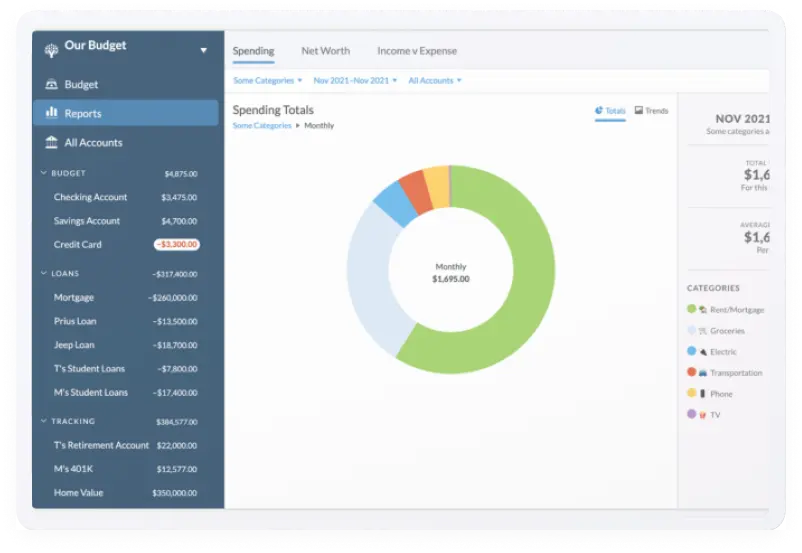

- YNAB (*) is my favorite tool to budget and get rich. It got me from 50kCHF to 1.7 Mio CHF in 11 years.

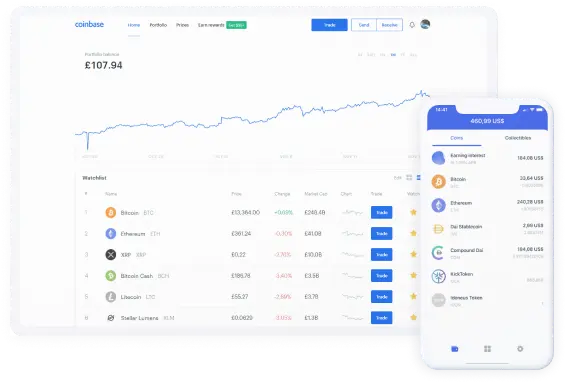

- Interactive Brokers (*) (**) and DEGIRO (*) (***) are the two discount online brokers that make my money work for me while I’m at sleep! Here is my complete brokers’ review for Swiss investors.

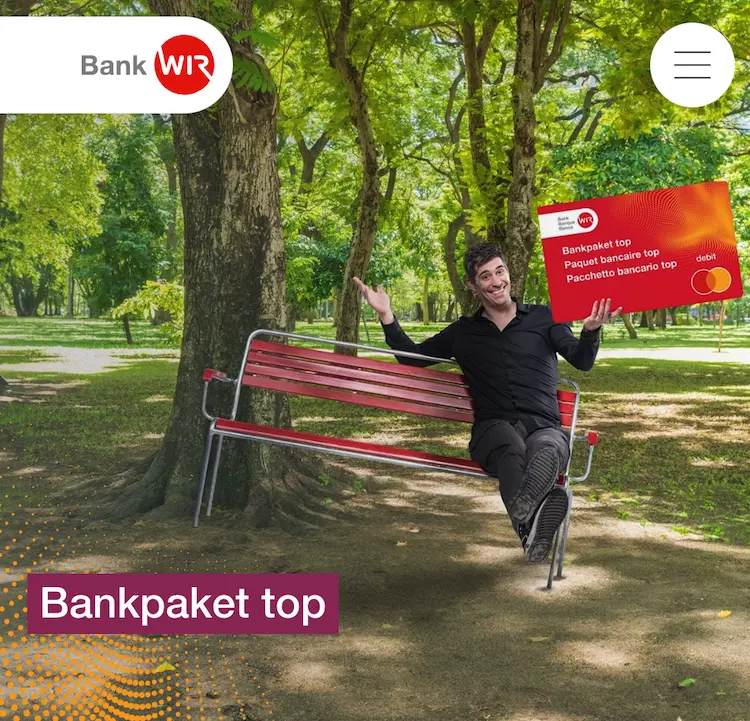

- The Bankpaket top from Bank WIR is my 100% free online Swiss bank. I have detailed my choice in this article. Bank WIR doesn’t offer any promotional codes as such. But if you want to support the blog, you can use my Bank WIR partner link to open your account, and start making big savings on your banking fees thanks to the Bankpaket top.

- Swisscard Cashback (*), Certo! One, and Bank WIR are my go-to Swiss credit cards to pay the least fees and get the maximum cash back possible.

Start Now

* These products and services are affiliate partners of the blog. If you click on them, you won't notice any difference but the blog will earn a small commission and I sincerely thank you for this.

** The inclusion of Interactive Brokers' (IBKR) name, logo or weblinks is present pursuant to an advertisingarrangement only. IBKR is not a contributor, reviewer, provider or sponsor of content published on this site, and is not responsible for the accuracy of any products or services discussed.

*** Investing involves risk of loss.