The end of November is the last moment until which you can switch of health insurance in Switzerland.

I was discussing with David about a future MP project, and we ended up talking about his premium, and how he never really took time to challenge it (a bit like his Swiss bank account, but that’s another story!)

When I heard how much he was paying monthly compared to us, a family of four, I couldn’t help to tell him that he’d save a lot of cash!

I thought it would be worth to share our conversation as this could help many of our new readers.

MP: Hey David. So can you tell us a bit more about you, like how old you are, at which insurance are you attached to currently, how much do you pay for it, and for which coverage/franchise?

David: Hi Marc. I’m 27 years old. My current insurer is Sympany and I pay roughly 420.- for a 2500.- franchise. The basic health insurance costs 376.- and the rest is for additional services like glasses, free hospital choice and risk capital insurance.

MP: Interesting. Why do you have the additional services? Did you do the math, and it’s worth to pay more each month instead of saving the difference and covering your expenses by yourself?

David: Good question. I haven’t done a lot of research so far. My parents signed me up for this insurance when I was a kid and I just kept it because it was the easiest thing to do. Mostly because I earned enough money to support it and heard a lot of negative feedback from friends about cheaper alternatives.

The hospital and risk capital additions I kept because they seem like a nice to have in case something goes very wrong. Although I’m not sure what would happen if I cancel them. Especially with the risk capital insurance. I think that should already be covered by the 1st pillar.

The third addition is for alternative medicine. That’s the one I’d say is worth it. I have glasses and a desk job. Although I try to do movement and posture exercises during the day, I still get tense muscles and my eyesight worsens from time to time. So they cover some of the costs for new glasses and massages which helps a lot.

MP: OK so let us help you a bit there. Can you tell us your city ZIP code so that we can run some comparis.ch research? Also do you already have an accident insurance in case you’re self-employed?

David: Sure, I’m living in town near Basel :)

And yep I already have an accident insurance so no need to add it.

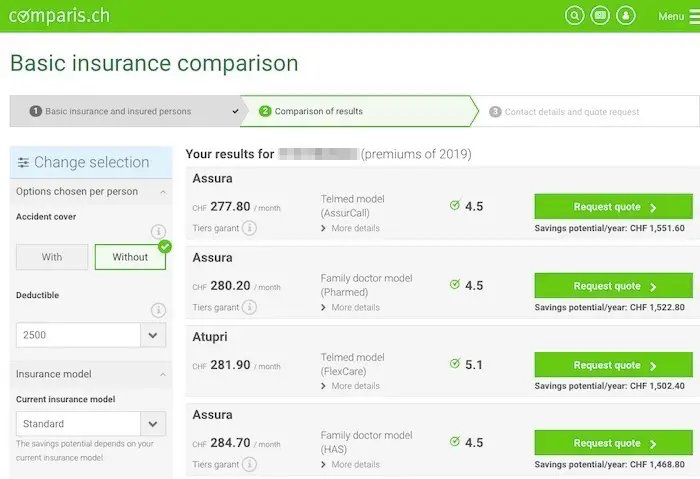

MP: OK so first thing first, the basic health insurance. I did some Comparis research and found out that for 2019, the cheapest insurance remains Assura. I use it myself for years now, and I’m satisfied with it.

For you who are 27 years old, and living in Basel, the price per month would be CHF 280.20.

I chose the Assura with CHF 2'500 deductible, and the PharMed option (family doctor) which implies that you always have to go to your family doctor first, except for gynaecology (not applicable for you, right :P), ophthalmology, or emergencies.

Your family doctor has to be on their list (which was the case for me): here for Swiss-German or there for french speaking people.

Also for drugstores, you gotta go to one of the list of Assura (in Swiss-German and in French).

You have to note that you need to pay everything from your own pocket first, and then send it to Assura for reimbursement. Which shouldn’t be a problem for a Mustachian!

These are some constraints I’m OK to live with.

If you would switch, you would save CHF 1'149.6 per year (12 x (CHF 376 - CHF 280.20)).

And if you invest this difference on the next 10 years, assuming a 6% stock market returns, you could save CHF 16'074.

This, by just sending two letters (one to Sympany before, and one to Assura) before end November.

David: Sweet. That sounds good. Although you might laugh but I already have the same constraints as you do. Not sure about the drug store one but it’s the same deal with the family doctor and paying out of my own pocket. Except I think for bigger stuff like surgeries. But not a 100% sure there.

I have to say it sounds good and I’ll definitely consider it.

My main issue is that Assura has kind of a bad reputation from what I’ve heard. Also the fact that you have to pay everything upfront by yourself (which I’m not quite sure I have to do as well for big stuff like surgeries) is a bit concerning if I ever get into this situation again. That can be easily 5-10k or more. If I can remember correctly the last one I had, Sympany payed it and I just had to cover the 2.5k deductible. But again, not 100% sure though. Even if I had the spare change if this would ever be the case, how long does it take them to pay me back and what if they decide not to?

MP: I actually dived into this “tiers garant” and “tiers payant” topic following your question.

The “Fédération Romande des Consommateurs” (aka FRC) has a detailed article explaining that, with Assura, you must pay in advance (i.e. tiers payant) for drugstores and certain alternative medicine practitioners. But for all what is doctor and hospital, it’s the insurance paying directly (tiers payant).

And the FRC states that with all insurances, they pay in advance for all what’s doctors and hospitals.

To me that’s a clear signal to switch, if you can manage to have the CHF 2'500 aside for the deductible :)

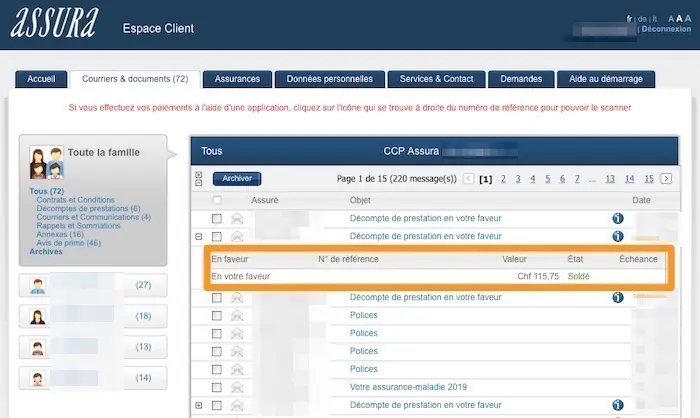

Side note about reimbursements, I honestly never cared about how long it takes because it was only for drugstore stuff and osteopath bills — amounts for which I expect Mustachians to have enough stash to cover. For both Assura (basic health insurance) and Groupe Mutuel (alternative medicine), I would say that the reimbursement came in approximately 1 or 2 months max after the consultation.

Regarding Assura, I heard the same negative feedbacks beforehand, but decided to give it a try nevertheless. I wouldn’t go back. Their e-system is great and very clear. Then for reimbursement, you still need to send them by post, and then they reimburse you. I just don’t see any rational reason to not choose them. But that’s based on my experience and point of view, as always.

David: Ok, thanks for the “tiers garant” / “tiers payant” topic. Didn’t know about that. Interesting.

You’re right. I’m not dependent on the reimbursements. So that shouldn’t be a problem. Especially with the newly obtained information about the different tiers, I feel much more confident to switch.

MP: Continuing with glasses. I myself stopped paying any insurance for this.

I kept my last glasses for 5-6 years, and saved the insurance amount (about CHF 144/year) to build a small fund myself. Even the optician was shocked that my glasses were in such a good shape except from the used part that hurt near my ears.

“That’s how Mustachians do it, dear Madam!”, I told the optician.

In case you need yearly renewal due to sight changes (don’t tell me you switch yearly only for having a new eyeglass frame!), then the cheapest alternative I could find so far seems to be KPT/CPT with CHF 10.90/month.

Please note that for KPT/CPT, the max amount they will reimburse you is CHF 200/year, so in the end that’s only CHF 69.30 (CHF 200 - CHF 10.90 x 12) they support you with yearly. And it’s the same for all other insurances — i.e. they all have a cap amount they reimburse per year (which is even lower for some).

David: I don’t really need it I guess. Although it’s already included in the alternative medicine insurance. I switched glasses (not the frame) quite frequently in the last few years, once a year maybe because of some issues. But I hadn’t any issues lately so definitely worth considering.

MP: Then, free choice of hospital. If what matters to you is the hospital choice (but you don’t care about private rooms and doctor choice there), then Groupe Mutuel offers you the best option at CHF 2.10 per month. I may be wrong, but looking at Switzerland hospitals’ quality, I wouldn’t care to have an hospital assigned (N.B. I never had to have a surgery like you did, so take my word carefully, and if you dear reader had to do so, let us know about your experience).

David: For hospital free choice, I had surgery twice so far and I think the hospital is assigned based on the doctor who does the surgery. I would have to check what the benefit of this insurance was in this case, if there was any.

MP: Let’s us know if you get more infos regarding the reality of this free hospital choice thingy.

You also talked about alternative medicine like osteopathy and kinesiology.

The cheapest alternative for 2019 is hard to find because for instance, with Visana (best result on Comparis.ch), it says CHF 4.80/month. But once you go to their website, you discover that such medicine must be prescribed, else it costs more.

Also, it seems you can’t take it alone as it needs to be part of a “package”.

In order to give you a concrete solution nevertheless, let’s look at my example. I have back pain sometimes too, and go four times a year at an osteopath practice. It costs me CHF 100 per consultation, and I’m reimbursed 70%. For this insurance at Groupe Mutuel, I pay CHF 9.90/m. The advantage is clear if we take the example of 4 times at an ostheopath: without insurance it’s CHF 400/y, and with insurance it’s CHF 238.80 (9.90.- x 12 + 4 x 30.-).

And within these CHF 9.90 are included the hospital choice (I totally forgot about it ^^).

David: Interesting. On my side, I currently pay CHF 16.30 for alternative medicine. Glasses are included in this one as well. I go to an ostheopath once or every other month which costs me 120.- per session and they pay me back 50%. Since when do you have the Groupe Mutuel insurance? I have the one for alternative medicine only since a few years and had some issues getting it at all. So my concern is that another insurer won’t take me because of recent surgery.

Interesting story: I phoned with a doctor regarding additional insurance for alternative medicine and he said with my age it’s almost impossible to get it. My parents should have signed me up when I was born for it. Otherwise the chance for getting signed up is very low.

MP: You may be right about alternative medicine. I only heard so far that it was mostly interesting to sign up kids on dental insurance, not alternative medicine.

I also know that such contract have generally 2 to 5 years of engagement… What I would advise you would be to simply check your contract end date, and then some months in advance, to call the new insurance (say Groupe Mutuel) and ask if they would back you up. This way you get a real answer and not guesses from your doctor or me!

I think it’s worth the try because you get only 50% back on your bills, for almost twice the premium I pay…

Finally, you mentioned a risk insurance. Can you tell me more about it?

David: Here you go: Sympany death and invalidity insurance. I have the one with the 10k death, 200k invalid one. But I pay “only” 14.50 for that.

MP: Interesting…on my side I decided to for sure not pay any life insurance, as:

- I prefer to insure myself and have full control over my stash.

- In case I die, I rely on my wife to find ways to make ends meet, as she expects it from me. And for the kids, what we aim to offer them instead of cash is education principles that you shouldn’t rely on anybody except yourself in life.

- Also, in case I die, there are these widow and orphan pensions that your wife and kids get. It’s not huge amount, but it’s still cash. You can find the amounts on your 2nd pillar yearly recap. For me it’s CHF 1'800/month for my wife, and CHF 610 for each kid.

As for invalidity, I prefer to do the following bets:

- If I get invalid, I hope that my wife can continue to work on top of the 1st pillar and 2nd pillar pensions I would get.

- I prefer to save as much as I can now that I’m valid (and already reached 350kCHF of wealth in only 5 years), and not pay such insurances.

- Also, I checked my 2nd pillar contract at work, and they provide quite a decent coverage amount already (around 4k per month). Make sure to check yours as well David, because you might be well covered there too.

Again, all of this are personal choices, and I’m conscious and grateful that both of us are valid people.

OK, so all in all with glasses + free hospital choice + alternative medicine, you could pay only around CHF 22.9/month. That means again some CHF 44 of savings per month, meaning CHF 528/year. This would result in CHF 7'383 on 10 years if you invest the money and it brings a decent 6% yield.

Are you willing to investigate further for a switch with such computation?

David: Yes, that sounds good and I’ll do that. Thanks a lot for all the effort you put into this. I learned a lot and have definitely been inspired to switch and save some money.

Conclusion

To summarize David’s situation, he is now paying CHF 420/month. With some writing effort to send two letters before the end of November (one to cancel Sympany, one to subscribe to Assura and Groupe Mutuel for instance), he could end up only paying CHF 303.10 per month instead (given he can switch the alternative medicine insurance due to his historical back surgery).

That’s CHF 116.90 additional monthly savings, resulting in CHF 1402.80/year. If he dares to invest it on the next 10 years, this would result in a CHF 19'608 comfy stash!

Again, I stress the point that all these are very personal choices depending on your health situation. Please make sure to really dig into all points and contracts before following any of my or David private experiences.

Nevertheless, I hope it gives you hints on what to do for you, and also for your future children regarding health insurance choices in Switzerland.

What about you dear reader? How much do you pay monthly for you/your family? Which basic and complementary insurance do you have? Are you planning to make a switch and save cash in 2019?

How to onboard your partner on a common budget and …

The MP family's net worth five years after our...