Interactive Brokers promo code 2026

IBKR unfortunately doesn't offer promo codes as such (but hey with an offer like this, I don't blame them). If you want to support the blog though, you can use my IB partner link below to open your IBKR account, and start saving lots of trading fees and getting access to the best ETFs there are for a Swiss investor. Thank you in advance.

- Interactive Brokers review in a nutshell

- Quick clarification of nomenclature

- My story with IBKR since 2016

- Why IBKR is the best brokerage platform for a Swiss Mustachian?

- User reviews of Interactive Brokers

- IBKR alternatives — and how they compare

- Open an Interactive Brokers account

- FAQ about IBKR

- Interactive Brokers Extensive Guide

- Conclusion

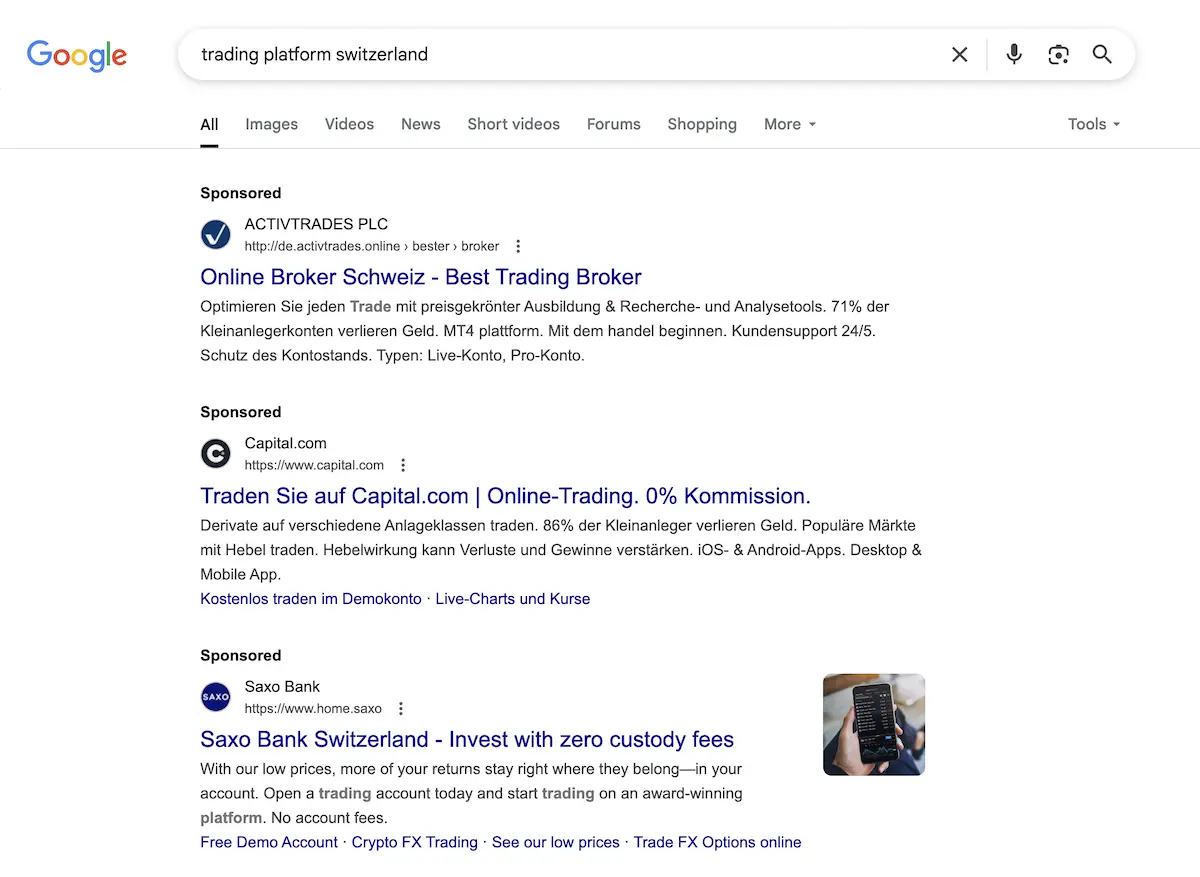

When you want to start investing in the stock market in Switzerland, you’re usually going to search the web for which trading platform to use in Switzerland, and in your own language. Because yes, it’s scary enough to get started in the stock market, you at least want to be able to do it in your native language.

And your search will bring you results like these:

And so it’s the broker who pays the most in advertising that will appear at the top of the results. Ditto for reviews and other “opinions” from unscrupulous influencers, which highlight the highest-paying online brokers…

Having been through this, I’ve obviously made some big rookie mistakes in my choice of online broker (I’ll explain that further down in the article).

My (long) journey led me to Interactive Brokers in 2016, which remains the best broker for any self-respecting Swiss Mustachian investor to this day.

Interactive Brokers review in a nutshell

In a nutshell, here’s my opinion of the Interactive Brokers broker (from the point of view of a Swiss investor), starting with the advantages of IBKR:

What I like about the IBKR broker

- Wide range of products available, including the best ETFs, with no limitations for the Swiss when regulations change (e.g. European PRIIPs regulation which imposes things for European countries, but not Switzerland; IBKR has not done like other brokers who have included Switzerland in Europe and reduced the availability of certain ETFs)

- Very competitive fees with ultra-low commissions, no custody fees, near-zero exchange fees, free account opening/closing and pricing structure advantageous for Switzerland

- Asset protection via SIPC, with coverage up to 500,000 USD (including 250,000 USD in cash), also available to non-US residents

- Available to Swiss residents, which is rarely the case for financial services from the US (or elsewhere), and with no restrictions on benefits (fees, ETF availability)

- Strong financial strength and stability. Established in 1978, Interactive Brokers founder Thomas Peterffy remains the company’s 75% majority shareholder, demonstrating a strong alignment of interests between owner and customers

- High-performance, efficient tools to invest your money (from the simple GlobalTrader mobile application to the more complex IBKR Mobile, right through to the “Client Portal” web platform)

What could Interactive Brokers do better in the future?

I had to rack my brains to find something to say. It’s not for nothing that I rate IBKR 4.9/5!

- Diversify their business by offering us, for example, an IBKR bank account, mortgages and other financial services. Nevertheless, if you think about it, such diversification would make them lose their focus of being the best broker to invest in the Swiss stock market. So in the end, I think it’s better that they don’t go down this route.

- A mobile application even simpler than GlobalTrader, and which would enable very gradual onboarding (via a chatbot or similar) for a beginner investor

MP recommendation

I recommend the online broker Interactive Brokers to all Mustachians looking for the best trading platform in Switzerland. It’s the cheapest and THE most complete solution for investing in the Swiss stock market. What’s more, IB is highly reliable and robust, having been around for decades with a founder who has been with us since 1978!

In 2016, after making the same mistake of choosing Swissquote to start investing in the stock market (like many of us), I discovered IBKR. Since then, I’ve never looked back.

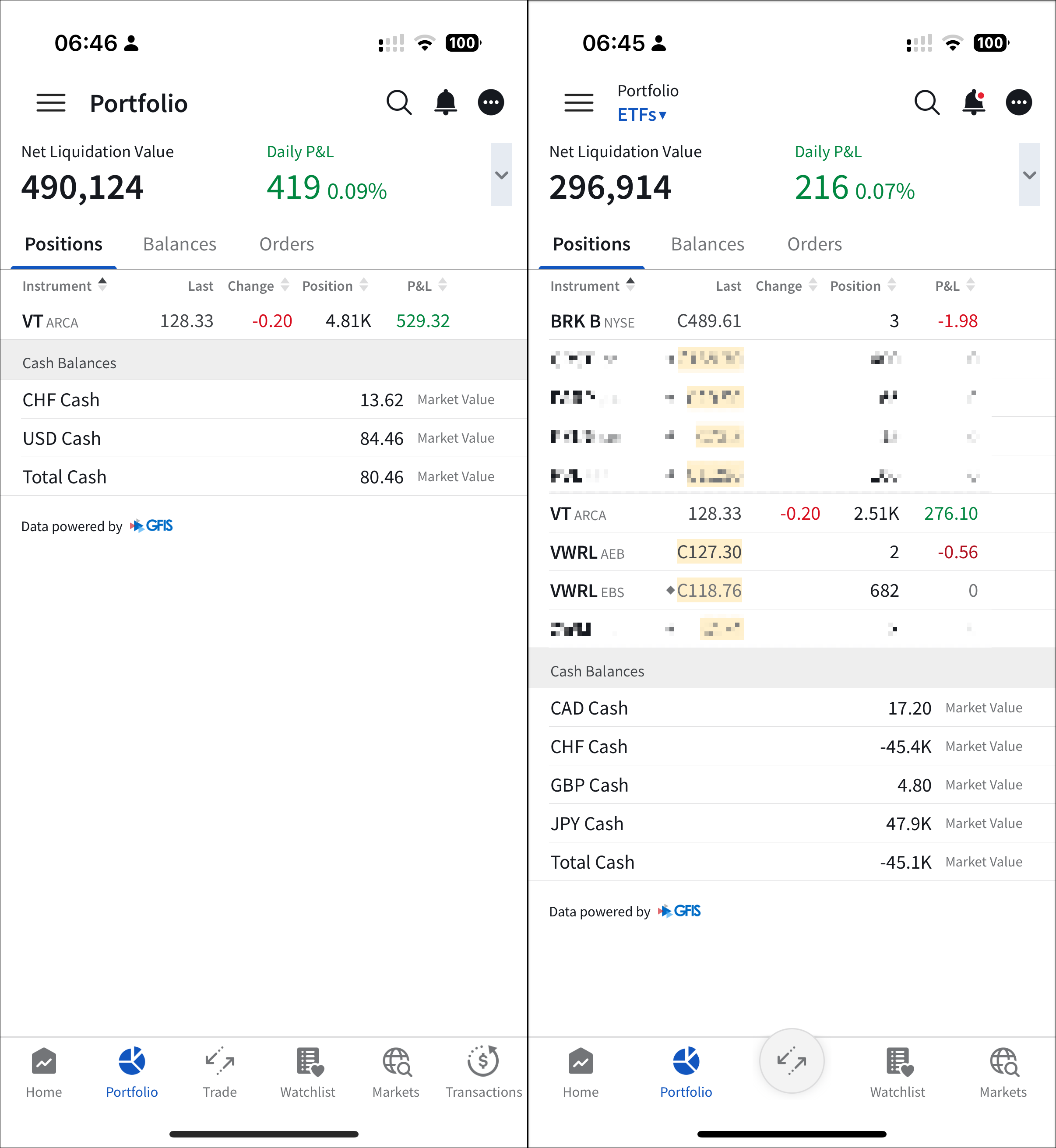

As I write this, I have CHF 971,428 invested in ETFs via IB Switzerland. So yes, I trust them a lot ;)

Rapide clarification de nomenclature

In my early days as a stock market investor, I remember being quite confused by two terms in particular. So here’s a quick glossary for the me of ten years ago:

- An “online broker” and “online trading platform” are synonyms. Both allow you to buy and sell stocks/bonds/ETFs online (via the Internet), and on different stock exchanges (such as the SIX Swiss Exchange in Switzerland, or the NYSE for the New York Stock Exchange in the US)

- Interactive Brokers is the official name of the brokerage firm whose platforms I use. IBKR is the short version of their name (also spelled IB sometimes). And you’ll often find French speakers misspelling this name: “Interactive Broker” (without an “s” at the end), or “Brokers Interactive”. The latter two are incorrect. Only “Interactive Brokers”, “IBKR”, and “IB” are correct. But they all refer to the same company

So, let’s move on to the story that led me to Interactive Brokers in the first place.

My story with IBKR since 2016

I’m not smarter than average. I’ve made many financial mistakes. And choosing my online broker was no different.

While I was discovering the FIRE movement in 2013, I wanted to start investing my money in the markets to grow my savings and put the famous 4% rule into practice in order to live off my financial returns once I was financially independent.

And when it comes to the stock market, you need an online brokerage platform.

So I started Googling for information. I remember I had no idea what to look out for. I knew I wanted the cheapest broker, but that was about it.

I quickly put aside solutions via banks, as the fees were outrageous for very limited access to global ETFs.

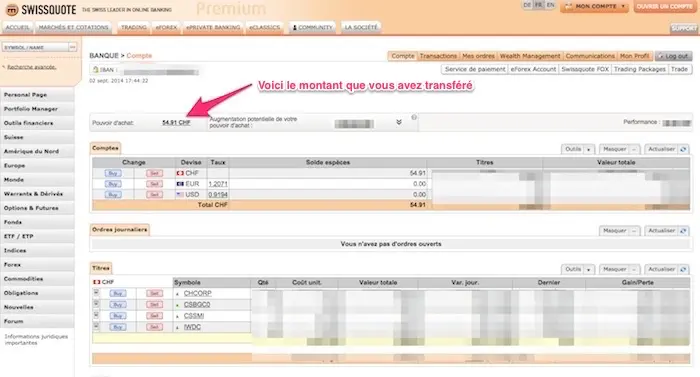

From memory (it’s getting old haha!), I hesitated between Swissquote or Cornèrtrader at the time. After a few evenings comparing the two in detail, Swissquote seemed relatively more “intuitive”. So I went with this broker.

As with all my Swiss financial services choices, I documented this on the blog. Not proud of having found what I thought was THE best solution.

Then, one day, a reader came up to me and challenged me, telling me that there was something much better than Swissquote for us Swiss Mustachians! He went on to praise the merits of an optimal American online broker: Interactive Brokers.

Even though it’s never fun to be wrong, I’ve always liked to have this “beginner’s mindset” where I move forward, test, blog about it, make mistakes, learn, find better solutions, blog about it again, etc. This never-ending cycle of continuous improvement keeps me alert and up to date with the best setup for my financial independence.

So I opened my Interactive Brokers account for the first time in 2016. It was a bit stressful because I thought it would complicate my stock market investments. Could I buy things (ETFs, stocks, etc.) the same way? What about Swiss taxes? And did dividends work the same way?

These kinds of questions seem strange to me today, with all the knowledge I’ve accumulated. But, at the time, I was facing all these fears. So I understand if you’re at that stage, you who are reading this article.

As proof that it’s possible to get over it, here’s a picture of all the money I’ve invested with IBKR to date:

Here are the details of my two IB accounts (private and professional) at the time of writing (July 2025)

And I sleep soundly with a feeling of serenity and sustainability because I was able to talk face-to-face with founder Thomas Peterffy about how he has prepared the succession with the introduction of a CEO who has been with IB since 1990, with a whole solid team around him! More than any other broker, therefore, I have no fear of Interactive Brokers being sold or bought out by a hedge fund or the like.

Why IBKR is the best brokerage platform for a Swiss Mustachian?

Interactive Brokers is the cheapest broker AND gives you access to all the ETFs and exchanges you need during your Mustachian journey. From the moment you start to the moment you reach early retirement, it’s the one and only tool you’ll need to invest your money. And on top of that, it’s the platform that offers the highest protection for your assets (in the event of IB fraud).

Mustachians’ criteria for selecting your frugal online broker in Switzerland

In concrete terms, here are the criteria for choosing the best trading platform (which will also answer the question of what IBKR’s trading fees are):

| Mustachian criteria | IBKR | Comments |

|---|---|---|

| Account maintenance fees | CHF 0 | |

| Inactivity fees | CHF 0 | |

| Custody fees | CHF 0 | |

| Transaction fees for purchasing US ETFs | CHF 0.35 | |

| Transaction fees for purchasing Swiss ETFs | 0.05% | Min. CHF 1.50 |

| Stamp duty fee | CHF 0 | Foreign broker = no stamp duty. |

| Currency exchange fees | 0.01% | Min. USD 2 |

| Stock exchange connection fees | CHF 0 | |

| List of free ETFs | 🚫 | No problem, because everything else is so inexpensive! |

| Minimum amount required to open an account | CHF 0 | |

| Securities account with IBAN in CHF | ✅ | |

| Amount of protection in the event of bankruptcy | USD 500'000 | Via SIPC protection. |

| Year the broker was founded | 1978 | |

| Country of the company | United States | |

| Available in EN, DE, FR, IT | ✅ | And even more languages! |

| Broker accessible to Swiss investors | ✅ |

Frankly, IB ticks all the boxes. I give it 4.9/5, because there’s always room for improvement. But they’re approaching perfection!

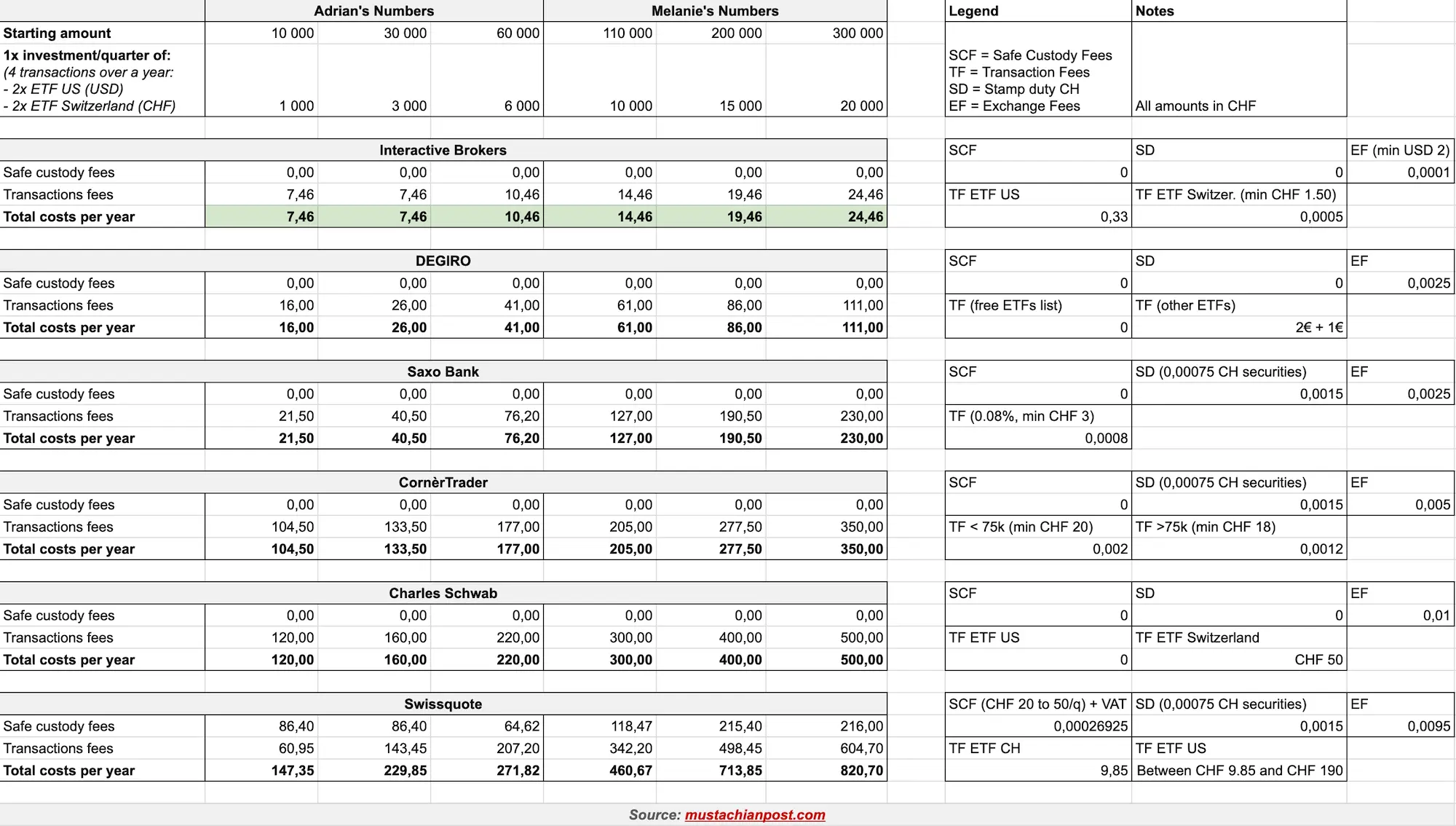

Also, I’ve prepared several scenarios for you to attest that Interactive Brokers takes the gold medal every time. We’re talking about two typical profiles, Adrian and Mélanie, who have different basic assets and invest a greater or lesser amount each quarter:

As you can see, these fees quickly eat into your wealth, depending on the broker you choose!

User reviews of Interactive Brokers

Like any self-respecting Mustachian, I’m like you: before choosing something as important as the place where virtually all my savings are stored, I consult several online reviews.

So I’m going to make it easy for you by putting together a few screenshots (from June 2025).

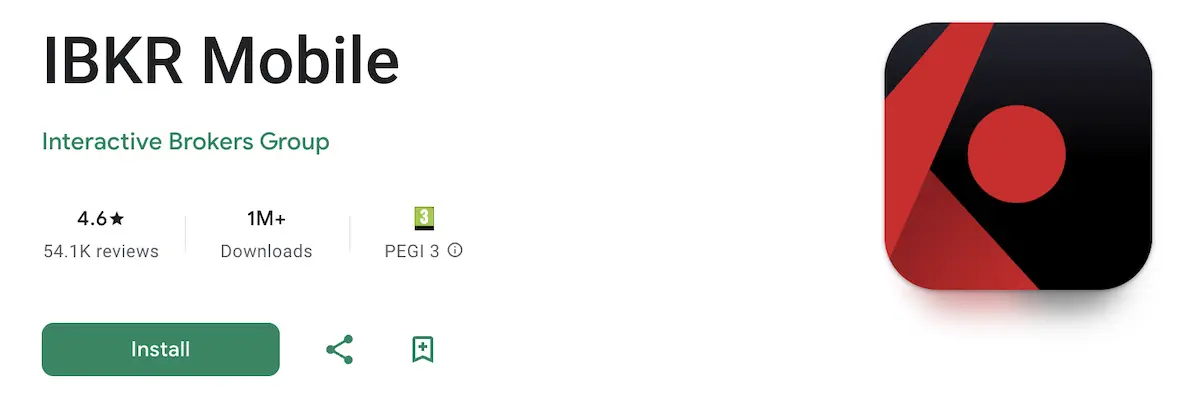

Average ratings IBKR Mobile application on app stores

First of all, below you’ll find the average ratings for the IBKR Mobile app on the iOS and Android app stores:

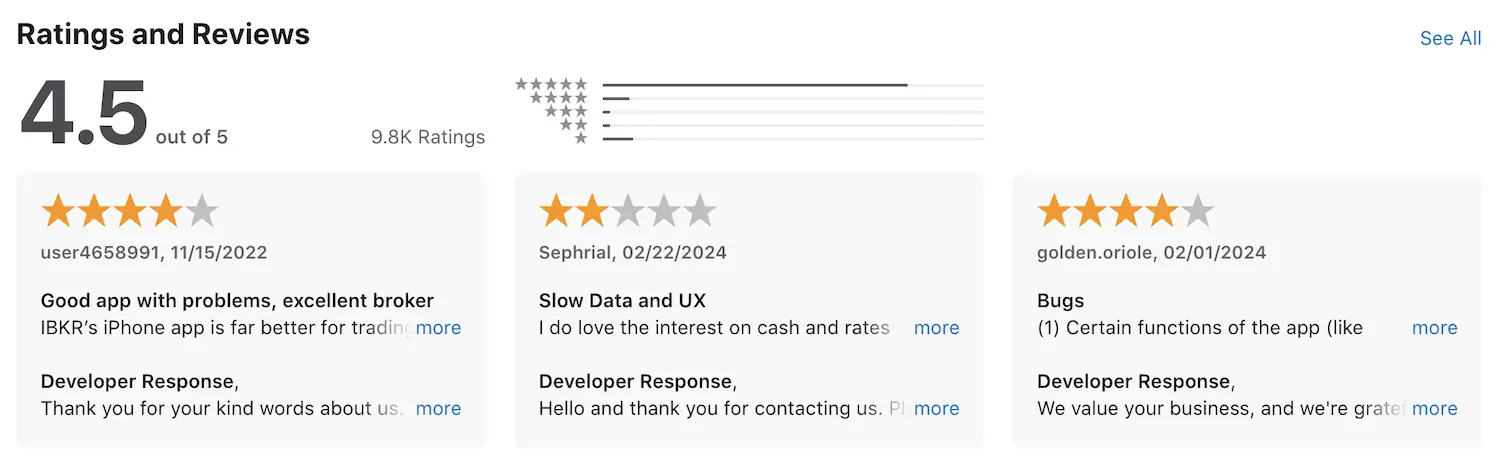

IBKR Mobile app reviews on app stores

And here are some public comments from IBKR Mobile users on the Apple App Store and Google Play Store:

I’m quite surprised to see the comments put forward by Apple (on the French version of the mobile app at least), when in total there are more than 3/4 of users who have given 5/5. But it’s still interesting, because the comments aren’t very justified in my opinion. For instance, it’s not possible to deposit money by credit card, the FAQ is put forward as much as possible before customer service takes over, and the third comment is rather cryptic/incomprehensible…

Anyway, I’ll leave the moaners (with dubious user names), and take the overall view: 4.5/5 out of 9,800 English-language reviews, 4.5/5 out of 1,411 German-language reviews, and 4.4/5 out of 527 French-language reviews.

You can also use these links to check out the most recent reviews of the IBKR Mobile iOS app and of the IBKR Mobile Android app depending on your smartphone type.

Interactive Brokers Awards

I’m just a tiny Swiss blog compared to other global comparators of the best online brokers. And it’s pretty impressive to see the list of awards IB has received for over a decade (including rankings from the prestigious financial magazine Barron’s):

You can go to this page on the IBKR website to see all their awards.

The Mustachian community’s choice in Switzerland

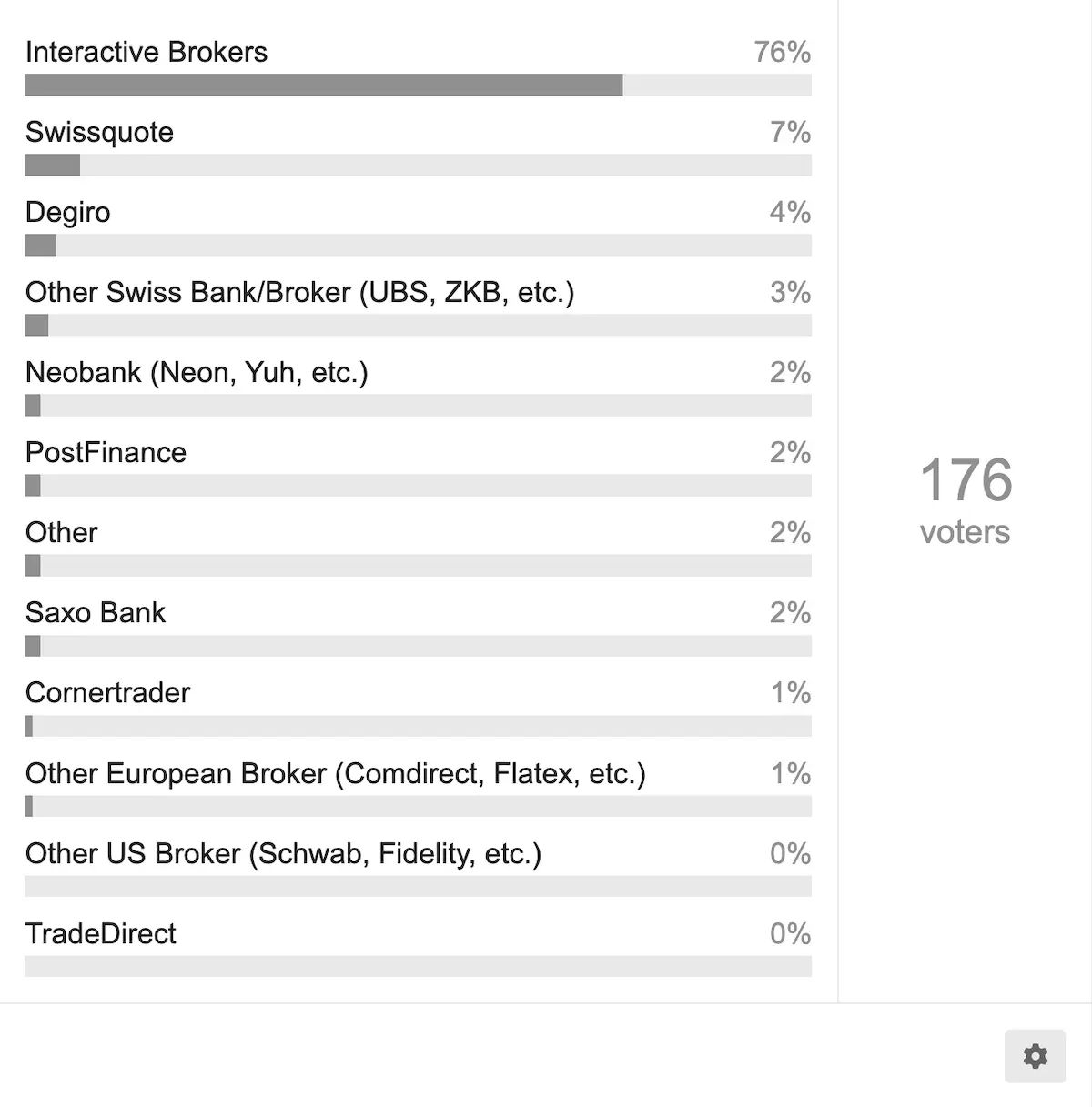

A member of the MP forum (hello @oslasho!) launched a poll two years running, to find out who was using which online broker to invest in the stock market.

The results speak for themselves:

IBKR alternatives — and how they compare

Interactive Brokers or Swissquote

Interactive Brokers offers significantly lower fees in Switzerland, compared to Swissquote. And I’m weighing my words when I say “significantly” because we’re talking about fees 20 to 35x lower with IB. And that’s regardless of whether your ETF orders are small or large. Add to that the SIPC protection available in the US, and IB is clearly better than Swissquote in every way.

Nevertheless, I would point out that Swissquote deserves credit for having pioneered online brokerage in Switzerland in the late 90s. Then they evolved into a Swiss trading leader; except that their strategy could be more aligned with their customer’s interests. How could they do this? Avoid blowing too much marketing budget on a soccer team, for example, which could drastically reduce their costs.

IBKR is cheaper across the board: custodian fees, transaction fees for Global and Swiss ETFs, stamp duty, and currency change fees.

By the way, if you absolutely must have a Swiss-based broker, there are better options. All the information in this detailed article.

Interactive Brokers or DEGIRO

Between IBKR and DEGIRO, Interactive Brokers is clearly superior for Swiss investors: brokerage fees 2 to 4.5x lower, access to the US VT ETF, less expensive foreign exchange, more comprehensive reporting, and SIPC protection (500,000 USD vs. 20,000€ at DEGIRO).

For several years, I myself used DEGIRO for our children’s investment accounts. Then, since I know how to properly manage multiple accounts with IBKR, I decided to migrate everything to IB.

The only reason I recommend DEGIRO over Interactive Brokers is if you want a broker based in Europe (and not in the US).

Interactive Brokers or Saxo Bank

Saxo Bank is 3-9x more expensive than Interactive Brokers once you add up all the brokerage fees. On the other hand, Saxo doesn’t charge custody fees or inactivity fees, and gives you access to US ETFs (like the VT ETF).

On the other hand, if you’re looking for a Swiss-based broker, then Saxo Bank is the most optimal option for a Swiss Mustachian investor. I explain all the details in this detailed Saxo review (incl. CHF 200 brokerage fee refund, applied within 24 hours of the initial funding, if you use my blog link).

Interactive Brokers or Cornèrtrader

Cornèrtrader is 14x more expensive than Interactive Brokers, and doesn’t give you access to as many products. It was the broker I recommended as the best based in Switzerland for many years. I say “was” because their pricing has become much less attractive than the competition (notably Saxo Bank).

I therefore no longer recommend Cornèrtrader at this time. I will update this section if their management and business strategy changes.

Interactive Brokers or Charles Schwab

For a Swiss-based investor, Charles Schwab is 16 to 20x more expensive than Interactive Brokers. Although Charles Schwab benefits from SIPC protection for investors (as they are based in the USA), it’s not worth it, as IB also offers this protection.

The day I want to diversify with several American brokers (when I reach 1.5-2MCHF in money invested in the stock market), I might look at Charles Schwab. And until then, I’m keeping 100% of my ETFs with IB.

Open an Interactive Brokers account

The opening procedure is simple and complete. Some would say complex, as you have to answer basic questions about financial products and markets. Personally, if I were to start my investor’s journey again today, I’d go through all the questions, and if I get stuck on some, I’d go and read up on Google or ChatGPT to fully understand what I’m answering.

I’ve written you a very detailed article with all the steps to open an IBKR brokerage account; you’ll find it by following this link.

Once your IB account has been created, you’ll need to wait 1-2 days for it to become active.

FAQ about IBKR

What type of account should I choose at IB?

IBKR offers a wide variety of trading account types. Those of interest to us, as retail investors, are individual accounts, joint accounts, and potentially family accounts.

All the others are less interesting, as they are aimed either at US residents or financial professionals. With one exception: IB offers you a “Small Business” account, if you wish to invest your professional money (which is what I do for one of my companies).

Is Interactive Brokers reliable?

My quick answer is often the same: do you think I’d store my entire stock market wealth (almost CHF 1,000,000 to date!) there if I had any doubts?

My longer, factual answer can be found in point 2 of this article.

Who’s behind Interactive Brokers?

IB was founded by Thomas Peterffy in 1978. And he remains the majority owner today. Given the passage of time (he was born in 1944), he has made arrangements to appoint a CEO who has been with the company for several decades, as well as others in key positions who have also been with IB for a long time.

I was lucky enough to be able to interview Mr. Peterffy in 2023! You can see the video via this link.

Can I use Interactive Brokers in Switzerland?

Ah, the famous two-thousand-franc question! That’s exactly what I asked myself back in 2016, when I was evaluating this trading platform. The answer is a resounding YES!

IB has the vision to be available in as many countries as possible. And they’re doing everything they can to have a smart presence in every country. Particularly in Switzerland, where they adapt their strategy (for example, with the choice of ETFs available) to our rules, and not by treating us as “just another European country” as other brokers do…

What are the disadvantages of Interactive Brokers?

As I mentioned earlier, I find it difficult to think of any disadvantages to IB. The only thing might be that it makes your tax return (slightly) more complicated, but I have prepared several guides to help you with your Swiss tax return:

- Swiss tax guide for investors in ETFs (USA, Europe, Ireland, etc.)

- Tutorial ZHprivateTax Tax Return

- Tutorial TaxMe-Online Bern Tax Return

- Tutorial eTAX AARGAU Tax Return

- Tutorial GeTax Tax Return

- Tutorial VSTax Tax Return

- Tutorial FriTax Tax Return

- Tutorial VaudTax Tax Return

- Tutorial eTaxes St.Gallen Tax Return

- Tutorial eTax Solothurn Tax Return

- Tutorial eFisc Thurgau Tax Return

When it comes to IB’s weaknesses, again, it’s hard to find any. In one of Standard & Poor’s rating reports, they point out these two weaknesses of IB:

- Lower recurring revenues than certain competitors in the retail sector

- Sensitivity to changes in brokerage customer confidence

I personally see these two weaknesses as advantages for us IBKR customers. Indeed, it forces them to be the best among all online brokers, in order to remain #1.

Interactive Brokers Extensive Guide

Having used IB for many, many years, I’ve created a very comprehensive guide with over 20 chapters! over the years.

Starting with account creation, to how to buy an ETF on Interactive Brokers, to everything you need to find the information for your Swiss tax return.

This guide is for you, dear reader, so if you see anything you’re missing, let me know, and I’ll add it!

Conclusion

Interactive Brokers is THE best online broker for any self-respecting Swiss investor. Key benefits include: the lowest fees on the market, and access to the best ETFs in the world for us Swiss Mustachians. And one important point: all their apps are available in English (and in German, French, Italian, and many other languages).

Also, IB is independent of any group, with a management team here to stay.

The IB team, whose mission has remained the same for almost 50 years: 'Create technology to provide liquidity on better terms. Compete on price, speed, size, diversity of global products, and advanced trading tools.'

To date, I have invested my entire stock market fortune with this broker (over 800kCHF at the time of writing), as well as investments for my children.