Today, blog reader Raphaël comes to tell us about his story related to the FIRE (Financial Independence, Retire Early) movement and personal finance in Switzerland. Enjoy your reading!

I come from a lower middle class family, with an Italian immigrant father. I have a university education with a lawyer’s Master degree. I have always been attracted by nature and frugal lifestyles, sometimes bordering on asceticism. It was mainly for ecological reasons that I limited my consumption in general.

I learned early on to work for a living, because my parents could not finance me in full. I worked on the assembly line in the metal industry, in a cement factory, I did housework, in short, every little job imaginable to support myself.

Low on spending but not frugal

My parents have always been acutely aware of the value of money and risk averse in general. They knew what hard earned money meant. They made few investments, except for real estate purchases as a primary residence that turned out to be very profitable (they took advantage of a particularly favorable economic climate).

So I spent little but had no basis for personal finances. My limit was the negative of my bank account. I had a vague idea of what was coming in (salaries, income) but no idea what I was spending and on what. As long as I had enough money left over to go on vacation and pay for the Friday night caipirinha, I was fine.

The discovery of frugalism

With my job, I was forced to think about the management of the patrimonial interests of others, especially financial (real estate law being my favorite field).

One thing leading to another, this started a deeper reflection on the management of my assets.

I tried to discuss it a little around me.

But I realized the abysmal lack of interest of people on these issues. Apart from the famous “Setup a 3rd pillar to deduct it from your taxes” or, worse, “Talk to your financial advisor at your bank”, it was the void…

So I pulled out my self-learning hat and spent hours and hours reading blogs and watching videos on the subject.

That’s when I came across MP’s blog where I’m now writing these lines as a guest reader :)

In fact, at the time I was looking for an online broker, and I was about to get robbed by the “e-banking” or Swissquote type trading platforms. And then I read MP’s article on the subject, and I switched to DEGIRO.

It was the best decision of my life in that respect, given the capital I had to invest.

It was a game changer.

I then read the other posts on the MP’s blog (and also the one by Mr RTF).

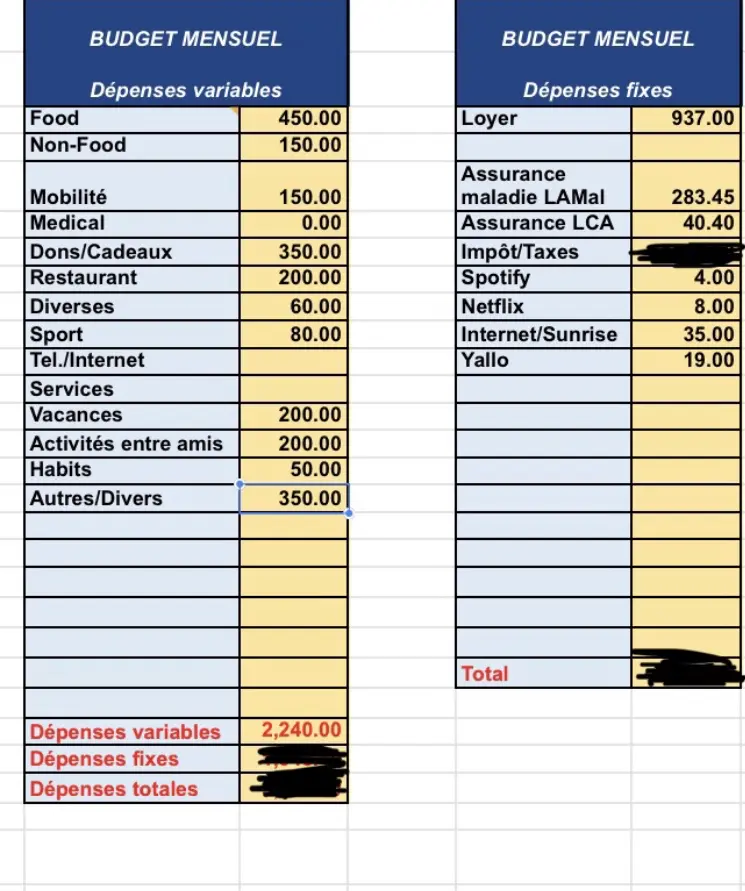

I didn’t see all the little financial leaks that were emptying my assets on a monthly basis. So I decided to fix these openings to limit the flow of my expenses. Here is a non-exhaustive list of some of the measures I took:

- I adopted Neon and drastically reduced my bank fees, as well as my credit card and foreign exchange fees. Bye bye the dinosaurs of the bank. And welcome the savings of CHF 20/month!

- I switched from M-Budget (CHF 35 per month) to Yallo, with a subscription at CHF 19 per month (MP note: another interesting article on the subject)

- I requested and obtained a rent reduction of CHF 60/month based on the Swiss reference mortgage rate

- I called Sunrise to negotiate my Internet subscription. I was paying CHF 50 per month and after a “threat of cancellation”, I got a reduction of CHF 20 per month. I now pay CHF 30 per month

- I started to cook my own food for the whole week, in order to avoid spending money in restaurants at lunchtime, or paying too much for a meal at my job’s canteen. Savings: CHF 150/month!

This gives us a total of CHF 51'825 in 10 years:

| Savings in CHF | Per month | Per year | Per decade |

|---|---|---|---|

| Banking fees | 20 | 240 | 3'762 |

| Mobile abo | 16 | 192 | 3'010 |

| Rent | 60 | 720 | 11'272 |

| Internet abo | 30 | 360 | 5'638 |

| Lunch at work | 150 | 1'800 | 28'167 |

| Total | 276 | 3'312 | 51'825 |

MP note: not a bad return for “just” reading a blog!

In short, reading MP’s blog gave me the courage to “put my ba$^# on the table” to talk straight, and start taking care of my finances.

And the Grail of Frugalism: I started budgeting ALL my income and ALL my expenses, with a monthly savings rate calculation.

It radically changed my life.

KNOWLEDGE is POWER.Raphael

When you have access to data, it allows you to make more surgical decisions.

And keeping a budget with goals also creates accountability to yourself. When you’ve been chasing a 40% savings ratio for 3 months, there’s a “pain” in dropping to 25% or 35% the next month.

Being very competitive with myself, it has created an incredible virtuous discipline in my life, forcing me to be more and more creative to take care of my savings rate.

Looking to the long term

The process took place over many months. But there was a gradual, iterative, almost magical evolution that took place.

Taking control of my “small finances” sharpened my intellectual reflexes, and put in place management and investment principles.

Creating a budget put in place a rigor and a kind of accountability for my finances.

I started keeping a budget at the beginning of 2020. I had a 30% savings ratio in January.

In February I had 41%, in March 42%, in April 76% (but you have to count the bonus), in May I reached a cruising pace of 50% savings. That’s still a 20% increase in my savings rate compared to the beginning of the year, without depriving myself of anything but simply fixing the financial holes.

By calculating my savings rate and keeping my finances up to date, I realized that I was saving quite a bit and that this money was “sleeping” on a savings account that was losing value every year due to inflation.

I have invested in the stock market and in various financial assets thanks to MP’s “reassuring” articles on the subject.

Seeing the amount of savings I had, and not wanting to invest everything in finance, I decided to diversify by investing in real estate as a primary residence. I was able to do this because I knew what I had and, more importantly, how much I was spending and saving each month.

I currently live in a small studio (1.5 room) in the center of Lausanne. Not expensive. Centered. But very noisy and old.

Raphaël's apartment in the center of Lausanne, with which he asked — and obtained! — his rent reduction on the basis of the Swiss reference mortgage rate

I found a 2.5 room apartment to buy on the outskirts of the city, being in the countryside and quiet, but 20 min from Lausanne by bike, and 10 min by train. Being single and without children, I thought it was perfect for my period of life. And if one day I meet a lady who wants to share my daily life, I could always rent this property which is very well located.

When I did my calculations, I realized that my rent (including interest, charges, and maintenance) would be CHF 700/month. Unbeatable. Currently, I pay CHF 1'000/month for an apartment twice as small and 30 times older.

Well I admit, this calculation does not take into account the transfer taxes, notary fees, interest, rental value, etc.

But considering that I wanted to move to a larger apartment of 2.5 rooms (or even 3.5 if I was a couple), my rent would be around CHF 1'500 to 2'500 depending on the location.

3D rendering of the future apartment of Raphaël in the Vaud countryside, in a quiet area :) (source: property developer)

Even taking into account real estate charges of CHF 800 or 900 or even CHF 1'000 per month, we are far from a rental cost.

By the way, I did the projections on Moneyland.ch, and the calculator tells me I’m a winner with the purchase, as soon as I keep my property for 4 years. Taking into account that I intend to rent it out when my civil status changes, I take little to no risk.

This reduction of “rent” will also have for goal to limit my expenses in order to start an independent activity, in order to diversify my income.

Only happiness to come.

What has frugalism taught me?

Frugalism has taught me, or rather reinforced, core values: responsibility and discipline.

These values are intimately coupled with another: self-education. With enough time and mental availability, we can find all the solutions in the world. You can manage your finances, your retirement, your taxes, etc.

Raphaël's budget (he uses the Excel template provided by my 'colleague' blogger Mr RTF if you wanna check it), and he tells me that he made a mistake for internet, because he only pays CHF 30 as mentioned above :D

And even if some investments turn out not to be very fruitful afterwards, you will always have made the best investment: in yourself.

To take charge is to train oneself, to enter into a process of perpetual and iterative improvement. The important thing is not the goal of the journey, but what we learn during the journey, as Ray Dalio so well said.

Conclusion

Naturally, I already had a very frugal lifestyle, but MP’s advice opened my eyes to the investment capacities I had, and above all to take the step of investing in real estate and the stock market in particular.

What was most impressive was not really the savings that resulted (even if there were some, and beautiful ones!) but especially the small founding principles that made me aware of the value of my capital and my investment power.

And above all: dare. Dare to take the plunge into the concrete stuff!

PS: Dear MP, I wanted to thank you for all the time you have invested in this blog and in your research. It has an exponential beneficial effect that I myself have benefited from.

By the way, I have read the first 5 chapters of your book and I think it is an excellent manual for starting out in life. It should be read by every little Swiss school kid. It’s so simple, but so essential!

Best wishes to you, Mrs. MP and to the little MP kids, Raph

If you too are interested in sharing your inspirational journey with Team MP members, please email me at contact [at] mustachianpost.com