- My opinion on life insurance has not changed, but...

- Short answer!

- What type of life insurance is available in Switzerland?

- Neo-life insurance in Switzerland

- Swiss life insurance comparison (death risk)

- Which Swiss life insurance would the MP family choose?

- Other important information

- SafeSide and EmmaLife welcome bonus codes

- And you, do you own or will you subscribe to a Swiss life insurance policy?

You must have had a good laugh at the title of my article today!

MP who cares about life insurance?!?

“He couldn’t resist the indecent commissions of the insurers or what?!” I hear you mumbling behind your smartphone screen.

I reassure you, it’s nothing like that, I don’t intend to reach financial independence in Switzerland with bonuses on the back of the insured ;)

My opinion on life insurance has not changed, but…

Let’s be clear: I still have no intention to subscribe to any Swiss life insurance.

On the contrary, I am still trying to get out of mine which is currently linked to a pillar 3a… the worst mistake of my Swiss frugal career…

Anyway.

This article is not so much about me, but rather about some readers of the blog. They write to me to tell me their life story.

And that’s when I realized that my Mustachian view of the life insurance world (in short: you don’t need it!) had its limitations.

Let me explain.

Some of you have family and/or personal situations that are much more difficult than the MP family.

The latest example is Stephanie’s.

She told me that yes, life insurance is useless if both spouses are working, and that each one is managing… but that in her case, because of her spouse’s (and her mom’s!) recurrent health problems, she was a pillar for these two important people in her life. And she wanted to be able to sleep soundly and not stress every night about what would happen to her loved ones if she were to be gone from this world overnight…

This made me reconsider my copy: life insurance can be useful in some cases.

In most cases, they are just a way for insurance companies to make money off of you through foolish fears. But in some specific cases, it can be useful.

Hence Stephanie’s question: “If you were in my situation MP, which Swiss life insurance would you choose? a mixed life insurance with a pillar 3a? or a pure life insurance?”

Short answer!

For you who only skim my articles (come on! ;)), read well the following sentence and repeat after me:

I will NEVER take out a mixed life insurance policy linked to a 3a pillar because it is the biggest scam ever seen in Switzerland!

There, I said it!

If you want to know more, this article from Bon à Savoir does a good job of summarizing the issue of mixed life insurance linked to a pillar 3a.

Now let’s take a closer look at what options exist today for pure risk life insurance in Switzerland.

Because yes, the market has drastically evolved over the last 3-5 years, to the benefit of us, the average Swiss. And the insurers who used to make a lot of money on our backs have to worry about the newcomers on the juicy Swiss life insurance market.

What type of life insurance is available in Switzerland?

While researching this type of product on the internet, which I don’t use myself, I (re)discovered that such a life insurance in Switzerland allows your loved ones and/or yourself to receive cash in two situations:

- If you die = life insurance in case of death

- If you become ill or have an accident that prevents you from working = disability life insurance

As we will see, the best life insurances in Switzerland allow you to choose which risk(s) you want to insure (and this is not given by all insurances :D) in order to optimize your premiums according to your real needs.

Neo-life insurance in Switzerland

So I put myself in Stephanie’s shoes, and started searching on the internet for the different pure risk life insurance options in Switzerland.

Here is the list of candidates that I have selected:

- VIAC Life (which I already knew, being a client with them for my 3a pillar)

- SafeSide

- EmmaLife

Swiss life insurance comparison (death risk)

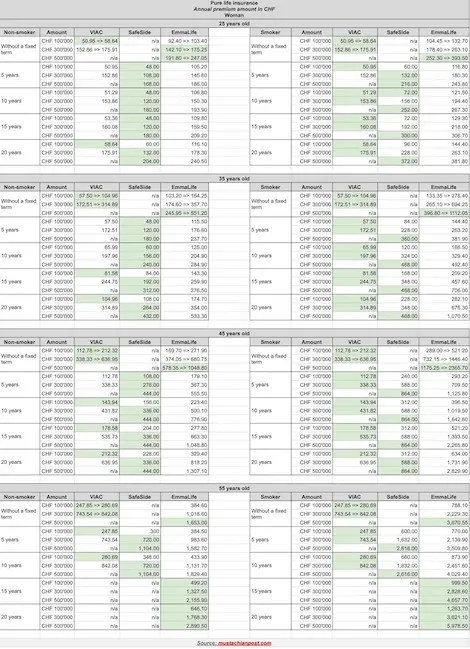

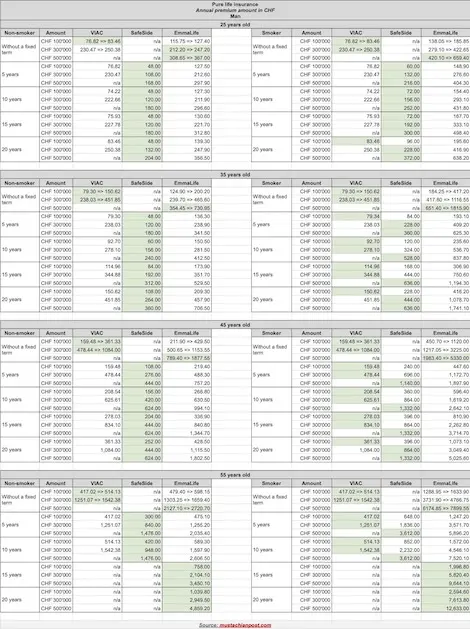

For each of these life insurance policies, I will compare the premiums according to a typical profile based on the following criteria:

- Gender: female or male

- Age: 25, 35, 45, and 55

- Smoker: yes or no

- Sum insured (amount paid in case of death): CHF 100'000, CHF 300'000, and CHF 500'000

- Life insurance only (as most requested)

- Life insurance duration: no fixed duration, 5, 10, 15, and 20 years

Here are the results of this comparison of life insurance in Switzerland:

Swiss life insurance comparison for women

Swiss life insurance comparison for men

As you can see, there is no ONE best life insurance in Switzerland. The amount of the life insurance premium depends greatly on the variables you insert.

Nevertheless, some conclusions can be drawn.

Indeed, the most advantageous Swiss life insurance is:

- SafeSide for non-smokers

- VIAC for smokers.

- SafeSide for an insurance of CHF 500'000, and this until your fifties, whether you smoke or not

- EmmaLife for an insurance of CHF 500'000 for a duration of 15 or 20 years when you are 55 years old

Which Swiss life insurance would the MP family choose?

If we were in a situation similar to Stephanie’s, we would choose a pure risk life insurance that does not commit us.

That is to say, depending on the amount we would like to cover, we would go with VIAC or EmmaLife (although depending on SafeSide’s insurer proposal, if SquareLife for example, you can apparently break your contract at no extra cost each year end).

The idea behind this choice is that life can change so much that you don’t want to sign a 20-year contract.

However, in some cases, such as with children and a sick parent, a fixed duration could be more interesting.

It’ll really depend on your situation. In this case, we would opt for SafeSide or VIAC (see the table with the best offer in green according to your personal situation).

Other important information

Life insurance in case of disability

When I was planning this article, I thought I would do a comparison of Swiss life insurance in case of death, and also in case of disability. Except that, apart from the fact that it takes a lot of time (but that’s my problem :D), the thing is that it brings many other variables and it would give an unreadable table in the end.

What I recommend if you need such a disability life insurance is to calculate your premiums with your real needs by comparing the results of VIAC, EmmaLife, and SolidaVita. According to my tests, these are the three best disability life insurances in Switzerland (knowing that SafeSide only offers life insurance and not disability).

SolidaVita

Also, know that there is a German-speaking-only alternative: SolidaVita. From my comparisons via Moneyland, it is interesting in some cases. But knowing that I am not bilingual in Swiss German, I cannot recommend it to you. But it might be worth a look if you live on the other side of the Röstigraben ;)

SquareLife

SafeSide is actually more of an independent, digital broker that works with different insurance companies, rather than a single life insurance provider as VIAC does through its (unique) partner Helvetia.

And SafeSide is a winner in many cases thanks to its partner SquareLife of Liechtenstein. However, be aware that compared to a VIAC/Helvetia, they have dozens of additional health issues that affect your premium:

- In the last five years, have you had any illnesses, or health problems that resulted in an absence from work for at least one month? If yes, has the underlying disease been cured without consequences for at least 2 years?

- Have you taken or been prescribed medication for longer than 4 weeks at a time in the last 5 years? If yes, has the underlying disease been cured without consequences for at least 2 years?

- Have you had high blood pressure in the last 5 years?

- Was your blood pressure within the normal range the last time it was measured by a doctor, nurse or similar?

- Have you been treated as an inpatient in the last 10 years? If yes, has the underlying disease been cured without consequences for at least 2 years?

- Is an examination (ECG laboratory, ultrasound, MRI…) or hospitalisation currently planned?

- Have you taken narcotics or drugs or been counselled or treated for them in the last 5 years?

- Have you ever been diagnosed with HIV infection (positive AIDS test) or are you waiting for the result?

- Are you planning to stay abroad for longer than 6 weeks in the next 12 months? (Outside EU, Switzerland, Iceland, Norway, USA, Canada)

VIAC

To be able to take out a life insurance policy with VIAC, you have to be a client of a pillar 3a or a 2nd pillar in vested benefits with them. BUT, the cool thing is that you can very well open an account and leave it empty, and that’s OK with them (I confirmed this with their CEO).

Flexibility, flexibility, flexibility

I’ll say it again here, because it can have quite an impact on your budget in the long run: your life is going to change whether you like it or not, even if you plan everything.

As a result, I would be very careful if I were to buy life insurance, and would most certainly take out one that I can cancel every month or year at most.

Especially because premiums and players in this market are constantly changing, and a good product/provider today could be bad in a few years.

So check all the lines of your potential life insurance contract before you sign it.

SafeSide and EmmaLife welcome bonus codes

As is often the case with fintechs, they offer promo codes. They allow you to have a small welcome bonus that is subtracted from your premium amount.

BE CAREFUL nevertheless, as compared to other products like the best Swiss neo-banks, I do not recommend you to engage in a life insurance contract just for the bonus!

And I repeat one last time: in most cases, a Mustachian generally does not need life insurance because he is self-sufficient and will be able to adapt to life’s challenges. But, unfortunately, we are not all so lucky.

So let’s go for the SafeSide and EmmaLife cashback codes (VIAC doesn’t offer them because they put all their marketing budget in the service of the product, which is a nice strategy too I think!), now that all these WARNINGs are explained:

EmmaLife: you'll get CHF 100 of cashback by registering via this special link for Mustachian Post readers if EmmaLife is the most advantageous Swiss life insurance in your situation

And you, do you own or will you subscribe to a Swiss life insurance policy?

If you need life insurance, it could help our Swiss Mustachian community if you share the reasoning behind your decision to have different situations and points of view.

You can do that via the comments section below.

PS: and in case you came across my blog by typing in Google the search “life insurance investment in Switzerland”, know that NO, a life insurance is NOT an investment. If you want to make your money grow in Switzerland, I advise you to invest it in the stock market or (in real estate) by following the advice in this dedicated article

Header photo credit: Tim Samuel via pexels.com