I would like to remind you that this entire Swiss tax guide for investors assumes that your tax domicile (i.e. where you pay your taxes) is Switzerland.

Chapter 1: Swiss stamp duty

| Swiss broker | Foreign broker | |

|---|---|---|

| Swiss security | 0.075% of the transaction amount | 0% |

| Foreign security | 0.15% of the transaction amount | 0% |

Reminder: here are the brokers I recommend as a Swiss investor.

Chapter 2: Swiss taxes on capital gains

As a private person, you do not pay Swiss capital gains tax as long as you comply with the following five rules:

- You keep your securities for more than 6 months

- You do not buy or sell more than 5x what you already have invested

- You are not living on the interest and dividends from your current returns

- Your ETF purchases are not funded by someone else

- You don’t buy derivatives

Chapter 3: Swiss taxes on dividends received

The first important point is that any dividend received must be declared in Switzerland.

Then, between accumulative or distributive dividends, it is more interesting to favor a distributive ETF because it is easier to declare to the tax authorities, you will lose less money in taxes no matter what happens than an accumulative ETF, and moreover it will be more useful when you are FIRE (Financial Independence, Retire Early) (because you will be able to use the cash received directly to finance your lifestyle, rather than having to sell securities).

Chapter 4. Withholding taxes on dividends received

There are two levels of withholding tax as an investor called L1TW and L2TW (for “Level 1 Tax Withholding” and “Level 2 Tax Withholding”).

As a Swiss investor, you buy either a share directly or via an ETF, which implies two different withholding tax scenarios:

- Company X [L1TW] ==> ETF ==> [L2TW] Investor

- Company X ==> [L2TW] Investor

To find out how you will be taxed in advance on your dividends, the two important criteria to know are your tax domicile and the domicile of the security you own.

It is important to optimize this tax because when you will be FIRE in Switzerland with several millions invested, you will not want to see several tens of percent of your dividends disappear as withholding tax.

The websites I use to find out what my ETF and stock dividends are going to be eaten are:

- Website of the Federal Tax Administration

- PWC website for the list of withholding tax rates for each country in the world

- PWC website for Swiss resident withholding tax rate for each country in the world, including double tax treaties

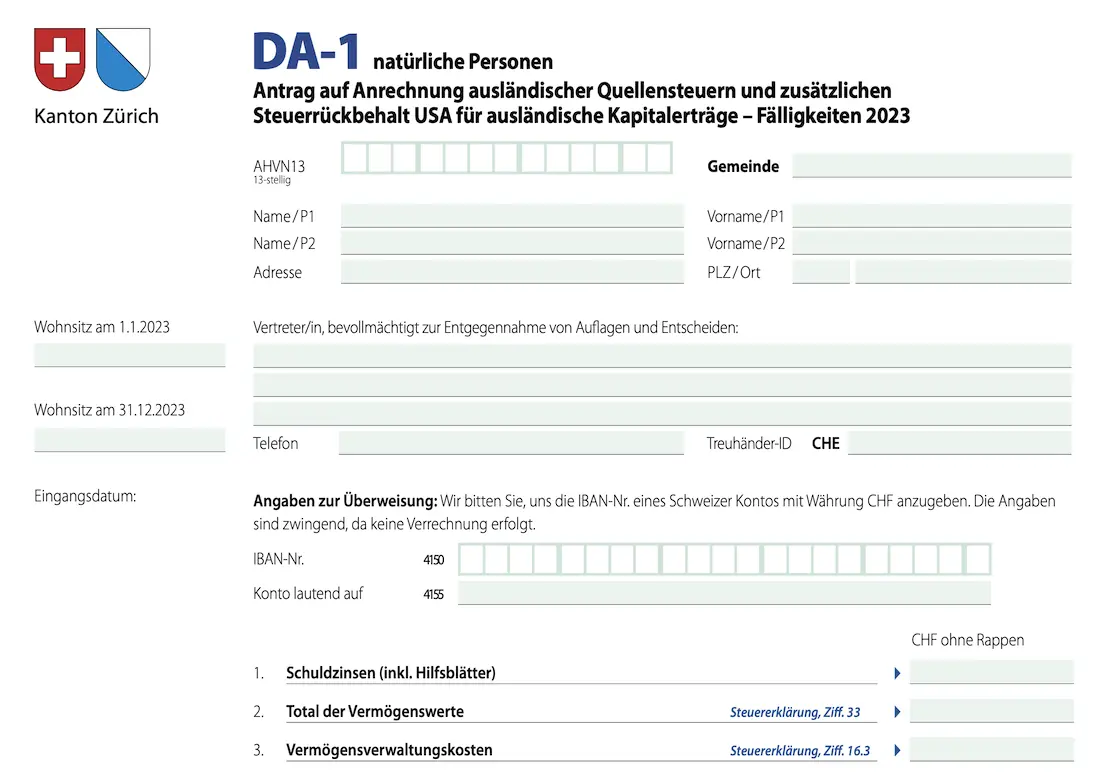

You will use the DA-1 form to get any withholding tax refunded to you.

In the case of U.S. securities, you will need to use additional forms depending on the status of your online broker:

| Status of your broker | Reimbursement of withholding tax on US securities via: |

|---|---|

| Swiss or foreign, without “Qualified Intermediary” status | DA-1 form and R-US 164 form, during your Swiss tax return |

| Foreign with “Qualified Intermediary” status (e.g. Interactive Brokers or DEGIRO) | W8-BEN form (often filled out by your broker when you open your account), and DA-1 form during your Swiss tax return |

| Swiss with “Qualified Intermediary” status (e.g. Swissquote) | DA-1 form during your Swiss tax return |

And here is a table summarizing different scenarios of withholding tax as a Swiss investor in ETFs and equities:

| Share or ETF domicile | Withholding tax L1TW | Withholding tax L2TW |

|---|---|---|

| Switzerland stock | n/a | 35%, reimbursed by tax credit on your Swiss tax return |

| Switzerland ETF | 35% (to be confirmed as perhaps 0%), reimbursed by request from the fund itself | 35%, reimbursed by tax credit on your Swiss tax return |

| Ireland ETF | 15% for US equities, composing the major part of a global ETF | 0% (thanks to the Ireland-Switzerland double taxation treaty) |

| ETF US | 0% for US equities, composing the major part of a global ETF | 15%, reimbursed by tax credit via the various forms W8-BEN, DA-1, and R-US 1641 on your Swiss tax return (thanks to the US-Switzerland double taxation treaty) |

| ETF Luxembourg | 30% for US equities, composing the major part of a global ETF | 15%, reimbursed by tax credit via the DA-1 form on your Swiss tax return |

FAQ

If your broker allows it, it is more interesting to buy a global ETF domiciled in the US from a tax point of view as a Swiss investor.

Concretely, your best choice of global ETF is the VT ETF (US domiciled). Your second best choice of global ETF is the VWRL ETF (domiciled in Ireland).