Since the beginning of the blog, I had never taken the time to write such an article where we reveal our annual expenses.

Or was it for fear of not being as frugal as I think I am?

Anyway, I decided to fill the gap. Because even if the figures I have obtained do not please me, it remains the reality.

I am counting on you to challenge me where you have ideas for optimizations. Because in the end it is also one of the goals of the blog for me to improve.

On your side, as long as your entire budget is not in auto-pilot mode with a savings rate in the 60-70% range, I recommend you do the same!

If you are new here and you wonder how it’s possible to know all your annual expenses with so much detail, don’t look any further! The answer is called YNAB.

Without further ado, here are the annual expenses of the Swiss family of 4 people who hide behind this blog:

| Category | 2018 amount in CHF | Comments |

|---|---|---|

| Groceries | 13'184.76 | Includes food but also everything that is home care and beauty products |

| — | — | — |

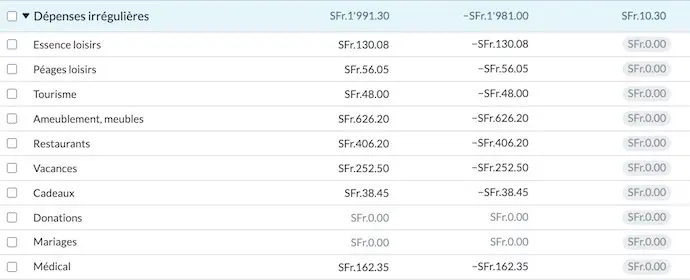

| Irregular expenses | 19'680.09 | Details below |

| - Leisure/tourism gas | 1'535.48 | Ouch, almost two full tanks of gas a month… The disadvantage of having friends and family scattered all over Europe |

| - Leisure/tourism tolls | 760.51 | Includes motorway tolls, car parks, and also a parking fine in Lausanne… |

| - Tourism | 1'024.71 | Ski/snowboard outings, concerts, baths |

| - Restaurants and outings | 2'386.15 | We like good gourmet restaurants, so more quality than quantity. This category also includes outings (including a rather expensive bachelorette party) |

| - Presents | 1'439.12 | This includes flowers and other items when we go to friends and family, Mother’s Day gifts, birthdays, weddings, etc. And also when the tooth fairy comes visit us :D |

| - Ameublements | 2'446.01 | A big cool DIY furniture project, a new router, mosquito nets (the only essential thing on this list), a new desk, and a garden furniture set |

| - Medical | 4'583.92 | Quite a few appointments for the children and also for us (costs go up quickly, but always less than paying for a lower health insurance deductible :)) |

| - Car expenses and repairs | 242.52 | 2x summer tires |

| - BCV fees | 13.50 | I look forward to the CHF 0 here thanks to Zak |

| - Clothes and shoes Mrs. MP | 562.84 | This amount includes CHF 157 for work clothes |

| - Beauty and care Mrs. MP | 213.04 | Hairdresser and beauty products (there are also other beauty products in the “Groceries” section that we have not categorized here because too many details kill the details :D) |

| - Clothes and shoes Mr. MP | 63.52 | This is perhaps the category I am most proud of :) I’m more of a one-time buyer of clothes/shoes, but they last me 5-10 years! |

| - Freedom budget Mrs. MP | 1'356.43 | The idea for this category came to us from the founder of YNAB, so that we didn’t have to justify some small expenses to each other. For us it is CHF 100/month for Mrs MP. We’re almost in the target. |

| - Lunch at work Mrs. MP | 295.20 | Nice score for Mrs. MP, who follows quite frugally our savings method described here |

| - Lunch at work Mr. MP | 671.20 | The only “valid” excuse I find is that some of these lunches are a professional investment to build and maintain business relationships |

| - Books, electronics, software | 227.37 | Books are an investment, as are software related to the blog mainly |

| - Miscellaneous | 1'858.57 | Passports, air mattresses, fines (which I misclassified I see now), photos, and other non-categorized things |

| — | — | — |

| Planned expenses (except apartment) | 45'161.88 | Details below |

| - Mobile and home internet abos | 1'398.20 | Cf. our setup in this article |

| - Gas and parking for work Mrs. MP | 812.94 | Living in the countryside has a cost :) |

| - Online computer backup service Mrs. MP | 36.00 | |

| - Beauty and care Mrs. MP | 839.70 | This comes in addition to the same category above because this one is for what is expected, and the other for what is unexpected |

| - Electronics Mrs. MP | 1'648.00 | iPhone battery replacement (we took advantage of Apple’s special program with this very low price) AND Mac laptop change (and yes, preview announcement, we adapted our laptop renewal strategy, I’ll explain everything in a future article) |

| - Public transport for work Mr. MP | 2'805.00 | The cost of living in the countryside, far from work. No regrets so far! |

| - Online computer backup service Mr. MP | 36.00 | |

| - Server and domain names | 419.03 | Servers and domain names for blogs, forums, and other pet projects |

| - Electronics Mr. MP | 2'628.90 | iPhone battery replacement (same as Mrs. MP) AND Mac laptop change for me too |

| - Clothes and shoes kids | 832.06 | Ah, the topic of the Swiss budget for children :) |

| - School supplies and outings | 104.10 | It also includes the famous class photo #memories |

| - Extra-curricular activities and supplies | 2'028.22 | The respective activities of the kids, with the necessary supplies for each |

| - Kids’ hairdresser | 18.12 | |

| - Health insurance HIA | 7'862.40 | Our basic insurance for the 4 of us at Assura, as recommended in this article |

| - Supplementary health insurance LCA | 622.80 | Supplementary for alternative medicine and dental insurance for children |

| - Childcare | 4'506.90 | It’s going down slowly but surely with the fact that they’re more and more in school :) |

| - Children’s canteen | 441.16 | |

| - Teleboy Plus + movie rental | 110.90 | Compromise with Mrss MP not to buy a box or TV subscription that is usually more expensive |

| - Auto insurance | 474.50 | |

| - Vehicle technical inspection | 0.00 | We put cash aside but it’s every two years that we need to pay for it |

| - Swiss motorway vignette | 40.00 | So much cheaper than tolls in Italy or France… |

| - Car tax | 103.10 | The advantage of driving a car like ours |

| - Private liability insurance | 193.70 | |

| - ECA | 34.50 | |

| - Billag | 451.10 | |

| - Taxes | 18'333.55 | Includes a payment to regulate the 2017 year |

| — | — | — |

| Planned expenses — Apartment | 17'182.29 | Details below |

| - Mortgage interests | 9'328.80 | |

| - Maintenance and repairs | 327.96 | |

| - Concierge | 1'148.04 | |

| - Electricity | 871.25 | |

| - Water | 327.96 | |

| - Building insurances | 573.96 | |

| - Maintenance abos | 410.04 | |

| - Banking fees | 41.04 | If only we could move it to Zak :) |

| - Renovation fund | 492.00 | |

| - PPE management fees | 754.44 | |

| - Heating and hot water | 1'557.96 | |

| - Purification and water taxes | 784.04 | |

| - Garbage tax | 100.00 | |

| - Property taxes | 464.80 | |

| — | — | — |

| Planned expenses — Birthdays | 2'344.32 | Family and friends birthdays, and also children’s friend birthdays (this position only represents CHF 25/month…) — we went a bit over-budget last year. UPDATE 03.10.2019 : thank you Claire for the comment that makes me realize that we are in fact at CHF 1'791.82 of real expenses because there are gifts for which we have been reimbursed and that I have misclassified. |

| — | — | — |

| Planned expenses — Christmas | 1'634.80 | Christmas gifts for family and friends. UPDATE 03.10.2019 : idem, thank you Claire for the comment that makes me realize that we are in fact at CHF 1'408.80 of real expenses because there are gifts for which we have been reimbursed and that I have misclassified. |

| — | — | — |

| Holidays | 2'570.76 | As explained in this article, this item varies greatly each year because it serves as an adjustment variable to stick to our 40% savings rate minimum target |

| — | — | — |

| TOTAL CHF | 101'758.90 | First reaction: delete this blogpost. Second reaction: find excuses like our early renewal of laptops… Third reaction: accept and use it as a source of motivation to do better next year! |

For a personal finance blogger, I feel a little ashamed to publish this after almost 6 years of existence… I realize that making decisions based on our monthly savings rate is one thing, but keeping an eye over the months on our annual expenses will only help us make better decisions to achieve financial independence even earlier. We’re always smarter afterwards, as they say…

Anyway, rather than playing the game of what we could not have spent here and there, I’m more interested in having your feedbacks on the categories where I inspire you; and conversely, where you have ideas for drastic improvements compared to now.

I look forward to reading from you in the comments’ section below!

PS #1: as I still like to set objectives, an easy thing to do would be to be below 100kCHF of expenses in 2019 as we will not buy new laptops this year. We’ll talk about it in six months :)

PS #2 : the patrons of the blog already know it, but in case you don’t read the Swiss German newspapers, I had the chance to be interviewed by the NZZ in a article about the FIRE (Financial Independence, Retire Early) movement and frugalism in Switzerland. It’s great because it will help the blog break through in the Swiss German region and inspire even more people to live frugally to focus on the real important things in life (vs. consumerism and materialism) — even if the counter-argument part of the article highlights financial advisors saying that it is not possible in order defend their livelihoods… Anyway, feel free to share the article around if you have friends or family who only speak this language :)