In the first part of the FriTax guide, we completed the first three parts of our Swiss tax return (for the canton of Fribourg), namely: personal data, salaried activities and professional expenses.

Now let’s move on to the rest of the categories, including the most interesting part, our stock market investments!

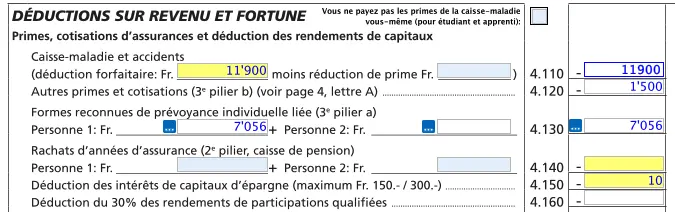

Step 1: Insurance premiums and contributions

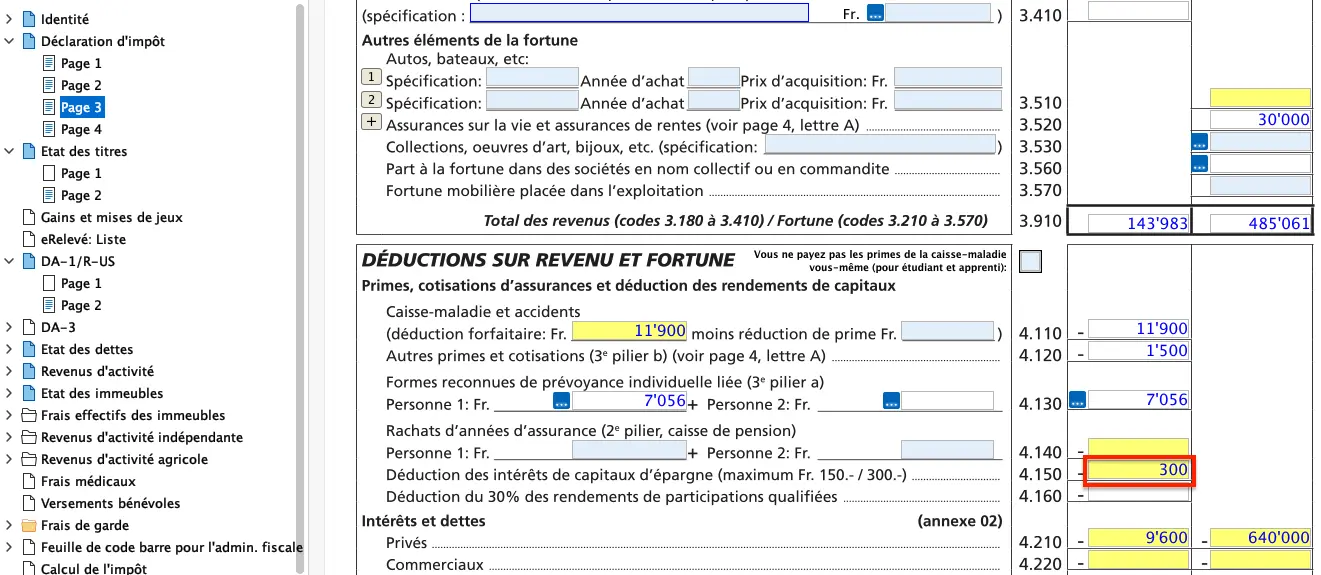

Health insurance premiums

You’ll find this field under number 4.110 on your declaration. It is automatically filled in according to your personal situation (single, married, child, etc.). In summary, for the year 2024, the following lump-sum health and accident insurance premiums are deductible:

- CHF 4,810 per year for single, separated, divorced or widowed taxpayers

- CHF 9,620 per year for spouses

- CHF 4,210 per year for each young adult in training at the end of the year (from age 18 to age 25)

- CHF 1,140 per year for each dependent child at the end of 2024 (under 18 at the end of 2024)

In our case, this gives a lump-sum deduction of CHF 11,900 (married couple with 2 children).

3rd pillar A (or 3a)

If you have a type A 3rd pillar (aka pillar 3a), you can declare it under item 4.130 of your tax return. The maximum deductible amount for 2025 is:

- CHF 7'258 for employees insured with an occupational pension scheme (2nd pillar)

- CHF 36'288 for self-employed persons

If this is the first time you are declaring this 3rd pillar, you will need to enclose proof when you send in your declaration. If you have already declared it in previous years, simply tick the box “already declared last year” when you send in your declaration.

3rd pillar B (or 3b)

If you have a type B 3rd pillar, you can declare it under figure 4.120 of your declaration. Click on the green arrow and fill in part A of the form. You’ll find all this information on the receipt you receive from your insurance company at the end of the year. A 3b entitles you to a maximum deduction of:

- CHF 1,500 for married people living in the same household

- CHF 750 for other taxpayers

With these 3 new headings filled in, your tax return should look like this:

Buy-back of insurance years (2nd pillar) and other contributions

If you have purchased a 2nd pillar year, simply enter the amount in the boxes under point 4.140.

If you have made AVS/AI/APG/AC contributions, enter the amount under 4.350.

In both cases, you will be asked to provide proof when you send in your declaration.

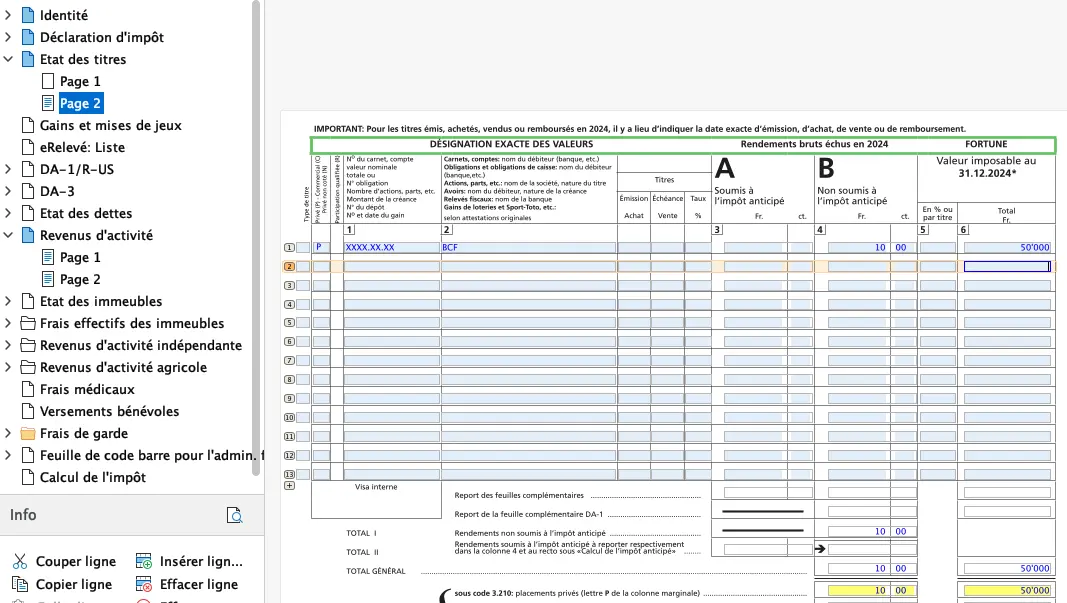

Step 2: Securities statements

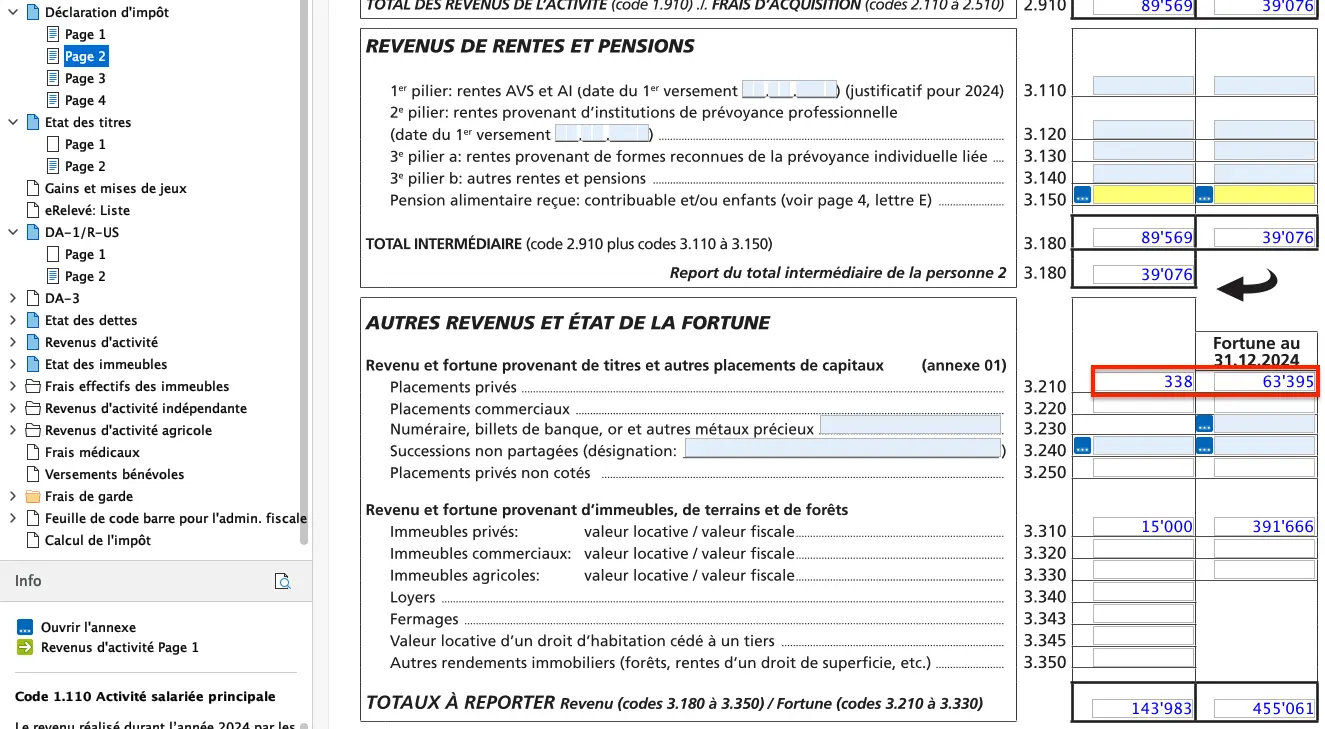

In this section, we’re going to declare all our bank accounts, savings accounts, gold and other crypto accounts. Just click on the green arrow in field 3.210 of your declaration.

In principle, you only declare your share (often 50%). Details are explained in the general FAQ here: FAQ Swiss tax return (2026).

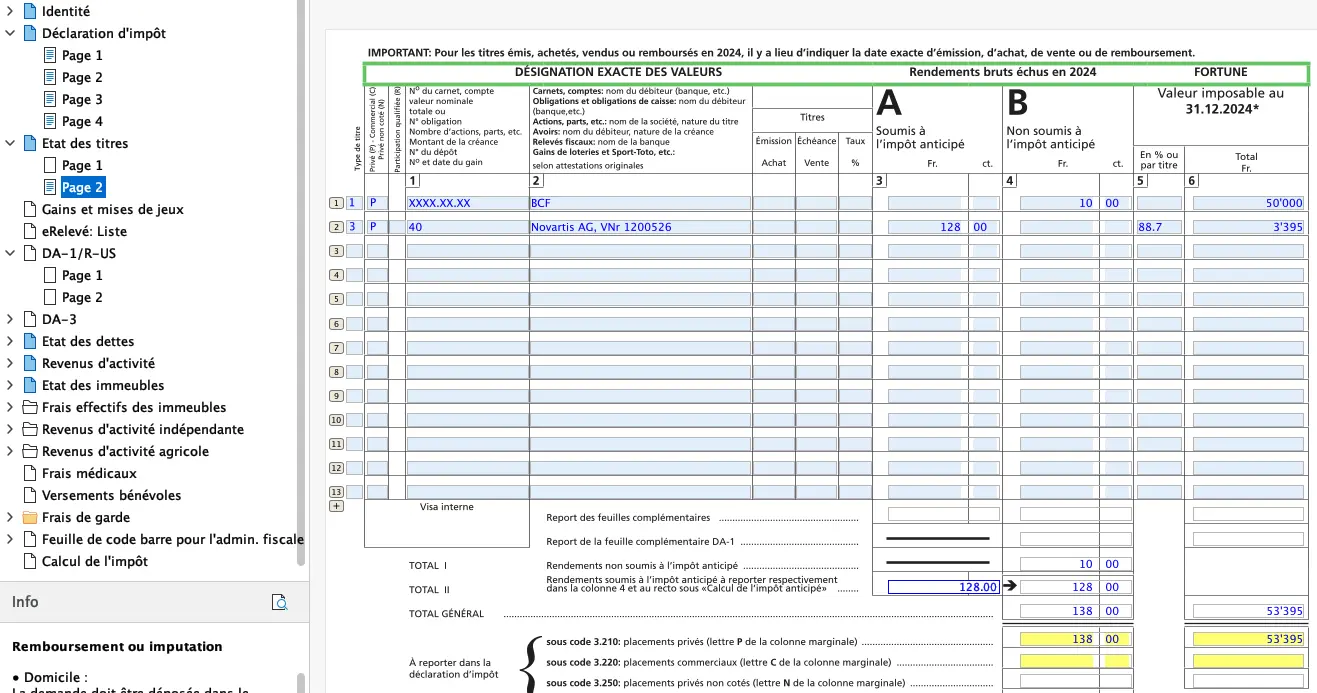

In the example above, I have simply entered an account at the BCF which has earned CHF 10 in interest not subject to withholding tax and whose balance at 31.12 is CHF 50,000.

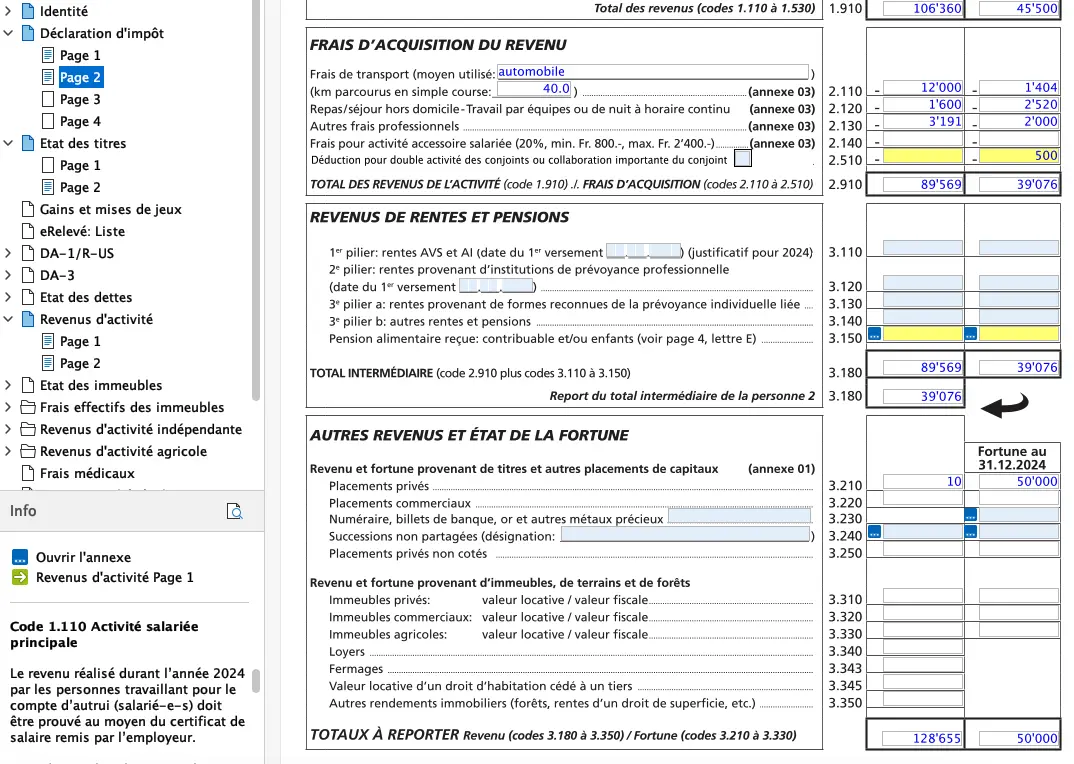

You simply need to repeat the operation for all the accounts you own. Once you’ve completed the form, return to your tax return:

The amount of your wealth has been updated and the sum of the interest your accounts have earned has been added to your income.

The amount of interest will be automatically deducted in point 4.150. The following maximum amounts are deductible: 300 fr. for married people living in the same household, 150 fr. for other taxpayers.

Under no circumstances may the deduction exceed the yields shown under codes 3.210, 3.220, 3.240 and 3.250.

Step 3: Securities statements — Stocks, bonds, etc.

If you invest in ETFs or stocks (US, Europe, Ireland), the tax side quickly gets confusing: dividends, withholding tax, DA-1, R-US 164, etc. I’ve put everything together in a clear, jargon-free guide, with concrete examples from my own tax returns:

Swiss Investor Tax Guide 2026: US, Europe, Ireland ETFs

Let’s take the following stock portfolio as an example:

- Novartis shares held directly

- Our good old equity ETFs

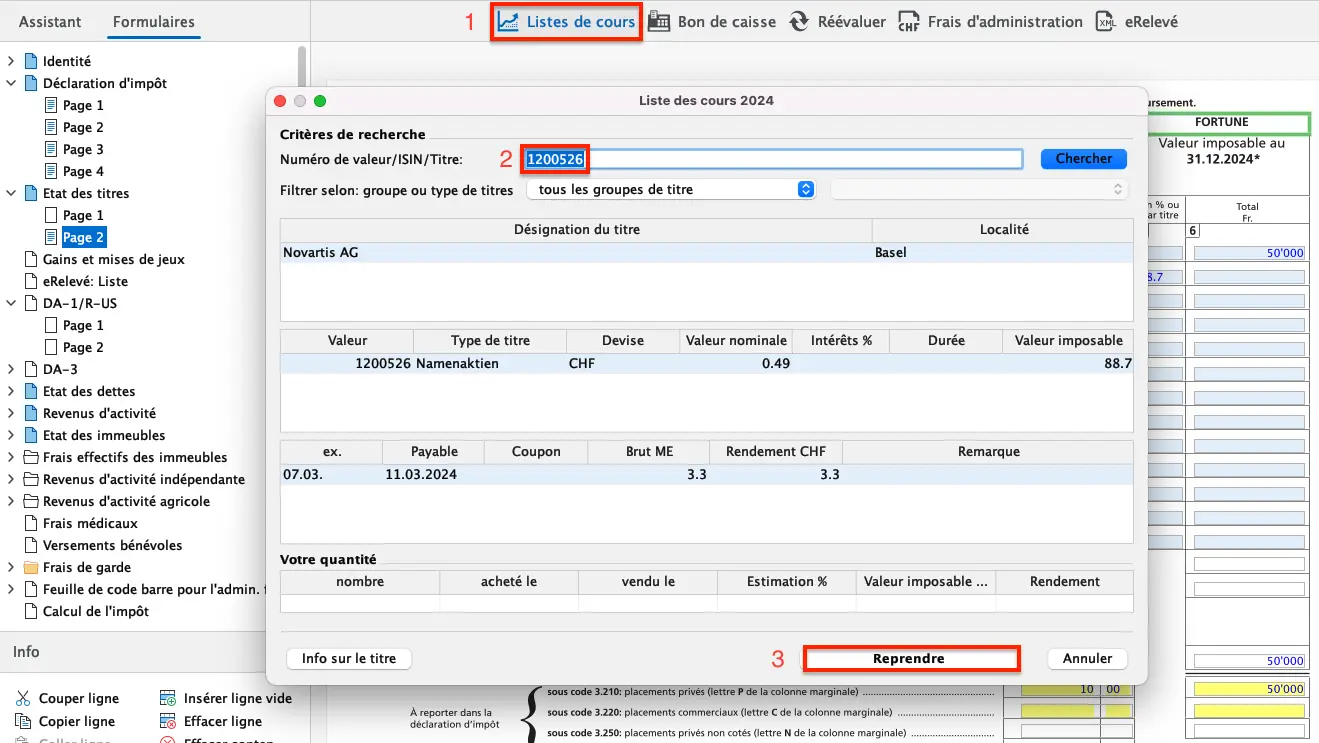

Shares

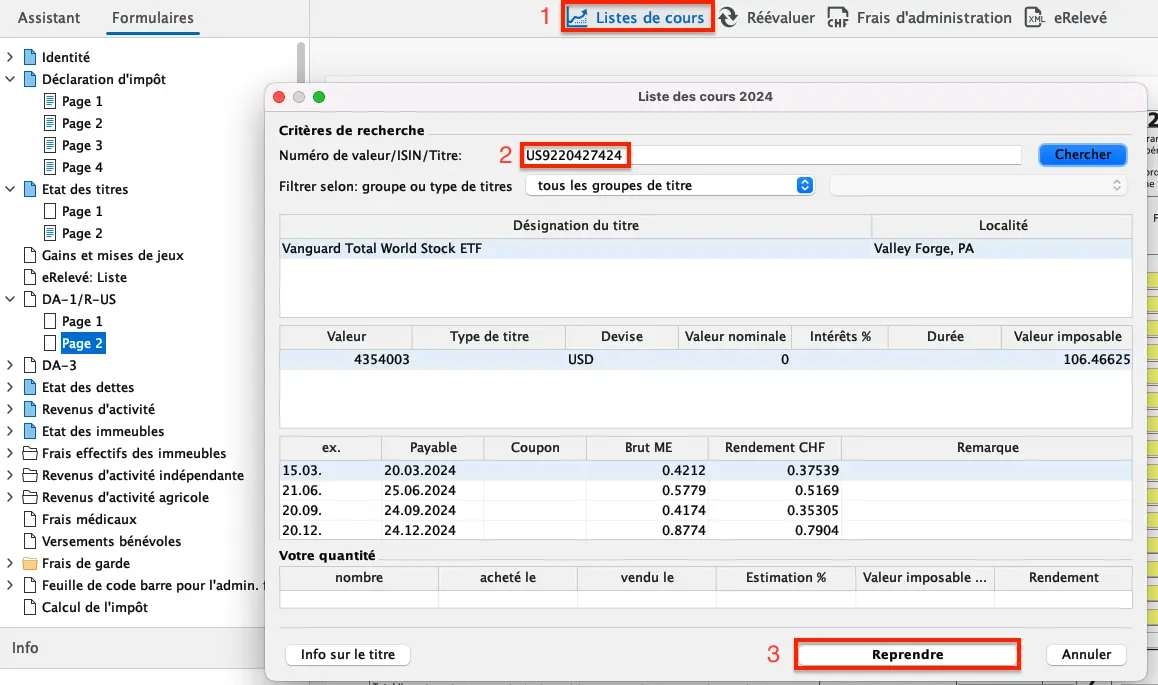

On page 2 of the “État des titres” section, proceed as follows to add the Novartis share:

- Click on “Liste de cours”

- Enter the ISIN of Novartis

- Click on “Reprendre”

Back on page 2, you’ll see that Novartis has been added to the list. Now you need to fill in the missing fields.

- Select “Titre” under title type

- Select “P” for private wealth

- Enter the number of shares you own

- Enter the amount subject to withholding tax

- Then fill in the taxable value as at 31.12.

You will notice that at the bottom of the form, the yield amounts are calculated and the final amount is automatically reported under code 3.210 of the declaration.

ETFs

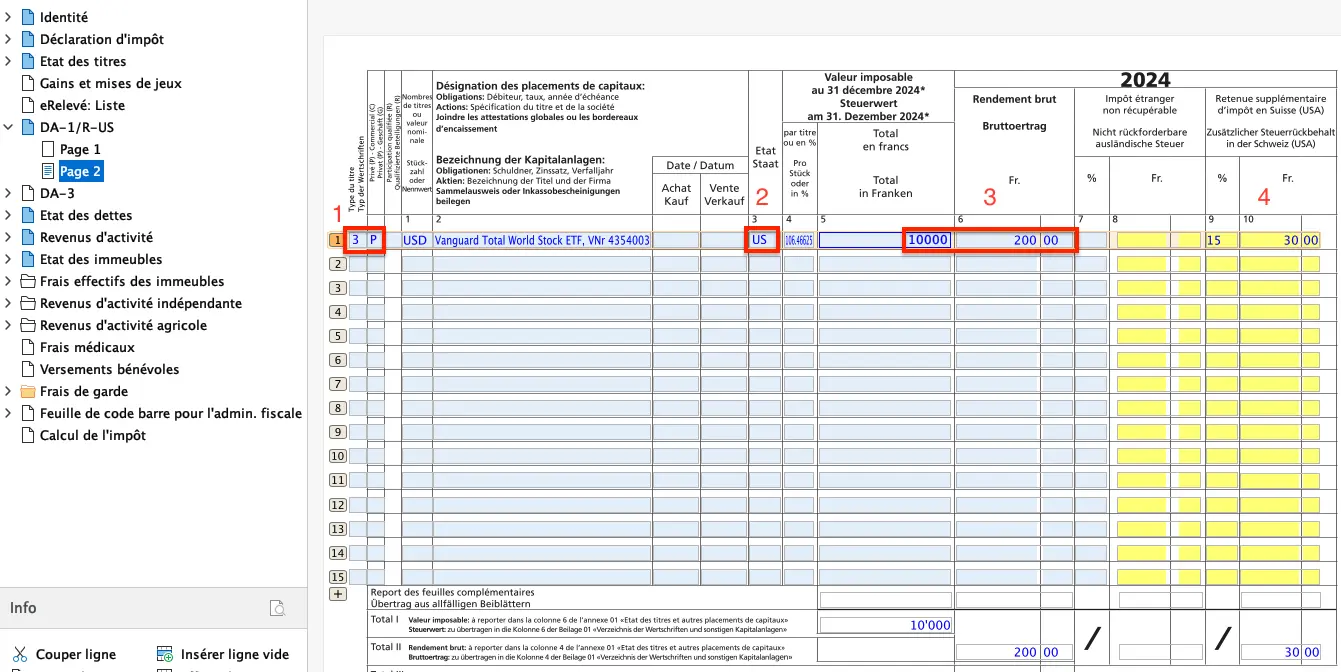

To declare your favorite VT ETF (that you bought with the best broker: Interactive Brokers, based abroad and not in Switzerland), you need to complete page 2 of the “DA-1/R-US” chapter. To complete this form:

- Click on “Listes de cours”

- Enter the ISIN of your ETF

- Click on “Reprendre”

Back on the form, add the following information:

- Type of security and private assets

- The state from which the security originates, in this case “US”

- Enter the taxable value at 31.12 and the yield for the year

- Fields filled in automatically

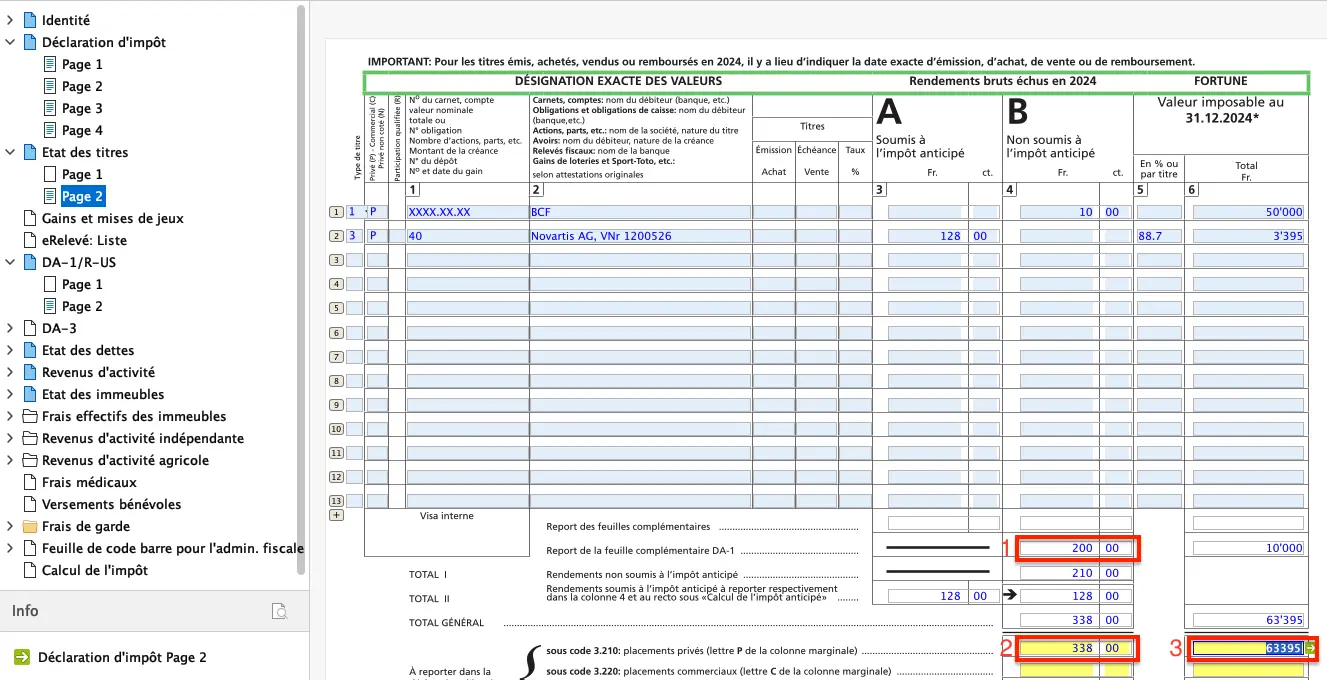

Now, if you go back to section 2 of your securities statement, you’ll see that the amounts entered previously have been added.

By returning to the tax return, the private investment amounts (income and wealth) on page 2, as well as the savings capital interest deduction amount on page 3, have been updated.

Under item 4.320 of the declaration, you can deduct securities administration costs. Unlike the canton of Vaud, there is no flat-rate deduction in Fribourg. Here, you can only deduct custodian fees and ordinary securities administration costs, or the cost of renting a safe-deposit box.

Next step

You see, it’s not that complicated to file your Swiss tax return!

In part 3 of our FriTax tutorial, we’ll talk about the following sections:

- Buildings, land and forests

- Interest and debts

- Tax calculation

If you find other tax optimization possibilities in the screenshots above (or if you have a question), don’t hesitate to let us know in the comments!