The canton of St. Gallen has announced its new tax return software, "E-Tax SG". I will update this tutorial as soon as possible.

New year, new (bad) luck? In the first few months of the year, the new St. Gallen tax return already arrives at home, waiting to be filled in. At this point, you have three options for action:

- You extend the submission deadline (but eventually, you’ll have to do it…)

- Hire a tax advisor to do the work

- Gather all your documents and get to work

As a true Mustachian, there’s no question of you calling in a tax consultant. You still have to do the hard work of collecting and sorting all your documents yourself, and it’s not free either. With the help of this guide, you can fill in the form without any problems. At home and entirely digitally!

Starting the program

First of all, you need to download the latest version of the “eTaxes St.Gallen” tax program here. Make sure you download the right version for your operating system and that the system requirements are met. This should be the case for any commercially available laptop or PC no older than 10 years.

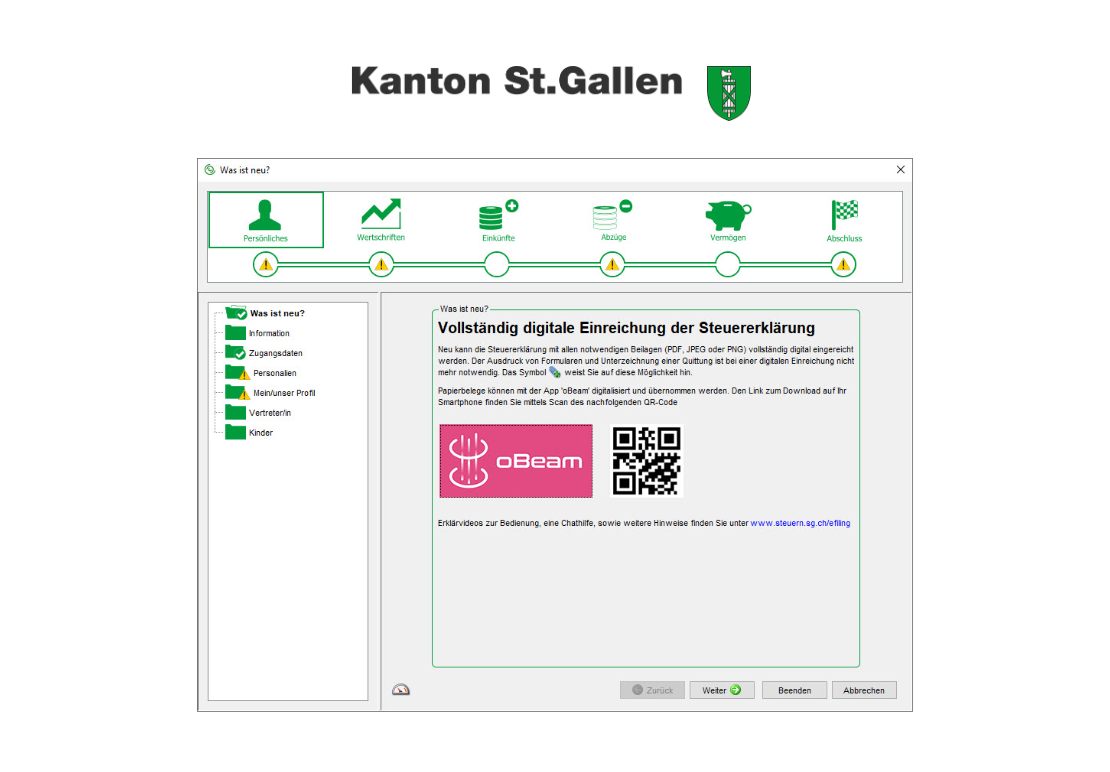

In addition, I recommend that you download the “oBeam” application. You need this application to scan documents. This way, you don’t have to physically submit anything, and you can do it all at home.

You can find the application in the relevant App Store or use the QR code displayed at the start of the tax program. Here too, any smartphone that isn’t museum-ready can use this app. Use of this app is voluntary, so nostalgic users can continue to send their receipts physically.

If you’d like to download your receipts at the same time as you fill them in, you can do so by clicking on this paperclip:

You can also submit all the receipts at the end with the application. As you wish.

Now start the “Steuer St. Gallen 20xx” program, select “Enter new tax return” and off you go!

Importing data and saving

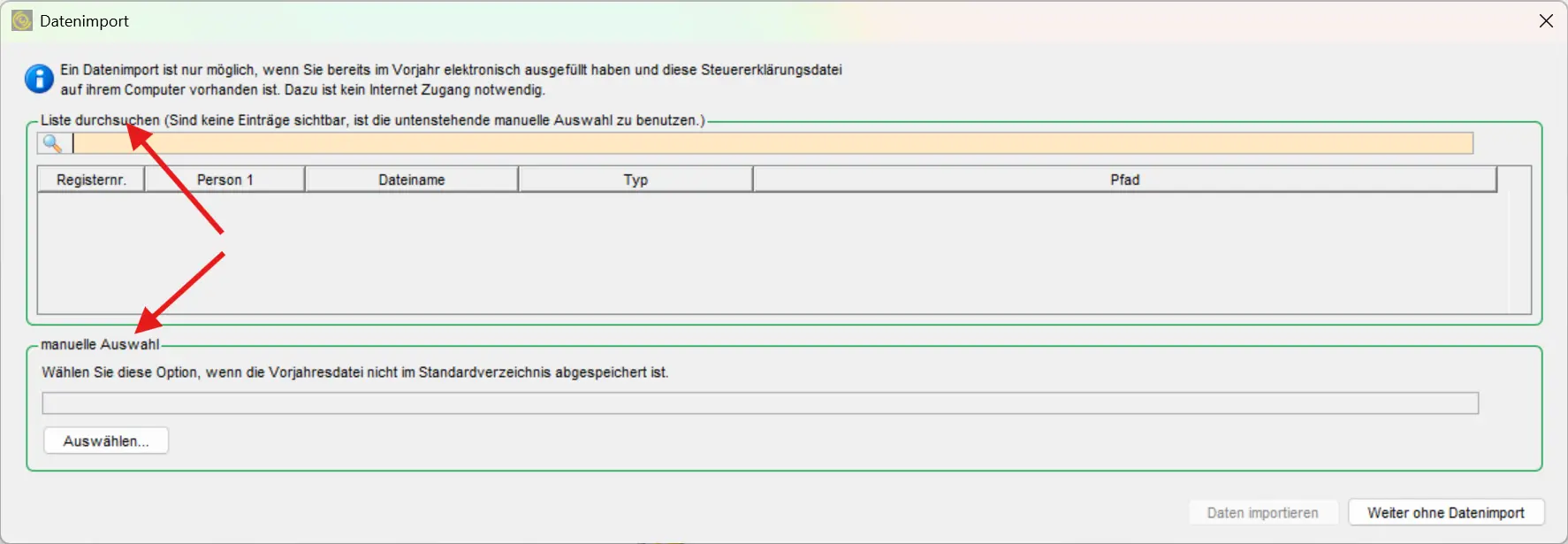

Have you already filed your taxes last year with this program? Then you can easily import the data and save yourself a lot of effort.

Importing data into eTaxes St.Gallen with automatic search for the previous year's tax return and manual file selection

If you choose the default folder every time, your file is probably already visible under “Browse list”. If not, select your previous year’s file under “Manual selection”.

Is this your first tax return? Then your effort is a little greater this time. Take comfort in the fact that the work involved in subsequent years will be massively reduced! Everything you do carefully today will make your life easier in the years to come.

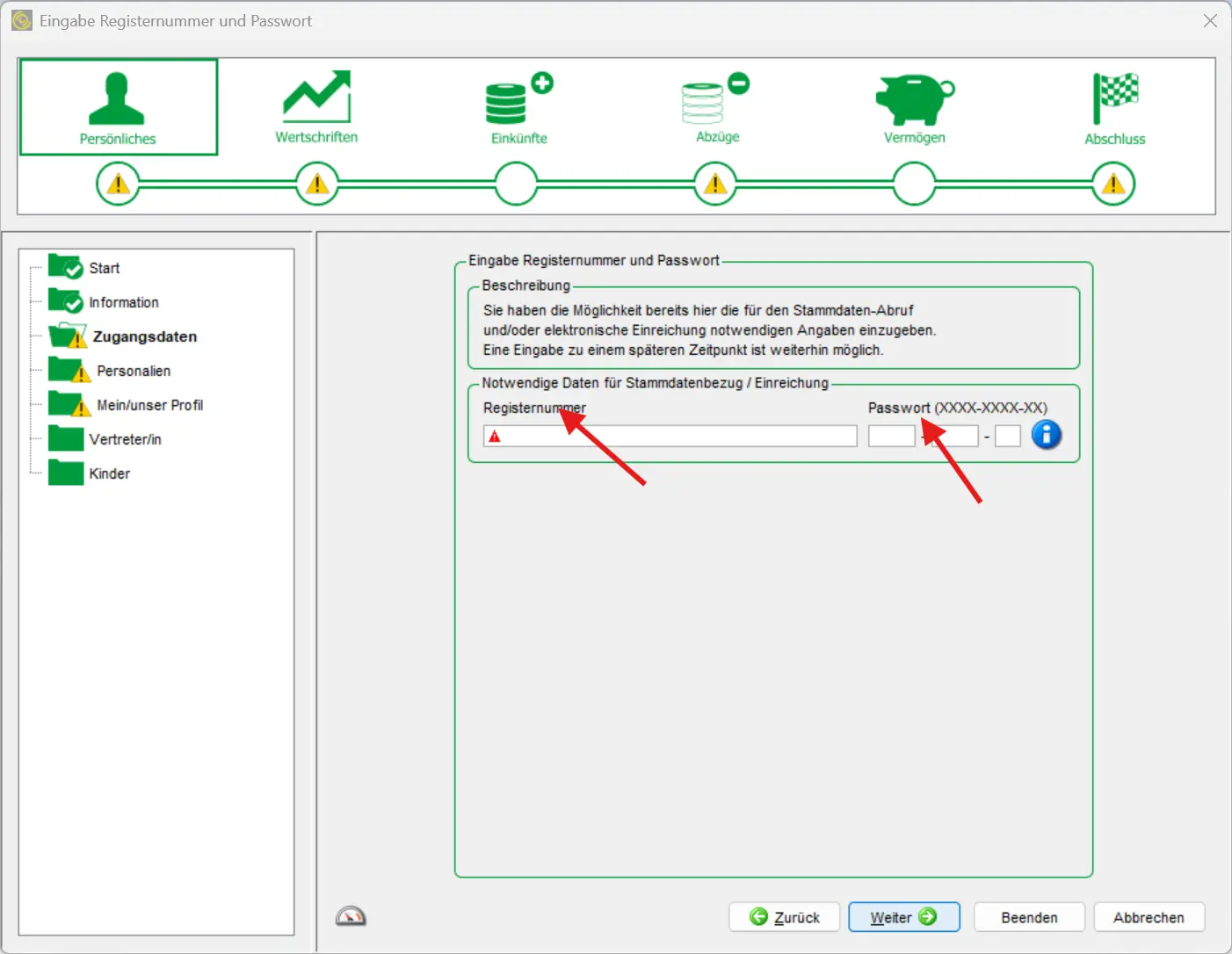

Next, enter your registration number and password. You’ll find this information on the form you’ll receive in the post from your local hometown, on page 1, in the top third.

In general, the way to use the software is: you enter your data each time and click on the “Continue” button. This will guide you step-by-step through your tax return. You can close the program at any time by clicking on “Quit” and continue at another time. All data is saved automatically. So you don’t have to do it all at once. The program also warns you at the end if you’ve forgotten any important data - and you’ve got that guide here too!

Personal data

Here’s some information you only need to enter the first time. In the years to come, this part will be taken care of in no time.

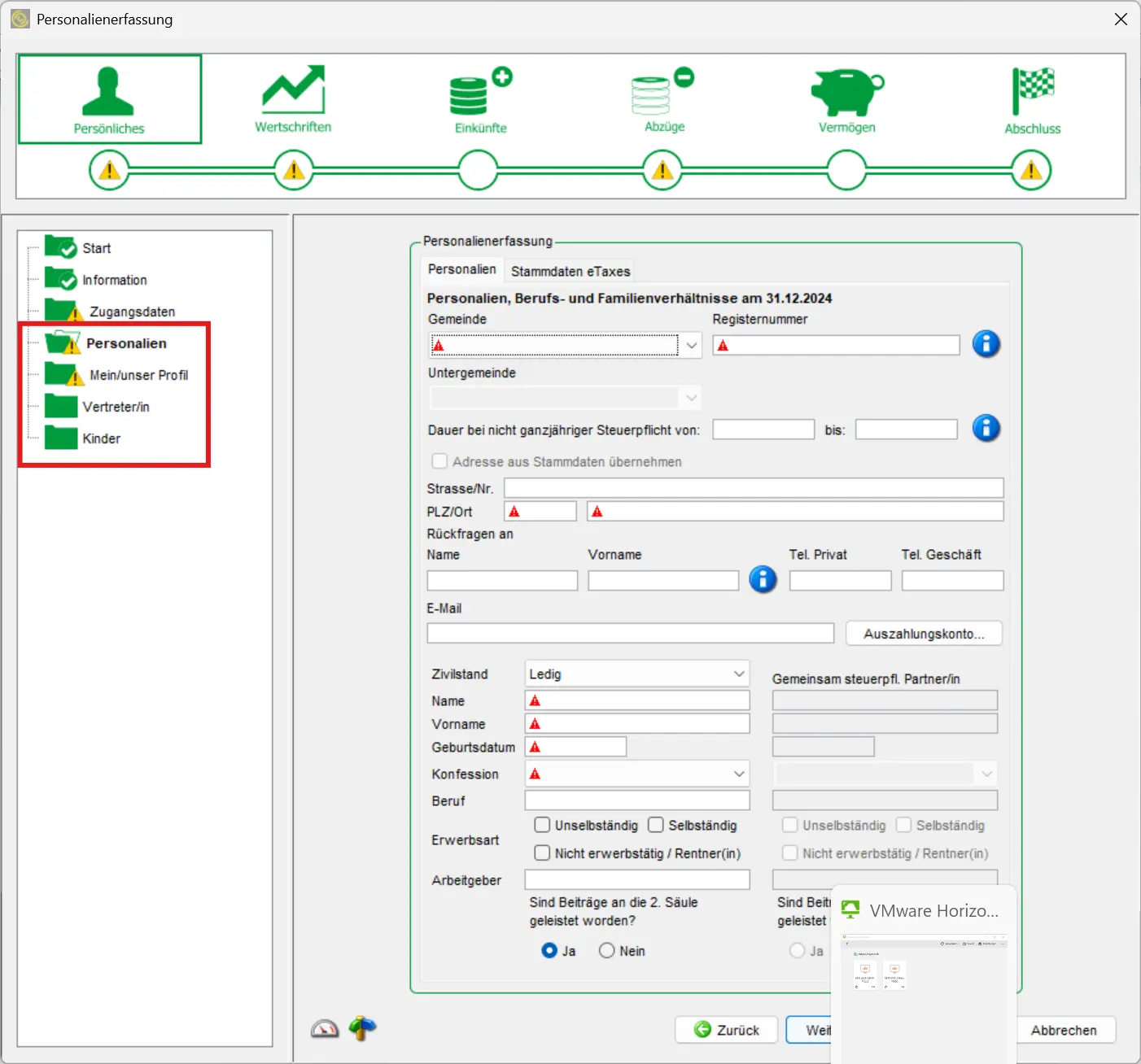

Personal data

No surprises here. The “(religious) denomination” field has an influence on your tax burden: if you are non-denominational, please enter it here accordingly.

The question “Have you made any 2nd pillar contributions?” is also very important. If you are employed and your annual salary is at least CHF 22'680, you must tick “Yes” here.

If you have already filled in your taxes last year, you can select the “eTaxes basic data” tab at the top and import it.

My/our profile

Here you can check off the additional income and deductions you wish to claim. Read the points carefully and tick what applies to you — but you’ll need to give more precise information on the individual points later in the document.

Representative

You’re not filling out the tax return for yourself, but for someone else, such as your parents? If so, you must indicate this here.

Children

Enter the personal details of your children.

Accounts and securities

Now comes one of the most complex parts: your securities.

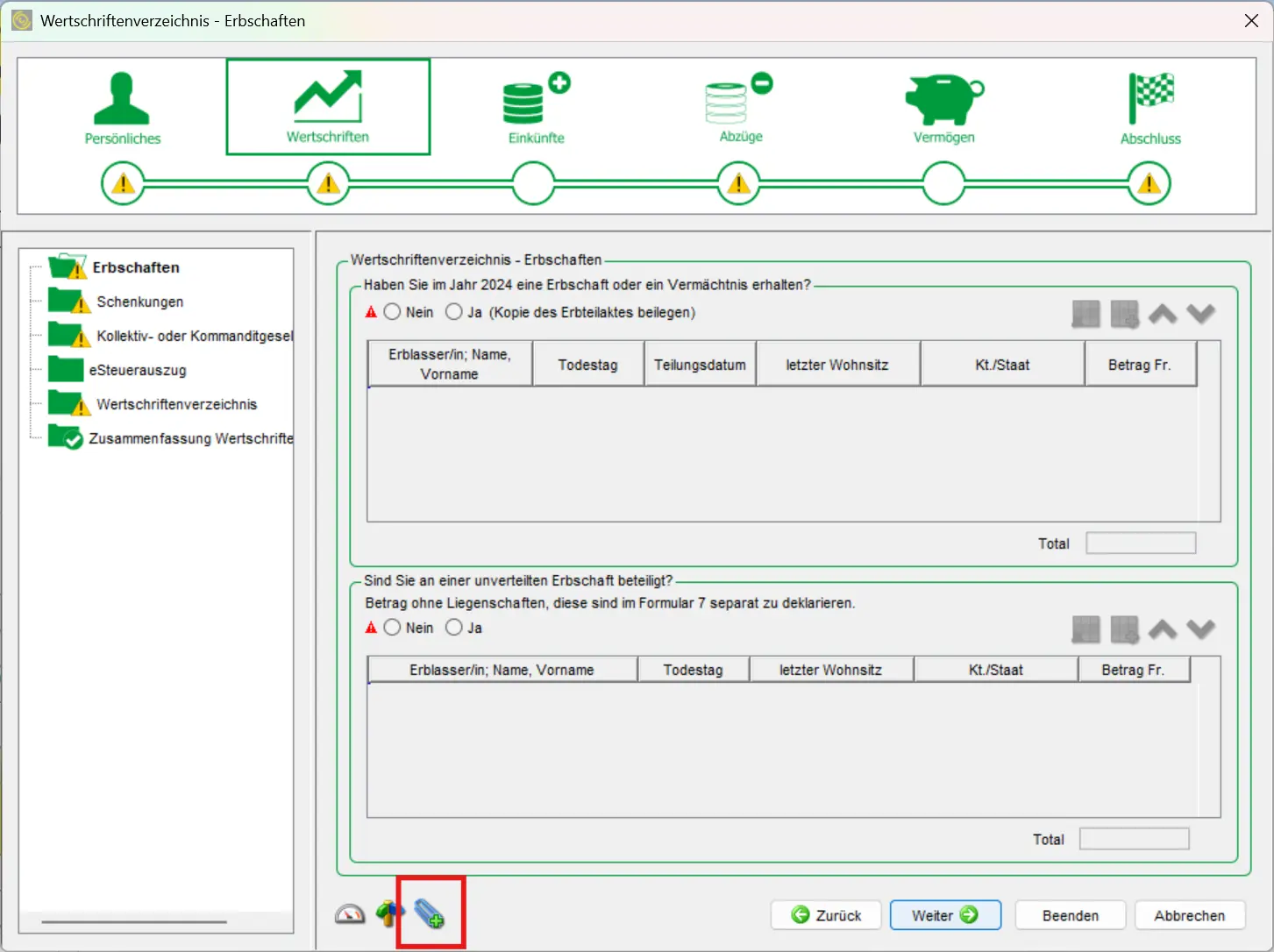

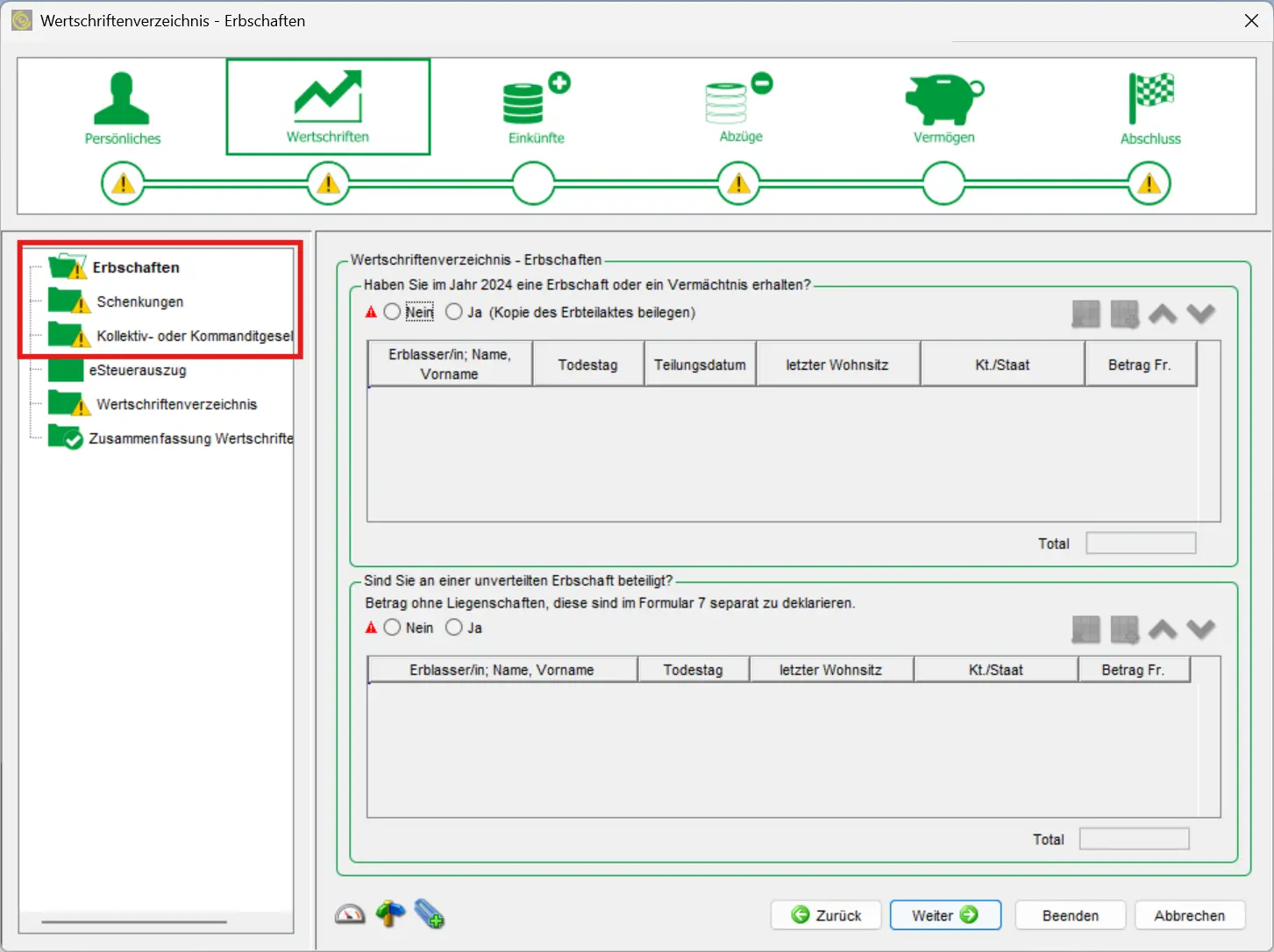

The first three points are usually dealt with quickly. If you haven’t received an inheritance or donation and you’re not part of a general or limited partnership, you can simply select “No” everywhere.

Otherwise, simply fill in the self-explanatory fields.

The most important part is the “Securities Register”. All your accounts and deposits must be listed here.

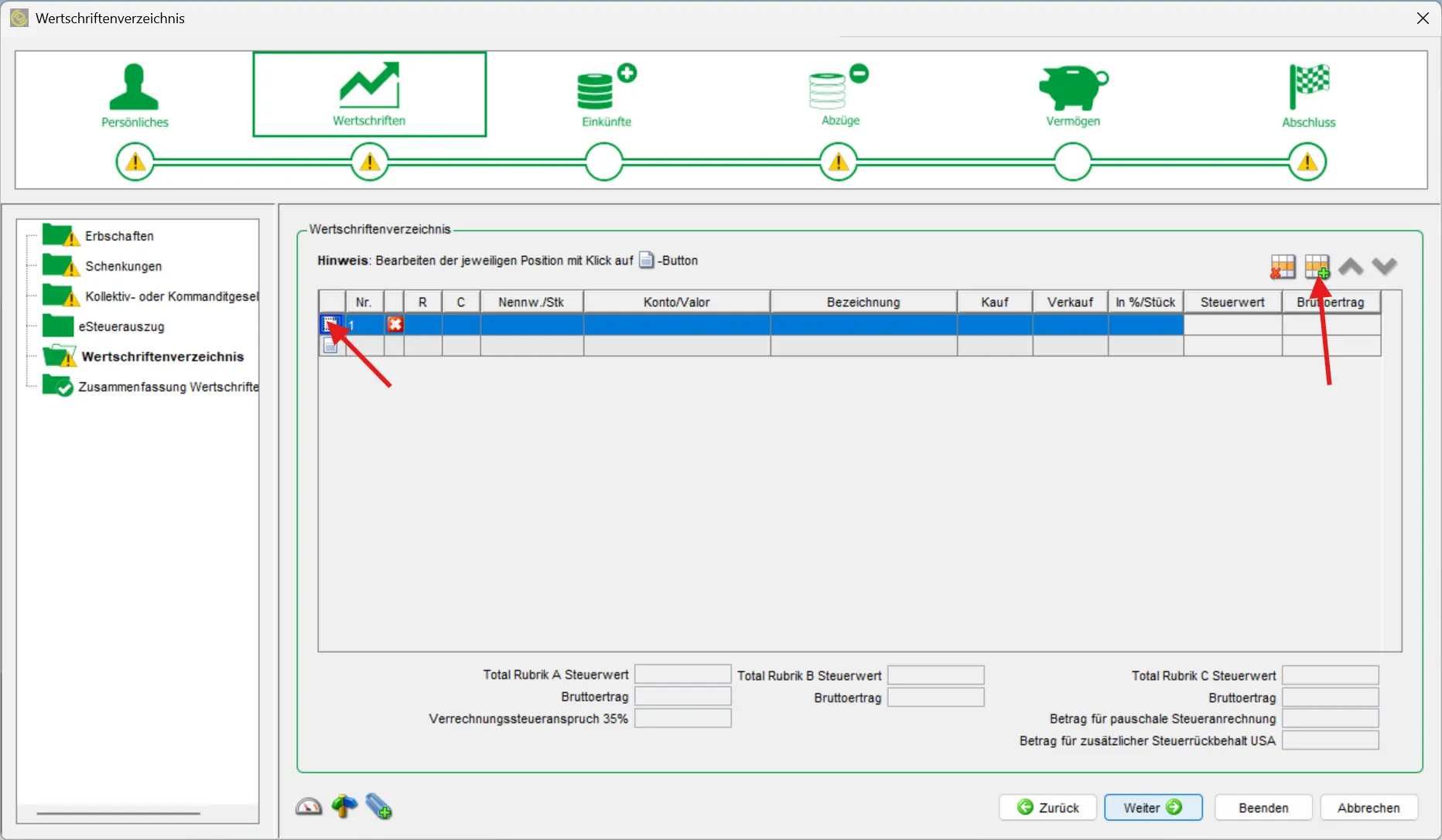

You can add a row by clicking on the table icon with the green plus in the top right-hand corner. By double-clicking on the new line or on the document sign on the left, you’ll come to a new mask in which you can enter the details of this title.

Accounts

In principle, you only declare your share (often 50%). Details are explained in the general FAQ here: FAQ Swiss tax return (2026).

For your normal salary and savings accounts, the procedure is simple. At the top, select “Bank/post office account”, heading B, and fill in the rest of the information according to your bank’s tax statement.

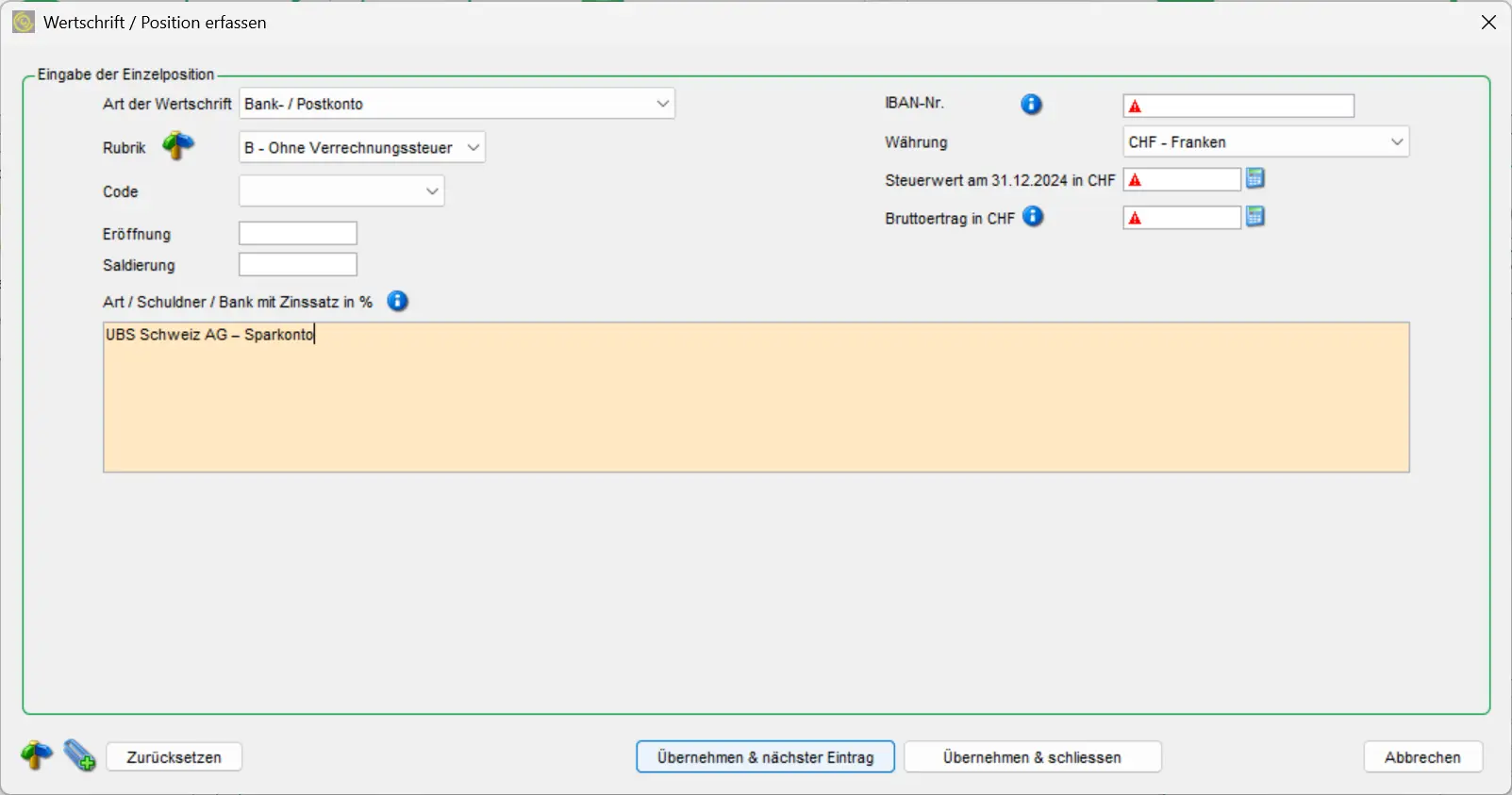

Entering a bank account in the eTaxes St. Gallen securities form, including tax value and gross income

Tip: only fields with red exclamation marks must be filled in. You can leave the others blank.

Don’t forget to mention all your accounts if you have more than one, or if you’re a married couple.

Securities: ETFs and stocks

If you invest in ETFs or stocks (US, Europe, Ireland), the tax side quickly gets confusing: dividends, withholding tax, DA-1, R-US 164, etc. I’ve put everything together in a clear, jargon-free guide, with concrete examples from my own tax returns:

Swiss Investor Tax Guide 2026: US, Europe, Ireland ETFs

For ETFs and stocks, it’s a little more complicated, but fortunately, technique helps. Let’s do an example with the very popular VT ETF and a Swiss stock. We start with the VT ETF.

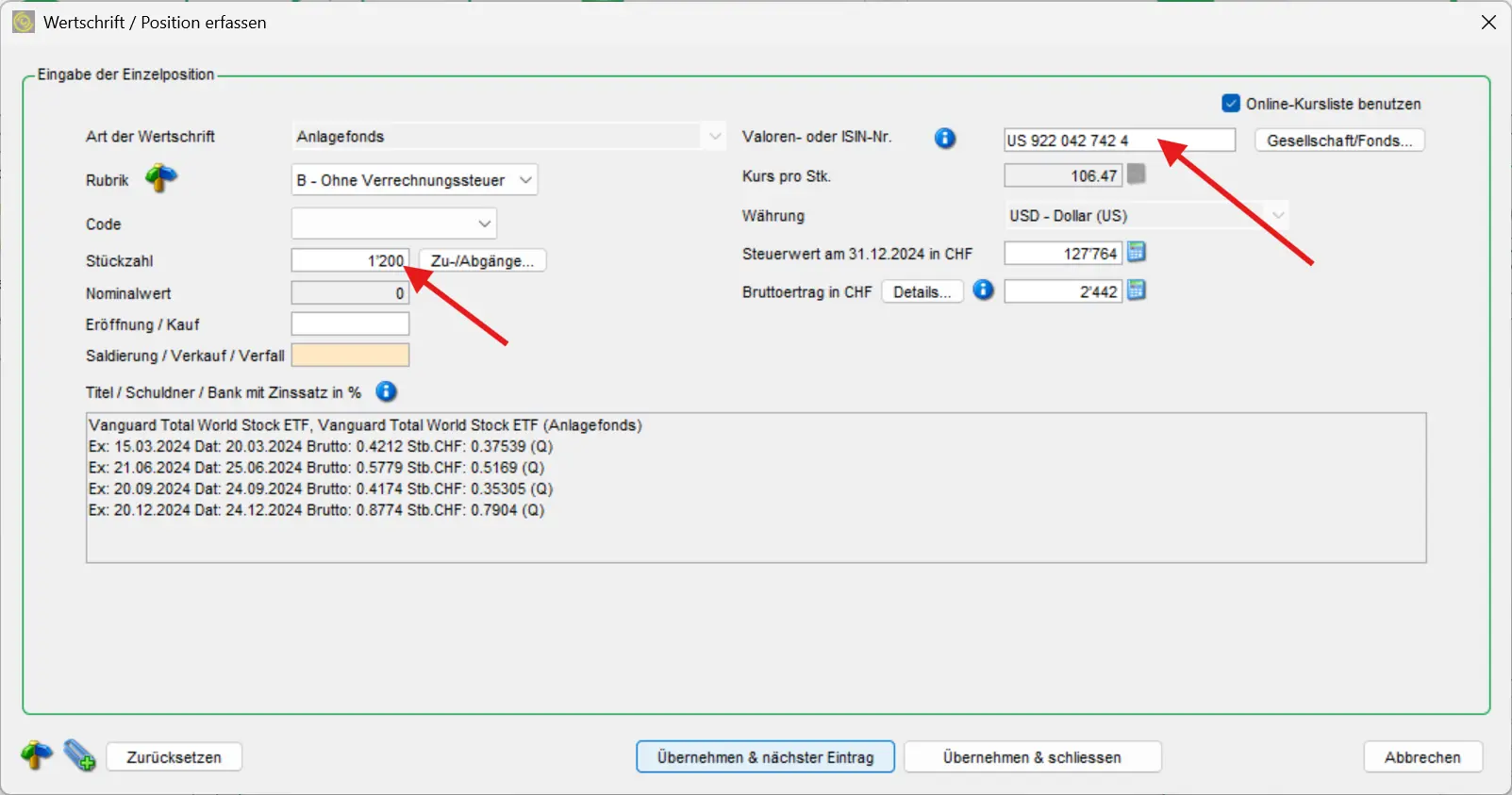

Declaration of our favorite VT ETF in the eTaxes St. Gallen securities form with ISIN, number of units and dividend income

Actually, you don’t need that much information. First, select “Investment funds” in the security type, then choose “B” in the heading.

Now you need the ISIN number of your ETF, which you’ll find in your documents. Then indicate under “Number of units” how many you bought over the whole year. Depending on the broker, you’ll either find this in an overview or you’ll have to do a little calculation. Now let the magic do the rest, because all the other figures are fed in directly by the program: price per unit, tax value and gross income are filled in automatically. Heureka!

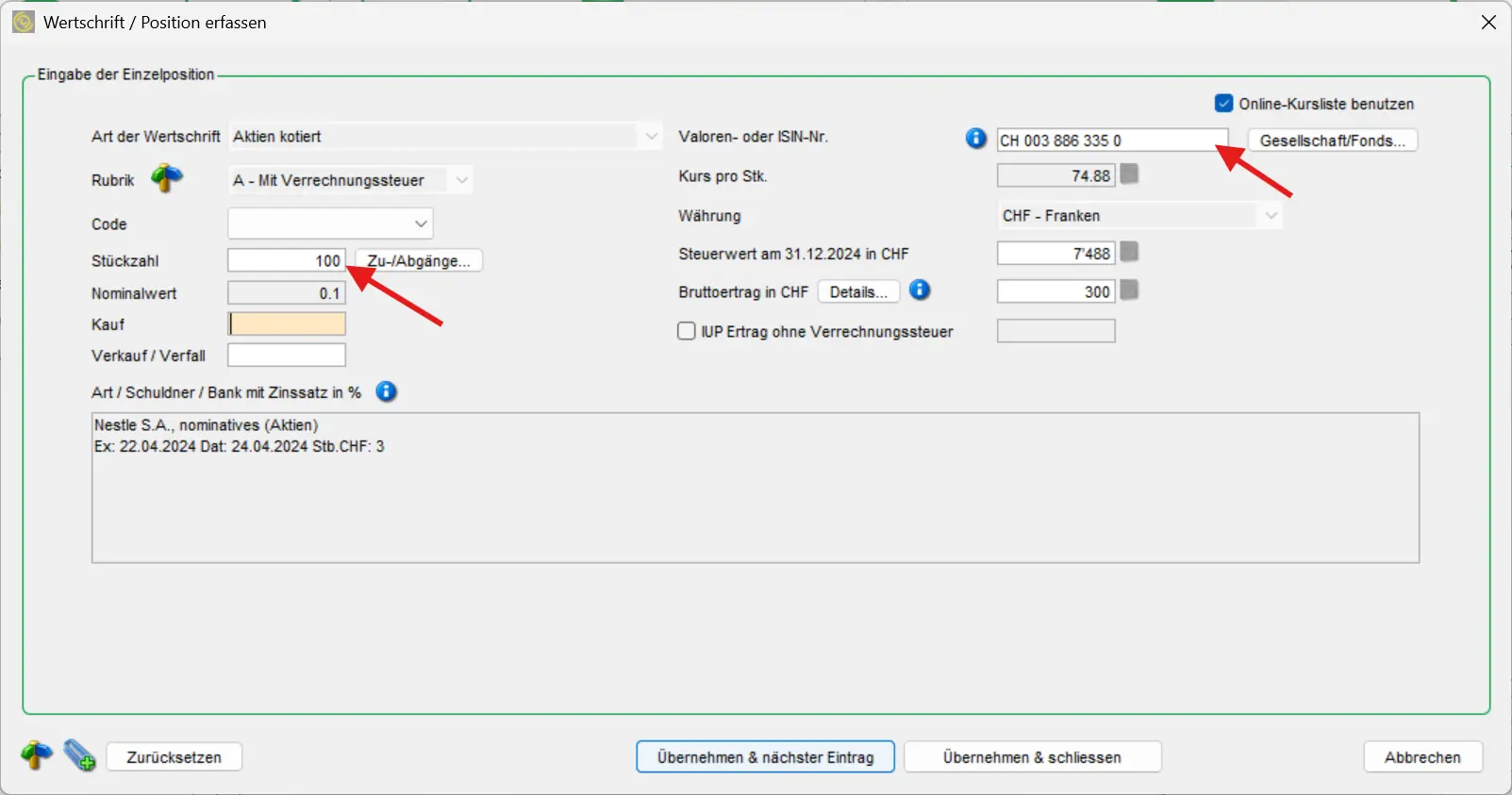

Next we move on to a Swiss stock, with Nestlé as an example.

For the type of security, this time you select “Listed shares”, the heading is now “A”.

The procedure is the same: enter the ISIN number, the number of shares purchased this year, and voilà! The program may look outdated, but the functionality is convincing.

For your own control, you can consult the summary of your shares at the end. To the left of the menu, or using the “Back” button, you can return at any time to modify or add anything.

Next step

And that’s it, we’ve done most of the work.

In the second part of my eTaxes guide for the canton of St-Gall, we’ll be looking at income and deductions.