In the first part of the St. Gallen eTaxes guide, we have completed the first two parts of our Swiss tax return (for the canton of St. Gallen): personal data and titles.

Most of you will pay very little wealth tax and much more income tax. To do this, you need to enter your income and deductions. You should pay close attention to this part, because the higher the deductions, the lower the taxes.

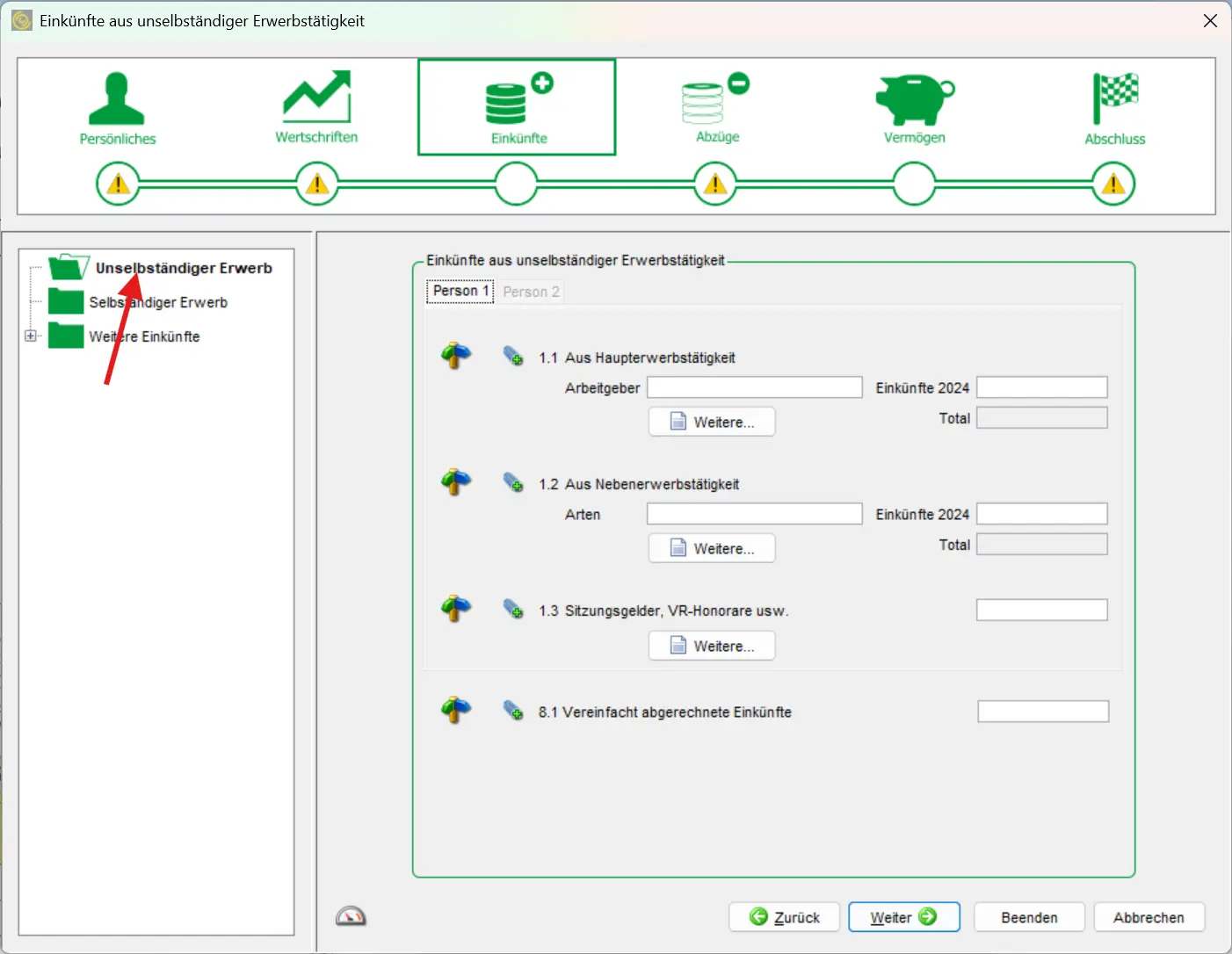

Income

Your employer will send you a salary statement for tax purposes. All you have to do is enter this figure in the “Salaried activity” section. A distinction is made:

- Your main activity: your job

- From secondary activity: possibly your second job or a small job you may also have; if not, leave it blank

- Salaries, board fees: if you have such a mandate, this income must be entered here; if not, leave it blank

If you are self-employed, you can go directly to the “Self-employed activity” section on the left and enter your earnings there.

Under “Other income”, you must enter the following:

- Pension and retirement income: if you are retired, you must enter this income here.

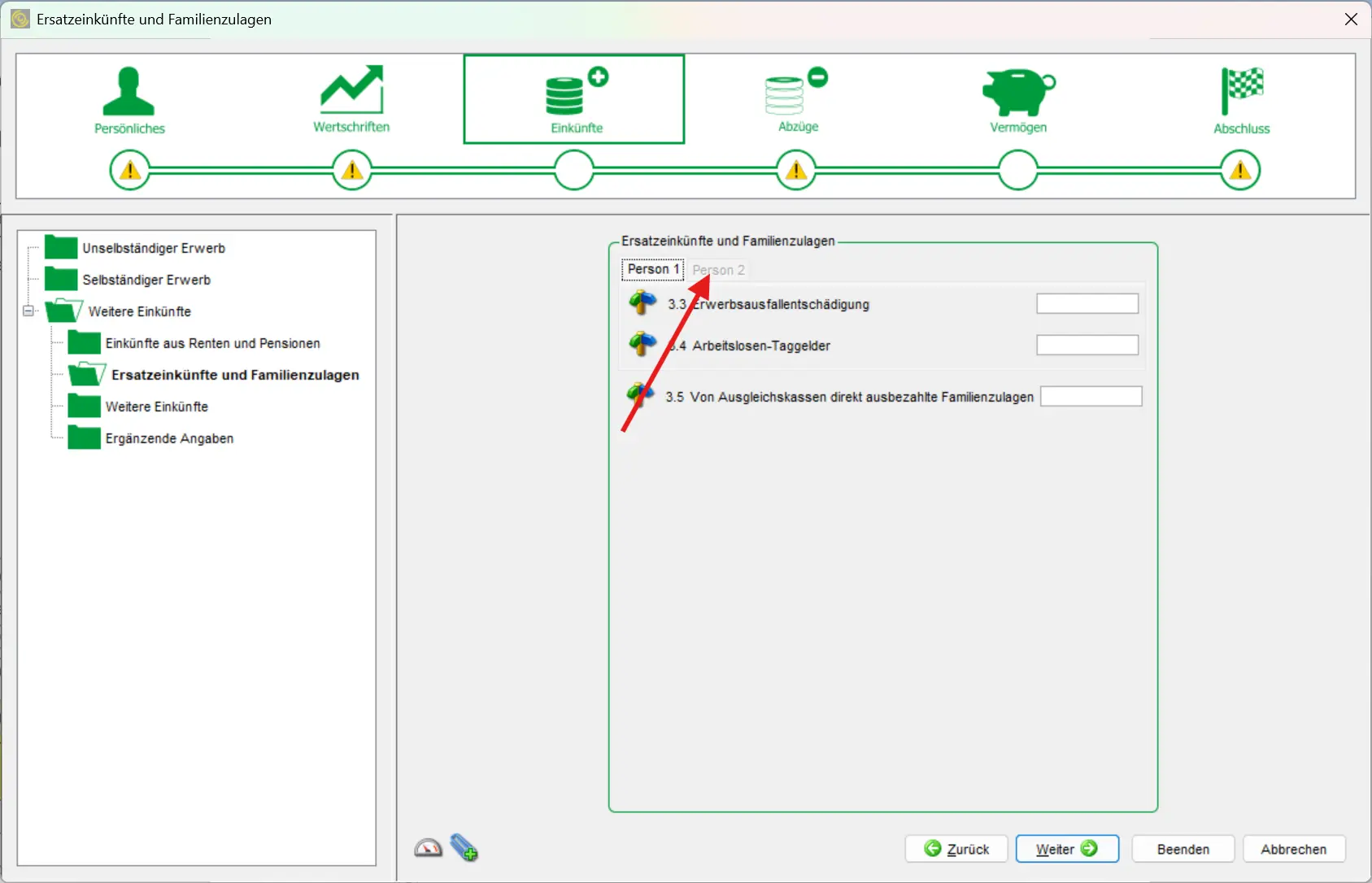

- Replacement income and family allowances: as indicated, loss-of-earnings benefits, daily unemployment benefits and direct family allowances must be entered here.

- Other income: mainly alimony received and undistributed inheritances.

If you are a couple: make sure you can toggle the tab at the top between “Person 1” and “Person 2” to enter this information for both.

Replacement income and family allowances in eTaxes St. Gallen such as compensation for loss of earnings and daily unemployment benefits

Now that the income has been settled, it’s time to keep taxable income as low as possible. This is achieved through deductions.

Deductions

Before submitting my tax return, I always go through the same checklist to avoid costly oversights. I detail all my Swiss tax deductions here, with concrete real-life examples:

My Swiss tax deductions: real-life example and checklist (2026)

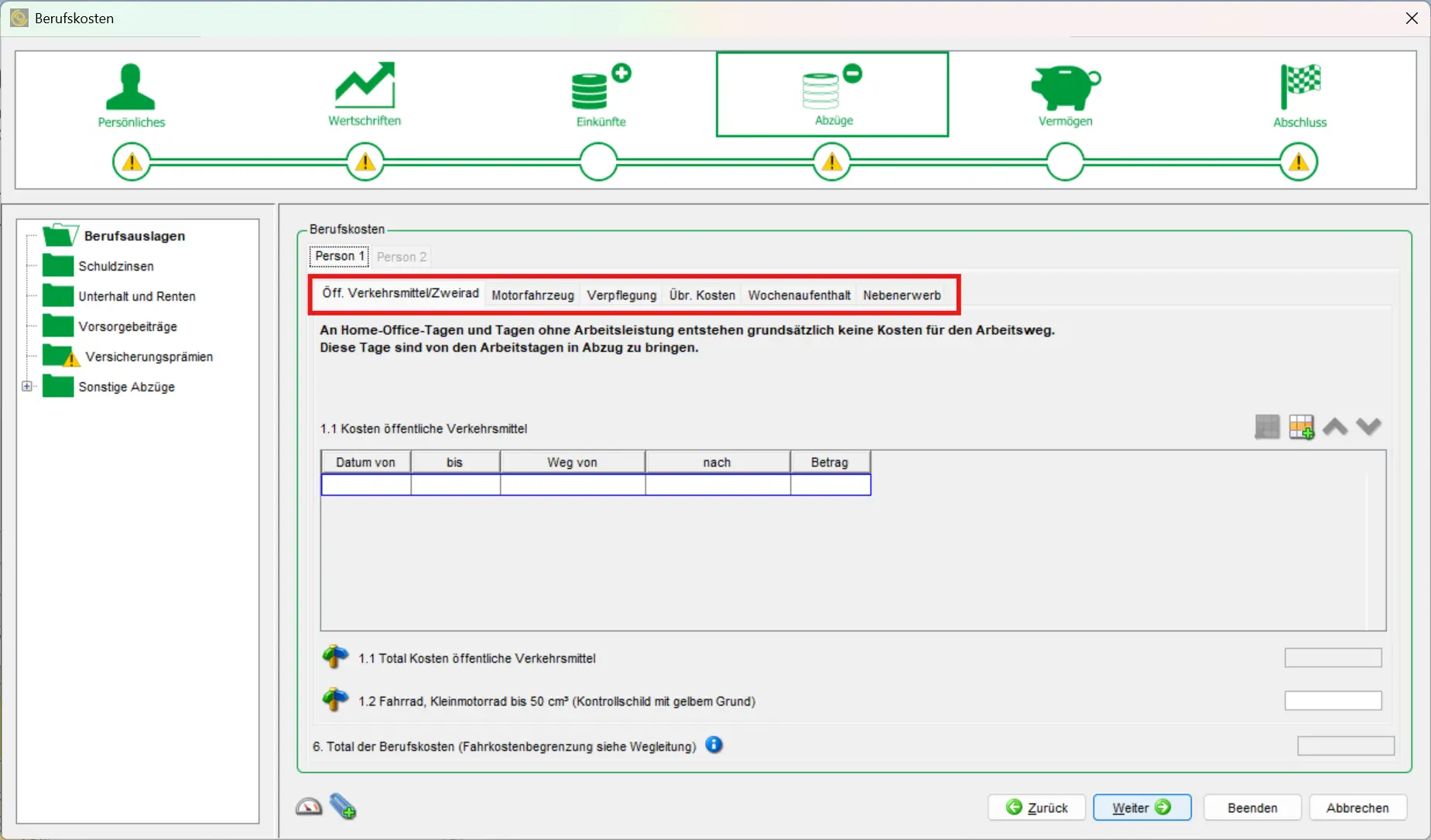

As usual, you can navigate between the different sections in the menu on the left. We start with business expenses. Note that you have different tiles in this menu; you don’t have to fill in just the first one. We’ll go through all the categories right away.

Public transport / two-wheelers

If you use public transport to get to work, you must enter all the information here. If you’ve changed jobs during the year, you can enter your public transport use in table form.

Motor vehicle

If you use your car to get to work, you must enter it here. However, you must first indicate the reason why you use the car and not public transport. As a general rule, the reason “Time saving” is sufficient, even if it’s not 90 minutes as indicated. You can simply add the time-saving reason under “Other”.

Meals

Do you have to eat out? You can enter it here. Tip: check whether it’s more advantageous for you, from a tax point of view, to indicate 4 times the journey to work or the lunch out. However, after a certain distance, the four-way trip is no longer credible for the tax authorities…

Other expenses

For most people, the flat-rate deduction is sufficient, amounting to CHF 700 plus 10% of net salary. If your expenses are higher, you should list them in tabular form and justify them.

Weekly stay

Here you can enter hotel or other overnight stays.

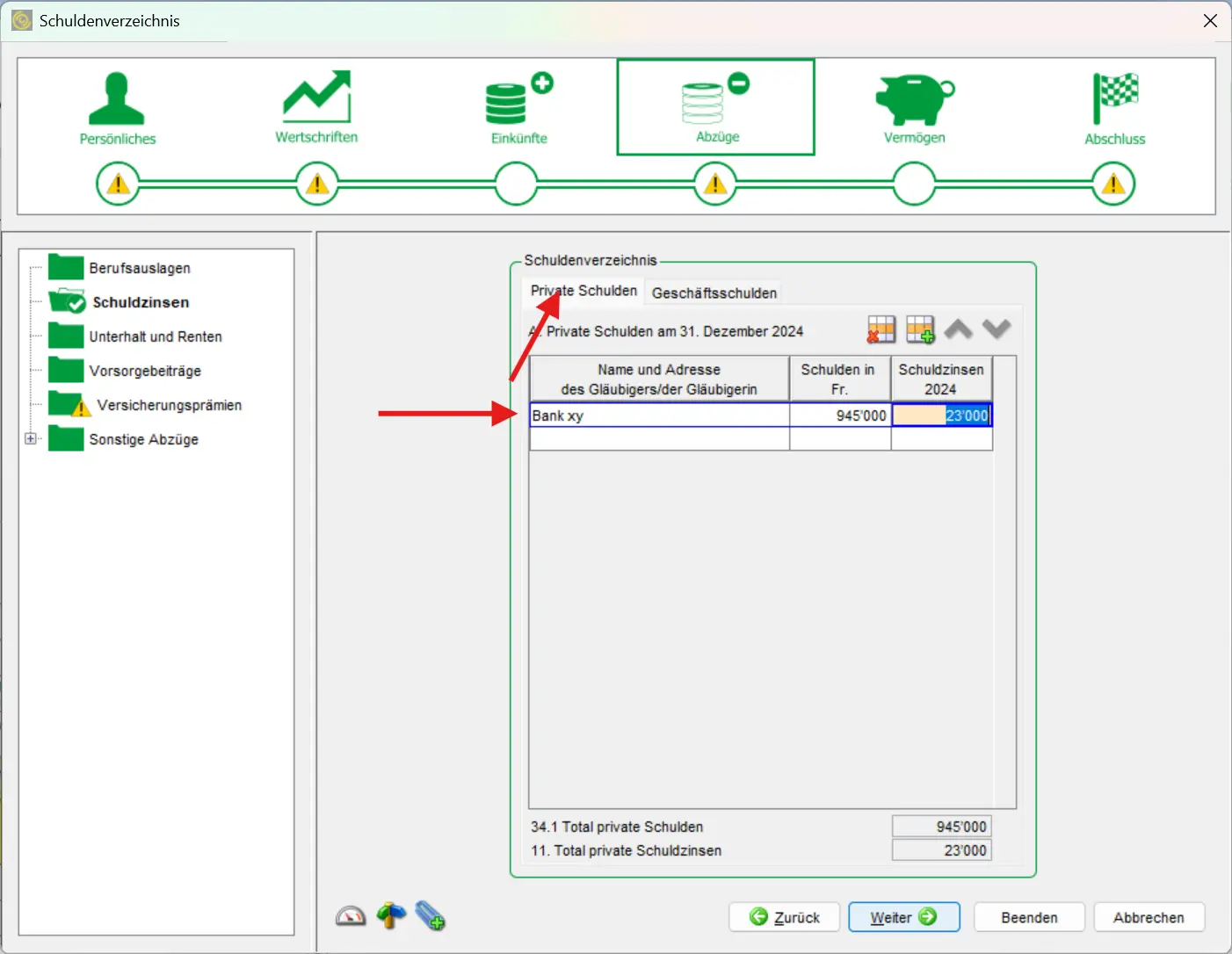

Interest expenses

A distinction is made between private and business debts.

Important for homeowners: mortgage interest can be entered under private debts! At least for the time being, thanks to the 2025 vote on the abolition of rental value, this will soon be a thing of the past. But for the time being, you have to indicate it, as you can see in the screenshot:

Alimony and pensions

Maintenance contributions for ex-partners, minor children and pension benefits can be entered here.

Pension contributions

Under pension contributions, you can deduct your Pillar 3a contributions; of course, only if you have paid the contributions. The maximum Pillar 3a amount for 2025 is CHF 7'258 per person.

You must also enclose your pension certificate. Don’t forget this part, as you can deduct a lot. For a couple, that’s almost CHF 15,000 in deductions!

Other deductions

Health insurance is constantly on the rise. At least, they can be deducted in the area of insurance premiums. Enter everything you want here.

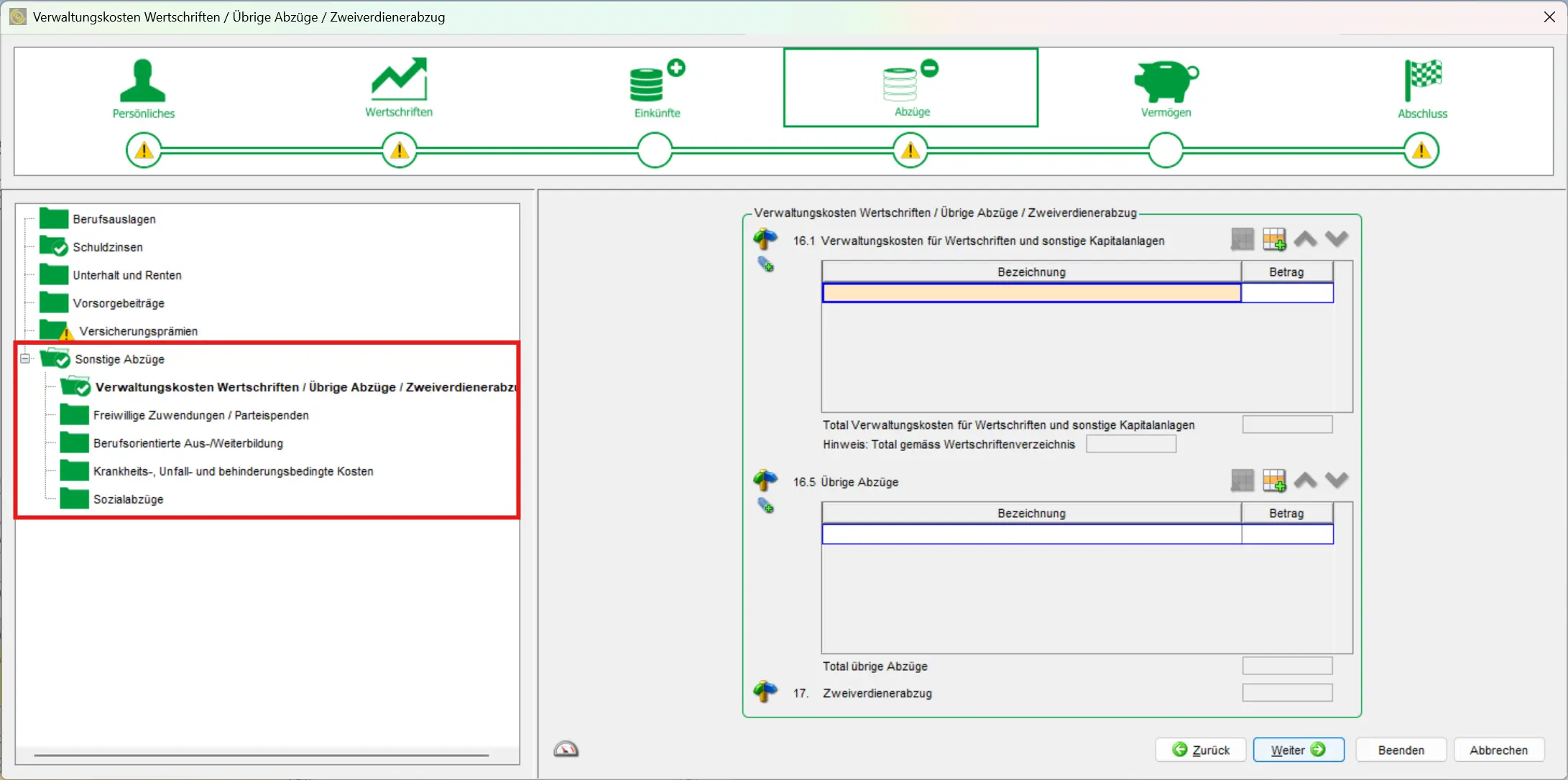

Clicking on “Other deductions” opens other areas where you can enter deductions:

- Administration fees, securities…: as a true Mustachian, I hope you don’t have administration fees, but manage your assets yourself. The deduction for two incomes is here automatically granted by the program if you are entitled to it. You don’t need to worry about it. Thank you, Canton St. Gallen ;)

- Voluntary donations / party donations: if you do something good with your money and donate it, you don’t have to pay tax either. This applies to a maximum of 20% of your net income.

- Professional training: If you are taking a paid training course, you can enter it here. Don’t forget to include receipts!

- Sickness costs: a distinction is made here between sickness costs and disability-related costs.

- Social deductions: if you are financially supporting another person, you can indicate this here. Deductions for children should be made automatically on the basis of the personal data entered. Thanks again, Canton St. Gallen.

Next step

You can now calculate your taxable income. But your wealth is also interesting.

In the last part of my eTaxes guide for the canton of St. Gallen, we discuss how to accurately report your net worth and what the final steps are for completing your tax return.

And it’s soon over already!