What if there was a way for Swiss investors to pay (even) less in transaction fees at Interactive Brokers?!

Me when I started out with my IB broker

When I opened my Interactive Brokers account in 2016, I, like everyone else, got a IB brokerage account with their fixed pricing (yet no custody fees) applied by default.

I was super happy as with Interactive Brokers LLC I was going to be paying lower fees on the same trade value than with my previous online trading platform Swissquote…

And as I was a beginner at that time, I didn’t want to complicate things by looking at this information about “tiered” pricing…

However, after exploring the various functionalities on their site for a few weeks, I realized it could be worthwhile to optimize the fees charged for trading even further to maximize savings ;)

Interactive Brokers commission: two options

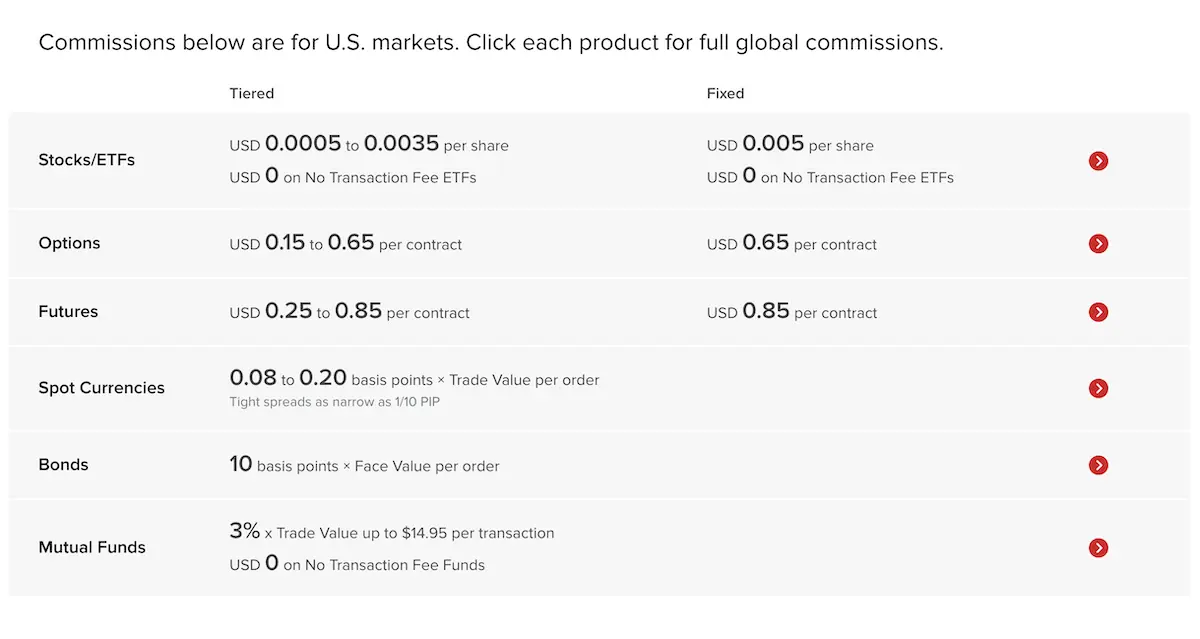

There are two pricing plans available for Swiss and European Investors with Interactive Brokers: fixed or tiered.

Fixed pricing IBKR

Fixed pricing is an always identical amount that you pay as a transaction fee. This amount is already very low compared to all other trading platforms on the market.

Good to know: for US markets where you buy your VT ETF, there are also regulatory fees that vary depending on the number of ETFs you buy. These are fees charged by the Securities and Exchange Commission (SEC) (which are free) and the Financial Industry Regulatory Authority (FINRA). However, these variable regulatory fees are negligible given their amount (for example, for FINRA, they are calculated based on the number of shares purchased multiplied by USD 0.000166).

Tiered pricing IBKR

Tiered pricing which reduces the amount of your transaction fees according to the size of the said transaction. However, this pricing is a little more complex, as it includes several third-party fees, the amount of which depends on the exchange where you buy and the amount of your transaction:

- Regulatory Fees

- Exchange Fees

- Clearing Fees

- Pass-Through Fees

Regardless of which pricing you choose, be aware that each type of product (bonds, options, futures, stocks and ETFs, etc.) has a specific pricing. And that goes for each of the global regions according to the stock market in which you are making transactions.

Which is the best IBKR plan for the lowest fees?

As you’ve likely gathered, selecting between the fixed or tiered pricing plan depends on the transactions you execute through Interactive Brokers.

As a reminder, my blog is aimed at passive Swiss investors with a long-term focus.

Regarding the investment vehicle, I’m only going to be interested in ETFs, which are the core of all investment strategies for any self-respecting Mustachian.

But if you’re just buying single stocks (like Apple, Tesla, or value investments), with Interactive Brokers, the pricing is the same for a stock as for an ETF. So everything you read below is valid if you trade on the Swiss or American stock markets.

IBKR tiered pricing minimum level

For the American stock market, the first tiered pricing band covers investments from 1 share to 300,000 shares per month. I’ll focus only on this band since I doubt many readers are buying over 300,000 shares monthly — haha!

Similarly, for the Swiss stock market, the first tiered pricing band ranges from CHF 1 to CHF 50,000,000 per month. I’ll stick to this band as well, since even fewer readers are likely investing 50 million Swiss francs per month :D

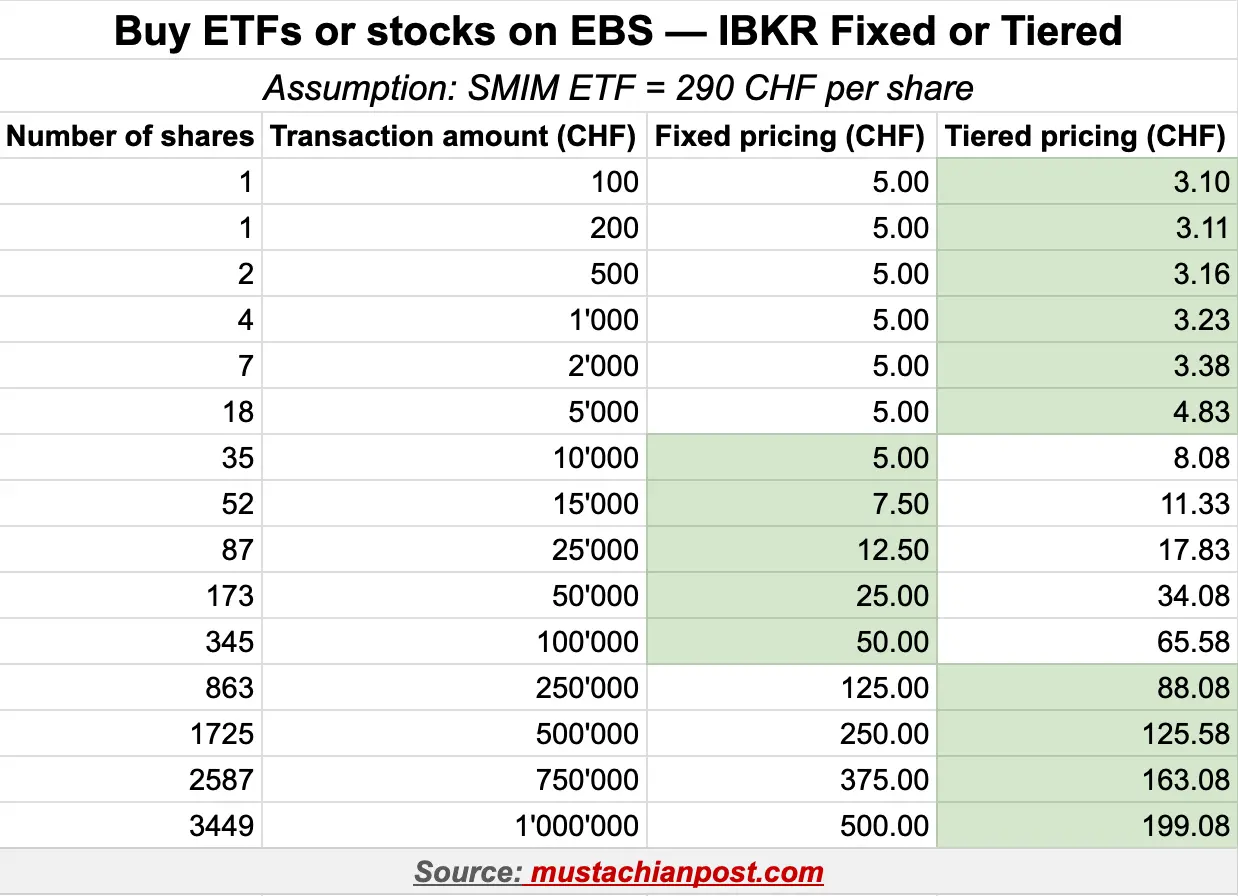

Example 1: Swiss ETF (in CHF) bought on the EBS

For a Swiss ETF listed in CHF (such as the UBS ETF (CH) SMIM (CHF) A-dis) that you buy on the EBS exchange, this is what you’ll pay in Interactive Brokers transaction fees:

Here are the most attractive IBKR pricing based on the amount of your purchase order:

- Between CHF 100 and CHF 5'000, IBKR’s tiered pricing is more attractive

- Between CHF 10'000 and CHF 100'000, IBKR’s fixed pricing is more attractive

- Between CHF 250'000 and CHF 1'000'000, IBKR’s tiered pricing is more attractive

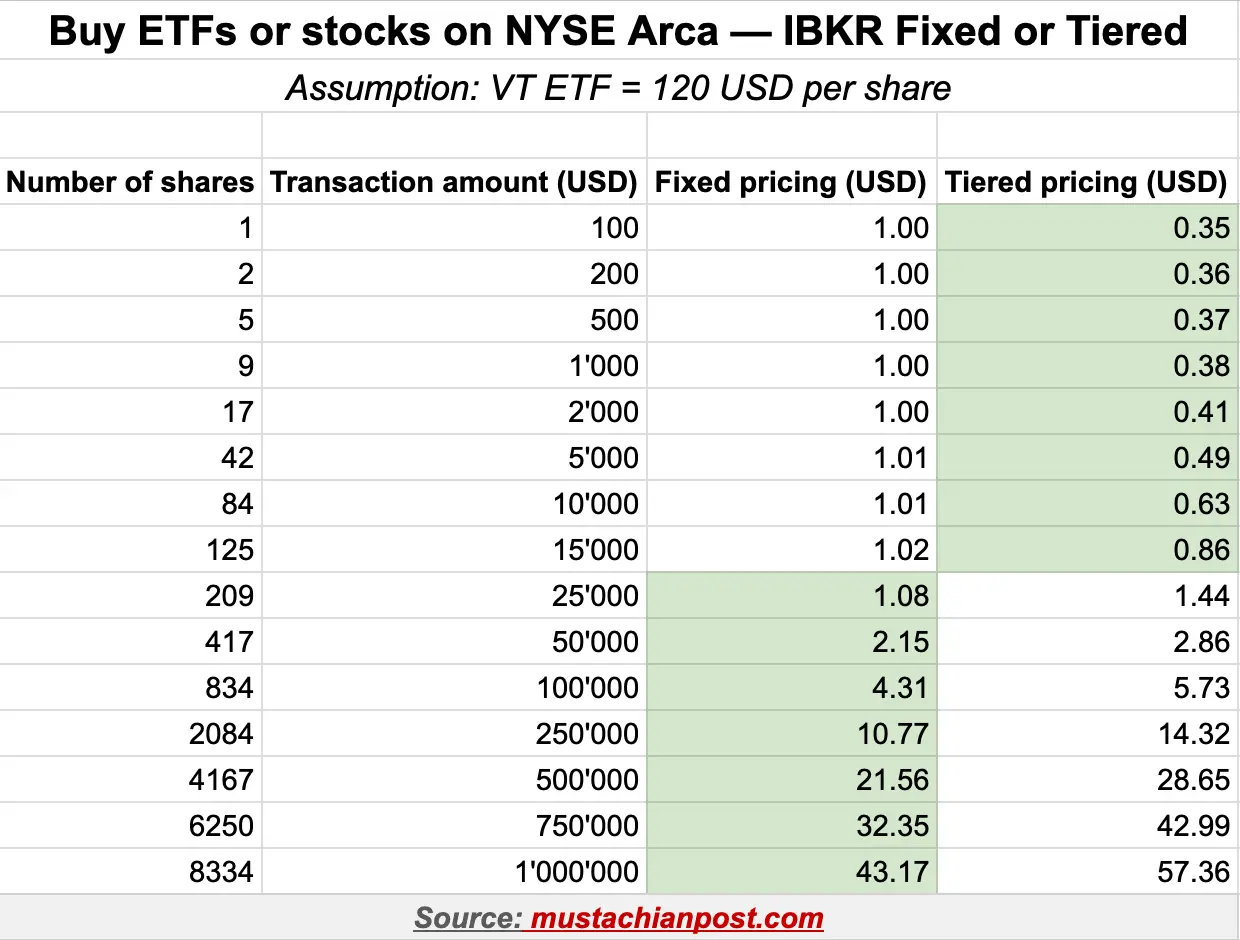

Example 2: ETF US (in USD) bought on an American stock exchange (NYSE for example)

And for an American ETF listed in USD (such as our favorite VT ETF) that you buy on the New York Stock Exchange, here are the transaction fees that you’ll pay to IB according to the pricing:

In this case, the most attractive IBKR pricing based on the amount of your purchase order is:

- Between USD 100 and USD 15'000, IBKR’s tiered pricing is more attractive

- Between USD 25'000 and USD 1'000'000, IBKR’s fixed pricing is more attractive

However, it is important to note that for US ETFs, the difference between fixed and tiered pricing is smaller (compared to IBKR fees for purchasing a Swiss ETF).

My choice of IBKR pricing for all my accounts

Regardless of our IBKR account type (private, joint, or professional), I have activated the tiered pricing feature to pay as little in transaction fees as possible with this broker.

This is because:

- I buy the VT ETF most regularly, and often for less than $15'000 US

- I hardly ever buy SMIM ETFs, as I own shares in my company in Switzerland, which would overexpose me if I were to buy SMIM again (and, in any case, if I were to buy any, I think it would be for CHF 5'000 or less)

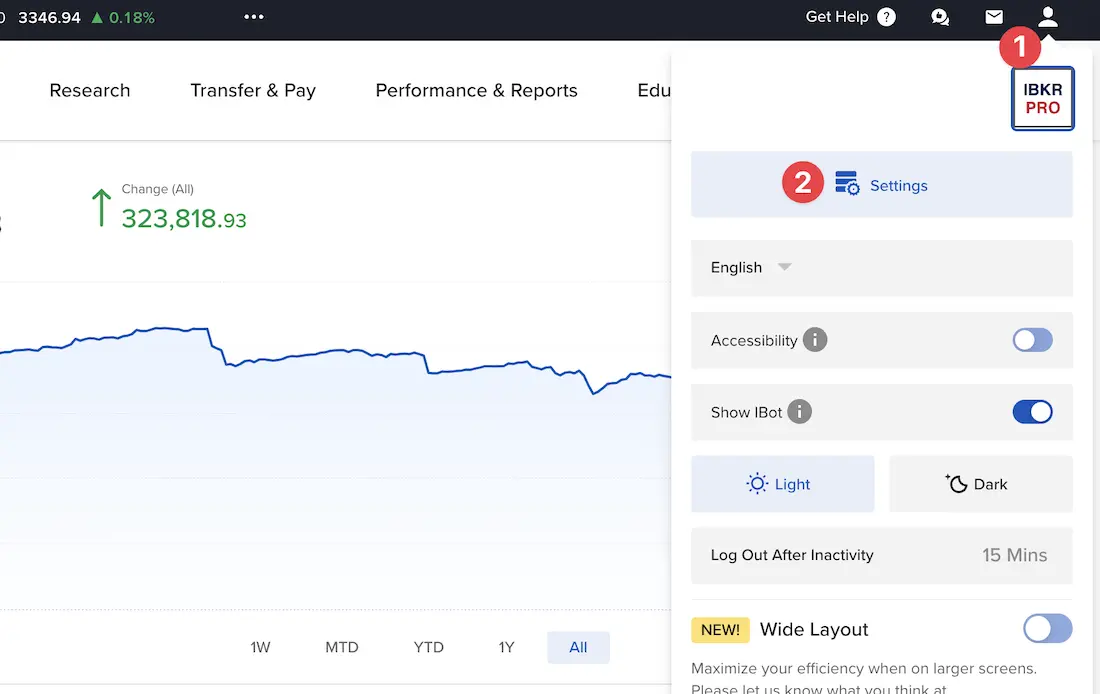

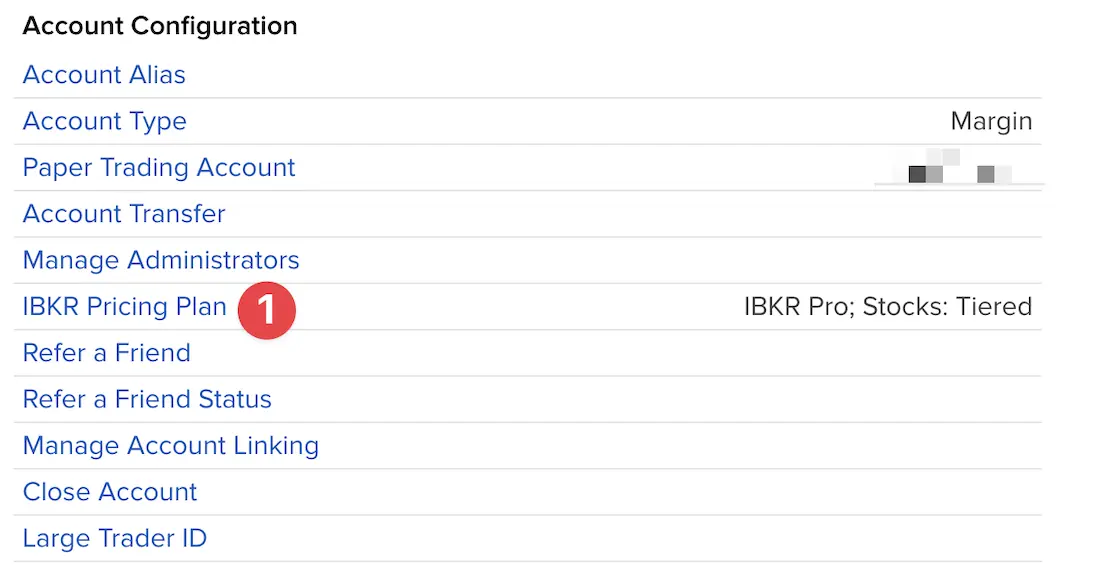

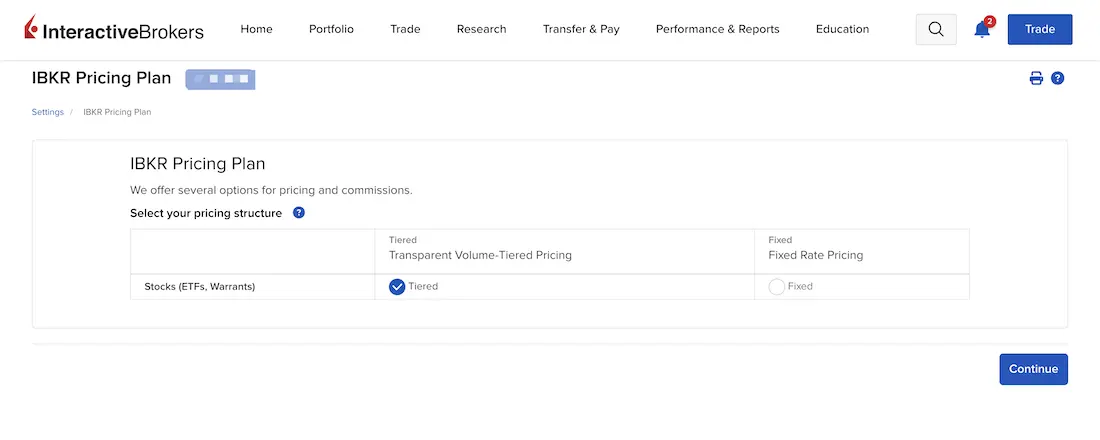

How do you switch to tiered pricing on Interactive Brokers?

Setting up tiered pricing on the IBKR trading platform takes less than a minute and just four clicks — just like making a bank transfer with a well-optimized system.

And voilà, you’ve done it, you’re now on IBKR’s tiered pricing plan :)

Conclusion

Interactive Brokers’ tiered pricing is usually the most economical for a Swiss Mustachian investor who invests in this manner:

- Buys and retains over the long term without selling

- Mainly buys ETFs

- Invests via American or Swiss stock exchanges

- Buy for a few thousand USD (between 100 and 15'000 USD) or CHF (between 100 and 5'000 CHF) per order

While Interactive Brokers was already THE most economical in terms of cost, it’s now become unbeatable!

And you, what Interactive Brokers pricing do you use? Fixed or tiered?

FAQ

Is IB’s tiered pricing applied across all the broker’s platforms?

Yes, regardless of whether you use the IBKR GlobalTrader mobile app, the Trader Workstation desktop app, or even the IB Client Portal, tiered pricing is applied to your Interactive Brokers account across the board.