What if I told you that I knew THE right time to invest in the stock market… (like when to buy and when to sell). And that this method can make you rich.

In this article, you’ll learn why “timing the market” is a very costly illusion… and discover THE only effective and accessible way to get rich with the stock market, without stress or crystal balls.

I hope I’ve clickbaited you into this article for once, as it’ll help to share a little wisdom with all those who think there’s such a thing as a miracle solution.

And when I say “those”, I’m including the 20-year-old version of me! Because at 20, I was a victim of that fantasy. I’d just started earning my first salary, and I regarded the stock market as a dangerous business, reserved for professionals. The result? I didn’t invest. Zero. Nada. For fear of making a mistake. Today I realize that it was probably my biggest financial mistake.

And maybe it’s the same for you, because when you don’t know anything about the stock market, the only thing you can think of is all those movies or stories about people who bought “at the right time”, and became rich overnight.

And these stories make so many headlines, it makes a lot of people want to buy.

But if you take away the luck, there’s not much left of those stories… and the hope of becoming rich one day evaporates for you.

Except… there is a better time to get in and out of the stock market.

But before we talk about good timing or crashes, we need to lay the groundwork. Because if you don’t understand what the market really is, everything else will be a blur.

What is the stock market?

Before going any further, I think it’s useful to clarify what we mean by “the market”.

People often associate the stock market with representing the actual companies behind the shares, when in reality it’s just a place (virtual today) where thousands of investors (like you and me) buy and sell shares in companies, called stocks.

The market is simply all the investors in the world buying and selling shares based on what they think the future holds.

But why is the stock market so volatile?" You ask.

Stock market volatility

It’s important to understand that the price of a share doesn’t always reflect the true value of the company behind it.

Because the market (i.e., all the world’s investors with their respective beliefs) is a bit like a crowd at a soccer match: one goal and everyone goes wild, one mistake and there’s panic. This crowd, like the market, often reacts to emotion, not common sense.

In real life, this translates into a new president of a big country who’s a bit whimsical, and everyone panics. And so everyone thinks the future is going to be very dark forever. And so everyone wants to sell their shares fast. This increases the supply of these shares, while there’s less demand. And so share prices fall.

The next day, the weather’s fine, the whimsical president has been replaced by someone a little more level-headed and with a long-term vision, and suddenly everyone is hopeful about the future. And everyone wants to take advantage of this wonderful thing called the stock market to make their money grow.

Everyone wants to buy. This time, there’s more demand than supply, and stock prices soar.

Ben Graham called this effect “Mr Market”: a manic-depressive trading partner who offers you a different price every day, depending on his mood.

When I first read such an explanation, it was a “Eureka” for me!

In fact, in the short term, the stock market (and the value of every share you can buy on it) in no way represents the true value of the companies behind it. In the long term, yes. But not in the short term.

Once again, the point is that the market is emotional, not rational. And that’s THE reason why you shouldn’t try to predict it.

The dream of becoming rich overnight

Reading my explanation below, I’m also willing to entertain the dream that you could very well buy shares for CHF 100,000 one day, and sell them the next for CHF 150,000.

Do that four or five times in a row, and you’re rich!

Except that predicting when to buy or sell a share at the best time is like saying you can guess the collective mood of 150 to 250 million private investors worldwide at any given moment (and that’s not even mentioning banks, pension funds, and other institutional giants).

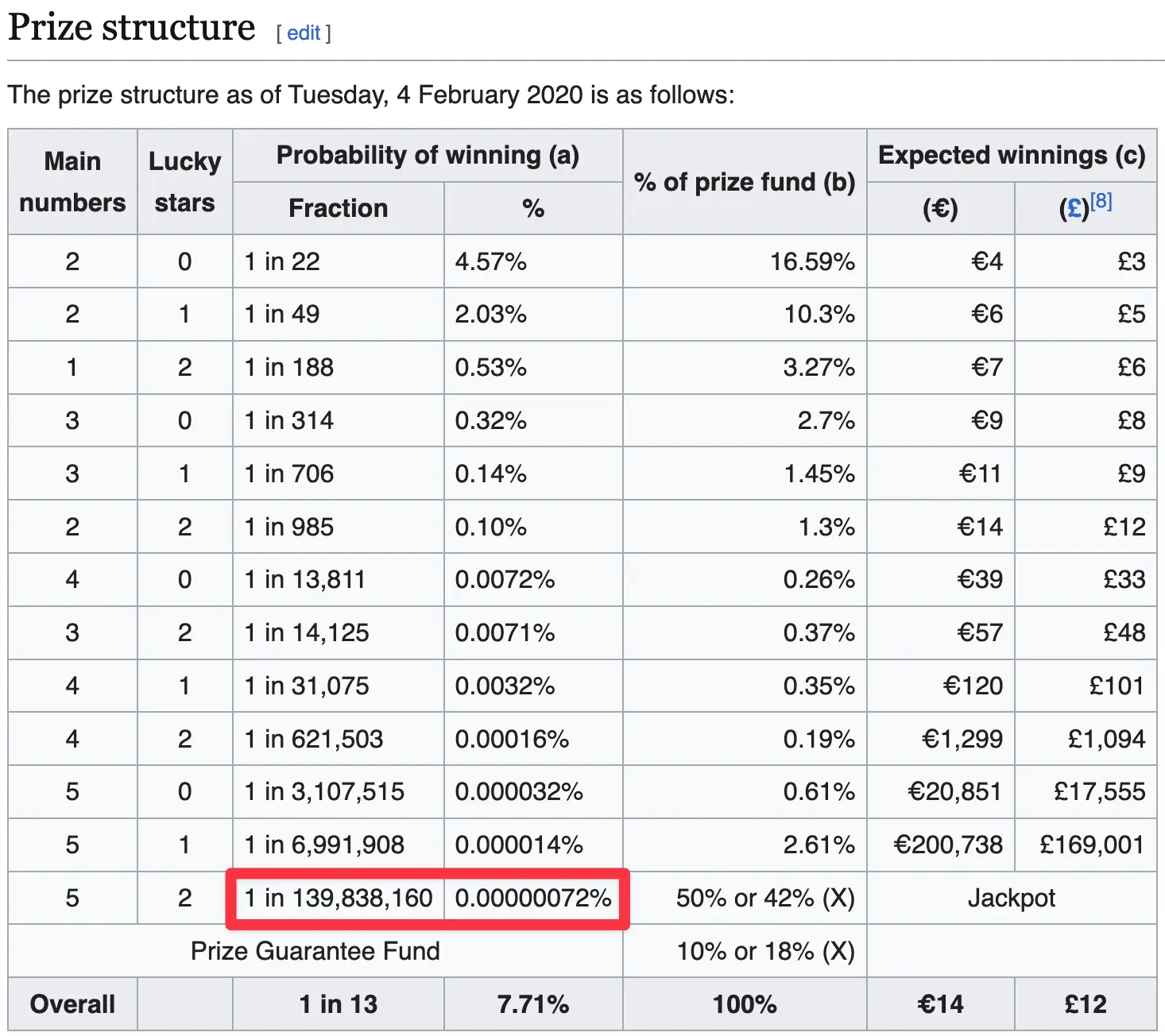

By way of comparison, the EuroMillions asks you to find 5 correct numbers out of 50 and 2 stars out of 12. The result: 140 million possible combinations.

Good luck then with market timing. Especially since you have to time it not once, but twice: when to buy, then when to sell ;)

So, believing you can time the market is a bit like believing a YouTuber who tells you he knows the right numbers for tomorrow’s EuroMillions. If you don’t believe him about the lottery, why would you believe him about the stock market ;)

The best time to buy shares on the stock market

But then, this best time to start investing in the stock market that you’ve been telling me about is just a lot of hot air, MP!

“It depends”, I reply.

It depends on whether you want to make a fortune overnight. If that’s the case, then yes, I do NOT have an answer (because it’s impossible to predict the market).

But if you want to be (multi-)millionaires in just ten to twenty years, then YES I do.

The answer? Start now.

Yesterday’s impossible. And tomorrow’s too late (because you can’t know if it’ll be better tomorrow morning or tomorrow night).

The only last option: now. Right now.

It’s all so logical once you’ve understood the mechanism of the stock market and its volatility.

That’s the real magic of the stock market: you don’t have to be a genius. You just have to have a plan, apply it, and let time do its work. It’s simple. It’s slow. And that’s what makes this method accessible to anyone who dares to start.

In any case, I’d advise you not to do what I did in my twenties… I used to say to myself: “OK, I’m just waiting for the right moment to start to invest… “ (you know, when it’s more stable… or when I’ve read a few more articles.) And that time never came. Until I realized that this is exactly the trap.

And when to sell on the stock market?

Your role as a new stock market investor is not to fall into Mr Market’s trap. Not to let his mood swings take you for a ride. Because while Mr Market is being a drama queen, companies are working. And in the long run, it’s their true value that comes through.

So you NEVER sell.

The only exception is once you’ve become FI (Financially Independent). That is, when you have enough money to pay your living expenses.

At that point, you’ll use some of the dividends from your ETFs, and potentially also some resales of your ETFs, to cover your annual expenses.

But that’s it.

For the rest, you behave like a long-term investor. You let your wealth grow via your money invested in the stock market. Forever. At least for the rest of your life. That way, once you’re dead, you can pass it on to your children, or donate it entirely to a charitable foundation, or whatever your values and beliefs dictate.

My failed history with the stock market…

So there you have it: my biggest failure wasn’t buying or selling badly.

No. My mistake was even worse… doing nothing. Staying frozen, paralyzed by fear.

And today, I can tell you with certainty: not investing at all is already losing money.

If I’d invested from the age of 20, even with a few mistakes along the way, my fortune would already be a lot further ahead today. But hey, it’s never too late. Even less so for you reading this ;)

Conclusion

If you’ve been too lazy (argh, I sound like my pre-teens…) to read the content of this article, here’s a summary for you who want to get rich in the long term:

- When to buy on the stock market: now. Not in two hours, not tomorrow, not next month. Now is the best time.

- When to sell: NEVER! Why? On the one hand, because as a Mustachian, you want to make a living from your returns (dividends, resale of a few ETFs), and on the other hand, you don’t want to spend your days trading (because, on top of that, speculating on the stock market will definitely lose you money — re-read the comparison with playing Euromillions above; I promise it’s short, clear, and fun, so you can’t get lazy!)

I’m counting on you to pass this article on to as many people around you as possible, so that they too can get that “Eureka” feeling, and start building their fortune. And if possible, share it with all the young people you know, because you’ll be giving them a priceless gift: time for their compound interest to grow into millions of Swiss francs over the next 10-20 years!

To go further

- 🎧 My interview with Jean-Pierre Danthine (former SNB Vice-President): to understand the stock market in layman’s terms, through the eyes of an internationally renowned economist

- 📖 My article on starting to invest in the stock market (the most widely read on the blog)

- 🧭 My program to start investing in the stock market with peace of mind (100% Swiss)

Last updated: July 31, 2025