“It was when we found ourselves having to ration pasta to buy the baby’s milk that I started to open my eyes. […] My way of seeing things (and spending) as well as my long term vision has radically changed thanks to your blog. From next year, without earning more, just by being careful, I expect a savings rate of 25% per month.”

After reading the story of Sébastien and his family, I thought that if for some reason the blog had to stop, it would be OK. All that time would have been worth it. Because my articles would have had the desired effect of bringing real value to at least one reader.

I hence let you discover how Sébastien went from a dangerous debt situation to being able to project himself in 15 years with one million CHF in his bank account!

Sébastien: So, my life before Mustachian Post was that of a carefree young man who had no conscience about money. My parents were always hard workers, children of peasants and workers, they struggled to have a better life. When they became owners of a small apartment in France at the age of 30, they knew how to manage their capital and take advantage of opportunities to become, today, owners of a beautiful house in Switzerland.

The other side of the coin is that they have done everything to ensure that their children lack nothing and enjoy everything. Before I turned 15, I had already spent a week in New York, two weeks in the Caribbean, not counting trips to London, and all over France and Spain. So I got used to a certain lifestyle.

As a result, I was spending so much money without counting that I could have opened a dinosaur park, and I was already in debt before I had my own apartment. Becoming a homeowner was downright impossible in my mind.

Not to mention the fact that I never negotiated my salary. I always settled for the union minimum, as long as it paid for my living expenses…

Then I became independent. First rent, insurance, first motorbike, insurance, first car, I started to pay attention to a minimum to pay these new charges. But without ever making any savings. Money literally burned my fingers. So much so that the money my parents left me “in inheritance” disappeared within a year.

I spent nearly CHF 35'000 in two years… probably close to CHF 100'000 in a decade.

Example of a compulsive purchase: the telescope... more than CHF 5'000 worth of equipment that is still sleeping in the basement and has not been used more than 4 times

And then I met my wife. At first, I wanted to impress her, so it didn’t help. Then we moved in together. Redecorating, adding furniture and so on.

Then she got pregnant. A bed for the baby, a changing table, a stroller, a crib, bottles and pacifiers (today, I’d have a lot to talk about when it comes to savings when one become parents in Switzerland!). We moved to a bigger apartment. Baby has arrived. We got married right away. In the beginning, with two salaries, we managed it easily.

Then my wife stopped working to take care of our child. At the same time, I was burning out at work and ended up quitting. That’s about where the trouble started. It was mid-2018.

I barely had a salary in advance on my account, which bravely withstood two months with the help of unemployment benefits. Then the credit cards ran out. It was when we found ourselves having to ration pasta to buy the baby’s milk that I started to open my eyes.

After I got a job, we spent almost six months cleaning up the negative balance in my current account. For another eight months, we didn’t manage to have more than CHF 1'000 available. We were able to have our future health insurance premiums frozen, and obtained a payment arrangement for the others.

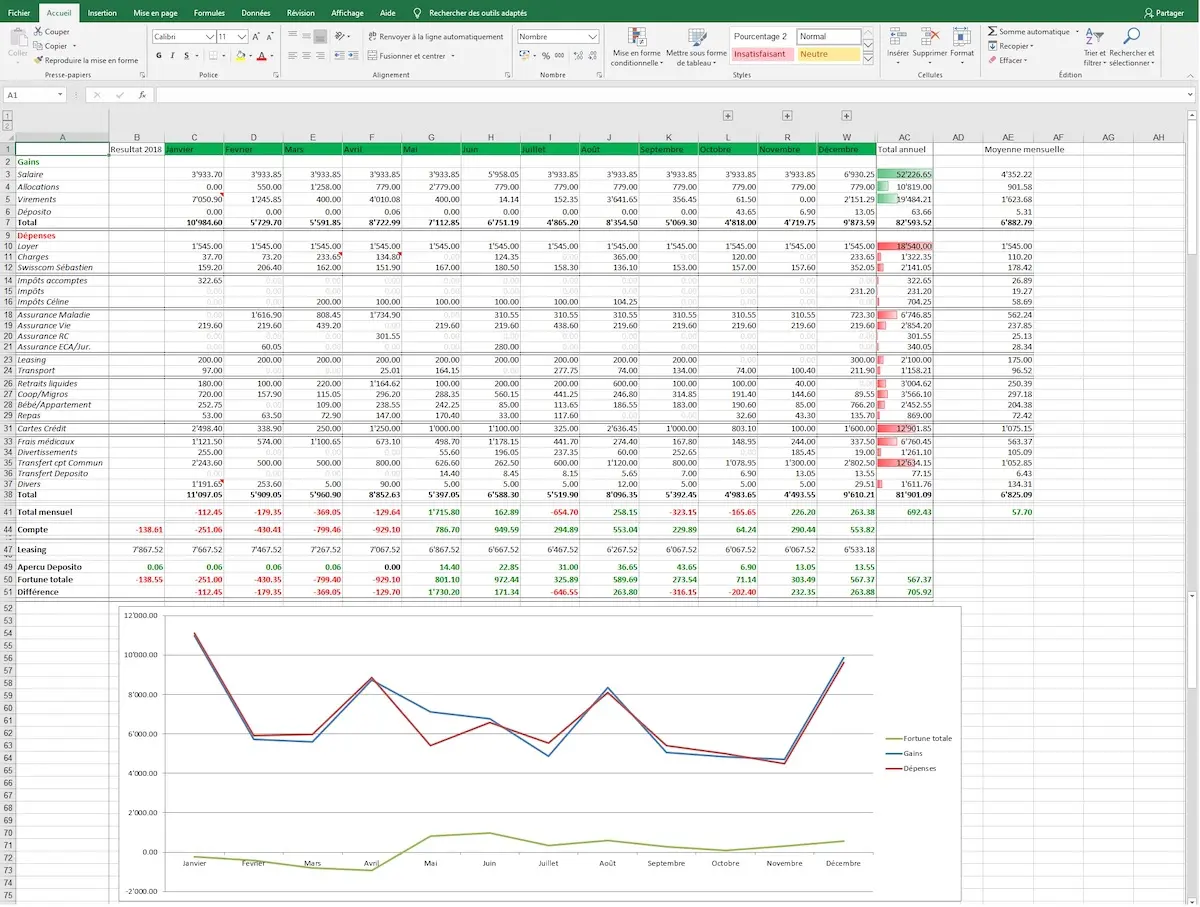

I started to make an Excel spreadsheet of our earnings and expenses, first by month, then by week. By December 2019, the situation seemed to be stable again.

It was when we found ourselves having to ration pasta to buy the baby’s milk that I started to open my eyes.Sébastien

But our expenses were still much too high, so my first reflex was… to make more money! Makes sense. So I started looking for tips on the internet… “Get rich on YouTube”… “Make 5'000€ per hour”… After going through the scams, I ended up falling into more serious areas, like trading and the stock market. After having done my homework in this area, I was ready to take the plunge. So I asked myself which broker to choose in Switzerland.

I came across your blog “Mustachian Post” when I asked Google this question.

First of all, I was a bit disappointed to find only tips on how to spend less… when I wanted to earn more. And then, from article to article, I started to understand.

I saw how much my irrational attachment to a mobile provider was costing me, just because 25 years ago the competition wasn’t at its best. I calculated how much I could have saved by comparing insurances. I discovered the “hidden” costs of my postal account and my credit cards.

It was a revelation!

I went back to my Excel spreadsheet and went through everything, point by point. And I searched, compared, studied for each expense category.

By the way, let’s talk about figures in concrete terms with our new situation today.

I used to pay CHF 160 for mobile and Internet at Swisscom. For Mrs., it was CHF 60 for her mobile phone at Swisscom too (the under 30s are lucky…).

We have cancelled the Internet and stopped the mobile subscription of Mrs. so that she can switch to a Salt offer (CHF 35 savings per month). I took Internet at Sunrise (I did try the 4G modem trick, but it was totally unstable and a speed worthy of the first 56K modems). This saved us CHF 25 per month on top of that. When my mobile contract expires, I’ll switch to Salt, to pay CHF 60 maximum (CHF 20 extra savings, and even more if there’s an offer at that time).

As far as shopping is concerned, we used to go grocery shopping almost every other day, we always had pre-cooked meals, pizza and ready-to-eat salads. Nowadays, we are much more careful with our daily expenses by making our own food. And we only go grocery shopping once a week now, which forces us to anticipate and organize ourselves. Result: savings of CHF 500 per month!

We have also discovered that our situation entitles us to various social benefits, in particular to reduce health insurance premiums. Even though it took 6 months to materialize, it offers us CHF 300 in additional savings per month.

As I write these lines (end of May 2020), I have totally changed my vision of money, spending and saving. We still have about CHF 10'000 of loans to repay, but it is already planned to have everything settled by December of this year. And I’m impressed myself that I’m capable of such a thing.

So I’ve extended my Excel spreadsheet until next year, to see how we’d manage without these constraints. Without earning more, just by being careful, I’m projecting a savings rate of 25% per month. If we manage this money properly, and with my wife going back to work in 5-6 years, we could have saved half a million in just 10 years! And the million less than 5 years later!

And now we’re even dreaming about buying or even building our own house, to raise our children in.

MP: Wow, your story is amazing, Sébastien. But I think we need to dig into this: “I’d have a lot to talk about when it comes to savings when one become parents in Switzerland!” Because there are a lot of future parents among the Team MP readers, so if they can also use your experience on this particular point, it would be a shame to deprive them of it :)

Sébastien: The world of childcare, especially when it’s the first child, is a wonderful world full of doubts, questions, anxieties and improvisations. This mixture of the unknown and very strong emotions is a real trap that some major brands willingly exploit.

We did our first shopping in two shops specialising in early childhood (Bébé 2000 and Orchestra, not to mention them), where absolutely everything you need to look after a baby is literally thrown in your face. So we came out with a changing table, two cradles (a modular one that also makes a crib, and another that hangs next to the parents’ bed), a top-of-the-range stroller, special blankets for babies, bottles and teats of all sizes, games and play mats to line the living room…

Much later, we realized that half of what we had bought was never used. In the other half, a good part of it was perfectly optional (the bottle warmer while we have a microwave…). And finally, the rest could have been bought second hand without any problem, or even elsewhere to make it much cheaper. For example, our stroller, which cost us CHF 1'200… whereas you can get one of the same size and with the same options for less than CHF 300 at Galaxus. The quality may be less good, I don’t know, but even if we bought it 3 times, it would still be cheaper.

Fortunately, we managed to avoid a few pitfalls, such as the Nestlé machine that promised bottles ultra-easy to make… for CHF 2 per capsule. Moreover, this machine was withdrawn from sale 6 months later.

In short, even when it’s for your own child, you have to take the time to ask yourself if you really need it and if you can’t find cheaper elsewhere.

MP: It reminds me a lot of the birth of our first MP kid… Thanks for sharing!

I have another question: do you think that “hitting rock bottom” is going to ensure that you’ll never have money problems again? Or did you put in place some special safeguards in place for that?

Sébastien: Hitting rock bottom made us realize that it’s extremely easy to sink. An illness, an accident, unpredictable unforeseen events can happen at any time and turn everything upside down. We have decided to put in place two safeguards for the moment:

- No more buying on credit, we only buy what we can afford in cash. We reload the Cumulus Mastercard or Revolut before we buy something with it, and write it down in the spreadsheet

- I’ll keep a minimum amount in my current account so I can go three months without any income… as soon as we finish paying off our debts

Another example of a compulsive purchase: the motorbike for CHF 10'000, which will not have driven even 2'000 kms, before being resold for less than CHF 3'000...

Starting next year, I’ll be able to set up our savings plan more concretely. I already have a VIAC account open, and I’ll add an account at DEGIRO, with a target of 20% minimum savings per month at the beginning.

MP: Congratulations on those safeguards. I think they’re clearly going to help you keep your financial boat afloat in the long run.

Finally, one last question for the ego: what would your life be like today if you had never discovered the blog?

Sébastien: Being optimistic, I tell myself that I would have gotten out of it anyway, but later, more slowly. If I’m honest, I think I could have gone on surviving from paycheck to paycheck for a long time, spending every extra penny every month…

MP: Thank you, Sébastien, for your testimony. I’m sure it will help a part of the blog’s readers to see how to get out of debts, as well as prevent another part of the readers from falling into this infernal spiral you’ve been going through. I wish you all the best on your way to the million CHF!

If you too are interested in sharing your inspirational journey with Team MP members, please email me at contact [at] mustachianpost.com

Note: many thanks to the 6 new patrons Soc, KP, Gordan, Sebastian, Daniel, and Jorge for their blog sponsorship via Patreon. It makes me so happy, sincerely.