A reader wrote to me last week:

Hi MP,

I am writing to thank you for all your articles and your book which I loved! I have started to put many of the tips into practice and the CHF are starting to add up :)

Also, I had a question: my boyfriend tells me that global ETFs are cool for us, Swiss “retail” investors, but he tells me that fintech is getting bigger and bigger these last years, and that it would be worth investing in a fintech specialized ETF. What do you think? (he also told me about cannabis ETFs but I think it’s too weird… :D)

Thanks in advance for your feedback!

Apart from re-explaining to her the principle of diversification and the lowest possible fees, and that no one can predict how this or that specific market will evolve, I had no other concrete and recent data on the subject.

Except that in the meantime, I came across the economic paper “Competition for attention in the ETF space” (whose one of the authors, Francesco Franzoni, is from Lugano — hello to you if you happen to be passing by, and thank you!) from earlier this year.

The title is not very revealing, but the content is very interesting. The researchers wanted to analyze the competition for investors’ attention in the ETF field.

They write:

“Since most ETFs are transparent investment vehicles that passively replicate indexes, ETF suppliers cannot tout portfolio managers’ past performance and skill (as in mutual funds) or rely on product opaqueness to promise high yields and shroud risk (as in structured products).”

The advent of ETFs

ETFs were born in 1993.

Their objective was simple: maximum diversification by replicating global indices at low cost to the investor.

Then, the world of ETFs became industrialized with the magnitude that retail investors gave it by rushing to buy them.

Logically, all the financial players wanted their share of the cake. But in a very competitive field with little margin, you have to be creative to sell.

We have thus witnessed a transformation of the simple and Mustachian world of ETFs into a jungle of new specialized products with high fees to allow the financial players to continue to make profits. All this sprinkled with marketing as we like it…

Diversified or specialized ETF for a Mustachian investor?

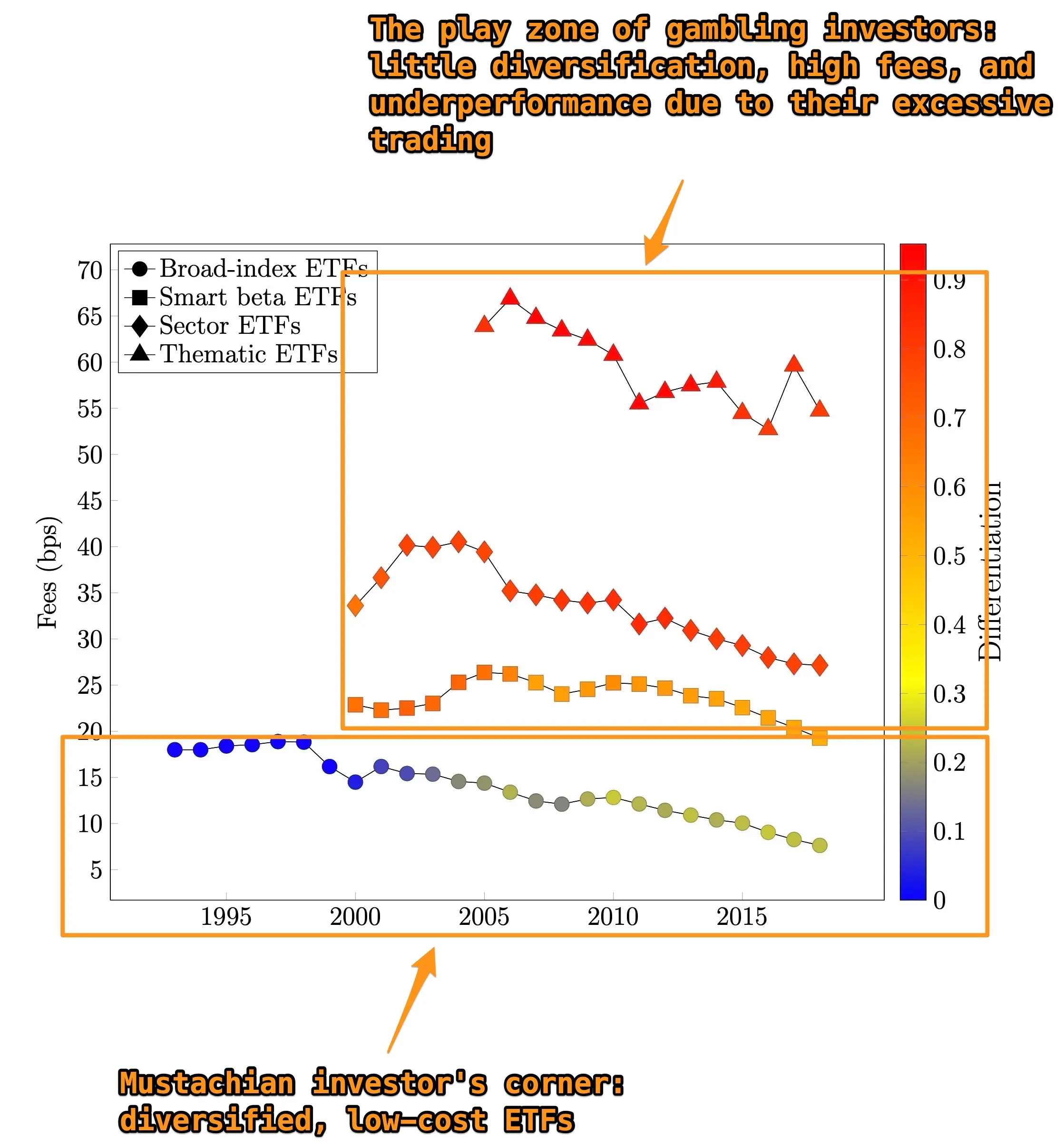

Analyzing data from US ETFs between 1993 and 2019, the team behind this economic paper indicates:

- Mustachian investors like you and me are primarily looking for maximum diversification with the lowest possible fees — because you and I know that minimal fees on paper add up to tens of thousands of CHF over several decades, and that under-diversification involves too much risk

- Investors in specialized ETFs — and therefore much less diversified by nature — are more sensitive to positive past performance. This sensitivity is increased by their high exposure to the media (24/7 news sites and other TV channels talking about the stock market), as detailed in the article. We could call this type of investor “gamblers”

Both types of investments are valid. If I pay less in fees but have less performance, and the gamblers pay more in fees but have more winnings, it’s the same.

The rest of the paper explains that this is not the reality. In fact, specialized ETFs perform worse than highly diversified ETFs after their launch. This is easily explained: specialized ETFs are under the spotlight at launch for their hype. This implies that they are overvalued because all the investors are betting on them. Then, the performance is not there, and the bettors sell to buy something else, which makes them lose money because of their excessive trading compared to Mustachian investors who keep their diversified ETFs over time.

The conclusion of the article is clear:

“The original ETFs, which are broad-based products, are beneficial investment platforms, as they reduce transaction costs and provide diversification. Specialized ETFs ride the same wave of financial innovation. However, these products compete for the attention of unsophisticated investors who chase past performance and neglect the risks arising from the underdiversified portfolios. Specialized ETFs, on average, have generated disappointing performance for their investors.”

Source at the origin of this article: Competition for attention in the ETF space (PDF), by Itzhak Ben-David, Francesco Franzoni, Byungwook Kim, and Rabih Moussawi

How to save money every month (no matter what!)

Ask the readers: what ETFs' database are you using...