Last updated: July 13, 2024

Neon referral code 2024

Use the coupon code "mustachian" when you register on the neon application.

You'll get a 10 CHF credit as a welcome bonus on your neon free account (and you'll help support the blog, thanks!).

Also, until further notice, you will receive up to 30 CHF cashback on the trading fees of your first 3 trades with neon invest.

- neon Bank Review in a Nutshell — by MP

- My visit to neon HQ

- My love story with neon

- Why neon Bank is the best Swiss digital bank for Mustachians?

- neon User Reviews

- Alternatives to neon — and how it compares

- Open a neon account in 10 minutes

- Frequently Asked Questions about neon bank account

- Conclusion neon review

I’m a highly satisfied fan of neon since I converted in January of 2022.

It could have been my primary bank for many more years, but our love story needed more time to take off (I’ll explain to you why later).

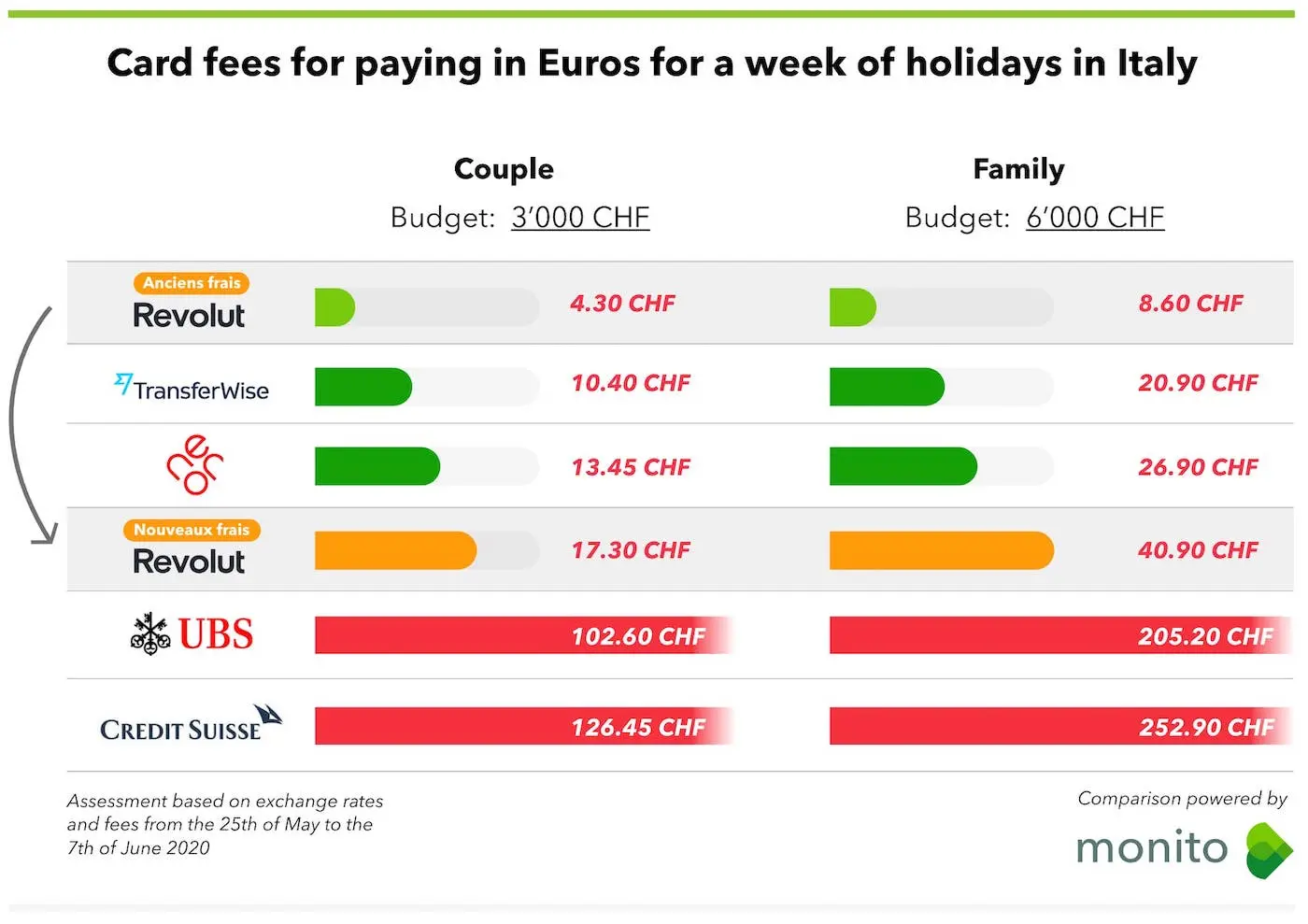

For the new Mustachians among you, I want to remind you that you can save money like crazy just by switching from your current institution to a new one.

We are talking about sums of around CHF 4'440 of savings in just over 10 years. And all this just to make the unique effort of changing bank accounts.

neon Bank Review in a Nutshell — by MP

In a Nutshell, below is my neon Bank Switzerland review:

What I love about neon banking services

- The first true neo bank in Switzerland built from scratch with a strong focus on its customers (vs., for instance, CSX from the traditional bank Credit Suisse which is “just” a product of an existing bank, hence they have less pressure to succeed by addressing key Swiss residents’ needs)

- Built upon their banking partner Hypothekarbank Lenzburg, a secure and trustful bank that protects your bank account up to 100'000 CHF thanks to the Swiss deposit insurance

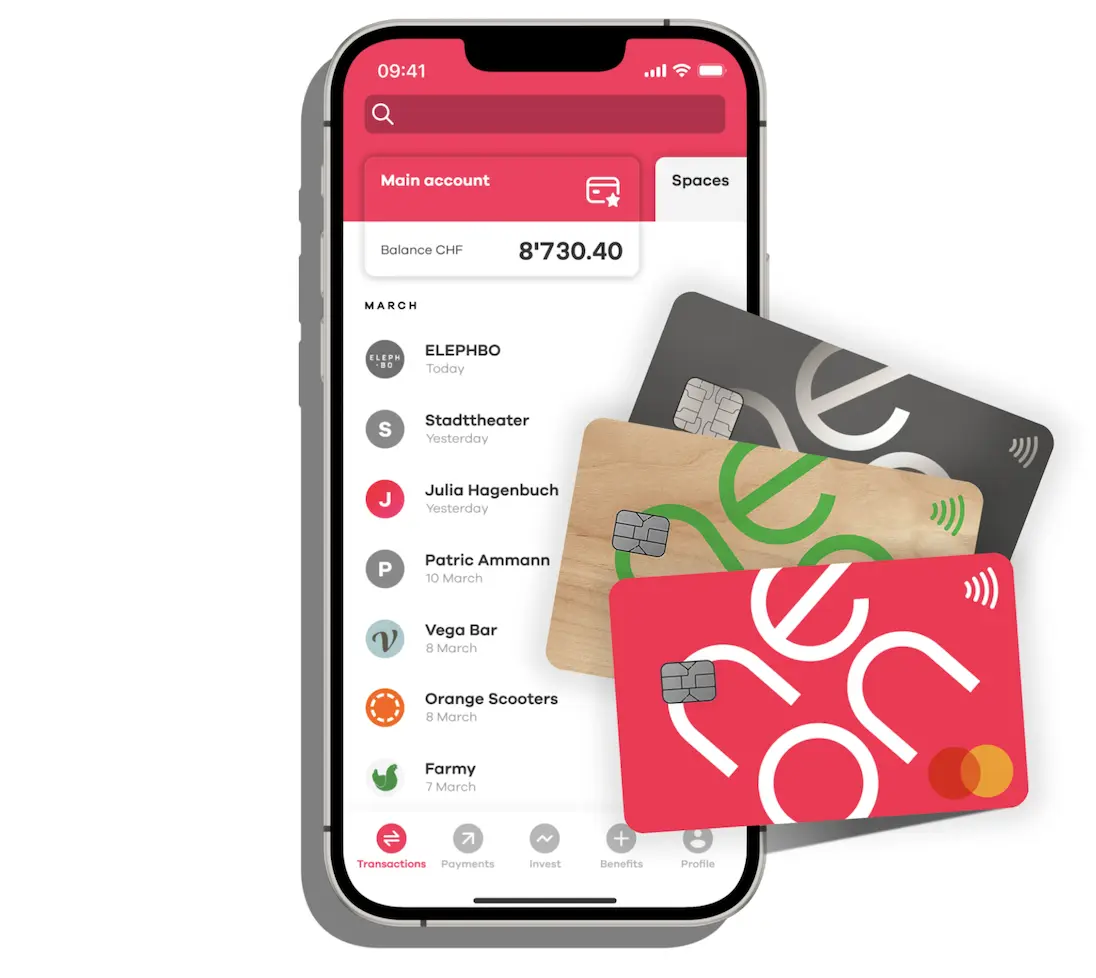

- Free bank account in Switzerland — for real, with unbeatable conditions: no hidden base fees, no currency exchange rate surcharge when paying with the neon card abroad in foreign currencies, low fees international transfers via Wise integration

- One card (the neon payment card) for all my international payments in foreign currencies abroad with a 0% exchange rate spread!

- The neon app is really easy to use (vs. usability of other digital banks in Switzerland which over-complicate processes like domestic payments with a painful input field for the security code)

- Digital banking platform from the ground up: fully online account creation, bank transfers in total autonomy in their app, high daily transaction limit (CHF 50'000/day!), push notifications, etc.

What cons neon could improve?

- Joint accounts, so that you and your partner can handle common household finances

- Partner credit card, so that your partner can use a secondary card linked to your neon account (it’s coming soon looking at neon’s roadmap)

- Cross-border Swiss account, so that border workers can open a neon account (same as a partner credit card, it should come soon!)

- Other “Made by neon” financial products like mortgage and pillar 3a to be a one-stop shop bank, vs. relying on partners (that are often not as best and cheap as neon itself is with banking)

- The fluidity of the mobile app user interface, similar to what Revolut or Wise do (that’s a detail that only geeks like me will notice, though)

MP’s Recommendation

I recommend neon Bank to all Swiss Mustachians. It’s the cheapest and most complete of all Swiss digital banks. Moreover, the neon app is secure both on a technological level as well as financially speaking as it relies on the well-established Hypothekarbank Lenzburg.

Since January 2022, neon Bank is my primary Swiss bank account. Mrs. MP and I receive our Swiss salaries on it and use their mobile application for our everyday banking needs.

PS: as it’s a fully online bank, and because the Internet can be down sometimes, I have a contingency secondary Swiss bank account (namely Zak from Bank Cler). I explain my banking strategy in detail in this article.

And until further notice, you will also receive up to 30 CHF cashback on the trading fees of your first 3 trades with neon invest.

My visit to neon HQ

Every time I start using a new finance product, I always try to get behind the scenes to learn about the real motives of its founders.

neon was no different.

I even visited them before I switched entirely from Zak to neon.

My goal was to understand if they had created this Swiss neo-bank to sell it in the short term for maximum profit, or if it was more of a long-term project as I like them, to solve one of their own problems — i.e. traditional banks with too expensive fees to fund their Porsches with unjustified bonuses.

Thanks to the blog, I got in contact with one of neon’s co-founders (namely Julius Kirscheneder, who takes care of neon’s marketing — rather than their CEO Jörg Sandrock who I imagined would be even busier!) to see if I could visit them in Zurich for an informal chat.

To my surprise, Julius was a reader of the blog!

He gladly accepted my request.

So I found myself in the ICN for Zürich on a Friday afternoon in December 2019.

I had a few questions about their roadmap (what about the joint account or the cross-border account), but mostly I wanted to feel the feeling and the atmosphere of this Swiss neo-bank.

My first impression upon arrival was positive, as their building was just like them: efficient and without frills. No big glass tower or boardroom to talk in the wind.

After greeting Julius, he introduced me to his team as the “famous” MP blogger. I am very discreet and don’t do this for fame, so I was a bit embarrassed because I am not used to it. But I admit that it’s nice to see who are those real people who read me behind these screens ^^

Anyway, we spent almost an hour and a half talking about future features of the neon application, my blog and how I got there, and other topics like our kids and their education about money.

This visit confirmed to me that the neon team was there as a challenger bank to change the Swiss banking landscape in the long term, and not to be bought by UBS or such big banks after 3 years.

My love story with neon

Quick flashback to 2013.

My finances were not optimized at all.

Our only way to make a budget was to look at our private account balance on the e-banking of our beloved, well-marketed bank.

Then, at the end of 2014, I took the time to simplify our Swiss bank accounts by combining all of our various Swiss accounts at one cantonal bank (the Banque Cantonale Vaudoise to be precise, aka BCV for those in the know).

This simple change at the time had already allowed us to save 300 CHF per year, all while preserving the same level of customer service and functionality.

It is only in 2018 that the first low-fee neo-banks arrived in Switzerland. With, for the first time, completely free account management.

I hesitated for a long time between neon and Zak at that time. And I ended up choosing Zak for two main reasons:

- The most important reason was that Zak offered a Maestro card that allowed us to: make free ATM withdrawals in Switzerland, and to be able to pay at certain merchants who only accept this means of payment in the Swiss countryside

- The second reason was more emotional: Zak was a product of the Bank Cler, which is well established. And so it was reassuring to know that I could talk to someone in real life in case my mobile banking app was not accessible — especially since this bank account was where we received our salaries and with which we were going to make all our daily transactions (bill payments, deposit cash, free cash withdrawals, etc.)

During those years with Zak, I was still eyeing neon because they already had eBill functionality, while Bank Cler was facing technical and internal prioritization challenges.

Also, neon seemed much more aligned with what I was looking for: one of the cheapest banks out there AND independent of any big slow institution.

As time went on, I became more and more comfortable with the idea of choosing a bank without a street address — knowing that I had only been to a Bank Cler branch once before.

It wasn’t until 2022 that things changed at the MPs, with the announcement of the end of the Maestro card in Switzerland in favor of the debit card at all Swiss banks.

So that’s how, since January 2022, neon has become my main bank for all our daily operations.

Why neon Bank is the best Swiss digital bank for Mustachians?

neon Bank is the cheapest bank for Mustachian Swiss residents’ everyday banking needs.

From their neon app from which you can manage your main bank account autonomously, to the cheapest fees for foreign currency transactions and foreign payments, neon does the job — in a secure way thanks to its Hypothekarbank Lenzburg’s partner.

Concretely, below are the criteria against which I judge what is the best frugal bank for a Mustachian. It needs to fulfill those requirements:

| Mustachian criteria | neon | Comments |

|---|---|---|

| Free bank account base fee | ✅ | |

| Digital and mobile bank | ✅ | |

| Secure | ✅ | FINMA-regulated, data stored in Switzerland, and two-factor-authentication for the e-banking |

| Free bank transfers in Switzerland | ✅ | |

| Free bank transfers in the Eurozone | ✅ | Via SEPA (no transaction fees, but exchange rate surcharge applies) |

| Cheap international transfer costs | ✅ | Optimal exchange rate of foreign currencies |

| Free debit card | ✅ | |

| Free ATM withdrawals | ✅ | AKA cash withdrawals |

| Free cash deposits | ✅ | Deposit cash via TWINT |

| QR-bill payment via scan | ✅ | |

| eBill support | ✅ | cf. blog post on how to set up eBill with neon |

| Accessible physically | 🚫 | |

| Download bank account statements in PDF format | ✅ | |

| System of pots for YNAB sync | ✅ | Or CSV export |

| Live push notifications | ✅ | |

| Mobile payment methods | ✅ | Apple Pay, Google Pay, Samsung Pay, Garmin Pay, and SwatchPAY! |

Thanks to its neon mobile app, neon credit card, and digital banking platform built by the Hypothekarbank Lenzburg (that has the Swiss banking license), neon ticks all the boxes except:

- “Accessible physically” — as neon is 100% digital (which helps reduce its fees to the minimum), it has no branch offices

Also, note that the “Free cash deposits” are checked thanks to a workaround with TWINT (see my detailed explanation about using TWINT to deposit cash on neon here) — else you have to pay a fee while going through a payment slip at the post office if you deposit money with them.

Similarly, a special note about “Free ATM withdrawals” with your neon card. You can withdraw cash for free twice a month in Switzerland at any ATM, no matter which bank it belongs to. And for further cash withdrawals, you need to use the Sonect app to still be free of any fees (you find detailed info about Sonect on the neon website here).

In summary, neon is my main Swiss banking solution. And I fixed the emotional issue of “no branch offices” by keeping my Bank Cler’s Zak account as my backup bank in case the neon mobile app would be having a very long downtime or maintenance period at a critical time when I need it AND if they wouldn’t answer my calls at the same time (close to no chances of both happening, but well, contingency plans are here for a reason you know!)

I specify here that I’m a user of the neon free offering (and not of the neon green or the neon metal). You can find more information about this choice in the FAQ section below.

PS: Zak also has a painful payment daily limit of 5'000 CHF (and 25'000 CHF per week), while neon’s payment daily limit is 50'000 CHF! Even though it’s not every day that I need to wire such amounts, it proved much more user-friendly with neon — rather than via the Zak daily limit workaround documented in this article.

neon User Reviews

Like any good self-respecting Mustachian, I’m like you, I want to have several opinions when I have to choose something as important as where my salary and other savings are stored.

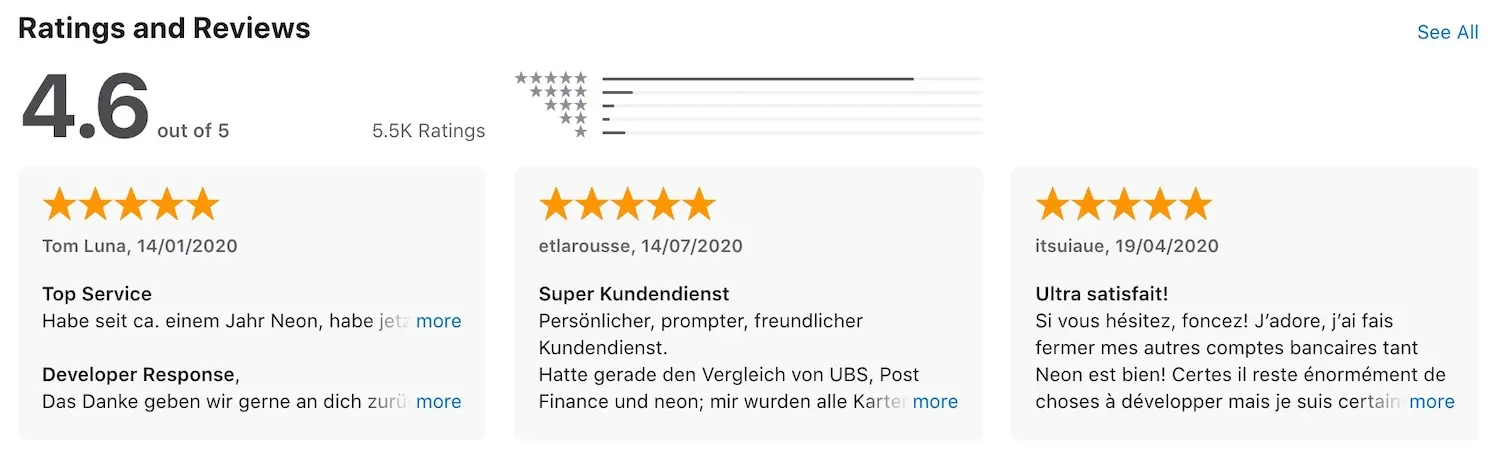

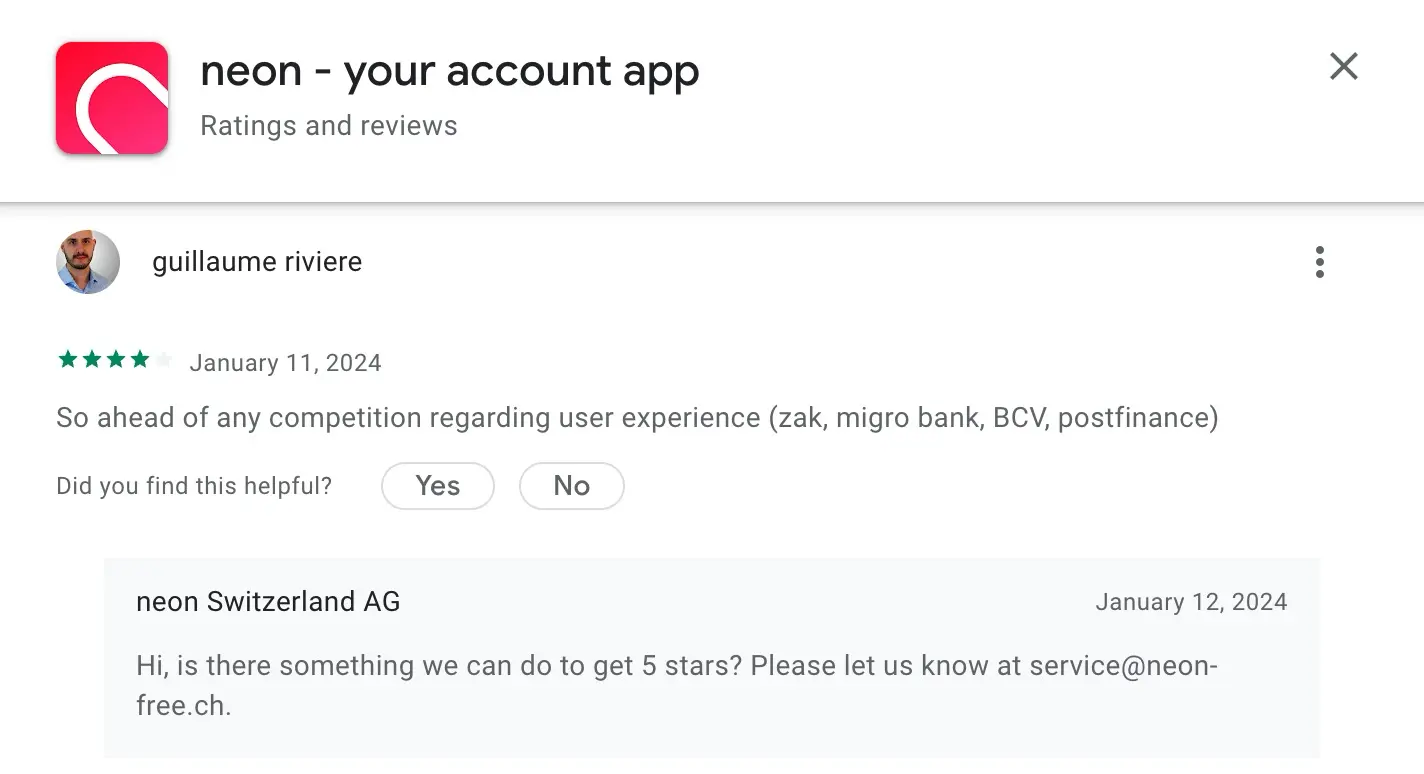

So I’ll make it easier for you by putting together some neon bank review screenshots (from November 2022).

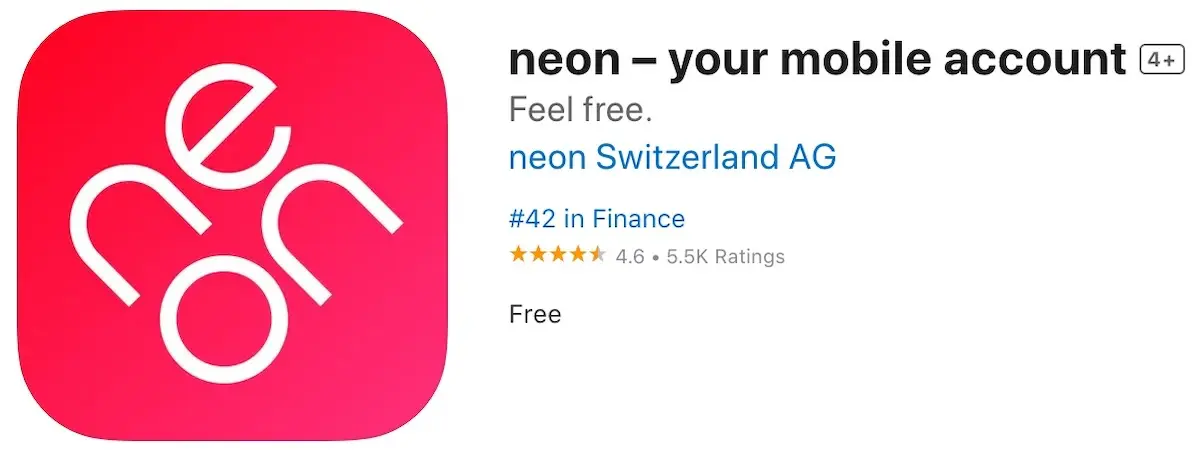

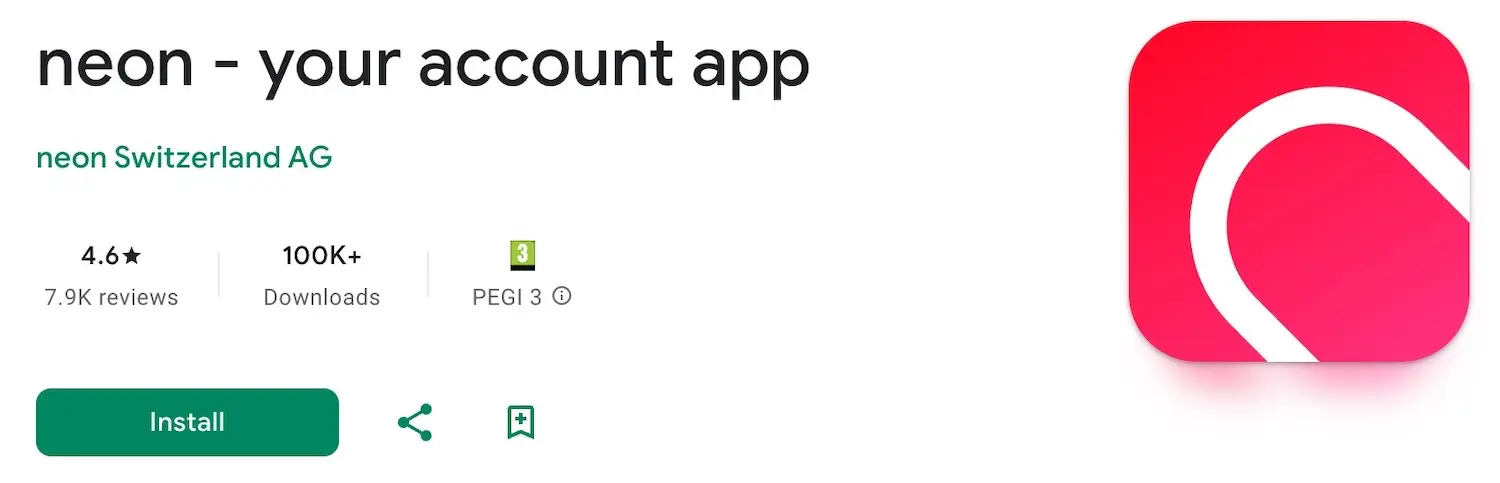

Average ratings neon mobile application on app stores

First, below are the average ratings of the neon mobile app reviews on the iOS and Android app stores:

Comments about neon mobile app on app stores

And here are some public comments from neon users on the Apple AppStore and Google Play Store (most are positive reviews at the time of writing):

You can also use these links to view the most recent ratings of the neon iOS app and of the neon Android app.

Alternatives to neon — and how it compares

Zak vs neon

neon and Zak are the two best banks for us Swiss Mustachians. I use neon as my primary bank, whereas Zak remains my secondary backup bank (contingency plan in case the neon app wouldn’t be available for hours or days — which never happened in years).

neon is overall a better solution than Zak because neon’s independence forces them to fully focus on their neon customers. Zak is responding to Bank Cler, and I feel they have less pressure than neon to satisfy their customers, as it’s Bank Cler who steers the boat, and not the Zak team and its customers’ needs.

Concretely, compared to neon, Zak is for instance applying a surcharge (about 2.5%) on the exchange rate when paying in foreign currencies abroad or online with their Zak VISA debit card.

Another example of better customer-centricity at neon than at Zak: neon’s website and neon app are entirely available in English (on top of the usual German-French-Italian trio).

Aside from these negative sides of Zak, I must be fair: Zak is the second best Swiss digital bank in Switzerland for us Swiss Mustachians. It’s a free digital bank for everyday needs, with Bank Cler’s branch offices that can reassure people.

neon vs Revolut

Revolut isn’t a Swiss bank. It doesn’t have a full-fledged banking license — not in Switzerland, nor anywhere else. It is only an e-money institution (aka fintech). This forces them to hold your money at a third-party UK bank. neon is different, as it relies on the Hypothekarbank Lenzburg, which has a Swiss banking license.

This makes it hard for me to compare Revolut vs. neon, as it’s a bit like comparing an apple to an orange. For instance, forget about paying a Swiss QR-bill with Revolut. With neon, you can pay QR bill.

As for the Revolut card, it’s one of the cheapest ways to handle any foreign currency and payments abroad. But again, compared to neon which is cheap on foreign currency payment no matter the day, Revolut is more expensive with those abroad payments during the weekend.

I was myself using Revolut so far to quickly exchange currencies, and then transfer money to someone in the changed currency. It was a bit more expensive than Wise (or neon via Wise), but it was handy. I could load Swiss francs from any of my Swiss credit cards for free — while it had fees with Wise. And then I would exchange currencies at a cheap rate in the Revolut app.

The problem is that Revolut has now introduced top-up fees when you load money via a Swiss credit card…

So all in all, I don’t use Revolut anymore. Instead, I use neon which is better both for banking services as well as currency exchanges and payments to transfer money to many countries in the world.

neon vs Yuh

Yuh is a digital-only bank. Like neon, Yuh relies on a third-party bank (Swissquote) for its banking infrastructure. Swissquote is FINMA-regulated and has a Swiss banking license, hence your money is protected up to 100'000 CHF. Yuh competes well with neon with its no base fee account but falls short on key points, including its high currency exchange fees (0.95%!)

On top of banking service, Yuh also plays in the investing realm. But idem, their fees there are too expensive compared to other investment alternatives available to Swiss Mustachians.

I feel Yuh is too diversified in initiatives (banking, foreign currencies, investing, crypto), and not enough optimal in any of those.

Bottom line: neon remains better than Yuh for my banking and payment needs.

neon vs CSX

CSX is the digital banking solution of Credit Suisse. It entered the market later than neon and Zak. CSX has no bank account base fee. But for a daily banking solution, it’s quickly limiting! ATM withdrawals (even at their own ATMs!) are subject to a fee. And currency exchange rates are less favorable with CSX than with neon.

I use neon over CSX because neon provides a banking solution that is focused on real customer usage (for instance with two free domestic withdrawals per month), vs. CSX and its clear plan to make you pay as soon as they can in an unfair way (i.e. ATM withdrawal at their own ATMs don’t cost them anything but they charge them to you!)

neon vs N26

N26 is a fully licensed mobile bank. It’s based in Germany, and protects its customers’ money up to 100'000€ via the German Deposit Protection scheme. Their N26 Standard account is free and comes with a virtual debit Mastercard. The problem is that the N26 account is in euros (EUR), and has a German IBAN.

Due to the N26 Swiss IBAN still not being available, you can’t deposit your salary in CHF in the N26 bank account. Idem, no QR-bill payment is possible with N26.

Hence I don’t spend more time comparing N26 features to neon, as the latter clearly beats it with its true Swiss mobile banking solution.

I will update this section as soon as N26 offers CH IBANs.

In the meantime, it’s cool to see a Swiss digital bank manage to keep the competitive edge over its foreign competitors!

neon vs FlowBank

FlowBank went bankrupt in June 2024. No need to say more ;)

FlowBank focused on the trading section of their offering (which was itself not the best on the market…). So it was obvious that neon was better than FlowBank for your banking needs.

neon Bank vs Migros Bank

Migros Bank is one of the cheapest traditional banks in Switzerland. It’s a brick-and-mortar bank with branch offices. You can get free account management if you leave 7'500 Swiss francs (CHF) on your Migros Bank account at any time. It also provides free payments and transfers (when used domestically). But it doesn’t compete with neon on foreign exchange transaction fees.

This makes Migros Bank a more constraining bank than neon with its minimum amount to get no fees. Add expensive foreign exchange fees to the equation, and you understand why I stick to my digital-only bank neon :)

neon or Alpian

Alpian is a new online private bank. It also offers investment services. However, premium banking also means premium fees. You’ll have to pay a minimum 0.75% investment mandate fee, as well as other quarterly fees if you have less than CHF 50'000 stored and invested with them.

Alpian is therefore much more expensive than neon in terms of banking services for us Mustachians.

For my part, I separate my banking activities from my investment activities to have the best in each category. So I opt for neon as my main bank.

Open a neon account in 10 minutes

It’s so straightforward to open an account at neon that it doesn’t require me to provide you with detailed how-to screenshots.

As neon states on its website: “It only takes 10 minutes to create your neon free account.”

The entire 4-steps process is digitalized through the neon app:

- Download the neon app (iOS AppStore, Android Google Play Store, Huawei AppGallery)

- Let the app guide you in entering your personal details

- Confirm your identity (via taking a picture of your ID, or via a short video call)

- Define your login code, and… you’re done!

Frequently Asked Questions about neon bank account

Security

Is neon a safe bank?

Yes, neon is safe as it’s relying on the banking infrastructure and back office of the Hypothekarbank Lenzburg which possesses the Swiss banking license. This makes your neon account balances protected up to 100'000 CHF thanks to Swiss deposit insurance.

Is neon a Bank?

Nope, neon is technically not a bank as it doesn’t have a banking license. It relies on its banking partner Hypothekarbank Lenzburg (which has a Swiss banking license) to be overall a viable banking solution for Swiss citizens. neon Bank provides an easy-to-use interface for neon customers, where all the boring FINMA compliance stuff is handled by Hypothekarbank Lenzburg.

neon accounts’ type

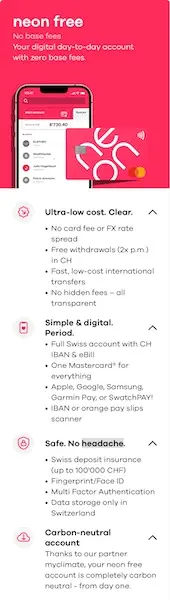

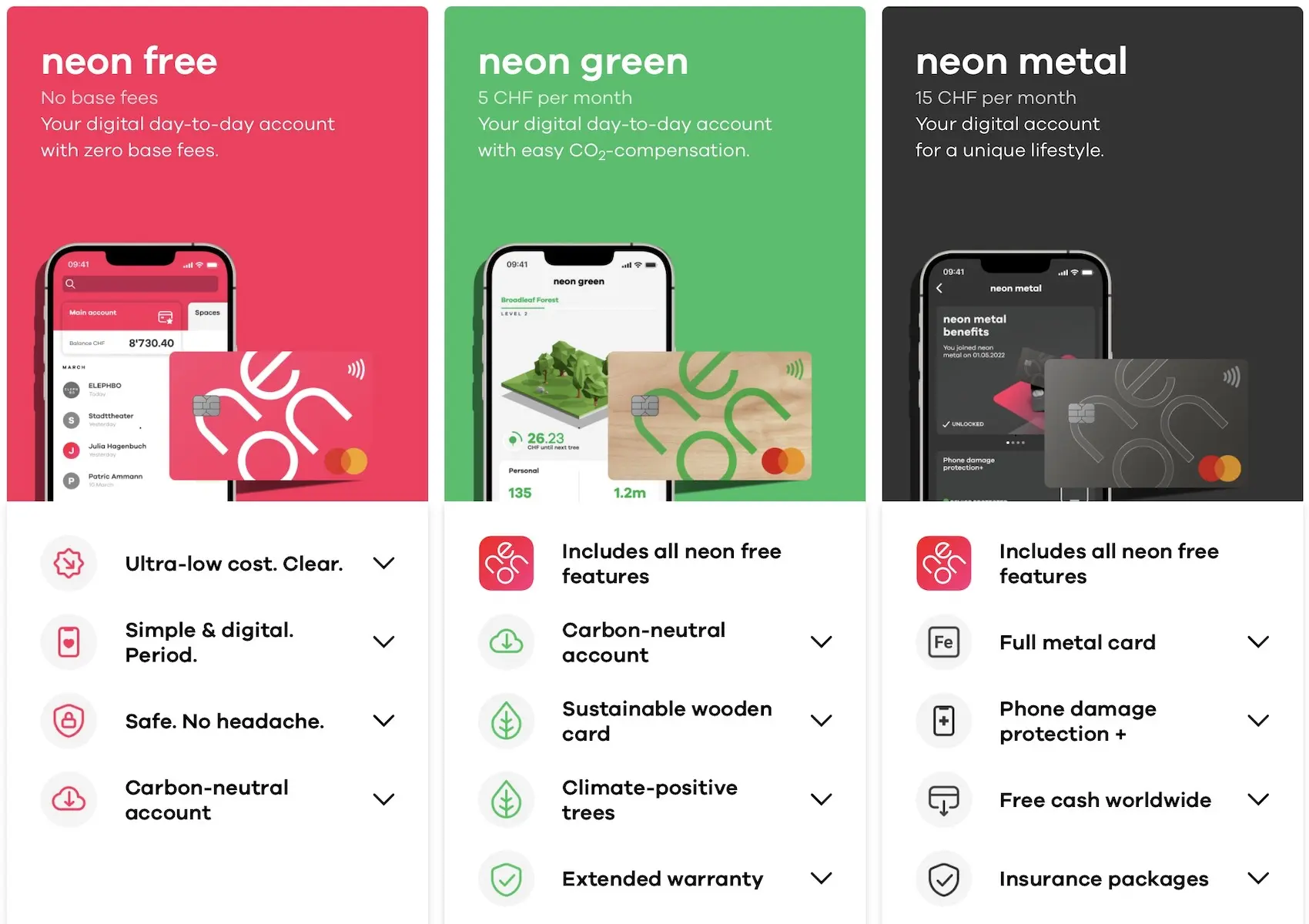

What is neon free?

neon free is the initial digital day-to-day account with zero base fees that neon announced back in 2018. The funding team was composed of Jörg Sandrock, Julius Kirscheneder, Simon Youssef, and Michael Noorlander. They wanted to fix their own problem as Swiss citizens: get a banking solution that is ultra-low cost, clear to understand, and simple to use. And safe as a Swiss bank, obviously. And by focusing on real issues, their team managed to release an excellent bank with neon.

As said at the beginning of this article, I use the neon free account.

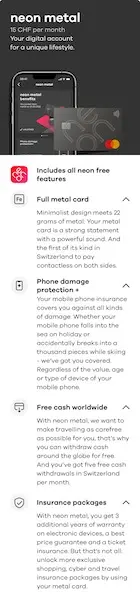

What is neon green?

neon green is the CO2-compensated version of the neon free account. It costs 5 CHF per month and comes with a sustainable wooden card. The neon green system plants a tree for every 500 CHF spent with your neon green card, to offset your CO2 consumption. Also, you are entitled to an extension of warranty of 3 years on any of your electronic devices.

neon green and its neon green card’s compensation system are a great initiative to make the world a better place, I won’t argue about this. It helps bring more awareness to the topic.

But as you guys know me, I’m also a Minimalist on top of a Mustachian. And I like the idea that the best way to not emit CO2 with your purchases is to not purchase them in the first place!

Also, I prefer to use my way of compensating for my CO2 emissions, as neon is not the only credit card that I use.

This is mostly why I don’t use the neon green account and its wooden Green card.

What is neon metal?

neon metal is the high-end version of the neon free account. It costs 15 CHF per month. Aside from the show-off neon metal card, it provides phone damage protection, and other insurance packages (best price guarantee, cyber, travel). Also, it allows free cash withdrawals worldwide (but limited to 5 per month in Switzerland 🧐).

I don’t see any use for the neon metal account for us Mustachians. Except if you are traveling a lot AND in need of cash in different countries each time. Else you could just open local bank accounts.

Also, if it’s the insurance parts (phone damage protection, ticket insurance, or warranty on electronic devices) that you like, I would first consider being more careful (!) as well as insuring yourself with a “Self-insurance fund” category in your budget.

I then would advise you to check other insurances available for this kind of accident to compare prices in case you really (really?) want to be covered.

And clearly, I don’t see any of us Swiss Mustachians switching only to satisfy our ego with the neon metal card — as it’s way too expensive ;)

All these reasons push me to not recommend you switch to a neon metal account.

What accounts does neon offer?

neon offers accounts for different profiles. Sometimes, a picture is worth a thousand words (MP’s choice is the neon free account 🏦):

neon account opening eligibility requirements

You must satisfy these pre-requisites to be able to open an account at neon:

- Be over 16

- Have a Swiss domicile (i.e. must be living in Switzerland)

- Be a Swiss tax resident exclusively

- Possess a Swiss ID or passport, OR a valid ID from one of these countries (in combination with a B or C foreigner’s permit)

- Oh yeah, and obviously, you better have an internet connection :D

Does neon propose a joint account?

Unfortunately, neon doesn’t propose a joint account, yet. I’ve heard that it’s one of their top priorities, but that it’s complex on the back-office side to make happen. This feature is one of the most requested by the Swiss Mustachian community (myself included), so I will ensure to let you know once it’s available.

In the meantime, in the MP family, we’ve just opened an account in one of our names, and it’s all running fine. But I know some readers would really like to have one joint account in case something bad happens to their significant other, so they don’t have to deal with administrative issues on top of the loss of a partner.

neon fees (incl. transfer money)

Is neon entirely free?

For your daily banking, yes, neon free is entirely free. No base fees as other classical banks have, or unjustified additional card fees. Also, all bank transfers in Switzerland are free of charge, as well as domestic payments in CHF.

Nevertheless, neon has some fees — and they are transparent about them — because they still are a company that needs money to live.

Below are the fees that apply to the neon free account (MP’s choice).

neon fees in Switzerland 🇨🇭:

- The first debit Mastercard from neon costs 10 CHF upfront (for the plastic) — but you get it for free (i.e. 10 CHF of credit) if you use the blog’s code “mustachian” during the registration process

- In case you lose your neon free payment card, neon charges 20 CHF for a replacement card

- You have 2 ATM withdrawals per month for free, then you need to pay a fee of 2 CHF per withdrawal for each additional withdrawal

neon fees abroad ✈️:

- When you make foreign currencies card payments abroad with your neon payment card, the Mastercard mid-exchange rate is applied — with no exchange rate surcharge as we’ve been so used to by traditional banks with their additional costs

- Withdrawal abroad at ATMs will cost you a 1.5% fee on your withdrawal amount

- International transfers are done via Wise to send money to another country, and neon charges for this a convenience fee between 0.8-1.7% depending on the amount and currency

You find a detailed overview of neon’s services and pricing in this PDF document on neon’s website.

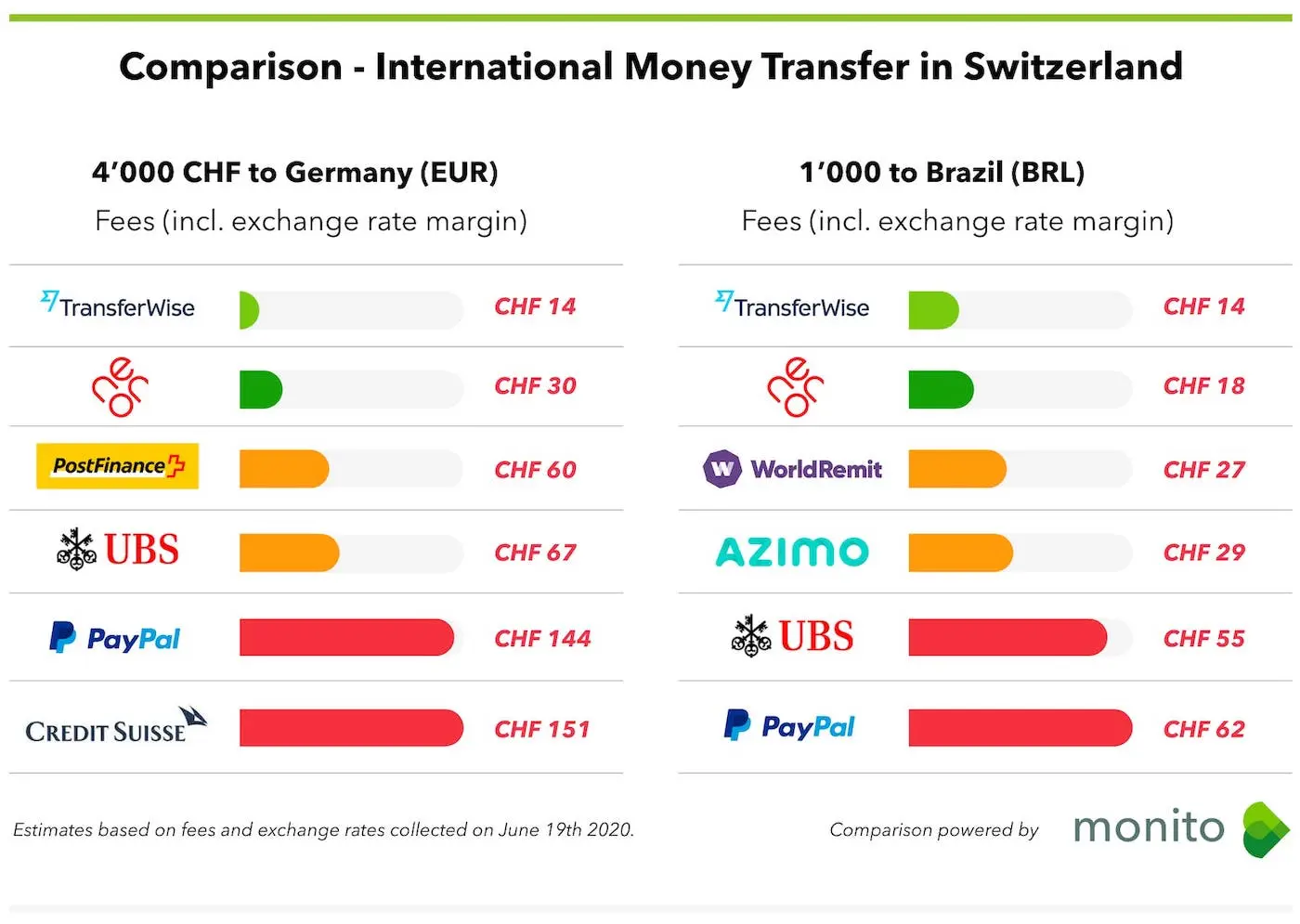

Comparison of neon bank and its alternatives for international money transfer in Switzerland (to send money abroad)

neon mobile application

Can I view my neon Mastercard details in the neon app?

Yes, you can view your card number, expiry date, and security code (aka CVC code), as well as your neon card PIN in the neon mobile application. That’s quite handy when you look for them for online purchases for instance.

Daily usage (incl. salary questions)

Should I use neon for my everyday banking needs?

In my humble opinion, neon Bank is THE best bank in Switzerland if you are a Mustachian and are ready to go with digital banking. Its cheapest neon free account allows you to save money on bank fees. Those savings can then be invested to make babies — for you, not for your banker’s bonus!

Can I receive a salary on neon?

Yes, you can. neon provides you with a Swiss IBAN (i.e. CH IBAN). It allows you to receive your salary in CHF.

Unlike N26, for example, which only offers you a German IBAN on which Swiss employers (and you too because of the CHF-EUR fluctuating exchange rate!) are often not OK to pay your salary (because it is a foreign IBAN).

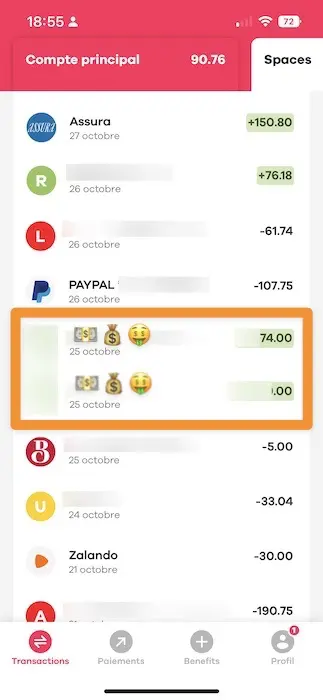

Here is image proof of Mrs. Mp and me receiving our Swiss salaries on the neon app:

Should I deposit my salary in my neon account?

Well, at least I do! And if you hesitate, I would ask you: “What’s at risk?” neon is certainly an independent account app provider, and as it only exists since 2018, it could be worrying. But remember: they rely on the secure Swiss Hypothekarbank Lenzburg where your money is protected up to 100'000 CHF thanks to the Swiss deposit insurance.

Conclusion neon review

neon is an excellent bank — the best digital bank for us Swiss Mustachians.

It’s been my primary bank since January 2022.

Our salaries get deposited every month on it.

And I pay all of our invoices (eBill for the win!) and do our domestic bank transfers in CHF via the neon app.

I use the neon debit Mastercard in Switzerland to withdraw money at ATMs, and to pay in shops when credit cards aren’t accepted (see my credit card strategy in this article.

Abroad, the neon credit card is the single one I need for all purchases in foreign currencies.

And for online payments, I use it also for foreign currency payments (else I use another credit card when paying online in CHF).

As they are independent (i.e. no major bank is a shareholder of neon), their focus is entirely on satisfying their neon customers above anything else.

The small number of negative reviews I could find are mostly about the missing joint account and cross-border account. Hopefully, that will come soon (2024? 🤞).

The other point mentioned sometimes is their mobile app that doesn’t feel as fluid enough as other digital banks like Revolut or Wise. I agree with this last point, but the neon app does the job and if they take such shortcuts to remain the cheapest option, I’m fine with it.

So voilà, in one sentence: neon is the MP’s bank choice. I recommend it to my family and friends, and hence to you too, dear reader.