After my article on tax optimization of 2nd pillar withdrawals, I received the same question several times:

I’ve transferred my assets to a vested benefits account with finpension. What happens when I start a new job? Am I forced to send this money back to the pension fund of my new job?

And often, the next question comes up:

What about my two vested benefits accounts (splitting)? Do I have to merge them and repatriate everything, or can I leave some or all of it invested in the stock market until I reach FI (Financial Independence)?

Good question. Here’s the simple answer.

The short answer

Yes, by law, your vested benefits must be transferred to your new employer’s pension fund.

But no, you don’t risk any penalties if you leave your 2nd pillar in a vested benefits foundation such as finpension or VIAC.

It’s a gray area: the rule exists, but nothing and no one will punish you if you don’t apply it.

| Option | What the law says | Benefits | Disadvantages |

|---|---|---|---|

| Transfer your vested benefits to the new pension fund | Provided for by law | Simple, system compliant | Often low yield |

| Keep your vested benefits invested in the stock market | Tolerated (no penalty) | Superior long-term performance | Outside of “official” BVG logic |

What the vested benefits rules really say

The law stipulates that assets must be transferred to the new pension fund.

But there are no penalties (to my knowledge) for someone who leaves their vested benefits where they are.

The legal text is located here in the Federal Law on Vested Pension Benefits in Occupational Retirement, Survivors’ and Disability Pension Plans (SR 831.42). Article 4, paragraph 2bis states exactly:

If the insured joins another pension scheme, the vested benefits institution shall pay the pension capital to the latter in order to maintain the pension. The insured person must notify:

a. to the vested benefits institution that he is joining a new pension scheme;

b. to the new pension fund the name of the vested benefits institution and the type of pension plan.

Some people simply tell the new fund that they have used their funds to pay off a mortgage or start a new business… and that’s the end of the discussion.

In a nutshell:

- The rule exists.

- The penalty is not.

So even if you can leave a vested benefit credit while you’re working again, this is neither provided for by the spirit of the system, nor recommended.

Can I leave my vested benefits account with finpension or VIAC?

Yes, many people do, for one simple reason: money works much better in shares in a vested benefits scheme like finpension, for example, than in the new employer’s BVG fund.

As long as nobody asks you specifically “transfer me X CHF now”, you can leave your assets invested, work, and make babies via compound interest.

What if you have two vested benefits accounts (for splitting)?

If you can avoid merging your accounts, avoid it.

Why not? Because splitting:

- optimizes your retirement withdrawal (less tax to pay), as it is made in two different tax years

- allows you to manage your assets in two different foundations (with two different investment strategies, for example)

Which is the best vested benefit account to optimize your 2nd pillar (Mustachian recommendation)

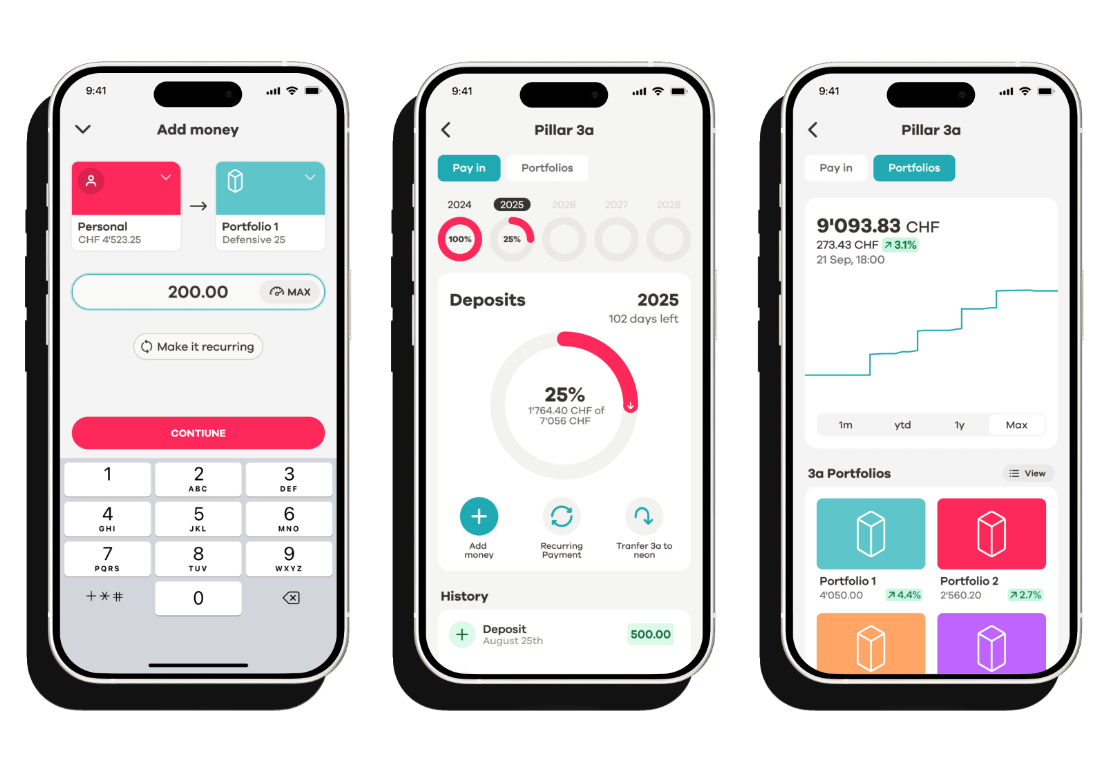

For long-term vested benefits, I currently recommend finpension (you can read here my comparison of the best vested benefits account in Switzerland).

It’s the only provider that lets you:

- Invest your entire assets (compulsory AND extra-compulsory portions) 100% in global equities, with passive investment

- Use two vested benefits foundations for tax splitting

- Have a head office in the canton of Schwyz, which is highly advantageous for withdrawals from abroad.

VIAC remains an excellent second option, but for maximizing your net return and optimizing your taxes, finpension comes out on top.

===> MUSTBC <===

Mustachian disclaimer

As usual: I’m not a professional financial advisor. All the content of this article is to explain to you what some people do. And, mainly, this article is for entertainment purposes only. So you can’t sue me if you’re messing around with your 2nd pillar. I hope you hear me.

After all, this feedback shared by blog readers is not fraudulent. In fact, you’re not evading taxes, since your BVG pension assets (2nd pillar) remain in the global system (i.e., vested benefits). It’s just that it’s more optimal in terms of performance, because you can choose how you invest this money (which ultimately belongs to you).

FAQ vested benefits account and changing employer

Do I have to transfer my vested benefits when I change employers?

Yes, the law provides for a transfer to the new pension fund, but there are no penalties if you keep your assets in a vested benefits account.

Is it illegal to leave my vested benefits with finpension or VIAC (even if I get a new job)?

No. It’s not an offence. The law describes a mechanism, not a penalty.

Can I keep two vested benefits accounts even after changing jobs?

Yes, splitting is still allowed and optimizes your final withdrawal.

Can the pension fund force me to transfer my assets?

Yes, if they explicitly identify you as having untransferred vested benefits.

In practice? Very rarely.

Does leaving part of your 2nd pillar in a vested benefits account reduce the insurance coverage of your current pension fund (disability, death)?

According to the Swisscanto study on Swiss pension funds in 2025 (507 funds), 29% of institutions apply the defined contribution model for all benefits, a proportion that is declining (they specify that “its share is decreasing in favor of the dual primacy model”). Conversely, around two-thirds use a “dual primacy” model: old age is based on contributions (= the savings portion), while risk benefits (including disability) are calculated on the basis of the last annual salary.

In other words, as long as you are affiliated with a pension fund through your employment, insurance coverage is calculated in 71% of cases on the basis of your insured salary, regardless of the LPP capital you have retained in a vested benefits account. However, please note that if your fund is one of the 29% of institutions that still operate on a defined contribution basis, disability coverage may depend on your BVG savings, and a vested benefits transfer may reduce your disability protection.

Conclusion

If you want to optimize your 2nd pillar and boost your FI strategy, letting your vested benefits work in equities (via an optimal financial institution like finpension) may be a more attractive option than sending everything back into your new employer’s pension fund (and its very meager returns).

And you, did you leave your vested benefits account invested after a job change, or did you transfer everything to your new employer?

Last updated: January 15, 2026