I regularly receive emails from readers who are still hesitating to switch their pillar 3a, for fear of not doing it properly.

Here is a recent example, with Tania’s email:

Hi Marc,

Thanks again for your article on the best 3rd pillar. For my part, I haven’t taken the plunge yet, because it would cost me CHF 300 to close my current 3a, so I don’t really know if it’s worth it…

And also, I’m wondering when is the best time to switch? Because right now, it’s May, and I’ve already paid in almost the maximum pillar 3a amount for the current year (around CHF 6,000)… or if I just change my strategy with my current 3a provider, might that be enough?

Anyway, lots of questions, and a bit of choice paralysis and, well… I still haven’t done anything. Also, I’ve got about CHF 50,000 on my 3a at the moment. And I’m 36.

What would you do in my place?

Thanks in advance if you have time to reply to my email, I know you get a lot.

Tania

Let’s take each of Tania’s questions, one by one, and answer them in detail.

I’m going to deliberately use numerical examples based on realistic but simplified assumptions, with a long-term horizon typical of pillar 3a (several decades), and annualized returns net of fees (not guaranteed, as usual).

How much does it cost to switch pillar 3a?

Switching pillar 3a comes with different fees depending on the provider. There is no single statutory fee. The choice is up to the provider.

In general, these fees for switching pillar 3a provider range from CHF 0 to CHF 500 from everything I’ve seen.

Tania told me that BCV (her third pillar provider) would charge her a termination fee of CHF 300.

So I asked her how much her 3rd pillar was yielding, and then made the following calculation:

- Pillar 3a capital: CHF 50,000

- BCV annual fee: 2.63%

- finpension annual fee: 0.39%

- Difference in fees: 2.24% per year, or CHF 1,120/year.

In other words, her CHF 300 exit fee would be amortized in just 3 months.

Suffice to say, she didn’t think much further ahead.

It’s a recurring principle in investing: fees can (very!) quickly eat away at your returns.

When is the best time to switch your pillar 3a?

The best time to switch to a better 3rd pillar is yesterday. It’s not technically possible, so the second best time is today.

From a tax point of view, it makes no difference whether you’ve already paid all or part of the maximum 3rd pillar amount into one institution, and are transferring your entire 3a to another. What counts is the amount of your pillar 3a payments over the whole year.

In Tania’s case, if she has paid in CHF 6,000, and moves to VIAC or finpension, then pays in the remainder of the maximum pillar 3a amount (CHF 7'258 in 2026), she will be able to deduct both these amounts from her taxes as she remains within the legal limit.

In her question, there’s also a hint about returns and fees. Knowing that her third pillar is not the best third pillar in Switzerland (according to my 2026 comparison), every day that goes by, she forgoes part of her potential return net of fees. It’s as simple as that.

So the best time to transfer her pillar 3a is now.

Switch 3rd pillar provider, or just change your investment strategy?

This is indeed a legitimate option: why bother creating a new 3a account, transferring your old 3a, then closing it. All this, when maybe you can “just” change your investment strategy.

Here again, there are a number of pitfalls in the path of someone taking their financial future into their own hands:

- Management fees generally don’t change if you change your strategy. So even if your new investment strategy is closer to the best 3a pillars such as finpension and VIAC, fees will continue to eat away at your returns over the long term (several decades).

- TER and retrocession fees (when applied) also quickly add up, especially when it comes to in-house funds, compared to ultra-optimized index funds where you don’t have to pay TER, and even less retrocession fees (= commissions paid by the funds to the bank that distributes them), inherited from old banking distribution models from the last century.

- Overall performance, which includes all these fees, is generally under-optimized in these other funds. And that’s why Tania’s third pillar is not in my top 3 of the best 3a pillars.

Although changing your 3rd pillar investment strategy (rather than changing your 3rd pillar) is a good idea, it’s actually a false one, as you’ll remain sub-optimal in terms of final performance.

An example is worth a thousand words. Please note that the returns below are average annualized returns, fees included, representative of what we observe over the long term with typical equity allocations for a pillar 3a (and not promises of future performance).

Tania assumptions:

- Initial capital: CHF 50,000

- No additional payments

- Annualized returns, fees included:

- Current 3rd pillar (95% equities): 3.6% p.a.

- Best 3rd pillar (99% equities): 6.9% p.a.

This example is deliberately simplified, with no additional payments, to isolate only the impact of fees and investment strategy on existing capital.

| Horizon | Current 3rd pillar (3.6%) | Best 3rd pillar (6.9%) | Difference |

|---|---|---|---|

| After 1 year | CHF 51,800 | CHF 53,450 | +CHF 1,650 |

| After 5 years | CHF 59,672 | CHF 69,801 | +CHF 10,129 |

| After 10 years | CHF 71,214 | CHF 97,442 | +CHF 26,228 |

With exactly the same starting capital today, the difference in yield alone is enough to create a difference of over CHF 26,000 after 10 years. With a pillar 3a, fees and strategy count for much more than you might think.

Why we do nothing, even when we know what to do

I don’t blame Tania for being stuck in inaction.

It’s called choice paralysis. Too many open questions, too many possible options. The fear of taking an “irreversible” action. And all this in the midst of an already busy life with her job, her family, her activities…

That’s also one of the reasons why I started this blog: to document my journey in the hope that it might give my readers enough information to take action on each subject I tackle.

In reality, doing nothing can also be explained by the fact that it's much more fun to go hiking at Seerenbach Falls towards Lago Mio than to compare 3a pillars ;) (photo credit: Melanie Obergfell)

FAQ switching pillar 3a

What is the maximum 3a amount for 2026?

The maximum amount that can be paid into pillar 3a in 2026 is CHF 7'258 for salaried employees, and CHF 36'288 for self-employed workers.

How many 3a accounts do you recommend I open?

I recommend that you open five pillar 3a accounts so that you can reduce your tax bill as much as possible when you withdraw from these accounts, especially if you are highly taxed and still several years away from the time of withdrawal. I recommend that you read my article on this subject: Tax savings in Switzerland thanks to staggered withdrawals from pillar 3a.

Are there any restrictions on transferring my 3a?

No, there are no legal restrictions preventing you from transferring your pillar 3a from one pension fund to another.

The only thing you may have is a contract clause indicating a penalty (the so-called exit fee) to be paid if you break your contract before a certain deadline (6 months at some cantonal banks, as far as I know).

Is your recommendation also valid if I have a mixed 3rd pillar linked to a life insurance policy?

Ahhhh, poor you… you got fooled too… YES, my article is even more valid if you’ve been scammed by the mixed 3rd pillar. I advise you to act even faster to limit your losses.

And in the specific case of pillar 3a life insurance, I recommend you read this blog article: Close your pillar 3a life insurance without further delay!

Conclusion: what I would do if I were Tania

Here’s what I would do if I were in Tania’s situation, and therefore not with one of the two best 3rd pillars in Switzerland (see my 2026 comparison):

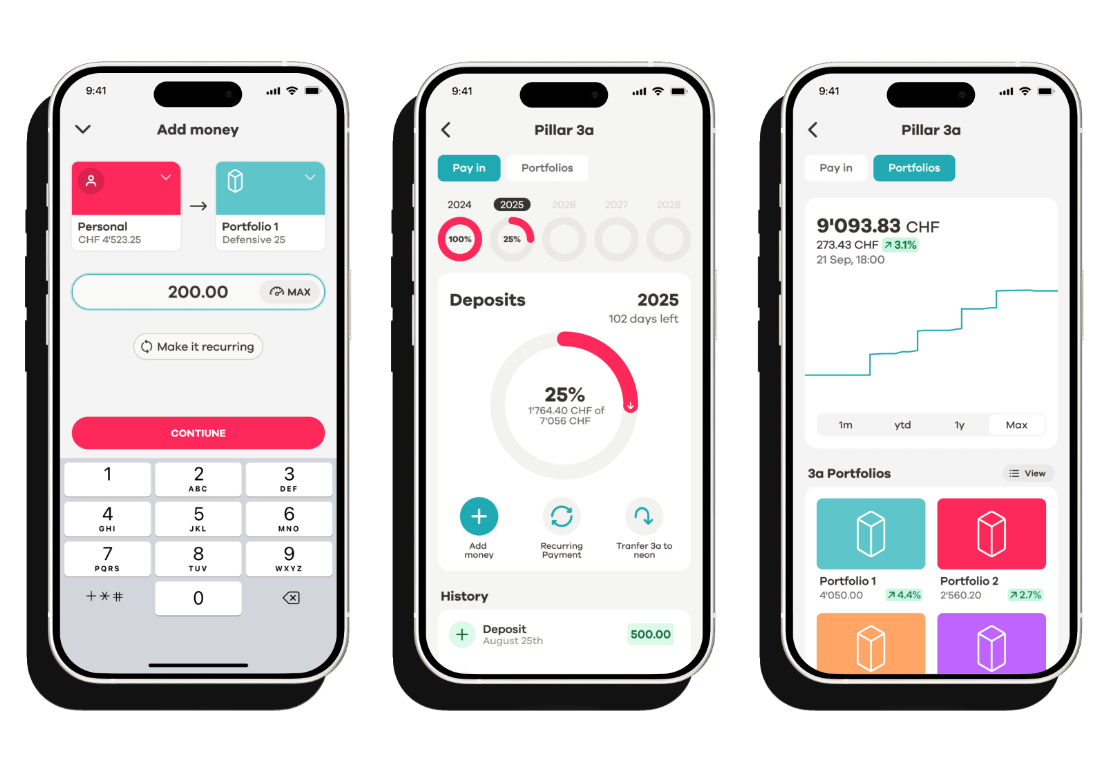

- I would create an account with one of these two best 3a pillars

- I would download the transfer form from their website

- I would send this signed form to my current 3rd pillar

- The transfer would then take place automatically

- If not automatic, I’d also ask for my old 3rd pillar to be closed, so that my financial life would be in order (if this is not done automatically after the transfer)

And all this, even if I had to pay several hundred Swiss francs in exit fees to my current 3rd pillar pension fund.

After that, I’d feel relieved of a mental burden for the next 20 years (all this reminds me of my early days!) And above all, I’ll be thanking myself for having made this choice several decades from now (I can confirm that’s what I’m already experiencing right now).

Last updated: February 19, 2026