A few years ago, I had to make a large transfer from CHF to EUR for one of my real estate projects (several tens of thousands of Swiss francs). Out of habit, I used Wise because I know it’s one of the best services for converting a large amount of money into another currency.

But I’d like to know if Interactive Brokers would be better for the job.

And then a reader who has retired in the UK wrote to me recently to ask if I had a comparison of the best services for transferring money from Switzerland. Because he was talking about several hundred thousand Swiss francs:

I am personally interested in the current options for converting and transferring large amounts, as towards the end of the year or early next year I will probably need to transfer one of my large vested benefit accounts from finpension to the UK. Wise still seems a good option and I will consider b-sharpe again, but there may be other ways I could use.

It was time to remedy that.

Why would I want to transfer a large sum of money abroad?

Switzerland is a small country compared to the rest of the world. And we’re the only ones with the Swiss franc (CHF) as currency.

So there’s a good chance that you or someone close to you will find yourself in the situation of having to transfer large amounts of money.

The usual cases among readers of the blog are:

Buying property abroad

Either you’re Swiss: and want to buy a second home in Europe, or for your future early retirement in the sun. Or you’re an expat: you want to buy a property in your home country (Italy, France, Portugal, Germany, etc.).

In each of these cases, it’s not uncommon for you to have to make a transfer of 100,000 euros or more.

Retirement abroad (or donation or family support)

In the same category of expatriates, we find the recurring situation of moving abroad at the start of your early retirement (or even standard retirement). Imagine the huge sums of cash involved when you think of the transfer of vested benefits (several hundred thousand Swiss francs, or even millions of Swiss francs).

Two recent examples I’ve had:

- An expat (hi Steve!) who made his career in Switzerland, and wants to retire and move to a house in the UK: needs to make large transfers from CHF to GBP

- An American expat who plans to return home in 5-6 years, with the same need to transfer CHF to USD in the U.S.

Investment outside Switzerland

The last case requiring the transfer of a large amount abroad is for the person who wishes to invest abroad. This is the case, for example, with my rental properties in France.

Although in some cases, the local bank will lend you the full amount, it’s not uncommon to have to pay cash for notary fees or renovation work, for example.

Transferring large sums of money from Switzerland: the rules you need to know

What is a “large amount”? How sensitive is it?

When I say “large amount”, I mean anything from a few thousand Swiss francs to several hundred thousand Swiss francs (or even several million)!

Above CHF 10,000, your bank may ask you for details of the transfer in question.

What are the limits imposed by Swiss banks?

Swiss banks generally apply these typical vigilance thresholds:

| Amount transferred | Likely bank reaction |

|---|---|

| Up to CHF 10'000 | No question in general |

| CHF 10,000 - 100,000 | Security check possible depending on context |

| > CHF 100,000 | Almost always a request for supporting documents |

| > CHF 250,000 | Systematic audit, internal compliance alert |

Note: even a small amount can be the subject of an alert if the origin, frequency, or behavior is outside the norm.

Note that depending on whether you’re making a transfer to yourself or a third party, and whether it’s a domestic bank transfer or an international bank transfer, specific rules may apply. In general:

| Transfer type | To myself (personal account) | To a third party |

|---|---|---|

| 💰 National (account CH → CH) | Rarely security checks up to CHF 100k | Moderate from CHF 10-50k if no clear link |

| 🌍 International (CH → Foreign) | Moderate from CHF 10k, high > CHF 100k | Common checks from CHF 10k, very high if outside EU |

| 🌍 International (Foreign → CH) | Checks starting from CHF 10k (especially USD or high-risk countries) | Highly controlled, documentation most likely required |

Do I have to declare a money transfer abroad?

As long as we’re talking about transfers between bank accounts (i.e., not you walking around with bags of cash at customs!), you don’t have to declare anything yourself. Your bank takes care of everything (compliance, anti-money laundering, reporting).

What documents should I provide for a large transfer?

The documents requested by your bank are generally:

- Proof of origin of funds

Examples: sales contract, investment statement, pay slip, inheritance… - Relationship with third party (if not yourself)

Examples: loan contract, family relationship, donation - Reason for transfer

Examples: property purchase, repayment, investment

How long does it take to transfer a large amount?

Depending on the online service (or bank) you use, a bulk transfer can take between 1 and 5 business days.

It can even be reduced to as little as 15 minutes with Wise, if you make an instant transfer (as some Swiss banks accept).

Currency conversion: how to optimize your exchange rate

When you’re thinking of converting a large amount of money from CHF into USD (or EUR or GBP), you usually think about which bank or financial institution offers the best exchange rate.

But those are not the only options, as there are other entities with more or less transparent fees involved.

And by optimizing these costs, you can save tens, hundreds, or even thousands of Swiss francs!

There are several options for transferring large amounts of money abroad: traditional banks, neobanks, fintechs, and even investment platforms.

To date, here are the six best services I’ve compared:

- Wise

- b-Sharpe

- Interactive Brokers

- Revolut (Standard account)

- OFX

- UBS, PostFinance (and other banks using averages)

These are the variables that influence the amount you’ll receive in EUR/USD/GBP:

1. Exchange fee

Also known as the “spread” or “exchange margin”: this is the difference between the actual interbank exchange rate (mid-market rate) and the rate offered by the service. This is where many players take their commission in a (more or less) transparent way.

Here’s a comparative table of the best spreads:

| Institution | Typical spread | Transparency |

|---|---|---|

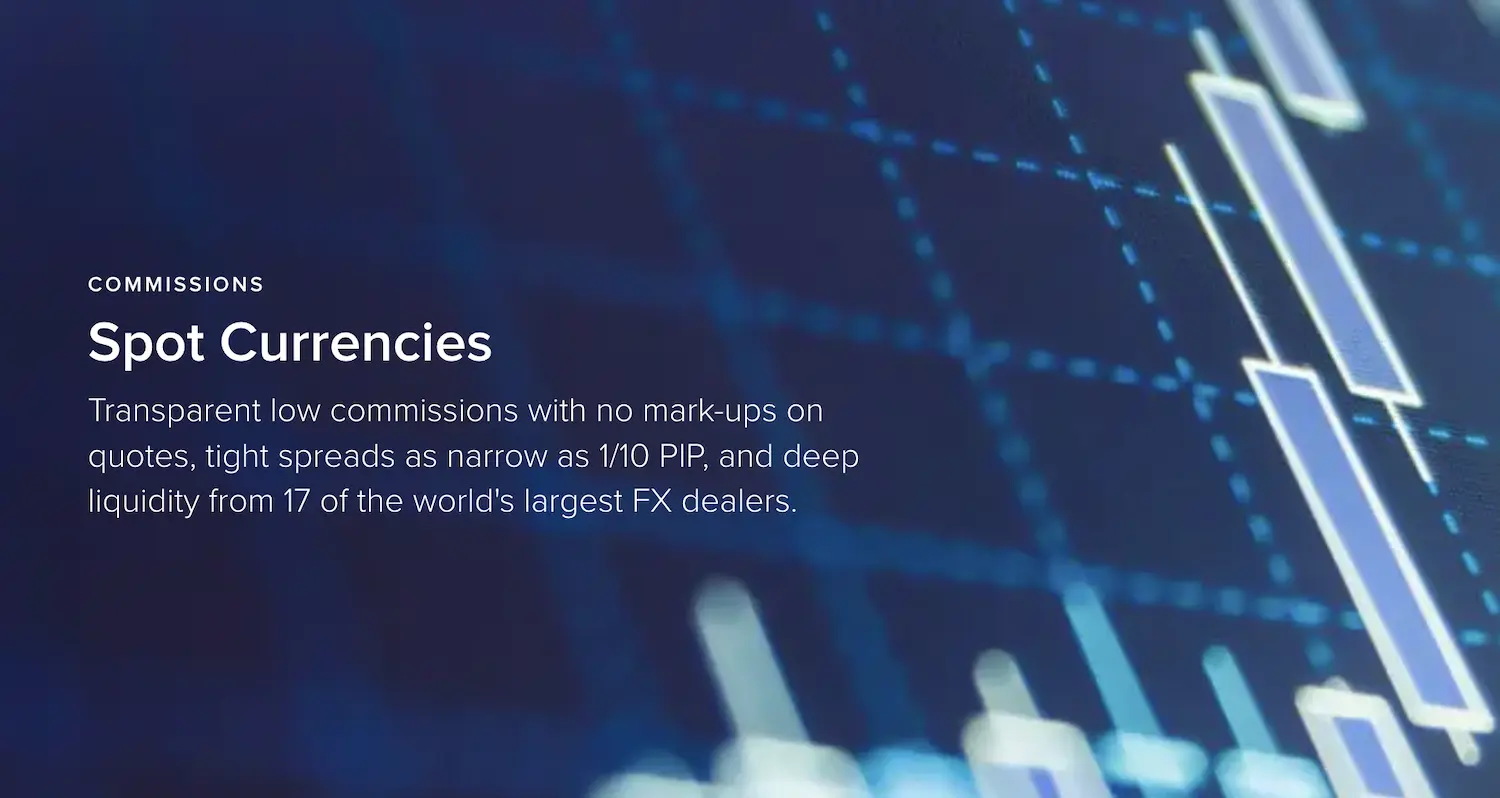

| Interactive Brokers | 0% (interbank spot rate, spread 0.1 pip included in it, often equal to the exchange rate displayed at Wise) | ✅ Very transparent |

| Wise | 0% (interbank spot rate) | ✅ Visible in simulation |

| Revolut (Standard) | 0% up to CHF 1,250/month, then 0.5% of the transaction amount (~0.1-0.2% in certain currencies such as EUR and GBP) | ✅ Clear in the app |

| b-sharpe | Between 0.12% and 0.64% depending on amount | ✅ Explicit |

| OFX | 1.5% to 0.4 (decrescendo depending on currency and volume) | ❌ Not very explicit |

| UBS / PostFinance / Other banks | Between 1.0% and 3% (often around 2%) | ❌ Very opaque |

For the newbies (like me at first!), 1 pip refers to a small unit of measurement used to express the variation in the exchange rate between two currencies. 1 pip is generally equivalent to 0.0001 (or 0.01 for pairs with the yen). The word “pip” comes from the English “percentage in point” or “price interest point”.

2. Fixed transaction fee

This is a fixed amount in CHF (or target currency) charged independently of the amount you trade:

| Institution | Transaction fees | Transparency |

|---|---|---|

| Interactive Brokers | 0.0002 x transaction amount (minimum USD 2) | ✅ Very transparent |

| Wise | Decrescendo (minimum 0.23% for CHF-EUR, 0.34% for CHF-USD, and 0.32% for CHF-GBP) | ✅ Visible in the simulation |

| Revolut (Standard) | None | ✅ Clear in the app |

| b-sharpe | CHF 5 if transaction amount < CHF 5'000 | ✅ Explicit |

| OFX | None | ❌ Not very explicit |

| UBS / PostFinance / Other banks | Depends on bank and currency, rarely free! | ❌ Very opaque |

3. Bank transfer and/or withdrawal fees

This is the cost of the bank transfer to send or receive the funds:

- From your CHF account to the provider

- From the service provider to the beneficiary account

Some providers have local accounts to avoid this (e.g. Wise, Revolut), others use SWIFT (b-sharpe, banks).

Some other services charge a fee for withdrawing funds in another currency, or making a second operation after the exchange..

| Service provider | Fees for receiving funds | Fees for sending funds to an external account | Sending money to third parties |

|---|---|---|---|

| Interactive Brokers | Free via standard bank transfer. | 1 free withdrawal per month; thereafter CHF 11 for each additional withdrawal. | 🟠 (indirectly, via Wise) |

| Wise | Free for local transfers. | Fees vary according to currency and amount; for example, 0.57% for GBP. | ✅ |

| Revolut (Standard) | Free of charge via local bank transfer. | Free of charge for CHF transfers in Switzerland; variable charges for international transfers, depending on currency and country. | ✅ |

| b-sharpe | Free of charge for bank transfers in CHF. | Free of charge for transfers over CHF 5'000; CHF 5 for amounts below. | ✅ |

| OFX | Free of charge; bank transfer fees may apply depending on your bank. | Free of charge; fees may be deducted by intermediary banks. | ✅ |

| UBS | Free for domestic transfers in CHF; CHF 6 for incoming international transfers. | Fees vary according to transfer type and destination | ✅ |

4. Hidden charges / indirect effects

These fees are often hidden and, therefore, invisible to you. Traditional banks are the most guilty of this kind of practice, compared to platforms like Wise or Interactive Brokers, which play the transparency card:

- Exchange rate used less favorable for you, and hidden in the spread

- SHA/BEN/OUR fee options poorly explained for international transfers (outside SEPA zone):

- SHA for “everyone pays their own costs (you and the beneficiary)”

- BEN: The beneficiary pays all the charges (he receives less)

- OUR: you pay all costs (he receives exactly the amount agreed)

- Voluntary delay of the transfer to take advantage of a more advantageous rate for them (rare cases, but possible with certain large conventional banks)

- Monthly cap on free conversions (e.g. Revolut Standard)

These fees are more or less hidden, so by definition they’re hard to find on the public websites of these entities. And when I say entities, I’m talking mainly about conventional banks, as the other services mentioned are transparent to them.

Why does the exchange rate have a big impact on such amounts

A picture is worth a thousand words:

| Amount sent (CHF) | USD received (cheapest service) | USD received (most expensive service) | Difference in USD |

|---|---|---|---|

| 1'000 | 1'198 | 1'170 | 28 |

| 10'000 | 11'980 | 11'700 | 280 |

| 100'000 | 119'816 | 117'000 | 2'816 |

| 500'000 | 599'080 | 585'000 | 14'080 |

As a good Mustachian, you invest your savings in the stock market, and with compound interest, you’ll end up with several thousand or even tens of thousands of Swiss francs more in your bank account!

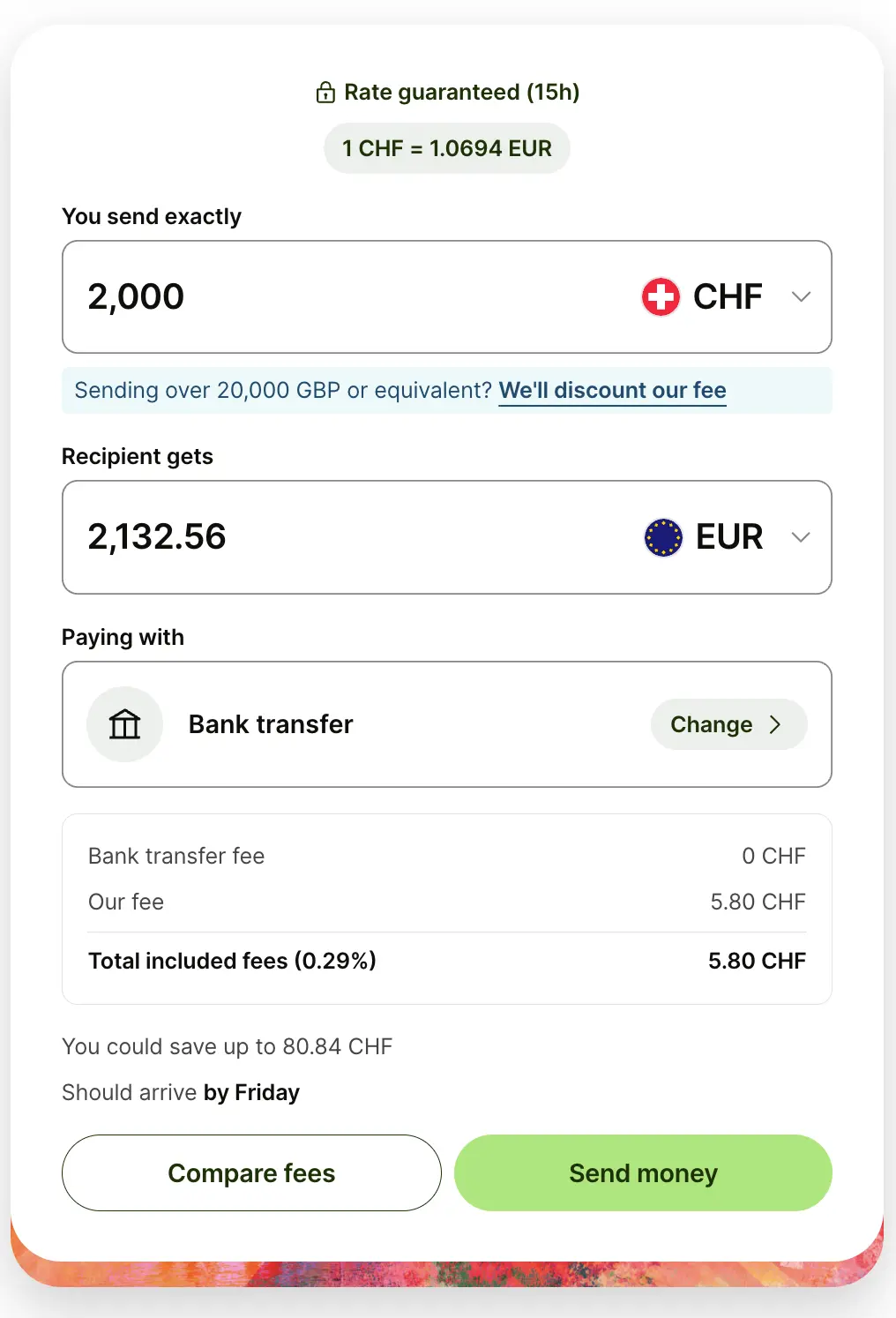

What tools can I use to simulate a CHF-EUR, CHF-USD, or CHF-GBP exchange rate?

To find out the exchange rate without bias or hidden charges, i.e., the true average market rate, I personally use the Wise currency converter.

As well as being accurate based on independent sources, it’s also updated in real time. And the cool bonus: their design is very intuitive and easy to use.

If you’re looking to convert CHF-EUR currencies, you should do your own research before you go to your banker - and you’ll realize just how much financial institutions take advantage of you rather than serving you!…

Which services should I choose to send a large sum of money?

Here’s a clear comparison to help you choose the service best suited to your situation.

Can I make a large transfer with Wise or Revolut?

Yes, these services are suitable for amounts of up to several hundred thousand francs, provided you respect the limits per account and have completed the KYC (for “Know Your Customer”) check. Wise, for example, allows transfers of up to CHF 1.2 million, Revolut around CHF 100k per day, depending on your plan.

What about investment platforms like Swissquote or IBKR?

These platforms, such as Interactive Brokers and Swissquote, although designed for investing, also enable conversions between foreign currencies (USD, EUR, etc.) directly via FOREX (the currency market that banks themselves use to exchange their currencies at low cost).

On the other hand:

- With Interactive Brokers: you can only send money to yourself. If you want to send money to third parties, that’s perfectly possible, using a service like Wise.

- With Swissquote: if you just want to convert your francs to use them (pay, transfer, invest elsewhere), the standard conversion service applies - and that’s where you get hit by the big 0.95% margin, so we’ll forget about Swissquote for the rest of this comparison :)

Note on Swissquote FOREX: with this service, you do speculative trading, but not real currency conversion in your Swissquote cash account. With IBKR, on the other hand, when you convert CHF-USD, for example, you really do have USD in your IBKR cash account.

When to choose a traditional bank?

If you want personalized service, or you’re already a premium customer, a bank like UBS or a cantonal bank can handle it. But expect to pay a lot more in (often hidden) fees and provide more paperwork to justify the origin of funds.

You know me, as a Mustachian who takes his life into his own hands, I don’t recommend this method at all.

Platform comparison: banks, fintechs, and brokers

As a reminder, here are the platforms compared in this article for transferring a large amount abroad:

Below you’ll find a comparison of the best (and worst) services for sending respectively 1'000 CHF, 10'000 CHF, 100'000 CHF and 500'000 CHF in EUR, USD and GBP..

For each service, I’ve noted the amount you actually receive in the target currency, after all fees (exchange rate margin and fixed charges). In short, what you actually receive in the end.

I used current interbank rates as a basis:

- 1 CHF = 1.0660 EUR

- 1 CHF = 1.1985 USD

- 1 CHF = 0.8968 GBP

You’ll see that choosing your service wisely can save you thousands of CHF on large amounts… and even a few hundred on already “modest” amounts.

Example of charges for converting CHF to EUR

Here’s a clear comparison table to help you choose, with examples of amounts such as CHF 1'000, CHF 10'000, CHF 100'000, CHF 500'000, and CHF 1'000'000:

Example of fees for converting CHF to USD

Example of fees to convert CHF to GBP

Comparative services, my overall ranking CHF → EUR/USD/GBP (from best to worst)

| Rank | Service | Remarks |

|---|---|---|

| 1 | Interactive Brokers | Interbank spot rate, ridiculous fees (~CHF 2), perfect if you send to your own account only. |

| 2 | Wise | Great value for money, fast, very transparent, good for you or a third party. Rates are slightly worse than IBKR, but much better than the banks. |

| 3 | b-sharpe | Interesting starting from CHF 100,000 thanks to a lower spread. Sending to third parties is possible. Beware of possible SWIFT charges for the beneficiary. IBKR and Wise are still the best, unless you want a Swiss-based service. |

| 4 | Revolut (Standard) | 0% fees up to CHF 1'250/month, then 0.5%. Ideal for small amounts. Beyond that, IBKR, Wise, or b-sharpe are better. |

| 5 | OFX | No fixed fee, declining spread. Less well-known, but reliable. |

| 6 | UBS / Swiss Banks | The worst: very bad exchange rates, SWIFT fees as bonus. “Reassuring”, but very expensive. |

What about outgoing international transfer fees?

To keep the above tables simple and readable, I haven’t taken transfer fees into account. Nevertheless, these are minimal and don’t change the final ranking regardless.

Also, I’m assuming that you want to send EUR to a European country, such as GBP to the UK, or USD to the USA; which results in:

- Interactive Brokers: you most likely don’t make multiple transfers of CHF 100,000 every day or month (or do you?!), I count CHF 0 as an outgoing transfer (otherwise it’s CHF 11 per additional transfer). And if you want to transfer this amount to a third party, I suggest that you use Wise. Interactive Brokers remains 1st in this ranking of the best currency transfer service.

- Wise: is free for international transfers in EUR and GBP. And for USD, it will cost you 1.13 USD per transfer. Negligible, so Wise remains a close second.

- B-sharpe: all fees are included when converting currencies, so there are no extra charges, and b-sharpe remains 3rd in our ranking.

- Revolut: they charge 0.15% of the amount transferred for such international transfers. Revolut, therefore, remains particularly interesting for amounts below CHF 1,250/month, and for larger amounts, it falls behind OFX.

- OFX: like b-sharpe, all fees are included when converting currencies.

- UBS (and other traditional Swiss banks): charge a fixed fee of CHF 5, and some banks even more. These banks, as expected, remain at the bottom of the ranking.

Is this ranking the same for all currencies (EUR, USD, GBP)?

Yes, in almost all cases: IBKR, Wise and b-sharpe remain on top in all 3 currencies, with constant fees and stable rates.

Traditional banks are still the worst, whatever the currency… what a surprise ;)

Revolut is the best for amounts under CHF 1,250 per month.

Frequently asked questions about large-value transfers from Switzerland

Is it legal to transfer CHF 100,000 abroad?

Yes, it’s perfectly legal to transfer such an amount abroad. You’ll simply face increased scrutiny from banks that want to combat money laundering (Money Laundering Act (MLA)).

Do I have to declare a transfer to Swiss customs?

As long as your transfer is electronic (i.e., not in cash), you don’t have to declare anything to customs. In fact, the banks’ compliance systems are in charge of managing this tedious process.

Do I pay taxes on a large transfer?

Not directly. In Switzerland, it’s not the amount of the transfer that triggers a tax, but the nature of the money transferred.

If the money belongs to you and has already been taxed (salary or other), then you pay no tax.

On the other hand, if it’s a gift from another person, or the proceeds of a property sale, for example, then you’ll certainly have to pay tax. It all depends on the local law in the country where you make the transfer.

What’s the safest way to transfer money (large amounts)?

The safest way to transfer large sums of money is through reliable and secure financial entities. For example, to transfer CHF 100,000 from Switzerland to the UK, I would use Interactive Brokers or Wise, and a UK-based bank to receive the transfer. And definitely not a little-known online service, and/or one that’s only been around for a year or two.

What about XE Transfer or CurrencyFair?

Neither is very transparent about their margins, which are hidden in the posted rate. I don’t like this kind of practice, as it often amounts to a less advantageous solution than all the other services presented in the above comparison.

Is it advantageous to use Revolut Premium without fees for currency exchange?

I don’t think using Revolut Premium is beneficial because:

- Once you have signed up for Premium, you can cancel, but you must pay for the additional months after cancellation (if the subscription is less than 10 months), otherwise you pay for the rest of the month.

- It’s annoying to switch between packages (and we don’t know if the 10-month period applies between two changes).

- For certain currencies (EUR and GBP), Revolut actually has a spread of ~0.1-0.2% compared to the interbank exchange rate.

Conclusion: the best service for transferring large sums of money

🥇 Interactive Brokers is the cheapest for exchanging currencies at the best price with the lowest possible fees. One point of attention: Interactive Brokers doesn’t let you send money to third parties directly. You must therefore: Send CHF from your Swiss bank > Interactive Brokers (CHF-USD currency exchange, for example) > send to your Wise account > the third party’s bank.

For large amounts such as CHF 100,000 or more, it’s well worth the effort.

It’s crazy to think that they, IBKR, are still in first place!

🥈 Second place on the podium logically goes to the famous Wise with super value for money, baffling speed, and very transparent. Their rate is slightly worse than IBKR, but much better than the banks! I recommend Wise for any currency exchange of less than CHF 10,000 that you need to send to a third party, because it’s more convenient and faster than Interactive Brokers.

🥉 Third place on the podium goes to Swiss b-sharpe service, which is right on the heels of the two best big-ticket transfer services. If you want a Swiss-based service (for whatever emotional reason), then I recommend b-sharpe.

And finally, for small amounts under CHF 1'250/month, Revolut is still a good solution. Beyond that, Wise or IBKR are better.

And two final tips:

Always anticipate the paperwork (especially with your bank)

A large transfer is rarely a simple click. Your bank may ask you for proof of origin or destination (invoice, contract, etc.). I recommend that you anticipate these requests by a few days (or even a week if it’s for something as important as a property purchase abroad) to avoid your transfer being blocked in the middle of the process.

Compare instead of trusting your default bank

Let’s be clear, your traditional Swiss bank is never the best option in terms of fees or exchange rates. Always compare with services like Interactive Brokers, Wise, or b-sharpe before initiating a transfer. The result: several hundred or even thousands of francs saved on a single transfer!

And you, what service do you use to convert large amounts into foreign currency (and then transfer these large amounts)?