Now we’re getting down to business! In this chapter, we’ll look at how to buy your first ETF via Saxo’s trading platform.

As explained in the previous chapter, I recommend you use the SaxoInvestor platform. It’s simple and efficient, with no unnecessary frills for us passive investors.

Step 0: Find out which ETFs to buy in Switzerland

If you haven’t yet decided which ETF to buy to build your investment portfolio, I recommend you read these two blog posts:

- How would I invest CHF 10,000 in the stock market if I were starting out today (stock market crash or not!)

- My Swiss investment portfolio

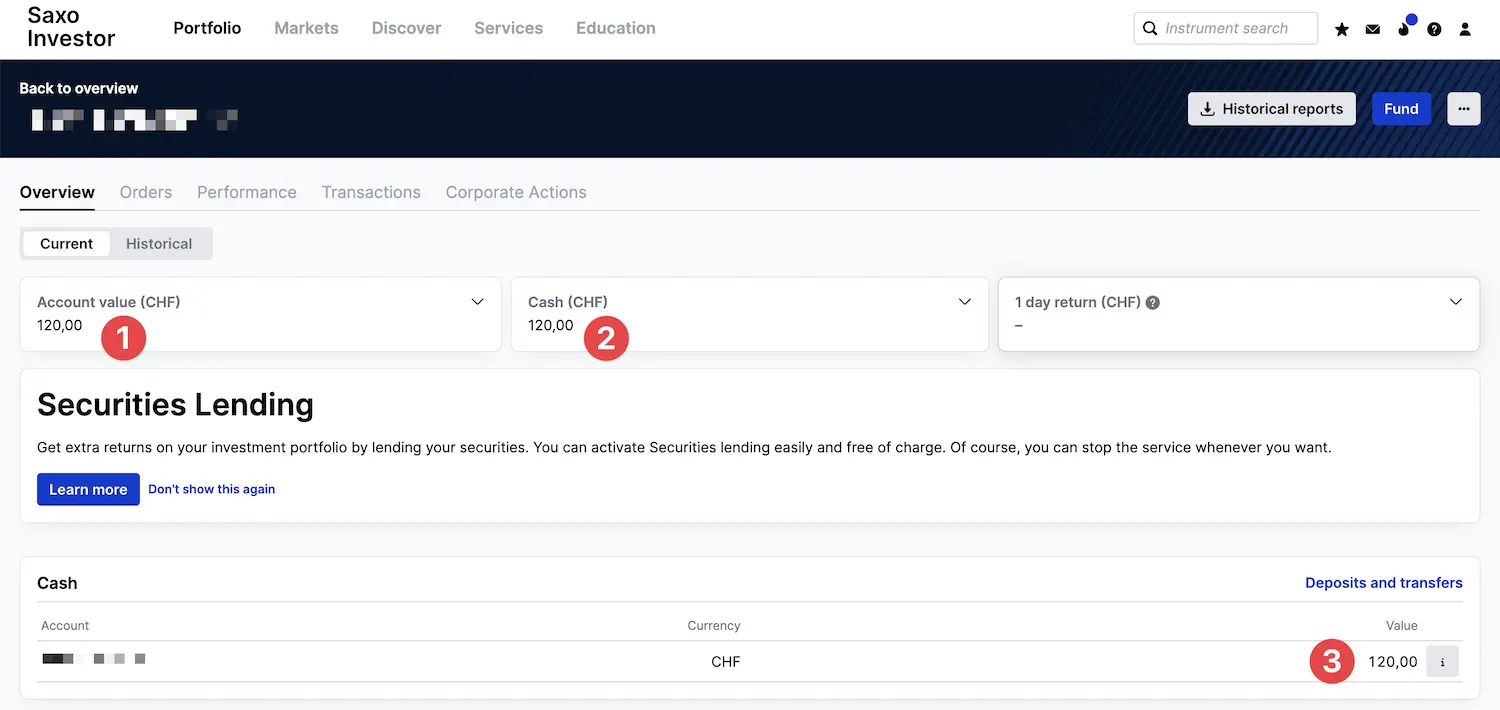

Step 1: Check how much free cash you have on Saxo

Before you buy an ETF or a stock, you want to make sure you have enough money in your Saxo account.

As a reminder, just check your “Portfolio” view on SaxoInvestor to see how many Swiss francs you have:

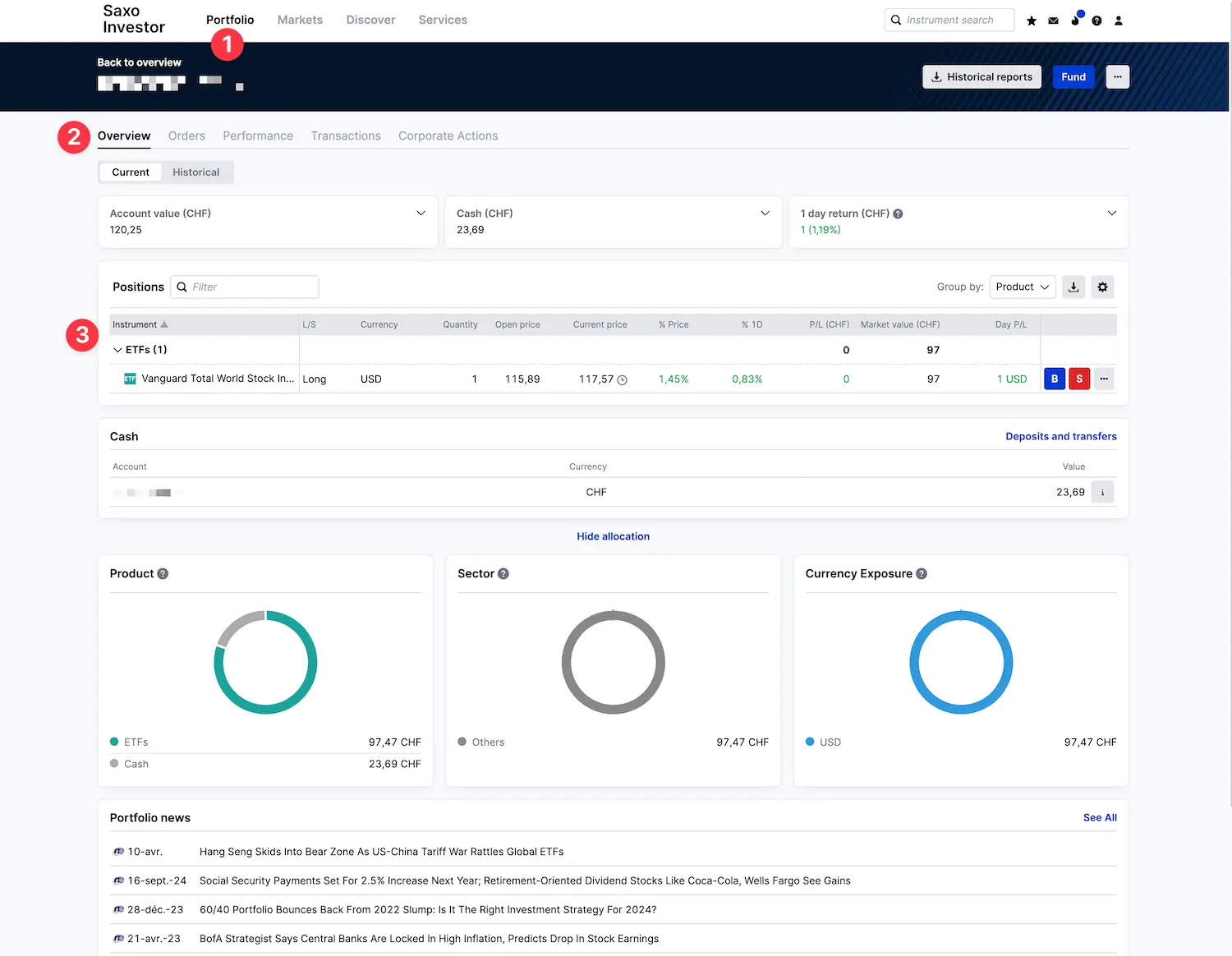

You can see on my screenshot that I have CHF 120.

Now let’s see how much the ETF I want to buy costs.

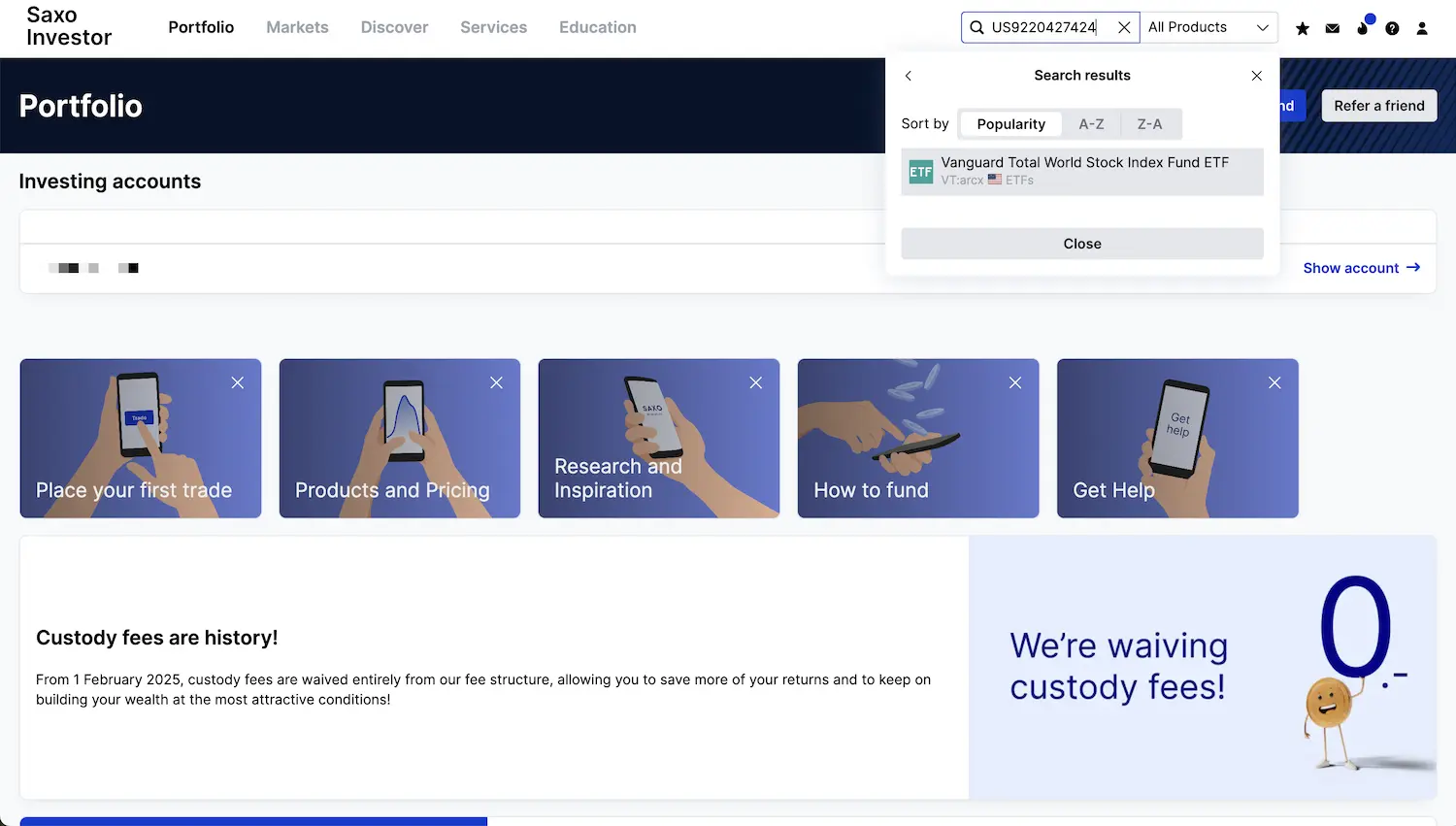

Step 2: Find my favorite VT ETF

Good news! Because, as mentioned in the previous chapters, Saxo offers us the US VT ETF of choice.

The proof is in the pudding, using the stock search field with the VT ETF ISIN “US9220427424”:

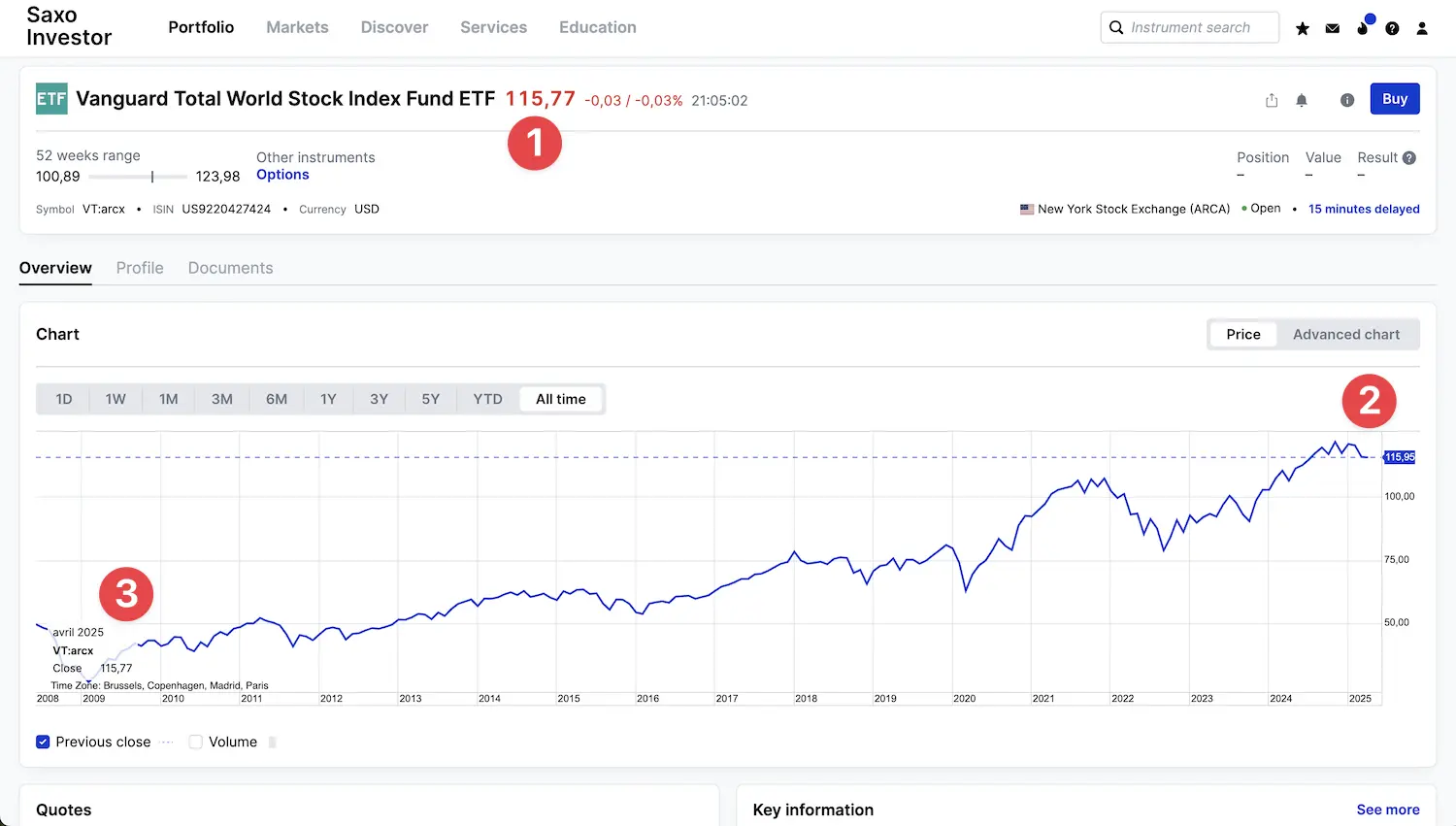

Just click on the search result to go to the detailed view of this ETF:

In the image above, you can see the price of the ETF to date, where there are numbers (1), (2), and (3). Note that this is the price in US dollars (USD). At today’s price, at the end of April 2025, this gives us a VT ETF at 115.79 USD worth CHF 95.32.

We therefore have more than enough Swiss francs in our account (CHF 120) to buy a VT ETF (CHF 95.32), including Saxo’s transaction fees (less than CHF 1).

Step 3: Finally, buy a VT ETF from Saxo Bank!

You’ll remember this moment for the rest of your investing life: the day you bought your first ETF.

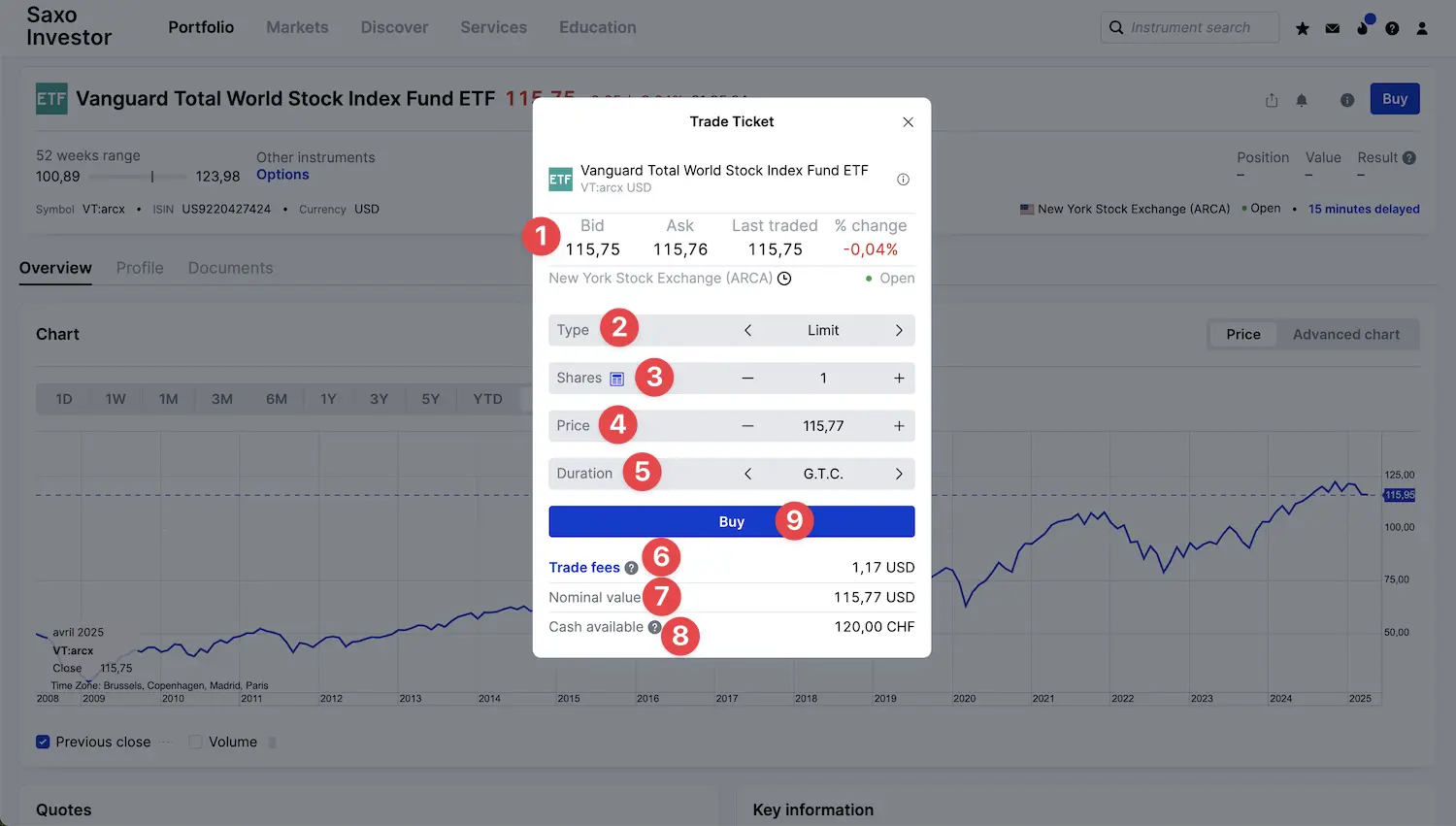

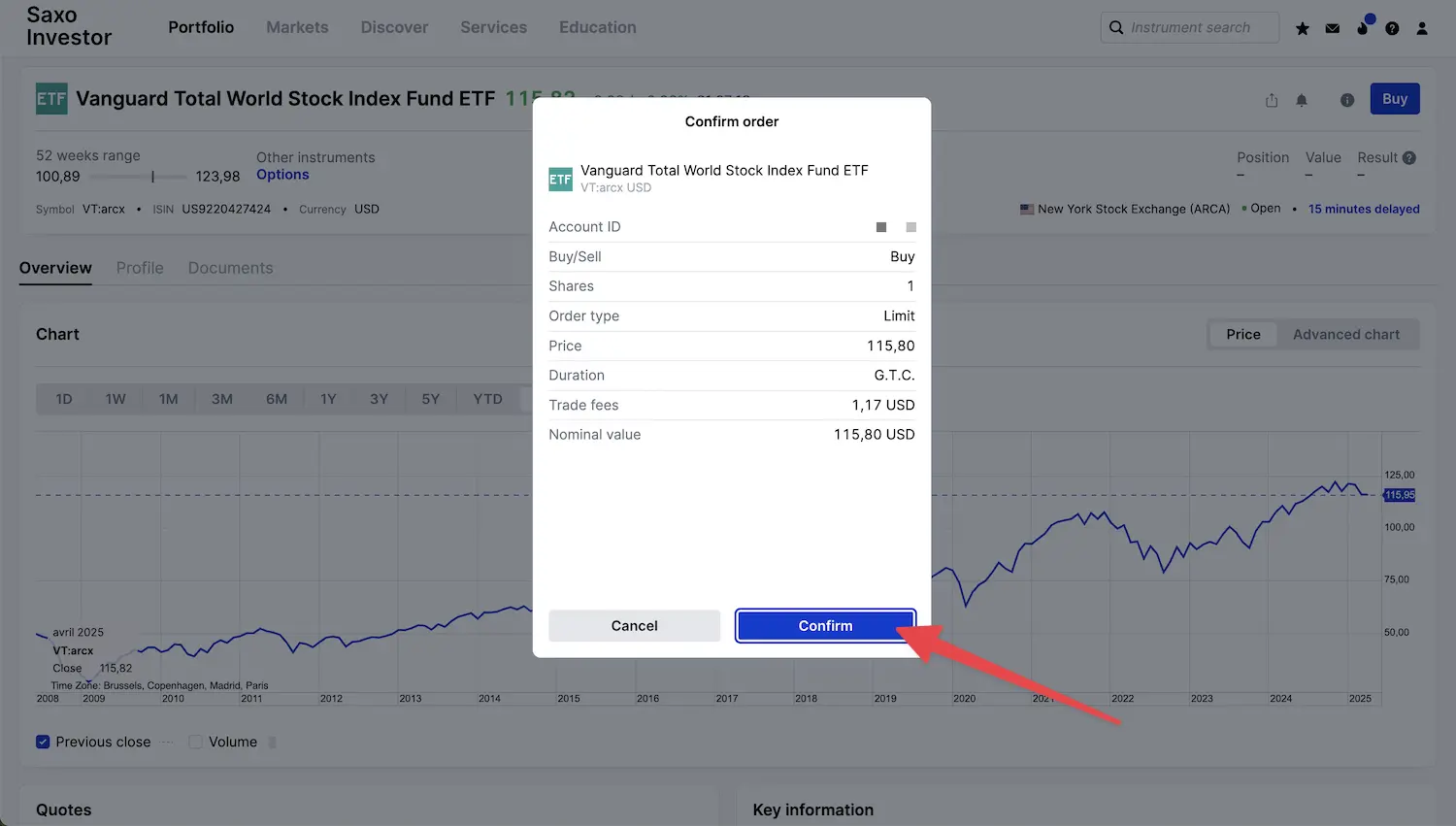

After clicking on “Buy”, you come across this screen:

And that’s the explanation for each of the points in the screenshot above on how to buy an ETF with Saxo Bank:

- 1 — ETF name and price: check that the security (ETF, stock, or bond) is the one you want to buy, in particular via its name and price

- 2 — “Order type”:* refers to the way you want to buy your ETF. Either at the market price, or at a maximum price limit that you define yourself. I myself only use the “Limit” type to say how much I’m prepared to pay for a stock or ETF at the maximum (here 115.79 USD)

- 3 — Quantity: indicates the number of VT ETF shares you wish to buy — as I only have CHF 120 in my Saxo account, I can only buy one ETF

- 4 — The limit price: As I said in point 2 that I wanted to place a limit order, I need to specify the unit price of an ETF share. I usually specify the current purchase price (as shown towards point 1 on the screenshot), i.e., 115.79 USD. If you indicate less than this price, it may take several days for your order to go through, since nobody will want to sell at such a low price

- 5 — Validity: You need to specify how long your trade order will remain valid. Personally, I always choose the “Good Till Cancel” (GTC) option, which means that the order remains active until it’s executed, unless I decide to cancel it. The other options are: just for the day (“Day Order”) or a date you enter yourself

- 6 — Trading fees: Saxo tells you directly how much you’ll have to pay for this ETF order

- 7 — Nominal value: corresponds to the amount in the ETF’s currency (in this case, the US dollar) of all the units you are buying (specified limit value multiplied by the quantity of units you wish to buy)

- 8 — Available cash: the amount of Swiss francs available in your Saxo trading account, useful for checking that you have enough for the purchase you want to make

- 9 — Buy: Once you’ve checked each point, it’s time to click on “Buy”! Take a deep breath, and… click!

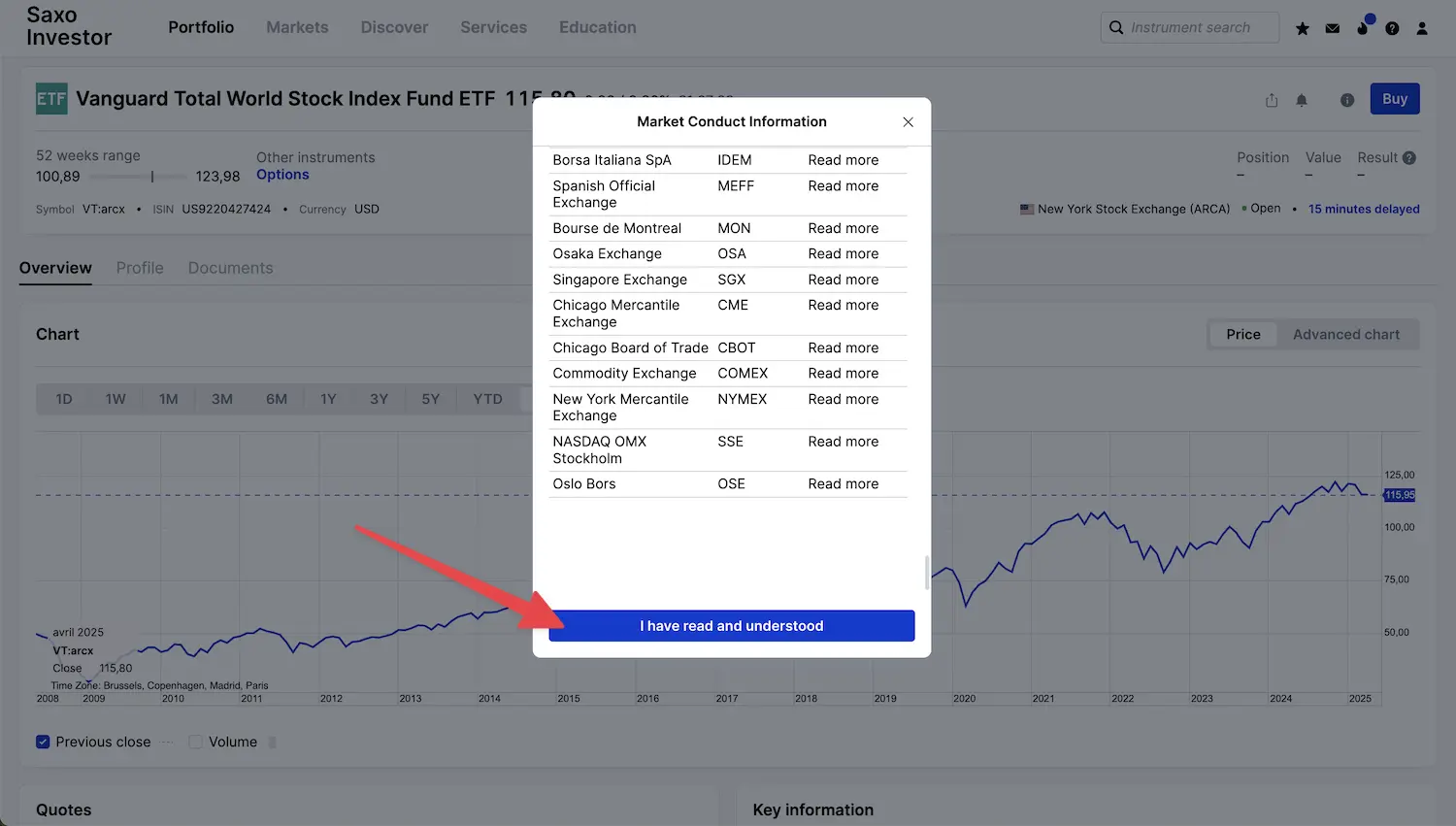

Saxo asks you to confirm that you have read the information about the rules of conduct on the markets (for each stock exchange in Switzerland, New York, Montreal, etc.)

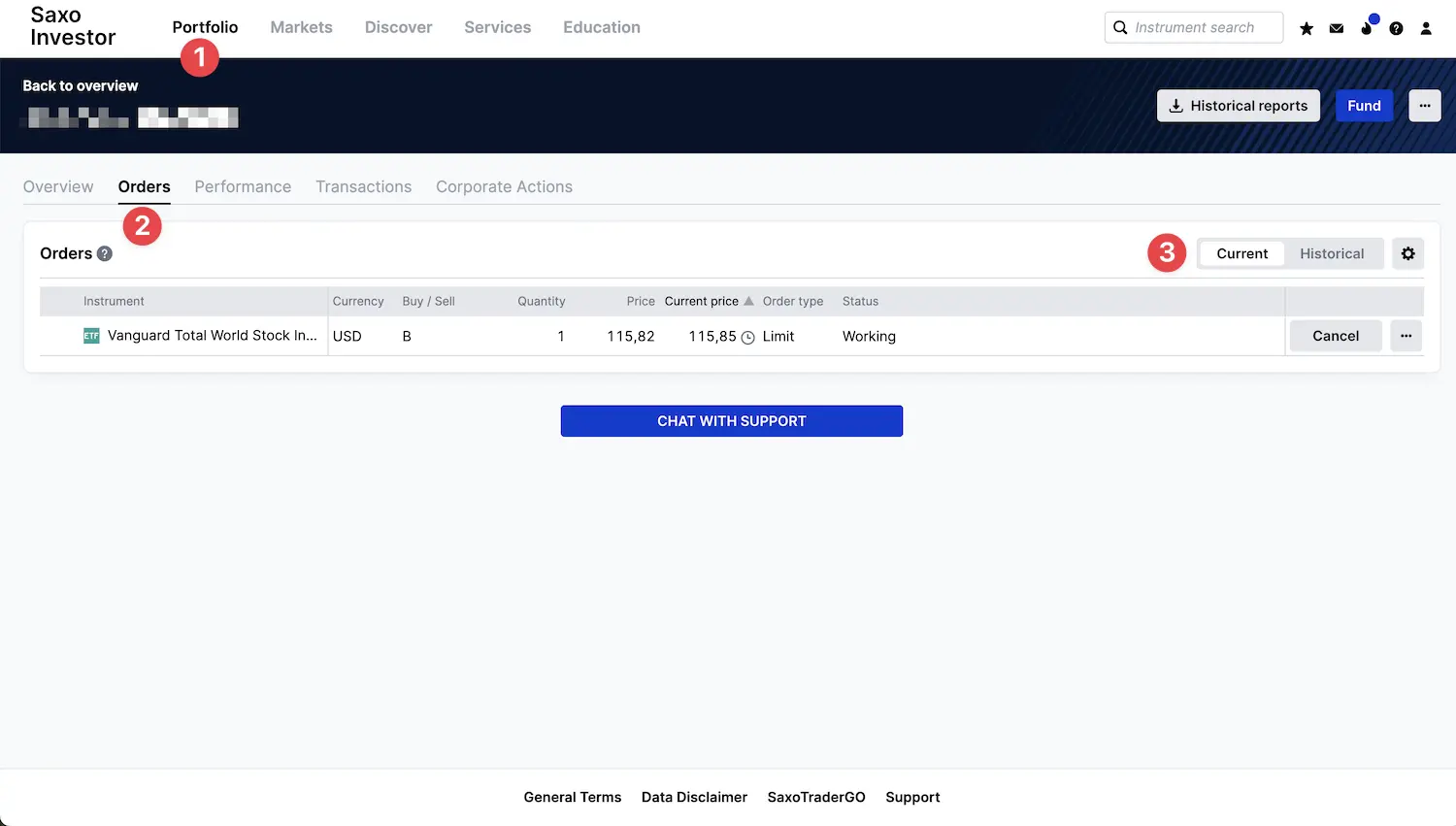

Step 4: Check your current orders

If the stock market is open AND your buy price is high enough to interest a seller in selling it to you, then your buy (or sell) order may be executed directly.

On the other hand, if the stock market is closed or if your purchase price is too low, your order may take some time to be executed. In this case, you can consult your current orders in the corresponding section of your “Portfolio” view:

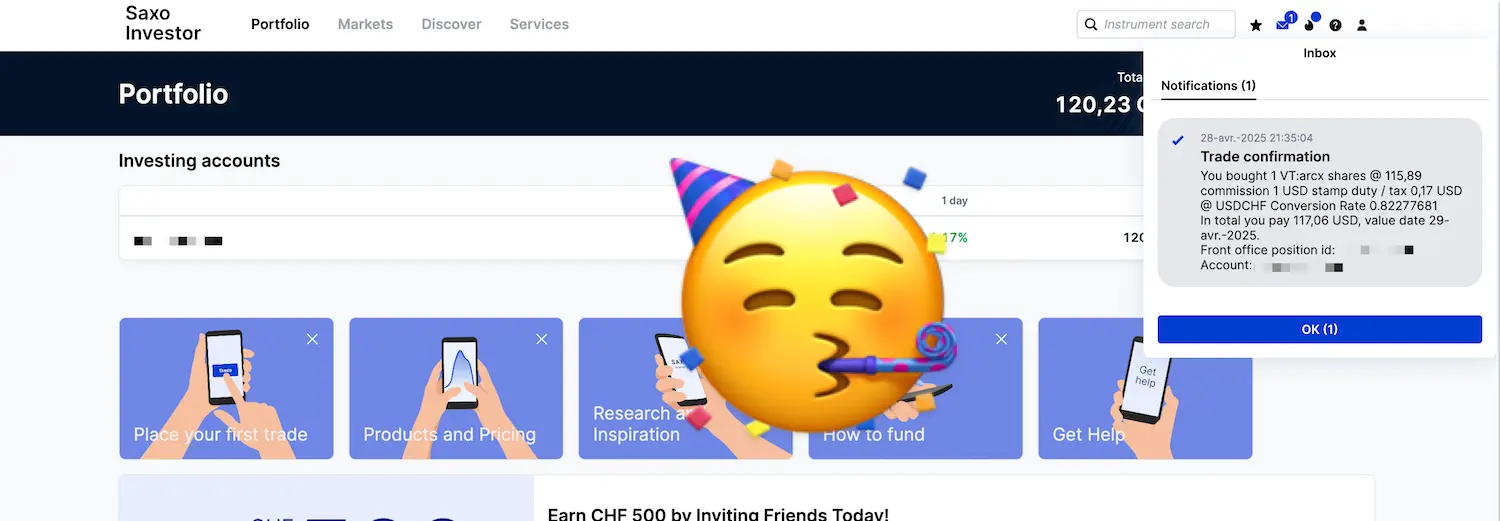

Step 5: Saxo executes your order

And once the stock market is open and there’s someone who’s willing to sell you their ETF at your price, you’ll see this notification appear in Saxo:

Step 6: Check out the ETF you’ve just bought

Just to make sure you own the ETF you’ve just bought, you can check it in your “Statement” view:

And here's your purchased VT ETF (click on 'Portfolio' > 'Statement' > and you'll see your 'Positions')

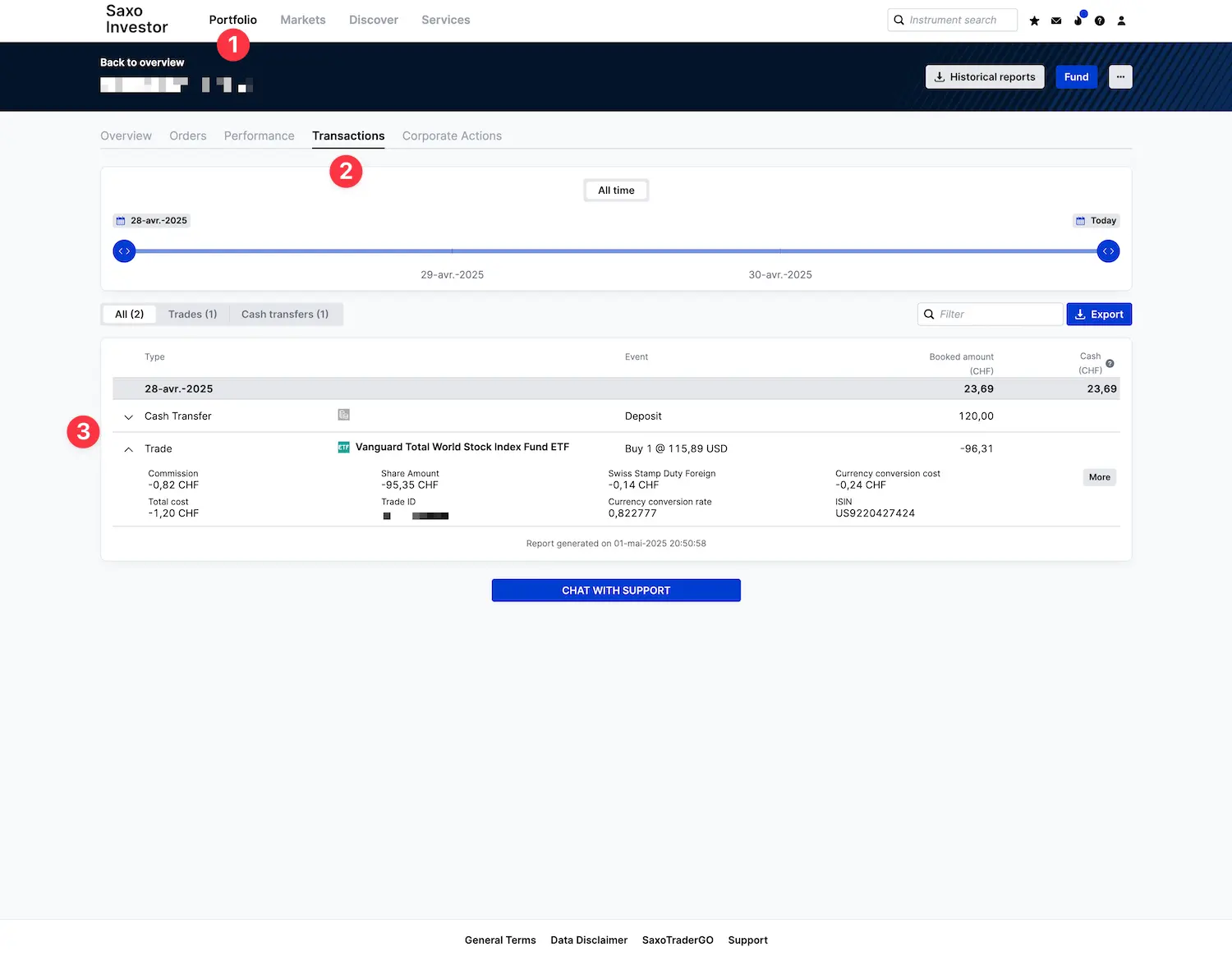

Step 7: See your executed trades

And you can also see a list of all your executed trades over a specific period:

Saxo Bank promo code

You can get a CHF 200 trading fee credit from Saxo Bank, applied within 24 hours of the initial funding (valid for 3 months after opening your account) by using my link:

With this link, you’ll also be helping to support the blog by the way, thanks!

And that’s it, we’re already at the end of this Saxo guide.

Congratulations on taking action. You’re well on your way to financial independence in Switzerland!

FAQ

What is Saxo AutoInvest?

Saxo AutoInvest is a feature offered by Saxo Bank that allows you to automatically invest in a selection of ETFs (including around 100 ETFs with no transaction fees — i.e., no commission on purchase, but a commission is charged when the investor wants to sell their ETFs). You choose which ETFs to buy (such as global stocks, bonds, etc.), how much to invest, and how often (e.g. monthly), and Saxo takes care of the rest.

It’s a good way to set up a regular investment strategy without having to place orders manually. I’m preparing a comprehensive article on AutoInvest to explain in detail how it works and who it’s really useful for. Stay tuned!