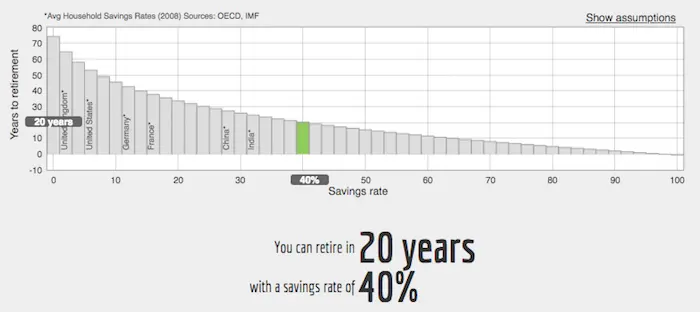

During the last two years, our (financial) life was on auto-pilot. All money optimizations to reach FIRE (Financial Independence, Retire Early) were done, and we could cruise to FI peacefully, stashing around 40% of our household income each month.

But, as the human being that I am, I felt into the “want more” trap once again.

I just ended up on the famous early retirement calculator that I like to play with from time to time. This was last November.

And it started all over again.

“The path looks so long, there must be something I can still optimized. I need to rethink my alternative paths. Let’s think outside of the box.”

These were the sentences that I was ruminating while staring at my actual numbers.

Make more money, no matter what it takes

Usually, I’d work on expenses optimization. But this time, I was in a “Think Big” mindset about income alternatives.

Coincidentally, I did chat with my friend Mr. RIP 1 during the same period. We talked about my current opportunities, and more specifically about one that would change my path to Financial Independence. One that’d dramatically increase chances to reach FIRE by 40. But one that’d also dramatically impact my happiness in life.

Filled with wishful thinking, I embarked onto the “dream stage” where I visualized myself a decade from now, financially free.

I decided to give it a shot.

During the next days, I crafted the perfect plan to make this hard-to-catch opportunity a reality. I even took a break from the blog to focus solely on this objective — this gives you sense of how I was committed to it.

At the start of the journey towards this new goal, I envisioned only the best-case scenarios regarding what I was about to trade in exchange of (a lot) more money: less freedom, less happiness (due to less time with family), and less meaning. I was convinced that I could live with a bit less of each, in exchange of a FIRE-shortcut-plan.

As I approached the finish line, I questioned more and more the new life direction I was about to take.

Was I really ready to make these trade-offs for almost a decade? I mean, we were talking in years, not just a few weeks or months!

When the project was close to completeness, I had to make a choice. Numbers were crystal clear, but reality was blurred.

The “Happy” Documentary

I spent evenings thinking about this happiness thingy. What it meant for me. At what level it would be if I made this life-change.

Thankfully, I ended up on this “Happy” documentary website.

It helped me to revisit answers I already read on blogs, and also to discover new paradigms that clarified my blurred reality.

The main concept laid out all along the movie is that genuine happiness happens when you focus on things that are bigger than yourself. Things like gratitude, compassion, caring, and love.

Happiness is a skill that can be learnt the same way you learn violin or golf. — The Happy Movie

Moreover, they explain that the formula for happiness isn’t the same for everyone. Nevertheless, most of the things anyone loves to do are the building blocks of a happy life:

- Play

- Having new experiences

- Spending time with friends and family

- Doing stuff that is meaningful

- Appreciating what we have

These things make us happy, and they are free. And the cool thing with happiness is that the more you have, the more everyone has. A perfect virtuous cycle.

This documentary helped me to step back from my FIRE-shortcut race for a moment, and to decide with more clarity what life option to follow.

After weeks of discussions with Mrs. MP and lengthy WhatsApp chats with Mr. RIP (who happens to also be in a questionning phase as you can read in his latest blogposts), I came to a final decision.

I chose to stop this opportunity before I crossed the finish line.

The shortcut-path would have taken me away too far from family and friends (i.e. less time with them), from doing things that are meaningful (something I luckily have in my current life setup), and from helping others (via this blog notably, as I’d have been more tired and stressed, hence lower writing frequency).

So now what? Back to the old slower-race?

This big opportunity (and challenge) ended up unexpectedly. But the learnings have been tremendous as it clarified a lot of things about my life. It allowed me to ask myself some serious question on my path to FIRE, and about how I want it to happen.

Here is how I’d summarize my new guiding principle: “My shortest path to FIRE is the one that brings the most money in, and ensures the same level (or more) of freedom, meaning, and time with family as I have nowadays in 2018.”

You may think something along the lines: “Tsss dear MP, you just refuse to admit that you like your comfort zone. That’s not really Mustachian. You accustomed us to a more challenging life.”

To which I reply: “Don’t get me wrong, I’m not refusing some money that easily, and I keep fighting as hell to find other revenue sources to shorten our path to FIRE. It’s just that now, I’m way more selective as I assess any such opportunity against my new guiding principle outlined above. For instance, if the new option isn’t meaningful, hence doesn’t bring more happiness, then I discard it as I don’t wanna trade meaningfulness against money.”

This thinking process reminded me the vision I did setup for this blog back in the days: “Build wealth while enjoying your life”. I only have one life, and I want mine to be happy. From now on.

Coasting to FI in a Tesla, with stops in nice coves

Before this sizable project, I had the feeling that I switched from the rat race to the FI race. Both being races during which I forgot to enjoy life, as well as to consider them just as a milestone vs. an end in itself.

I now switched my mindset to something like the “Coasting to FI” concept, but that I amended it with “in a Tesla, with stops in nice coves”.

Which means that I get to do a job that I love (i.e. Coasting to FI, also known as BaristaFI), and that is quite well paid (the “in a Tesla” part, with its regenerative braking that brings more cash in) vs. a fun-but-low-paying job in the initial model!

I also think to compensate more regularly my overtime (the “with stops in nice coves” part) to enjoy it like mini-retirements (temporary reduced working percentage or full weeks off), instead of getting it paid at the end of the year.

That’s the theory I aim to live up to. For this, I’ll have to work consciously on my high achiever mindset 2 in order to enjoy this luxury situation more, on a daily basis.

As Mr. RIP told me at some point during our evening conversations: “You seem to already have a post-FI job bro!”

He was right, and I’m all in to seize this rare opportunity.

What about you? Did you already favor more money for less happiness — by trading meaning or time with loved ones? How did it end?

Side note for the INTJ readers like me: find the right person(s) who can be a good confidant, and then force yourself to open up and share your struggles and ideas, because that’s one of the most powerful thing to make you go forward in life (included on FIRE topics). ↩︎

I need to remove (or at least diminish) the pressure I impose to myself on any project I get to work on (at the job or at home) ↩︎