Neon referral code 2026

Use the coupon code "neonMustachian" when you register on the neon app.

You'll get the neon Debit Mastercard for free (instead of CHF 20) and a 10 CHF credit as a welcome bonus on your neon free account (and you'll help support the blog, thanks!)

(N.B. the app may not reflect the bonus directly, but it'll be taken into account, I checked with their support)

- neon 3a in short

- What is neon 3a concretely?

- Why is neon 3a the second best 3rd pillar solutions for Mustachians?

- User reviews about the neon app

- Alternative solutions to neon 3a — and their comparison

- How to open a neon account within 10 minutes

- My exclusive interview with the CEO of neon

- FAQ about neon 3a

- Conclusion

If you’ve just discovered the FIRE movement (“Financial Independence, Retire Early”), then you’re in luck.

When I started my Mustachian journey in Switzerland around 2013, the financial landscape was quite different: no trace of the modern platforms we know today.

Even less so in the world of pillars 3a…

At the time, optimizing your retirement savings sometimes meant looking for obscure solutions in other cantons (I even went as far as Lucerne!), just to find a bank a little more open to passive investment.

Since then, we’ve seen the emergence of a fine line-up of Swiss fintechs specializing in 3rd pillar products, which have really changed the game. They are finally making it possible to invest in diversified portfolios, based on index funds, with low fees. Everything you need to boost your FIRE strategy with efficient pension provision.

neon 3a in short

In a nutshell, here’s my take on the neon 3a 3rd pillar, starting with the advantages of neon 3a:

What I like about neon 3a’s services

- 2nd in my overall ranking of the best 3rd pillar. Clearly one of the best products in Switzerland nowadays.

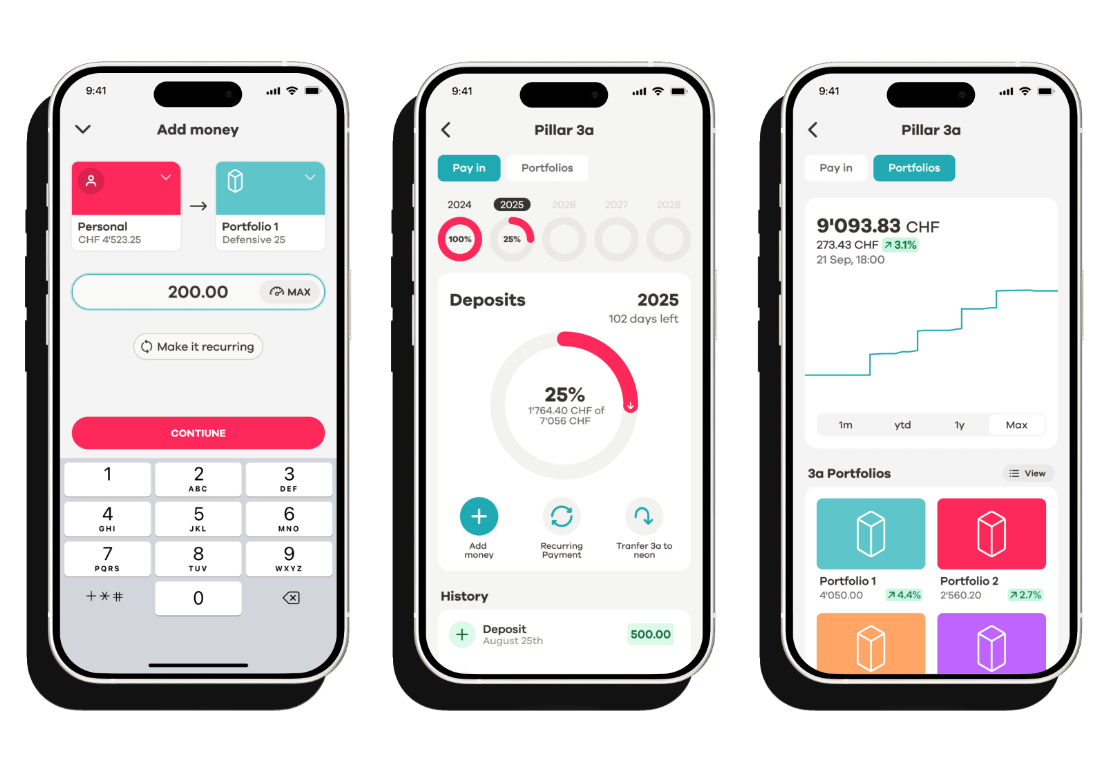

- All-in-one experience: you can manage your neon bank account and your neon 3a pillar in a single app. Simple and efficient.

- Good alternative to putting all your eggs in finpension or VIAC. It diversifies your institutional risks.

What could neon improve in the future?

- Better tax optimization with IPF funds (explained later in the article), resulting in a higher net return (~0.3 to 0.4%/year) compared to an equivalent portfolio allocation.

- A customized strategy option: so you can choose your own funds and your exact allocation.

For such a young product (N.B. the funds used are well-established and recognized), it’s already very solid.

MP’s recommendation

My Mustachian recommendation is to follow a strategy of opening several 3rd pillar accounts to stagger your withdrawals, and then maximize your tax savings.

As we’ll see later in this article, there are two better solutions than the very good pillar 3a of neon.

At the time of writing, here’s how I invest my 3rd pillar money (I fill them up to the maximum annual amount): 3/5 on finpension 3a, and 2/5 on VIAC 3a. As they are ex-aequo, Mrs MP does the opposite with 3/5 on VIAC, and 2/5 on finpension.

Mrs MP and I have been following this investment strategy ever since we were finally able to close that damn mixed 3rd pillar linked to life insurance!

What is neon 3a concretely?

neon 3a is a 3rd pillar offering in Switzerland.

If you’re a new blog reader, you may be wondering: What’s a 3rd pillar again?

Basically, the 3rd pillar is your favorite toolbox for preparing for retirement while reducing your tax bill. Every franc you pay into it means you pay less tax.

But if you’re a Swiss Mustachian worthy of the name, you know that the aim isn’t just to save on taxes.

You also want that cash you put aside to work for you, just like the rest of your stock market portfolio (note: this article on “how I would invest CHF 10'000 in the stock market today” should interest you).

And of course, you want it to be managed by a local fintech that plays the transparency card, with a clean interface and, above all, low fees. Not like those Swiss banking dinosaurs who charge you abusive fees to finance their Porsche via their end-of-year bonuses!

That’s exactly where neon 3a comes in, to help you make the most of your private pension provision.

With neon 3a, you invest your pillar in well-diversified index funds across a range of ready-to-use profiles. Whether you’re cautious or 100% equities (like any self-respecting Mustachian), you’ll have everything you need to make your retirement savings grow intelligently, year after year.

The ultimate goal? To build a real financial cushion for the future, while optimizing your tax situation today.

So the question is: how does neon 3a compare with the other 3rd pillars available?

Why is neon 3a the second best 3rd pillar solutions for Mustachians?

The neon 3a 3rd pillar ranks 2nd behind finpension and VIAC. Well integrated with the neon app, it offers fair fees from CHF 50'000, but uses less optimized funds. It’s better than the classic banks, but below the leaders in terms of performance and portfolio customization.

Mustachian criteria for selecting your Swiss 3rd pillar plan

Let’s face it: as Mustachians, we’re not exactly like everyone else ;)

So, here are the criteria I take into account when deciding whether a Pillar 3a is really worth it or not:

Criterion 1 - “100% global equities” strategy available

You’re looking for a solution that lets you invest 100% of your pillar 3a in global equities, via index funds. The aim: to maximize diversification to achieve the best possible return/risk balance on a global scale.

Criterion 2 - Best return (including fees)

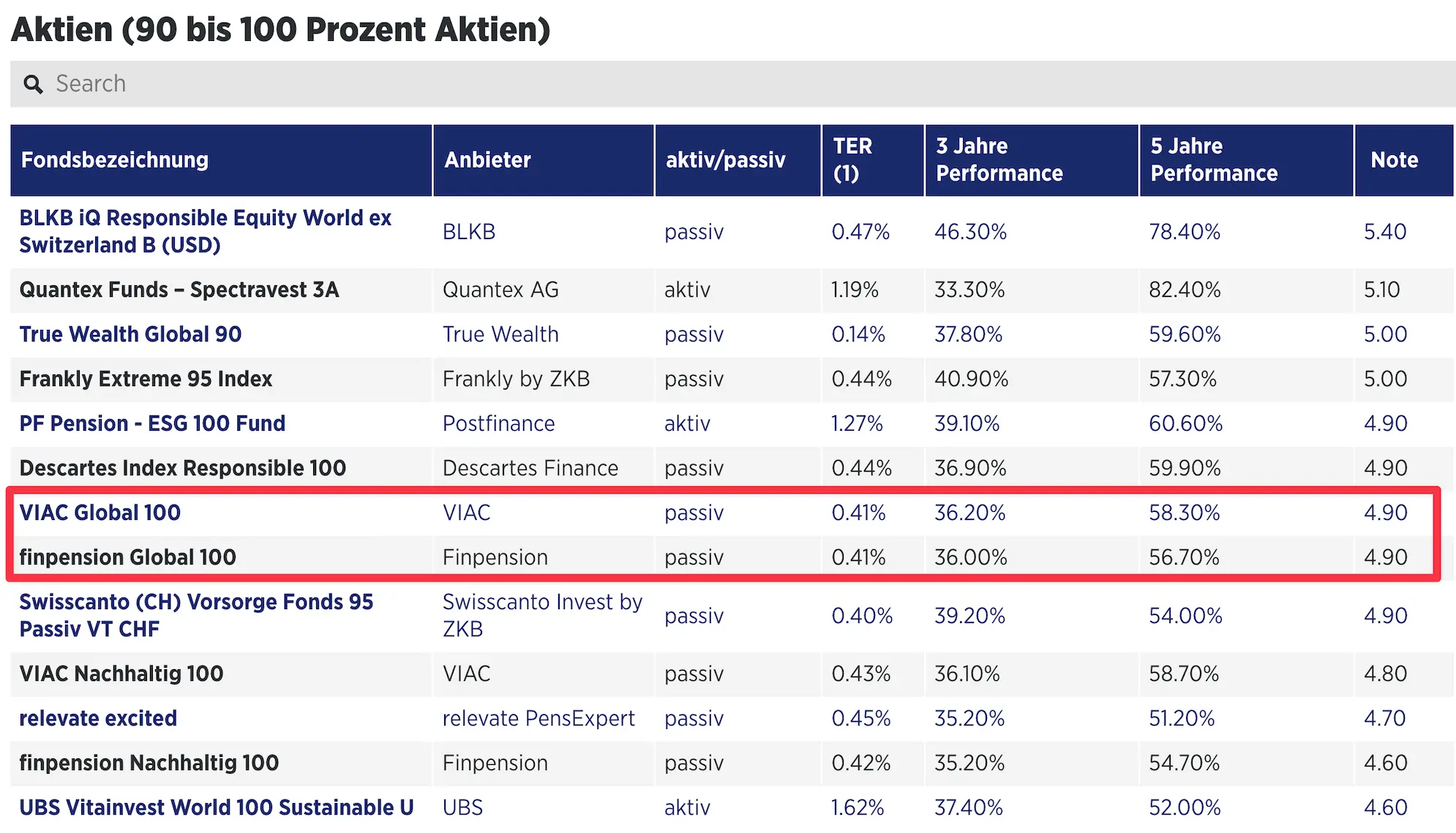

For a long time, I used to do all the hard work myself to break down the fees for pillar 3a products and find the best deal. But since 2023, I’ve been relying on the Handelszeitung score published at the end of each year to easily spot the most attractive financial institution.

The Handelszeitung score takes everything into account, including the net return after all fees, and that’s what interests me :)

So as a Mustachian, what I’m aiming for now is THE pillar 3a that delivers the best net return, period.

Side note: if you’re wondering why I prefer VIAC and finpension, even though there are other pillar 3a providers ahead of them in the Handelszeitung ranking, take a look at my comparison of the best third pillar in Switzerland for my detailed answer.

Criterion 3 - A secure 3rd pillar

I want a 3a solution that verifies all personal info at account opening, not just at withdrawal time (which finpension did at first, but they’ve corrected that since 2023).

On this point, neon 3a ticks all the boxes: formal identification is carried out as soon as your neon account is opened. No ghost accounts, no mistakes that go uncorrected for 20 years. It’s clean from the start, and that’s exactly what I expect from a fintech that manages my money for retirement.

The neon 3a offer meets two of these three criteria.

As neon 3a is brand new, it does not yet appear in the Handelszeitung 2024 ranking. But a 3a pillar comparison written by neon suggests that they are outperforming all other market players with their “Offensive 100” strategy.

Except that neon 3a’s 100% Equities strategy is far more aggressive than that of VIAC or finpension. In other words, the allocation (i.e., the choice of what percentage in world equities, what in Swiss equities, etc.) is different. So it’s a bit like comparing apples and pears.

neon 3a’s “Offensive 100”:

71% world equities

10% Swiss equities

18% emerging market equities

1% cash“Equities 100” by finpension 3a:

37% world equities

40% Swiss equities

12% Asian equities

10% emerging markets equities

1% cash

Whereas if you recreate the same neon 3a “Offensive 100” allocation with VIAC or finpension, you’ll end up with a superior performance with VIAC and finpension. This is because they invest your money via IPFs (Investment Foundations for Pension Funds), which recover foreign taxes, which neon 3a does not.

And all these withholding taxes recovered can be reinvested in your 3a, making finpension and VIAC more efficient than neon 3a.

And in terms of fees, neon on the right path… but only from CHF 50'000 onwards. So if you’re just starting to fill up your 3rd pillar, neon 3a remains a good option, but I’d place it just behind finpension and VIAC.

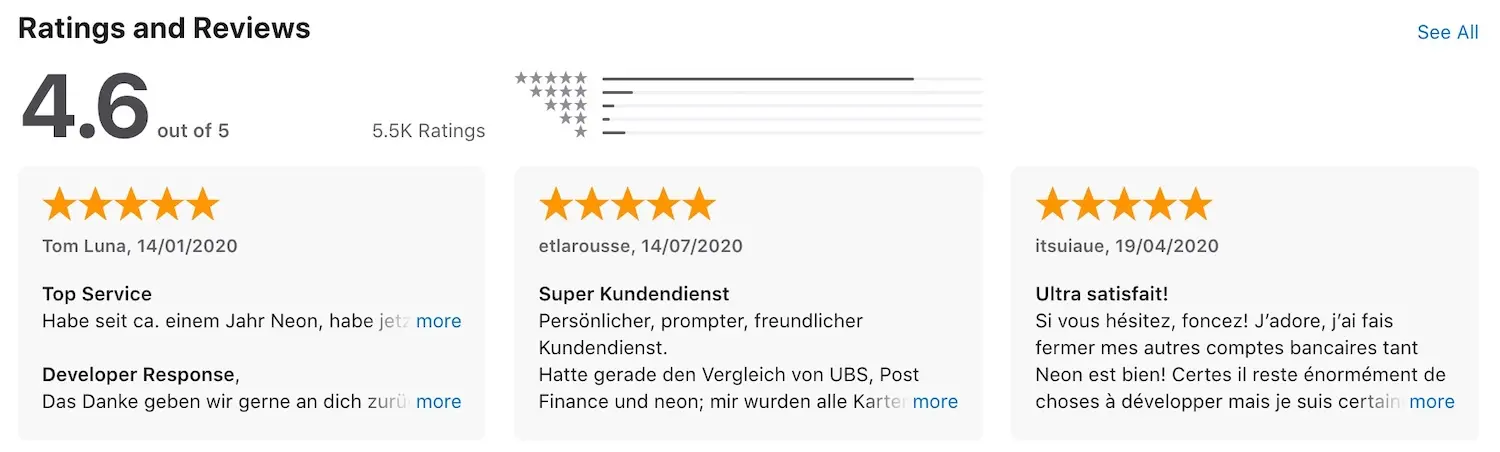

User reviews about the neon app

I usually go and look at the ratings given by end users when I use a service like neon with a mobile app.

It’s handy for getting a feel for the provider, as unhappy customers are the first to post their negative reviews there.

If a mobile app passes the 4/5 mark on the stores (and there are more than 20-40 reviews), then that’s a good reassurance for me.

Average ratings for neon app reviews on iOS and Android are:

That’s pretty good.

And regarding the comments about neon:

You can also use these links to check out the most recent reviews of the neon iOS app and the neon Android app depending on your smartphone type.

Alternative solutions to neon 3a — and their comparison

neon 3a vs finpension 3a

neon’s 3rd pillar is not as good as finpension’s 3rd pillar. neon therefore ranks second behind finpension 3a. My comparison takes into account fees, performance, and taxation.

Compared to finpension, neon could optimize its 3a offer by:

- Using IDF index funds, which are more tax-optimized

- Offering even more aggressive fees from the first Swiss franc deposited

- Offering a customized strategy

neon 3a vs VIAC 3a

neon’s 3rd pillar offering is mathematically inferior to VIAC’s. neon, therefore, ranks second behind VIAC 3a. My analysis takes into account fees, performance, and tax comparisons.

As said for finpension, neon could improve its 3a offer by:

- Using IDF index funds, which are more tax-optimized

- Offering even more aggressive fees from the first Swiss franc deposited

- Offering a personalized strategy

neon 3a vs frankly

It’s clear: neon 3a lets you invest up to 99% in equities, while frankly tops out at 95%. And inevitably, with a higher exposure to equity markets, the performance potential is higher over the long term. Fewer equities = less return.

neon 3a vs True Wealth

True Wealth’s 3rd pillar stands out for its ultra-low fees: you pay only the TER of the products ~0.18%, and 0 CHF in fees. Also, True Wealth offers tax-optimized index funds, which maximize net performance (but they also have ETFs in their portfolio, which is less optimal).

The neon 3a solution remains competitive, but its fees only become attractive above CHF 50'000, and its index funds do not recover foreign withholding taxes.

True Wealth automatically creates 5x 3a accounts, which is convenient for withdrawals, but restrictive if you already have pillars elsewhere. With neon, you choose how many accounts you open, with the option of applying a different strategy to each account.

In short: True Wealth is more financially efficient, but neon offers greater management flexibility.

neon 3a vs Descartes (formerly Descartes Vorsorge or Descartes Prévoyance)

Descartes’ 3a offering (also known as Descartes Vorsorge 99%) is less attractive than neon 3a. Even though Descartes scores well in Handelszeitung, this score mainly relates to the “Descartes Index Responsible 100” strategy. When comparing the factsheets, neon 3a offers greater diversification, while Descartes 3a remains more concentrated (due to ESG exclusion criteria). For a long-term third pillar, I therefore favor neon 3a for its superior diversification.

neon 3a vs Selma

The neon pillar 3a is more suitable than a Selma 3a for a Mustachian investor aiming for 100% equities. With neon, you can invest up to 99% in equities, compared with a maximum of 97% with Selma. And inevitably, fewer equities = less potential performance over the long term.

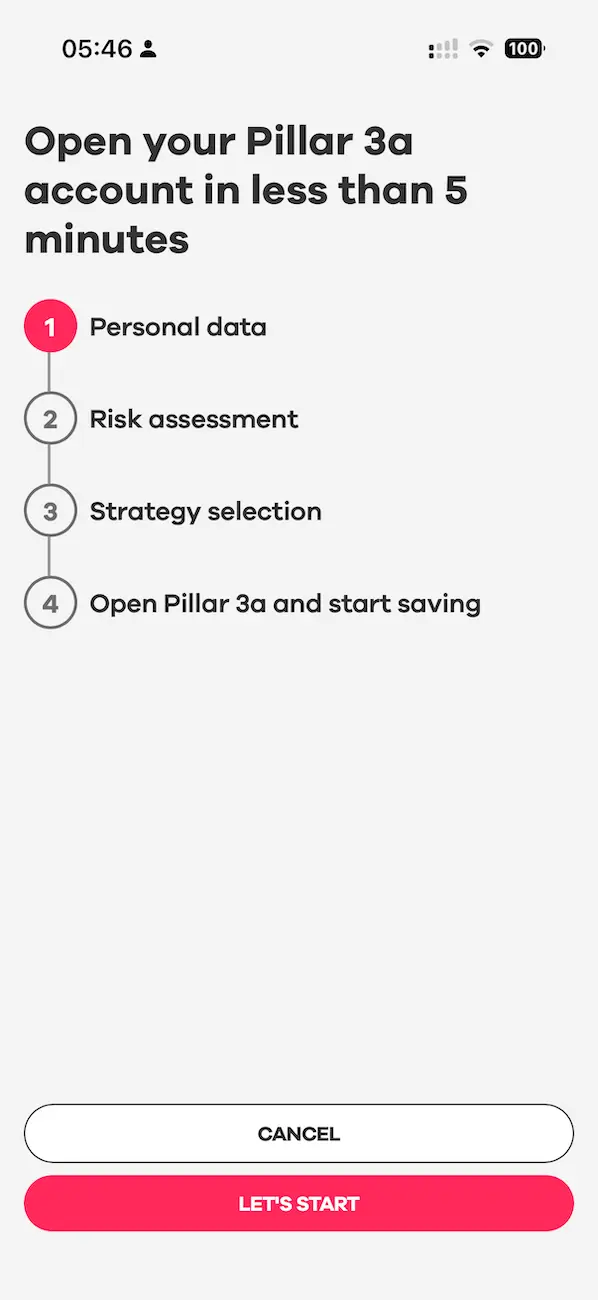

How to open a neon account within 10 minutes

It’s crazy to think that in 2026, you can open a 3a pillar in just ten minutes, watch in hand!

And without running the risk of an insurance advisor trying to force you to buy his mixed 3rd pillar linked to a life insurance (REMINDER: NEVER TAKE ONE OUT!!!!)

Your neon account opening is entirely digitalized via their mobile application:

- Download the neon app (iOS App Store, Android Google Play Store) on your smartphone

- Create your neon account

- Go to “Profile”, select “Pillar 3a”, then “Open a portfolio.”

- Answer questions about your risk profile, investment horizon and monthly deposit capacity

- Choose your investment strategy for the money in your third pillar

And that’s all there is to it. Now all you have to do is make your first payment from your neon account to your 3a.

My exclusive interview with the CEO of neon

I was able to interview Jörg Sandrock, CEO of neon.

We discussed his background, neon’s strategy (including whether they were for sale!), as well as diversified global ETFs.

You’ll find the full interview with Jörg Sandrock at this link.

FAQ about neon 3a

Who can open a neon 3a pillar?

A pillar 3a neon account can be opened by any Swiss resident who is 18 years old and has an income subject to AHV.

How much does neon 3a charge?

neon 3a charges sliding-scale fees based on the total amount of your 3a portfolios:

- From 0 to CHF 4'999: 0.45%

- From CHF 5'000 to CHF 9'999: 0.44%

- From CHF 10'000 to CHF 24'999: 0.43%

- From CHF 25'000 to CHF 49'000: 0.41

- Over CHF 49'000: 0.39%

These fees include TER (except for the “neon Offensif 100” strategy, for which 0.04% must be added, and the “neon Dynamique 80” strategy, for which 0.07% must be added).

What is the maximum number of 3a neon portfolios I can open?

You can open a maximum of 5 neon 3a accounts.

I already have a 3rd pillar account elsewhere. Can I open a neon 3a account?

Yes, as long as you respect the maximum total limit of five 3rd pillars.

Is neon 3a secure?

Yes, neon 3a is secure. Your 3rd pillar money is stored in separate securities from neon’s company. This means that if neon were to go bankrupt, you would not lose your neon 3a assets.

Conclusion

neon 3a is an excellent 3rd pillar solution, especially if you’re already a customer of their bank account or want to centralize everything in one well-thought-out app.

With a clear interface, a 100% equities strategy available, and competitive fees (from CHF 50'000 invested), it’s clearly one of the best offers on the market, even if it remains slightly below finpension and VIAC due to the absence of tax-optimized index funds and limited customization.

For our FIRE strategy, Mrs MP and I have chosen to concentrate our annual payments on finpension and VIAC (3/5 - 2/5), but neon 3a remains on our radar. We’ll be keeping an eye on how their solution develops over the next few years.

In short, if you want a simple, effective, and mobile solution for your 3rd pillar, neon 3a is a solid choice. But if your objective is maximum net performance and total flexibility, you’re better served with finpension or VIAC.

Use the promo code below when registering on the neon app.

You'll get the neon Debit Mastercard for free (instead of CHF 20) and a credit of CHF 10 as a welcome bonus on your free neon free account (and you'll help support the blog in the process, thanks!)

(N.B. the app may not reflect the bonus directly, but it will be taken into account, I've checked with their support).

===> neonMustachian <===