Are you looking to achieve financial independence so you want to invest your money successfully? And so now you’re looking for the best online broker as a Swiss investor to make all your savings grow?

Then you’ve come to the right place.

Since 2016, Interactive Brokers Switzerland (IB or IBKR for short, or simply Interactive Brokers) has been my favorite online brokerage platform. If that alone convinces you, then you can create your own account by following this link:

» Create my Interactive Brokers account now «

If, on the other hand, you’re more of a person who wants to understand all the ins and outs, then keep reading my Interactive Brokers guide. The online broker will have no more secrets for you after that!

My goal with this complete 9-part guide is to help you open your account, make your savings grow and watch you receive your first dividends.

Ready?

Can you remind me what an online broker is, please?

Concretely, by opening your account with Interactive Brokers (the Interactive Brokers Group is an online brokerage company), you can buy stocks, ETFs, bonds, or even exchange money on FOREX (and other stuff I don’t recommend such as CFDs, futures, or contracts).

And once you’ve completed your shopping, you can use the online broker’s reporting tools to track how your wealth grows from stock price increases and the dividends you earn.

Who is the Interactive Brokers Group?

Interactive Brokers LLC is an American brokerage firm founded in 1978 by Thomas Peterffy. Over the years, it has become one of the largest online brokerage companies in the world (it has offices in the following countries: USA, Switzerland, Canada, Hong Kong, United Kingdom, Australia, Hungary, Russia, Japan, India, China and Estonia).

Thomas Peterffy, founder and CEO of Interactive Brokers, which almost invented digital trading (credits: forbes.com)

By reading the story of the birth of Interactive Brokers on Wikipedia (it is really worth the detour), we understand that its founder was nothing less than the pioneer of computerized trading since 1977. And that IB is “only” the fruit of its creativity and perseverance during 15 years to convince the markets that IT was the future :)

In 2018, Interactive Brokers LLC was still the leading American online broker in terms of the number of orders executed at the stock exchange each day (purchase or sale of securities), reaching 695'000. Also, its financial stability remains supported by their strong capital position.

How I invested successfully with Interactive Brokers LLC

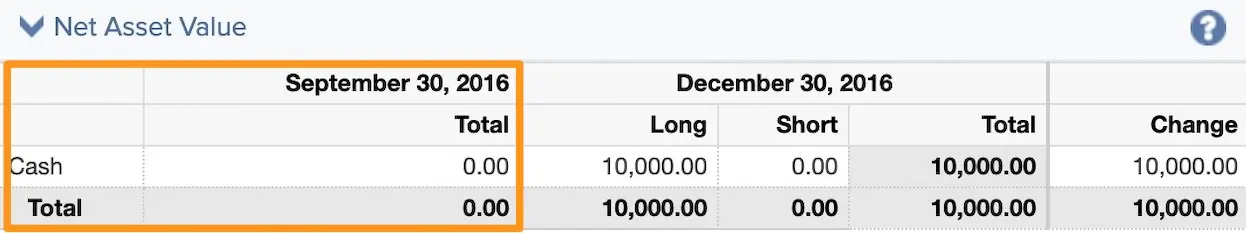

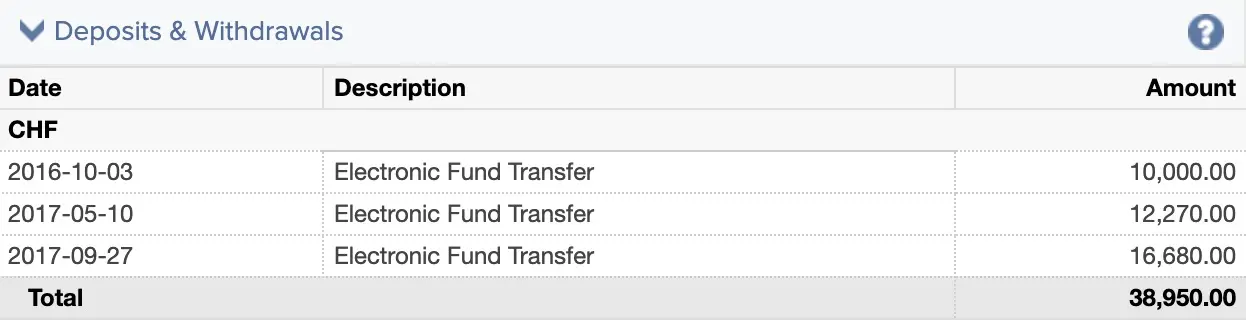

I started with Interactive Brokers in September 2016 with CHF 0 on my account.

Then I transferred my first CHF 10'000 in savings, and then CHF 12'270, and then another CHF 16'680.

Slowly but surely, I transfer all our savings set aside in our Interactive Brokers account every quarter (investing more money at once means I get to pay fewer transaction fees — and no custody fees at all anyway!)

And then one thing led to another, this whole stash of cash began to grow in stock market value. When I say “increase in market value”, it means that if, for example, you buy an ETF or share for CHF 100 today, and in 2 years it’s worth CHF 150, then you can sell it and the additional CHF 50 corresponds to your gain in market value.

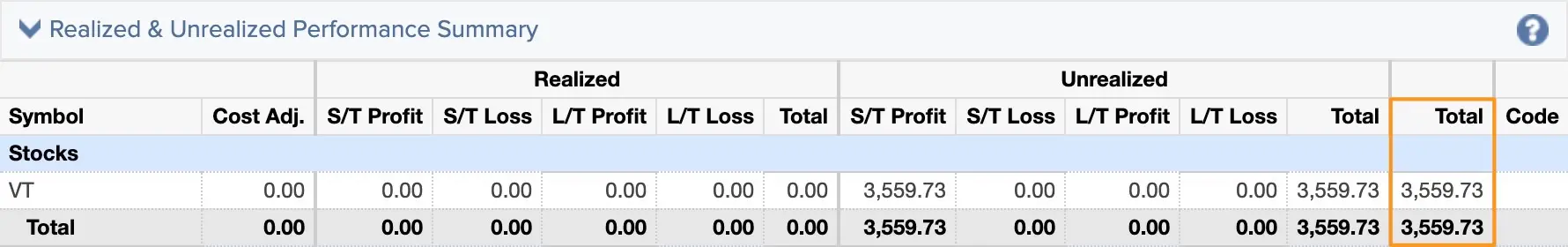

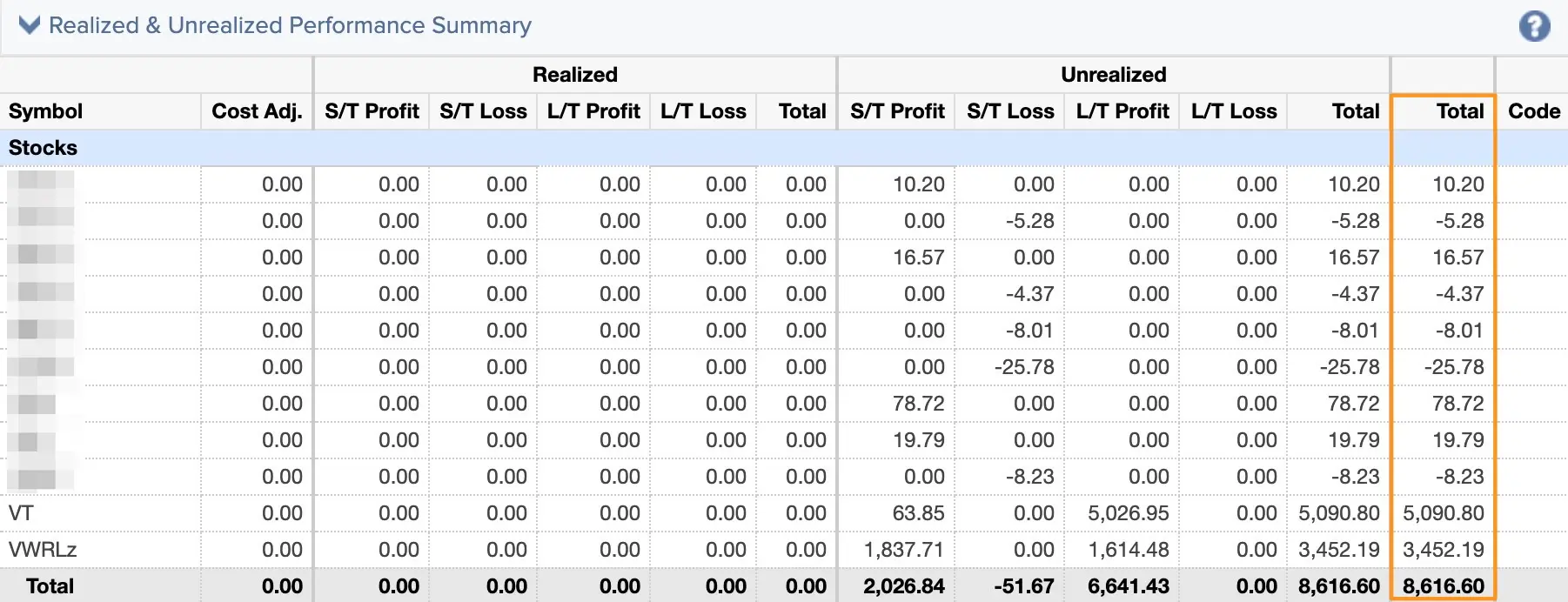

As a reference, here’s an example of how my account performed, showcasing investment opportunities between early 2017 and mid-2019.

Loss of market value of my ETFs and shares in 2018 — we said long-term vision, it's not for nothing :)

The increase in the market value of my securities (a security can be an ETF, a share, or a bond for example) is in the “Unrealized” column as I didn’t sell anything but IB calculates everything automatically as if I had sold at the end of the period to know if I made or lost money.

If I had really sold my shares and ETFs at the end of the period, the figures would be the same except that they would be in the “Realized” column (aka “in my pocket!”).

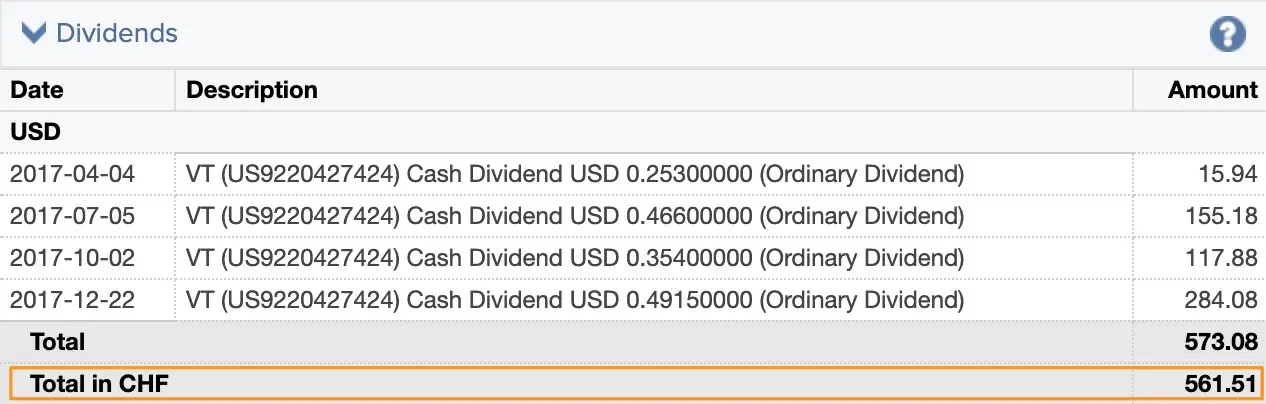

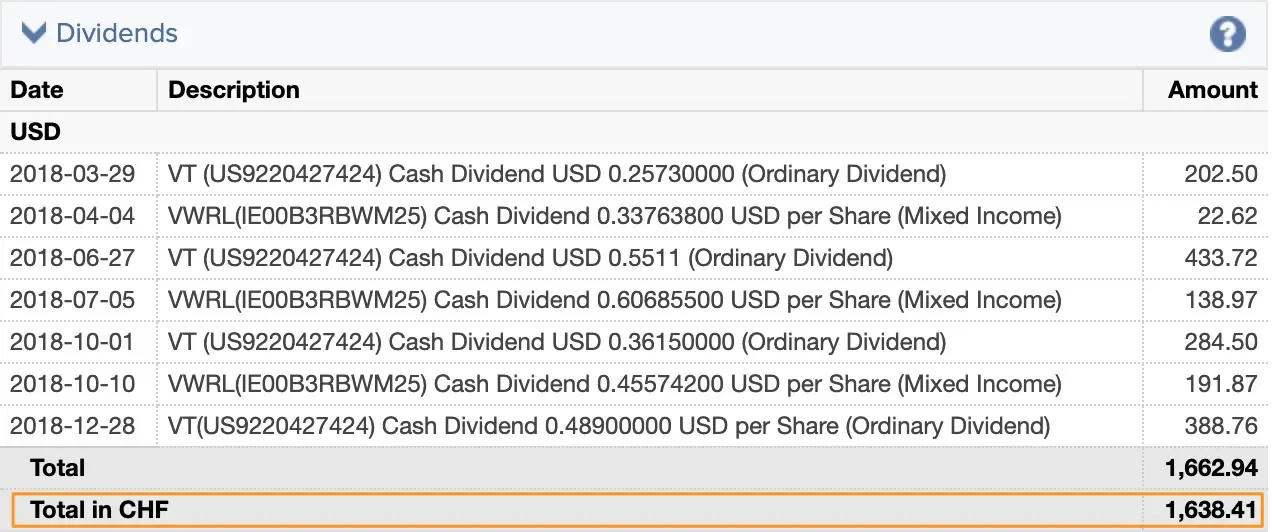

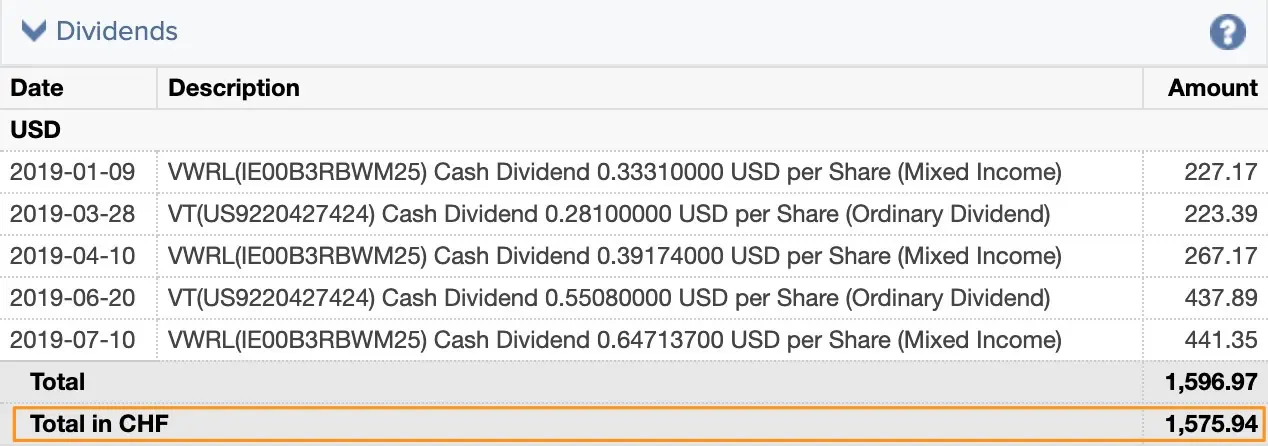

And that’s not to mention the dividends that companies pay you when you own their shares. Ditto, the screenshots of my Interactive Brokers account from 2017 to 2019:

Dividends from my ETFs and shares from January to July 2019 (as you can see, it goes fast because I won in 6 months what took me 1 year in 2018)

You too can invest with Interactive Brokers — and I’ll show you how

I’ll admit, Interactive Brokers isn’t the easiest online broker to start investing with.

And even though since 2017-2018, their strategy has been to simplify their tools more and more so that they are more accessible for the average person… So imagine how the platform looked like when I started in 2016…

Anyway, once I show you the basics, you’ll find your way very quickly. To tell you the truth, buying an ETF or a share in a foreign currency takes me less than 3 minutes now.

Throughout the 9 chapters of this complete guide, I will explain the following step by step:

- How to open your Interactive Brokers account

- The easiest and fastest way to log into your Interactive Brokers account

- How to buy your first ETF via Interactive Brokers to make your money grow in the most passive way possible

- The world’s cheapest way to exchange money in any currency

- The Interactive Brokers reporting tool I use to observe my earnings

I remember how nerve-wracking it was when I had to open my account (argh especially the long forms with lots of financial jargon…) and buy my first ETF (“Uh, it’s flashing colors everywhere. I’ll close the platform because I’m afraid to make a mistake!”).

Believe me, I know how scary it is, and how I would have liked someone to take me by the hand and put me on the right path from the beginning of my life as an investor.

That’s why I created this guide — to answer questions and help others get started with confidence.

This guide is something I dreamt of having when I started investing in the stock market in 2014 (unfortunately not with Interactive Brokers at the time…).

Still motivated? So here’s what’s in store for you:

Chapter 1: Why choose Interactive Brokers?

The Interactive Brokers Group is my top choice and one of the best online brokers for a Swiss Mustachian investor. Before diving into how the solution offered by Interactive Brokers LLC works, it’s important to understand why it consistently ranks highly in online broker reviews and why I chose this online broker over others.

Chapter 2: How to open an Interactive Brokers account

Once I’ve explained why Interactive Brokers is the best online broker for Swiss retail investors, it will be time to take action and open your account. This chapter will guide you through each step of the way, ensuring that opening your account is simple.

Chapter 3: Securing my Interactive Brokers account (and therefore all my money!)

This is an important chapter not to skip. If you’re like me, you only want one thing: to transfer cash and buy your first ETF or share. But imagine if someone hacked into your account and stole all your savings… not cool, huh? So we’ll see how to make your Interactive Brokers account 100% secure.

Chapter 4: Making my first CHF transfer to Interactive Brokers

We finally start talking seriously in this chapter, with the first key step in your investment journey: having cash in your Interactive Brokers account. I will explain to you every detail, with screenshots, on how to transfer your hard-earned money to your IB account.

Chapter 5: Which Interactive Brokers software to use?

As I explained in the preamble, Interactive Brokers may seem complicated at first glance. The typical example is that you have 4 different ways to access your account. But once we go through them together, you’ll understand why and how. And there’s really nothing hard about it!

Chapter 6: Convert foreign currencies on Interactive Brokers

The ETFs or shares I buy are often in currencies other than the Swiss franc. So you have to change your CHF. The good news is that Interactive Brokers is one of the cheapest places in the world to exchange currencies. And it takes you less than a minute!

Chapter 7: How to buy your first ETF on Interactive Brokers?

TADAA! Finally, it took 7 chapters to start touching the grail that will one day allow you to achieve financial independence: buying an ETF or stock from any country in the world. And you’ll know how to do it in just a few clicks on Interactive Brokers after reading this chapter.

Chapter 8: How to check the money you make in the stock market on Interactive Brokers

Personally, that’s what I prefer to look at on Interactive Brokers when I do my accounting work every month: how much my savings earned me while I was sleeping, playing with my children, or at work. I bet you’re looking forward to reading this chapter too, aren’t you?

Chapter 9: Where can I find information about my taxes on Interactive Brokers?

The most unpleasant chapter: Well we don’t want to have any problems with taxes so you have to be careful and declare all the securities and earnings you own on Interactive Brokers. In this chapter I show you how I use their reporting tool to complete my Swiss tax return.

Bonus chapters

How to forecast future dividends on Interactive Brokers

Ah, now that’s a feature I really like! It allows you to forecast future dividends from your Interactive Brokers portfolio using the income projection functionality.

How to invest automatically with Interactive Brokers

Getting (and staying!) rich requires financial discipline. This automatic investment feature from Interactive Brokers brings you this rigor.

Interactive Brokers detailed review (and comparison with other Swiss brokers)

Find out about my experience as an Interactive Brokers customer since 2016, and why they’ve been the best trading platform all this time.

Interactive Brokers vs DEGIRO for a Swiss investor

I’ve been asked countless times by Swiss investors and European investors in general, “Which online broker should I choose: DEGIRO or Interactive Brokers?” So, I’ve written a dedicated article to answer this question! :)

How to create multiple Interactive Brokers sub-accounts?

You can separate your portfolios or children’s accounts on IBKR using sub-accounts, while maintaining an overview via your Master Account (acting like an “admin” account).

Interactive Brokers pricing: fixed or tiered?

You can pay (even) less for your transaction fees at Interactive Brokers, via their tiered pricing.

How to transfer stocks from DEGIRO to Interactive Brokers (portfolio of ETFs)

And to follow on from this, I’ve also described in a separate article how to transfer your ETFs from DEGIRO to Interactive Brokers.

How to open a margin account IBKR (Interactive Brokers)

Chapter reserved for seasoned investors! Here’s how I invest leveraged money by borrowing from my online broker — carefully and thoughtfully.

How can I convert a single account into a joint account with Interactive Brokers Switzerland?

When we started investing, we opened our IB account in the name of just one of us. Not great in the event of death… So we corrected that by converting the account into a joint Interactive Brokers account.

How to invest for my children with Interactive Brokers?

What if investing with Interactive Brokers after my children turn 18 could be as natural as them getting up in the morning for school or brushing their teeth?

Testing the Interactive Brokers Stock Yield Enhancement Program

Just like with the margin account, this chapter is reserved for seasoned Mustachian investors. Here, you will learn how to lend your securities for a higher return.

Interactive Brokers Switzerland: GlobalTrader or IBKR Mobile?

IBRK offers two mobile applications: GlobalTrader and IBKR Mobile. Here’s which one I recommend depending on your situation.

Interview with Thomas Peterffy, founder of Interactive Brokers

I was lucky to interview CEO Thomas Peterffy for half an hour! A source of inspiration for any self-respecting entrepreneur (and investor).

So much for the program. I hope it will help you to start investing to ensure a bright financial future for yourself.

Anyway, if you use this link to open your Interactive Brokers account, I thank you because it will help finance the blog and allow me to spend even more time on it to create other guides like this one.