It’s pretty crazy to realize that many Swiss people have little or no knowledge of the 3-pillar system, even though it will be their retirement. And I include myself in that sentence, at least the me from ten years ago…

After all, you can’t blame yourself, knowing that this kind of personal finance subject isn’t covered in school… 1

As much as we hear about GDP or the world economy, if we choose the option “Economics” in the Compulsory Cycle, we don’t talk about budgeting or how to build a private pension plan via pillar 3a.

So, as here on the blog, we all want to become financially independent one day or another, so it’s important to make sure we’re clear about the basics of the Swiss retirement system (aka Swiss pension system).

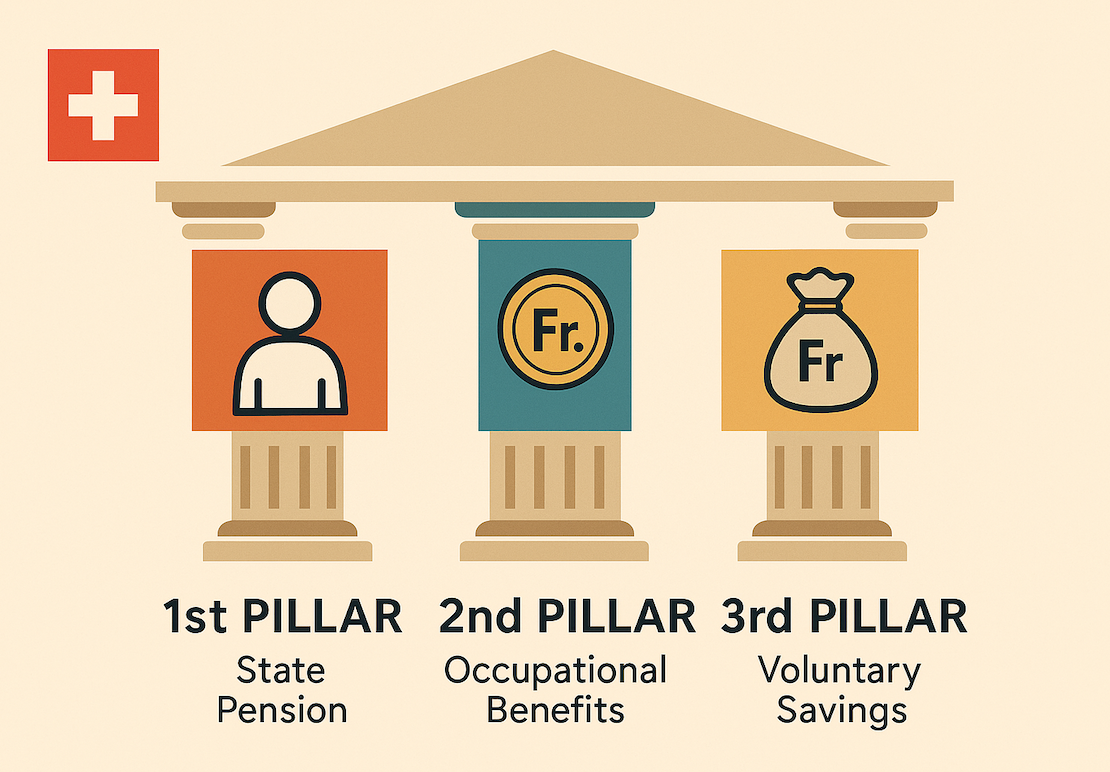

Introduction of the Swiss three-pillar principle

The Swiss pension system is based on three pillars:

- 1st pillar: basic insurance (public)

- 2nd pillar: occupational benefits (private)

- 3rd pillar: individual pension provision (private)

The basic aim of the Swiss pension system is to guarantee financial security in retirement, as well as in the event of disability or death.

This three-pillar model has been enshrined in the Swiss Federal Constitution since 1972. In concrete terms: Pillar 1 was introduced in 1948, Pillar 2 in 1985, and Pillar 3a in 1972.

It’s a combination of public funds (a common pot into which everyone pays something), occupational pension plans (deducted from everyone’s salary), and, optionally, individual pension plans (which you may or may not choose to set up for yourself). The latter is tax-advantaged to motivate the Swiss to put money aside for themselves.

1st pillar: old-age and survivors insurance (and disability insurance)

The 1st pillar corresponds to the state pension scheme, also known as Old-Age and Survivors’ Insurance (OASI), managed by the Federal Social Insurance Office.

It covers vital needs in the event of retirement, disability, or death.

And if you don’t reach a minimum income, then you may also be entitled to supplementary benefits (EL/PC) to supplement your OASI pensions and cover your basic living expenses.

So, let’s say you’ve never worked (so no OP) and never contributed to pillar 3a, this social safety net prevents you from ending up on the street in extreme poverty, and guarantees you a minimum income.

Let’s be clear: even if you’re very frugal, it’s going to be very hard for you to live in Switzerland on OASI alone. The OASI’s minimum pension is CHF 1,260/month, and the OASI’s maximum pension is CHF 2,520/month. This amount depends on your average annual income.

OASI contributions (= 1st pillar) are compulsory for anyone living or working in Switzerland.

Also, the money in this 1st pillar does not belong to you personally. It is managed by the OASI compensation funds (under the supervision of the Swiss Confederation).

2nd pillar: occupational pension benefits

The 2nd pillar is occupational pension provision, governed by the Federal Law on Occupational Pension Schemes (OP) for old age, survivors, and disability.

I hear people say to themselves, as I did when I first started working:

Ah, but that’s that, the OP/LPP! Thanks, MP, for the explanation :)

The purpose of the 2nd pillar is to supplement the 1st pillar’s Old Age pension to maintain the usual standard of living in retirement. And given the amount of the 1st pillar, I suggest that the 2nd pillar will provide you with a substantial additional income for retirement. Well, especially for those who are not frugal and rely solely on it to live beyond the age of 65.

All Swiss employees with an annual salary in excess of CHF 22,050 are covered by the 2nd pillar. This means that contributions to the 2nd pillar are compulsory for salaried employees in Switzerland (self-employed persons can join voluntarily or not).

To be clear: the second pillar is money in your name, contributed by you and your employer, which is invested and capitalized. Although this money is in your name, it remains under a form of legal guardianship by the State until retirement (except in special cases such as purchase of primary residence or moving abroad) under current Swiss law.

3rd pillar: individual pension provision (aka private pension provision)

The 3rd pillar is the individual provident fund, which supplements the benefits of the 1st and 2nd pillars.

It offers savings and insurance solutions to bridge income gaps at retirement or in the event of death.

The 3rd pillar is divided into linked 3rd pillar (3a) and free 3rd pillar (3b), with tax advantages for the 3a. This private provident scheme is encouraged by the Confederation and cantons, through possible tax deductions for greater financial security after the age of 65.

This topic is a personal crusade, after being duped not once, but twice by so-called insurance "advisors"... BS!

In practical terms, this means I've lost several tens of thousands of francs. Yes, you read that right... several TENS of thousands of CHF!!!

The rule to know and share with everyone around you: NEVER TAKE A 3A PILLAR LINKED WITH A LIFE INSURANCE. EVER!

And if, unfortunately, you've already fallen for it, I recommend reading this article to find out what to do.

The financing of the pillars of the Swiss pension system

The 1st pillar is financed respectively by employees and employers (who each contribute a share of their salary via a direct deduction from your pay slip as AHV contributions), the self-employed (who also contribute according to their income), and the State and VAT who supplement with a contribution (federal subsidies, to balance the system).

We could say that the 1st pillar falls within the public “domain”, since the money is collected and redistributed via a collective system managed by the Federal Government.

The 2nd pillar is financed by contributions from workers and employees. So it’s private money that you and your employer set aside each month for your future retirement. As mentioned above, the OP is compulsory for all Swiss employees.

The 3rd pillar is financed by individual contributions. It is optional.

The advantages of the 3-pillar system

We hear a lot of people complaining about our three-pillar system and all the politics that surround it. But if you look at it with hindsight, AND compare it with other countries around the world, it’s really not as bad as they say.

I’ll list below the main advantages I see, from the point of view of a Swiss lambda citizen (because a Mustachian might be even more independent in the way he applies it):

Advantage 1: Diversification of income sources in retirement

- 1st pillar (OASI): basic income based on solidarity, which reduces the risk of poverty.

- 2nd pillar (OP): forced savings linked to salary, creating retirement capital.

- 3rd pillar: individual freedom, tax optimization, investment choices.

This avoids putting all one’s eggs in one basket (e.g., only the State or only the private sector).

Advantage 2: Mix of solidarity and individual responsibility

The 1st pillar mutualizes risks (intergenerational solidarity). The 2nd and 3rd encourage individual responsibility and capitalization. It’s a flexible balance that “reassures” society while leaving room for personal initiative.

Advantage 3: Attractive tax incentives (especially pillar 3)

Pillar 3a allows deductions from taxable income, which is a real frugal lever for optimizing your savings rate. Buying into the 2nd pillar can also reduce taxes (if used properly, i.e., as close as possible to the legal retirement age). For a Mustachian, it’s a way of boosting speed towards early retirement while respecting the pension fund regulations.

Advantage 4: Protection against certain life risks

Pillars are also insurance: disability, death, surviving spouses, orphans’ pension, etc. It protects your family if you’re no longer around (and you were the only one who knew about personal finance…). It completes the FIRE logic, where you want to limit the big risks of “game over”.

Advantage 5: Stability and predictability

The 3-pillar system has been in place for a long time (iterative creation between 1948 and 1972), and is well accepted politically. OASI pensions are (relatively) guaranteed. And pension funds are regulated and supervised by FINMA. All this gives our beautiful country of Switzerland a certain legal and economic security.

Advantage 6: Flexibility of use

Even if everything is relative, you can still be a little flexible with your pension capital:

- The possibility of early withdrawal (real estate purchase, independence, going abroad).

- The choice of more dynamic investments with certain 3a products (ETFs, equities).

This allows you to remain (partly) a player in your own strategy, and not just a passive complainer against the state.

Conclusion on the 3-pillar principle

The Swiss pension system is based on three pillars: basic insurance, occupational retirement pension, and individual pension.

The main objective of the Swiss pension system is to guarantee financial security in retirement, disability, and death..

The three pillars of the retirement pensions work together to provide a comprehensive pension plan.

I’m not familiar with all the world’s pension systems, but I have to say I’m pretty satisfied with them overall. In any case, it’s quite balanced (like any Swiss thing!)

And you, without getting too political (I’ll delete comments like that, just so you know), what do you think objectively? Also, if I’ve missed any important points on the subject of retirement in Switzerland, let me know in the comments below.

FAQ 3-pillar system

Is it really worthwhile to contribute to pillar 3a?

The short answer: yes!

The detailed answer: you can save around 1,000 Swiss francs a year in taxes by paying in the maximum 3a amount each year. If you also invest in the stock market these savings, then it becomes a very, very good financial plan.

Also, you can invest your pillar 3a in the stock market, which is even more financially attractive.

What are your 3rd pillar recommendations MP?

I keep an up-to-date 3rd pillar comparison on this link. I update it every year to guide you through the plethora of private pension plans, with a lot of crappy products between them.

Which vested benefits account will you choose once you retire early (FIRE)?

As my FIRE date is approaching, I took the time to do a detailed comparison of the best vested benefits in this article. Unsurprisingly, it includes the same modern candidates that revolutionized pillar 3a.

Is accident insurance (UVG) part of the 2nd pillar (OP)?

No, accident insurance (LAA) is not part of the OP (2nd pillar), even though the two are often managed by the employer and confused by the people.

If you’re an employee: your employer must insure you against occupational accidents, and (if you work >8h/week) also against non-occupational accidents. So it’s indeed job-related.

If you don’t have a job (FI, no activity): you’re no longer covered by your employer’s accident insurance. You must then cover yourself via your LAMal (health insurance), by adding “accident” cover to your basic policy (this is compulsory if you don’t have an employer).

UPDATE 09.10.2025: reader Oliver (thanks again!) wrote to me to say that the Swiss school system is changing for the better when it comes to personal finance. He is a secondary school teacher in Switzerland (high school and vocational training) and reminded me that the basics of personal finance (budgeting, retirement planning, the three-pillar system) are now well covered in schools through the “Lehrplan 21” (aka “Plan d’études 21” in French) and in economics classes. The real challenge remains less the content than the interest of the students, which is strongly influenced by what is discussed (or not) at home. ↩︎

Last updated: October 9, 2025