Interactive Brokers is my favorite online brokerage platform for many reasons as I explained in the previous chapter.

I still remember when I made the decision to open my account with Interactive Brokers. That was in 2016. But between making the decision and doing it, that took several days because I wasn’t sure what to expect in terms of the complexity of the process (and I didn’t find a simple Interactive Brokers Switzerland tutorial at the time).

If you feel the same way as I did in 2016, then this chapter is for you.

This chapter describes the steps you need to open an account at Interactive Brokers.

💡 Alongside your reading below, I recommend that you sign up for the “IBKR Challenge” that I have created.

Over the course of 9 days, this challenge will allow you to test the stock market and Interactive Brokers risk-free (and free of charge), with 3 mini-tasks each day (taking less than 2 minutes per day):

Documents and information required to open an Interactive Brokers account

As a Swiss investor here is the information you will have to provide to open an account with the Interactive Brokers Group:

- Full name with one proof of identity (see below)

- Residential address with one proof of address (see below)

- Date and country of birth

- Citizenship

- Tax residency & tax identification number

- Employer’s name and address

- Information on assets and income

- Information on source of wealth and funds

- Investment objectives and experience

- Bank or 3rd party broker account numbers for funding purposes

- Details of other account users, if applicable

In terms of proof of identity, Swiss and European investors must prepare one of the following three documents (valid, of course) to the brokerage firm:

- Passport

- National identity card

- Driver’s license

And as far as your proof of residence address is concerned, you must provide one of the following documents to Interactive Brokers Switzerland which must be less than 6 months old:

- Utility bill (electricity, gas, water, landline telephone, home broadband, or TV; mobile phone bills are not acceptable forms of proof of address)

- Council tax bill

- Home insurance bill

- Bank, mortgage or brokerage statement

- Signed and stamped letter from your bank on the bank’s letterhead confirming address

- Credit card statement (not older than six weeks)

- Government issued letters or statements (property tax bill, confirmation of residential address from the local authorities or a pension statement; must be on official government letterheaded paper)

- Resident permit

- Driver’s license or national identity card (cannot be used as proof of identity and also as proof of address)

That sounds like a lot, but in the end, apart from your taxpayer number, your proof of identity, and your proof of address, everything else is standard information.

Are you ready?

Then let’s go!

1 — Creating your IB account

If you want to support the blog, you can use the following link to open your account (the website is exactly the same but the blog will earn a commission):

Open Interactive Brokers account

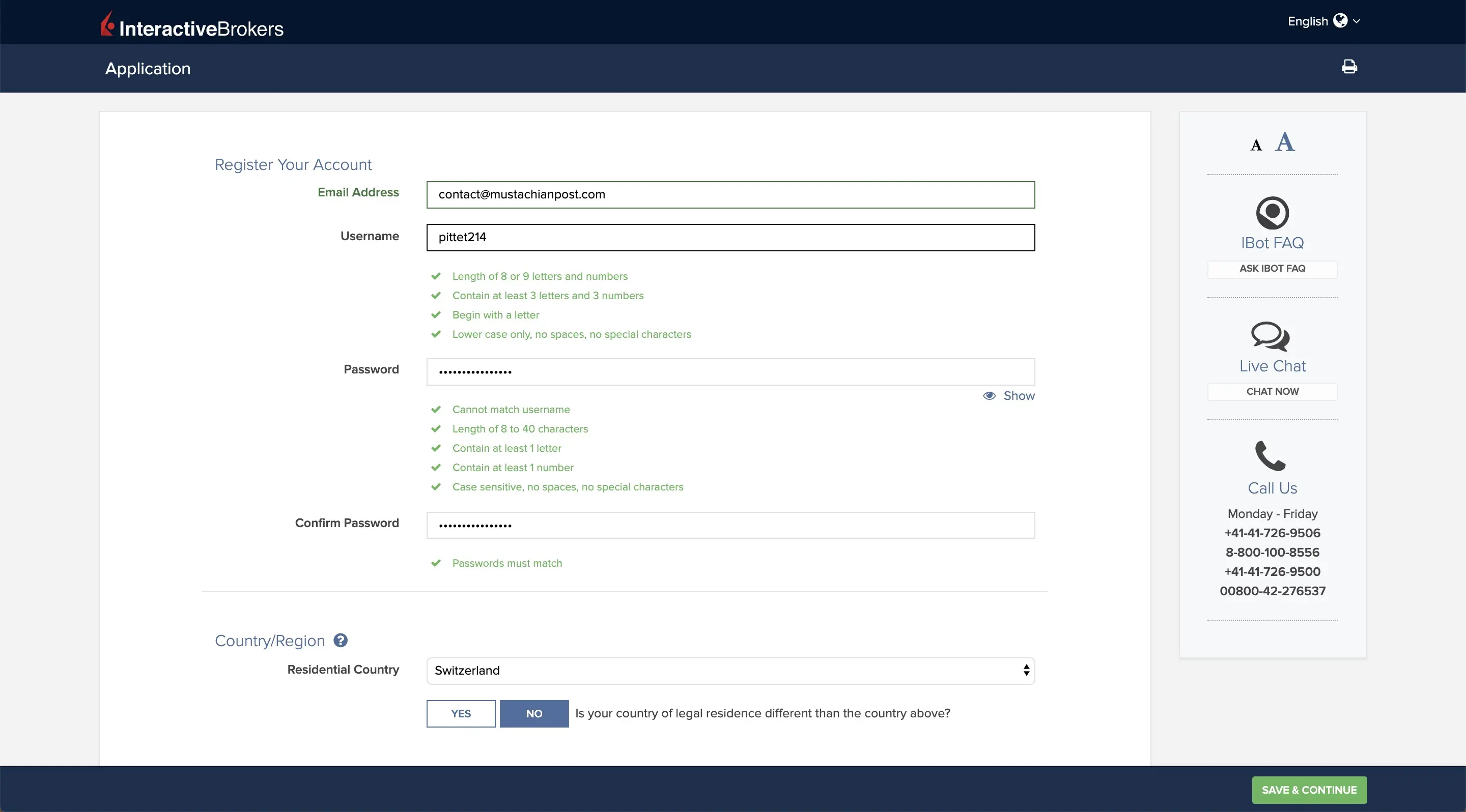

The first window you will have to fill in looks like the following screenshot. Pretty standard, you must indicate your email, a username, a password, and your country:

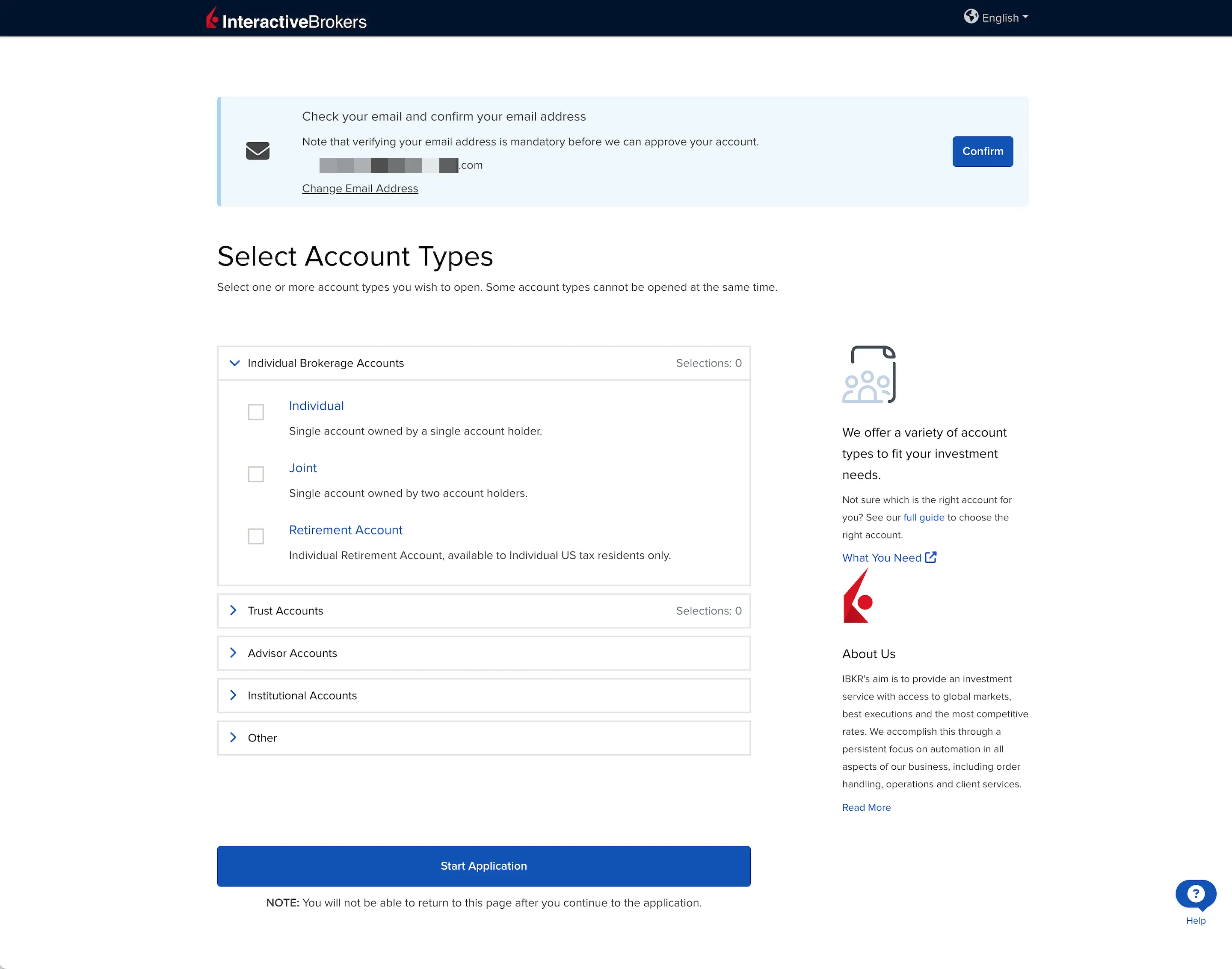

Once completed, you will see the following screen that tells you that you will receive a verification email to validate your account (this screenshot is in French because I couldn’t recreate an account twice):

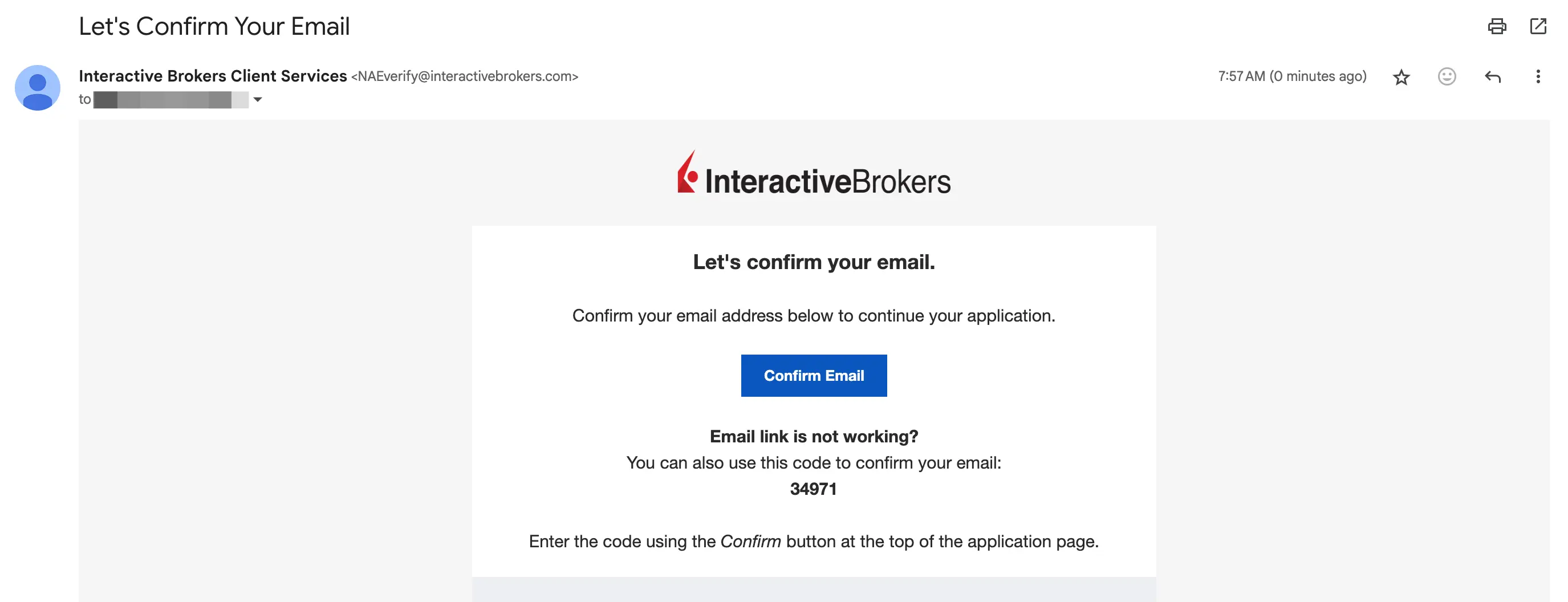

All you have to do is check your emails to find a message as follows:

2 — Login to your Interactive Brokers account

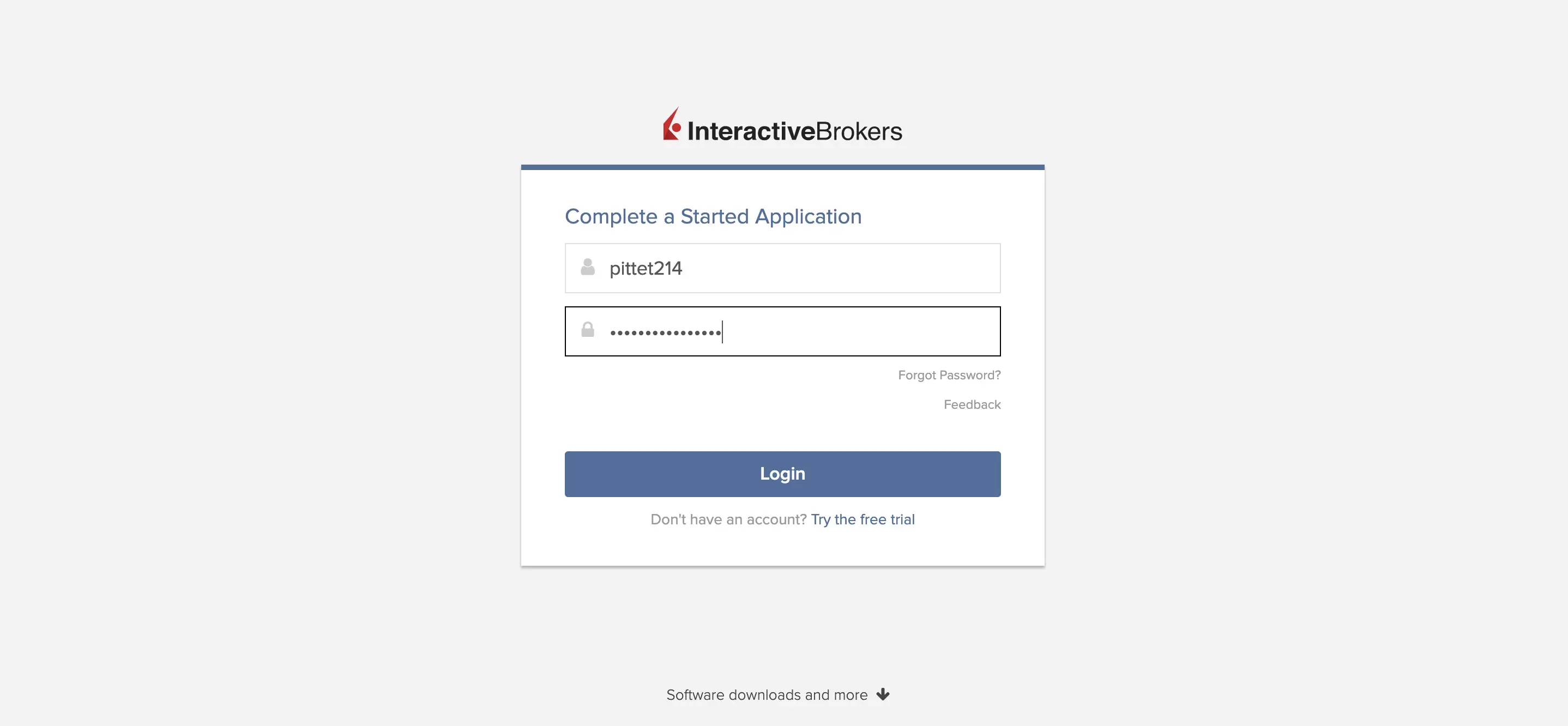

Now that you have an online broker account with IB, you can use your username and password to log in:

3 — Choice of your account

As indicated, you cannot change this choice later on. So you have to decide if you want an individual account or a joint account with your partner (screenshot in French as forgot to do it in English):

You also have to indicate to Interactive Brokers Switzerland your input language and whether you are the beneficial owner of all funds and investments in the account. I put yes because I think it will fit most cases.

If you decide to open a joint account like Mrs. MP and I, you will have to choose one of the four existing types ("Joint tenant with rights of survivorship (most common)", "Tenancy in Common", "Community Property", or "Tenancy by the Entirety"). In our case, we chose "Joint tenant with rights of survivorship (most common)" so that the surviving spouse will always have access to our Interactive Brokers accounts in the event of the death of a spouse.

4 — Personal information: basic infos and address

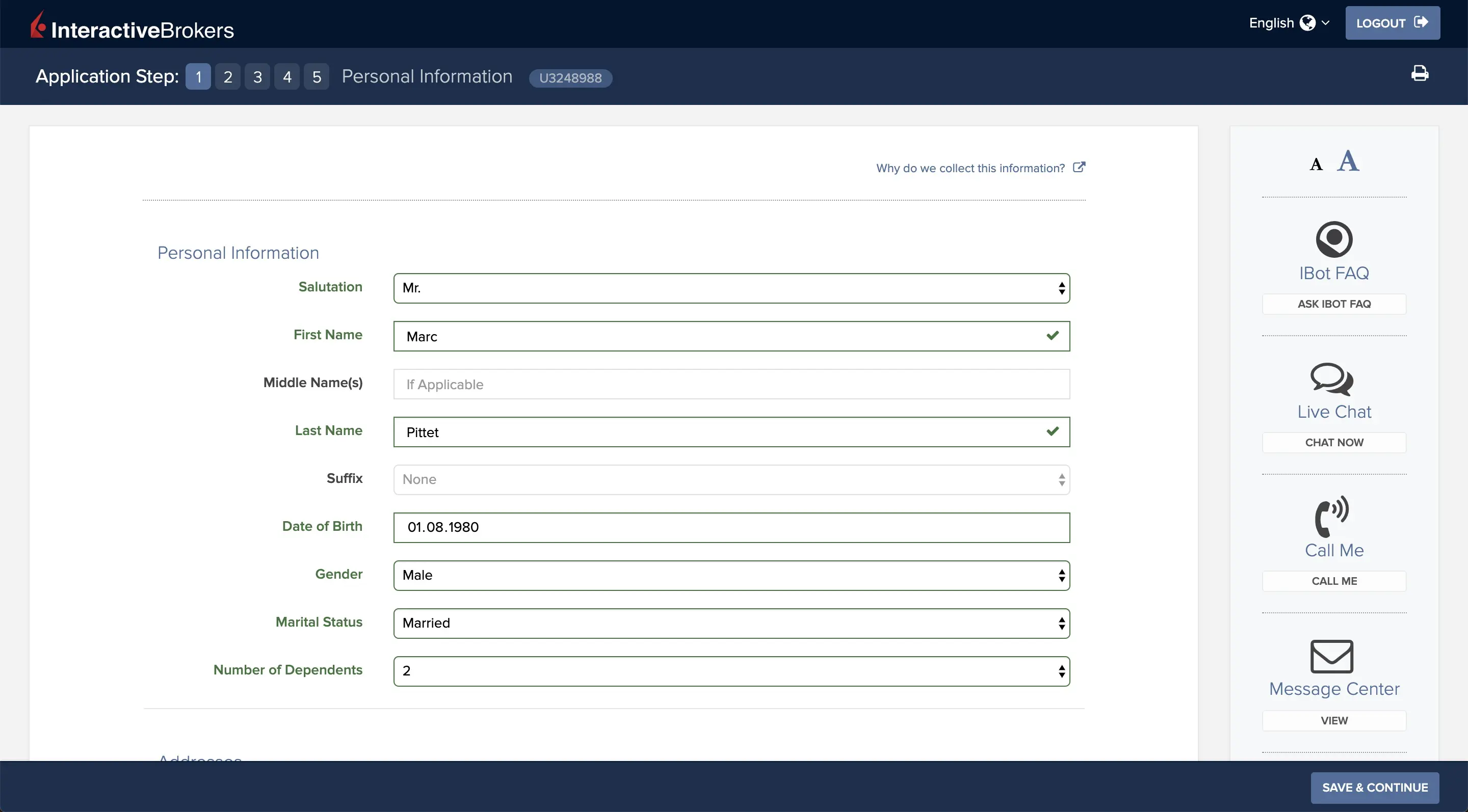

To make the screenshots easier to read, I have divided them into sections. First, there are the basic questions, including your mobile phone number (for account security, which we will cover in a later chapter):

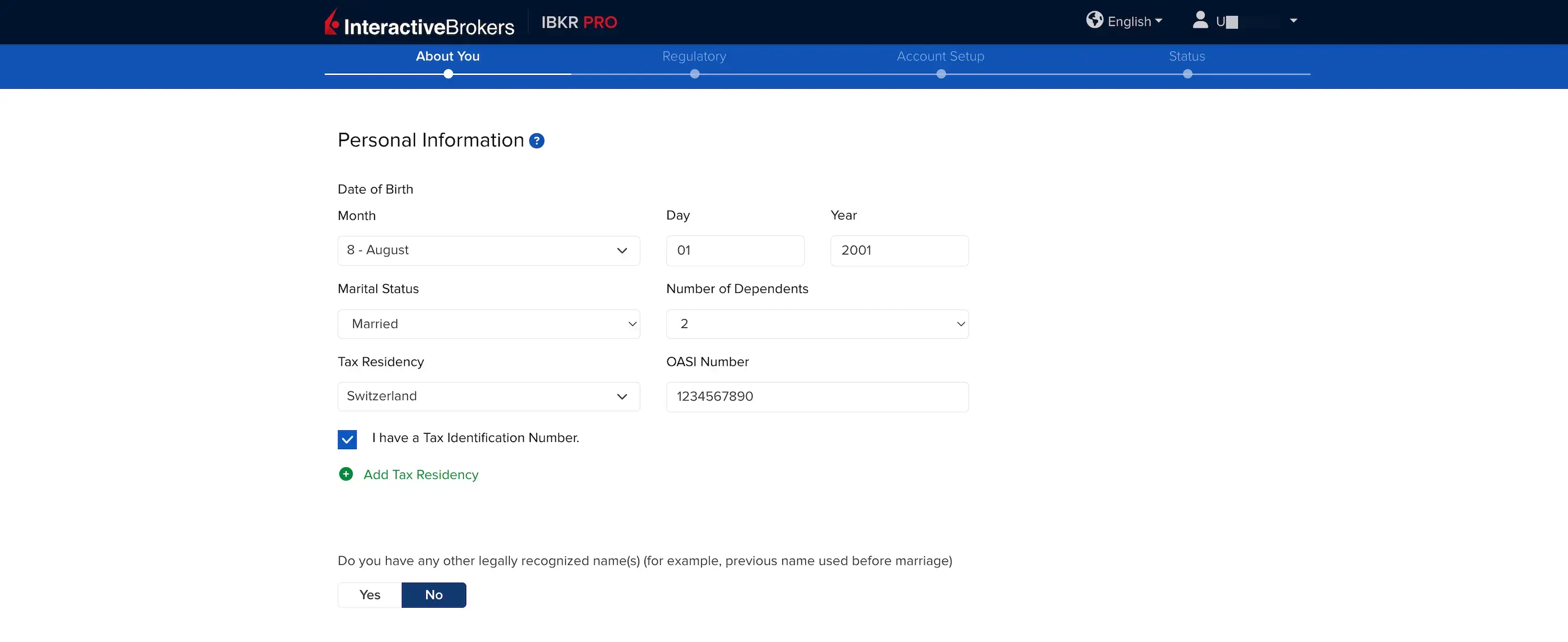

5 — Personal information: date of birth, identification, and tax residence

Next, you must enter your date of birth, marital status, number of dependents, and information about your tax residence (OASI number):

6 — Personal information: identification and proof of identity

Next, you need to enter the details from your identification document (I used my Swiss passport):

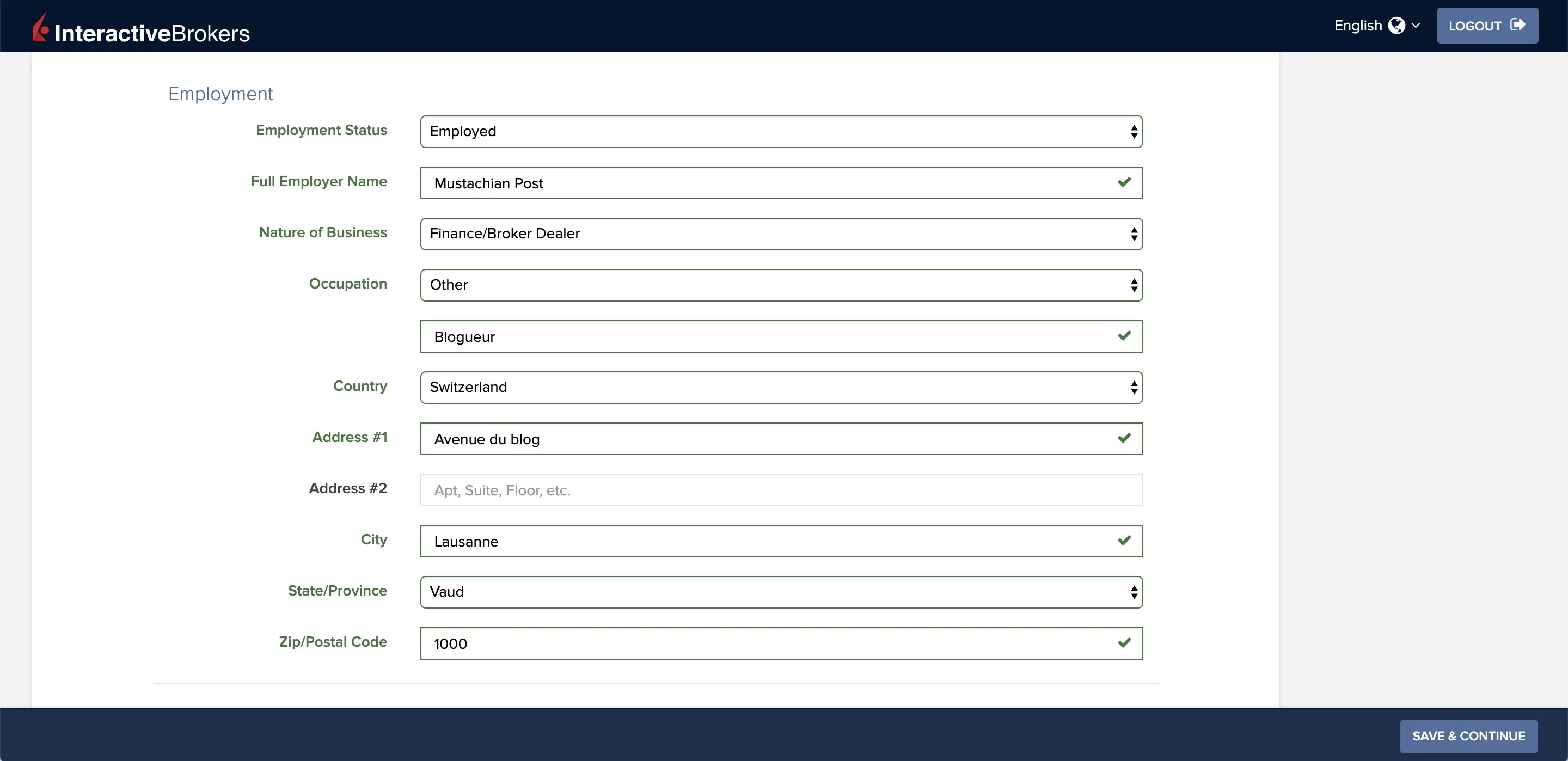

7 — Personal information: employment

Then nothing very complicated with this section:

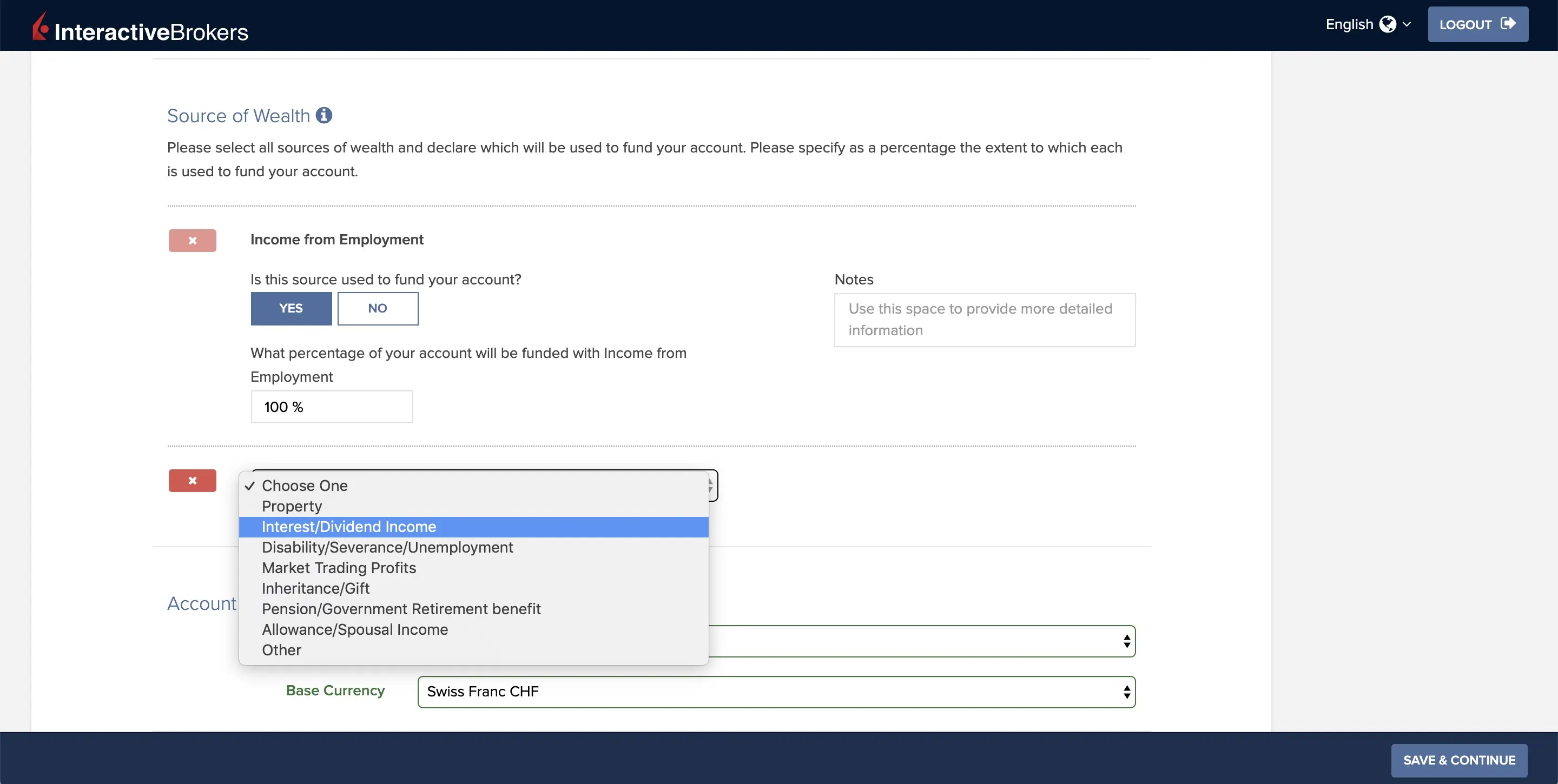

8 — Personal information: source of wealth

In this section, you must declare the assets you will use to fund your IB account. To make it simple I said that it was 100% via my main income but as you can see there are other options:

9 — Personal information: base currency and security questions

As for the base currency, I used the CHF so that all reports and information in my Interactive Brokers Switzerland account management are converted into this currency.

Finally, there are the security questions in case you lose access to your account so that IB has a way to identify you.

If you find this form tedious, please note that your form is automatically saved. This means you can take a break for as long as you like and then reconnect, and you will be taken back to the right place on the form automatically. Handy!

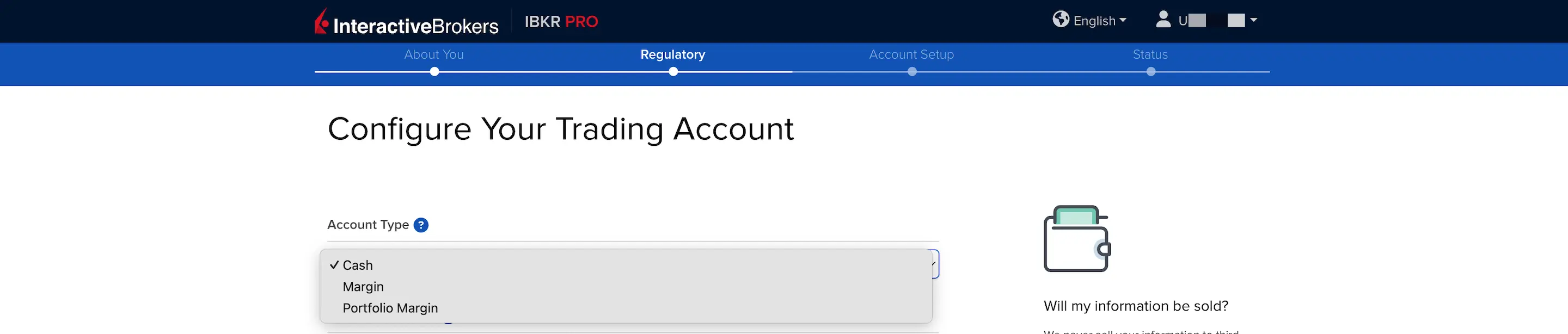

10 — Interactive Brokers account type

You must first indicate what type of account you want.

I recommend the “Cash” account that allows you to invest with your own money vs. the “Margin” accounts that allow you to invest by borrowing money from Interactive Brokers Switzerland (which you don’t want to do:)).

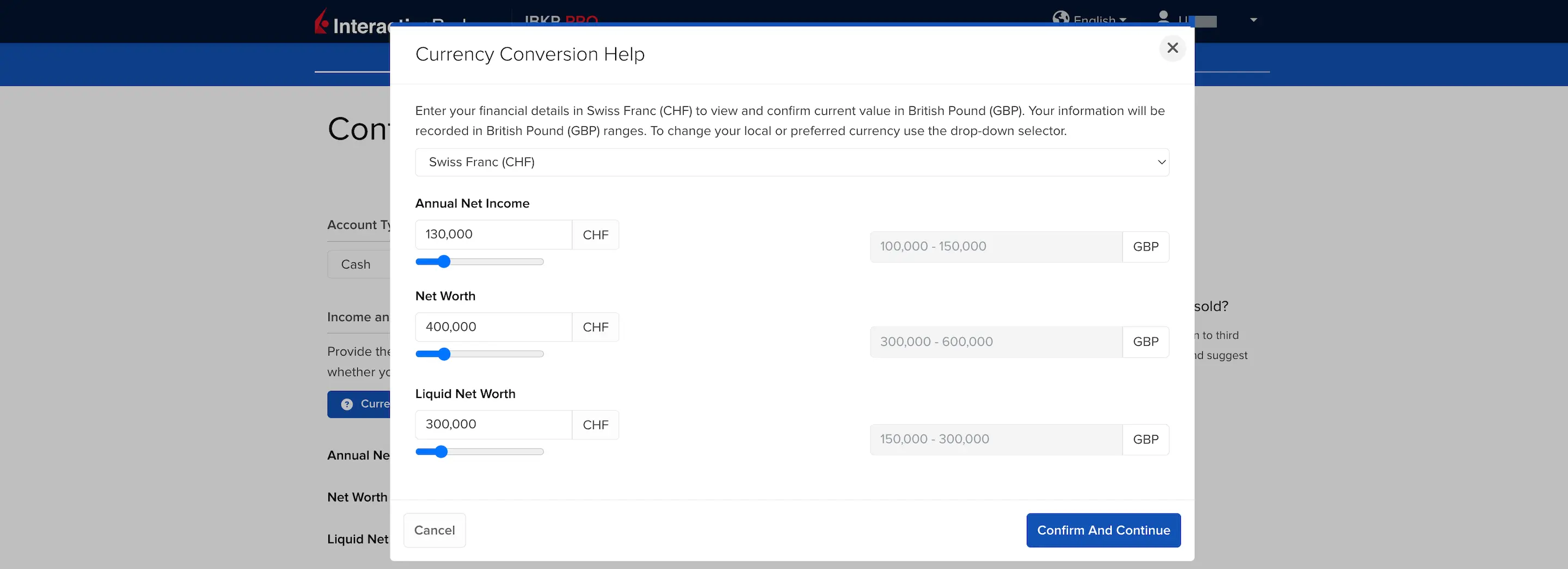

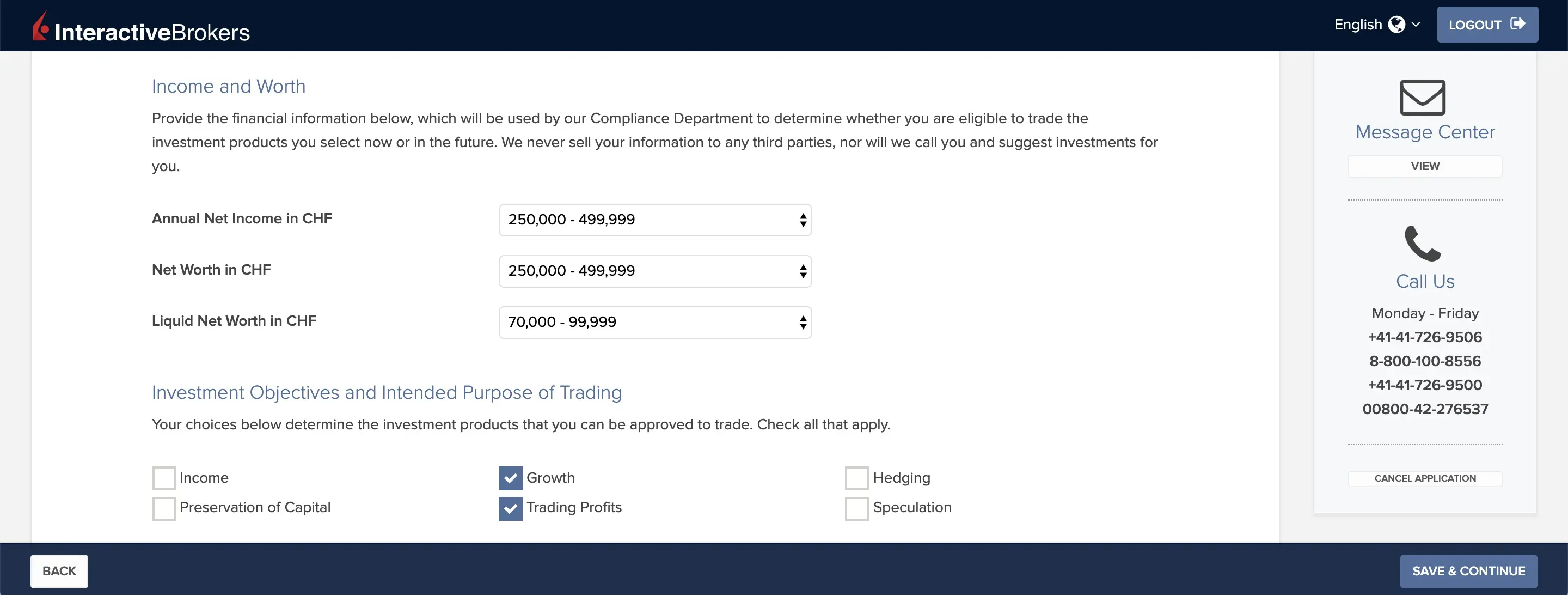

11 — Regulatory information: income, net worth, and investment objectives

Same as for above, you can be transparent here knowing in addition that Interactive Brokers Switzerland explicitly tells you that they are not going to spam with marketing :)

Your annual net income is information that you can find on your most recent salary statement.

If you don’t know your net worth, look at this article which explains how to calculate it.

Liquid net worth is the same as net worth, but minus anything that is real estate or something that you can’t sell in a day for example (your car could be another example).

Regarding my investment objectives, I have stated my goal, which is to grow my invested wealth on the stock market.

As I write this, we, as Swiss investors, are going through Interactive Brokers UK to open our IBKR account. So the information must be entered in GBP. But Interactive Brokers has thought of everything and provides currency conversion assistance (see the first image below).

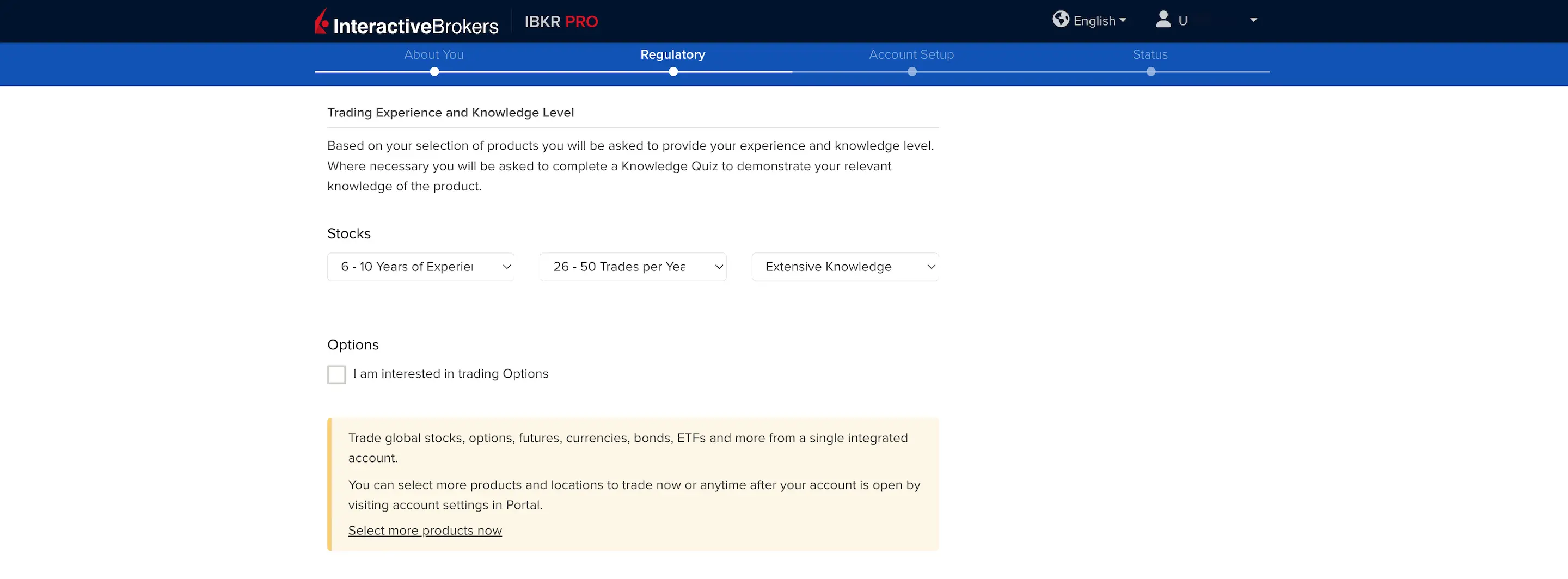

12 — Trading experience and regulatory information

This last section of the regulatory part is important.

It is thanks to it that you will or will not have the right to buy/sell certain types of financial vehicles.

As a reminder, on this blog, I recommend my philosophy of long-term investment in ETFs and in value. And I don’t touch on all the speculation and other loan-based investments that I don’t understand.

If you also follow this philosophy, then you only need to tick the following investment vehicle: “Stocks”.

You will also need to indicate your level of experience. It’s up to you whether you want to embellish your experience a little so that IB doesn’t block you from buying/selling these vehicles; after all, it’s your responsibility, not mine, we’re clear on that!

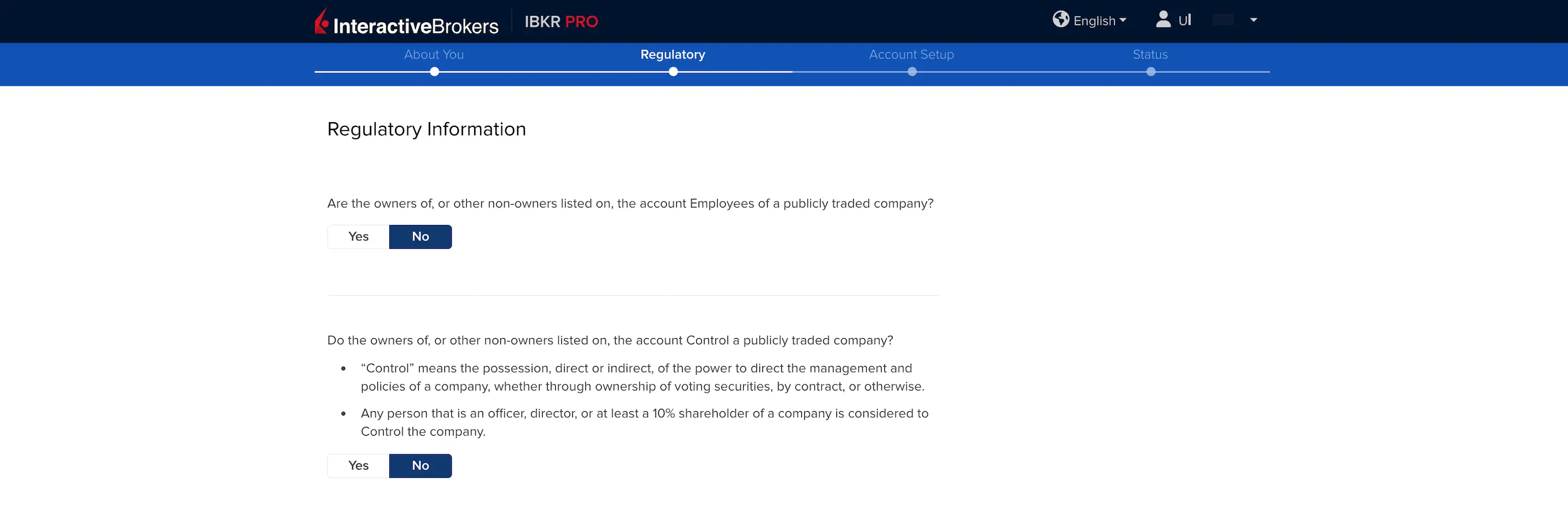

Next, you must indicate whether you are employed by a publicly traded company or whether you control a publicly traded company; these questions are intended to prevent insider trading:

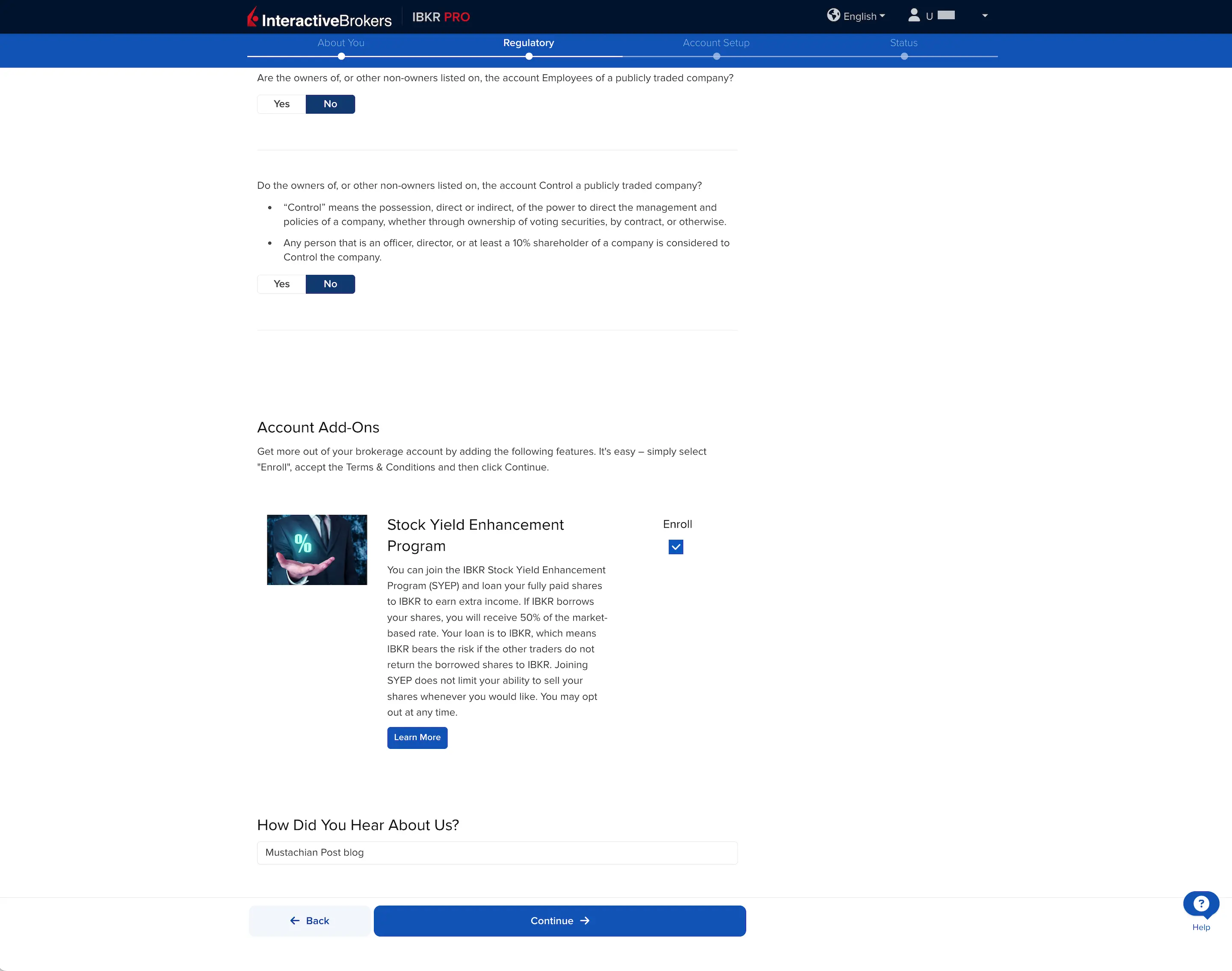

13 — Stock yield enhancement program

I don’t remember having this section on Interactive Brokers Switzerland when I created my account in 2016, or maybe I didn’t understand what it meant and skipped the section…

Anyway, I took the time to read the details of this program which allows you to improve the return on your shares by lending them to other traders and it sounds interesting. For the moment I am not recommending it to you because I have not tested it but I will check and update this section if I adopt it (UDPATE 08.09.2022: testing of the Interactive Brokers Stock Yield Enhancement Program is ongoing).

Until then, I let you choose whether or not you want to participate (you can change your mind after opening your account in any case):

At the bottom of the same page, they ask you how you heard about Interactive Brokers (Switzerland), so I let you choose what best suits your situation.

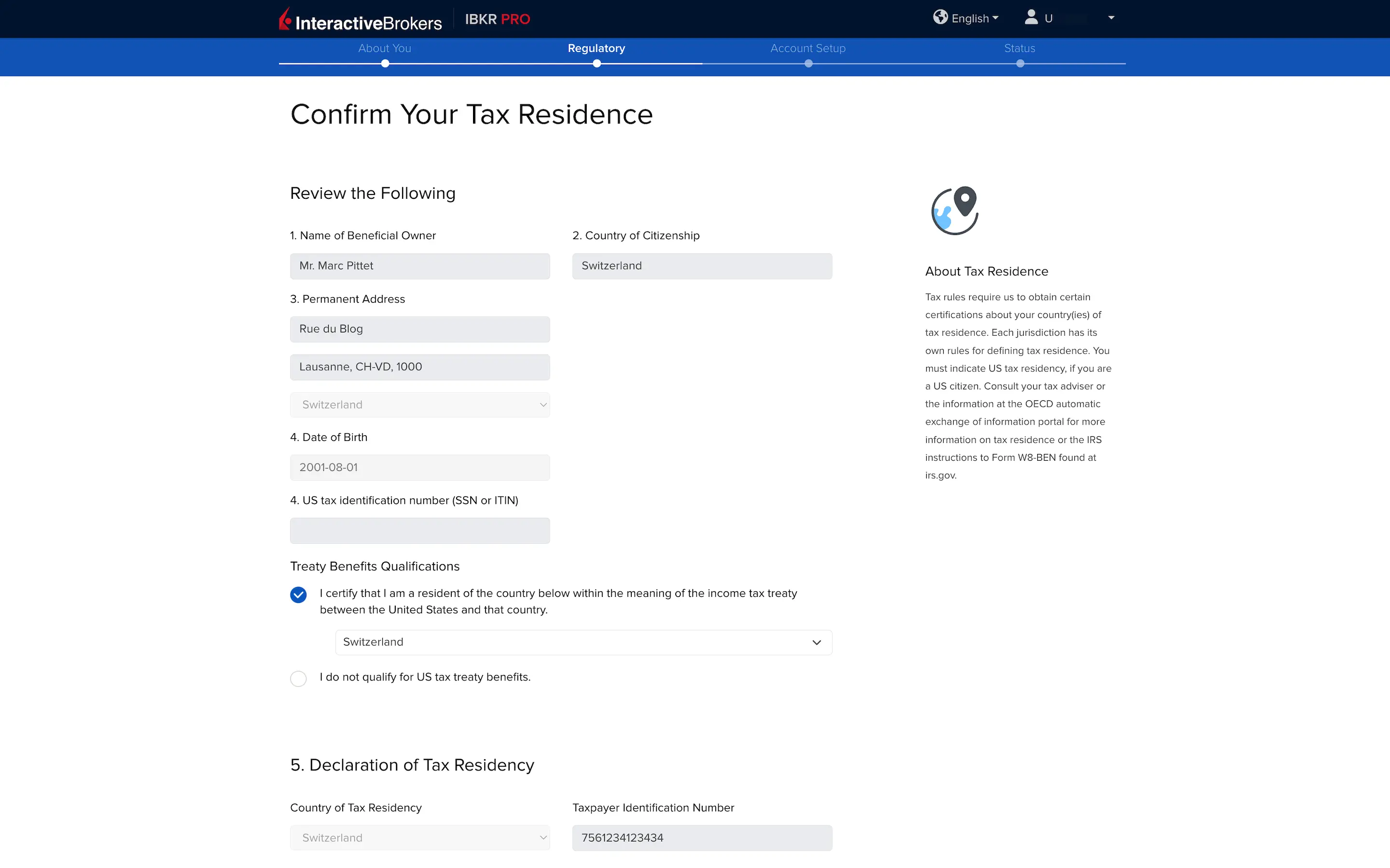

14 — Certification of tax residencies

In this first section, it is important to confirm that you are a Swiss resident (if this is the case, of course) when answering the question about the US tax treaty. If you check this box, it guarantees your compliance and will allow you to recover US withholding tax thanks to the treaty in place between Switzerland and the USA.

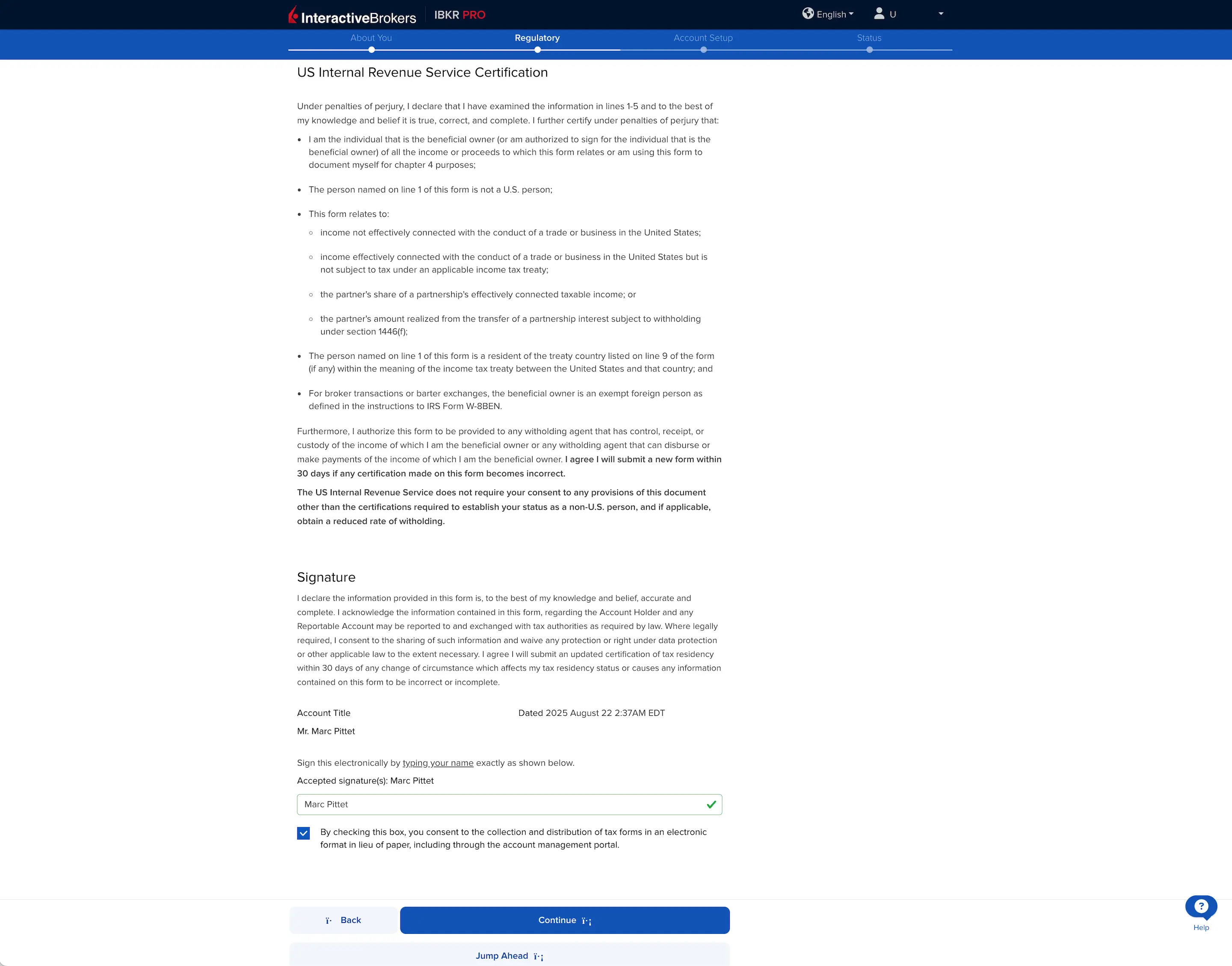

Then we are entitled to a little legal blabla to say that we are not trying to evade the American tax authorities (and confirm, if applicable, that you are not a US resident), as well as to indicate that you are willing to send this form via internet rather than paper ;)

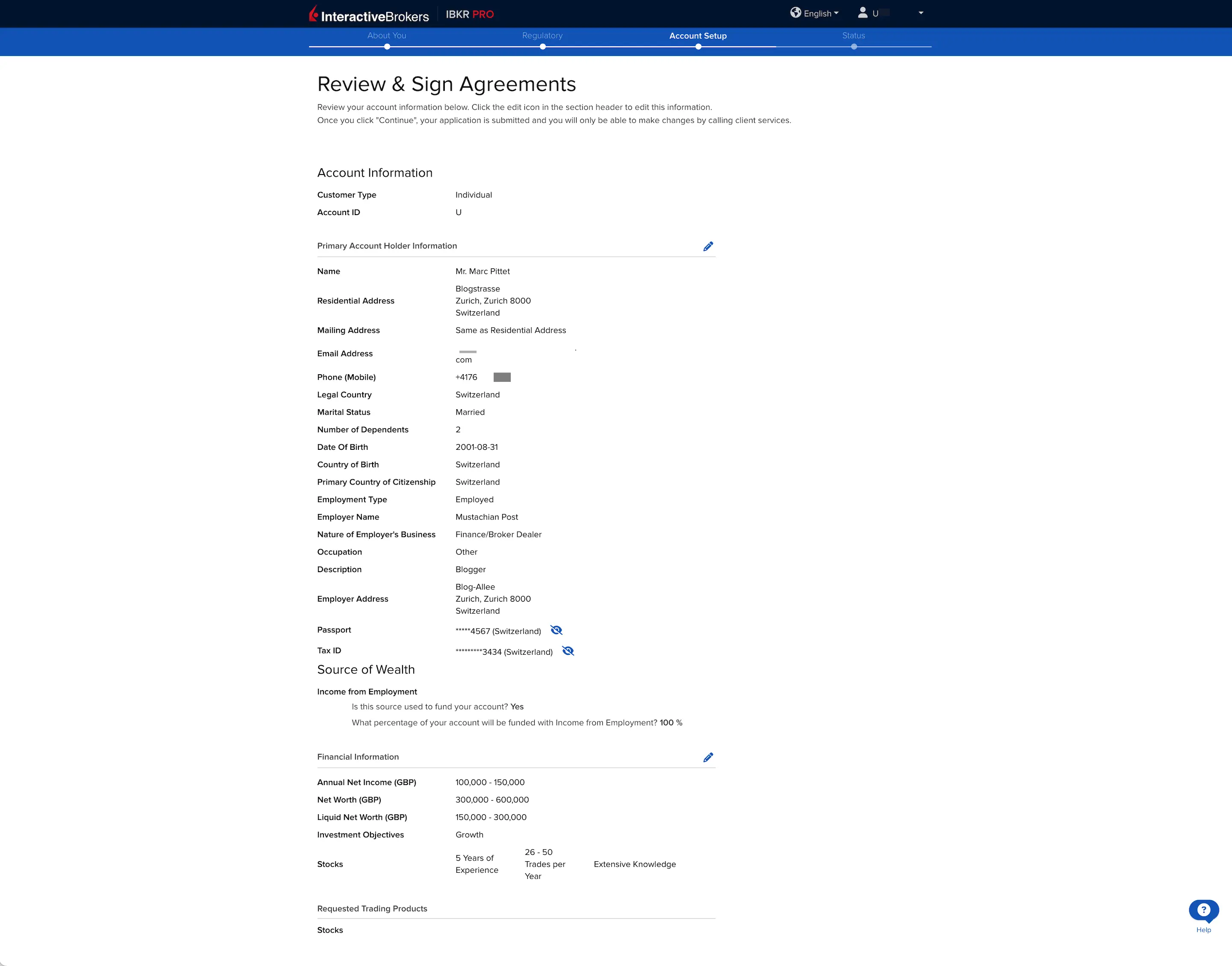

15 — Application review

Here we are. The hard part of signing up to the best online broker in Switzerland is done!

All you have to do now is:

- Check your details, because after that, if you want to make any changes, you will have to do so by calling customer service (or directly in your account management interface once it is open)

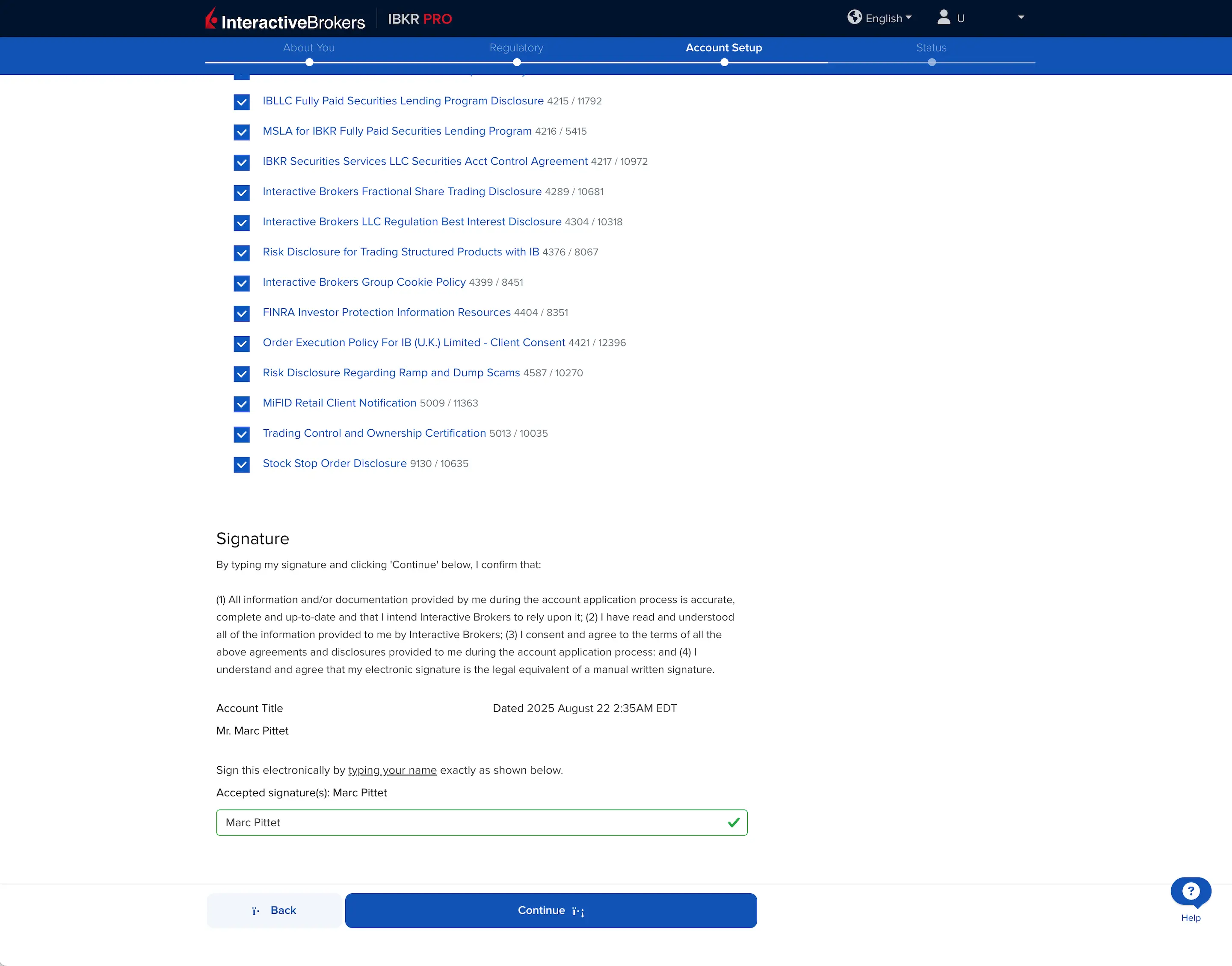

- Accept all agreements, conventions, and declarations

- Sign with your first and last name

- Click on “Continue” to finalize your request

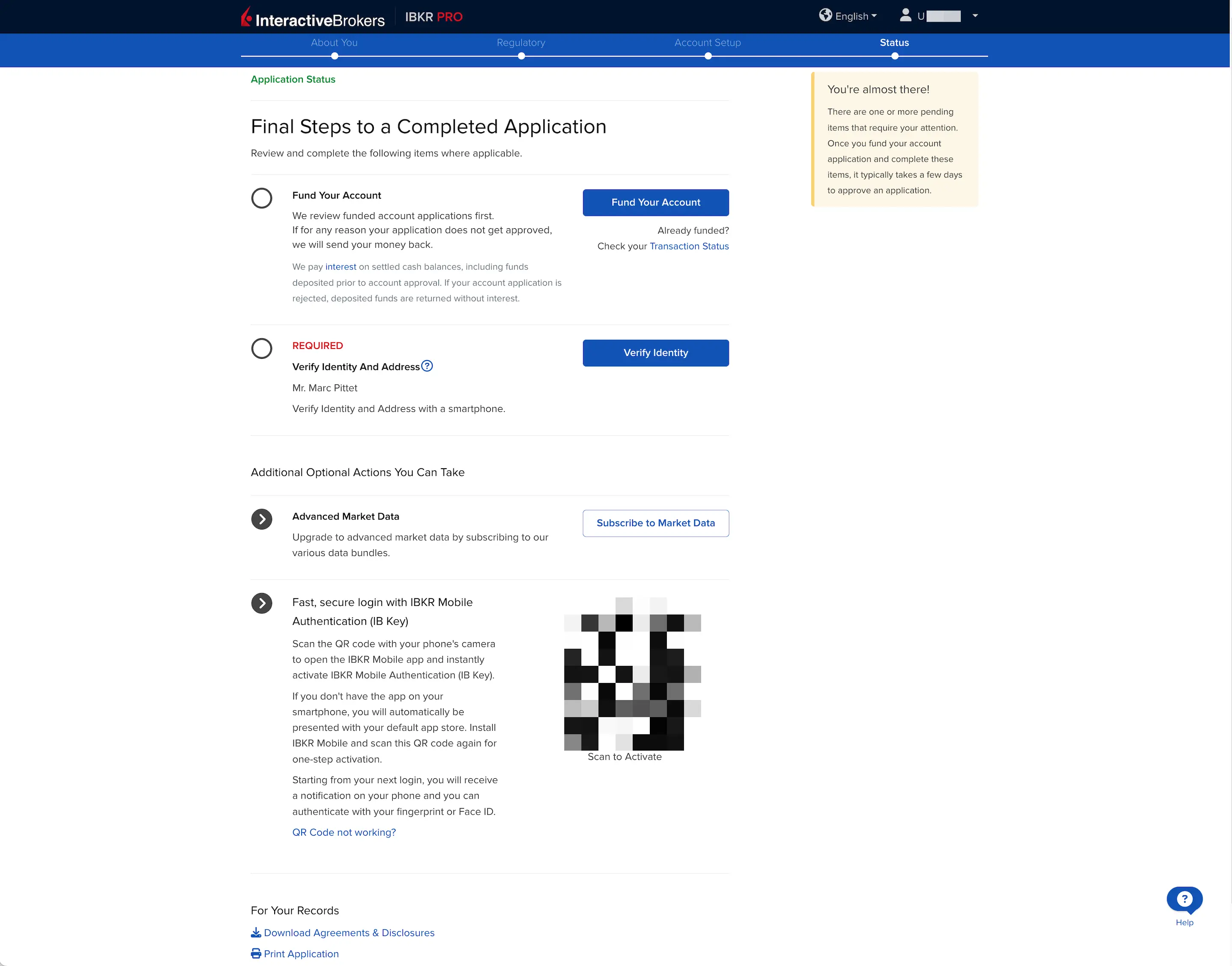

You will then be presented with this screen indicating that your account opening at Interactive Brokers Switzerland is (almost) complete, and that all you have to do is upload your proof of identity.

And if you want to speed up the processing of your application, I recommend that you make an initial deposit into your IBKR account at that time (we’ll see how to do this in one of the next chapters of the guide).

Congratulations!

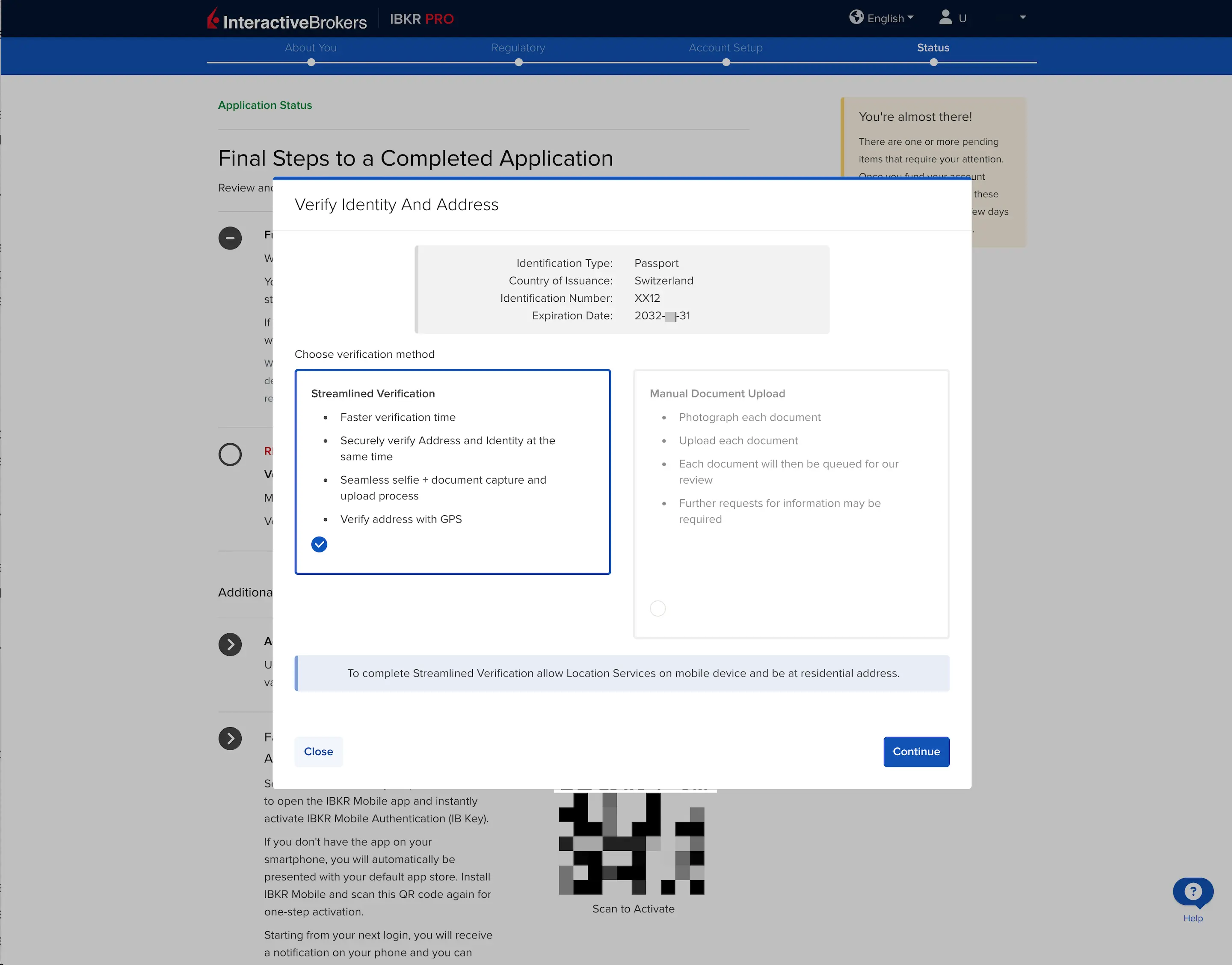

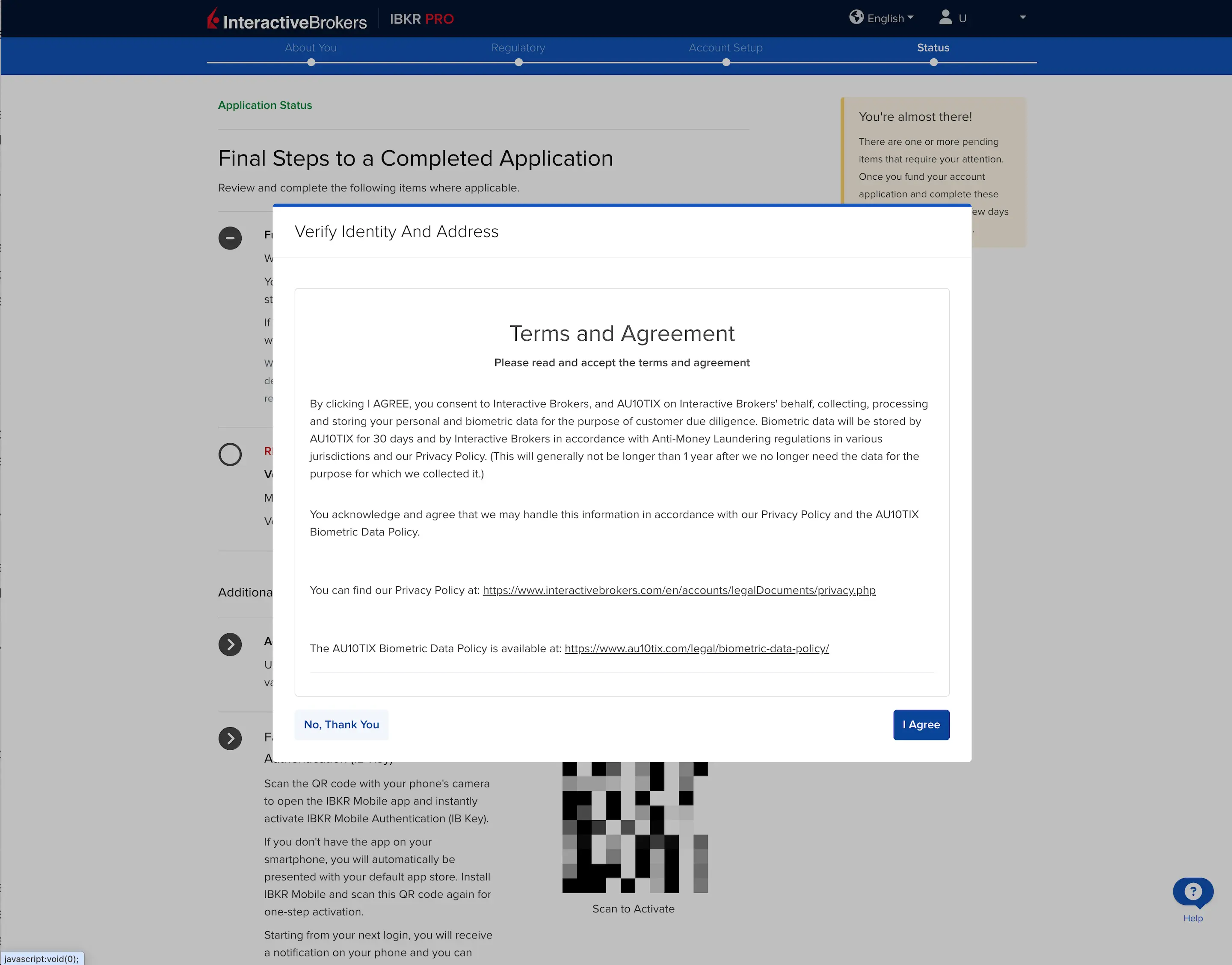

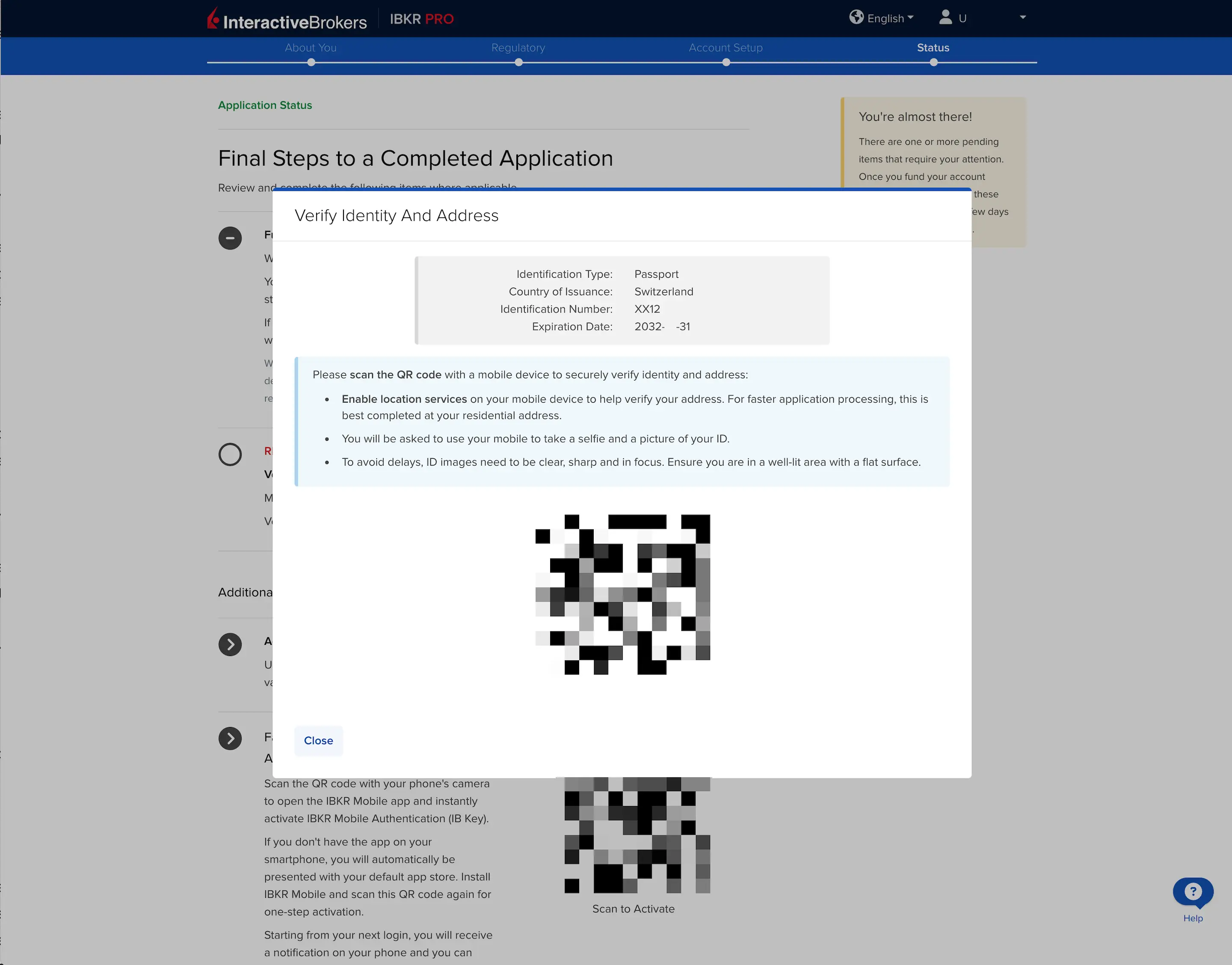

16 — Proof of identity and address

Here is what the screens look like for verifying your proof of identity and address:

Then you will be guided on screen to take a photo of your ID and a selfie.

Congratulations, you’ve finished opening your Interactive Brokers account!

And that’s it, it’s done. All you have to do now is wait 1-2 business days for your account to be opened (and enjoy the low transaction fees, as well as the no custody fee!)

But to make it fully functional, you still have two key steps to take: secure your access, and fund your account.

This is what we will look at together in the next two chapters.