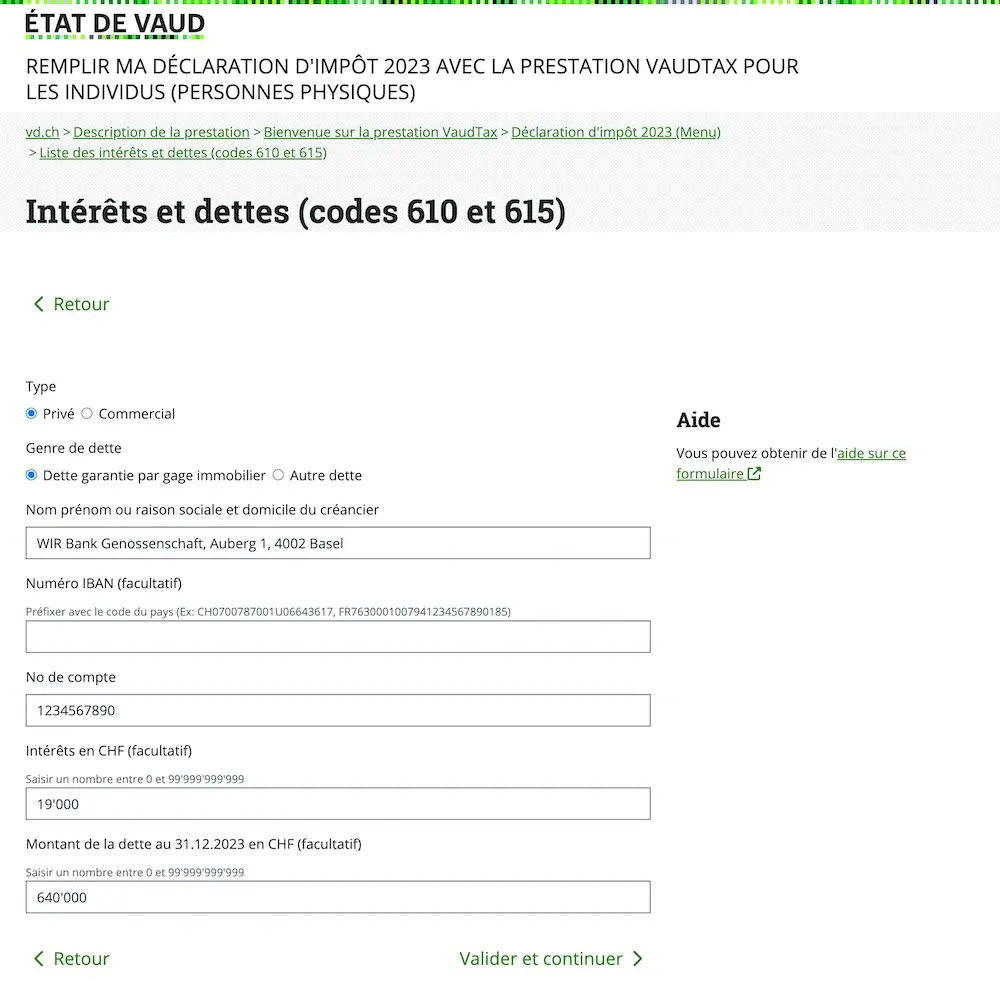

However, if you own your main residence in Switzerland, then you need to add your mortgage and its interest here:

Tax declaration of my Swiss mortgage (you need to put the same figures here that you put for your main residence in the 'Buildings' section above)

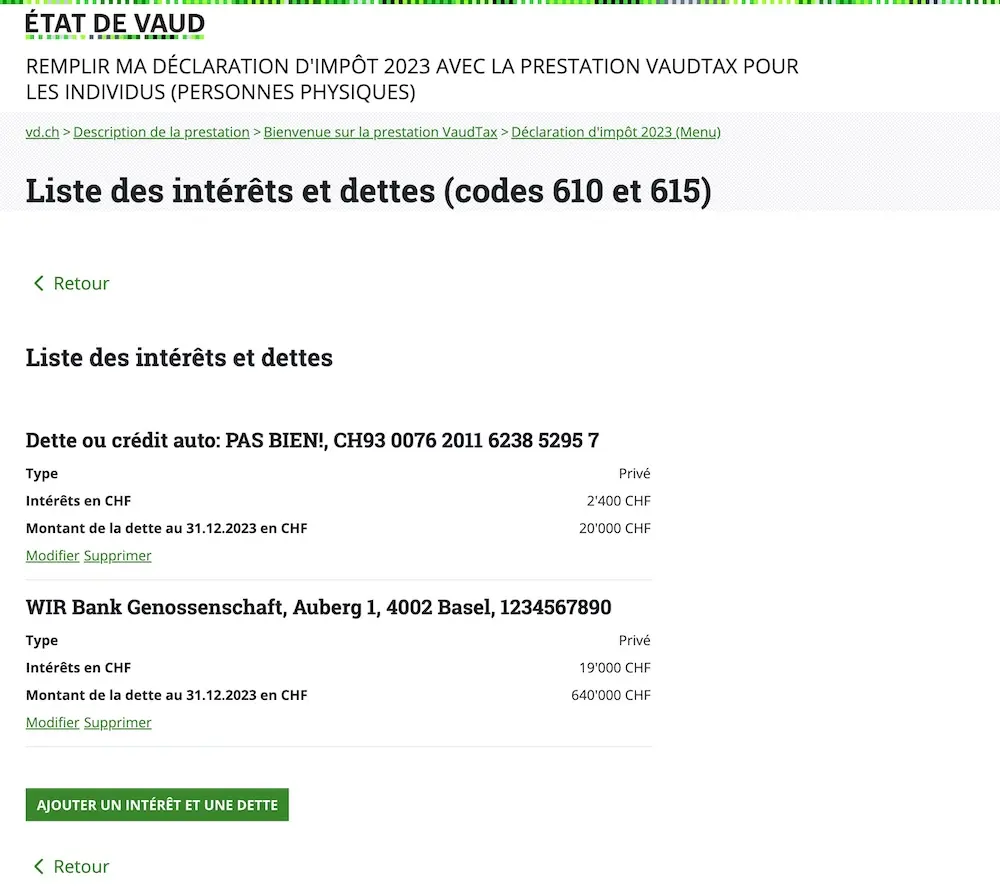

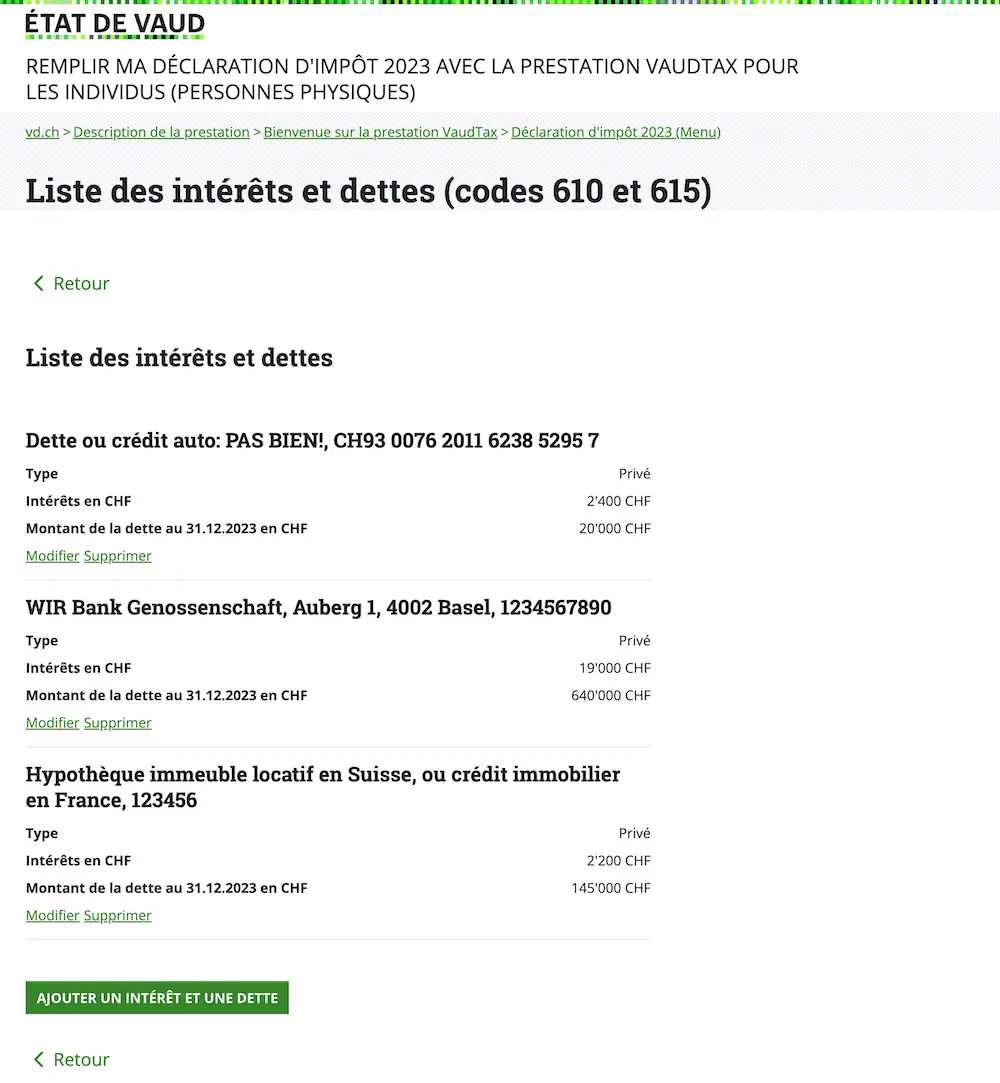

And this is what the summary of your debts then looks like:

As a “Rental real estate investor”

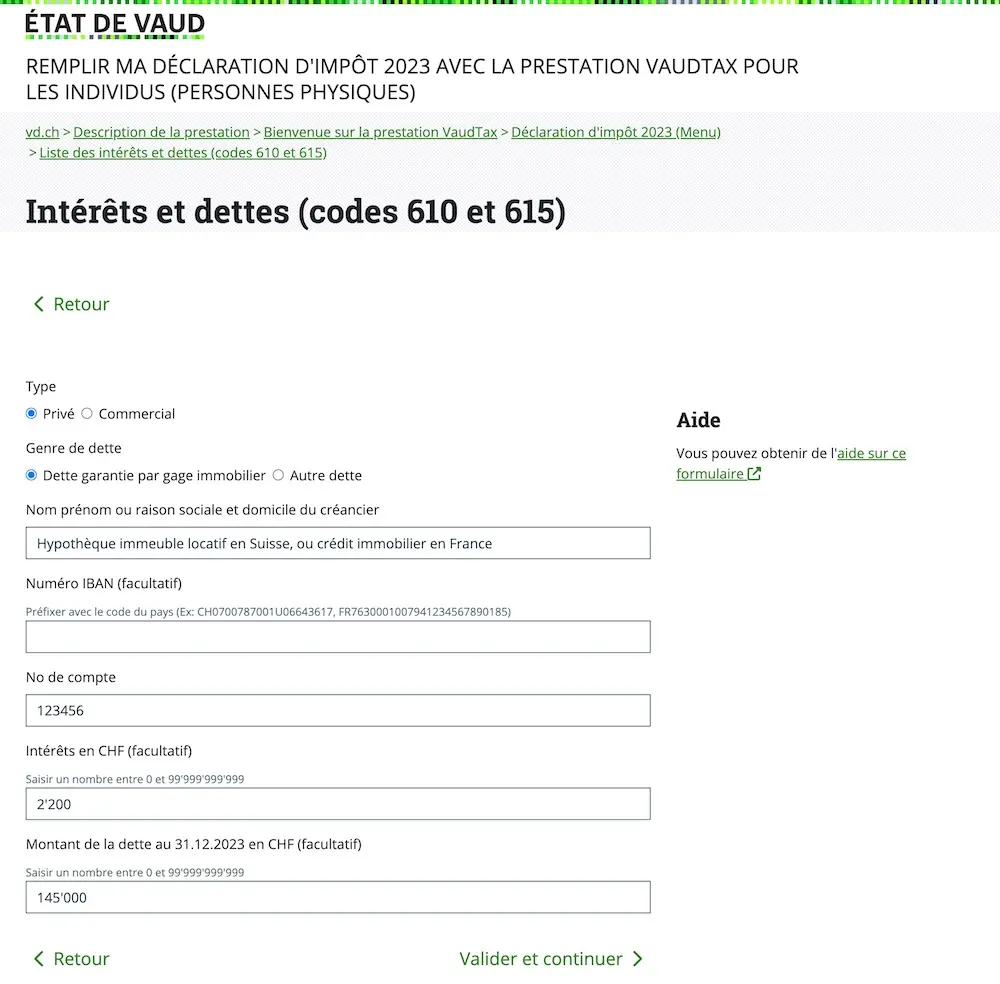

You also need to add here your interest and debts linked to any real estate investment in Switzerland or France.

The location of the real estate doesn’t matter; it’s the same process:

And here is what the summary of interest and debts then looks like:

It’s really that easy. Anyway, let’s carry on; I’ve got a walk to do afterward :D

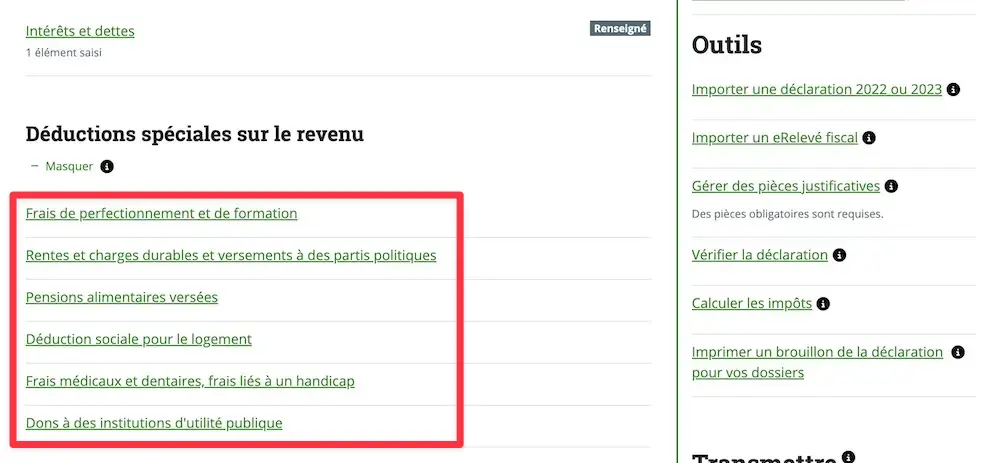

Step 3: Special deductions from income

In this section, you can deduct the following items:

- Development and training expenses

- Ongoing pension payments, charges and payments to political parties

- Alimony payments

- Social housing deduction (different if you’re a tenant or owner of your main residence — cf. explanations below)

- Medical and dental fees, expenses linked to a disability

- Donations to charitable institutions

For me, I usually only have to complete the “donations” section.

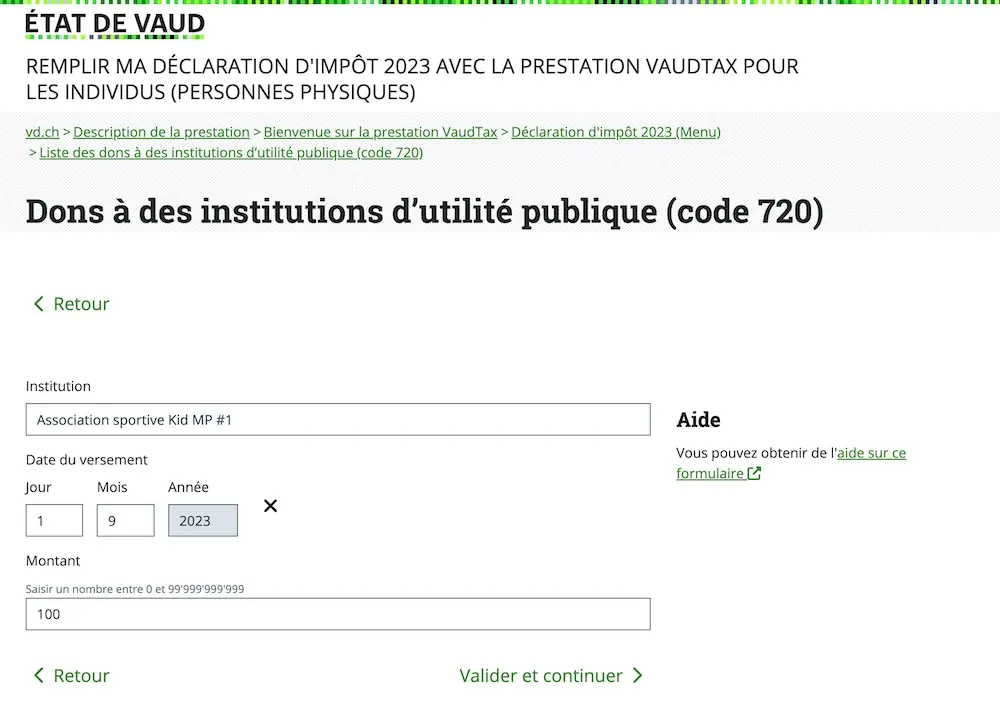

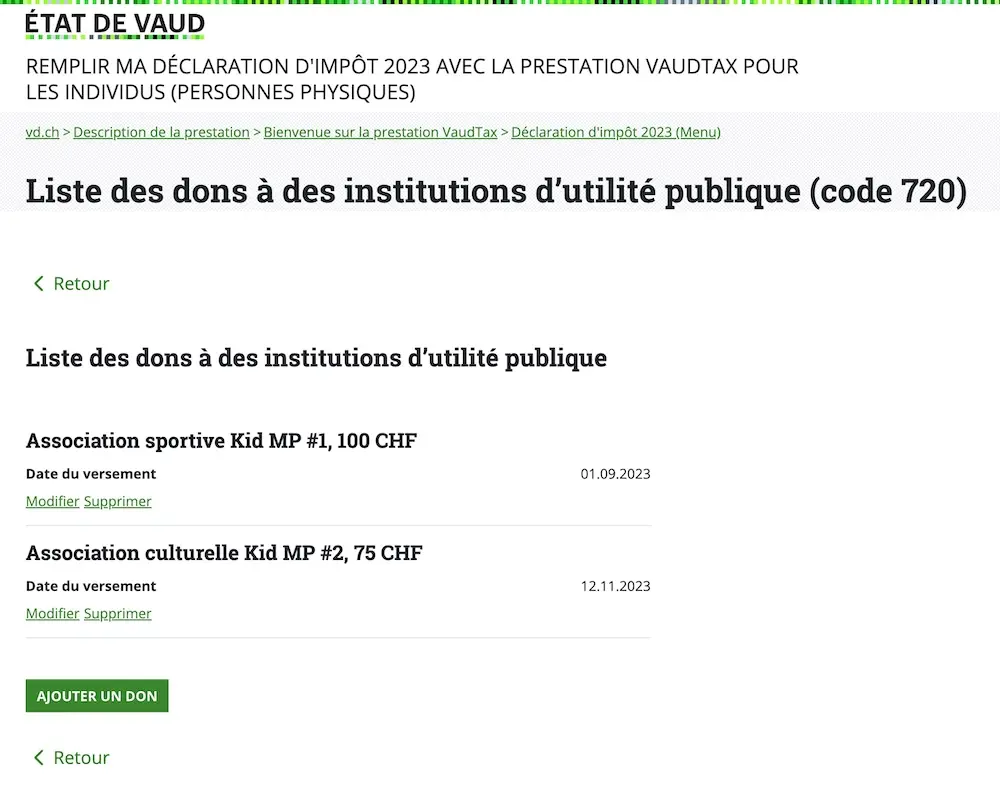

Donations to charitable institutions

Each year, we make donations to two sports or cultural associations in which our children participate:

And then the summary once it’s all completed, as for each section in VaudTax:

As a “Tenant”

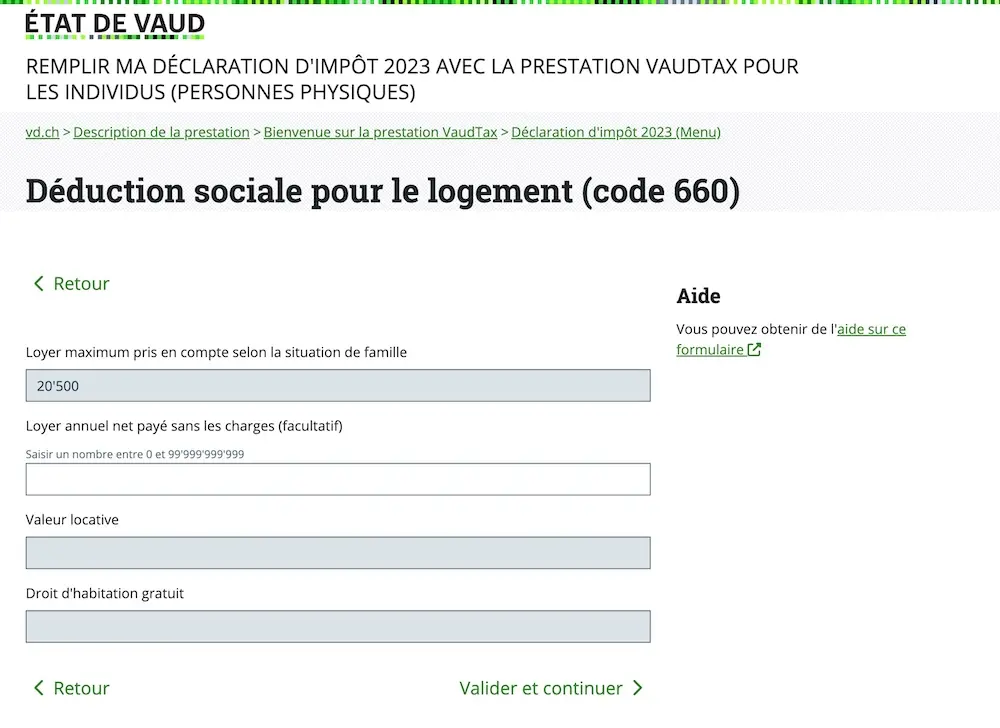

If you’re a tenant, the “Social housing deduction” (“Déduction sociale pour le logement”) section is filled in automatically with a flat rate that corresponds to the maximum amount for the housing deduction (code 660).

For example, for 2023, this amount is CHF 6,600 per person, maximum. This explains why I have CHF 20,500 listed, as Mrs. MP and I are married, and we have children (the calculation is made automatically by including the corresponding parts of the family quotient):

You can add your rent excluding charges (which I’ve tried to do several times ^^), but the tax department will only consider the value that’s been calculated automatically, as it’s the maximum authorized limit of deduction. So it’s only worthwhile if you want to pay more tax… 🙃

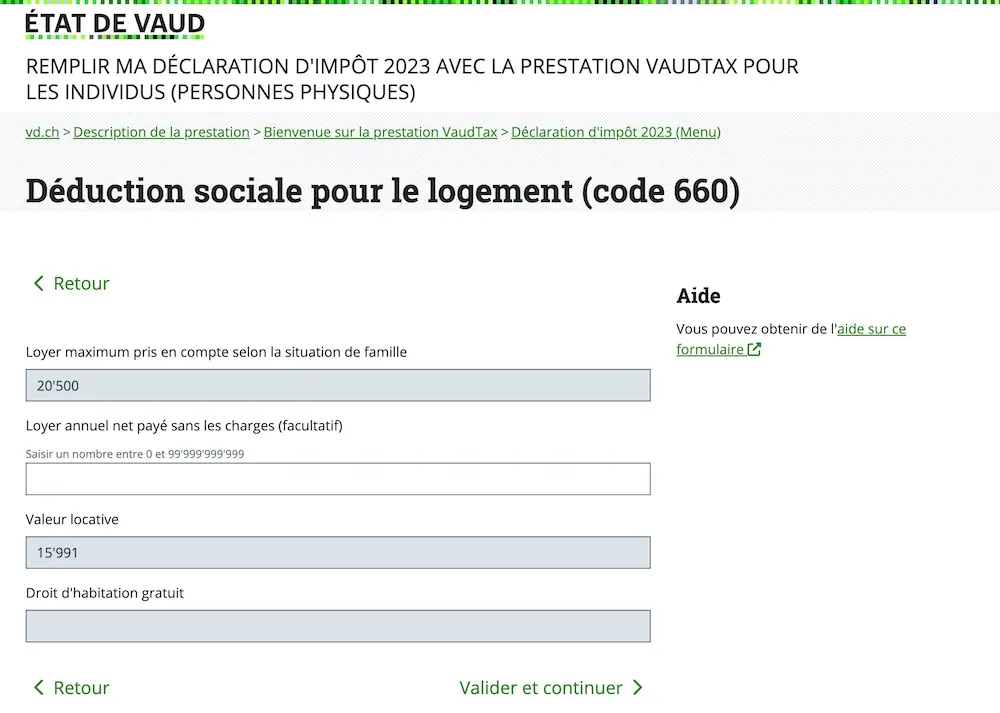

As an “Owner”

As an owner, you’ll see your well-known rental value (“valeur locative”) get added so that you don’t get too much of an advantage with the deductions linked to your mortgage…

Like you can see, it’s also calculated automatically:

And that’s all for this section :)

Step 4: Additional information

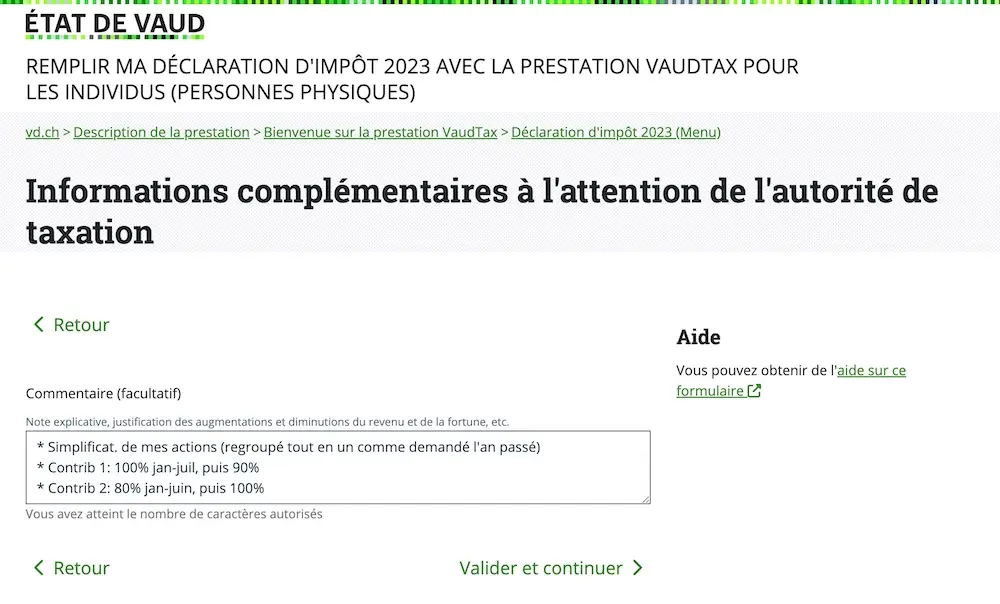

As explained in the “Business expenses” (“Frais professionnels”) and “Status of assets” (“État des titres”) parts, you can leave a (voluntary) note for the tax authorities in this section, if required:

For me, here is what I explain to them:

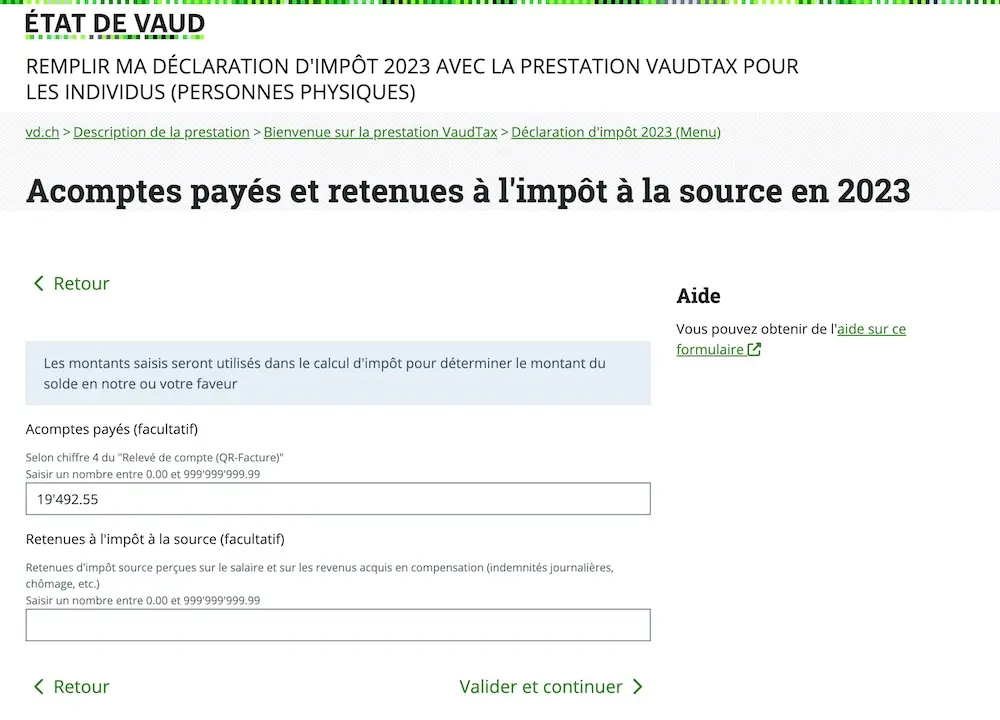

Step 5: Payments on account

We’re already at the end of our Swiss tax declaration; it turns out it wasn’t so bad!

In this section, you need to enter the number of payments on account that you have made during the tax year.

Then, the VaudTax software will be able to compare what you need to pay against the total of your payments on the account connected to your taxpayer number. And you will then either have to pay the difference or be reimbursed by the cantonal tax administration.

Step 6: Supporting documents

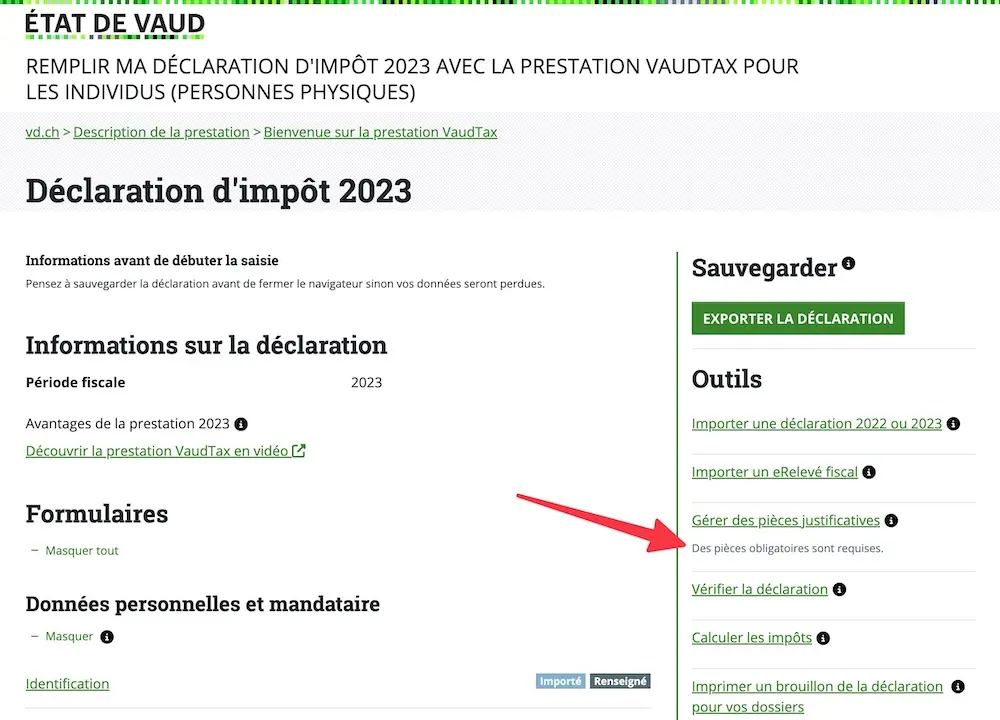

Then you need to go to the top of the VaudTax webpage to see if you have to provide supporting documents to the tax office.

As a “Tenant”

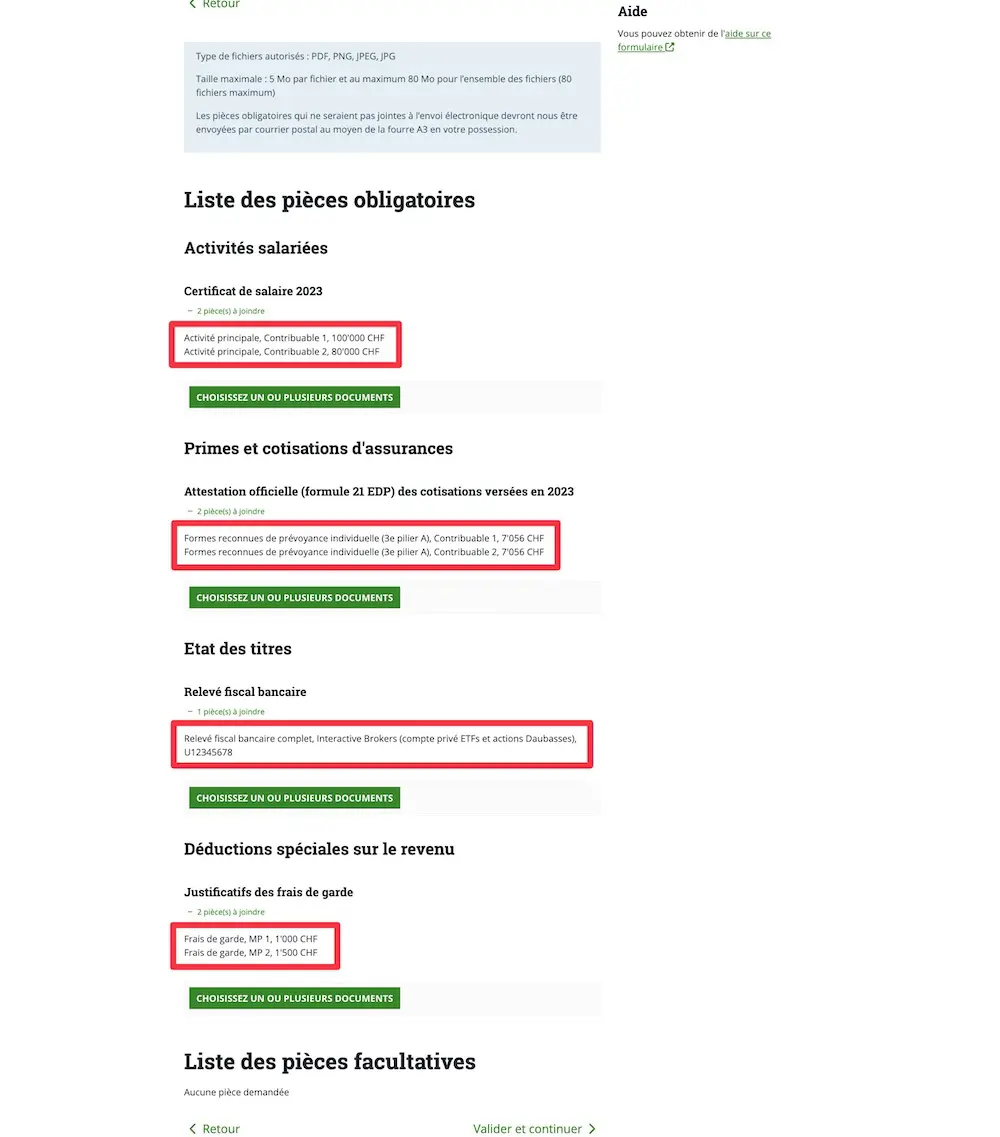

As you can see in the screenshot below, for me, I need to provide:

- Salary certificate for Mrs MP. and me

- Official confirmation (form 21 EDP) of the contributions made into our 3a pillar (for Mrs MP and me)

- The bank tax statement of our Interactive Brokers trading account

- Proof of the childcare fees for our two children

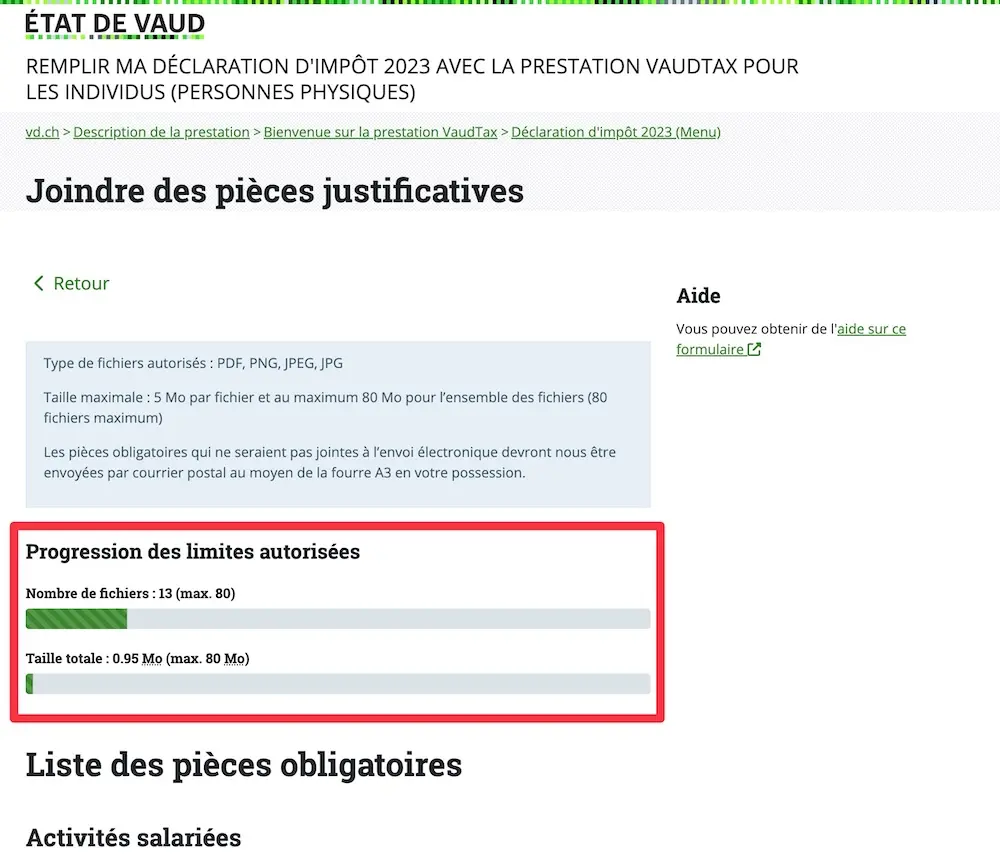

And, something that’s really handy, VaudTax allows you to easily see if your attachments are too large (rather than having an error that crashes the whole thing when you save…):

As an “Owner”

If you’re an owner, the non-mandatory supporting documents for the maintenance costs of your property are requested:

Personally, I never added them when I only owned my main residence. The tax office never asked me for them.

However, since I’ve owned the two rental properties in France, they’ve asked me for them every time they’ve done a tax audit.

But out of sheer laziness, I still don’t put them in by default.

And I leave the tax audit system to do its thing. And if I get audited again, then I will take the time to go and find everything in my digital archives!

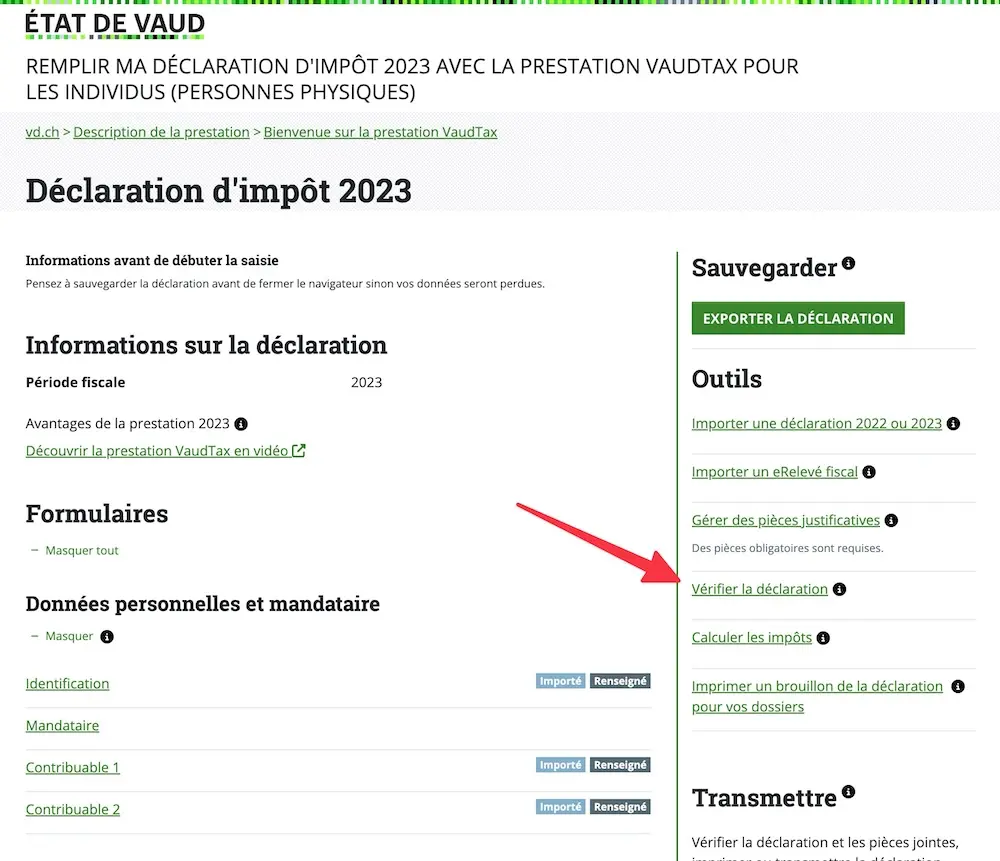

Step 7: Check the tax declaration

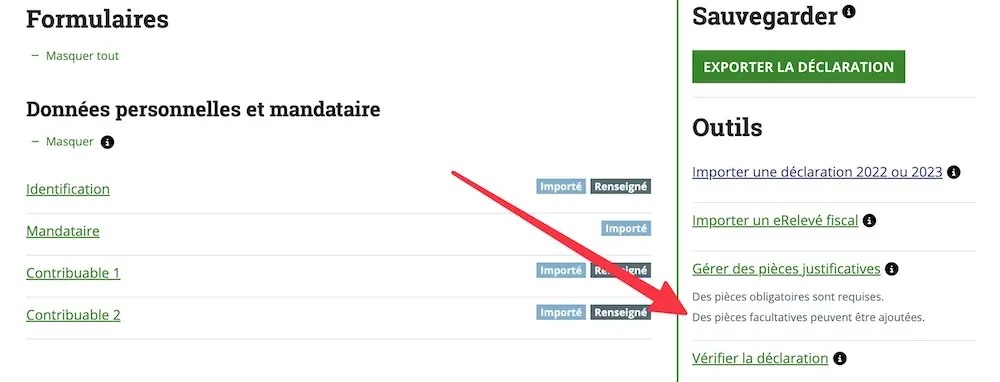

Once you’ve done it all, it’s always a good idea to reread the whole tax declaration to make sure you haven’t forgotten anything like certain living expenses, taxable income, and earned income, expenses included or made a mistake:

If you think everything seems OK, you can move on to the next step.

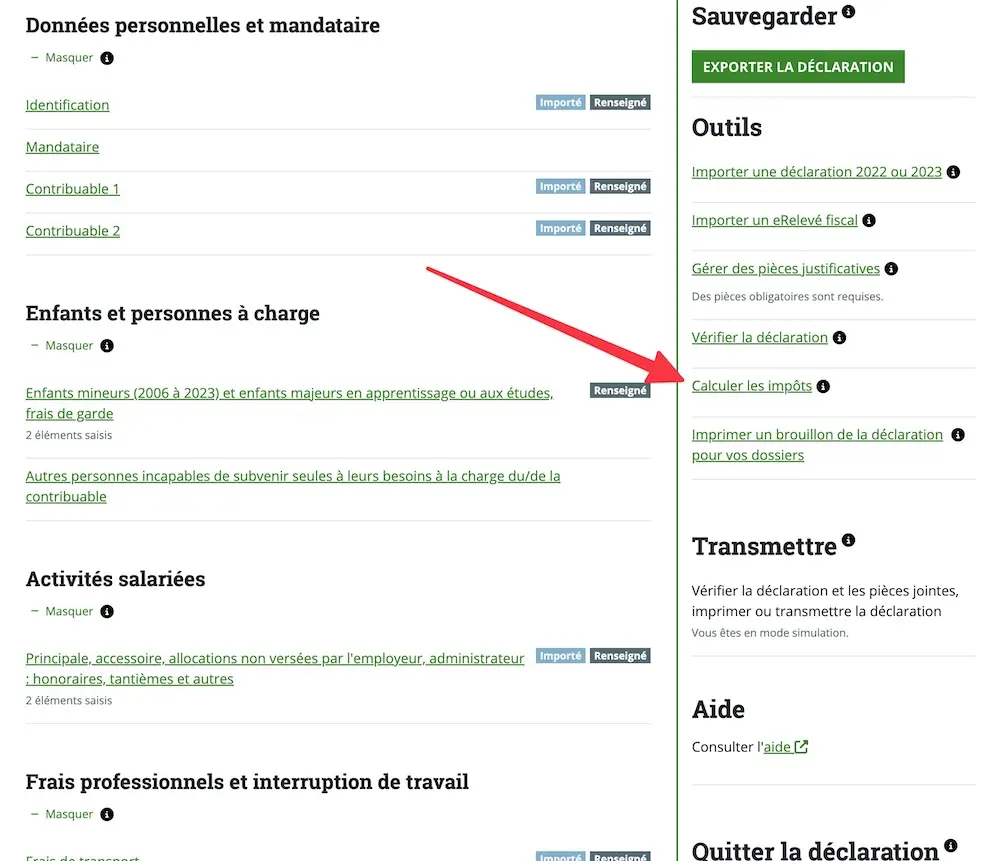

Step 8: Calculate the tax

Ah, the most important section ;)

This is the crucial moment that I eagerly await every year: finding out if I’m going to get money back or if I have to pay more tax than my payments on account have covered…

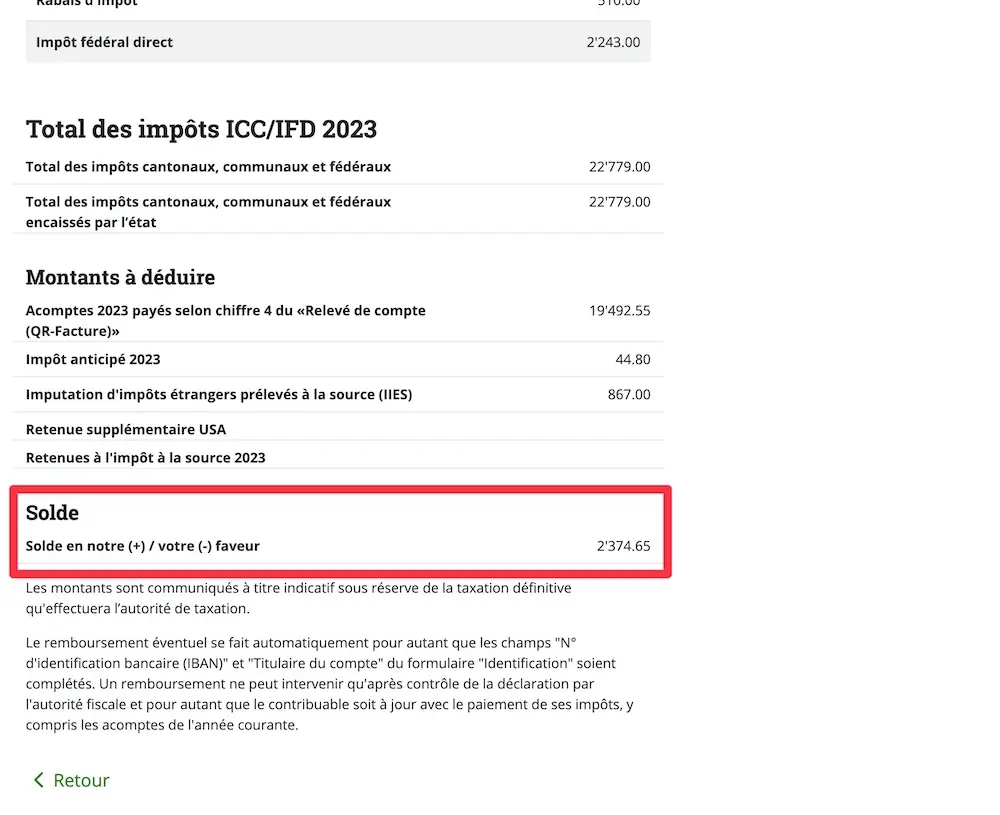

As stated, if the number is negative ("-" symbol), then the tax department will reimburse you some money.

On the contrary, if the number is positive (as is the case in my screenshot below), that means that you have to pay even more tax (CHF 2,374.65 in my example…)

Step 9: Submit the tax declaration

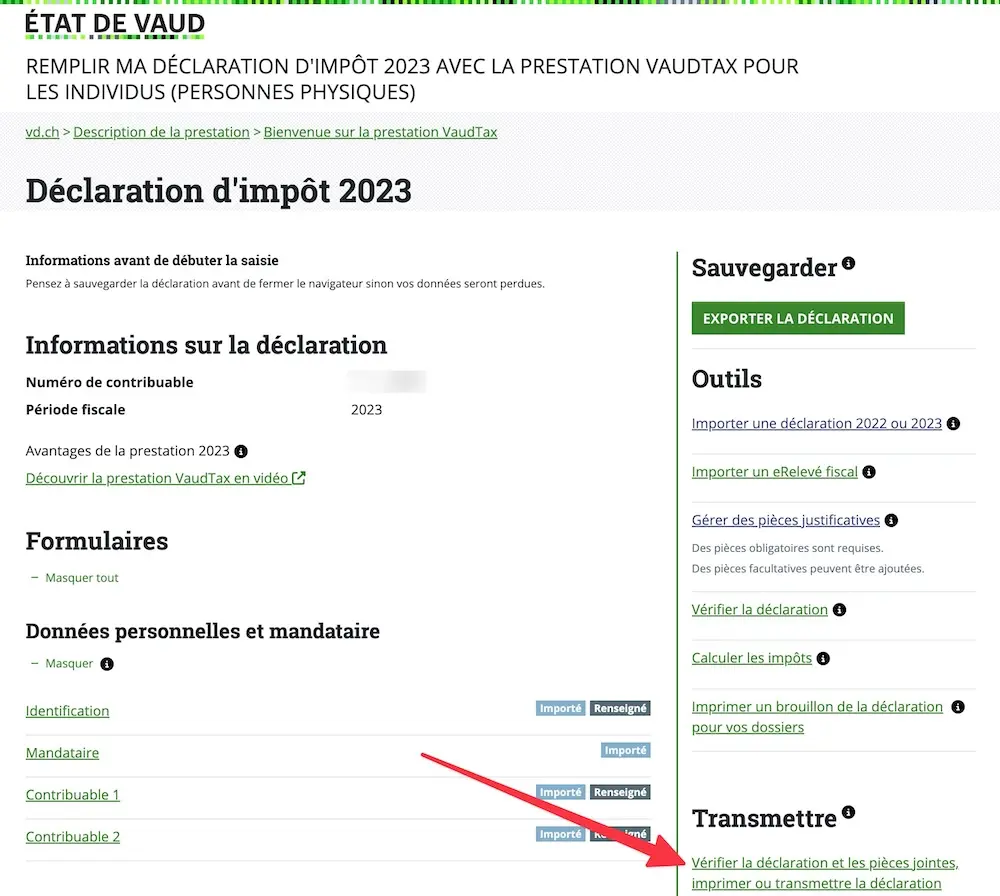

And finally, the very last step: you need to submit your declaration to the tax office.

It’s so much simpler than when it all used to be on paper… all it takes is a few clicks, and then it’s sent!

Click on 'Check the declaration and attachments, print or submit the declaration' ('Vérifier la déclaration et les pièces jointes, imprimer ou transmettre la déclaration')

It's a good idea to export your final declaration in .vaudtax format one last time, and also to save your final tax declaration as a PDF, along with the receipt confirming that it has been successfully submitted.

Conclusion

I hope that this step-by-step guide to completing your tax declaration and getting your final tax bill has been useful.

If I’ve missed any potential tax savings in the above screenshots (or if you have any other questions), please let me know in the comments section below!

Best of luck with your tax savings!