UPDATE 01.05.2019

We changed our credit cards’ setup recently. All infos are in this new blogpost.

UPDATE 14.06.2019

And now it’s the turn of our banking setup. Bye bye BCV! I let you discover our new Swiss bank choice in this article (special welcome-cash code included for MP readers).

There we go, we finally made it! All bank accounts moved to one single low fees bank! Simplify while reducing your costs! What a nice motto!

When we arrived in Switzerland, I asked a friend who was born here about which bank we should choose. Back then, we were in 2009 right after the big crisis implying big players such as UBS and Crédit Suisse.

He explained me that those players were strong enough that I shouldn’t bother with the current news at the time. He also pointed out that Cantonal Banks were a good choice too due to their huge network all across Switzerland.

In the end, we were planning to visit both Crédit Suisse and BCV (Banque Cantonale Vaudoise) but we first went to Crédit Suisse and the feeling with the bank advisor was good and reassuring that we eventually opened our accounts there straight away. No need to mention that back then, I wasn’t in optimizing my contracts, neither into Mustachianism.

Challenge the status quo - or how to save CHF 300 per year by just switching bank

Fast forward five years later: optimizations of all my contracts (from <a href=/blog/optimize-your-swiss-car-insurance-policy/" target="_blank">car insurance, to <a href=/blog/toyota-prius-switch-what-a-great-decision/" target="_blank">gas consumption, and <a href=/blog/unlimited-internet-and-mobile-subscription-for-chf-50-yes-in-switzerland/" target="_blank">Internet and mobile subscriptions) on the way, I then start focusing on how to reduce these damn banking fees.

Before the switch, my wife and I were paying CHF 15/month each, for 2-3 accounts and two credit cards. Even before finding our new bank, I was thinking that this was very stupid of us to have about 7 accounts (including our joint accounts) and nothing less than 5 credit cards and 2 debit ones…

I started googling and looking at comparis.ch but I found their comparisons complex to read. Then I stumbled upon this awesome website of the Fédération Romande des Consommateurs where I found two very interesting PDFs comparison factsheets:

- Banking fees for traditional usage (in french)

- Banking fees for ebanking-only usage (in french)

In summary, for us, digital natives, the choice was to be done between the BCV and PostFinance. We chose BCV because of their debit card which seems to be accepted better out of Switzerland - even if we have to pay it CHF 2.5 per month.

Of course we don’t pay any of their fees as we are always above the 10k limit thanks to our cash cushion.

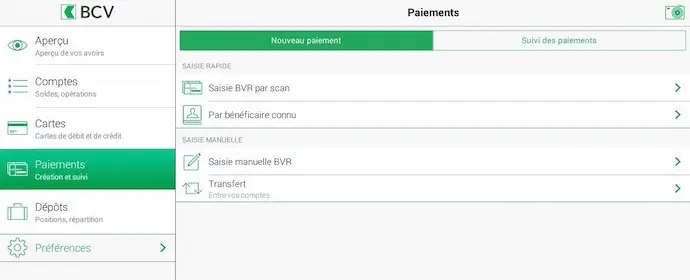

Also, our joint account being already opened there, this drove our choice too. And after some talks with friends being at PostFinance, it seems that their new ebanking solution isn’t that nice to use. At least the one from BCV is lean, and fairly easy to use. Plus their new mobile and tablet apps are the best out there in my humble opinion (way better than the new ones from Crédit Suisse or UBS).

In the end, for our household situation, this means we are saving CHF 300 per year. Only because we switched banks!!! What a damn great optimization for a good start into 2015!

One bank relationship, (almost) no more fees, and a simplified life!

We end up currently with five bank accounts: one checking account and one savings account each. And one joint account.

I must say that we could live well without the savings account as there is YNAB (referral link) and all of our savings go directly to our investment account. But my wife is still not completely onboarded onto this little piece of software…

We could also discuss the fact that a couple could live on a single account for the whole household but that’s not fitting our way of living.

As we seek financial independence, we also wanna keep our own independence financially.

Say NO to credit card fees, and YES to cash back!

If you checked the FRC documents above, you’ll see that these focus only on the bank accounts. But they also did the same with this credit cards comparison document (in french).

As I found out earlier this year that <a href=/blog/travel-hacking-does-not-work-in-switzerland/" target="_blank">travel hacking isn’t working here in Switzerland, we then decided to go with the Migros Cumulus MasterCard (referral link) for the following two reasons:

- It offers cash back - and not these stupid points with which you can buy useless stuff

- We more often shop for groceries at Migros (vs. Coop and their free credit card too)

We have a setup with three credit cards: one for our joint expenses, one for my wife, and one for myself. This allows to prepare birthday and Christmas presents without losing any surprise effect ;)

The joint expenses card is in fact the additional one on the same account as my own credit card. And my wife has her own.

We linked all the cards to our single common Migros Cumulus account so to get all the cash back on one account.

For the record, we get approximately CHF 165 per year of cash back money + the yearly fees we don’t pay anymore.

Bank and credit card optimization total savings = CHF 465 per year

I really like this kind of optimizations as they are so simple and effortless to setup. And once it’s done, the cash you save is forever, and not just a one shot.

I’m glad that these frugal (and qualitative) options exist here in Switzerland as usually, we’re not that much lucky - see telecoms for instance.

In order to thumb our nose at banks, we created a dedicated “Holidays” fund in YNAB so to see our money grow there - and not in the bank’s pocket!

What about your setup?

Which bank did you choose to store your money?

What about your credit cards?