We got lucky today!

I recurringly get questions about the three following FIRE (Financial Independence, Retire Early) topics:

- How does early retirement work after you are FIRE (withdrawal rates, 2nd and 3a pillars, minimum AHV contributions, etc.)?

- How to FIRE abroad (challenges like taxes, 2nd pillar and 3a pillar money, etc)?

- How to deal with multiple countries’ pensions once you are FIRE?

Thankfully (for us!), Steve’s story ticks all the boxes.

I hope you enjoy it as much as I did, and that it answers some of your own FIRE challenges!

Over to you, Steve :)

Introduction

Thanks for having me on your blog, Marc, it’s a real pleasure!

As you originally contacted me just before I officially retired (late 2021/early 2022), and I provided you with information that included my expectations and plans for retirement and some details on our financial situation at that time.

Since I think it might be of interest, I’ve contrasted the situation at the time of retirement vs. how things have actually panned out almost a year and a half into retirement.

Also, note that I agreed to do this interview to satisfy a desire I have to have an impact on people’s lives during retirement by helping them consider their own financial situation and retirement plans.

Particularly if they intend to retire abroad.

I think my situation serves as a useful case study of what can happen when the market crashes just after you retire (in our case in February 2022 with the invasion of Ukraine). Showing that this kind of negative situation need not be devastating, might give people more confidence in their own planning.

In addition, the article might generate discussion and questions from readers.

This in turn might be a benefit to our family in the years ahead.

If needed, we might consider a follow-up article.

I’ve of course provided my financial numbers 💰 (since this is probably of most interest to readers of the Mustachian Post :D)

You will see that there are challenges to having assets in multiple countries and/or when you wish to retire to a different country.

However, the non-financial aspects of retirement also require a lot of preplanning to try and ensure a fulfilled meaningful and happy retirement.

I hope my experience will get people thinking about their own lives and start to implement some ideas even before retirement.

Our family backstory

So, my name is Steve, aged 56.

I’m currently living in a rented apartment in Riehen (Basel Stadt, Switzerland) since 2004 with my wife (55 years old) and 20 year old son.

I’ve been a statistician working in the pharmaceutical industry at various levels since I started in 1988 after completing my Masters’s degree in the UK (our home country).

After working in the UK, we then moved to Canada in 2000 for 4 years before moving in 2004 to Basel in Switzerland, where I worked for a large pharmaceutical company (being located in Basel, you can guess that it is one of two companies…)

In January 2022, I officially retired from work.

At 55, I guess this can just about be called “early” retirement or FIRE :)

My wife is continuing to work part-time in child care, but she also intends to stop paid work once we move back to the UK.

My son is in his second year as an apprentice Informatika and plans to remain in Switzerland when we move.

Moving abroad after retirement — the FIRE one ;)

We plan to remain in Switzerland in the short term to ensure our son is in a stable position while he completes his apprenticeship, but our aim is to move back to our home country (UK) in the spring of 2024.

Our son is in the process of completing his Swiss citizenship application since his intention is to remain in Switzerland for the long term.

In fact, a few months ago, he passed his local community citizenship interview, so he is just waiting for the rubber stamping at the cantonal and federal levels.

We have a C Permit which expires in Summer 2024, which my wife and I will not be renewing.

Soon after moving back to the UK, we aim to buy a house in Cornwall for somewhere between 350k to 450k CHF.

Our current thoughts are that we might temporarily stay in my wife’s Mum’s house in North Wales to start our life in the UK before moving to Cornwall.

We are also not averse to renting first, so we can take the time to buy the right house in the right location for a reasonable cost since this is a big decision to make.

Why Cornwall?

We’ve been to Cornwall a number of times recently so know that it can give us the type of lifestyle we want in retirement.

It has wonderful scenery, interesting culture, and warm people and it is a straightforward location to do most of the activities we have planned (see later section).

Furthermore, it is not too expensive to live there, if you avoid the most popular tourist areas and are not fixated on a property with a coastal view.

The house we eventually buy should not be too far from a local airport (e.g. Newquay airport), since travel is important to us.

Of course, it will also be good for us to move back to our home English speaking culture in the UK.

Switzerland has been good to us and we’ve enjoyed our time here, but we both feel it is now time to return “home”.

Retirement activities

In the UK, I intend to step up and extend my activities.

This should be easier for me in my home country since I’ve always struggled with the language while in Switzerland (languages were my worst subjects at school…)

I believe that having sufficient money in retirement can largely satisfy basic safety and physiological needs such as shelter, safety, sufficient food, water, etc. that can avoid unhappiness.

Then, there are also the obvious pleasures and experiences that give shorter-term dopamine hits (new gadgets, visiting new places, nice gourmet food, etc.).

Beyond this, I think true happiness in retirement (and indeed in life in general) depends on meeting needs in additional specific areas such as:

- Social interaction (love and belonging)

- Physical and mental well-being (health and fitness)

- Impact or purpose

- Personal development or learning

- Self-esteem/recognition

(note: this kind of thinking is similar to Maslow’s hierarchy of needs)

As I’ve moved into retirement, I’ve come to realize that my activities in retirement need to target these areas, and in particular I need to work on social interactions, connect more with friends and family, and start making new connections.

Last year, we had to deal with the traumatic death of a close relative which put everything into perspective…

Having an impact or purpose in life is also important to me.

As a statistician working in the pharmaceutical industry, I worked in teams helping to develop and provide life-saving and life-improving drugs to people.

And this helped me cope with the often stressful fast-paced working environment.

In retirement, I still think you need a purpose in life and therefore, my future activities will be chosen with this in mind.

Activities that cover multiple areas at a lower cost are ideal.

Currently, my plans for the next few years are as follows:

Travel

We are keen on visiting new and interesting places (New Zealand, Iceland, East Canada) and returning to places we already like (e.g. Western Canada).

However, if we can align this with meeting up with friends and family, this can increase the value of such trips.

In addition, during our travels activities like hiking and skiing, these places will maintain our physical well-being and fitness.

One thing I’m increasingly conscious of is the impact of travel on the environment and climate change, so I think there is a need to factor this into our future travel plans.

This will involve choosing means of transport that have a lower climate impact and perhaps choosing “slow” travel options (i.e. staying in the same destination for longer rather than short stays in multiple destinations requiring more transport).

I’m already considering buying an EV for our next car once we are back in the UK.

Since retiring, I have substantially increased my travels but, apart from the occasional family holiday, the main priority for me has been to meet up with friends and family. I guess travel for just leisure purposes will increase once my wife is no longer working.

Health and fitness

I’ve stepped up my running schedule in preparation for my first ever marathon in October later this year.

This will take place in Victoria (British Columbia, Canada) where we used to live between 2000 and 2004, so it will be great to meet up with old friends who are still living there.

I actually completed a half-marathon at the same event in 2002, so it will be good to go a step further this time.

Victoria (and Canada) still holds a dear place in our hearts so we intend to keep on visiting the place in the future.

At present, I’m also doing a lot of hiking, mainly in the local area, including daily walks with our 10 year flat-coated retriever, Molly.

In winter, I enjoy typical seasonal activities such as downhill and cross-country skiing.

Beyond this, I hope to join a gym when back in the UK and increase hiking, etc, perhaps joining clubs to incorporate a social interaction element.

I regularly attended a subsided company gym in Basel but canceled my membership when COVID hit.

I was meaning to join a gym again post-retirement, but was put off by the high cost of many gyms and the fact that we are leaving Switzerland soon anyway.

Making an impact: with financial education

I’ve been thinking about how I can make use of my financial knowledge accrued over the last few years to make an impact in other people’s lives.

Educating my son about personal finance One straightforward way is to try to teach money matters to my son who is transitioning to the world of work and is having to deal with money he has earned himself for the first time.

Part of my approach to teaching him is through example, showing him what I’ve been doing my numbers, and what difference being able to handle money in the correct manner has made to our lives.

Hopefully, he can absorb and apply the principles himself without needing to directly tell him what to do.

Although it is possible to give him books to read and relevant podcasts and blogs (your book will help with this!), like many young people, he probably lacks the motivation to take time to use these resources effectively given the other competing priorities in his life.

I also think my son’s specific learning style is such that self-motivated book reading is probably not the best approach to use.

Educating or helping others with personal finance At the start of retirement, since I thought I had lots of time available, my intention was also to put together some financial material e.g. PowerPoint slides or video recording modules on specific topics, or even develop a podcast or even develop something on Youtube, with my son helping on the technical side.

I thought I could then use these materials to teach my son or for him to use as needed but perhaps also roll them out to a wider audience, perhaps adapting so that the material is different from the usual stuff already available.

Most blogs, podcasts, and co focus on money only or with happiness almost as a side effect, but I think I could have linked the financial aspects with how happiness itself could be optimized — this kind of approach would give a better framework for long-term planning and spending decisions in general.

I did initially start to make notes on this project and make some initial slides, but I soon came to realize that this was too ambitious for me.

In retirement without specific deadlines and other competing non-stressful activities, without knowing that the material would eventually be good enough, it was difficult to find motivation.

Therefore this project has been put on the back burner.

Instead, I’ve been trying to help individual friends and family with personal financial issues and this has been good for my self-esteem since I think I have made a good impact. Examples of this include the following:

- Advising a friend living nearby to increase her upcoming UK state pension by making additional UK National Insurance contributions, to make up for missing years’ contributions since 2006 while she has been living abroad. A payment for a missing year would probably pay for itself in either one year or 3 years depending on the class of contribution she has to make.

- I gave advice to a friend in the UK deciding on whether to make additional contributions to a workplace pension and also in what type of fund the additional money should be invested.

- Providing this article on our early retirement life to Marc for inclusion in his website is also another way we can help people. Hopefully, we get some good feedback and that might give me the confidence to do more in the future.

Off the top of my head, it could be useful to do a follow-up article addressing questions or feedback areas or even an article giving my wife’s viewpoint on the retirement process if she’s up for it.

Making an impact: with community and charity work

At present, my wife is helping out quite a bit with support for Ukranian refugees and I also help out to a small extent.

We hope to increase my community and charity work when we return to the UK, when we both have more time and where it will be easier to communicate in English.

Personally, I’m also interested in getting involved in local politics.

Making an impact: on the environment and fighting climate change

Now I have more time, I am keen to support initiatives to improve the environment and fight climate change. At present, I am doing some research on the topic and will hopefully step up to some practical activities once I’m back in the UK.

Other activities

Apart from the above, I’m aiming to target additional activities that increase social interaction and other areas of learning and development, self-esteem, etc.

These include the following:

- Joining a pub quiz team: at present, we have an informal group that attends a pub quiz on a Sunday evening and any winnings for first or second place go towards charity. Therefore, this activity targets multiple areas needed for happiness: social interaction, learning, self-esteem, impact, and purpose. The only downside is that it could detract from the health and fitness side if I indulge too much in alcohol and/or unhealthy food such as Nachos…

- Joining a singing club: Cornwall is famous for its singing groups who perform local popular and folk songs such as sea shanties etc. My voice isn’t perfect but I think this activity would be great for meeting new friends.

- Joining other clubs such as hiking clubs etc.

- Taking up education classes and courses: I’m very interested in topics such as History, Politics, and Finance, and regularly listen to podcasts while I am hiking and during my runs.

ALL our financial details disclosed

Now let’s get to what we all love to talk about on your blog: money numbers!

For interest, I have included the numbers from around the time I retired in January 2022 and provided more recent updates (in parenthesis “update 06.2023:”) so people can see the impact of the recent market downtown, and currency changes as we have drawdown our assets for spending purposes.

All valuations have been converted to CHF where necessary.

In a nutshell:

- Total net worth is approximately 2.46 Mio CHF (update 06.2023: This is now 2.13 Mio CHF)

- State pensions worth approx 44.7k CHF per year (combined, inflation-linked, starting from ages 65-67 in the different countries) — (update 06.2023: the expected state pension income is approx 46k CHF p.a.)

And below are the details by country.

I added how I found the numbers for each of them.

Some of the pension accounts have online access where you can log in to your accounts to check the current status and others provide yearly updates.

There is still some missing info that I request periodically by contacting support departments by email and/or phone.

I like to keep on top of the current numbers, so I have a good idea of our current net worth and likely pension payments so I can check whether I am still fine financially.

UK

Steve Company Pension

I have a frozen company pension in the UK.

This is a hybrid pension scheme in two parts; (1) a retirement account is meant to provide a guaranteed income based on your final salary at the time of leaving the company. The annual pension is meant to go up by approx inflation each year although there are some complicated rules. You can convert this to a single capital value if you want to transfer out or take in one go but the conversion is complicated and depends on current interest rates etc. (2) There is also an investment account with money invested in mixed asset funds of your choice with very low fees.

In terms of checking current value and options I have an online account, where I can check the current value of the investment account whenever I want and this changes on a daily basis.

It is more difficult to get online info on the retirement account and the numerous options for converting to a capital amount or taking annual pensions (which can take both accounts into consideration). For this, I usually contact the pension administrators by email and they usually take a number of weeks (or months) to make the calculations and produce a report giving the valuations and possible retirement options.

The company also allows me to have two separate and free meetings with a specific financial advice company to talk through my options prior to when I need to access money or transfer to another provider.

The estimated transfer amount is about 230k CHF. (update 06.2023: 206k CHF. Increases in inflation since retirement countered by a fall in the market, fall in transfer value due to increases in interest rates, and fall in the value of GBP vs. CHF ^^)

Wife’s UK personal pensions with same company

My wife also has 3 personal pensions, two will give annual pensions of 4.3k CHF and 1.4k CHF (non-inflation adjusted) (update 06.2023: unchanged in sterling value but reduced in CHF — also less valuable because of high UK inflation), and the remaining fund will be available as a lump sum valued at 25k CHF (update 06.2023: probably reduced, due to market fall and sterling depreciation, but no recent valuation). The total transfer value in the 3 funds is about 66k CHF. (update 06.2023: probably less than 60k).

The pension company sends regular statements (annually) and we can request a more detailed single report as needed which is sent by email (with a security password).

UK Endowment Plan

We also have an endowment fund left over from a house we bought and then sold in the UK. We have been making small monthly payments to this fund for over 24 years with the last payment done in August 2022. Its current value is about 45k CHF (update 06.2023: worth approx 41k CHF). It’s a multi-asset fund with about 60% equities in it.

Again, I have an online account that I can access with a username and password where I can check current valuation which changes on a daily basis.

UK State Pension

In addition, since leaving the UK in 2000, we have both been making monthly voluntary National Insurance contributions. So we should both be able to receive a full UK state pension at the state retirement age. From April 2030, the total value for both pensions combined will be 23.8k CHF p.a. based on January 2022 money. (update 06.2023: similar value today — increase due to inflation is countered by a reduction in sterling value)

Bank account

Finally, we still have a current UK bank account containing approx 17k CHF. (update 06.2023: around 9k CHF)

Canada

I have an RRSP (Canadian retirement account) at Manulife with an estimated value of 39k CHF. (update 06.2023: value reduced to approx 34k CHF).

It is invested in funds of about 70% equities.

Note that there are restrictions on taking out this money during retirement with possible tax penalties if you take too much in any one year.

I have an online access account which I can access via username and password.

We will also eventually receive a small CPP (Canadian Pension Plan) pension worth approx 1.3k CHF p.a. (update 06.2023: value is rather uncertain since I haven’t obtained an estimate from the Canadian government)

Switzerland

2nd pillars

I’m in the process of transferring my large company pension fund (aka LPP/2nd pillar money) to 3 separate vested benefits accounts (update 06.2023: money was transferred easily and quickly with no problems):

- 1x SZKB vested benefits account (low interest) with 400k CHF (update 06.2023: I transferred 405k CHF but similar value now since the SZKB account still has a very poor interest rate)

- 2x vested benefit investment accounts at finpension with 265k and 585k CHF respectively (update 06.2023: 237k and 532k CHF respectively)

The total value of those 3 funds will amount to about 1.25Mio CHF. (update 06.2023: worth approx 1.175M CHF)

The SZKB money will be used to help fund the buying of a house when we move to the UK.

The finpension funds will be high-risk strategies with 80% equities. (update 06.2023: I still have a similar higher-risk strategy but I’m starting to consider bonds more as interest rates increase)

I did research on the possible vested benefit investment accounts.

I chose finpension since it’s better for people moving abroad. Indeed, finpension is registered in the Canton of Schwyz, so withholding tax for withdrawal of 2nd and 3rd pillar accounts is generally lower than in any other canton.

This is important since when you withdraw the capital when you have already left Switzerland, it is the tax rates of the canton the company is based in that are relevant and Schwyz has among the lowest rates, irrespective of capital value.

The finpension promo code below gives you a fee credit of 25 Swiss francs (provided you transfer or deposit at least CHF 1'000 within the first 12 months after creating your finpension account).

Important note: you must use the finpension app to get this bonus (as valuepension is their former website, and will be integrated into finpension soonish)

===> MUSTBC <===

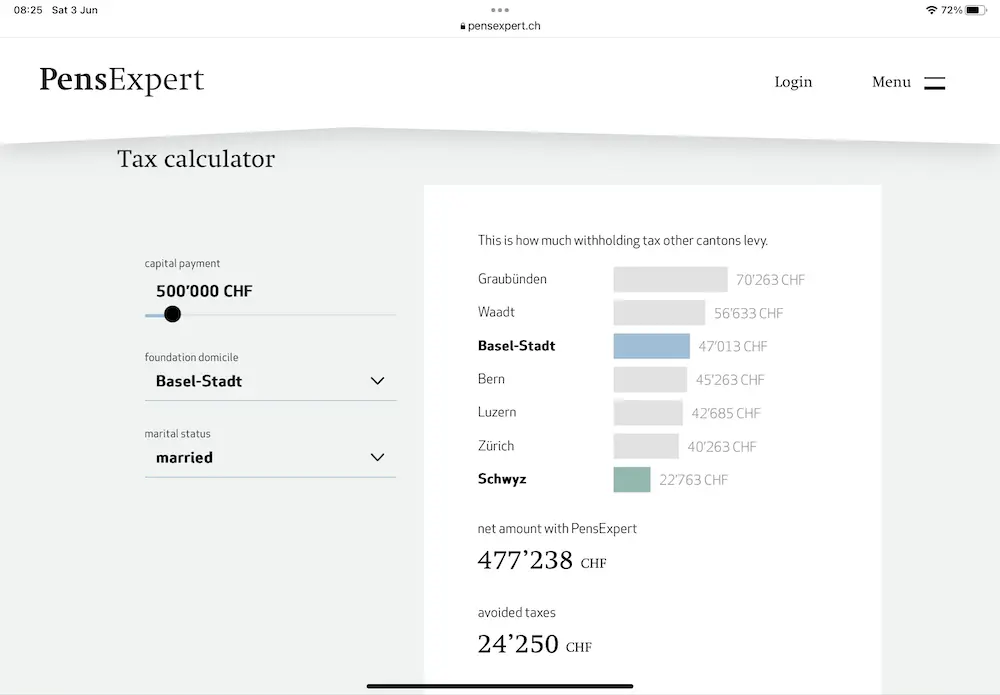

You find here a link to a calculator that I have used to calculate the tax savings for various capital values in our “moving abroad” situation.

Below is a snapshot example for an account with CHF 500'000 showing the total withholding tax:

- Schwyz based company (like finpension) ~ CHF 22'763

- Basel-based company (like VIAC) ~ CHF 47'013

- So we talk about a tax saving of CHF 24'250!

In your comparison of 3rd pillar companies, you should include this aspect since a number of people may have left Switzerland when accessing their 2nd and 3rd pillar accounts.

Note that you can always transfer funds later to a company with a good cantonal tax location, but there are sometimes penalties if you withdraw the money soon after the transfer. I think this is to stop people gaming the system by transferring to a low-cost canton just before withdrawal in order to take advantage of low withholding tax rates.

My vested benefit cash account with SKB is also based in Schwyz, containing money for a house when we move to the UK, so we will get a similar low withholding tax rate on withdrawal.

As for access, finpension is well known on your blog with its easy online access.

And SZKB sends annual statements via post of valuation and interest accrued.

3rd pillars

At the time of my retirement, we both had third pillar 3a accounts (valued at approximately 13k CHF, 25k CHF, and 111k CHF with equity components of 75%, 50%, and 80% respectively). (update 06.2023: worth approx 11k, 22.5k and 96k CHF respectively but now with finpension — see below)

The first two were with UBS, and the larger one with finpension (which will have lower withholding tax (update 06.2023: over the last year, we have transferred both of our UBS 3rd pillar accounts to finpension. All the withholding tax savings may be negligible on these lower value accounts, but finpension has a better choice of funds which are also much lower cost. Having all 3rd pillar accounts and vested benefit accounts with one company also simplifies our finances.)

Stock Exchange account (Non-retirement)

Outside of retirement accounts, we have combined investments in Swissquote worth 565k CHF. (update 06.2023: current valuation = approx 460k CHF after market downturn and withdrawal of 28.5k CHF)

These are composed of ~30 funds and ETFs, and are distributed like this:

- 80% equities

- 10% real estate

- 10% in bonds and cash

I will need to sell these before leaving Switzerland to avoid capital gains tax when I’m back in the UK. (update 06.2023: although the recent market downturn has reduced gains and given me losses on a number of investments)

In addition, it will be better to switch to a UK-based brokerage firm since active funds are generally much cheaper as they are not allowed to include trial commissions (on average around 0.5%) in their ongoing fees, unlike a lot of other countries such as Switzerland.

1st pillar (aka AHV)

At the time of leaving Switzerland in early 2024, we expect to have accrued 20 years worth of (full) state pension (AHV) years equivalent to give a combined Swiss state pension of approx 20k CHF p.a. In today’s money

Note that my wife is currently working part-time but contributing the minimum AHV amount for us as a couple so this means I don’t have any additional contributions to make myself. If my wife (and employer) did not contribute at least twice the minimum AHV contribution then I would also have to make payments, with wealth also taken into account.

Swiss income

My wife is currently earning 21k CHF p.a. As a part-time child-minder and this has been extremely helpful in the initial drawdown period.

My son also has a small apprenticeship salary increasing every year. During his apprenticeship, we will also receive an education allowance for him (325 CHF per month) while living in Switzerland.

As for myself, at retirement, my salary was approx 150k CHF p.a. plus around a 15% performance-related bonus. The last salary payment was received in Jan 2022 and I have received no other earned income so far.

Cash

We also have approx 110k CHF in a bank account which we will use for the next year’s living expenses including a tax bill for 2021. (update 06.2023: this has been whittled down to around 13k CHF, even after topping up with the sale of investments)

We also have some small amounts elsewhere on Revolut and Wise cards.

Inheritance

My wife will eventually inherit some assets from her mother including a house, but this has not been included in our calculations.

However, this does reduce the risk that we will run out of money in retirement and can perhaps let us plan for leaving a legacy of our own.

My investing journey and philosophy

Journey

Note that I have only seriously been involved in personal finance and investing with the aim of retiring for about 10 years or so.

Indeed, a decade ago, at Novartis, I went to an information event on my pension for the first time and that got me thinking about my finances in general.

At the time, I was rather stressed at work and I started to think when would be the earliest I could finish work altogether.

Searches on the internet eventually led me to the FI and FIRE communities.

I also had meetings with various representatives from different finance companies, a lot of which contacted me at work by phone.

I was very unsatisfied with many of these meetings since they seemed to be primarily salespeople with no deep understanding of finance and/or had false friendliness.

In 2013 I went with Grether Macgeorge in Basel to handle my investments outside retirement funds as they seemed to be a small well-run company with transparent (although very high) fees.

Around this time I also started doing a lot of research into personal finance in general and investing in particular to try to better monitor how Grether MacGeorge was handling my assets. The interactions I had with GM also helped to improve my understanding of investing.

Through this research, I also realized ways of minimizing tax in Switzerland.

For example by making a lot of additional contributions to my company pension fund and paying the maximum amounts into pillar 3 accounts (including my wife’s pillar 3 account). I also tried to invest more into equities within pillars 2 and 3 although this was only possible to a small extent in my company pension.

After 3 years I realized that I wasn’t getting good value from GM, based on the high fees I was paying and my level of knowledge was such that I thought I could handle the investments myself and get rid of the high fees.

And so I did.

Initially, I probably did make some mistakes e.g. chopping and changing my investments too much, possibly diversifying too much into niche areas, and not being fully aware of the high currency conversion fees in the Swissquote platform. However, overall I think I have done an okay job and my net worth is probably higher now than it would have been had I delegated totally to a financial advisor with high fees.

The result: around a decade or so ago, my net worth was probably only around 650k CHF.

And by January 2022, it had increased to nearly 2.5 Mio CHF.

Philosophy

I use my statistical knowledge and experience to inform my investment decisions.

For instance, I ensure proper diversification (assets with low correlations) and diversify across regions.

I also invest in large and small companies with a slight value tilt.

The majority of my investments are index funds or ETFs, but I do see some benefit to lower-cost active funds in certain areas. And indeed, some of my best funds are active. (Either giving good performance after adjusting for risk or giving me assets in areas not adequately covered by index funds to ensure better diversification.

I know MP readers like to know each other’s investment portfolios, so here are more details about my active funds that have done well for me in periods in the past:

- Blackrock Continental European flexible fund (but had a very bad start to 2022)

- M&G Japan Smaller companies fund

- Norden Nordic Equity small cap fund (again 2022 was a bad year)

- Stewart Investors Asia Pacific leaders sustainable fund (lower volatile fund providing diversification)

- First Sentier Global Listed Infrastructure fund (this provides diversification rather than spectacular performance)

Spending and withdrawal strategy

In Switzerland

At the start of my retirement (January 2022), we targeted approx 100k CHF of expenses in retirement, and so far this has largely proved a good estimate.

On top of this, we needed to keep extra money aside for a large tax bill from my last year of employment (2021) — roughly 26k CHF.

By contrast, we’ve just made a tentative tax payment for 2022 of 1'400 CHF which is primarily wealth tax since our combined income is very low in retirement.

At the start of retirement, my plan was to have at least 12 months’ worth of cash in our current account.

And then use this for our spending needs — refreshing it when needed by selling our Swissquote investments, hopefully when market valuations were still high.

Eventually, when I retired, the markets started to go down quite a bit, triggered by the Russian invasion of Ukraine.

As a result, my net worth has taken quite a hit.

Due to increased interest rates, the bonds part of my portfolio did not provide any ballast against falling equities, nor did the REIT funds (aka real estate) which we also hold.

The 12-month cash reserve that I built up ran out a few months ago and I’ve had to start selling investments which have only partially recovered since the low of last year.

In retrospect, I wish I had built up more of a currency reserve, perhaps two years’ worth to see us through to our move to the UK.

It was a strange feeling to see our net worth reduce by hundreds of thousands of CHF (market reduction + spending) with only my wife’s part-time income partially offsetting the reduction… My assessment of the numbers calmed my nerves somewhat.

I also think the fact that we have only a short time left in Switzerland where there is a very high cost of living helped us psychologically.

The fact that the money we have kept aside for buying a house is protected in our SZKB account with a bonus of a strengthening CHF against GBP has also helped take the downturn in our stride.

Based on my calculations, we are still not in any danger of running out of money in retirement, but the market uncertainty is making me think twice about any big splurges in spending in the near future. Even assuming a constant 0% real return over the long term, I’ve calculated that we won’t run out of money.

(Note: I had a quick meeting with my old financial advising firm at Grether MacGeorge in the autumn of 2020, and at that time they quickly confirmed that I should have enough for my needs at that point. Despite the recent market downturn our net worth has since increased since that meeting.)

Hopefully, the markets will be better than that, especially after the recent downturn!

However, it is possible that growth will be tepid in the future as we enter a period of energy transition and need to pay a cost to deal with environmental issues.

There is a scenario where the availability of plentiful and low-cost renewable energy and the integration of AI into the economy accelerates growth, but I have my doubts.

Regardless, I think that our spending plans are conservative and even allow for some charitable giving.

In addition, I think we can still have a great life even with much-reduced spending if we target our spending on the things in life that really matter.

In the UK

The spending level required once we return to the UK is more difficult to ascertain and made more difficult by high inflation levels.

The fluctuating currency levels of GBP also make decisions on withdrawing Swiss and Canadian assets for UK income more difficult.

We have an idea of annual spending needs from recent UK vacations and visits to family, but without truly living in the country it is difficult to accurately estimate our needs.

Nevertheless, we have targeted around 60-65k CHF assuming a paid-for house, and this estimate has not changed much since I retired.

We predict that we will require more spending in the first few years of retirement and this will gradually reduce in later years.

My plan at the time of retirement was to continue the process of moving some more of our wealth to lower-risk assets to cover us for the period beyond this and avoid having to sell many equities in a down market.

However, the fall in the market has interrupted this process so, at the moment I’m reluctant to sell a lot of equities until the market has recovered a bit more. To pay for ongoing expenditure I’m selling a mixture of bonds and equities as required on a bimonthly basis.

We still intend to buy a house in the UK eventually and the SZKB vested benefits account should be available for this purpose. I think it was wise to protect this money from the swings in the market.

We may look for a smaller energy efficient house in a good location, at least walking or biking distance from the coast.

Our spending philosophy

In general, our spending is aligned with activities or things that we value and lead to greater happiness (see the section on activities in retirement) and we don’t tend to waste money.

We intend to maintain this approach into retirement.

I like the ideas of Ramit Sethi who believes in spending money on things that you value whilst reducing spending on things you don’t:

Spend extravagantly on the things you love, as long as you cut costs mercilessly on the things you don’t.

(ed. this is actually matching my definition of frugalism)

I don’t agree with everything Ramit says, but I agree that we shouldn’t necessarily miss out on happiness today for some greater financial security in the future.

There is a balance to be struck which will vary between people.

I don’t think my wife and I would spend too extravagantly on anything (e.g. 5-star hotels, or first-class air travel) since we both think that there are a lot of deserving causes in the world.

And therefore, our money might have more impact if it was directed elsewhere.

In fact, directing more money to charitable causes might increase our level of fulfillment in life, so it is kind of a selfish action in an indirect way.

How to assess whether one has enough money to retire?

Obviously, in my particular complex situation, using the “4% rule” to calculate whether I have enough just doesn’t cut it, especially as we expect various annual pensions relatively soon compared to very early retirees.

To determine whether I have sufficient money built up to retire, and to have confidence that I can “pull the trigger” safely, I’ve used various online tools such firecalc.com and cfiresim.com.

However, I know that even the most sophisticated tools can have flaws e.g. they may just use historical US data, have flawed Monte-Carlo simulation modeling, etc.

Virtually all have the problem that they do not account for current market conditions and valuation when calculating prediction probabilities of running out of money and/or when estimating withdrawal rate to give an x% chance of running out of money.

For instance after a very strong bull market is it wise to assume a predicted rate that does not adjust for current market conditions?

I like the analogy of a trip to the airport where you want to know what is the risk of making it there within one hour.

Ignoring the time of day it could be said that only 4% of all trips would lead to the arrival not being on time.

However, if you know that you would be setting off at rush hour (5 pm) then the risk of not making it within an hour would be much greater.

Therefore I take the results from all such calculators with a pinch of salt and try to interpret the results conservatively when the markets seem high.

Nevertheless, the tools do provide a certain degree of comfort.

Like firecalc which suggested a spending level giving 95% chance of “success” which was well above our desired annual spending level.

Why we might now need independent financial advice

Although I think DIY investing has worked so far, I think it is coming to a point soon where I will need a second pair of expert eyes to look over our finances to ensure there are no gaps and help plan a successful retirement.

UK complexity

The UK is quite complex with respect to the financial products available and taxation rules which are constantly changing.

The country has different progressive tax rates for income, dividends, and capital gains tax with different personal allowances for each and there are ways to mitigate or avoid certain taxes by locating money in tax wrappers such as pensions and ISAs.

Unlike Switzerland, taxes are always levied on a personal level (so cannot file as a couple).

So, the allocation of assets between a husband and wife can be important.

Compared with some other countries, the UK can be quite a good place to avoid tax on wealth, and in particular, locating money in ISAs is particularly advantageous for early retirees (which I’ll describe later).

Also, pension rules are complex.

People can avoid tax on income as they are accumulating wealth by putting money into pensions and this grows tax-free until withdrawal.

There are various choices for withdrawal but basically, money can be taken out in lump sum form (with 25% tax-free), or as a regular pension and this will be counted as taxable income.

Pensions can be especially good if your marginal tax rate at the time of putting money into a pension is likely to be less than that at the time of withdrawal (e.g. if income is below the personal allowance threshold).

Money in pensions is not liable to Inheritance tax, which can be great for legacy planning.

However, the one big disadvantage to pensions is that you can access any money from them until 55 (and this age is going up in the future), so this is not good for anyone wishing to retire very early.

Furthermore, a lot of old pensions have their own restrictive rules which can be problematic.

For instance: the UK pension I hold has penalties if you access the money before age 60.

Although ISAs don’t give any tax benefits on the way in have some key advantages over pensions and we hope to take advantage of this when we get back to the UK.

In the UK, you can put up to £20'000 per year into an ISA, which may be a cash ISA or stocks and shares ISA (including funds, ETFs, etc.)

Anything within an ISA grows tax-free so no capital-gains or dividends tax and no tax on interest, etc. You can take out money from an ISA at any time without paying any tax and there are no age limits to this.

Note that there are also some niche ISAs such as a Lifetime ISA (aka LISA) for people opening such an account before age 40 which can be used to buy a first property — up to £4'000 annually can be saved in a LISA and the government will also add 25% to this although this will be clawed back if the money is taken out before aged 60 if the money is not used to buy a property.

For us, a LISA is not relevant because of the age restriction but I just thought I'd mention it.

Based on my own research with careful management, I think it should be possible to avoid all UK income tax up to the point where state pensions are taken.

This is by keeping income below our separate personal threshold levels.

We should also be able to minimize or avoid a lot of dividend and capital gains tax by utilizing the various personal threshold levels for paying tax and by using pensions and ISAs wisely.

Once we start receiving the different state pensions, I think the overall level of tax should still be fairly low.

Taxation of Swiss Assets and state pension

With respect to eventually moving money from our 2nd pillar and 3a pillar accounts in Switzerland, I also had to do some research to confirm how these accounts would be taxed in UK and/or Switzerland.

This involved looking at the double taxation agreement between the two countries (and ensuring it had not substantially changed because of Brexit).

If you move away from Switzerland, any 2nd pillar and pillar 3a money can be withdrawn early in lump sum form.

These are subject to withholding tax in Switzerland based on the registration canton of the fund company, but the money is then not liable for tax in the UK.

In contrast, pension income taken as a regular payment (e.g. Swiss state pension) would be taxed in the UK as normal income but is not liable for tax in Switzerland.

For information to readers: if you are moving to an EU country, then the mandatory part of the 2nd pillar must remain in the retirement account in Switzerland until 5 years before statutory retirement age.

Taxation of Canadian RRSP

I also had to do research on how to take income from my Canadian retirement fund (RRSP) which also has complex rules and depends on the country residence of the person taking out the money.

The RRSP requires a regular minimum payment to be taken out each year, but below a maximum threshold amount I would not be subject to Canadian withholding tax but this money would be taxable in the UK.

Above this maximum threshold amount, a withdrawal would be subject to Canadian withholding tax.

Because of all this complexity, the possible strategy for asset location and sequence of withdrawal between individuals in a couple is not straightforward.

Therefore, once we return to the UK we will seek out a fee-based financial planner to help optimize our financial plan in retirement.

One concern I have is that a UK-based financial planner will not be familiar with the rules in different countries, or indeed may be legally restricted in giving advice on them.

This means it is important that I personally understand the rules and keep abreast of all changes in case I cannot find an advisor or need to help the advisor navigate the rules.

If we do eventually employ a financial advisor, we will mention that we want to maintain a large degree of flexibility so we can adapt spending, etc. as needed.

A final note: in recent years we did try to find a financial advising firm in Switzerland to indecently look over our finances to see if everything was on track. However, this search proved very difficult so we abandoned these efforts. For example, we did get a quote of around 4000 CHF for a financial planning report from VZ.

But since they were not legally allowed to cover our UK finances nor our detailed strategy once back in the UK, this would have been largely useless to us.

Key takeaways for early retirees moving abroad

The following are what I think are the key take-home messages focusing on topics relevant to a retiree (especially of the FIRE variety) who is considering retiring outside of Switzerland, and who may also have assets and/or pensions in other countries:

- It is important to understand the main rules regarding withdrawal and taxation of your assets residing in each separate country and the general taxation rules of income, dividends, and capital gains in the country you are intending to move to. Is there a double taxation agreement between Switzerland and your destination country? If so, I’d advise you to read the key relevant areas

- Knowing the rules can help you prepare financially for moving and inform you to what extent this needs to be factored into your retirement timing decisions. For instance, if it is likely that your calculated net worth and pension income will be highly taxed in the country you are moving to, then you may want to provide an increased buffer on your net worth prior to retirement

- Moving countries and perhaps having existing assets in multiple countries can very much complicate retirement planning. In theory, this means that this would be an ideal time to get financial planning help, at least to take a second look at a plan you may have put together. In practice, it may be difficult to get hold of a planner who can deal with assets in multiple countries at a low cost. Therefore, it is important to do your own research to get an understanding of the multi-national rules

- It is often difficult to get a true idea of the likely cost of living in your destination country. Holiday trips and online research will help build up knowledge, but this is no substitute for actually living day-to-day in the country and having to pay long-term costs

- It may help to diversify your currency exposure in the lead-up to the move abroad and have a certain amount of assets already in the country you are moving to. This might lessen the impact of currency movements in Switzerland vs your destination country

- If you have worked in different countries, it is likely that you have a state pension entitlement in each country. Try to find out relevant information on your individual entitlement and check whether the estimate you are provided with is correct (in the UK the estimate has often been incorrect). There may also be ways of boosting these state pensions which can be great for retirement planning (e.g. we have made additional National contributions to the UK government at a very low cost to make sure we will receive a full UK state pension)

- If you think you may not stay forever in the country you are moving to, then you probably want to build some additional flexibility into your plans to allow easier movement of assets to other countries

The finpension promo code below gives you a fee credit of 25 Swiss francs (provided you transfer or deposit at least CHF 1'000 within the first 12 months after creating your finpension account).

Important note: you must use the finpension app to get this bonus (as valuepension is their former website, and will be integrated into finpension soonish)

===> MUSTBC <===

MP notes on Steve’s interview

As usual, I’m adding my comments below on all the very interesting points mentioned by Steve.

Thank you!

First of all, my warmest thanks to Steve because it’s not so easy to find Mustachians who succeeded in becoming FIRE, and who still take the time to answer questions for a blog.

Just like he says, once you’ve achieved that goal, your priorities change.

So thank you, Steve!

Independent financial advisor to validate your FIRE plan

I agree with Steve’s idea of having all his retirement assumptions assessed. And of wanting to do another assessment once you’ve arrived in the UK.

The most important thing is to do this with an independent company, not a bank that will obviously want to sell you its products…

Personally, I see it as an investment because the ROI can be monstrous if you don’t make any easily avoidable rookie mistakes. It can save you several thousand CHF in taxes and other costs.

I myself did a similar “reality check” at the Financial Advisory Center in Lausanne, which I still recommend to this day.

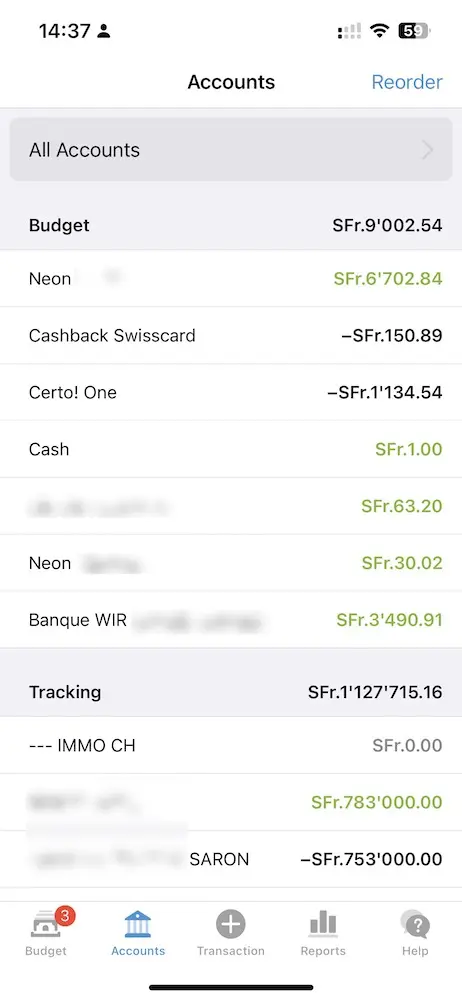

A global view of your assets (pension, investments, cash)

However, no matter what financial advisor you choose, it will always be up to you to get all the information you need to have an overall view of your assets.

You could mandate your independent financial adviser to fetch all of this information, but I think that would be a mistake…

Because you want to have control over these data sources.

Besides budget management, that’s also why I love YNAB!

As you can see below, this tool gives me a global view of all my assets.

If you were to take it away from me, I would be completely lost as it’s such a central aspect to my financial life.

I recommend you to have such a system in place, either via YNAB or a simple Excel file, to keep control of your personal finances.

FIRE Blogs and FIRE Forums in the UK

In addition to being a UK-based financial advisor, I would recommend that Steve starts researching FIRE blogs as well as FURE forums in the UK.

The goal? Find the same Swiss FIRE community in the UK so he can discuss his issues with people who have context.

If you’ve got any good plans for Steve in this regard, add them directly in the comments section below!

FIRE Movement Psychology

I definitely agree with Steve mentioning everyone’s focus on money and investment in the FIRE world (with the exception of a few bloggers).

I was just talking about this in my last article with my upcoming book dedicated to the psychology of the FIRE movement.

As a result, I’m very pleased that other people are starting to write content on the web to cover this important subject!

I might come back to you in the future Steve, to interview you as part of my research for my new book :)

How about you:

- What are your reactions to Steve’s FIRE adventure?

- Do you have the same issues as you will be moving abroad after your early FIRE retirement? If so, what are your current challenges?