Last updated: October 12, 2024

In the last article, we looked at how to open a DEGIRO account. Now let’s take action and buy your first ETF!

Being able to purchase the VWRL ETF for extremely low commissions at DEGIRO (with just a 1€ handling fee) is one of the reasons why I chose this online broker as a Swiss investor.

As a reminder, I opened an account at DEGIRO for the money we invest for our children (CHF 100/month) because we are not going to reach the invested amount of CHF 100'000. If this had been the case, then we would have chosen Interactive Brokers because above 100kCHF there is no longer the monthly fee of CHF 10. For your information, this is the online broker that Mrs. MP and I use for our own investments.

DEGIRO updated its user interface during the last quarter of 2019, and it has become even simpler than before to buy an ETF on this broker.

Why the ETF VWRL (in EUR on the Amsterdam stock exchange!) as a Swiss investor?

In case you come across this blog for the first time, you can read my article explaining how I build my ETF portfolio.

Then, know that until the end of 2019, I was always buying the VT ETF. Except that the new European regulations PRIPs require that from 01.01.2020 any ETF offered on a trading platform has a KIID (aka. informative document for the investor explaining the corresponding ETF product). And some brokers, such as DEGIRO, have therefore withdrawn this VT ETF from sale to European investors because they do not (yet?) have a KIID translated into all languages for the VT ETF.

My second choice for an ETF that covers the world is the VWRL ETF.

You can buy this VWRL ETF (whose ISIN identifier is IE00B3RBWM25) on several markets and in several currencies (including the Swiss stock exchange in CHF).

But there’s an important point to note with DEGIRO.

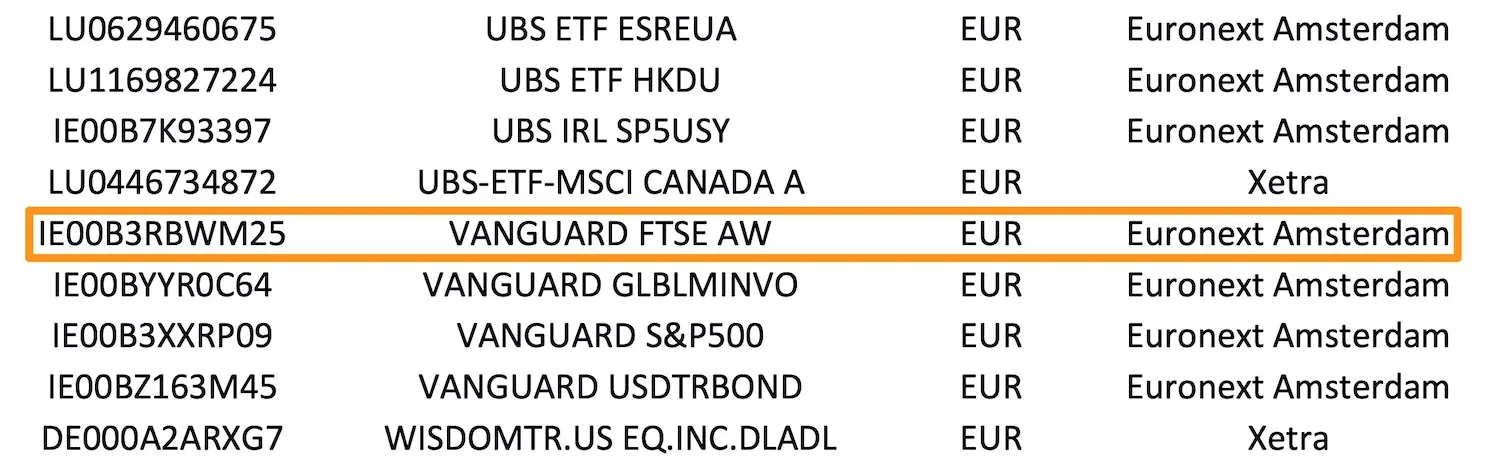

The online broker DEGIRO offers a list of extremely low commissions ETFs (i.e. no transaction fees, just a 1€ handling fee). And the VWRL ETF is one of them as you can see on the screenshot below:

The important information to note is that the extremely low commissions VWRL ETF at DEGIRO is the one you buy on the “Euronext Amsterdam” stock exchange in euros.

As we are both Swiss investors, this means that our base currency at DEGIRO is CHF. So when you buy the VWRL ETF in euros, you have to pay 0.25% of the transaction amount in exchange fees to DEGIRO.

With the example of the CHF 100 per month for my children, this amounts to CHF 0.25 in exchange fees.

Now that this has been clarified, let’s move on to buying your first VWRL ETF on DEGIRO!

Step 1: Login to your DEGIRO broker account

Just go to degiro.ch and click on “Login” then sign in:

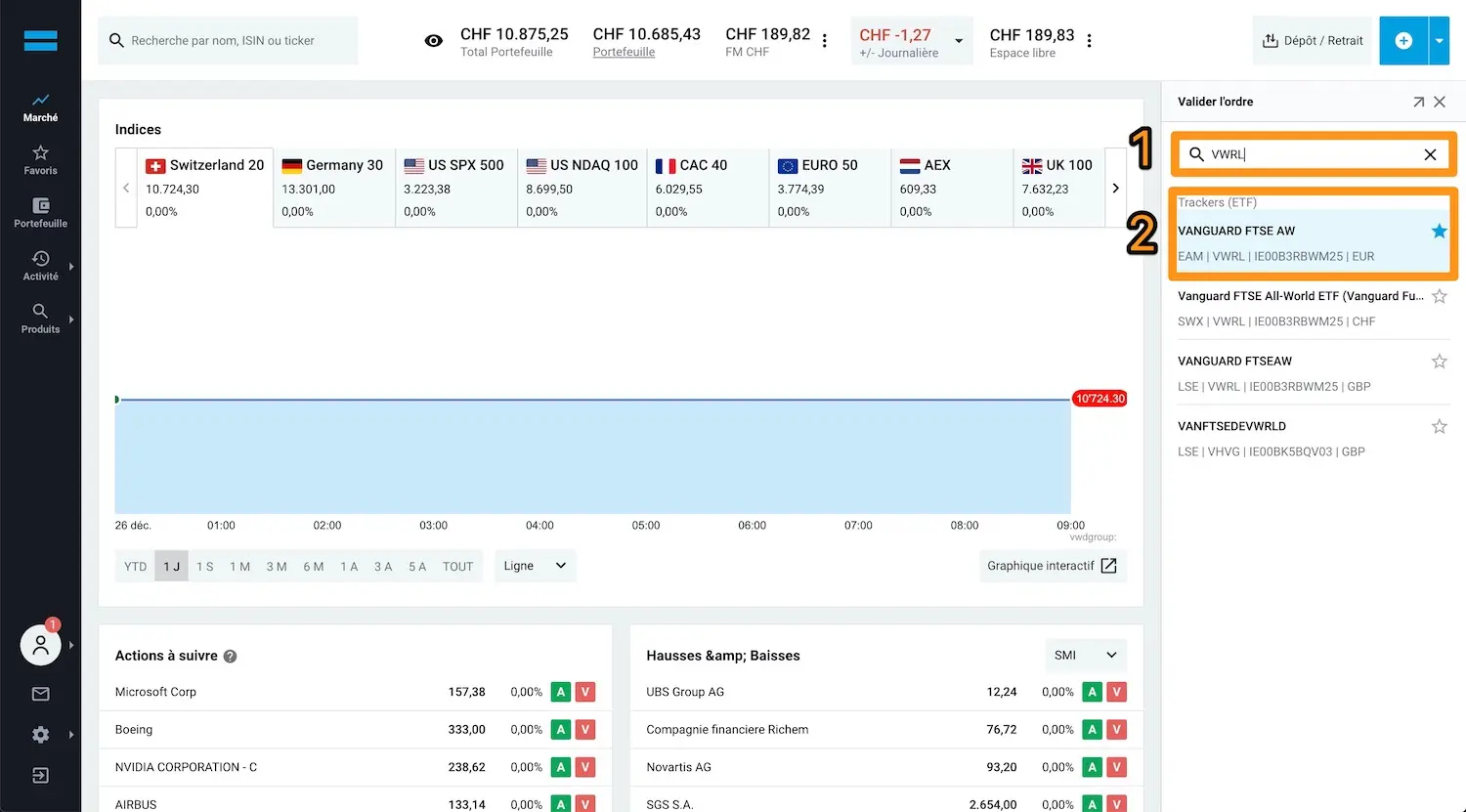

Step 2: Buy ETF VWRL on DEGIRO

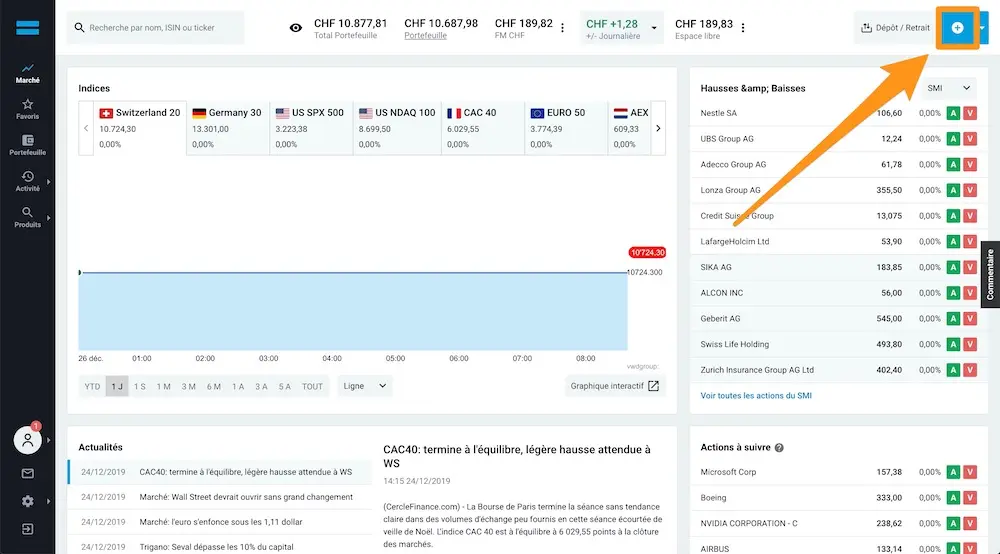

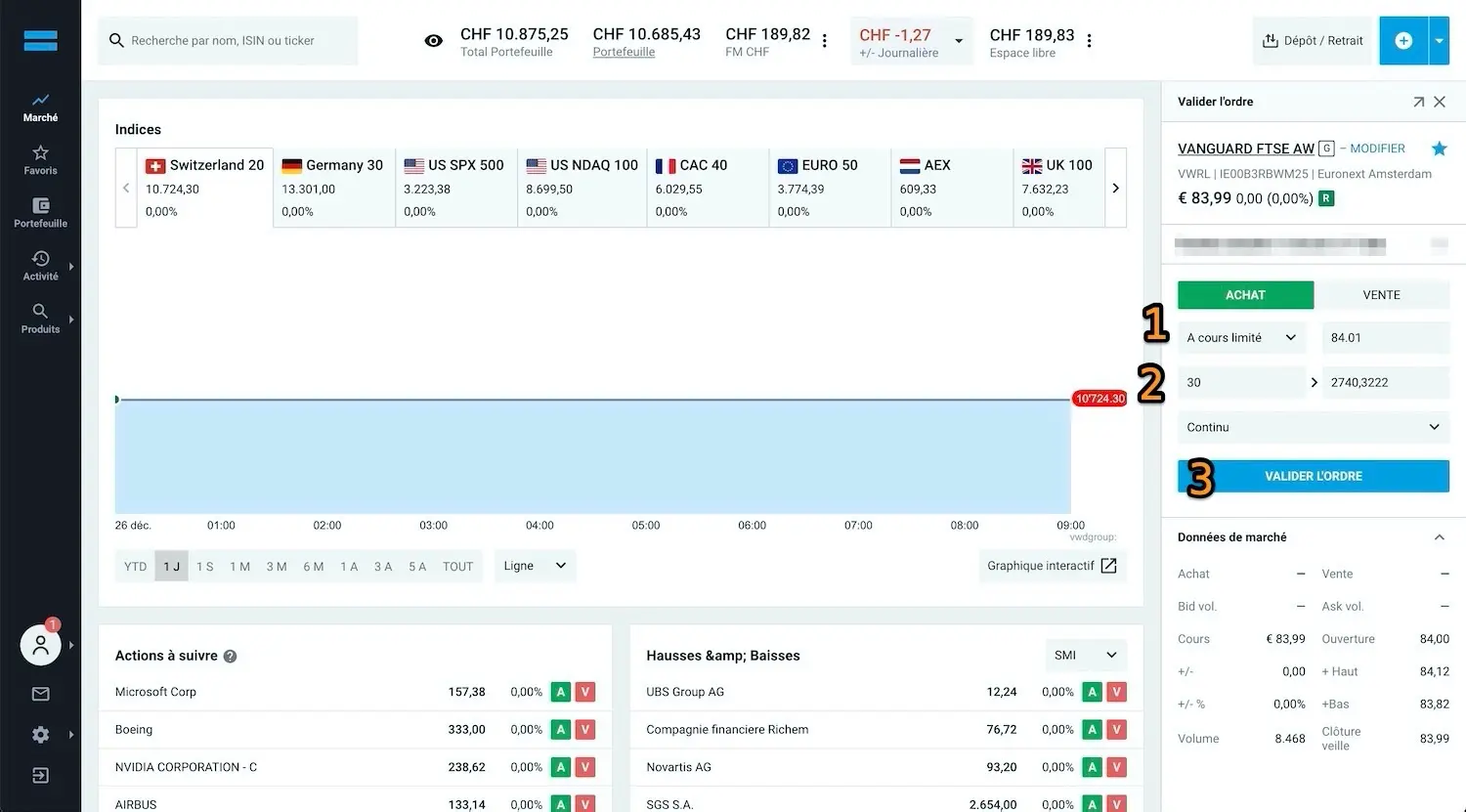

Once logged in, all you have to do is place your VWRL ETF purchase order on DEGIRO in just a few clicks:

Search for the VWRL ETF on DEGIRO (1) (take the one with 'EAM' (2) which corresponds to the stock exchange 'Euronext Amsterdam')

Select 'Buy', indicate the maximum amount (1) you are willing to pay for an ETF (the value 84.01 in my example), specify how much you want to buy (2), and validate your order (3)

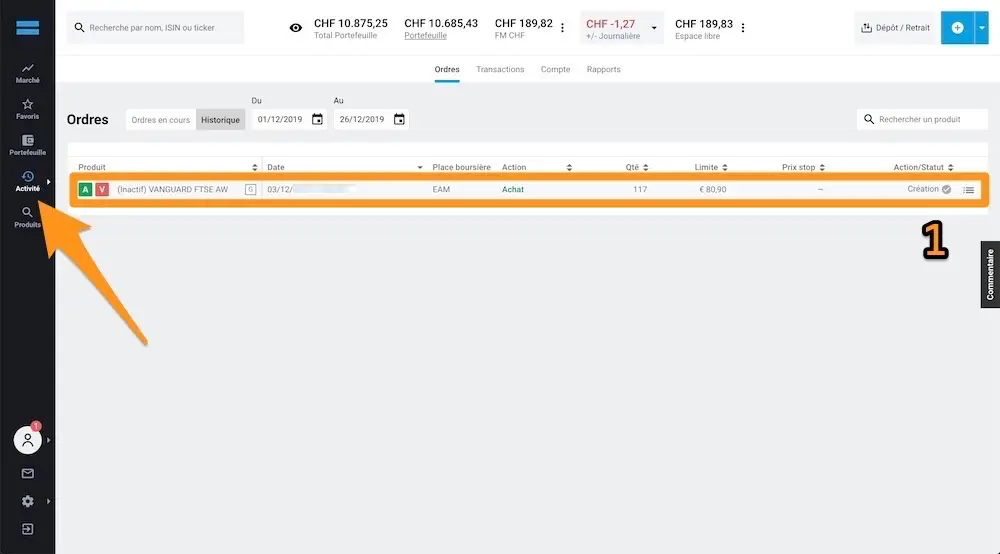

Step 3: Verify that your VWRL ETF buy order on DEGIRO has been placed

To see if your purchase order has been placed, just click on “Activity” > “Orders” in the menu.

If everything went well, you should see a line with the status (1) (in my case, the small check indicates that the order has already been passed successfully because I forgot to make a screenshot in between ;)).

Once you have verified that your purchase order is registered in DEGIRO’s system, you can go about your business.

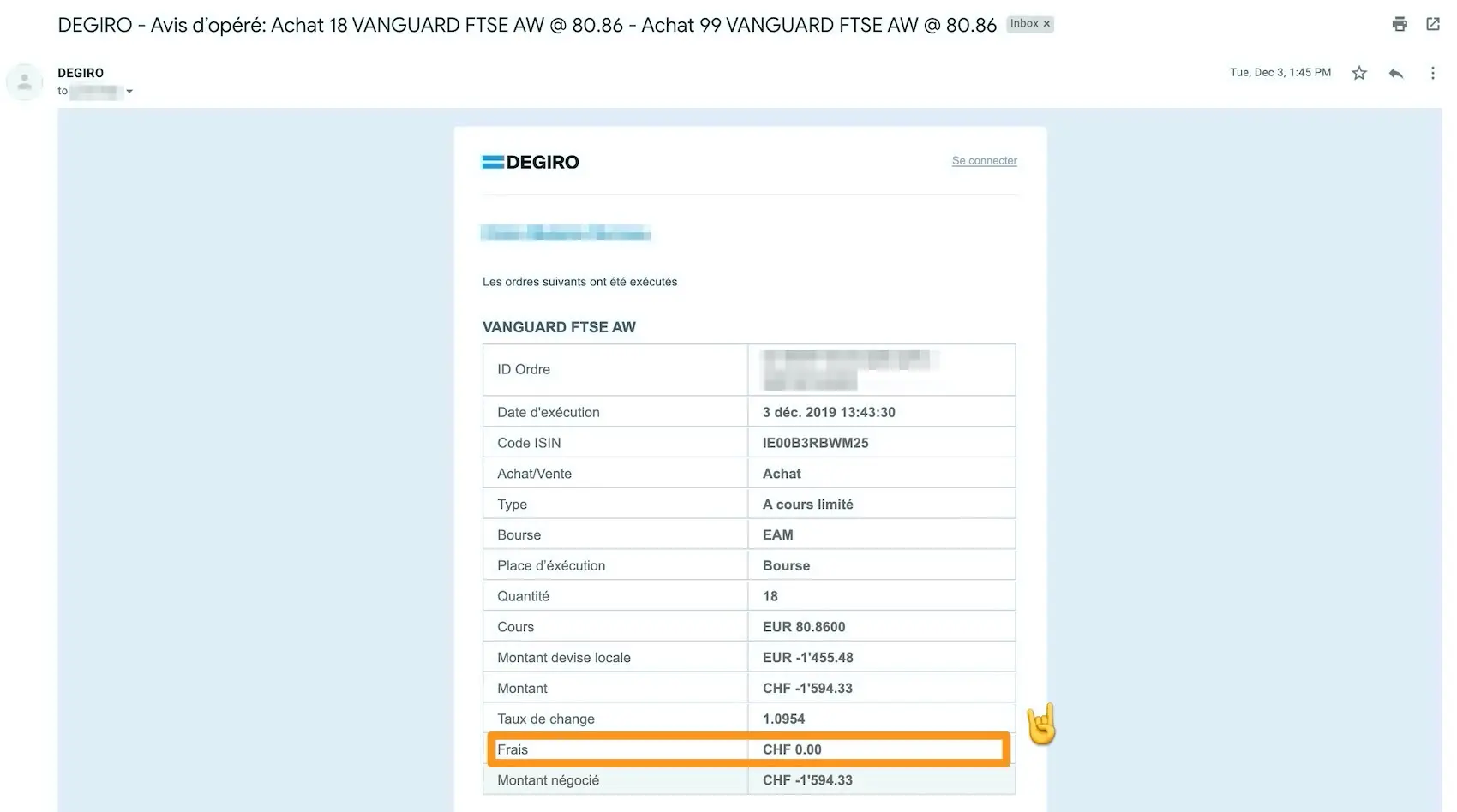

Step 4: Email notification when your VWRL ETF DEGIRO purchase order has been successfully placed

Once the purchase order is successfully completed, you will receive an email notifying you. This is quite convenient instead of having to go and check DEGIRO’s interface every ten minutes ;)

As you can see in my case, the purchase order was placed via two transactions:

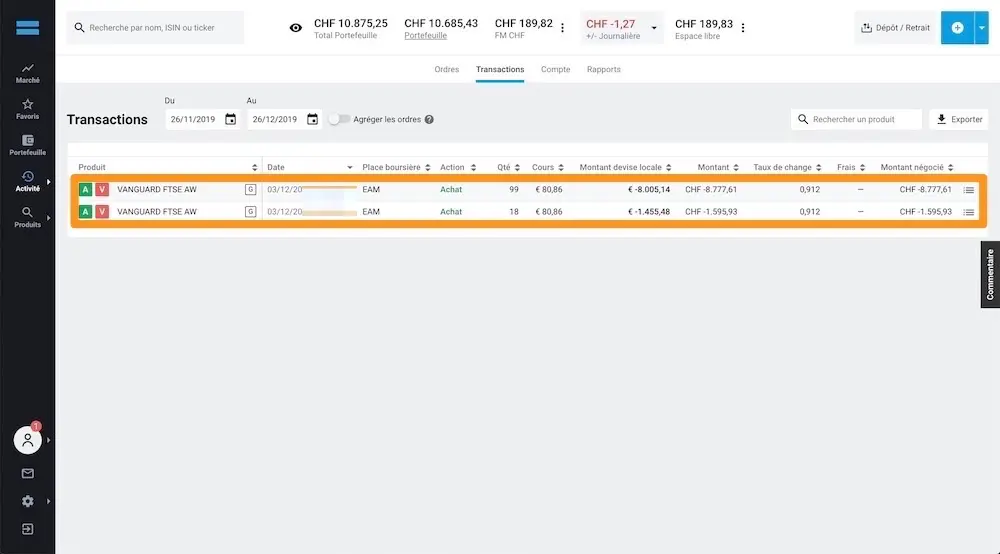

Step 5: Checking your transactions on the DEGIRO web platform

In order to check your transactions, you can go back to DEGIRO’s web platform, in the section “Activity” > “Transactions”:

And then what?

First of all, congratulations! You have just bought your first VWRL ETF via DEGIRO. And all this with extremely low commissions (just a 1€ handling fee), without any transaction fees!

And then, nothing could be simpler: you go back to enjoying your life while your money is working on its own!

And in the next chapter, we’ll see how you can see how much your capital has increased, as well as how many dividends you’ve received :)