With the income tax savings possible with the 3rd pillar at the end of this year, several of you have written to me in the last couple of weeks to get my opinion on True Wealth’s new pillar 3a offer, and whether I had any experience with it.

For newcomers: True Wealth is one of the oldest Swiss robo-advisors. I didn’t talk about True Wealth much, because when it comes to asset management, we are more DIY than automated on this blog — in order to optimize our management fees as much as possible ;)

True Wealth are nevertheless serious and secure since they rely on one of the two following deposit Swiss banks for its assets: the Baselland Cantonal Bank (BLKB) or Saxo Bank (Switzerland) SA.

But at the beginning of November, True Wealth announced its 3rd pillar offer which shook up the competition of the classic pension funds (good for us Mustachian investors!) with one of the best offers on the market — at least on paper.

In fact, their ad did the trick as they are selling this competitive advantage in “0.0% True Wealth fee” mode.

0.0% does not mean free investing

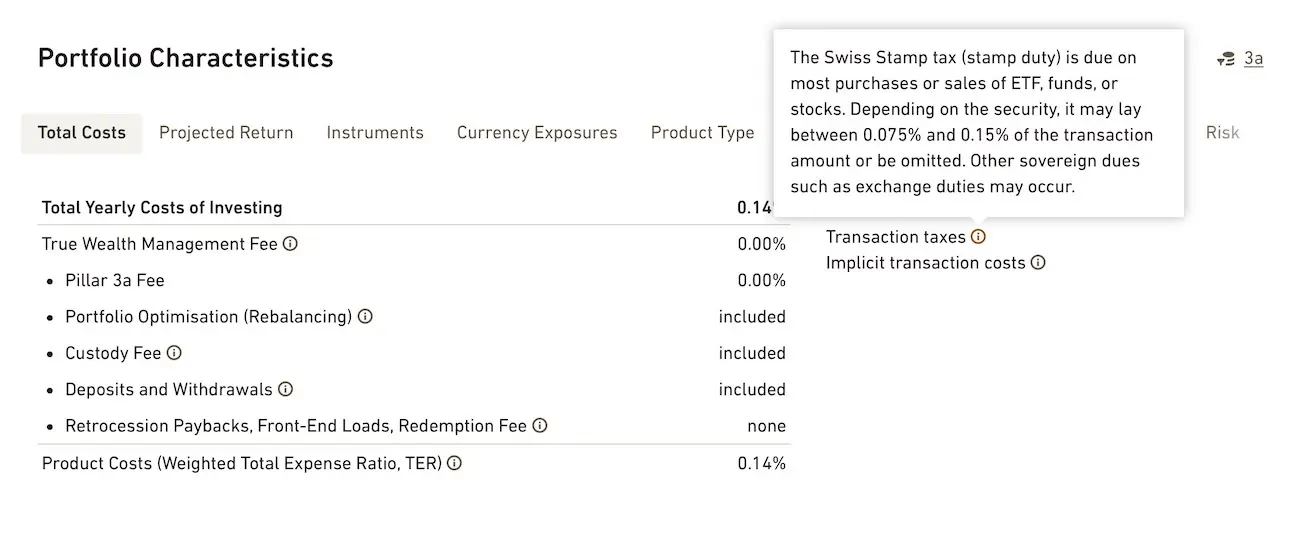

So yes, True Wealth does not charge any fees on its behalf.

But as with any investment solution, the products themselves have fees.

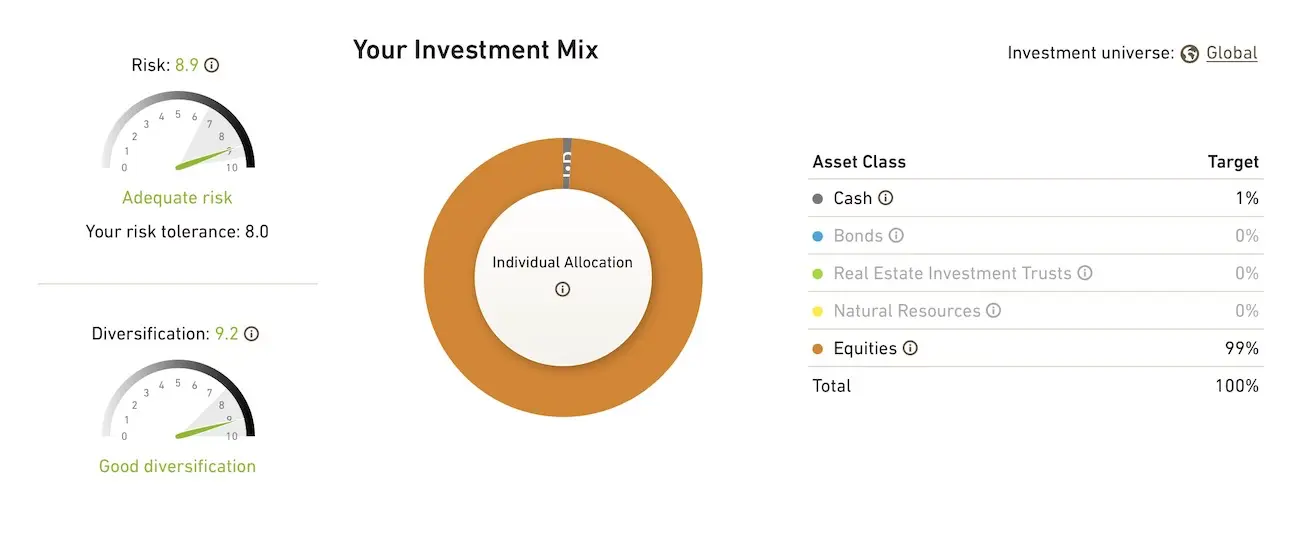

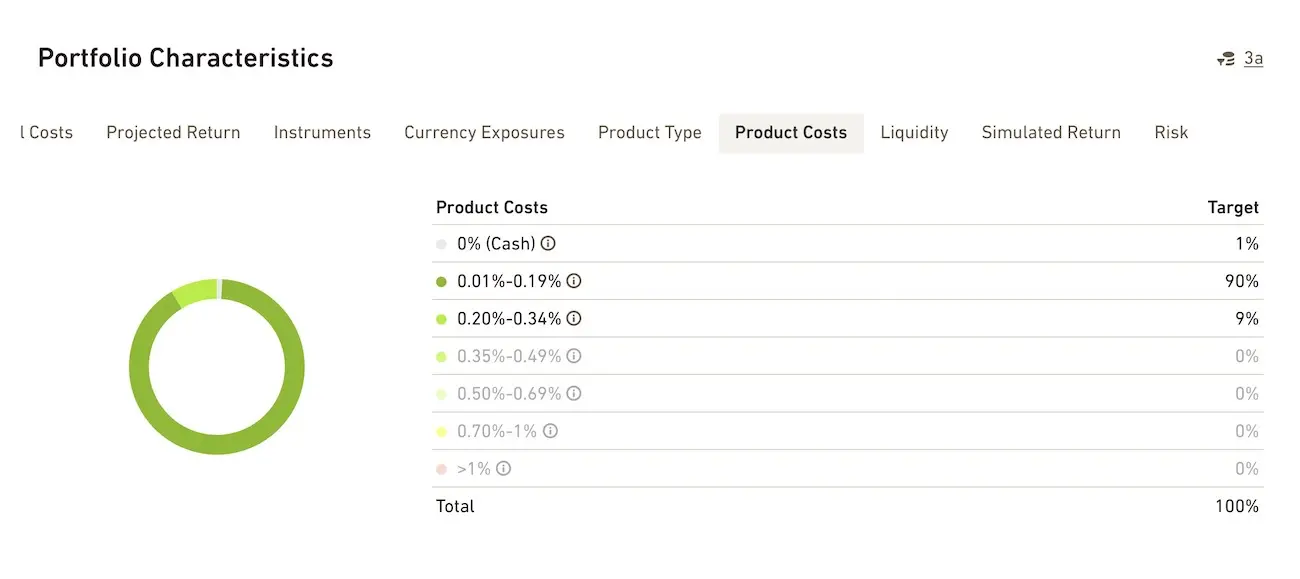

So in reality, for a risky type of profile (99% of equities’ asset class as an investment strategy) such as the Mustachian investor that we are, we are at 0.14% TER (“Total Expenses Ratio”).

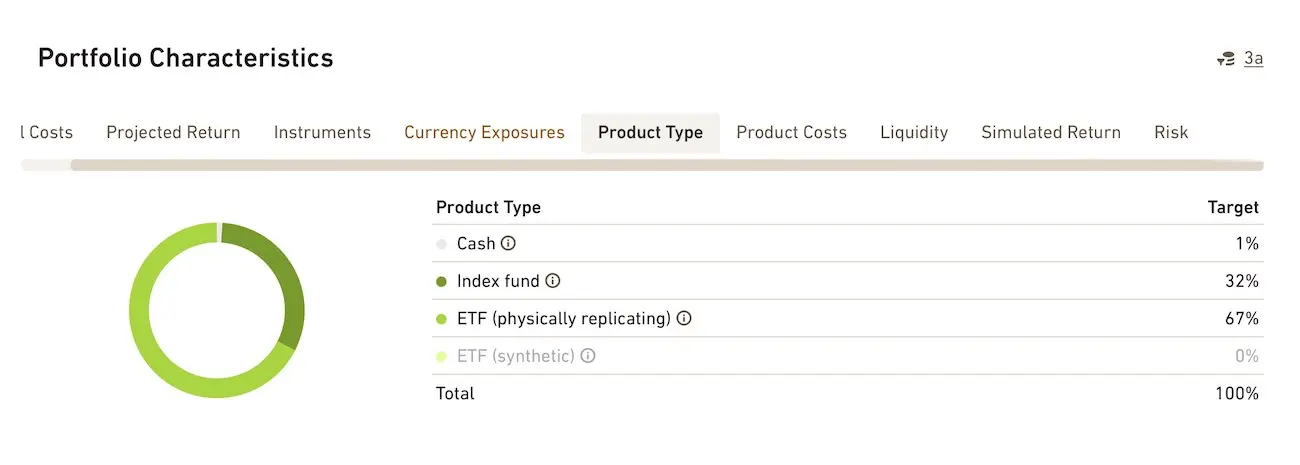

Then, by digging a little, I quickly realized that their pension solution is indeed free of True Wealth fees, but on the other hand, they are investing mostly via ETFs 1…

This means that you have to add stamp duty to the TER. This has its disadvantage compared to 3rd pillar retirement solutions such as finpension or VIAC which are investing mostly via index funds without these stamp duties to pay (that eat your returns).

And finally, you have to add the transaction fees and the currency exchange fees.

In total, we arrive at around 0.20-0.22% when investing your third pillar money at True Wealth.

But then, 0.22% is still lower than True Wealth’s competitor — aka 0.39% for finpension and 0.39-0.41% for VIAC.

So you could say that True Wealth pillar 3a is the new best 3rd pillar in Switzerland to maximize the returns of your retirement savings! 🎉

Except that…

True Wealth fees will “possibly” increase on 01.01.2024

UPDATE 10.01.2025: True Wealth never raised their fees as promised. Better yet: they’ve done away with it altogether, so you can ignore this paragraph entirely.

True Wealth are very transparent in their FAQ, which I recommend you read here.

They indicate about their 0% fees:

The cost regulations of the 3a retirement savings foundation state that the Board of Trustees could introduce a management fee to a maximum of 0.225 per cent per annum on the securities portion.

Nevertheless, due to a contractual agreement between True Wealth and the Foundation, no management fee will be charged on the pension assets until further notice. If, contrary to expectations, the Foundation Board decides to introduce a management fee at the beginning of a calendar year (possibly at the beginning of 2024 at the earliest), we will inform our pension fund members of this in July of the previous year.

Idem, on the MP forum, an employee of True Wealth confirms that True Wealth’s strategy has always been to move towards a decrease in fees in the 10 years they have been in existence. This reduction will be possible thanks to the increase in the share of index funds in their pension investing solution.

Nevertheless, there is still some doubt.

What should you do if you are choosing your new 3rd pillar to invest part of your wealth?

My recommendation regarding True Wealth 3a in 2022

For the moment, my decision is to wait before switching my 3rd pillar from VIAC or finpension towards True Wealth.

I will indeed set a reminder for myself at the end of July 2023 to see what happens with the Foundation behind True Wealth 3a.

If True Wealth stays with 0% management fees as announced (and I trust them enough since I’ve been following them since their debut in 2013 already), then I will name them as the best 3a pillar in Switzerland, open my account there, and report about my experience here on the blog.

If they add the 3a pension foundation fees of 0.225%, then they will still be in the top 3 of the best Swiss 3rd pillars.

See you on 31.07.2023 to take stock of True Wealth 3a :)

There’s still time to save on taxes

There is still time to save on taxes for 2022, and to fill up your 3a pillar to the max (6'883 CHF this year) to make your retirement savings grow by investing them AND save about CHF 1'000 in taxes each year!

You will find in this article all the details of my comparison of the best 3rd pillar for investing your retirement savings.

True Wealth indicates on their site and on the MP forum that they will gradually offer more and more index funds rather than ETFs for their Pillar 3a investment strategy. ↩︎