Like last year, it was about time to unveil what our 2019 annual expenses were in order to face reality.

Exactly like 2018, I’m a little nervous about doing such an article because it’s pretty much undermining my own beliefs about how frugal I think I am.

In any case, I am counting on you to challenge me where you have ideas for optimizations. Because in the end, it is also one of the goals of the blog for me to continuously improve.

Moreover, as long as your budget is not in auto-pilot mode with a savings rate in the 60-70% range, I recommend that you do the same!

If you’re new here, and you’re wondering how it’s possible to keep track of all your annual expenses in such detail, don’t look any further! The answer is called YNAB.

Enough blah blah, it’s “Pants down” time:

| Category | 2019 amount (CHF) | 2018 amount (CHF) | Comments |

|---|---|---|---|

| Groceries | 13'971.15 | 13'184.76 | It’s quite a constant level at about CHF 800. But it would have been better if we had spent less… This category includes food, but also all the cleaning and beauty products. |

| — | — | — | — |

| Irregular expenses | 35'044.08 | 19'680.09 | Details below |

| - Leisure/tourism gas | 1'757.40 | 1'535.48 | One week of unplanned vacation, and another one planned (but on top), and here are our expenses that take off… |

| - Leisure/tourism tolls | 1'284.72 | 760.51 | I almost fainted when I read this figure, but in fact it’s normal because one of us had to take a training course that resulted in parking fees. This category contains motorway tolls and parking fees |

| - Tourism | 1'425.4 | 1'024.71 | We had fun in tourism with different members of our family throughout the year. And it was worth every penny spent! |

| - Restaurants and outings | 2'637.65 | 2'386.15 | Same as last year: we focus on good gastronomic restaurants, but not every week ;) This category also includes restaurants to thank people who have helped us in different areas |

| - Presents | 1'017.16 | 1'439.12 | Either we ate less at a friend’s house (this category includes the flowers and other desserts we brought), or the tooth fairy had to come less, or a combo of the two :D |

| - Furnishings | 1'211.41 | 2'446.01 | A few cookware renewals (necessary), decoration for different rooms (not necessary), and new dishes (not necessary:D). But we’re starting to feel at home here. The next expenses should only be things like washing machine or similar |

| - Medical | 8'511.18 | 4'583.92 | And there is the explosion! The year 2019 was a very special year with the beginning of orthodontics for one of the MP children (a large part of which was reimbursed, but we still count it in the expenses because we had to get the cash out), as well as a health problem for one of us (everything is fine, nothing serious, don’t worry!) |

| - Car expenses and repairs | 3'435.16 | 242.52 | 4x winter tires (great deal on Anibis, 20% used, for a price divided by 8!), but most of all, replacement of our hybrid battery on our Prius. But it’s all good, we set off again for at least 500'000kms ^^) |

| - BCV fees | 17.01 | 13.50 | It’s over, we’ve closed everything at the BCV!!!! Now this category will disappear for 2020 thanks to our new free Swiss bank Zak |

| - Investments fees | 1'876.70 | N/A | Stock exchange transactions, VIAC fees, foundation fees of our SCI in France, purchase newsletter daubasses.com |

| - Clothes and shoes Mrs. MP | 573.69 | 562.84 | In addition to the “normal” purchases for Mrs. MP, part of the fee was for the renewal of ski equipment |

| - Beauty and care Mrs. MP | 446.03 | 213.04 | Increase but there is a change with respect to investments in more sustainable beauty products that should be reflected in the long term (there are also other beauty products in the “Groceries” section that we have not categorized here because too much detail kills the detail :D) |

| - Clothes and shoes Mr. MP | 161.75 | 63.52 | A new beanie that should last me if I don’t lose it like the old one, and new summer shoes that should also last 2-4 years |

| - Freedom budget Mrs. MP | 1'204.10 | 1'356.43 | The idea for this category came to us from the founder of YNAB so that we would not have to justify certain small expenses to each other. For us it was CHF 100/month for Mrs. MP in 2019. We are almost on target. On the other hand, there has been a change in 2020 about this. An article is coming ;) |

| - Lunch at work Mrs. MP | 771.55 | 295.20 | Rather bad score compared to 2018 which was quite frugal thanks to our savings method described here, but which is explained by particular professional needs that we will deduct from taxes ;) |

| - Lunch at work Mr. MP | 663.54 | 671.20 | I thought I had invested even more than in 2018 in personal networking lunches (not paid for by my company), but apparently not :) |

| - Books, electronics, software | 120.18 | 227.37 | Books are an investment, just like software (mainly blog related) |

| - Professional education | 4'050.00 | 0.00 | Unplanned but mandatory training, which can be seen as an investment because, spoiler alert, it has already allowed us to increase one of our two salaries! |

| - Miscellaneous | 2'292.96 | 1'858.57 | Movie rentals, Rendementlocatif.com subscription (which I could have put in the “Investment costs” category in fact), commissioning Sunrise internet abo, Netflix that you take and then cancel when you want to see a series, train tickets, criminal record extract, and other administrative documents |

| — | — | — | — |

| Planned expenses (except apartment) | 46'325.57 | 45'161.88 | Details below |

| - Mobile and home internet abos | 1'346.40 | 1'398.20 | See our setup in this article |

| - Gas and parking for work Mrs. MP | 1'828.98 | 812.94 | Living in the countryside has a cost :) Mrs. MP is transitioning to public transport, hence the higher costs (including a half-fare card) |

| - Online computer backup service Mrs. MP | 36.00 | 36.00 | |

| - Beauty and care Mrs. MP | 854.80 | 839.70 | This is in addition to the identical category above because this one is for what is expected, and the other one is for the unexpected |

| - Electronics Mrs. MP | 0.00 | 1'648.00 | Beware, the devil hides in the details. Mrs. MP changed her phone ahead of time compared to our phone renewal strategy described here, but the costs are included in our phone bill. I’ll explain all the why and how in a future article (I know I’m running late…) |

| - Public transport for work Mr. MP | 1'062.80 | 2'805.00 | The cost of living in the countryside, far from the job. No regrets so far! The big difference can be explained because the abo I had was not so profitable as taking my ticket every time. Math never lies ;) |

| - Online computer backup service Mr. MP | 36.00 | 36.00 | |

| - Server and domain names | 391.71 | 419.03 | Servers and domain names for blog, forum, and other custom projects. I’m going to remove that next year because I’m going to treat the whole MP project as a separate business |

| - Electronics Mr. MP | 0.00 | 2'628.90 | Ditto Mrs. MP above, the devil is in the details because I also changed my phone |

| - Clothes and shoes kids | 700.04 | 832.06 | Ah, the subject of the Swiss budget for children :) |

| - School supplies and outings | 415.01 | 104.10 | Ski camps, as well as the famous class photos #memories |

| - Extra-curricular activities and supplies | 2'257.13 | 2'028.22 | The respective activities of the toddlers, with the necessary supplies for each one |

| - Kids’ hairdresser | 35.00 | 18.12 | |

| - Health insurance HIA | 8'745.60 | 7'862.40 | Our basic insurance for the four of us at Assura, as recommended in this article |

| - Supplementary health insurance LCA | 622.80 | 622.80 | Complementary for alternative medicine, and dental insurance for children (fortunately we took it for orthodontics as recommended by all the parents in our entourage) |

| - Childcare | 6'353.35 | 4'506.90 | It went up because we needed more childcare during some vacations, and also because the meals are no longer via the canteen but included in this category |

| - Children’s canteen | 0.00 | 441.16 | |

| - Teleboy Plus + movie rental | 189.00 | 110.90 | Compromise with Mrs. MP not to buy a box nor a TV subscription usually more expensive (and we switched to the annual vs. monthly abo of Teleboy, to pay “only” CHF 7.50 instead of CHF 9.00 per month) |

| - Auto insurance | 323.30 | 474.50 | We (again) changed our car insurance to save CHF 2'253 over ten years. All the details in this article |

| - Vehicle technical inspection | 130.00 | 0.00 | We had to go twice to the inspection because we had a small problem during the first visit |

| - Swiss motorway vignette | 20.00 | 40.00 | So much cheaper than tolls in Italy or France… and at half price this year thanks to my job :) |

| - Car tax | 103.10 | 103.10 | The advantage of driving a car like ours |

| - Private liability insurance | 193.70 | 193.70 | |

| - ECA | 40.60 | 34.50 | |

| - Billag | 365.00 | 451.10 | |

| - Taxes | 20'275.25 | 18'333.55 | Includes a payment to regulate the year 2018, and it’s not going to go down given our salary increases and revenues from personal projects |

| — | — | — | — |

| Planned expenses — Apartment | 17'172.55 | 17'182.29 | Details below |

| - Mortgage interests | 9'328.80 | 9'328.80 | |

| - Maintenance and repairs | 393.60 | 327.96 | |

| - Concierge | 416.60 | 1'148.04 | |

| - Electricity | 749.15 | 871.25 | |

| - Water | 152.15 | 327.96 | |

| - Building insurances | 528.35 | 573.96 | |

| - Maintenance abos | 543.20 | 410.04 | |

| - Banking fees | 35.00 | 41.04 | If only we could go to Zak :) |

| - Renovation fund | 454.00 | 492.00 | |

| - PPE management fees | 694.35 | 754.44 | |

| - Heating and hot water | 1'781.4 | 1'557.96 | |

| - Purification and water taxes | 648.50 | 784.04 | |

| - Garbage tax | 100.00 | 100.00 | |

| - Property taxes | 464.80 | 464.80 | |

| - Other one-time costs | 882.65 | 0.00 | Cooking plates, hail deductible: the joys of being a homeowner ;) |

| — | — | — | — |

| Planned expenses — Birthdays | 2'156.75 | 1'791.82 | Family and friends birthdays, and also children’s friends birthdays |

| — | — | — | — |

| Planned expenses — Christmas | 989.65 | 1'634.80 | Christmas gifts from family and friends |

| — | — | — | — |

| Holidays | 6'050.97 | 2'570.76 | As explained in this article, this item varies a lot each year because it serves as an adjustment variable to keep our savings rate within the 40-50% minimum. Last year was full of unexpected events, as well as winter sports, and the purchase of plane tickets for a trip in 2020 (cancelled because of COVID…)! |

| — | — | — | |

| TOTAL CHF | 121'710.72 | 101'758.90 | The 2019 objective was to be below CHF 100'000 in annual expenses. Well, we missed it :D Even scraping out the exceptional events (i.e. CHF 8'927.55 for professional training, health problems, and orthodontist), we ended up with CHF 112'783.17. And by removing 2/3 of our big vacations (i.e. CHF 4'033.98 less) if we had planned for cheaper ones, we still end up with CHF 108'749.19. |

The slap in the face…

The lesson I take away from this is that I want to define CHF 8'500 (i.e. 100kCHF over a year) as our maximum allowed expenses per month.

Since I have started publishing our savings rate each month again, it will be pretty easy to keep track of it.

And rather than playing the game of what we could not have spent here and there, I’m more interested in getting your feedback on the categories where I inspire you; and conversely, where you have ideas for drastic improvements compared to the current situation.

I’m looking forward to reading you in the comments below!

And else, how went your spendings in 2019?

PS: Until the end of 2019, I sorted my expenses according to the following YNAB categories:

- Groceries

- Irregular expenses

- Planned expenses (except apartment)

- Planned expenses — Apartment

- Planned expenses — Birthdays

- Planned expenses — Christmas

- Holidays

The thing that bothered me about this categorization was that it didn’t give me the opportunity to compare myself with Swiss statistics and other bloggers who have more readable categories (including knowing how much children cost in Switzerland!)

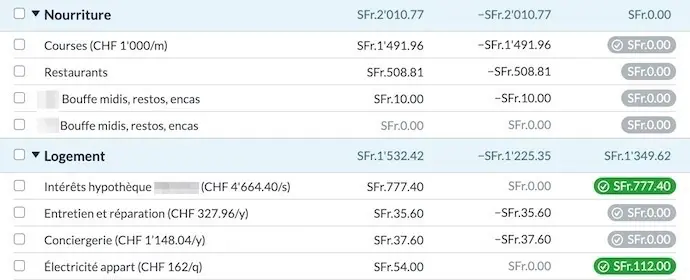

So from the beginning of 2020, here are the budget categories I use:

- Food

- Housing

- Telecoms and tools

- Transportation

- Medical

- Personal expenses Mr. and Mrs. MP

- Gifts

- Birthdays

- Christmas

- Children

- Entertainment and vacation/leisure

- Taxes

- Miscellaneous

- Reserve funds

- Mr. MP’s personal projects expenses

- Ms. MP’s personal projects expenses

- Investment fees

Review Cashback Swiss credit card (incl. bonus CHF …

Net worth and savings rate update September 2020...