We’re getting closer to the ultimate goal of buying your first ETF (or stock) on Interactive Brokers.

But before you do, it’s important that you know how to convert your currency into foreign money via the best online Broker: Interactive Brokers Switzerland.

Important reminder: Why would I want to exchange money into another currency on Interactive Brokers (forex)?

When people start to invest in the stock market, many Swiss investors think that they will be able to use the same Swiss francs that they have transferred to their IB account.

On the one hand this is right, you can purchase CHF stocks and ETFs, but on the other hand it would also mean that you would limit yourself to CHF products only. This means that Swiss and European investors would miss out on other opportunities to make their cash grow. That would be a pity.

Some examples of why you might want to convert currencies via your Interactive Brokers account are listed below:

- Buy your favorite ETF that is perfectly diversified between developed and emerging countries of the world: I am obviously talking about the Vanguard VT ETF which is bought in US dollars

- Buy Japanese net-net shares (via value investing) in yen to aim for returns above 10%!

- Convert a lot of CHF cash in EUR to buy your rental yield building in France while saving hundreds or even thousands of CHF compared to exchanging this money via a standard bank (by doing: your Swiss bank account > transfer to IB > currency change > re-transfer to your euro bank account)

- Change currencies like CHF to USD at the lowest price, in anticipation of a big trip, and save several hundred CHF on your vacation!

The question that usually comes next is: “But is it really cheap to exchange money at Interactive Brokers?”

I answer questions like this as follows: “Have you ever heard of ‘forex trading’?”

You must have seen movies where people wear suits and trade currencies. Just like the movie “The Wolf of Wall Street”.

The first thing to clarify is to explain that “forex” means “Foreign exchange”, or “currency change”.

As a reminder of how forex works: forex is the market where currency pairs such as EUR.USD or CHF.EUR are traded.

So by exchanging cash directly on the forex via Interactive Brokers, you are sure to get the best price at a given time because you buy/sell at the source.

CHF 1.78 of Interactive Brokers fee to change ~CHF 15'000, and this with the best possible exchange rate because we convert our currencies at the source (aka on the forex)

Instead of going through an intermediary such as a bank that adds “exchange fees” (and I don’t speak about potential custody fees depending on your account type) which usually means a higher exchange rate to you.

If you want to see this for yourself, just visit the live exchange rates page on the Interactive Brokers website here.

Now that you have heard about the different advantages of changing your CHF via the Interactive Brokers Group, and that this is also the cheapest place to change currencies, let’s see how it works in practice.

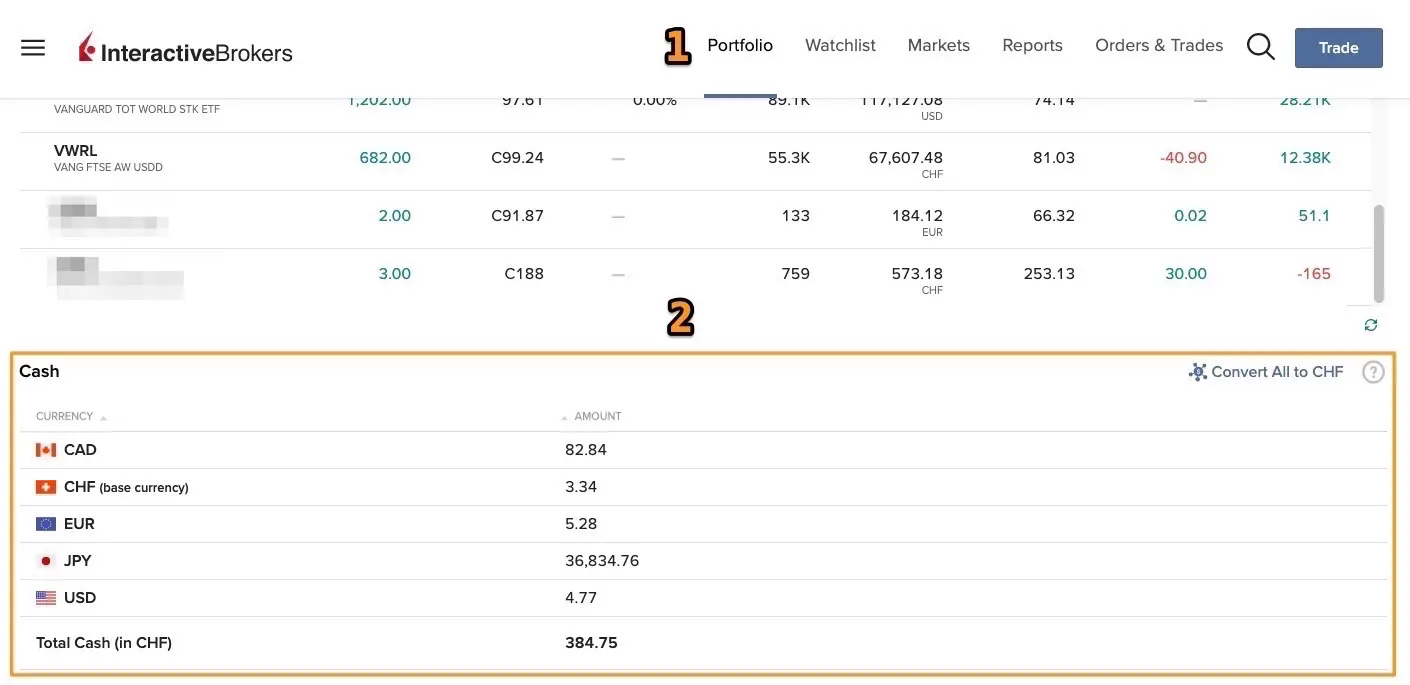

Step 1: Look at the currencies you have on Interactive Brokers

Once you arrive on the Interactive Brokers web platform, I’ll show you how to know how much cash you have and in which currencies (because yes, it’s going to be hard to convert USD to EUR if you don’t have USD in the first place :D)

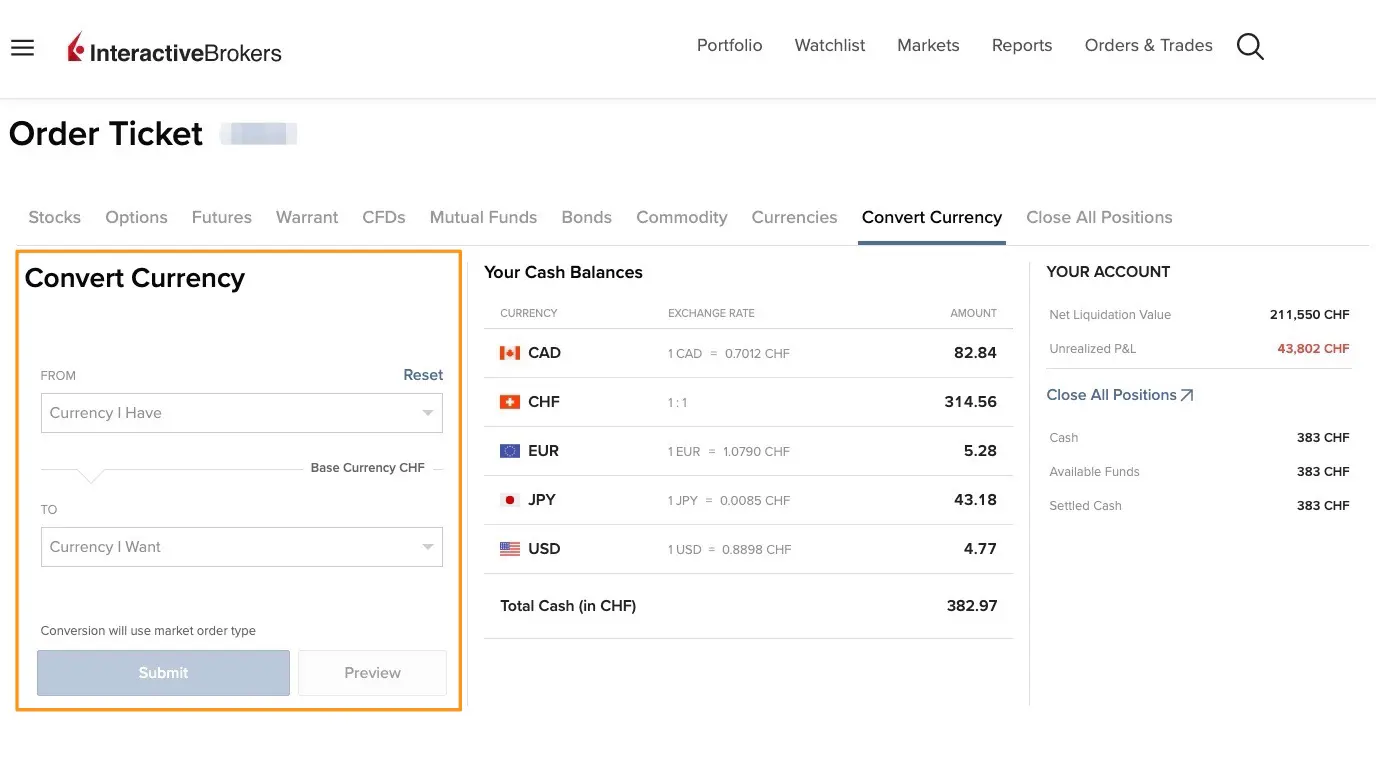

Choose the portfolio section (1), then you will be able to see at the bottom of the screen (2) your available cash in each of the currencies you own

Step 2: Convert currencies with Interactive Brokers

You are very lucky, you who read this guide today, because it has become so much more user-friendly on IBRK to exchange currencies, whereas before it was at the limit of cryptic (cf. point 1 of this old article).

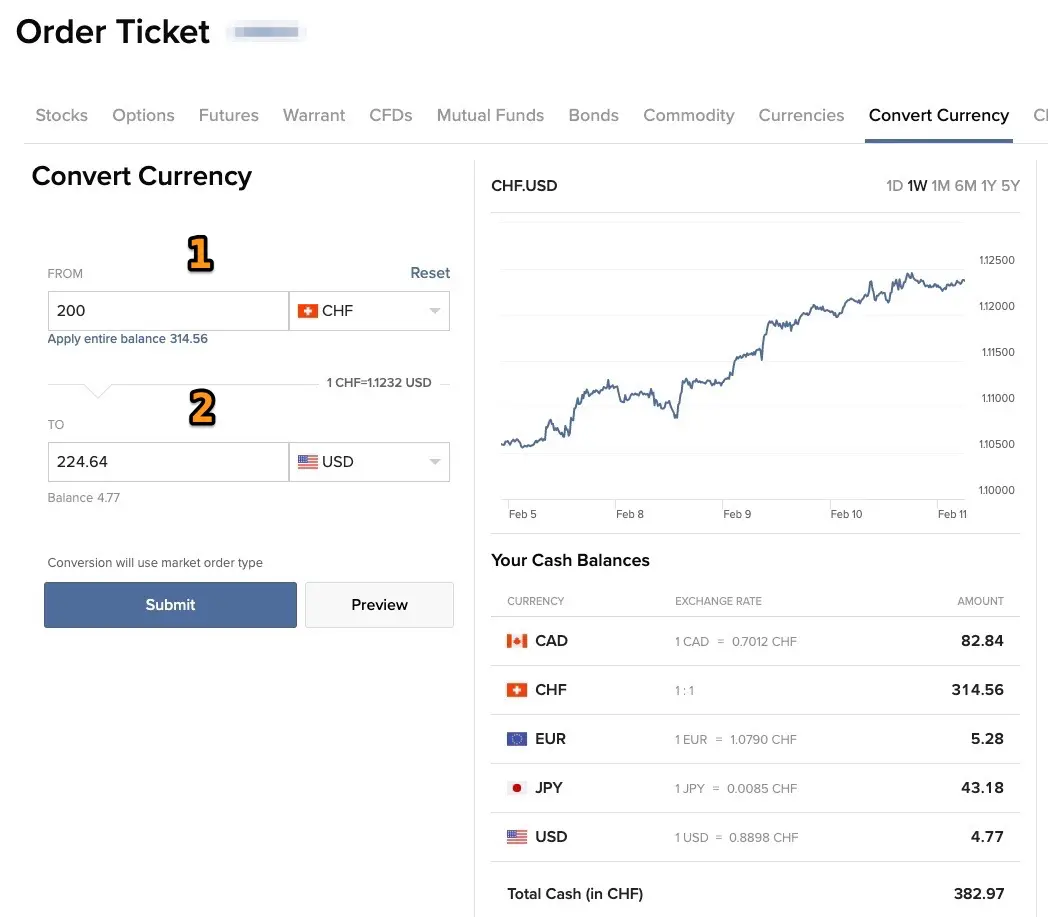

For our example, I will show you how to convert CHF into USD. This is my most common case when I buy my favorite VT ETF.

But if you want to convert CHF into EUR, or any other currency combination, it’s the same process.

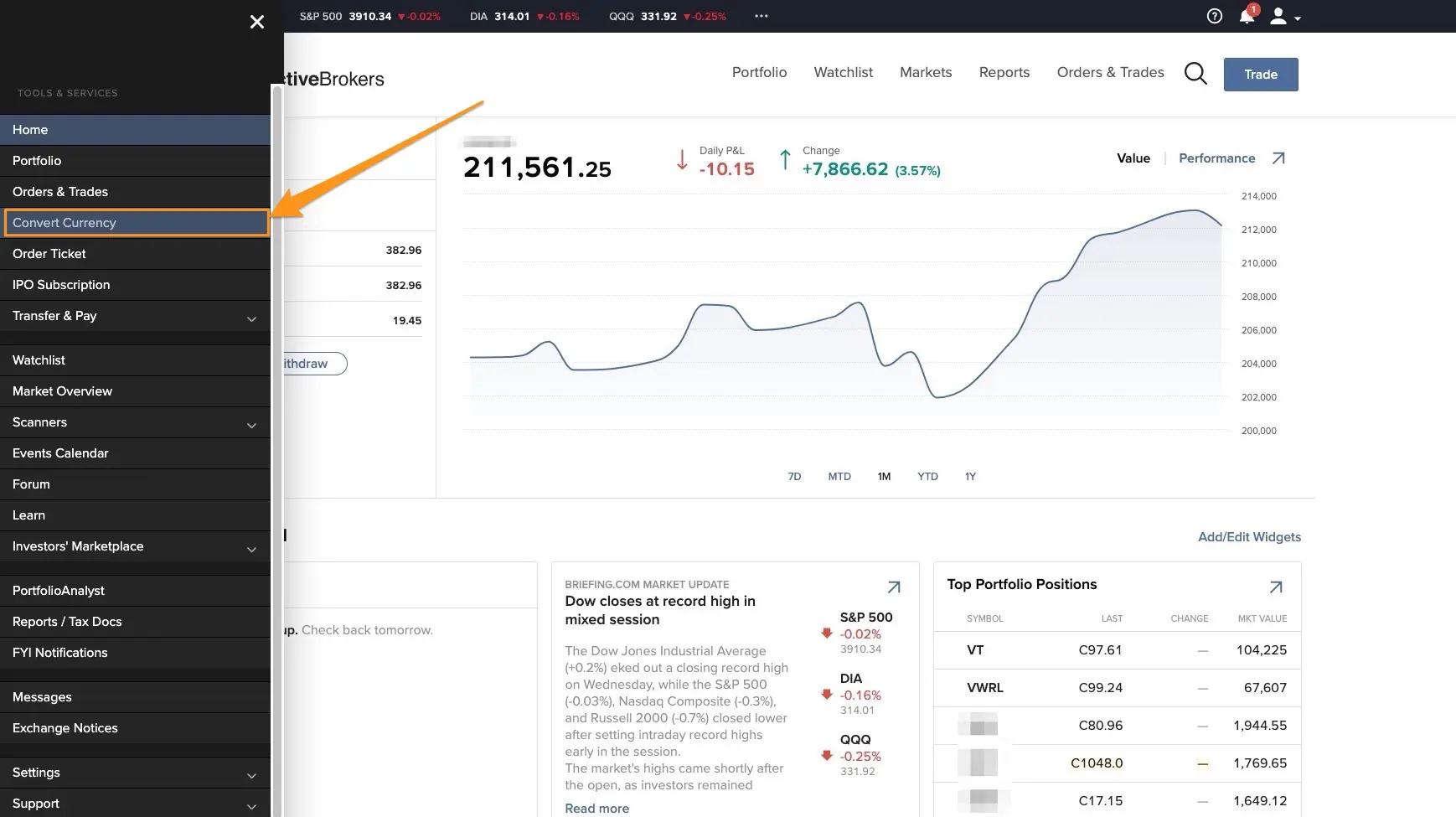

First of all, you need to click on “Convert Currency” in the menu (if it is not displayed, it means that you are not logged in with trading authorization but just in “Account Management” mode; the probable reason is that you are also logged in to your Interactive Brokers application on your smartphone, so log out on your smartphone):

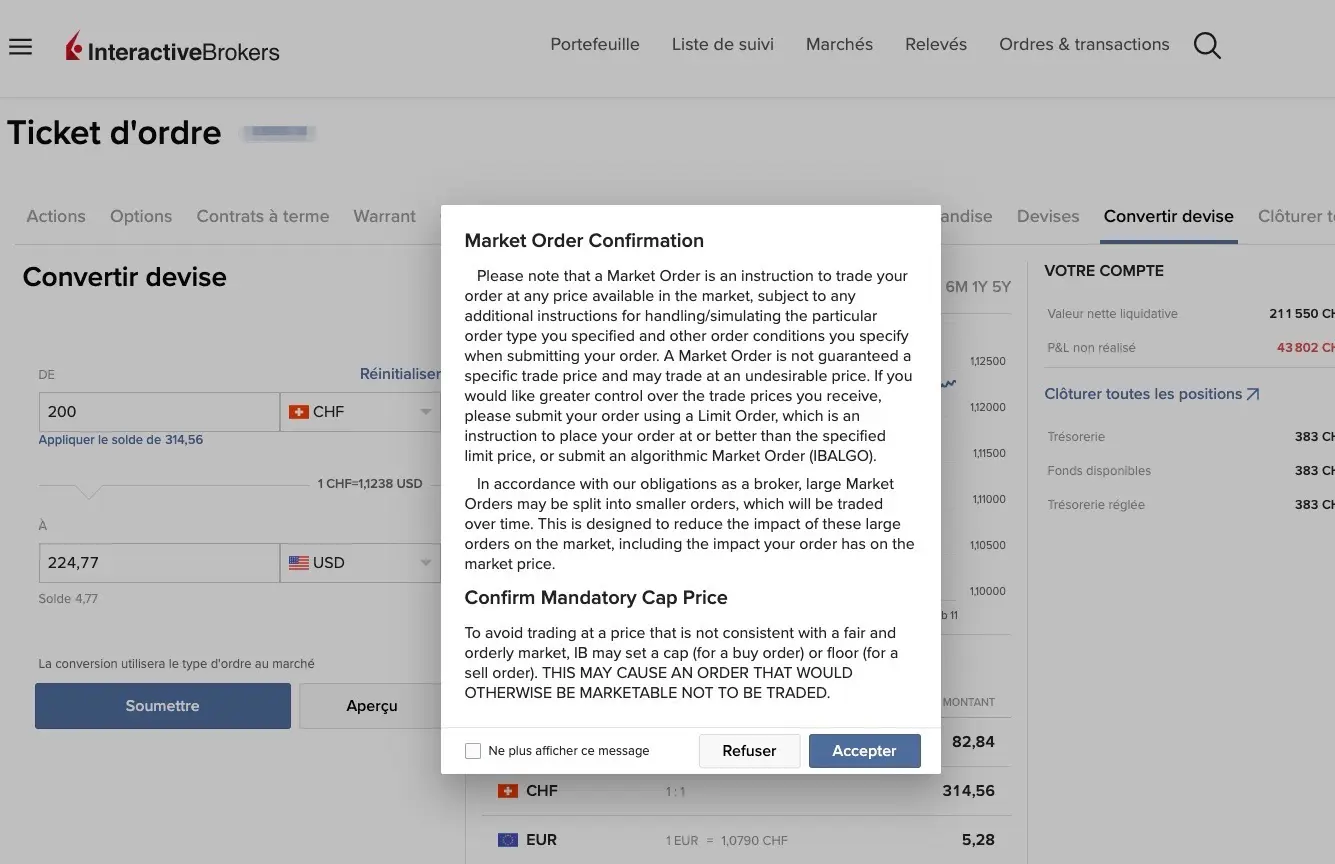

Then you just have to enter how many CHF you to convert (1) — CHF 200 in my example, and it tells you how much you will have in USD (2)

A little 'Warning' from Interactive Brokers that explains you that you have no guarantee on the fx conversion rate etc. etc. — Accept and no longer display this message as far as I'm concerned :)

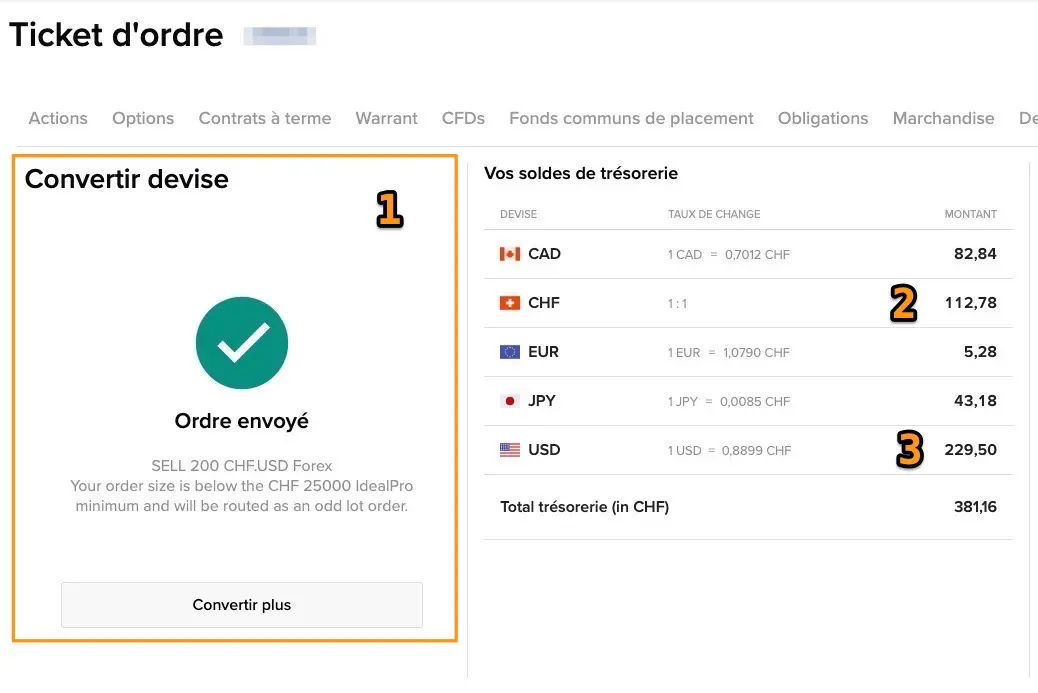

And here we are, our currency conversion order of CHF 200 into USD has been successfully completed (1). You can see that now I have CHF 200 less + the CHF 1.78 exchange fee from Interactive Brokers (2), and some more US dollars (3)

Interactive Brokers has done a great job of harmonizing its web platform with its IBKR mobile app. So much so that I find myself doing more and more of this kind of currency trading on my smartphone.

And if you want to convert other currencies, like CHF to EUR, or USD to CAD, then it’s still the same process as described above.

Also, if you want more granularity in the exchange parameters used (like setting a maximum exchange rate for example, or choosing between FXCONV or IDEALPRO), you can read my older, more complex article on this topic — personally, I only use the method described in this guide because it is so much simpler.

Step 3: Wait until your converted currencies are available to buy securities

I listen to you mumbling behind your screen: “What do you mean, MP, I can’t get direct access to my cash in my new currency on Interactive Brokers?!”

I had the same reaction as you when I learned the meaning of the word “settled cash” on this brokerage firm.

Basically: at the moment you clicked “Submit order” to validate your currency exchange transaction on Interactive Brokers, the computer program will launch a request to exchange your cash in your original currency, and receive cash in another currency in exchange.

And it is this process, which looks so simple on the Interactive Brokers web interface, that is actually more complex behind the scenes.

If you’re interested, I’ll let you read it on Wikipedia: settlement (finance).

In the end, what this means is that on average, you will have between a few hours and up to 2-3 days between the time you exchange your currencies, and the time you can use them to buy ETFs/shares/other securities.

In reality, when I convert my currencies from CHF to USD, I can directly buy my securities straight back most of the time. But if it’s not the case in your situation, at least you know why! :)

N.B. Other important information for currency conversion: central bank holidays!

This happened to me around July 4th two years ago. I had just converted about CHF 10'000 in USD to buy my favorite VT ETF. And I didn’t understand why it was taking so long to make this currency conversion.

No matter how hard I tried to redo the transaction, I kept getting the message “YOUR ORDER IS NOT ACCEPTED. THERE IS INSUFFICIENT SETTLED CASH [-180 USD for 20190704] IN YOUR ACCOUNT TO OBTAIN THE DESIRED POSITION” which means that I didn’t have enough cash to buy my ETF VT. But I had just waited 1-2 days after my conversion from CHF to USD on Interactive Brokers.

I hadn’t taken into account that the central bank of the US, also known as the Federal Reserve Bank of the United States, was on vacation on July 4th (national holiday, aka Independence Day). And so, nothing gets settled on the holidays of the central bank of the currency you want.

That’s how I discovered this vacation calendar for “currency settlement” on the Interactive Brokers website.

Now you know how to convert currencies in the most frugal way in the world via your Interactive Brokers account.

In the next chapter, we will FINALLY get down to business: buying your first ETF!