On the way to the office, Olivia can’t help but replay her conversation with William.

“Is it really possible to invest properly in the stock market by only spending 15 minutes a quarter? “ she asks herself.

When she gets to her computer, she finds an e-mail from William waiting for her in her inbox. He took the time to copy and paste several links to guide her in her research:

“As discussed:

- Who are Warren Buffett and Jack Bogle

- Warren Buffett’s shareholder letters

- Interview with Jack Bogle

- Why gold is not as good a refuge as you might think (this Ben Felix is a guy who knows what he’s talking about, and for once it’s understandable to the common man!)”

Olivia’s checking her work schedule.

“Perfect, no meeting this afternoon, I’ll set myself as ‘Do not disturb’ in my calendar in order to study all this calmly. And it’s good timing, considering all the overtime I have to compensate…” she thinks to herself.

Olivia discovers the first financial precepts of the investment wise men

After finishing her last meeting of the morning late, Olivia decides to have a quick salad at the cafeteria of her job. Thirty minutes later, she goes back to her office and closes the door to be quiet.

She dives into Wikipedia to learn that Warren Buffett is an American investor who is one of the richest men in the world. This speaks to her!

She then learns that he has made a fortune by investing in companies with growth potential.

“It’s weird that. Cause william bragged to me about funds so I don’t have to spend hours trying to figure out which stock to buy. And now I read that his ‘Oracle of Omaha’, as he calls him, does just the opposite.” she says to herself as she notes down a comment on a post-it for her next discussion with William.

She then moves on to the Wikipedia biography of Jack Bogle. Jack being his nickname because his birth name was John C. Bogle.

What she reads speaks to her more than Buffett:

Jack Bogle is the founder of The Vanguard Group, ranked second in terms of assets under management, and is considered as the father of index funds.

In addition to having already heard the name Vanguard’s reputation in the investment world, she feels reassured to see that it is this gentleman who invented the principle of funds that follow an index such as the SMI, the CAC40, or the S&P500.

She’s hesitant to move on to the gold video right away. She’s interested to know why William told her it wasn’t useful.

But she decides to tackle the biggest chunks first, which are Warren Buffett’s letters and the interview with Jack Bogle. And she saves the easy way out for last.

She prepares herself a good coffee, a Bahia from Brazil that has this soft and long taste. Then, she takes her tablet and curls up in the armchair near the window of her office. She feels positive because she is learning the right precepts of investment basics. The sun pierces through the few remaining clouds of the morning, which accentuates her good mood.

After almost two hours of uninterrupted reading, Olivia finds herself with two pages full of notes. She takes her favourite blue highlighter and highlights all the points she finds most important:

- “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.” — Warren Buffett in his 1996’s shareholder letter

- “Remember the late Barton Biggs’ observation: ‘A bull market is like sex. It feels best just before it ends.’ The antidote to that kind of mistiming is for an investor to accumulate shares over a long period and never to sell when the news is bad and stocks are well off their highs. Following those rules, the ‘know-nothing’ investor who both diversifies and keeps his costs minimal is virtually certain to get satisfactory results. Indeed, the unsophisticated investor who is realistic about his shortcomings is likely to obtain better longterm results than the knowledgeable professional who is blind to even a single weakness.” — Warren Buffett in his 2013’s shareholder letter

- “Most investors, of course, have not made the study of business prospects a priority in their lives. If wise, they will conclude that they do not know enough about specific businesses to predict their future earning power. The typical investor doesn’t need this skill. […] The goal of the non-professional should not be to pick winners – neither he nor his ‘helpers’ can do that – but should rather be to own a cross-section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal.” — Warren Buffett in his 2013’s shareholder letter

A bull market is like sex. It feels best just before it ends.Barton Biggs

While re-reading a passage from Warren Buffett’s 2013 letter to shareholders, Olivia takes the post-it on which she had written her question for William, and tears it up.

She found by herself the answer to her question as to why William was recommending funds and was a fan of Buffett when Buffett seemed to select the stocks he bought himself.

The answer being:

“My money, I should add, is where my mouth is: What I advise here is essentially identical to certain instructions I’ve laid out in my will. One bequest provides that cash will be delivered to a trustee for my wife’s benefit. (I have to use cash for individual bequests, because all of my Berkshire shares will be fully distributed to certain philanthropic organizations over the ten years following the closing of my estate.) My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.” — Warren Buffett in his 2013’s shareholder letter

As she wanders from site to site, interview to interview, she also noted the following example of compound interest. It confirms to her that the best time to start investing was yesterday (as it’s impossible, the second best time is today!), and especially that you have to start with the idea that it’s long term if you want to make a decent profit.

“Time is my ally in investment.” she concludes in her head.

“Example of how to become a millionaire in 40 years by setting aside only CHF 5'000 a year: “

| Year | Savings | Savings with interests (7%) |

|---|---|---|

| 1 | 5'000 | 5'350 |

| 2 | 10'350 | 11'075 |

| 3 | 16'075 | 17'201 |

| 4 | 22'201 | 23'756 |

| 5 | 28'756 | 30'769 |

| 6 | 35'769 | 38'273 |

| 7 | 43'273 | 46'303 |

| 8 | 51'303 | 54'895 |

| 9 | 59'895 | 64'088 |

| 10 | 69'088 | 73'925 |

| 11 | 78'925 | 84'450 |

| 12 | 89'450 | 95'712 |

| 13 | 100'712 | 107'762 |

| 14 | 112'762 | 120'656 |

| 15 | 125'656 | 134'452 |

| 16 | 139'452 | 149'214 |

| 17 | 154'214 | 165'009 |

| 18 | 170'009 | 181'910 |

| 19 | 186'910 | 199'994 |

| 20 | 204'994 | 219'344 |

| 21 | 224'344 | 240'049 |

| 22 | 245'049 | 262'203 |

| 23 | 267'203 | 285'908 |

| 24 | 290'908 | 311'272 |

| 25 | 316'272 | 338'412 |

| 26 | 343'412 | 367'451 |

| 27 | 372'451 | 398'523 |

| 28 | 403'523 | 431'770 |

| 29 | 436'770 | 467'344 |

| 30 | 472'344 | 505'409 |

| 31 | 510'409 | 546'138 |

| 32 | 551'138 | 589'718 |

| 33 | 594'718 | 636'349 |

| 34 | 641'349 | 686'244 |

| 35 | 691'244 | 739'632 |

| 36 | 744'632 | 796'757 |

| 37 | 801'757 | 857'880 |

| 38 | 862'880 | 923'282 |

| 39 | 928'282 | 993'262 |

| 40 | 998'262 | 1'068'141 |

She feels like she just learned more in two hours than she has in years.

Then she moves on to the gold video of this Ben Felix:

She notes a four-point summary of what she learned there:

- In the economic paper “Golden dilemna”, authors Claude Erb and Campbell Harvey state that between 1975-2012, gold was not a good protection against inflation. And that to find such an example, one has to go back to BC era during the reign of Emperor Augustus. Their conclusion is that yes, gold can protect you against inflation in the long term, but this “long term” will certainly be longer than your life as an investor or even your life at all…

- Ben Felix goes on to explain that it is not a safe haven either, with his counter-example showing that during the 2008 crisis, gold certainly performed at +5%, but the bonds on their side performed at +14%!

- The price of gold is set by those who want to buy it. But it’s not a stock that produces anything. Gold produces no value. So uno, people make it very volatile in value with supply and demand, and secondly, besides being more volatile than stocks, gold provides lower returns!

- Finally, Ben explains that a portfolio with 90% equities + 10% gold performs less well than a portfolio with 10% government bonds instead. So there is clearly an opportunity cost to owning gold.

Faced with these conclusions, she finally understood what William meant when he explained to her that gold no longer had a place in his portfolio.

Dividends, that sweet siren song in the investment world

As Olivia was about to wrap up her tablet to prepare an action plan, she stumbled upon a financial independence blog talking about a dividend-focused investment strategy. It speaks well to her because it’s something reassuring: dividends are falling every month, and the goal is to grow those types of gain with a portfolio that favours them.

On top of that, she reads on another investment site that you can combine a dividend strategy with mechanisms such as “stop-loss” which prevents you from keeping a stock that is losing too much value.

She feels the euphoria rising. She has a strategy that would suit her. Just the thought of seeing her investment account fill up with dividends every month brings a big smile to her face!

She hurriedly goes to the Swissquote website to start opening an account. She has heard a lot about this online broker on forums. What’s more, it’s one of Switzerland’s old website when it comes to investing via the Internet.

“I don’t think I’m wrong, otherwise no one would use it anymore.” she says to herself.

As she fills out the long application form, she has a doubt. What if she’s rushing? She quickly discards this negative thought, reassuring herself that she’s beginning to understand how it all works.

She is therefore completing the Swissquote registration questionnaire.

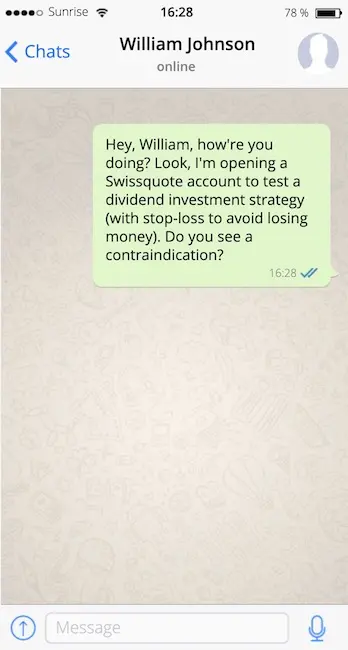

When she is about to click on “Confirm My Account”, she nevertheless sends a WhatsApp message to William for a short feedback from him:

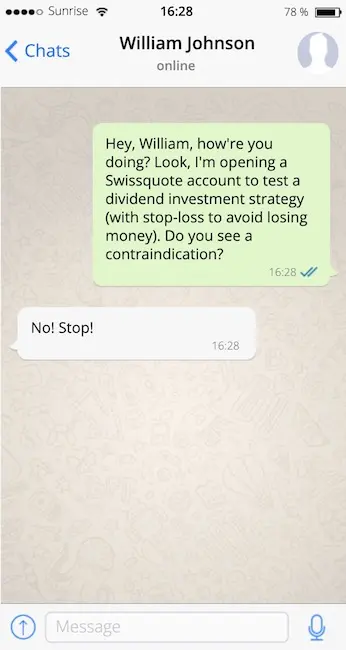

Less than ten seconds later, William already answers her:

The discussion continues:

Olivia: “Why?!”

William: “1/ Dividends are taxed in Switzerland, whereas capital gains (i.e. when you make CHF 20 by selling CHF 120 a share you bought at CHF 100) are not. Investing with a focus on dividends is therefore not the best investment from a tax point of view in Switzerland. Then, 2/ when a company pays you CHF 1 in dividends, then the value of your share drops by CHF 1. There is nothing magical, money doesn’t fall from the sky. What’s more, you’ll pay more taxes for it.”

William goes on:

“3/ A company that performs is a company that knows how to invest its cash to create more value in the future. Paying dividends should be the last choice it makes. So, you don’t want to own companies that don’t know what better to do with their cash than to pay it in dividends (careful, I’m not saying that dividends are useless, but that you shouldn’t focus on that when choosing your shares).”

Olivia: “OK. It’s a good thing I wrote you. But I still think it’s cool to see cash falling out every month…”

William: “You’re not the only one. I love it, too. But it’s a decoy because you can get better returns via other ways.”

William continues on the stop-loss:

“Concerning your idea of selling so as not to lose money, you also want to avoid this for several reasons. The first one: you risk becoming a professional investor to the eyes of the Swiss tax authorities, and therefore paying more taxes. The second reason is that you will have to spend several hours a month or even a week if you decide to go ahead with it. Psychologically, it’s also hard not to try to beat the market. Remember what you’ve read: you buy and you hold for the very long term (10+ years minimum).”

Olivia: “OK… and what about Swissquote? Can I at least keep opening my account so I feel like I’m doing something?”

William: “Don’t! There are much better alternatives to online brokerage as a Swiss investor. I’ll tell you about it later, I have a meeting now.”

He ends: “This Friday I’m in Zurich to see a client. Wouldn’t you be there by any chance? I’m worried about you, and I wouldn’t want you to go in the wrong direction.”

Olivia: “Yes I’m there! I have a meeting with my Swiss-German team at 2:00.”

William: “Bingo! Meet me at 11:30 at the Time Lounge at Zurich station.”

Olivia: “Deal! And thanks again for your help ;)”

The coffee at the Time Lounge at the Zürich train station

Olivia was able to spend some time reading new shareholder letters from Warren Buffett until she met with William that Friday.

The fog over her understanding of the investment world was beginning to lift.

Impatient, she gets out of the ICN arriving in Zürich. She rushes towards the SBB clock at the station and climbs up to the Time Lounge.

William is preparing his afternoon session when Olivia arrives:

“Hey there, William. How’re you doing?”

“Tip top, and you?” He goes on without giving her the time to answer: “Your last WhatsApp scared me, so I thought it’d be nice to talk to you in person before you hit a new wall!”

“I couldn’t have said it better! So I went back to your first email after we texted. I dug up into more letters from Buffett, testimonials from Bogle, and so on. I even wrote down a few quotes that spoke to me and that I think go in the direction that you’re advising me:”

The trick is not to choose the right company, the trick is essentially to buy all the large companies through the S&P 500 and to do it systematically.Warren Buffett

Costs really matter in investing, if returns are 7% or 8% and you pay 1% fees, it makes a huge difference in how much money you’ll have in retirement.Warren Buffett

“And one last one that made me smile about derivatives, which, by the way, is something I didn’t understand at all:”

Improved “transparency” — a favorite remedy of politicians, commentators and financial regulators for averting future train wrecks — won’t cure the problems that derivatives pose. I know of no reporting mechanism that would come close to describing and measuring the risks in a huge and complex portfolio of derivatives. Auditors can’t audit these contracts, and regulators can’t regulate them. When I read the pages of “disclosure” in 10-Ks of companies that are entangled with these instruments, all I end up knowing is that I don’t know what is going on in their portfolios (and then I reach for some aspirin).Warren Buffett in his 2008’s shareholder letter

Olivia goes on: “I really like the idea of how easy a setup with a low-cost fund can be compared to having fun with stop-loss or some other way of trading. Also, it’ll allow me to waste less time buying several companies at once, rather than having to search for the worthy ones, one by one.”

William interjects: “Exactly! But the even more important advantage of index funds is the diversification they bring you. Because investing involves a risk of loss. And as a result, the more diversified you are, the more you dilute and spread this risk among the companies you own. Because if one company goes bankrupt, it doesn’t matter to you because you have thousands of others to rely on to make your money grow.”

“Indeed, I didn’t see it that way. It’s a good winning combo actually: easy and less risky! So I think I’ve got the final version of my IPS with this last point.” she explains while completing her second draft.

| Investor Policy Statement | Olivia (finalized version) |

|---|---|

| Assets | - CHF 257'000 on SBU savings account at 0.2% - CHF 78'000 on pillar 3a |

| Debts | Car loan with CHF 9'300 still to be repaid |

| Why do I want to invest? | Switch to 70% for my 45 years old (for my personal projects and to have time for me) |

| Risk profile | 8/10 (1 = unimaginable to lose would only be CHF 1, and 10 = I can survive stock market lows of -50% of the initial value of my portfolio) |

| Asset allocation | Stocks and bonds, and possibly real estate (% still to be defined) |

| Alternatives | Maybe keep 1% margin to be able to “play” with e.g. P2P loans |

| Monitoring & control | - Revise your allocation every quarter - Do not stress to the nearest %, these are estimates - Compare my portfolio to a similar index to see how it performs (for example the SMI if you choose a fund that replicates it) |

| Investment philosophy | - Start investing today to enjoy the magic of compound interest - Invest in the stock market with a long term vision (10-15+ years) - Buy and hold indefinitely - Diversify via funds to limit the risk of loss - Keep costs to a minimum via index funds - Invest regularly without ever trying to time the market - Growth strategy vs. dividends - Understand what I’m investing in to avoid aspirin like Warren Buffett - Be rational and avoid the emotional like the plague |

“It’s perfect! I couldn’t have done better as a summary!” replies William with a smile as he sees that Olivia is beginning to understand the ins and outs of the investment world.

“OK but then, not counting my 3a that I want to keep safe in a bank and not invest, what do I do with my CHF 257'000 that sleeps in a 0.2% savings account?! Because, yes, I have a lot more confidence in your approach than I do in John’s unicorn. On the other hand, I’m hesitating to wait for the end of the stock market bull cycle, just to get in at the right time with such an amount…”

“How do you think you’ll know when it’s the best time?” William asks her.

“Well, I was thinking that like in 2008 and 2019, one can feel when there’s gonna be a bubble that’s gonna burst. So I thought I’d wait a little bit longer to see how it goes. But then there’s this compound interest thing that I’m worried about because I might be missing opportunities while I’m waiting… Ugh, I’m lost!” Olivia exclaims.

“It’s crazy, you really look like me when I started. We all go through the same psychological torments I feel. But the cool thing is, once you rationalize it, all those thoughts become futile. To answer your first point about waiting for the end, I myself almost got out of the stock market in 2017 because everyone was announcing the end of a cycle for December, or at the latest early 2018. I had to beat myself up and hold on to my IPS in order to remain rational. And so I continued to buy my ETFs regularly, as planned. In 2018, I regretted my decision when I saw the market declining every day in the second half of the year. But I stuck to my rational process. And gosh I was glad I did so! Because 2019 was a vintage that any investor would not have wanted to miss!”

He concludes: “The best time to start investing is now. Period.”

But then you tell me to invest all of my 257kCHF at once tomorrow?” interrupts Olivia, who already feels the stress of making a transfer of that amount.

“So there are actually two schools. The first is called ‘dollar cost averaging’, which simply means that you spread a large amount over several months so that you don’t get in at the worst possible time. The second one comes from JL Collins (which I highly recommend you as a complementary reading by the way) which explains in its article dedicated to this topic that this averaging method is not necessarily useful. For my part, if I were in your situation with such a large amount of money, here’s what I would do to sleep on my two ears: I would divide your 257kCHF by 10, and I would invest this amount every month for 10 months. But really, once you’ve decided to go this way, you have to stick to it no matter what happens on the market. And once the ten months are over, then you continue to invest your savings every month, systematically. The goal is to have a rational process that prevents any emotional bias such as a crisis or any event in the world. This is confirmed by the Omaha’s oracle:”

In the 54 years we have worked together [with Charlie Munger — another big name in finance — at Berkshire Hathaway], we have never foregone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions.Warren Buffett in his 2013’s shareholder letter

Olivia feels reassured by such a spread. But another doubt pops into her head: “OK, but then what do I have to buy?! Where do I find those funds, and which do I buy? And by the way, can I buy them on the stock market or is it directly via my bank?”

Listening to this, William thinks that Olivia needs a little refresher course on the basics of the stock market, what a stock is, what a fund is, and what an ETF is.

So as not to offend her, he says to her: “You know what, come over for dinner one night. Kathy will be happy to see you again, as well as the kids. And that way, I can calmly explain you my ETF strategy and the most important basics to know so that you have all the keys to start investing in the stock market. I’ll look at our schedule for the next few days with Kathy, and I’ll tell you again, is that OK with you?”

“With pleasure, it’s really nice of you to take the time. And it’ll be nice to see your little family too!” answers Olivia.

- Start investing today to take advantage of the magic of compound interest (see the example of how to get rich in 40 years)

- Invest in the stock market with a long term vision (10-15+ years)

- Buy and hold indefinitely

- Diversify via funds to limit the risk of loss

- Keep costs to a minimum via index funds

- Invest regularly without ever trying to time the market

- Growth strategy vs. dividends (because of the Swiss tax system and because it is not more profitable)

- Understand what you're investing in to avoid aspirin like Warren Buffett

- Rational, you'll win. Emotionally, you will lose.

- The best way for a novice investor to invest successfully is a very easy and time-saving method

Next step

In the next chapter, Olivia will review all the basics of investing in the stock market. This will allow her to understand what to invest in, and more importantly, why she should invest through this vehicle that is an ETF.