UPDATE 11.07.2025: Swissquote has acquired all shares in Yuh and now owns 100% of the neobank Yuh (previously, it was owned 50/50 with PostFinance).

UPDATE 21.08.2025 after receiving several requests from readers for a more in-depth blog post, I wrote my detailed opinion about Yuh in this article.

I have been using Zak as my primary bank for several years now. I am satisfied with it because it is efficient and free. Since early 2022, neon is my primary Swiss digital bank (and Zak is my secondary backup Swiss bank).

Nevertheless, I received lately several emails asking me my opinion about Yuh, the new Swiss neobank by PostFinance and Swissquote. I had seen the announcement of its release, but had not paid more attention because how to do better than Zak, efficient and free? :)

But while digging into the Yuh website, I saw some features like multi-currencies that could allow me to simplify my banking system.

Hence, instead of copying and pasting my answer by email, I thought it would be more useful for everyone if I made an article about it in my “Quick Answer” series.

Before going any further, I’d like to point out that I’m only comparing the banking part here.

Indeed, in addition to payments and savings, Yuh offers an investing feature. Except that the rates are too expensive for a Mustachian with 0.5% of transaction fees.

Whereas with Interactive Brokers or DEGIRO, if you invest for example CHF 10'000 in an ETF, you only pay a few dollars or even nothing at all — compared to CHF 50 (= CHF 10'000 x 0.5%) with Yuh.

Ditto for cryptocurrencies: it costs you 1% in transaction fees, compared to Coinbase Pro which only charges 0.5%.

And the same goes for foreign currency transactions. This is one of the things that immediately made me think that maybe Yuh could replace my various Wise, formerly TransferWise and Revolut solutions.

Except that Yuh charges 0.95% fee on every foreign currency transaction… Too bad!

Then, I give you here the list of criteria I use to choose my best Swiss bank:

- Free

- Online and mobile

- Secure

- Free bank transfers in Switzerland

- Free bank transfers in the Euro zone (via SEPA)

- Free Maestro debit card

- Free ATM withdrawals

- Free cash deposit at ATMs

- ISR and/or QR code payment via scan

- eBill support

- Accessible physically (via real people in real offices)

- Download of account statements in PDF format

- Live push notifications

So this is what Yuh looks like in comparison to my current Swiss bank Zak:

Free ✅ (Zak = ✅)

No opening fees nor account fees.

Online and mobile ✅ (Zak = ✅)

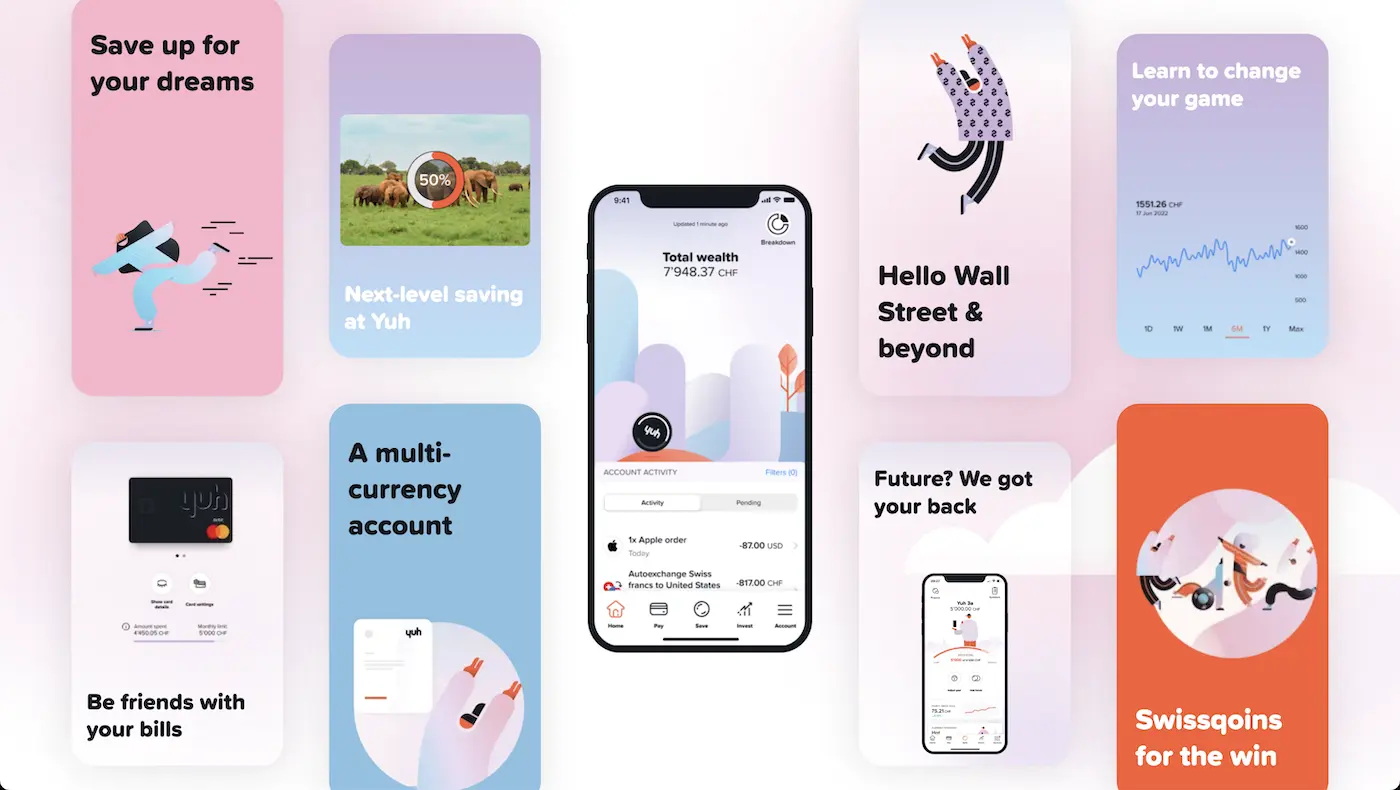

Yuh bank is completely online, and their mobile app really looks slick. It does the job.

Secure ✅ (Zak = ✅)

With PostFinance and Swissquote behind it, Yuh is secure. In addition, it uses the Swissquote banking license which protects your assets up to CHF 100'000.

Free bank transfers in Switzerland ✅ (Zak = ✅)

It’s free, in CHF and EUR.

Free bank transfers in the Euro zone (via SEPA) ✅ (Zak = ✅)

Ditto, free of charge.

Free Maestro debit card ✅ (Zak = ✅)

Yuh offers a free Mastercard debit card.

I know this is a point of contention among readers, as many of you have no use for a Maestro. But it’s also the purpose of my blog to provide a personal, real-world perspective. And with our life in the countryside where we regularly have stores that only accept the Maestro, it remains a criterion for us for now.

Free ATM withdrawals ✅ (1x/week) (Zak = ✅)

I put a ✅ because 4 withdrawals per month are enough in our situation.

On the other hand, the daily withdrawal limit is CHF 1'000 and the monthly limit is CHF 10'000, and that could bother us in some situations.

Free cash deposit at ATMs 🚫 (Zak = ✅)

I couldn’t find any information about this, so I assume that you just can’t deposit cash via the PostFinance offices. And that you have to use a (paid) postal slip like with neon.

ISR and/or QR code payment via scan ✅ (Zak = ✅)

The mobile application of the neobank Yuh supports this feature.

eBill support 🚫 (Zak = 🚫)

No eBill support for the moment.

Accessible physically (via real people in real offices) 🚫 (Zak = ✅)

As I said above, Yuh has no direct link to PostFinance and its offices. Too bad, it could have been a good argument for Yuh.

Download of account statements in PDF format ✅ (Zak = ✅)

Not having opened a Yuh account (I have too many already!), I’m not sure about this (if you’re a customer with them, I’m interested to know). But from what I’ve read via their chatbot, there’s a “My Documents” section in the Yuh app, so I assume you can find your statements there. To be confirmed.

UPDATE 21.07.2021: confirmed, it exists, thanks to Xavier for the info!

Live push notifications ✅ (Zak = ✅)

Same as the point above, all the demo videos I’ve watched don’t mention this point. To be confirmed.

UPDATE 21.07.2021: confirmed, it exists too, and thanks also to Xavier for the info!

In addition to my usual criteria, I also mention that the Yuh mobile app does not support standing orders or non-SEPA transfers at this time.

Also, Yuh’s pricing model will change in 2022 but nothing is very clear yet on who will have to pay what…

Conclusion

Yuh is a free neobank that competes with Zak, neon, Yapeal and CSX. And that’s good for us as customers because such competition can only benefit us.

Likewise, I like Yuh’s idea of having multi-currency functionality in the same app as my main bank.

On the other hand, the following points make me not take the step of opening a Yuh account:

- Daily withdrawal limit at CHF 1'000, and monthly at CHF 10'000

- No option to have a Maestro card

- No standing order nor eBill

- Cash deposit is not free

- No visibility on potential future Yuh fees in 2022

- Zak’s pot system works better for me to reconcile my accounts on YNAB

- No option to speak with a person in a PostFinance office

So for my part, I’ll stick with my system based on a primary bank — neon, and a secondary backup one — Zak, as explained in this detailed article.

Last updated: July 20, 2021