Oh. My. God!!!

I don’t know where to start, it’s so heavy!

In a nutshell:

- That’s it, I got rid of the biggest legal scam in Swiss insurance: my mixed Swiss pillar 3a linked to a life insurance

- And at the same time, I cleared my second big mistake of young Mustachian in the making: my 10-year fixed rate mortgage (we still had 3 years to go normally)

Back to February 2022

I was rereading for the n-th time the e-mail from a reader who thanked me for my detailed analysis about whether he should stop the hemorrhaging of his mixed Swiss 3a pillar linked to a life insurance, or resign himself to keeping it because it was too late…

In his situation, the numbers were clear! It was still time to stop the financial hemorrhaging generated by the scam his supposedly empathetic insurer had made him sign a decade earlier.

Which he did by transferring his surrender value to VIAC in a Global 100 strategy. Well, before drinking the champagne, he had to dry his tears when he saw that he had financed about CHF 27'000 of bonus to his beloved insurer… risk premium my a**!

Anyway, I was happy for him.

But I was still stuck with that damn mixed 3a pillar that was pledged to my fixed-rate mortgage. And I still had to keep it until 2025…

Or how to lose tens of thousands of CHF in opportunity if I were at VIAC or finpension…

A burst of “There must be a way, this is not possible!!!"

Since I had a little time that day, I thought that there must be a legal way to terminate this 3a pillar…

So I went back to the master agreement for my mortgage, and all the pledging schedules.

Because in the end, it was the mortgage that was technically blocking me with the termination of my mixed 3a pillar.

Because if I only had this 3a pillar linked to a life insurance with no link to any mortgage, I could have cancelled it a long time ago!

While analyzing my contracts, I remembered that this damn insurance company had created a sub-entity to which it delegated all its mortgage contracts.

I even found the letter telling me how much better it would make my relationship with them thanks to dedicated AND ultra competent AND super mega nice people.

Since the master agreement for this sub-entity completely replaced the previous one (you know, from that “Switzerland” insurance), I went through every line.

Every word.

Every turn of phrase.

And then… surprise!

I didn’t believe it at first. I thought I was wrong.

I reread the 30 or so pages of the contract 3 times to make sure I hadn’t missed a line.

But no…

There was a contractual loophole!

As a reminder, at this time, we are in February 2022. This is important for the thread of the story, and for you to understand why it’s boiling in me so much, still as I write these lines.

The loophole

My master agreement literally stated:

Provisions for amortization of the mortgage are set out in a separate product agreement. During the fixed term of the rate, only the agreed amortization can be made.

Then, in the product agreement for the master agreement governing the mortgage, this is what was mentioned:

Indirect amortization related to the mortgage master agreement: CHF 6'768.00 per year

With this last sentence, I had my loophole!

I reread and reread the document, but there was no mention that the product used was to be my famous mixed 3a pillar linked to a life insurance from my dear “Switzerland” insurer!

No mention meaning legally that any Swiss 3a pillar could do the job!

The beginning of a 5 months long negotiation…

You can imagine how thrilled I was when I found this loophole in their contract.

I was full of hope. And fortunately when I think back, because I didn’t expect what would happen next…

In February, I sent an e-mail to my “Switzerland” insurance company to ask for the cancellation of my 3a pillar linked to a life insurance, and the replacement of my indirect amortization by a VIAC 3a pillar.

Initially I did not want to cancel my mortgage as well, because it suited me and the rate was OK.

Following my e-mail, my “advisor” explains to me that I cannot change my amortization method.

I reply that he is right, and that I want to keep my indirect amortization. But that I want to change the product, and that my contract allows me to do so.

The “advisor” calls me to tell me the same thing as by e-mail, and that it is not the policy of the “Switzerland” insurance. Which I object to… again.

He tells me that his director can call me back.

Let’s do it, because I have too much time to kill, as we all know…

The director calls me back the next afternoon.

He is now trying to understand my problem. As the management changes every 3-5 years in this kind of insurance, I explain to him that I was sold a mixed 3a pillar product whose predecessor had minimized or even omitted the disadvantages, and that their product was a legal scam.

And then, all of a sudden, a door opens:

Ah, but if it’s the type of 3a pillar that bothers you, we can discuss changing it for another normal 3rd pillar without life insurance, but it must be a product of our “Switzerland” insurance for your mortgage.

Uh, thanks, but no thanks!

But we’re making progress:

- Before this call: impossible to change anything.

- After this call: ah well yes, we can discuss…

We are already around March at this point…

At the end of the call, I insist to the director that I know I am within my legal rights and that I want to break my mixed 3a pillar.

And then we go into big, BIG joke mode!

The director explains to me that the “Switzerland” insurance company subcontracts its mortgages since a few years. And that I have to call one of their “Credit Officer “ because she will be able to tell me if it is OK for them to make an “exception”…

But an “exception” to what for f*** sake?!? It’s in your contract!!!

Anyway.

The one who shouldn’t have…

So I call the “Credit Officer” of the daughter company of “Switzerland” who manages their mortgages.

At first I meet a nice person.

I explain to her that I want to change my 3rd pillar while respecting my contract which says that I must indirectly amortize CHF 6'768 per year.

She seems OK with the idea. But she mentions that I will have to leave my current mixed 3a pillar surrender value as collateral.

We would also need a life insurance policy as collateral.

“No problem!”, I said to myself, thinking of VIAC Life.

Frankly, I’m not that picky if I can at least stop the bleeding of having to pay the bonuses of the “Switzerland” insurers via my 3rd pillar premiums.

I mention VIAC as a 3rd pillar, and still no contraindication on the phone.

However, things are starting to go wrong because she is trying to convince me to stay with my 3a pillar linked to a life insurance policy which is “still a good product, and that at worst I’ll keep it for another 3 years and then I can change. After all, 3 years is not a long time?”

Naaaaaaah, not at all, and neither the CHF 12'500 that I’m going to throw out the window. You’re right, I don’t know why I bother with such trivialities dear Credit Officer… Couldn’t you give me those CHF 12'500, just like that, between you and me?

Once the phone is off the hook, I send her an email summarizing my request, along with the VIAC Global 100 3rd Pillar data sheet.

And then, first LOL!

In fact, it is not possible.

No way to pledge a pillar 3a invested in securities, even if completed with a pure life risk insurance.

I was actually not surprised…

But I was pissed off that I lost over 1.5 months to get back to the same result.

After this first failure, I took a break for 2-3 days to let the anger go and stay focused on my only goal: GET OUT OF THIS SH**** MIXED PILLAR 3A no matter what!

72 hours later, I pick up my keyboard again (thanks to the blog for the prose writing training!), and re-explain in very legal terms that their answer is not legally valid under our contract.

And that I therefore reiterate my request to close my pillar 3a and replace it with another one as a pledge for my mortgage.

Of course, I get an auto-responder by e-mail telling me that the person in charge of my file is on vacation for… 15 days…

The April fool

Polite as I am, I wait patiently for two days after the return from vacation of Mrs. Credit Officer, to give her time to land.

Then I write her a short and very cordial email to know what is happening with my file.

I will wait another full week to finally get an answer.

And what an answer!

We cannot respond favorably to your request, and therefore, you will have to accept this biggest scam of history that is your pillar 3a linked to a life insurance.

Anyway.

Always remaining polite and irreproachable in my words, I answer this dear Credit Officer of “Switzerland” to tell me the point of our contract to which she refers to refuse my request.

We are now in mid-April.

I’m still waiting for two weeks without any answer… I try again.

And then I get a pamphlet summarizing the situation (in case I have amnesia) that mentions the contract that I have reread about ten times:

“Only the agreed amortization can be done… Sincerely. Thanks, bye, we won’t argue about it anymore.”

As I read this email, my brain thinks: “Oh boy, she doesn’t know who she’s messing with, this dear lady…”

So I’m getting into her contractual game.

I explain to her that I fully agree with her reading of the contract. And that as stipulated, the agreed amortization is: “Indirect amortization relating to the master agreement governing the mortgage: CHF 6'768 per year”. And that I therefore legally wish to change it.

I obviously wait 1.5 weeks more to get an answer. Answer that obviously does not come…

We are in the middle of May.

Tired, I ask to speak to someone higher up, or at least someone with the authority to decide on my case so that we can move forward because I’m really starting to boil — it’s been 3.5 months!

Unexpected answer in one day: the lady tells me that she takes calls during the week from this time to that time (implying that she can decide herself, and that she won’t pass me her boss).

I can’t tell you how motivated I was at that moment not to leave the call without an acceptable solution!

The point of no return

At that time, I had spoken with Ms. MP about writing to the management to explain to them how their business relationship handling was one of the worst I have experienced in my two decades of working life.

But hey, I’ll have better things to do once my pillar 3a is closed, I thought… like describing this whole crazy story to you so that you’ll have the strength to fight if you were in the same situation as me…

By the way, I thank you here dear reader for following me since the beginning. Because knowing that I could share everything with you on the blog once everything is finished, well, it gave me the necessary motivation boosts so that I wouldn’t give up along the way.

So I was saying.

It is mid-May.

I’m on my way to work, in my regional train with few people on board.

I feel as determined as ever, and ready to make a not-so-pleasant phone call, with the firm intention of not hanging up until I get my way.

And here, hold on tight because it is almost science fiction (in any case my letter to the management of the Lady in a few weeks will be very real!)

The Credit Officer lady, at the beginning however sympathetic, picks up.

Politely, I ask her if I am not disturbing her because I call early in the morning.

Ah, yes, Mr. MP, you are bothering me.

As a good Swiss, I apologize, and ask her when I can call her back.

And then………..

“Oh no, I mean, you are generally bothering me with all your emails for weeks. I have a lot of work and files to deal with, you know.”

This is what I look like at that moment:

I still manage to keep calm and focus on my goal.

I repeat my request, specifying that contractually, “Switzerland” is not in its right, and that I think that it is in both our interests to find an amicable solution to avoid the courts.

And then she starts to get on her high horse. That I’m bothering her on the phone, that the poor lady has about twenty (!) e-mails to deal with every day. That she has already answered my question and that no, it is not the policy of “Switzerland” to change the collateral pillars 3a, and that…

STOP!

You’ve gone too far, Marcelle!

You’ve just woken up the guy who’s not too friendly with insurance companies and bankers that was hiding inside me.

I cut her off.

My tone is suddenly much more authoritative and very angry.

I tell her that now she will listen to me. That this story has been going on for months, and that her company is not in its legal right. That I’ve already talked about it with a lawyer friend of mine, and that it’s going to be really bad if we don’t find a solution today.

And then, two things happen.

As if by magic, she will be able to speak with someone from the general management of “Suisse” (supposedly at least), to either propose that I close everything with them (pillar 3a AND my fixed-rate mortgage) with penalties of course, or change my pillar 3a.

The second option is unexpected, to say the least, in the way it is formulated…

Because it comes with threats:

I warn you, if you choose this option of only changing your pillar 3a, we will review your entire file, and I am not sure you want that.

Subtext: *“You could lose your mortgage with us."

It was at this point that the point of no return was reached.

Threats.

Here, yeah, we have indeed reached the summit…

Then, she summons me to think it over and to tell her again by e-mail what decision I take.

I hang up with a dry and firm tone: “Thank you, I understood the message, goodbye.”

My decision was now made: I wanted to get out of this business relationship at all costs.

But doubt suddenly invaded me.

What if she was right, and that “Switzerland” blacklisted me or whatever. And what if we don’t have a mortgage anymore from one day to the next?

I talk about it with Mrs. MP at night when I get home from work, and we agree that we need to make sure that the situation doesn’t turn against us.

By chance, I have an acquaintance who works in a bank (but he is nice, him, yes, this exists ^^).

I tell him the situation and ask him if we could be homeless without a mortgage?

He says no, because if I can only break my mortgage with penalties, so would the “Switzerland” insurance company, which would have to pay me a lot to suddenly stop my mortgage.

Here I am reassured, and reboosted to the max!!!

You only get what you fight for (and no one will do it for you)

We are already around the end of May at this time.

So I send an e-mail to Mrs. “Credit Officer” explaining that yes, we want to go ahead and change our pillar 3a, and that we gladly accept that our file be revised at the same time.

All of a sudden things start to move faster.

After 3 days, I receive an e-mail from her.

She supposedly presented my file to her management, and these are the options available to me:

- Full repayment of the mortgage with CHF 28'000 in penalties, and CHF 250 in closing costs

- Release from the payment of the premiums of my pillar 3a mixed policy, but which will have to remain pledged until the end of the fixed mortgage (i.e. my money will not be able to go to VIAC). And I would have to make an extraordinary amortization of CHF 6'768. Without forgetting to provide my last tax declaration, extract from the debt collection register, and extract from the land register

I immediately forward this mail to Mrs MP with this message: “We’ve won!!!!!!!”

I reply to the lady that I would like to make sure of a few details:

- That all amounts include VAT

- That option 1 includes the fact that I am released from the payment of the premiums of my mixed pillar 3a, that I can CLOSE IT AD VITAM AETERNAM, and that I can transfer the cash value to VIAC

10 days pass… no feedback.

I ping her back…

The next day (around June 10), I get pushed back into my seat again: “We answer our customers in order of arrival!”

And underneath, I have the confirmation that everything is VAT included, and that once the mortgage is transferred to my new financial institution, my pillar 3a linked to a life insurance will be free of premiums, and that I could close it!

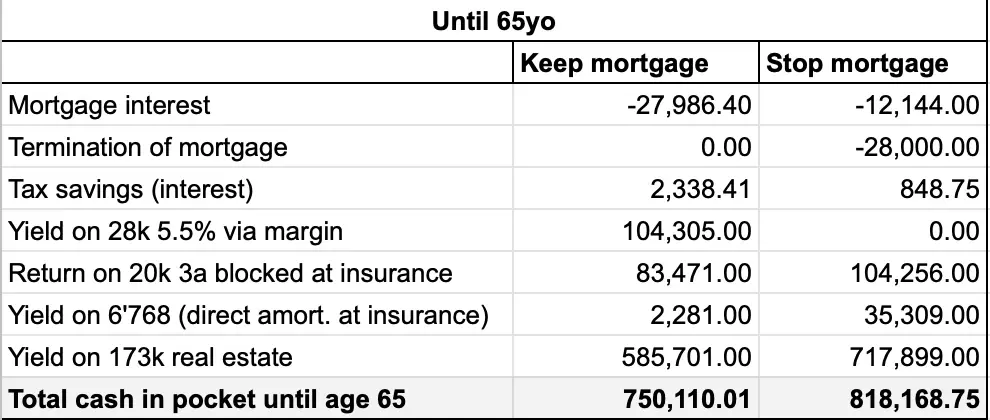

Mustachians calculations: closing pillar 3a only OR terminating Swiss pillar 3a AND fixed rate mortgage

For the next two weeks, I spent many evenings playing with Excel files to make sure I chose the right option rationally.

I didn’t want to let my emotions get the better of me: I wanted to show her a certain finger virtually by closing all my contracts with this “Switzerland” insurance!

Most importantly, I also used these two weeks to make sure I could get a VIAC mortgage.

Basically, I laid the following two scenarios side by side:

Scenario 1 — Closing my pillar 3a only:

- I terminate my mixed pillar 3a with “Switzerland”

- I leave my surrender value (about 20k CHF) as collateral for my current mortgage

- I make an exceptional direct amortization of CHF 6'768

- From 2023 I will fill up my new pillar 3a at VIAC or finpension with a 100% equity strategy!

Scénario 2 — Closing my Swiss pillar 3a AND my fixed-rate mortgage:

- I cancel my mortgage (gaining 3 years of fixed rate at 1.70% for SARON around 0.85%)

- I pay CHF 28'500 in early exit penalties

- I switch my mortgage to SARON at VIAC

- I am taking advantage of this to have my main residence re-evaluated, in order to get out some cash that I will reinvest in a rental property in Switzerland (in theory I could also have done this with my “Switzerland” insurer. But under what conditions? No thanks, I didn’t want to get involved again with these scammers!)

- I also cancel my pillar 3a life insurance with my “Switzerland” insurer

- I can transfer the entire surrender value of my Pillar 3a to VIAC or finpension in a new 3rd pillar invested 100% in shares which will no longer suffer the haemorrhage due to bonuses from swindling insurers!

And here are the results of the two calculations (tell me if you see an error or a missing variable — I hope not… ^^).

I expected this result, which confirms the magical power of compound interest.

The remaining 3 years of my fixed rate locked mortgage was enough to make all the difference in the long run.

And that, because I can reinvest the newly generated cash from the revaluation of our primary residence.

Decision taken

So at the end of June, I announced my final decision to the worst sales employee I had ever seen at an insurance company.

I was going to cancel my pillar 3a mixed life insurance (VICTORY!!!), and ALSO cancel my fixed rate mortgage :D

Since 31.08.2022 (due to the denunciation deadline of 1 month), I am FINALLY with VIAC for my pillar 3a, and I FINALLY have a mortgage entirely in SARON which is historically the most economical choice!

Champagne!!!

Notes on the VIAC mortgage (and the Bank WIR mortgage) + SPOILER ALERT

By the way, this VIAC mortgage via the Bank WIR is really great.

I completed the application in less than 30 minutes.

I sent it by e-mail.

And in the same week, I had an answer and an agreement in principle!!

But since I wanted to have 100% financing (by pledging our 2nd and 3rd pillars) and not 80% as was the case with my “Switzerland” insurance, and to be able to use my newly generated cash after the revaluation of the value of our main residence, this did not fit in the standardized VIAC mortgage model.

Fortunately, the two Bank WIR advisors I’ve had are really competent, and understand the true meaning of the banker’s job (i.e. providing a service rather than trying to rip you off as much as possible!)

Here are the new conditions proposed by the Bank WIR for my new mortgage of our main residence in Switzerland:

1. Re-evaluation of property value

When you renew your mortgage in Switzerland, any bank will perform a revaluation of your property.

Good surprise in our case: our initial purchase price was below CHF 700'000 in 2016, and the Bank WIR has valued the property at CHF 783'000 to date!

This gives us a growth of 12.5% in 6 years :)

However, it remains virtual because finally, as long as we did not sell our apartment, we do not see the color of this cash…

Unless… wait, we talk about it in a point below ;)

2. Bank WIR mortgage

The Bank WIR offered me a SARON type mortgage with a 3 year contractual commitment to obtain the interest rate of 1.07%.

That’s more than VIAC’s 0.68%, but I’m fine with that given the last item on this list :D

3. Pledges

The Bank WIR asked us for the following pledges (i.e. if we can’t pay our interest or amortization anymore, they will tap into these cash reserves):

- CHF 22'300 2nd pillar Mr MP

- CHF 26'000 2nd pillar Mrs MP

- CHF 54'094 pillar 3a VIAC Global 100 Mrs MP (they have taken the value at a moment T, and it doesn’t matter if stock market fluctuations come afterwards!!!)

- CHF 24'300 new pillar 3a VIAC Global 100 Mr MP (while waiting for the transfer “old pillar 3a => new pillar 3a VIAC” to be done, we agreed that I would block this money on a WIR account — I used my IBKR margin account for this :))

4. Amortization

The best thing about the Bank WIR is that they didn’t try to sell me a life insurance, or even worse, a pillar 3a linked to a rotten mixed life insurance!

And above all, the great thing is that I can indirectly amortize my WIR mortgage via my pillar 3a VIAC invested 100% in shares!

No other Swiss bank or Swiss insurance company has ever agreed to this.

We agreed on an indirect amortization amount of CHF 7'400 per year, divided into two payments of CHF 3'700 on our respective pillar 3a VIAC.

This will allow us to have amortized the 2nd tranche of our mortgage (value of CHF 111'000) within 15 years, as required by the legal framework in Switzerland.

5. THE news: increase of our mortgage!!!

You, the former reader of the blog, remember that our initial mortgage was about CHF 550'000 for a property worth less than CHF 700'000.

That is 80% maximum of our apartment financed by a mortgage as the law requires.

Thanks to the revaluation of our main residence to CHF 783'000 by the Bank WIR, and the fact that they take as collateral our 3rd pillars VIAC and our 2nd pillars, this is what happens:

Mortgage at 100% possible!!! 🎉🍾

This gives us in detail:

- Bank WIR mortgage of CHF 753'000

- Repayment of our current mortgage of CHF 552'000 to our dishonest “Switzerland” insurance

- Payment of the CHF 28'000 early exit penalty on our current mortgage

- Release of CHF 173'000 in cash to be used for a new real estate investment in Switzerland (SPOILER ALERT: we are going to buy a rental property in Switzerland!!)

- Total: 552 + 28 + 173 = 753k CHF

Conclusion and epilogue

You can’t imagine how happy I am to publish this blogpost!

I FINALLY got rid of the worst legal financial product in Switzerland that was this mixed pillar 3a linked to a life insurance 🍾🍾🍾

Then, and this was not scheduled in the program, I release almost 175kCHF from the stone that will allow me to invest in a rental property in Switzerland :)

And finally: I will be able to write a factual, but very very salty letter to the general management of my former “Switzerland” insurance.

And for you who just stumbled upon this blog, the MOST IMPORTANT information to remember:

NEVER, NEVER, NEVER take out a pillar 3a with an insurer. NEVER!!!

The corollary of this is also to NEVER — as in: NEVER EVER — take a mortgage with an insurance company, because the latter offer attractive lower rates thanks to their products that they impose on you (such as my mixed pillar 3a linked to a life insurance), and that costs you in the end a lot more than if you had gone with a bank and a rate a little higher.

Another important point to verify when you take out a mortgage with any institution is to always have a fixed rate mortgage contract exit clause even if it implies penalties. In my case, I didn’t have it, so it was up to the insurer to let me out. The only extraordinary cancellation possible was if I sold my main residence. But there, in the end, they made a “commercial gesture” I guess to let go a disgruntled customer who was generating too much work by asking all his questions ;)

And finally, if you see yourself as a Mustachian in the making, never take out a long-term fixed-rate mortgage, but always take out a SARON mortgage, which has proven to be the most economical solution in Switzerland over the past decades!

UPDATE 28.11.2024: I’ve written a comprehensive article to help you find the best mortgage in Switzerland.

On those good words, I will start my salty (and constructive!) letter to the director of the “Switzerland” insurance. Then I’ll move on to the much more interesting part, which is the search for our first rental investment in Switzerland :D

Header photo credit: Oleksandr Pidvalnyi (via Pexels)