If you fill in your tax return in Switzerland yourself, you could be missing out on one or more tax deductions.

I paid the price myself early in my working life. At the time, I remember staying later at work with a good colleague. We showed each other our tax returns and deductions.

So I decided to create for myself a complete checklist of the tax deductions I use, with indicative amounts and points to watch out for.

I’m sharing it with you here to help you legally optimize your tax bill, whatever your situation (employee, parent, tenant or owner).

It’s not a theoretical catalog (your canton’s tax authorities will provide you with that), but concrete feedback based on what I’ve actually deducted and checked over the years, and which I systematically review before validating my return.

How to use this checklist of tax deductions

To be clear: this checklist is not to be applied line by line.

Some deductions apply to almost everyone, while others clearly depend on your situation: whether you’re employed or self-employed, whether you have children, whether you rent or own property, or whether you’ve had a “special” year (training, major health expenses, etc.).

So basically: you go through each section one by one, and check if it applies to you this year.

Also, the amounts I mention are indicative, as they correspond to my own situation. They may therefore vary according to your canton and tax year. If in doubt, use this page as a reminder, then check the details in your cantonal tax software or with the tax authorities.

Important note: I have deliberately not listed the deductions applied automatically by the tax authorities, such as certain social deductions for children or married couples. In principle, these are calculated automatically according to your personal situation. This checklist therefore focuses only on those deductions where action or verification on your part is required.

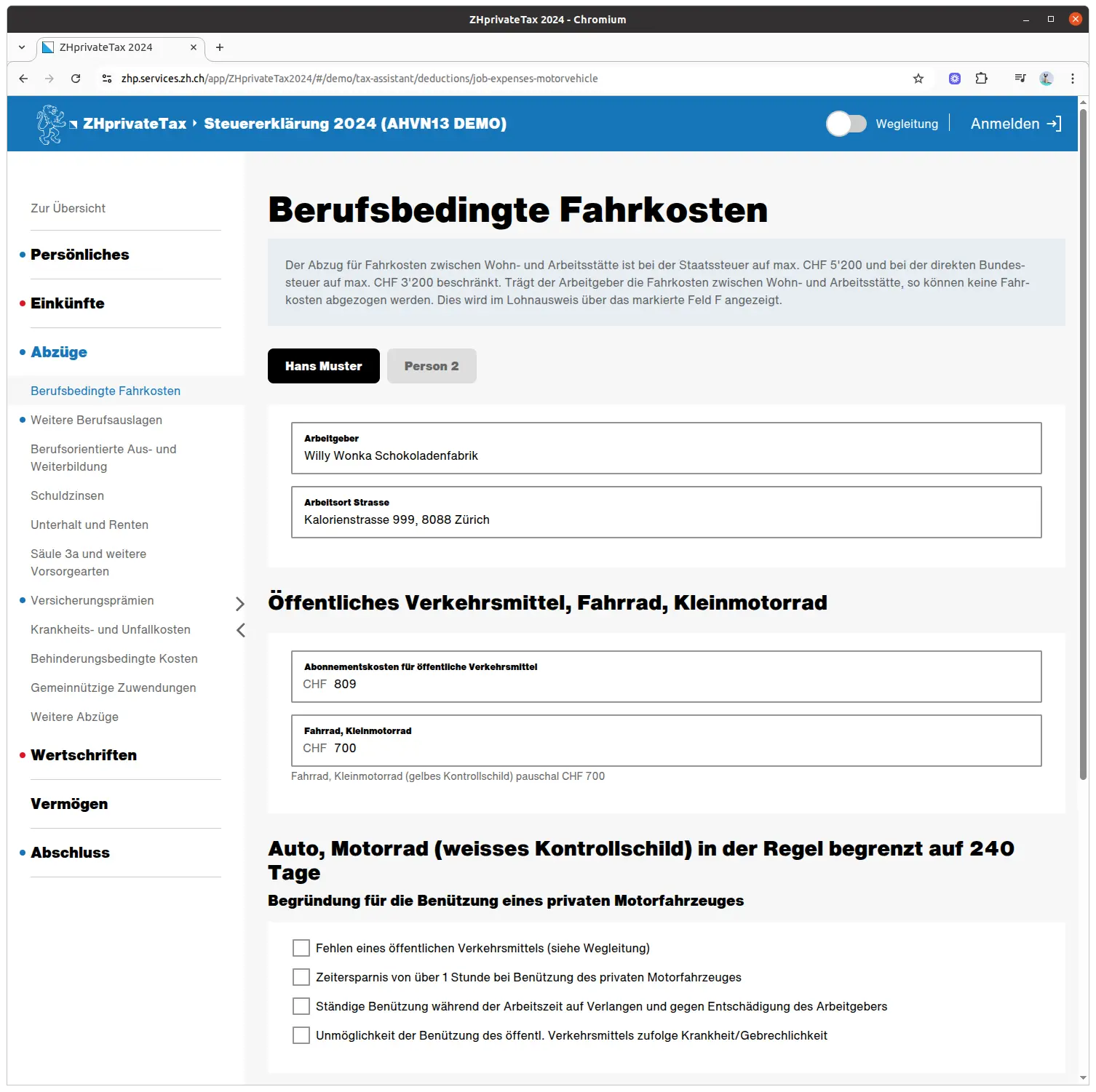

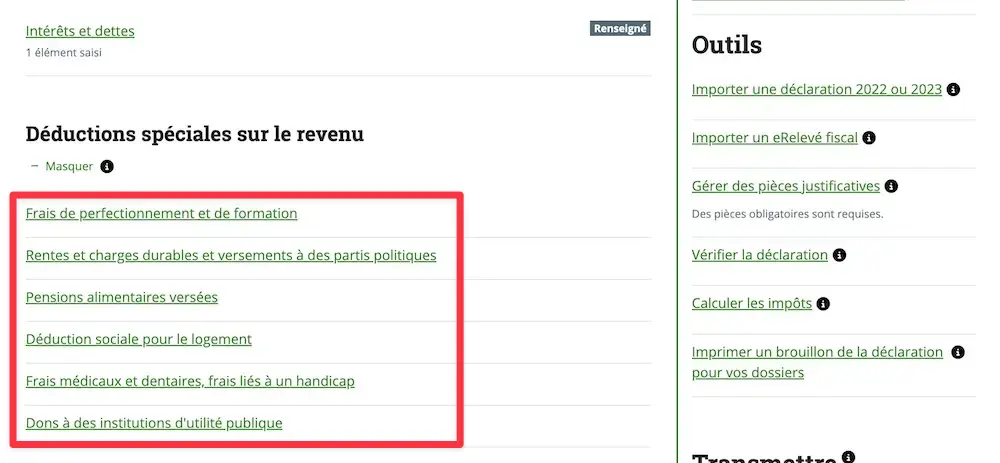

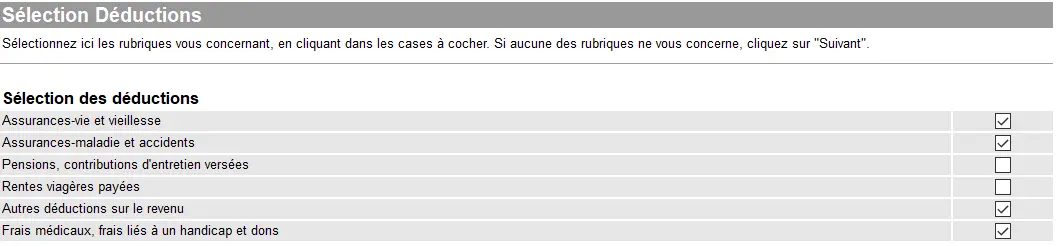

By way of illustration, here’s what the “Deductions” section looks like in various cantonal tax software packages in Switzerland. The titles vary, but the logic remains the same:

Tax deductions for salaried work

These are the most common deductions. They are also the ones that are most easily forgotten when you fill in your tax return a little too quickly.

If you’re salaried and taxed in the ordinary way, take the time to go through this section line by line, even if your situation hasn’t changed since last year.

Checklist of work-related deductions

| Deduction | Amount in CHF | Points to note |

|---|---|---|

| Commuting costs (home–workplace) | 4'980 | To be calculated pro rata based on your employment rate and days of presence. In some cantons, combining public transport + bicycle is allowed. |

| Meals taken outside the home | 5'160 | Flat-rate deduction, depending on the number of days worked |

| Professional expenses | Flat rate or actual | The flat rate is often sufficient, actual expenses require supporting documents |

| Expenses listed under item 15 of the salary certificate | Variable | To be reported separately in the tax return (e.g. code 340 depending on the canton) |

| Secondary salaried activity | 800 | Useful if you have a side job with actual expenses (Mme MP had this case last year) |

| Education and further training | 4'050 | Must be related to your existing gainful activity or a recognised career change |

Key points for this category

- Amounts are almost always prorated according to your activity rate and number of days worked

- In most cases, the fixed rate is sufficient and saves you having to keep receipts for years

- The “Actual expenses” option can be interesting in certain years (new job, training, new computer, special clothes for your job), but it attracts the attention of the tax authorities more easily…

- Concerning remote work: if you work remotely, transportation and meal expenses are often deductible, but it depends on the canton (some companies indicate whether or not you work remotely on your salary certificate).

- Finally, some expenses indicated directly on your salary certificate (figure 15) are not automatically included in your tax return. Check that they are entered in the corresponding section of your cantonal tax software.

Mustachian tips (meals at work and commuting)

- Bring your meals to work

You’ll save hundreds of CHF a month (read: Earn CHF 400 per month by cooking for yourself (10 minutes per day)), and on taxes too :) - Make the most of your commuting time

Whatever your mode of transport, there are plenty of options for putting that time to good use. In particular, I recommend reading: How to make your daily commute more profitable: simple and realistic ideas - Declaring meals or journeys: do the math

If you have to eat at lunchtime during your working day, there are two situations: either you actually eat away from home, or you actually go home to eat.

Depending on the distance between home and work and your activity rate, deducting meals eaten away from home or commuting may be more advantageous from a tax point of view.

My advice: calculate both options, but only according to your actual situation, as systematically indicating four journeys per day becomes difficult to justify beyond a certain distance, and the tax authorities are not fooled. - Spreading a part-time job over more days can also help

If you or your spouse work part-time (e.g. 60%), this rate can sometimes be spread over 5 days instead of 3. Result: more days of declared presence, so more deductible transport and meals taken away from home. Of course, this has to correspond to the reality of the job (and to what appears on your salary certificate). But when it does, the tax impact can be far from negligible.

Tax deductions for children and families

As soon as you have children, the tax return changes dimension.

Some deductions can quickly add up to several thousand Swiss francs a year, especially during the years of day nursery, day mother or after-school care. The trap is to forget to adjust your tax return as your situation changes…

And beware: in many cantons, childcare costs are only deductible if both parents are gainfully employed (or equivalent). Check this point carefully, depending on your situation… and bear in mind that a declared part-time job may sometimes be enough to qualify for the deduction.

Checklist of child- and family-related deductions

| Deduction | Amount in CHF | Points to note |

|---|---|---|

| Childcare costs | 5'941 | Daycare, nursery, after-school care, subject to cantonal caps |

Having been there, childcare costs can be a real pain (I remember paying almost CHF 2'500 some months for two small children…)

But I reassure you, fortunately, this amount goes down from year to year as the children grow up and no longer go to school. Phew!

Housing-related tax deductions (tenant vs. owner)

Housing is often the most expensive line item in a budget… and a major tax lever.

Whether you’re a tenant or a homeowner, there are deductions to be aware of, and especially to remember when your situation changes (buying, selling, renovating, moving).

Checklist of housing-related deductions

Important: the nomenclature used below is that of the canton of Vaud.

Deductions exist in all cantons, but the exact titles may vary. If you can’t find a term in your tax software, please refer to my page: Swiss tax return (2026): guides by canton.

| Situation | Deduction | Amount in CHF | Points to note |

|---|---|---|---|

| Tenant | Housing-related social deduction | 2'050 | Net rent (excluding additional charges) |

| Owner | Housing-related social deduction | Up to ~6'800 | Automatic (no need to enter anything else once the rental value has been declared). Calculated based on your family situation, income, and housing costs. |

| Owner | Mortgage interest | 6'400 | Always declare the actual amount paid |

| Owner | Property damage insurance premiums (ECA) for the building | 500 | Declare your annual premium |

| Owner | Property liability insurance premiums | 400 | Declare your annual premium |

| Owner | Annual waste collection and wastewater disposal taxes | 1'200 | Declare the actual amount paid |

| Owner | Janitorial services, cleaning, lighting and heating of common areas | 2'000 | Actual expenses |

| Owner | Property management fees charged by third parties | 850 | Actual expenses as well |

| Owner | Property tax | 570 | Amount paid annually |

| Owner | List of property maintenance costs | 3'500 | For example: water damage repair in the bathroom |

| Owner | Rental property | Variable | Same deductions as above for owners |

In my experience, this section was difficult to fill in when I moved from renting to owning in Switzerland.

But hey, once you’ve filled in this section once, subsequent years are much easier. And even easier with my checklist ;)

Note about the “rent deduction” when you are a homeowner

Even as an owner-occupier, there is in some cantons (such as Vaud) a housing-related social deduction.

This deduction is not based on a “fictional rent” that you can deduct, but on the imputed rental value of your property, which you declare in the “Real estate” section of the tax software.

Based on this value, and depending on your income level, family situation, and other social criteria, the tax authorities automatically calculate whether a housing-related social deduction applies or not (for example, in Vaud it appears under code 660 in VaudTax).

In practice, as a homeowner, there is nothing specific to “optimize” here: you simply declare the imputed rental value and your mortgage interest correctly, and the calculation is done automatically in the background.

Tax deductions for investments and savings

This is often where optimization really comes into its own.

As a good Mustachian, these deductions aren’t just about paying less tax, they’re more about turning the tax saved into invested capital.

Checklist of investment and savings deductions

| Deduction | Amount in CHF | Points to note |

|---|---|---|

| Contributions to the 3rd pillar (3a) | Annual legal limit | Deductible only if paid during the tax year |

| Contributions to the 3rd pillar (3b) | Cantonal annual limit | Deduction possible only in the cantons of Geneva and Fribourg |

| Donations to public-interest organisations | 100 | Recognised organisation (e.g. Terre des Hommes), supporting documents required |

| Securities-related costs (flat rate) | 298 | Tax flat rate, not the broker’s actual fees |

| Declared debts | Variable | Includes private debts existing as of 31.12 (credit cards, outstanding bills, taxes due but not yet paid). Reduces taxable wealth, not income. |

| Interest on debts | Variable | To be declared separately from the debts themselves |

Mustachian tips (feedback)

- The 3rd pillar, or how to save taxes while making your savings grow

Every year, Pillar 3a is a no-brainer for me. It’s a clear, capped deduction that’s accepted everywhere, and turns tax directly into a long-term investment (because, yes, you’re going to invest your 3rd pillar AND the tax savings you’ve made, we agree ;)).

For the year 2026, you can deduct up to CHF 7'258 if you’re employed with a pension fund, and up to CHF 36'288 if you’re self-employed without a 2nd pillar (within the legal limit). And last year (2025), the maximum 3a amounts were CHF 7'258 and CHF 36'288 respectively.

If you’re still hesitating, start small, but start. And if you’re wondering which pillar 3a to choose specifically, I’ve also written a detailed article on the best third pillar in Switzerland (2026 comparison), based on fees, investment strategy, best return and my own use (obviously!) - Pillar 3b: maximum deductible amounts, for the cantons of Geneva and Fribourg only

In the canton of Fribourg, premiums paid into a recognized pillar 3b (life insurance) are deductible from taxable income up to CHF 750 per year for a single person and CHF 1'500 for a married couple or registered partners (employment status vs. self-employment does not affect these amounts).

In the canton of Geneva, Pillar 3b tax deductions vary according to status: for a single employee around CHF 2'200 , for a self-employed person without a 2nd pillar (and without 3a) around CHF 4'400 , and higher amounts for couples depending on their pension situation. - Don’t forget your debts!

Yes, you have debts too. And so do I!

It was a reader, Jani, who pointed out this point to me that I had completely forgotten. Every year, she declares her open debts: taxes still owed, credit card balances, telephone bills, subscriptions not yet paid, etc.

As long as these amounts are real, justified and in existence on December 31, they can be declared as debts. Simple as that… and yet I’d never thought of it. Since then, I systematically check and declare this point every year :) - Securities administration fees are often underestimated

Even if you invest via very cheap brokers, you’re entitled to the flat-rate deduction for securities administration fees. Many people don’t declare it, under the mistaken impression that you need high fees to be entitled to it.

It’s actually quite counter-intuitive: personally, I use a broker with very (very!) low fees, and I still declare the flat-rate “Securities administration fees” every year. And I do it legally!

If you’re wondering which broker to choose for the lowest fees in 2026, I’ve updated my comparison with the most competitive options in Switzerland: Best Broker in Switzerland (Updated 2026). - Interest on private debts

If you have a limited liability company (LLC) or a corporation (SA) and it lends you money (for example, when you withdraw your initial capital), with a clear contract and declared interest, you can deduct this interest (which you pay to your LLC or SA) in your tax return.

Another less well-known case: if you used leverage via a peer-to-peer (P2P) loan to invest in a rental property (as I described in my article “Investing in a rental property in Switzerland: my first experience”), this loan must be declared as a debt. And the interest paid is therefore deductible, reducing your tax bill. - Swiss withholding tax of 35%

And don’t forget: Swiss interest and dividends are subject to a 35% withholding tax, but this can be fully reclaimed via your tax return, provided you declare this income correctly (see also my Swiss Investor Tax Guide 2026: US, Europe, Ireland ETFs)

Health-related tax deductions and exceptional situations

This section mainly concerns “non-standard” years.

Most of the time, you won’t be able to deduct anything here. But some years, these expenses can suddenly become significant, and it’s a shame to forget about them.

Checklist of health expenses and exceptional situations

| Deduction | Amount in CHF | Points to note |

|---|---|---|

| Medical and dental expenses | Variable | Deductible only above a legal threshold |

| Financial support to a dependent relative | Variable | Accepted only in certain cantons, under specific conditions (proof of dependency, regular payments) |

Medical deductions don’t go through every year, and that’s normal. Most years, medical expenses don’t exceed the minimum threshold for deductibility. But some years, between dental treatment, surgery or an unexpected health concern, that can change quickly. Moral: always check, even if you think “it won’t pass”.

Note: glasses costs (lenses and frames) are considered medical expenses. Sometimes, they are enough to push the total above the deductibility threshold :-)

In some cantons, it is also possible to deduct regular financial support paid to a relative in need (e.g. a family member living abroad). A reader of the blog, Matthias, explained to me that in Lucerne, he deducts an amount each year that he pays to a family member, assimilated to a form of social contribution. As always, it depends on the canton, the dependency relationship and your ability to justify these payments… so this really depends on the case.

What I deliberately don’t cover (and why)

This article deliberately focuses on ordinary Swiss taxpayers, who fill out their own tax returns and seek to optimize their deductions in a simple and legal manner.

I do not cover the following situations in detail, either because they merit specific treatment, or because they go beyond the scope of a general checklist:

- People taxed at source (B permit), who have different deduction rules (see FAQ)

- Alimony payments are in principle deductible

- Full-time self-employed workers, for whom the logic of deduction (business expenses, depreciation, VAT) is more complex

- Retirement taxation (2nd and 3rd pillar withdrawals, withdrawal planning), which is more a question of wealth planning. And also because I haven’t yet had this experience myself ;)

- Specific international situations (cross-border commuters, expatriation, return to Switzerland), with their own tax rules.

If you recognize yourself in one of these cases, and if you have complete and concrete information based on your own experience, I’d be interested in knowing more (either for inclusion in this article, or in another dedicated one).

FAQ Swiss tax return

Can I deduct anything if I’m taxed at source (B permit)?

In principle, no, or only to a very limited extent. People subject to withholding tax already benefit from standard deductions that are directly built into the tax rate.

However, in some cantons and depending on the situation, it can make sense to request a subsequent ordinary tax assessment, for example in the case of significant professional expenses, pillar 3a contributions, or high medical costs. The process is lengthy, and it is only worthwhile if the amounts that could potentially be recovered are meaningful. That is why it makes sense to run a calculation or test it once.

As a concrete example, here is the experience shared by Sylvain (a blog reader): an employee, tenant, with modest initial assets and no real estate investments. He requested a subsequent ordinary tax assessment from the Vaud tax authorities. The result: around CHF 1'800 recovered per year, mainly thanks to professional expenses and pillar 3a contributions, exactly as listed in this checklist.

And you, can you think of any tax deductions I may have overlooked? (if so, let me know by email or directly via the comments section below)

Deductions exist in all Swiss cantons, but their wording and location vary depending on the tax software used.

If you want to know where to actually enter each deduction in your return, I've prepared step-by-step guides by canton, based on official tools (ZHprivateTax, VaudTax, GeTax, etc.).

It’s over here -> Swiss tax return (2026): guides by canton