I receive many emails from readers wanting to know how to make a budget. Indeed, they want to save money for a specific project but don’t know how to do it:

- “How can I save money for the purchase of my future home?”

- “How to save money from salary for a long family trip?”

- “What’s the best way to save money for financial independence?”

- “How to budget money each month for future planned bills?”

Their objectives are different, but the way to achieve them remains the same: budgeting in order to save money.

But the problem they often tell me is that knowing how to manage money is not a skill that everybody has. Moreover, my budgeting method with You Need A Budget (aka YNAB) is not for everyone because you have to enter each transaction manually (or via import), which is too time consuming for some readers. Which I can understand. We’re not all budget geeks.

But there are other methods that are simpler and quicker, but just as effective.

As my answer to these emails is often the same, I thought I’d make an article to help newcomers to the blog about the types of budget that exist.

After reading many articles and forums on the subject, I came to the conclusion that there are four main categories of how to make a budget.

4 ways to make a budget, from the simplest to the most complete

1. The simplest budgeting method: self-taxation!

Olivia is 29 years old. She wants to take a sabbatical for her 32nd birthday in order to fulfill her dream of exploring Asia for a year in backpack mode. All her readings on how to achieve happiness in life have shown her that you don’t fully enjoy a country when you go on holiday for 15 days. Because you try to see everything in a frenzy that is more tiring than restful.

Her objective is to test the “slow travel” way in order to immerse herself in these cultures so different from the West.

By doing her calculations, she saw that she would have to reach 50% savings rate from today on to achieve her goal.

But Olivia doesn’t imagine having to enter each of her transactions by hand into a budget. She’s already tried, but it’s not for her. She gave up after two weeks… She’s willing to make every possible concession to her spending to get to that 50% savings rate, but she wants to keep her budget management as simple as possible.

After two months of testing my monthly budget solution, she can’t believe it. It works!

The simplest solutions are often the most effective.

She has therefore adopted the “self-taxation budgeting method”.

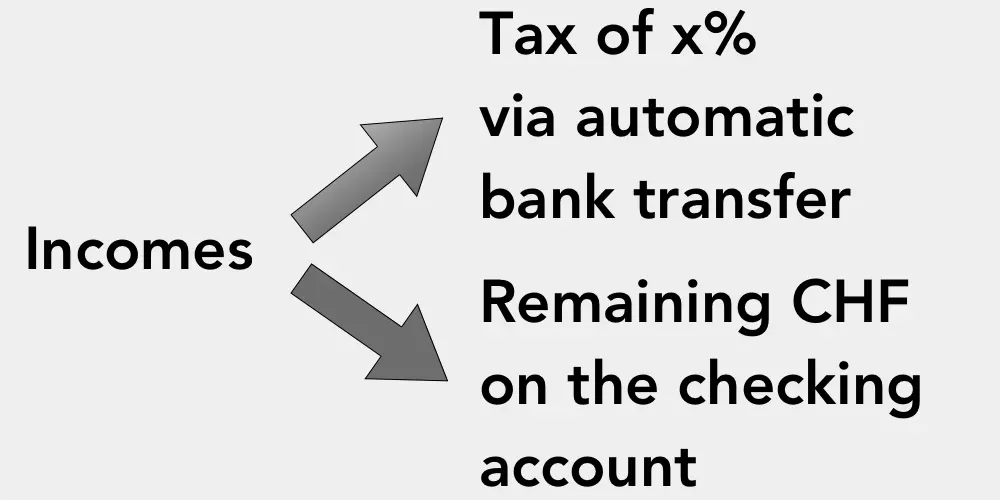

From now on, any income that came into her account was split in half. 50% of the tax went directly to her savings account which she couldn’t easily access (i.e. she had to find her login and password, and that alone discouraged her from dipping into it). And she could use the other 50% as she saw fit.

Of course, she had some difficult endings at the beginning, but her life goal motivated her to eat pasta for several days. And as the months went by, she implemented two additional tactics:

- She has calculated her total annualized invoices and a margin for unexpected invoices. Then she divided it all by twelve, and set up an additional automatic transfer to her savings account to keep it aside

- She divided her 50% monthly allowance by four (from which she first subtracted her annual invoices) in order to regulate her expenses week by week

As you can see, Olivia no longer needs to enter her transactions on via this budget method. All she has to do is to be disciplined when she receives her salary (and any extra income) by splitting it in half.

And if she needs to know where she’s at in terms of spending, she just has to look at what she spent during the week compared to what she had planned. The amount left over is what she can spend. No more, no less.

An important point I made to Olivia when I introduced her to this method: you must obviously inform your bank that you do not want an overdraft authorization. Otherwise you risk getting into a debt spiral and this is not an option for us on this blog.

This precept of paying yourself first, via this self-taxation, can be used as a budgeting method in itself. But it is also a basic precept that combines very well with the three other methods that we will see later on.

Also, this method of personal budgeting can work for any life goal. All you have to do is adjust the percentage of self-taxation on any income that comes into your account, as well as to which account you transfer it (i.e. if your goal is financial independence then you will prefer to send your savings to an investment account rather than a Swiss savings account…).

On the other hand, if you have a personality that likes tangible stuff, then move on to the next budgeting method #2.

2. The cash envelope system for those who like concrete stuff

Philippe lives in Thalwil, on the periphery of Zurich. He is 42 years old, divorced, and father of two grown-up girls who will soon enter adolescence ;)

He has always had a hard time managing his money. His biggest problem with the family budget? It may sound silly, but he hates anything digital like e-banking or mobile apps from banks. He likes the concrete. He wants to be able to see his cash so he can count how much he has left over for the month. And don’t talk to him about Excel budget files, it gives him hives!

When he contacted me, it was a bit hard for me to help him because I’m rather his opposite… but it reminded me of a US blog I had read several years ago. The author explained that the budgeting method that had worked for her was based on a cash envelope system!

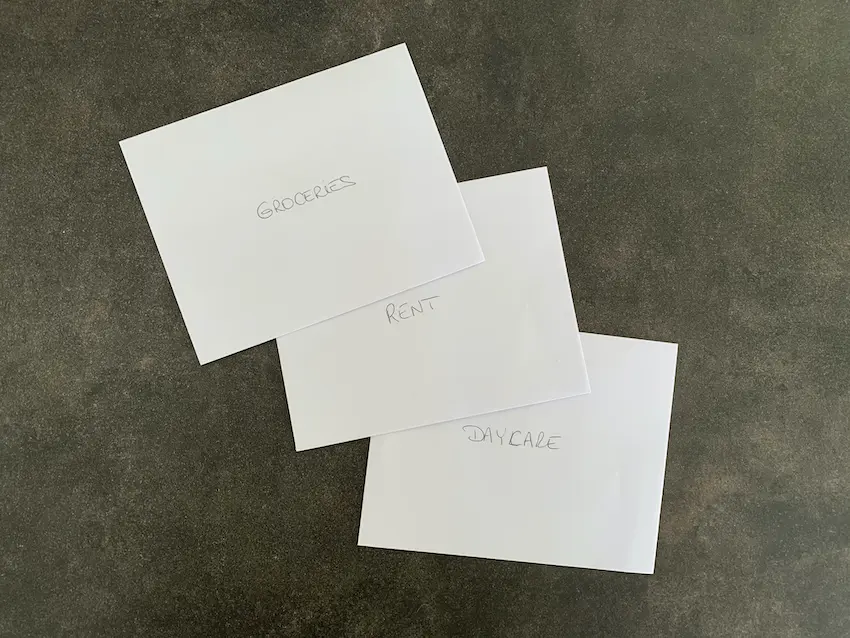

The principle is very simple again. When you receive your income, you withdraw (literally) all your monthly allowance in cash at the ATM. Then you divide this into as many envelopes as you have budget categories (e.g. groceries, public transport, outings, etc.).

And when your friends call you on the 15th of the month, you can quickly take a look at your “Outings” envelope and see if you can afford it or not. And if you really don’t want to miss that evening for CHF 10, you always have the option of consciously deciding to take CHF 10 out of your “Groceries” envelope, and you know you’ll have to be more careful in this category that month.

Some aficionados of this method even go as far as having four groups of envelopes containing each all the categories of expenses in order to reproduce the system used by Olivia in the previous example, i.e. having a weekly allowance rather than a monthly one.

The big advantage of this method is that it is not virtual. If the envelope is empty, well, it’s empty! And no temptation to use your Maestro card because your entire account is already empty since you have withdrawn all your cash.

Although pragmatic, this cash envelopes system has a big disadvantage in today’s world: how to pay by card on the internet or in places where they don’t accept cash (festivals or other)?

One idea might be to go and deposit cash back into your account so that you can use your card. It’s impractical, but potentially interesting from a frugal point of view because it can save you a lot of impulse spending. But I understand that it may not be suitable for everyone… hence, the following method.

3. The spreadsheet budgeting method (aka DIY budget)

Antonio, a reader of the blog, uses the spreadsheet budgeting method (Microsoft Excel, Google Spreadsheet, or any other similar tool) to compensate for the impracticality of the cash envelope system.

Because, let’s face it, he’s a bit of a geek when it comes to the budget. But he has two conditions (besides it being digital) to choose his method of managing his money: first, he doesn’t want to pay for a budget planner app, and second, he wants the flexibility to play with his personal finance data without restrictions.

That’s why he chose a spreadsheet budget.

There are a plethora of online Excel budget templates available, but he preferred to create his own in order to really make it his own.

His system is basic, yet effective.

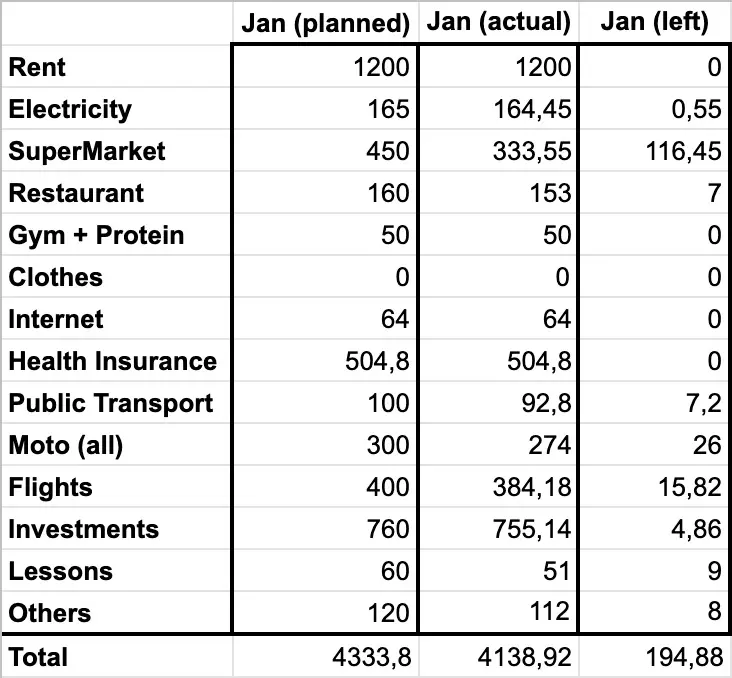

He creates an Excel monthly budget table in a tab for the current month. Then, when the next month comes up, he duplicates the previous month and deletes all the amounts to start from scratch.

This month’s tab looks like this:

- In the first column, he listed all his usual budget categories

- In the second column, he listed the Swiss franc allocations for each category

- In the third column, he enters his actual expenses. If goes several times for groceries in the month, then he enters the sum of the different expenses in the same spreadsheet cell

- In the fourth column, he subtracts

— . This allows him to see how much he has left in each category

This method requires more discipline because all transactions must be entered. An alternative is to pay everything with your card and to do your personal accounting every weekend by entering all the transactions.

If you’re the type of person who doesn’t like to do spreadsheets from your smartphone (because you have to zoom in, aim for the right cell, zoom out, etc.), then this system can be restrictive because you have to have access to your computer before you know where you stand with your budget. Not very practical when you’re in the middle of IKEA and your significant other has a crush on a new sofa…

4. The method of the budget app

This method of budgeting software is the most advanced, but not necessarily the most complex.

Entrepreneurs have also realized that it’s not practical to navigate a spreadsheet from a smartphone. And that’s not to mention the notorious miscalculation that hurts when you see that at the end of the month you’re actually in the red zone… :

What the hell is this mess?! Why are we overdrawn on our e-banking? Argh darling, I did put a — instead of a + in this column of the spreadsheet… we’re going to have to eat rice next month…"

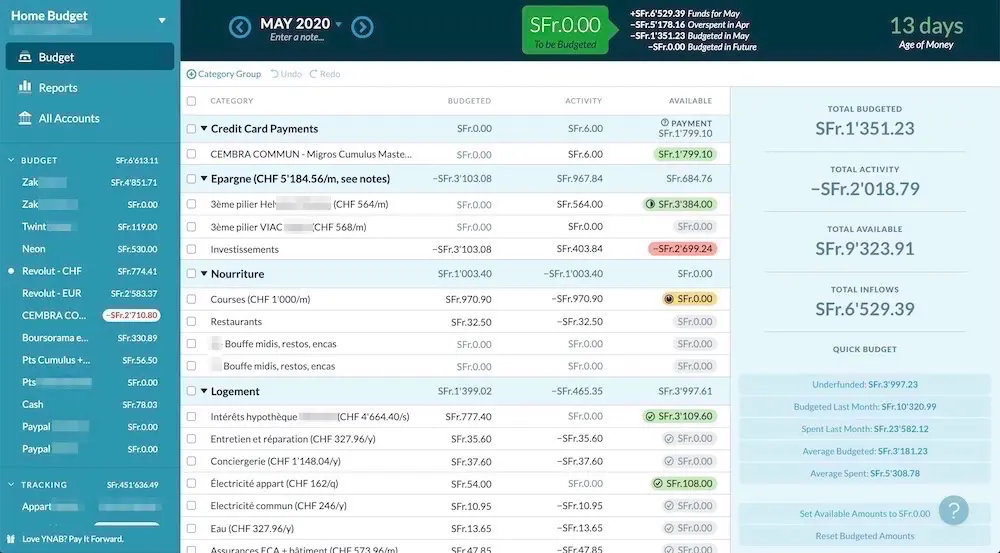

Since the advent of the internet and smartphones, we’ve seen a plethora of budget apps come up. Their big advantage is that they can be used and consulted from a computer as well as from a smartphone. All data is always up to date and synchronized. This also facilitates budgeting as a couple when everything is in common.

Some softwares even allow you to directly connect your bank accounts so you don’t have to enter your transactions manually (not often the case in Switzerland, but it’s coming!).. And if your bank doesn’t offer this, you can often use the alternative of downloading the data and importing them all at once.

On my side, I have been using and recommending the software YNAB since 2013 and I am not about to change it. It made me go from 50kCHF up to 450kCHF of net worth in less than 6 years. I appreciate it for its ease of use and especially because it allows me to have a global view in one place of all my accounts, mortgages, and other investments. And the little extra that changes everything, it has an accompanying methodology that has taken more than one out of debt, or out of the “paycheck to paycheck” lifestyle.

What’s more, YNAB offers a mobile app, an iPad app, and a web-accessible version. And all these versions are always in sync with each other. It’s great for budgeting as a couple.

If it’s this last budgeting software option that tempts you, I advise you to browse the Team MP forum where readers share their feedback (including free budget applications other than YNAB). Don’t hesitate to test several of them before choosing your final budget solution. Especially since these services, when you need to pay for them, often offer demo versions or free trial periods.

Summary

In order to help you choose the best way to create a budget for your own situation, I prepared you a table comparing the different types of budget:

| Budgeting method | Complexity | Time it takes ? | Global wealth overview | Budget history |

|---|---|---|---|---|

| 1. Self-taxation | Simple | 1h/month | ⛔ | ⛔ |

| 2. Cash envelopes system | Simple | 1h/month | ⛔ | ⛔ |

| 3. Spreadsheet budgeting | Complete | 1h/week | ✅ | ☑️ |

| 4. Budget app | Complete | 1h/week | ✅ | ✅ |

(☑️ It’s fastidious to create a system that saves each transaction via a spreadsheet budget)

There’s got to be a budgeting method that’s right for you. From the easy budget to the complete one, there is one for every type of person.

I’m personally in the last category of the geek who wants to have a complete view without any mistakes, hence my choice of YNAB.

But as I often say, the ultimate goal is to find the budgeting way that suits you and allows you to control your money. And the only valid way is:

- The one that works for you and your situation

- The one that makes you save the most

- And finally the one you manage to hold on to in the long run!

Exercise

I’m the kind of person who likes to put into practice what I read, rather than “only” getting inspired, without taking action.

So, I suggest the following exercise:

- Choose the type of budget that corresponds best to your situation

- Test it for 30 days (this is the average time for a habit to develop)

- Come back and post a comment below to tell us if you were able to stick to it, what worked well, and what didn’t work so well

It’s your turn!

P.S. #1: Don’t hesitate to tell me if there’s a big category of type of budget missing

P.S. #2: if you’re a budget pro and you have budgeting tips and tricks to share with someone new to the subject, feel free to do so via the comments below

P.S. #3: I’d like to take this opportunity to thank the three new patrons of the blog Jean-Claude, Dino, and Andrey. A big thank you for your support!

Net worth and savings rate update April 2020 CHF …

Estate tax treaty US-Switzerland the final answer...