The two acronyms are YNAB and MMM.

Thanks to these seven letters, I’ve grown our household wealth by thousands of CHF - this applies to USD and EUR too, don’t worry!

We saved CHF 37'000 during 2014 only, to be precise.

All that thanks to seven letters that I wish I would have known years ago…

YNAB + MMM = WEALTH

Assuming that you’re a new reader, or that you came over this blog randomly, I will need to explain first the meaning of both acronyms.

“YNAB” stands for “You Need A Budget” and is a personal finance software to manage your budget.

“MMM” stands for “Mr. Money Mustache” and is a blog talking about frugal living while stashing cash. The term “Mustachianism” was invented there as far as I know.

These acronyms are preaching two methodologies that are very complementary.

When combined together, they are taking you, your budget and your wealth up to the next level.

If I compare our situation before using these secret recipe with what happened last year, the computing tells us that we saved six times more money than we were doing previously.

It does feel magic, but the best part is that you can also achieve it.

YNAB: my life companion

This all started because of a simple piece of software (including the blog you’re reading)! Being from the IT world, I’m still amazed at how technology can bring positive things to our world!

YNAB (referral link) became such an essential and evident part of our household life that I had to think twice about why I like so much this application!!!

I know it is something I couldn’t live without anymore but let’s analyze why so much love!

I won’t go through the 4 steps of their methodology because this YNAB introduction video explains it way better than I would.

Instead, I will focus on what this software and methodology brought as benefits to our household.

#1 - Don’t let money be randomly spent

Before, we were the kind of people who live paycheck to paycheck. As Switzerland salaries allow for a lifestyle which is more than correct, we were simply spending (almost) all of the money that we were earning.

Want to go out for dinner? Let’s go!

Want this new shiny Mac that just got released? Just get it man, my next (Swiss) salary will pay it in one shot!

Want to visit family abroad next week-end? Let’s pack up, fill the greedy car tank with some fresh gas, and there we go!

This can sound like usual lifestyle to some, or completely surreal to others. At that point in time, it was our way to deal with our finances.

What changed with YNAB is that at the beginning of each month, every cent we make gets a specific task to do. Every. Cent.

That way, we plan how money gets out of our pocket, instead of letting it be randomly spent depending on the events, the weather, etc.

This first point alone helped us save tons of money as you don’t see any remaining money that you could spend. Everything is used for something and it removes completely the temptation of using some left alone cash!

Once you experienced it, you just wonder why no one taught you that in school instead of some useless fancy math algorithm that you’ll never use!

#2 - Know where you are and where you go financially speaking

The second fantastic thing is that you know exactly where you are regarding your money. You don’t have to login to your e-banking to get your balance, then remove what you think you will spend this month for groceries, for your mother’s birthday, for your bike repairs, etc, etc.

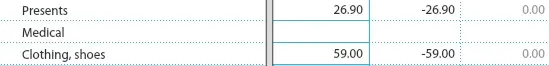

Because every cent has its own category, you can plan in advance your yearly expenses such as insurance bills, or also Christmas and birthdays.

Thanks to this expenses categorization, you gradually discover how much on average you spend on what.

That’s when the magic happen: you can then look at your own future and make plans based on real data and facts, instead of just guessing.

When I say plan, I talk about big things/dreams that are now reachable as you just have the data to plan for them. Things like buying your first home, replacing some big stuff such as a car (by another more frugal but still a used one, right), and even the financial independence graal!!!

A whole new different world is now at your fingertips.

#3 - Forget about your e-banking and manage your money from one single central place

Until recently, I still had (too) many bank accounts as it might be the case for you too.

One thing that YNAB doesn’t take enough pride in is how it hides any complex banking setup you can have. It may sound crazy to you but I’m going to my e-banking about twice a month nowadays. Before the YNAB era, it was more like twice a week or even more.

The tool makes it so simple: all your accounts centralized in one single place. You enter your incomes and expenses as soon as they happen, that’s it!

It removes all the hassle of having multiple logins and browser tabs opened in the same time together with your calculator and homemade physical or digital spreadsheet! Even if old school methods are usually the best ones, trust me that it is not the case for personal finance management with YNAB!

The hidden benefit of not going often to your e-banking platform is that you don’t see all the possible cash cushion you stashed. So you’re not tempted to use it!

#4 - Have pleasure and be excited when paying your bills

OK, for this one, I don’t ask you to take my word because you really need to experience it in order to trust me!

I already see you laughing out loud: “Yeah MP, you’re so funny! Are you really serious that you are excited and take pleasure in paying your bills?!? Like seriously?”.

Indeed this may seem weird to the first comer.

But you are just so happy when you see the balance of your budgeted yearly insurance/taxes/younameit hitting “0.00” perfectly! It’s a mix of feelings between control and power on your own money.

And don’t worry, these rejoicings aren’t happening once or twice a year but more like several times a month when you see your budgeted amounts getting closer to the balance amounts.

Budgeting begins suddenly to be a game. And when you start to see it as a game, you want to win it. That’s the start point of yourself becoming rich.

#5 - Overbudget? So be it! YNAB is flexible!!!

“Fair enough MP, your perfect match may work for you but what about us, humans with life full of unexpected events?!?”.

Thanks mate, but unfortunately, I’ve got a life with its load of unplanned things that happen every month. It wouldn’t be fun else actually.

Thankfully, YNAB was also built by humans and is completely flexible regarding this aspect.

You will manage it by taking the missing money of the overbudgeted category from another category. Two clicks, that’s it!!!

#6 - Track your spendings easily from wherever around the world

Thanks to its laptop (Mac and PC), tablet and mobile apps (iOS, Android and Windows Phone), you can log your expenses wherever you are. Everything is synchronized and works like a charm.

The expenses logging part is I honestly think the most reluctant part of budgeting. Ideally, I would like my banks to push any expenses I make to my YNAB database.

But I prefer to see this drawback as a way to improve my ability to build habits. After few weeks of usage, it has become an automation. As soon as I get my credit card out of my wallet, I take my iPhone as well.

UPDATE 04.04.2024: I was lucky enough to interview the founder of YNAB! You can watch the video by following this link.

MMM, a blog for a new (wealthy) lifestyle

For the little story, I discovered MMM blog not long after I started to use YNAB (referral link).

I found it was such a great source of early retirement information that I took up the challenge to read every single article so to develop my frugal knowledge as fast as possible. This took me few months if I correctly remember, but I really recommend you to do the same as it will opens your eyes regarding various lifestyle aspects.

Combining these two acronyms was what really put my money on steroids!!!

#7 - Enjoy peace of mind in any situation, forever

This benefit is I think the favorite of my wife who tends to worry as soon as we get a money issue.

Good news: she didn’t worry about cash since more than one year!!!

Thanks to MMM, we analyzed all what could go wrong financially speaking, mainly because of insurances lowered at the minimum. Then we wrote down this final amount of cash as a goal in YNAB, and we started to build our cash cushion.

Now that we are fully covered since months, it’s so amazing how we don’t care anymore about unexpected bills or events. Got the iron broken, unplanned week-end abroad, laptop broken.

No more worries. Always sleep well. We are ready to face those potential problems!!!

#8 - Optimize every line of your budget - or how we saved CHF 37'000 in one year!!!

From all MMM blogposts, I preferred the ones who talked about optimizing every damn lines of your expenses report.

Step after step, one YNAB line after the other, we downsized the following:

- Car tax yearly fees thanks to my wife’s superpower

- Car insurance because no one wants to crash against a wall

- Our V6 car for an hybrid one

- Internet and TV subscription

- Strengthened our cooking habits

- Closed useless banks accounts and choose the best Mustachian credit card out there in Switzerland

Last 2014 was the first complete year I tracked all of our incomes, expenses and savings. It was also the first complete year where we enjoyed the total results of all our optimizations.

Computing the final number, I can happily tell you that our household put aside nothing less than CHF 37'000 in a single year!!!

And honestly, we don’t feel restrained. Even though we still have plenty of decluttering to do, we enjoy less useless stuff and more valuable (often free) moments.

Conclusion

I truly think that every country of this world should provide personal finance mandatory courses so that children aren’t depending on the randomness of (maybe) finding out someday that there is another way of living than consumerism, debt and paycheck to paycheck.

As Mark Cuban said: “While money can’t buy happiness, it can sure make life a whole lot better.”

So now, if you’re interested by the idea of becoming rich and build wealth, here are your next steps:

- 1/ Go on YNAB website (referral link) to download their software

- 2/ Build your budget following their advices and courses

- 3/ Go on MMM blog and start reading two articles per day until you’ve read all of them

- 3 (bis), if by any chance you’re from Switzerland, please read also all MP articles written so far to build wealth even faster!

- 4/ By then (in about one year), enjoy the huge amount of cash you’ll have stashed in investment accounts!

Let me know in the comment section below what you managed to achieve! You can do it!!!

BONUS: Want to win a free YNAB license?

YNAB and its founder Jesse are such an amazing company that they accepted to give away one free YNAB license (worth 60$) to one of MP readers!!!

Two simple rules to participate in the game:

- 1/ You have to let a comment in the section below explaining what benefits you think YNAB would bring to your own budget and life

- 2/ You have to retweet this MP tweet

- 3/ (Optional) Last but not least, if you win and happen to follow MP on Twitter and like the MP Facebook page, you will get some of my favorite selection of Swiss chocolate as a bonus on top of your YNAB license!!!

The winner will be announced the 16th of March 2015 so stay tuned ;)

UPDATE 16.03.2015

And the winner is…Aki!!!

Congratulations to you! For both the YNAB license and Swiss chocolate!

Please private message me your contact infos so I can organize the sending.