Today I wanted to address a topic that I started to cover (a bit) in the first post: what are my real financial goals. Meaning what do I plan to do with all that amassed stack of savings?!? I basically have two main goals that drive my will to live a mustachian lifestyle.

Short-term goal

Living in Switzerland is a real chance because we have here a country where one can feel safe. It’s easy to find a job without too much trouble. We are one of the most innovative countries in the world with nice education possibilities. The country also has a good reputation regarding its so called “quality of life”: people are polite and nice, there is nature all over us (Jura, Alps, lakes), and it’s very clean! Not to mention the chocolate, our banks (ergh, really?) and the Swiss watch manufacturers! Finally, salaries are high comparing to the European mean.

Painting this picture could make most of you foreign mustachians willing to move right now to the Swiss confederation in order to get rich quickly. That would be a good plan if we didn’t have to take into account a last factor: cost of living! Having high salaries correlates with high costs of living too, unfortunately - but trust me, it is still to your advantage if you apply mustachian lifestyle.

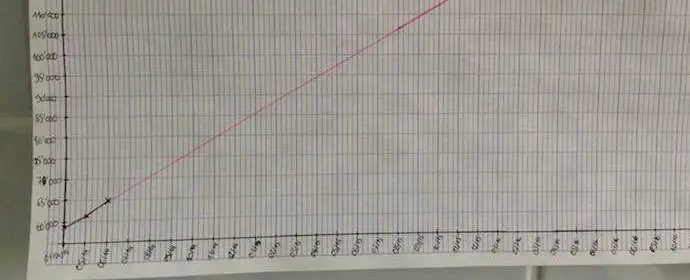

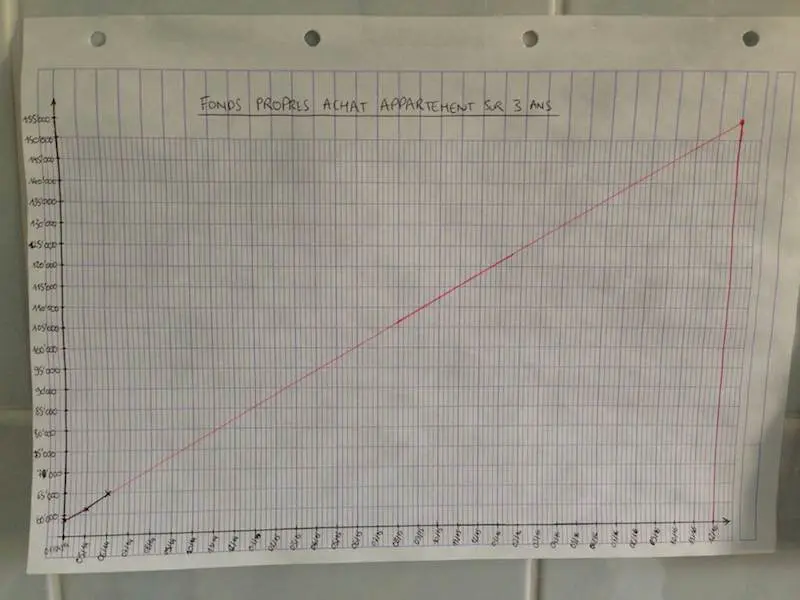

The hardest costs to face is linked to my short term goal: real estate. My first financial goal is to buy an apartment/house as soon as possible. I’m 28 and following the graph below [1], we should reach the gap when I’m 31; that’s the challenge at least.

Regarding numbers, that means we will have stashed CHF 160'000.- until then. And for the non-Swiss readers, this amount doesn’t represent the overall price of the home we dream of - that would be too easy! This is just the amount of cash that allows you to knock-knock at a bank for a mortgage. 20% of the total house value to be precise. So if you are fast at math calculation, that will leave us with a CHF 800'000.- home.

What we are targeting with this price isn’t a castle though (‘cause you could buy one in France with this money), it is a 3-bedrooms and 2-bathrooms apartment of about 120m2 located in the city center of Yverdon-les-Bains. I precise that what we look for is more a new/recent (vs. old) building. First because we like the new materials quality that are more efficient and better looking, and second because I’m not that used to home construction stuff and all my family who could help me is 300 kms away…

Again, this is somehow cheap if you compare it to bigger cities like Lausanne: there, you get easily over one million for the same kind of home! So yes, Switzerland is expansive regarding real estate!

That’s it for my short-term goal: own my home when I reach 31 with about CHF 160'000.- stashed!

Long-term goal

This goal is more obvious to mustachians and is nothing else than financial independance. Such a target implies numbers that get bigger, and a longer timeframe - unfortunately…

Short recap: we are a 4-persons family. One boy and one girl who will respectively be 4 and 2 by the end of the summer, a wife working 60%, and myself still at 100% (I’m targeting 80% but that’s another story). We live a damn cool life in a small green town counting 30'000 people.

Financially, we are having expenses similar to other mustachians except:

- childcare three days per week: this is incredibly expensive in Switzerland compared to other European countries. It also depends of the canton you live in. At the moment, we are paying around CHF 2'000.- monthly for both children. As a comparison, a friend of mine was paying CHF 800.- per month in the Neuchâtel’s canton. Another French friend, who get less salary, is paying 80-100 euros (~ CHF 120.-) in France…

- gas and tolls: we visit our French family and friends every 1.5 months. Meaning some additional costs of about CHF 150.- per month. Thankfully the Prius helps to get the costs lower than they were before. Unfortunately this has no effect on the unexplainable high toll prices.

Taking out the childcare costs to be realistic (hopefully we won’t have childcare fees once they are 30!), we are remaining at an expenses level of about CHF 50'000.- per year.

To calculate the total amount of cash that you need to retire and not have to work for money anymore - living on your investment interests - you can use several mathematical formulas but the simplest is to multiply your yearly expenses by 25 (thanks to the 4% rule explained here).

This means that with our current level of life, we would need around CHF 1'250'000.- saved in various investment account types.

Now, this number assumes that we are going to keep renting the same appartment, but remember, the first goal is to get one bought so these costs should lower with time going on.

Also, by the time we get ready for early retirement, we might move more in the country near Yverdon, or to Canada or maybe to France. Three potential plans that could help decrease our home costs while bring closer the rat race finish line!

But, “What is your early retirement deadline?!?” are you asking! Great question! To answer it, I first need to reveal our monthly savings…which are equal to CHF 3'000.- more or less, depending the month.

This means that we should be able to retire in about 26 years - actually in 29 years as we need to take into account the 3 years period to reach my first short-term goal during which I won’t save money for this long-term goal. Still better than the official Swiss legal age: 65.

But hey! Wait! That’ is a correct result only if:

- I don’t get any salary raise during 29 years, neither my wife

- we would still be renting our home or always paying our mortgage

- we would still pay our children clothes and insurances

It is hard to predict the future regarding salary raise, when the children will leave home and - the more impactful - in which country we will live in 20 years… But approximately, this would be it: ending the rat race in 29 years maximum. I actually do set myself the year of my 40 as a challenging target. First because I don’t wanna wait until I’m 57 years old, and second because this keeps me motivated to lower and optimize our expenses, and also to find various sources of income to raise our savings.

So here you go with MP financial goals revealed!

What about you? How does it look like? What are your financial goals? Before, I was living paycheck to paycheck as many people do but as soon as I got a clear objective of what to do with my savings, it got really easy to put some cash aside, seeing the curves going upper and upper.

I would be very interested to read about your story in the comment section below!

Notes

[1] This kind of physical graph is a very powerful tool to help you achieve any of your goals, having them in front of you every day. I find it way more powerful than digital graphs because it is tangible.

The target is to be always on track with the pink line (or above!) if we want to own our home in 3 years. I do update our stash amount every month and this is great to see the black curve trying to keep up with the pink one.