If you want to be part of the 1/3 of the Swiss population who own a property, you’re going to come up against the big question: which is the best mortgage in Switzerland?

This is closely followed by the Saturday night chat among friends (or, for the more mature among us, Sunday lunch with an aunt who “knows all there is to know”) which quickly moves onto the unavoidable current best fixed rate.

If I could join you and auntie (haha), I’d interrupt:

What if the interest rate of a mortgage WASN’T the only criteria to consider, and maybe not even the most important?

In any case, this is the crucial information that I’d have liked to know in my thirties when we were looking to buy our home…

It would have enabled me to avoid making two crucial mistakes, which cost me several tens of thousands of francs in cash… (and that’s without even mentioning the compound interest…)

The 5 criteria for choosing the best mortgage in Switzerland

There are five criteria to consider choosing your mortgage in Switzerland:

1. Flexibility in calculating the debt-to-income ratio

Typically, your bank will assess your ability to cover the costs of your primary residence (mortgage interest, amortization, maintenance, and other expenses) using a standard rule: the total costs should not exceed 33% of your total earned income.

This 33% rate is also called debt-to-income ratio, as the bank wants to ensure that you will be able to pay your mortgage rate and the amortization.

However, some banks are more flexible than others with this calculation. Some are willing to simply increase the ratio limit, and others may take additional income into account (not only the salary).

All of that depends on the policy of the bank management at a given moment. The best way to find out is to go and see a maximum number of banks (the Banque du Léman is more flexible on this point from what I know, for example).

2. The cash deposit required by the bank

Some banks are more flexible than others regarding the cash deposit required for a mortgage in Switzerland. The general rule is a 20% deposit from your own funds and an additional 5% for notary fees, allowing you to finance 80% of the property’s value.

A typical example of flexibility is that some financial lenders are OK with lending you up to 85% of your property’s value, and you therefore don’t need to use cash for the 5% notary fees. Instead, you can make this money work for you by investing intelligently in the stock market.

For a property like a main residence, we’re talking about a timescale in terms of decades. So the opportunity cost you miss out on by tying up cash in bricks and mortar can be counted in tens or even hundreds of thousands of CHF.

3. The bank’s estimated value of your property

Another key point which is rarely mentioned when discussing mortgages among friends is the value of your property as estimated by the bank. Some banks are very conservative, while others are more optimistic.

Why does this affect you? Quite simply because the bank lends you a percentage of the property’s value. And it’s the bank which sets this value. Because no, the bank doesn’t use the sale price…

This means, as with point 2 above, that you might use more cash from your own money, depending on how the bank has estimated your future dream home. And taking out more cash to tie it up in property means an opportunity cost lost where this cash could have been working for you if it had been invested elsewhere (in the stock market or in a rental investment property for example).

4. Being able to use your 3a invested in the stock market as collateral

The best 3rd pillar A in Switzerland for a Mustachian is one that you can invest 100% in stock market shares (see my full comparison of 3rd pillars here).

However, most banks and insurance companies in Switzerland typically don’t accept a 3a pillar invested in the stock market as collateral, especially if it’s not managed by them. While technically feasible, it’s rarely offered as an option for a mortgage in Switzerland.

This is important because if you can’t use your 3a as collateral, that means you need to take this money out of your own cash funds. Again, opportunity cost lost by tying up your money in bricks and mortar…

5. The mortgage interest rate

Lastly, there’s the mortgage interest rate. This much discussed the best Swiss mortgage rate that you’ll have to pay every quarter or half-year (depending on your contract) to the bank for lending you money as a mortgage. All Swiss people focus their attention on this last factor, because of banks, who highlight this in their marketing campaigns.

Yet, as we’ll see in the following example, the mortgage rate is the criteria that has the least impact compared to the other four…

Example of the importance of these criteria

Let’s see how these criteria can guide your choice. I’m going to deliberately take a very striking example.

Let’s imagine that you want to buy a house for CHF 900'000 in the countryside near Aarau or Payerne.

Also, let’s assume that we’re talking about:

- A period of 10 years

- A fixed mortgage interest rate

- A stock market return of 8%

After two appointments with bank A and bank B, you’ve received the following mortgage offers:

- Bank A:

- Mortgage interest rate: 1.5%

- Own money in cash: 25% (20% of the amount loaned by the bank, and 5% for the notary fees based on the sale price)

- Bank’s estimate of the house: CHF 750'000

- So you need CHF 345'000 (as 20% of 750'000 + 5% of 900'000 + the difference between 900'000 and 750'000 = 150'000 + 45'000 + 150'000)

- Interest to pay over 10 years on CHF 750'000 mortgage: CHF 112'500

- Bank B

- Mortgage interest rate: 1.65%

- Own money in cash: 20% (as the bank agrees to finance you with a mortgage up to 85% to cover the 5% notary fees)

- Bank’s estimate of the house: CHF 900'000

- So you need CHF 180'000 (as 20% of 900'000)

- Interest to pay over 10 years on CHF 765'000 mortgage: CHF 126'225

If we put that into a table, this is what it shows:

| Initial cash required | Opportunity cost (10 years, 8%) | Interest over 10 years | |

|---|---|---|---|

| Bank A | 345'000 | 112'500 | |

| Bank B | 180'000 | 126'225 | |

| Difference | 165'000 | 356'228 | 13'725 |

The difference in interest of the mortgages (CHF 13'725 more for bank B over 10 years) remains significantly below the potential opportunity cost over 10 years if you invest the CHF 165'000 available in the stock market to make your cash work.

Mortgage on fixed rate or SARON rate (for a Swiss Mustachian)?

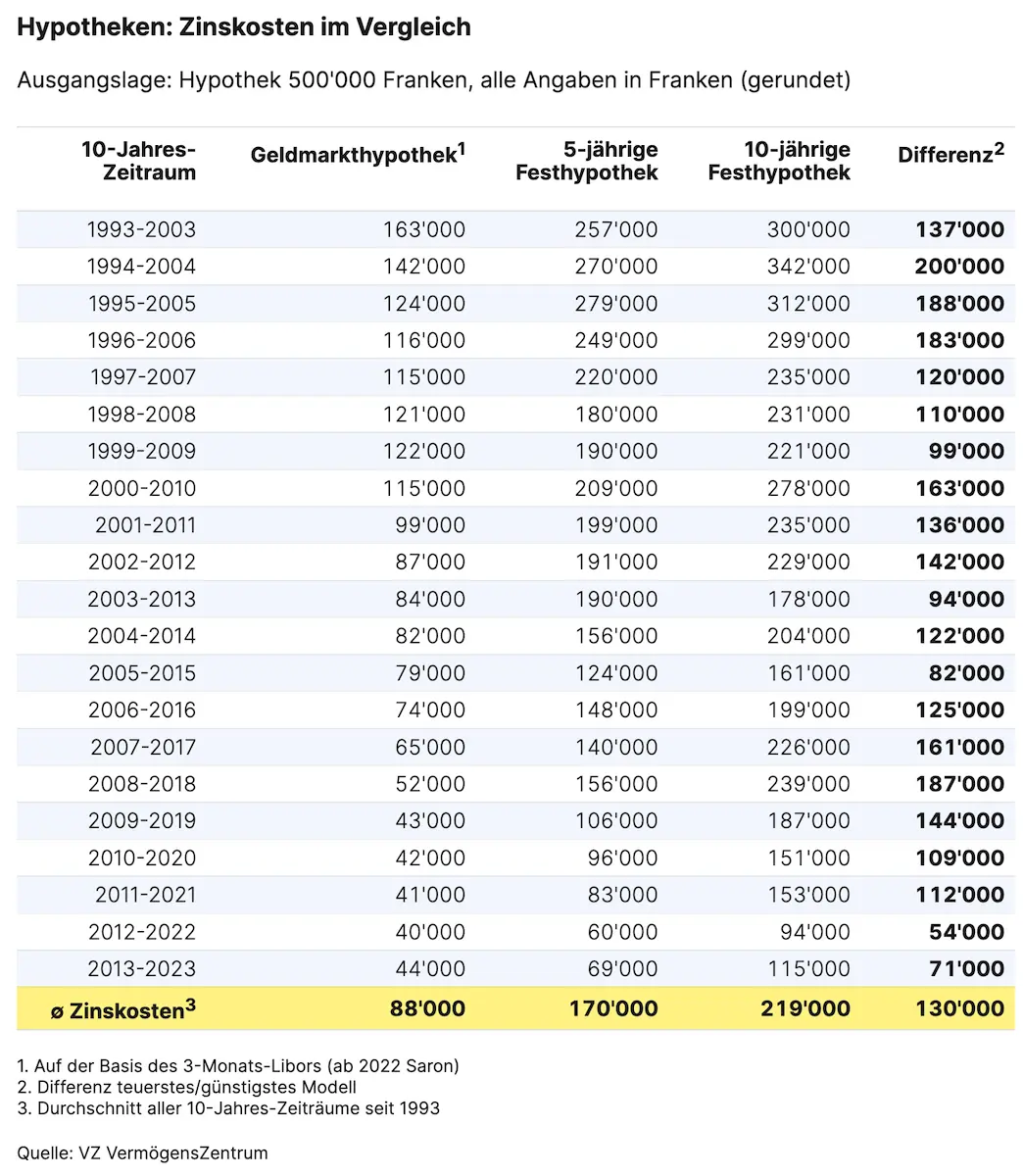

Historically, the SARON rate (formerly LIBOR rate) has always been more attractive than any fixed rate. The data aggregated by VZ show this year after year.

There’s no question about it, here’s the evolution of rates, simulated since 1993:

I’ll mention VZ again as they are truly independent: “As a general rule: the longer the mortgage period, the higher the intermediary’s [bank or so-called adviser] margin. They therefore clearly have an interest in recommending fixed-rate mortgages for the longest period possible because that’s how they’ll earn the most money.”

So build up your Mustachian muscles by putting aside a safety buffer to absorb the quarterly rate changes in the money market (aka SARON), and take out a SARON mortgage!

The only valid exception for taking out a fixed rate is if negative rates make a return.

And don’t forget to negotiate your SARON rate! See the FAQ at the end of this article for more details.

Remark concerning mortgage tranches…

Another strategy of financial lenders for tying you to them is to offer you mortgage tranches of different durations.

Let’s look at an example of bank U which has sold you 3 different maturity models:

- Tranche 1: CHF 500'000 over 3 years

- Tranche 2: CHF 300'000 over 5 years

- Tranche 3: CHF 100'000 over 10 years

At the end of the 3 years, you decide that bank U isn’t really the best for Mustachians. So you start to look around elsewhere, and you find better at bank V.

So you go to see banker U to tell them that you want to change bank… except that they’re not going to let you leave with your tranches 2 and 3.

Similarly, bank V isn’t going to agree to only take you on for remortgaging tranche 1… it’s all or nothing…

And so you find yourself stuck like a fool for a decade…

The solution to that: ALWAYS take out equal length mortgage tranches to be FREE to act at the end of the tranche periods.

Indirect amortization via 3a pillar: yes, but be careful!

Now that’s clear, let’s move on.

Yes, indirect amortization via a 3a pillar is a good idea because you gain financially (you’ll find detailed examples in this article).

If you want to get the Mustachian gold medal, the best strategy to increase your wealth in the long term is to choose a 3a pillar that is 100% invested in stock market shares (like VIAC or finpension).

However, the only bank (to my knowledge) which allows you to amortize your mortgage via such a 3a invested in the stock market is VIAC’s solution: you take out your mortgage from their partner bank WIR, and you can use your VIAC 3a as collateral AND as indirect amortization.

This is the option Mrs MP and I chose for the mortgage on our main residence (meaning privately inhabited).

Comparison tool for Swiss mortgage rates

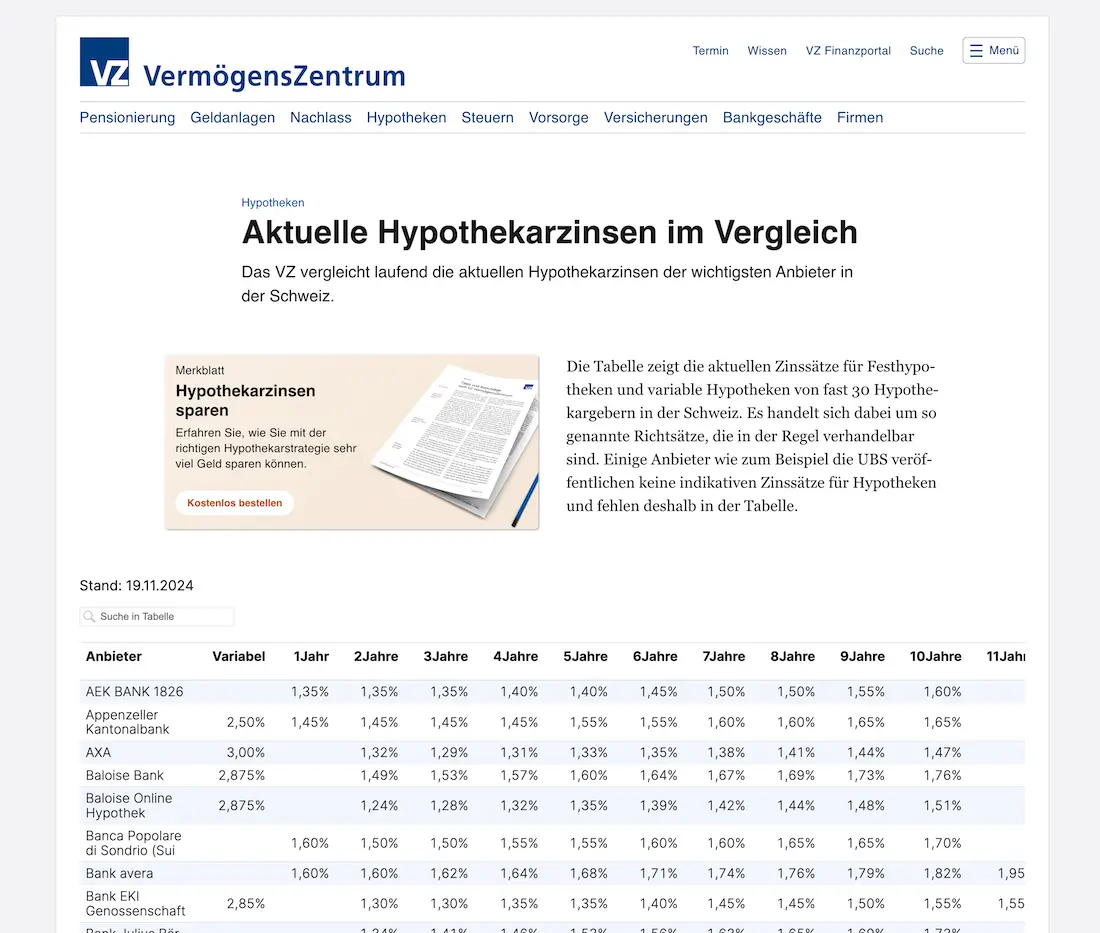

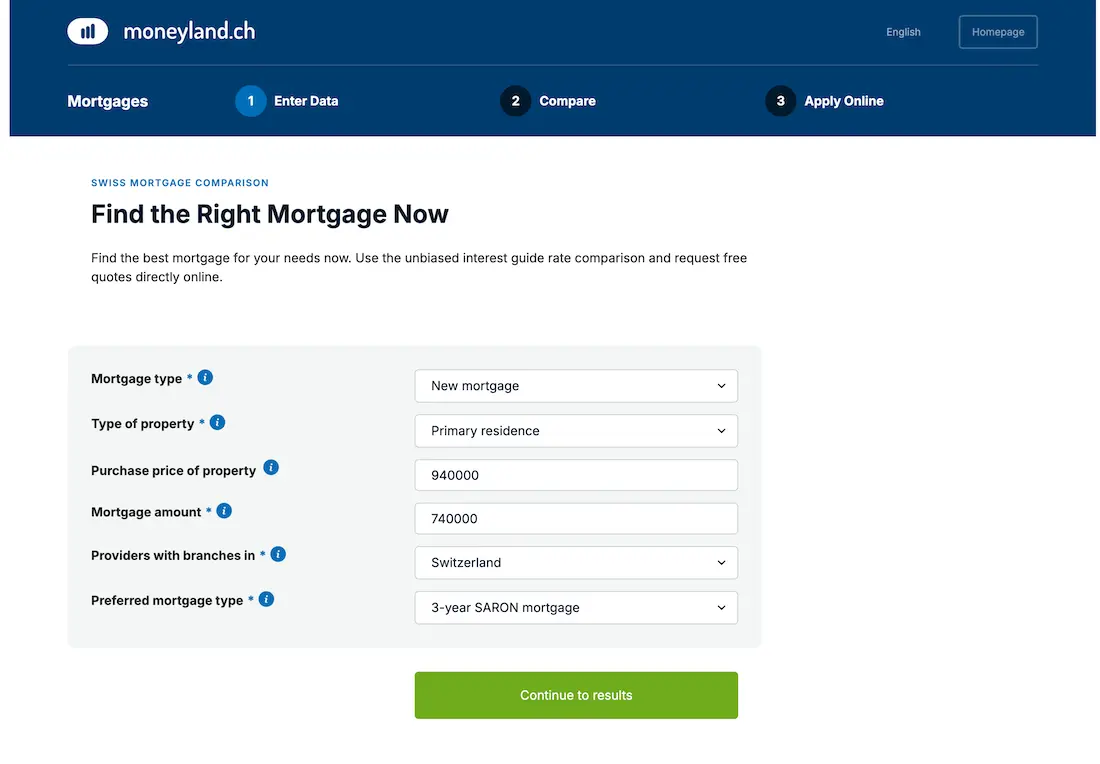

To get an idea of current mortgage rates, I use two tools from VZ and Moneyland. For me, they’re the most independent without bombarding you with ads, which can lead you into making a mistake in your mortgage choice.

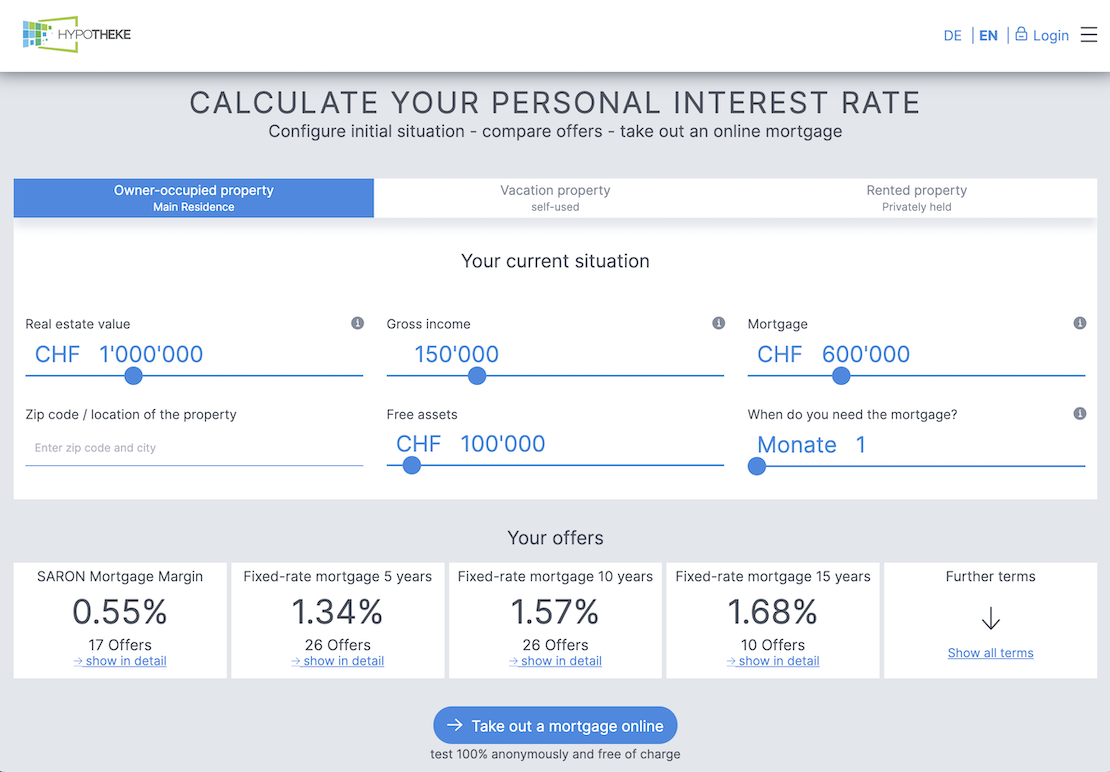

Then, to compare mortgages with my own situation, I use the Hypotheke.ch service (more details in this article) which allows you to search for and conclude your mortgage entirely online, and 100% independently. It’s the best online service available today.

Process for finding the best mortgage

Here’s my strategy if I needed to take out my first mortgage (or remortgage) today in order to find the cheapest interest rate:

- I go onto VZ’s comparison website for Swiss mortgage rates to get the lie of the land

- I use Moneyland’s tool for comparing mortgages to cross-reference the data

- I request a mortgage offer via Hypotheke.ch including requesting the details regarding the 5 key criteria listed above, to obtain the best mortgage in Switzerland

The best mortgage in Switzerland 2025 for a Mustachian

As we saw with the 5 key criteria, it’s very difficult to determine THE best mortgage in Switzerland. Basically, banks take a perverse pleasure in keeping things vague to get you to come into their offices and dazzle you with mortgage rates (so they can do the opposite with the other four criteria).

If I, personally, had to renew a mortgage again today, I’d go even further by requesting the best mortgage from the online service Hypotheke.ch and from VIAC. That would enable me to be sure I wasn’t missing a good opportunity.

And from my recent experience in 2022 (the year in which I remortgaged), VIAC and Bank WIR are just about on top in all the 5 criteria.

I’d go even further, as the VIAC mortgage allows you to:

- Obtain finance of up to 100% of your main residence!!!

- Use your 3a pillar as collateral even if it’s 100% invested in shares (VIAC takes the value of the 3a at a given time)

- Negotiate the best rates for you directly (so nice!) — always in the top 3 of the market from my observation

The first two points are key as they enable you to keep a maximum amount of cash out of being tied up in the property, and therefore be able to make this money work elsewhere (in the stock market), with the compound interest effect that we saw earlier…

For me, the VIAC mortgage is currently the best Swiss mortgage for 2025.

A few financial lenders might occasionally offer better deals than VIAC, saving you several thousand francs over 10 years through temporary marketing promotions. Since offers change frequently, it’s essential to compare options. As Raiffeisen banks operate independently, they should always be part of your mortgage Switzerland comparison.

Conclusion

The lucrative mortgage market in Switzerland is starting to see challenges from financial institutions such as Hypotheke.ch and VIAC. I hope that the likes of finpension and neon will bring even more competition to the market, which will benefit us future owners.

The figures in question are too large for you to make a hasty or emotional decision.

As a future first-time buyer, I recommend that you:

- Prepare a list of the key criteria to analyze

- Don’t allow yourself to be pressured by anyone

- Get the best offer from Hypotheke.ch and VIAC

- Negotiate the best one

- Take out your mortgage with confidence

And if you have a strong aversion to negotiating or talking to these bankers, then choosing the VIAC mortgage will always be a sound choice — so says a Mustachian!

FAQ

What about MoneyPark’s services?

I’m fairly critical of MoneyPark’s services, particularly after having interviewed 11 of their clients about their real-life experiences. I’ll let you read all the details and my conclusion in this article.

What is the SARON rate?

The SARON rate is a benchmark interest rate for the Swiss money market, which reflects the rates at which banks lend each other funds on a very short-term basis (overnight).

When the SNB (Swiss National Bank) adjusts its base rate, it influences the cost of financing on the money market, which impacts SARON. If the SNB increases its base rate, SARON also tends to increase, as banks need to pay more to borrow funds in the short term. Conversely, if the SNB reduces its base rate, SARON decreases.

Is it possible to negotiate your SARON rate?

When a bank lends you money via a mortgage at the SARON rate, the bank takes a margin on the SARON rate.

It’s this margin that you can contractually negotiate to reduce your mortgage costs.