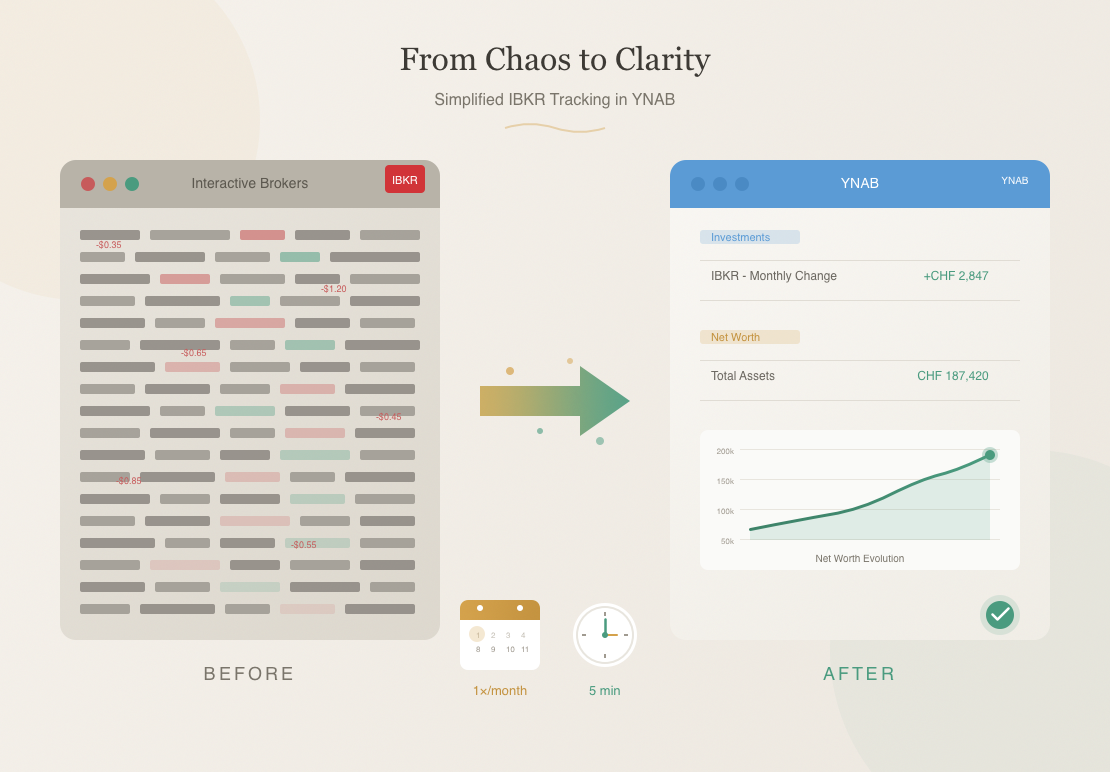

TL;DR: I no longer report every IBKR micro-transaction in YNAB. From now on, I update my accounts once a month, with 1-2 correction transactions, and my net worth remains accurate.

When I started investing in the stock market with Interactive Brokers, I wanted to report every single transaction in my YNAB budget app. And when I talk about transactions, I’m talking about my own, but also those implicit in stock market investments via an online broker:

- Transaction fees

- Exchange fees

- Gain/loss due to exchange rate fluctuations

- Withholding tax for each ETF/stock

- Dividends for each ETF/stock

- Etc.

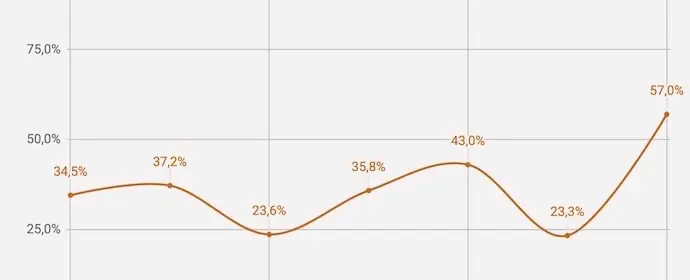

And I also regularly updated the value of my IBKR portfolio in YNAB, in line with stock market fluctuations.

At first, I thought it was fun. And accurate.

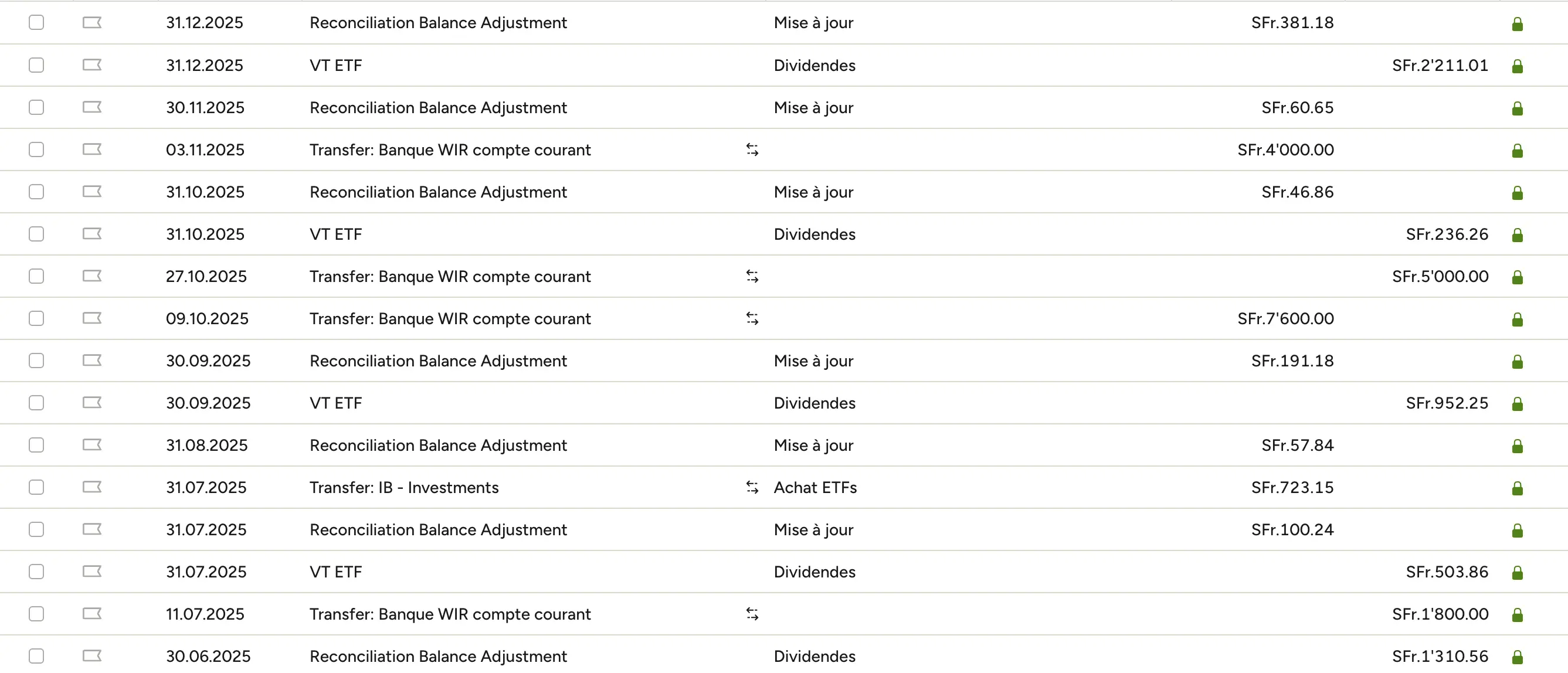

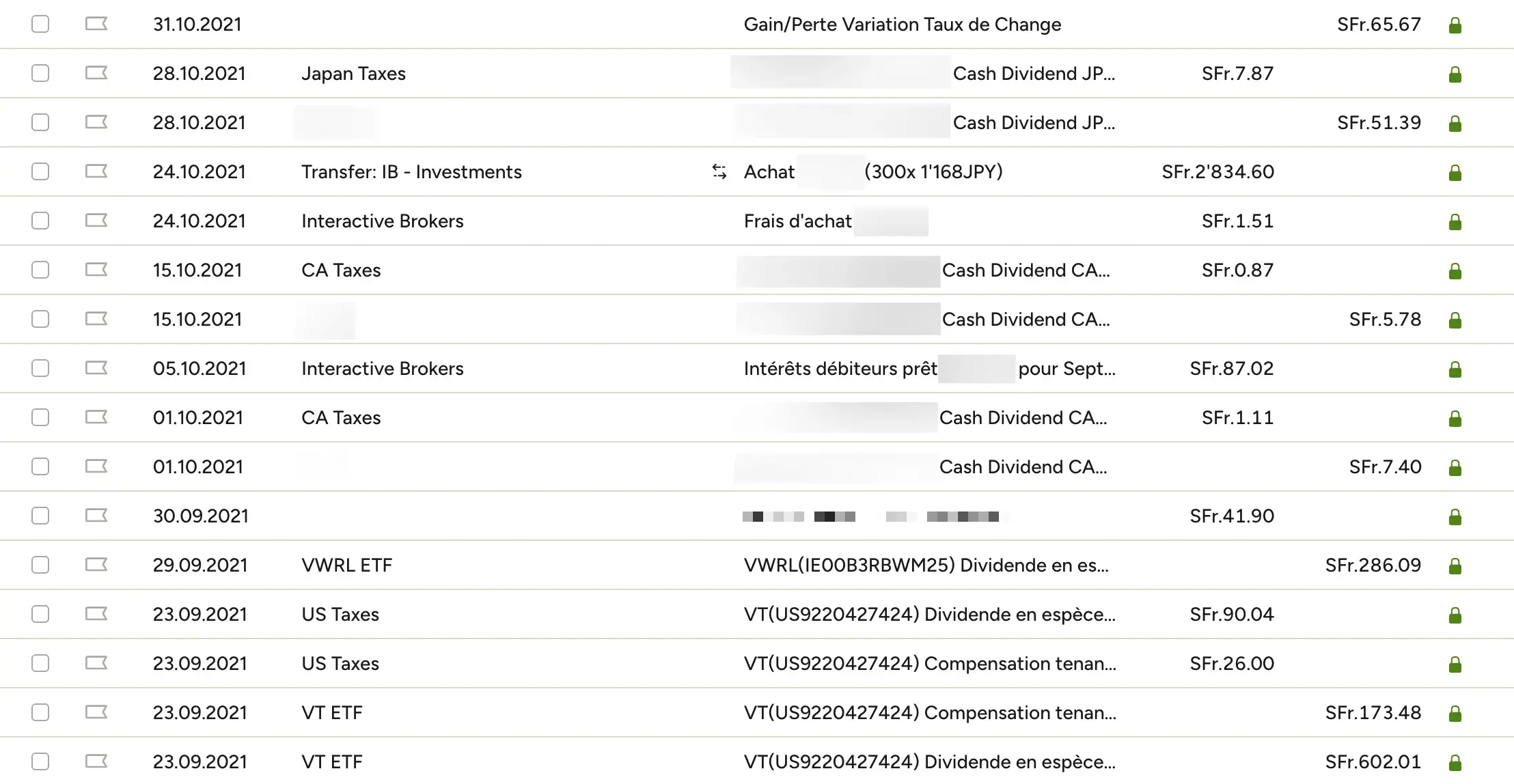

It looked like this (note the number of transactions for one month only):

As you can see, I reported everything from my Interactive Brokers statement.

But after several months (years?!), it started to get boring and time-consuming beyond belief.

All that for what?

For me to use:

- the Interactive Brokers “Statements” feature, which is very comprehensive and answers all my questions about my transactions over the years (you may also be interested in this article: How to see how much money I make with Interactive Brokers)

- the IBKR Mobile app, which lets me track the value of my portfolio as often as I like

So I’ve changed my way of doing things since 2021. And drastically so.

My “Tracking” accounts for IBKR have not changed in YNAB

Between what I did before and what I do now, my IBKR accounts in YNAB have not changed.

I mimic what’s on my favorite broker in the form of a “Tracking” account:

- An account named “IB - Cash” for my IBKR Cash account (in CHF)

- An account named “IB - Investments” representing my IB brokerage account where my ETFs are stored

Note: a “Tracking” account in YNAB corresponds to an account for which you cannot budget what it contains (like my Interactive Brokers investment accounts). Conversely, my Swiss bank account is a “Cash” account in YNAB. Indeed, I can use the cash in it to assign it to categories in my budget.

Simplifying the monitoring of Interactive Brokers accounts in YNAB

Now here’s my process when I reconcile our IBKR accounts to track our YNAB budget at the beginning of each month.

On our “IB - Cash” account in YNAB, I note in this order:

- All incoming and outgoing transfers from our Swiss bank account to our IBKR Cash account on the date they actually took place (so that it’s correct in my bank account transaction tracking)

- Purchases or sales of ETFs grouped in a single transaction

- Dividends received grouped in a single transaction (on the last day of the month), just because I like to have this information available in my YNAB ;)

- A single reconciliation transaction on the last day of the month to match the IBKR balance with the YNAB balance (this transaction is mostly negative, as it includes all the fees mentioned above)

⬆️ You'll notice that my YNAB screenshot above is the same height as the previous one, except that it covers six months instead of just one (from our Interactive Brokers 'Cash' account)!

And on our “IB - Investments” account, I note:

- A single reconciliation transaction on the last day of the month to match the total amount of my Interactive Brokers investments with the balance of this account in YNAB

Update only once a month (vs. much more regularly before) of my YNAB account for my ETFs on Interactive Brokers

FAQ about Interactive Brokers and YNAB

Does this tracking method distort my YNAB budget?

No, because IBKR accounts are “Tracking” ones, and don’t impact actual budgetable money.

What is the “Reconciliation Balance Adjustment” transaction in YNAB?

This transaction is the result of YNAB’s practical account reconciliation functionality.

You click on a “Reconcile” button, and YNAB asks:

- Is the current balance of your account (“IBKR - Investments” for example) equal to XYZ?

- You answer “No”, because the stock market prices have changed on your “IBKR - Investments” account

- YNAB asks you for the current balance of this account

- And bam, YNAB inserts an automatic transaction (the famous “Reconciliation Balance Adjustment” line) with the correct amount to reconcile IBKR with your YNAB :)

Conclusion

This new process is much simpler and above all much faster for the monthly monitoring of my IBKR accounts on YNAB. And it still allows me to track my net worth every month, with the exact amount from IBKR.

And you, how do you keep track of your Interactive Brokers accounts (or any other online trading platform) on YNAB?

Last updated: February 12, 2026