Oh, it feels nice to get back to talking about frugality on this blog!

As the summer vacation will soon be here, I thought it would be great to help you save a few tens or even hundreds of Swiss francs!

And I’ve nominated…

Card fees abroad!

Whether you’re planning to go to the Amalfi Coast in Italy, the Atlantic coast in France, or even the cooler climes of Germany’s Black Forest this summer, you’ll have to pay for things in euros…

Likewise, if you’ve gone off to spend a three-month sabbatical cycling to Scandinavia or China (and yes, we Mustachians have rock-solid calves!), you’ll have to pay in a currency other than your usual CHF.

And if there’s one thing that traditional Swiss banks dream of doing, it’s emptying your wallet with card fees abroad!

What card fees are there when paying in a foreign currency?

You’ll find there are various bank fees when you pay for something in a different currency to Swiss francs.

1. The exchange rate

First, there’s the interbank exchange rate (also called “mid-market rate”). This is not in itself a fee, as this rate corresponds to the average “gross” rate at which banks exchange currencies between themselves, often for very large amounts. This rate does not have any margin or commission added. It’s the real exchange rate that you’ll find on websites such as Google or xe.com.

The bad news for us: banks rarely use this exchange rate, and instead use other rates.

VISA and Mastercard rates

In general, banks use the Mastercard exchange rate (Mastercard calculator here) or Visa exchange rate, depending on your card issuer. Even though this exchange rate is close to the interbank rate, it already includes a small markup of around 0.5% maximum.

Exchange rate margin

But on top of this Mastercard or Visa rate, Swiss banks generally apply what is called an exchange rate margin, also known as exchange rate markup.

On your bank statement, if this information is transparent, you’ll sometimes also see mentioned “currency processing fees” or “exchange commission”.

This conversion markup added by banks to the interbank rate usually varies between 1.5% and 2.5%!

2. Fixed fees on transactions in foreign currencies

In addition to this exchange rate margin, some Swiss credit card issuers and banks then add fixed fees of around CHF 1.5 or CHF 2.5 per foreign currency transaction.

These fees are certainly applied to ATM withdrawals abroad, but it’s become less common for banks to apply them to transactions in a foreign currency.

3. Payments in CHF abroad (DCC)

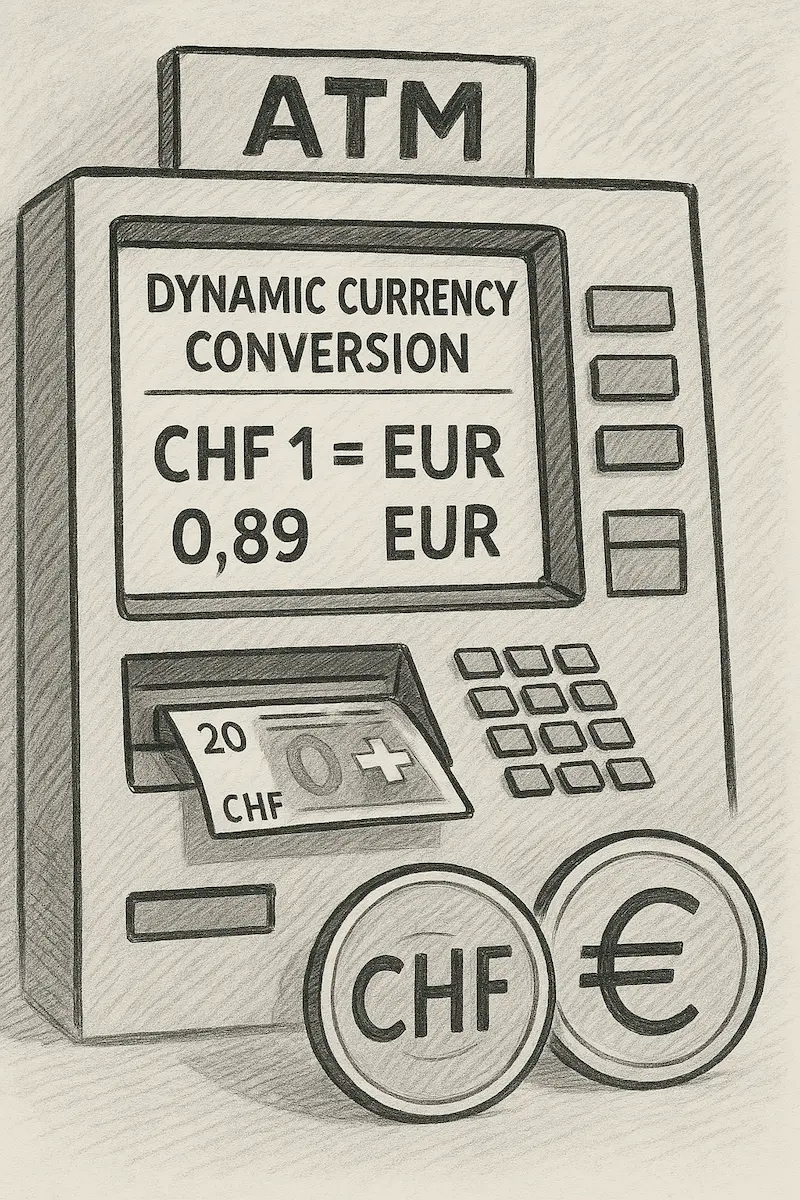

And lastly, there’s our friend “DCC”, “Dynamic Currency Conversion”.

This is the trick that our bankers have found in order to “reassure” you into paying in your preferred currency (the Swiss franc), and ripping you off with new fees in the process…

You remember the last time that the Argentinian or Quebecois or German waiter handed you the terminal to pay, and you had the choice of paying in EUR or CHF (or any other currency combo)? Well, that’s the DCC model in action.

In practical terms, if you choose to pay in CHF (instead of the local currency), this is what happens:

- The local payment terminal provider doesn’t use the Mastercard/Visa conversion, but applies their own not very favorable exchange rate along with potential fees (with a markup that can be from 4% to 8% on top!)

- And there’s a risk that your bank nevertheless considers this transaction to be “foreign”, and applies its usual fees!

- So it’s doubly to your disadvantage

The general rule to follow is therefore ALWAYS pay in the country’s local currency to avoid hidden fees, and benefit from the Visa/Mastercard or other rate which is more advantageous.

Practical examples with payments in a foreign currency

Let’s imagine that we’ve got an exchange rate where 1€ gets you CHF 1.20, here’s what it would cost you for payments of 1'000€, 5'000€, and 10'000€ respectively:

Comparison of conversion rates for 1'000€, compared to the interbank rate:

| Conversion method | Exchange rate used | Amount of CHF charged | Difference in CHF |

|---|---|---|---|

| Interbank rate | 1.20 | 1'200.00 | 0.00 |

| Visa/Mastercard rate | 1.205 | 1'205.00 | 5.00 |

| Visa/Mastercard rate with 1.5% markup | 1.2231 | 1'223.10 | 23.10 |

| Visa/Mastercard rate with 2.0% markup | 1.2291 | 1'229.10 | 29.10 |

| Visa/Mastercard rate with 2.5% markup | 1.2351 | 1'235.10 | 35.10 |

| Visa/Mastercard rate with 2.5% markup + CHF 2.5 of fees | 1.2351 | 1'237.60 | 37.60 |

Comparison of conversion rates for 5'000€, compared to the interbank rate:

| Conversion method | Exchange rate used | Amount of CHF charged | Difference in CHF |

|---|---|---|---|

| Interbank rate | 1.20 | 6'000.00 | 0.00 |

| Visa/Mastercard rate | 1.205 | 6'025.00 | 25.00 |

| Visa/Mastercard rate with 1.5% markup | 1.2231 | 6'115.50 | 115.50 |

| Visa/Mastercard rate with 2.0% markup | 1.2291 | 6'145.50 | 145.50 |

| Visa/Mastercard rate with 2.5% markup | 1.2351 | 6'175.50 | 175.50 |

| Visa/Mastercard rate with 2.5% markup + CHF 2.5 of fees | 1.2351 | 6'178.00 | 178.00 |

Comparison of conversion rates for 10'000€, compared to the interbank rate:

| Conversion method | Exchange rate used | Amount of CHF charged | Difference in CHF |

|---|---|---|---|

| Interbank rate | 1.20 | 12'000.00 | 0.00 |

| Visa/Mastercard rate | 1.205 | 12'050.00 | 50.00 |

| Visa/Mastercard rate with 1.5% markup | 1.2231 | 12'231.00 | 231.00 |

| Visa/Mastercard rate with 2.0% markup | 1.2291 | 12'291.00 | 291.00 |

| Visa/Mastercard rate with 2.5% markup | 1.2351 | 12'351.00 | 351.00 |

| Visa/Mastercard rate with 2.5% markup + CHF 2.5 of fees | 1.2351 | 12'353.50 | 353.50 |

Depending on your family situation and frugality, we’re talking about savings of a few tens of Swiss francs, or as much as several hundred francs!

And that’s without even doing anything with these savings!

Invest these savings and earn CHF over 10 years

Let’s start from the premise that over one year, you spend around CHF 10'000 in foreign currencies (vacation by the beach, weekends, internet purchases, and so on).

As you’re a Mustachian, you invest all savings in the stock market to make them grow while you’re sleeping and going about your business.

By investing these CHF 353.50 of bank card fees every year for 10 years, you’ll end up with CHF 5'240 more in your account in a decade! Thanks to compound interest :)

The best Swiss cards for paying the least

So, then comes the question of choosing the best bank card in Switzerland for paying the lowest exchange fees on your purchases abroad.

Here are the exchange rates used per card, ordered from the best card to the worst:

- Bank WIR debit card: interbank rate

- Wise card: interbank rate (except if you don’t have enough in the currency, in which case they charge a 0.43% conversion fee — but you just need to plan in advance and always keep enough in the currency with which you want to pay)

- Revolut: interbank rate on business days (up to 1'000 USD per month, then 0.5% commission), and a markup of 1% on the exchange rate on weekends

- neon debit card: Mastercard exchange rate marked up by 0.35% with the “neon free” plan, and no exchange rate surcharge with the “neon plus” plan (CHF 20/year, if paid in a single installment for the entire year)

- Certo! One Mastercard: markup of 1.5% on the exchange rate

- Swisscard Cashback: markup of 2.5% on the exchange rate

If you regularly pay in a foreign currency, I therefore recommend that you open a Bankpaket top, and enjoy the benefits of their Mastercard debit card with its interbank exchange rate that doesn’t have any exchange rate margin.

The MP family’s choice

Our main Swiss bank has been WIR Bank since 2025. Thanks to their Bankpaket top, we benefit from the best exchange rate (with no surcharges) on their debit card for all my purchases in foreign currencies. This fits in well with our minimalist lifestyle as it allow us to carry only one card with us at anytime.

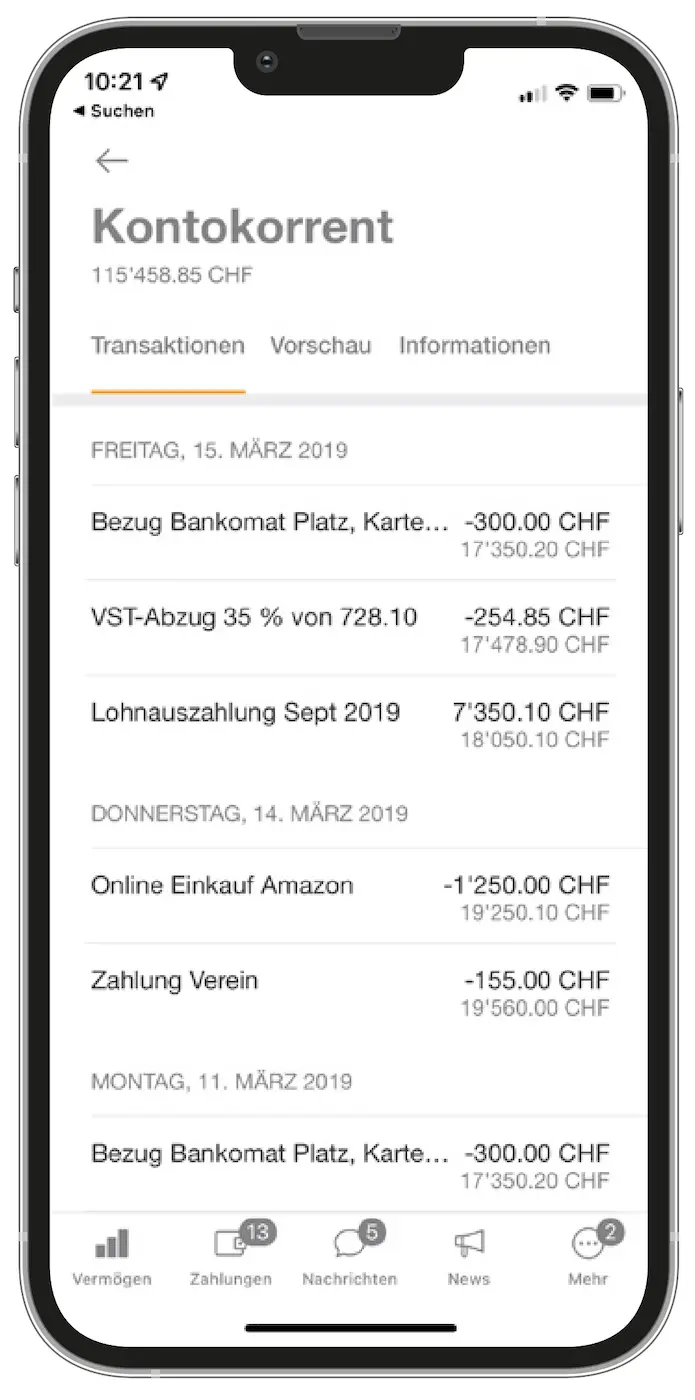

The Bank WIR Mobile Banking app for tracking all my foreign currency purchases with my Debit Mastercard

Conclusion

You just need to make a small smart choice (i.e., choose the best payment card) in order to easily save several hundred CHF per year on your payments in foreign currencies. And if you get in the habit of investing these savings, that’s several thousand francs that will end up in your pocket over the next ten years, with no additional effort.

So, before packing your suitcase for the summer vacation, think about having a look at your bank card. A small change today, and you’ll travel with a lighter load tomorrow!

FAQ

Mastercard or VISA exchange rate?

With Visa and Mastercard cards, the exchange rates are very similar. The difference between the two exchange rates is less than 0.5% and, importantly, it varies according to the currency and the day of the transaction. Therefore, sometimes it’s Mastercard which is best, sometimes it’s Visa… but nothing significant over the long term.

And so, the choice between Visa or Mastercard shouldn’t be made on this basis. What really counts is to check the other fees linked to your card (like the exchange rate margin and the fixed fees per transaction).

Last updated: May 22, 2025